- Home

- »

- Digital Media

- »

-

Online Video Platform Market Size And Share Report, 2030GVR Report cover

![Online Video Platform Market Size, Share & Trends Report]()

Online Video Platform Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Type (Video Processing, Video Analytics, Video Management), By Streaming Type, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-206-6

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Video Platform Market Summary

The global online video platform market size was estimated at USD 6,133.5 million in 2020 and is projected to reach USD 18,706.0 million by 2027, growing at a CAGR of 17.3% from 2021 to 2027. An online video platform is a fee-based software that allows content owners and publishers to transcode, manage, store, publish, track, and monetize online video content on their channel.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2020.

- Country-wise, U.S. is expected to register the highest CAGR from 2021 to 2027.

- In terms of segment, solution accounted for a revenue of USD 3,272.2 million in 2020.

- Services is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2020 Market Size: USD 6,133.5 Million

- 2027 Projected Market Size: USD 18,706.0 Million

- CAGR (2021-2027): 17.3%

- North America: Largest market in 2020

In addition, the platform also facilitates users to stream live videos simultaneously, record the live broadcasting, and host videos as per the demand. The online video platform is gaining significant traction from handheld devices such as smartphones and tablets, as the gadgets are compatible with playing live or pre-uploaded video content anywhere and at any time.

The market has recorded significant growth over the past few years due to the rising popularity of online videos, with viewership steadily surpassing traditional video content platforms such as cable and satellite television. The trend positively impacts the online video platforms market, majorly in developed regions, including North America and Europe. For instance, in 2023, Comcast, a U.S.-based broadcasting and cable company, lost 614 thousand customers in the first quarter. It was largely attributed to the competition created by Over the Top (OTT) and Video on Demand (VOD) players. On the contrary, Google's YouTube TV added 300 thousand subscribers in the first quarter of 2023.

Moreover, the increased penetration of advanced wireless telecom networks and easy internet access across developing regions is shifting mass users toward online video platforms. For instance, the high penetration of 4G networks across the globe is making seamless access to high-quality online video content possible for many users. The global introduction and adoption of the 5G network in the next few years are expected to significantly increase video content consumption on online platforms. The super-fast internet browsing speed promised by the network (nearly 13 times the average network connection) is expected to play a key role in the increased demand for video content on online platforms globally.

The growing practice of designing video-based marketing content to increase user brand awareness is attracting more enterprises toward online video platforms. For instance, in April 2020, Procter & Gamble partnered with Charli D’Amelio to create the #DistanceDance challenge and asked people to encourage and practice social distancing. Within the first week of the campaign, the video got more than eight billion views, and 1.7 million people posted their version of the video.

Many brands use live video shopping events to attract customers via digital platforms. A recent instance of this is the live event hosted by Samsung Sweden in Sept 2020 to help its customers learn more about its latest foldable series of smartphones, the Galaxy Z Fold2. In 2019, a similar launch event yielded around USD 60 billion in revenue globally. The entire online video campaign was managed by Bambuser, a live-streaming video company headquartered in Stockholm. Other prominent players providing similar solutions include Alphabet Inc., Endavo Media.; Frame.io, Inc., JW player; Facebook; and MediaMelon Inc.

According to media reports, it is estimated that nearly 1/4th of the world’s population was locked in their homes due to the COVID-19 pandemic and the corresponding social distancing norms issued by local governments. This significantly limited the entertainment options for individuals. It has resulted in a prominent spike in the worldwide viewership of online video platforms, such as Netflix, Amazon Prime Video, YouTube, and Disney+, and the consumption rate of online video content. For instance, in March 2020, Netflix registered an increase of more than 50% in the number of first-time installations of its mobile application in Italy and more than 30% in Spain.

In the education sector, the e-learning business recorded notable business growth in recent times. This is attributed to tthe he stringent lockdown policies of governments globally compelling schools and colleges to conduct classes online. The lockdown also attracted several working professionals to enroll in online learning programs to enhance their skills and stay relevant in their respective industries. For instance, in March 2020, LinkedIn recorded a 130% surge in total memberships over its online learning platform and a 26% increase in its total ad revenue.

Component Insights

Based on components, the solution segment accounted for the largest revenue share of 52.3% in 2022. It is attributed to the surging demand for subscription-based video content over the OTT platform and a continuous rise in demand for live-streaming video platforms. In addition, the availability of low- and free-of-cost video hosting platforms and monetization features, such as running ads between videos, are anticipated to fuel the growth of the solution segment over the forecast period.

The services segment is expected to expand at the fastest CAGR of 22.4% during the forecast period. It can be attributed to the increasing demand for professional and managed services for video streaming platforms. Data security threats are also increasing with the rise of cloud-based video content. Enterprise-managed services provide cloud security solutions that enable users to protect their websites, applications, and cloud data centers against many cyberattacks.

Type Insights

The video processing segment accounted for the largest revenue share of 37.4% in 2022. Video processing platforms provide features such as efficient IP conversion, high-density transcoding, adaptive bitrate packaging, encryption, and streaming into a modular and visualized solution. These solutions give broadcasters a cost-efficient way to provide online video solutions on live streaming and video-on-demand platforms. Several video processing platforms in the market also deliver personalized video experiences based on aspects such as website behavior, geolocation, and demographics, or hyper-personalized videos by including details such as preference settings and selection of multiple languages.

The video analytics segment is expected to expand at the fastest CAGR of 22.8% during the forecast period. Several reasons for this growth include the increasing popularity of online video, the growing availability of video data, and the development of more sophisticated video analytics tools. As more and more people watch online videos, the amount of video data available will also increase. This data can be used to track viewer behavior, identify trends, and improve the overall user experience.

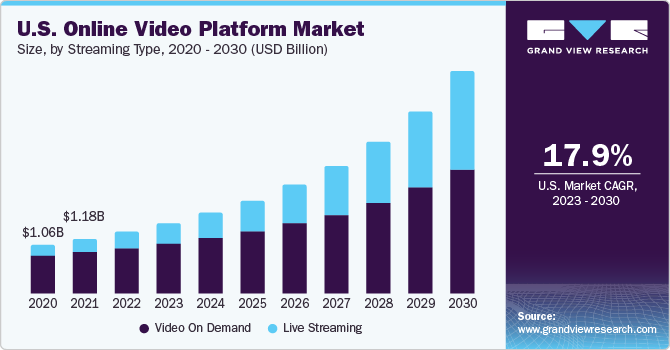

Streaming