- Home

- »

- Next Generation Technologies

- »

-

Online Trading Platform Market Size & Share Report, 2030GVR Report cover

![Online Trading Platform Market Size, Share & Trends Report]()

Online Trading Platform Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Platform, Services), By Type (Commissions, Transaction Fees), By Deployment, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-449-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Trading Platform Market Summary

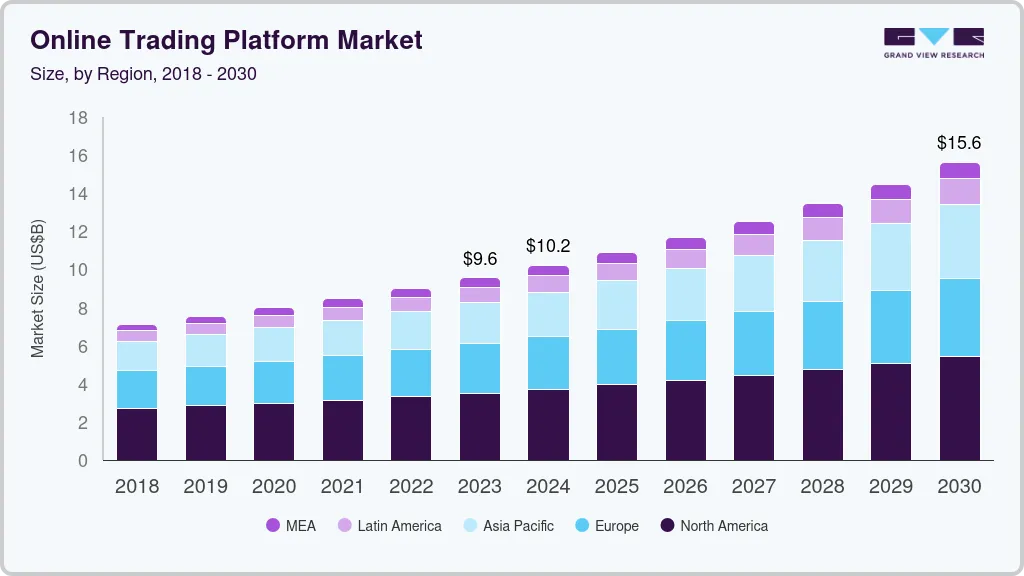

The global online trading platform market size was estimated at USD 9.57 billion in 2023 and is expected to reach USD 15.62 billion by 2030, growing at a CAGR of 7.3% from 2024 to 2030. Rapid advancements in technology drive the market's growth.

Key Market Trends & Insights

- North America online trading platform market dominated the global market and accounted for 36.6% of the global revenue share in 2023.

- The U.S. online trading platform market is anticipated to register significant growth from 2024 to 2030.

- On the basis of component, the platform segment led the market and accounted for 66.0% of the global revenue in 2023.

- On the basis of type, the commission segment accounted for the largest revenue share in 2023.

- On the basis of deployment, the cloud segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.57 Billion

- 2030 Projected Market Size: USD 15.62 Billion

- CAGR (2024-2030): 7.3%

- North America: Largest market in 2023

High-speed internet connectivity has become widely accessible, enabling traders to engage in real-time trading from virtually anywhere. This level of accessibility is a significant advantage over the past when trading was confined to physical locations like stock exchanges or required intermediaries such as brokers. Now, anyone can access global financial markets with just a smartphone or computer.

Mobile trading applications, in particular, have revolutionized trading. These apps are designed with user-friendly interfaces catering to novice and experienced traders. They provide features such as real-time market data, customizable alerts, and easy-to-use trading tools, making it simpler for users to manage their portfolios and execute trades. The convenience offered by mobile trading apps has significantly expanded the user base, attracting a younger, and more tech-savvy demographic.

Moreover, many investors are increasingly interested in managing their portfolios, motivated by a desire for more direct control over their investments. Online trading platforms empower individuals to research, analyze, and execute trades independently, allowing them to tailor their investment strategies to their specific financial goals and risk tolerance. This control appeals to those wanting to be more hands-on with their investments and make decisions based on their market views.

In addition, many online trading platforms offer a wealth of educational resources and tools to support self-directed investors. These resources include tutorials, webinars, market analysis, and even simulated trading environments where users can practice without risking real money. Such tools empower investors to build their knowledge and confidence, making it easier for them to manage their investments independently. The availability of these resources has contributed to the democratization of investing, making it accessible to a broader audience, including those with little prior experience.

However, online trading platforms handle vast amounts of sensitive financial data and are prime cyberattack targets. The growing sophistication of cyber threats, including hacking, phishing, and ransomware, poses a significant risk. Concerns about data breaches and financial fraud can deter potential users, especially those less technologically savvy, from adopting these platforms. Additionally, platforms must continuously invest in robust cybersecurity measures, which can be costly and impact profitability.

Component Insights

The platform segment led the market and accounted for 66.0% of the global revenue in 2023. The growing participation of retail investors, particularly during and after the COVID-19 pandemic, has significantly driven the growth of online trading platforms. The combination of increased financial awareness, social media influence, and the rise of communities like Reddit's WallStreetBets has encouraged more individuals to engage in trading. This surge in retail trading activity has led to higher trading volumes on online platforms, boosting their revenue streams.

The services segment is expected to register significant growth from 2024 to 2030. The integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics has significantly enhanced the services offered by online trading platforms. These technologies enable platforms to provide personalized trading experiences, predictive analytics, and automated trading strategies, attracting novice and experienced traders. AI-driven chatbots and virtual assistants also enhance customer support services, making the trading process smoother and more user-friendly.

Type Insights

The commission segment accounted for the largest revenue share in 2023. Institutional investors and high-net-worth individuals (HNWIs) represent a significant source of commission revenue. These clients often engage in larger, more complex trades requiring higher service and support. Online trading platforms that cater to institutional clients or HNWIs typically charge commissions as part of a broader service offering that includes personalized account management, custom trading strategies, and priority customer support. The commissions earned from these clients contribute significantly to the segment's growth.

The transaction fees segment is expected to register significant growth from 2024 to 2030. The surge in online trading activity, fueled by the growing popularity of retail investing, has led to higher trading volumes on these platforms. More trades translate directly into more transactions, which typically incur a fee. The increasing participation of retail traders, partly driven by the democratization of trading through easy-to-use platforms, has significantly boosted the volume of transactions, thereby driving the growth of the transaction fees segment.

Deployment Insights

The cloud segment accounted for the largest revenue share in 2023. The scalability and flexibility offered by the cloud drive the segment's growth. Cloud deployment provides unmatched scalability, allowing online trading platforms to handle fluctuating workloads easily. As users and transaction volumes grow, especially during market volatility, platforms can scale their resources up or down quickly without needing significant upfront investments in physical infrastructure. This flexibility is crucial for meeting the dynamic demands of the trading environment, making cloud deployment an attractive option.

The on-premise segment is expected to register significant growth from 2024 to 2030. The decreased latency and enhanced performance offered by the on-premise drives segment growth. For high-frequency trading firms and other institutions where speed is critical, on-premise deployment provides superior performance and lower latency compared to cloud-based alternatives. By hosting the trading platform on-site, organizations can minimize the time it takes for data to travel between servers and trading venues, which is crucial in executing trades swiftly and effectively.

Application Insights

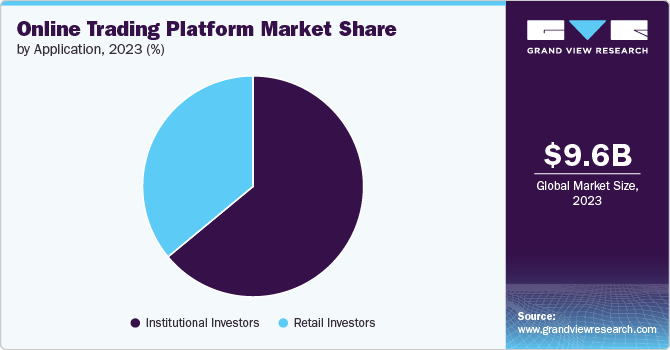

The institutional investors segment accounted for a significant revenue share in 2023. The advanced technologies the online trading platform offers drive its adoption among institutional investors. They rely on sophisticated technology and analytics to gain competitive advantages in the market. Online trading platforms provide access to advanced trading tools, real-time data, and analytics essential for making informed investment decisions.

The retail investors segment is expected to grow significantly from 2024 to 2030. The cost-effectiveness of online trading platforms has been a significant driver of growth among retail investors. Many platforms offer low or zero-commission trading, which makes it more affordable for individuals to buy and sell securities without incurring high transaction costs. Additionally, the availability of various fee structures, such as low account maintenance fees and no minimum deposit requirements, has further reduced the financial barriers to entry.

Regional Insights

North America online trading platform market dominated the global market and accounted for 36.6% of the global revenue share in 2023. The presence of robust financial market infrastructure in North America supports the growth of online trading platforms. Major financial hubs such as New York and Toronto are home to well-established stock exchanges and trading venues that facilitate high liquidity and efficient trading.

U.S. Online Trading Platform Market Trends

The U.S. online trading platform market is anticipated to register significant growth from 2024 to 2030. The regulatory environment in the U.S. is well-established and supportive of online trading activities. Regulatory bodies such as the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) provide a framework that ensures transparency and protects investors. The clarity and stability of these regulations contribute to investor confidence and encourage the use of online trading platforms.

Europe Online Trading Platform Market Trends

The Europe online trading platform market is poised for significant growth from 2024 to 2030. European online trading platforms increasingly offer access to global markets, allowing investors to diversify their portfolios and explore investment opportunities beyond Europe. This globalization of trading platforms appeals to European investors seeking exposure to international assets, such as U.S. stocks, Asian markets, and emerging economies. By facilitating access to a broader range of markets and financial products, online trading platforms cater to the growing demand for global investment opportunities and contribute to their growth.

Asia Pacific Online Trading Platform Market Trends

The Asia Pacific online trading platform market is poised for significant growth from 2024 to 2030. The rapid advancement of technology and widespread mobile phone penetration in the Asia Pacific region has facilitated the growth of online trading platforms. Mobile trading applications are particularly popular in the region, as they allow users to trade on the go with ease.

Key Online Trading Platform Company Insights

The market is highly competitive, with companies constantly seeking to gain an edge through unique service offerings and advanced technological innovations. Firms are prioritizing the development of sophisticated AI-driven platforms that enhance efficiency and accuracy of trades.

Key Online Trading Platform Companies:

The following are the leading companies in the online trading platform market. These companies collectively hold the largest market share and dictate industry trends.

- MetaQuotes Software Corp.

- Interactive Brokers

- E*TRADE

- Saxo Bank

- IG Group

- eToro

- Robinhood

- Plus500

- CMC Markets

Recent Developments

-

In June 2024, HSBC launched WorldTrader, a pioneering digital trading platform that allows customers to trade a variety of financial instruments, including equities, exchange-traded funds (ETFs), and bonds, across 77 exchanges in 25 markets globally. Initially introduced in the UAE, WorldTrader aims to cater to the growing demand for international investment opportunities among affluent clients.

Online Trading Platform Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.21 billion

Revenue forecast in 2030

USD 15.62 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, type, deployment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

MetaQuotes Software Corp.; Interactive Brokers; Charles Schwab & Co., Inc.; E*TRADE; Saxo Bank; IG Group; eToro; Robinhood; Plus500; CMC Markets

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Trading Platform Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global online trading platform market based on component, type, deployment, application, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Platform

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Commissions

-

Transaction Fees

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Institutional Investors

-

Retail Investors

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online trading platform market size was estimated at USD 9.57 billion in 2023 and is expected to reach USD 10.21 billion in 2024.

b. The global online trading platform market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 15.62 billion by 2030.

b. North America dominated the online trading platform market with a share of 36.6% in 2023. The presence of robust financial market infrastructure in North America supports the growth of online trading platforms.

b. Some key players operating in the online trading platform market include MetaQuotes Software Corp.; Interactive Brokers; Charles Schwab & Co., Inc.; E*TRADE; Saxo Bank; IG Group; eToro; Robinhood; Plus500; and CMC Markets.

b. Key factors that are driving the market growth include the increasing retail investor participation and technological advancements in AI and automation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.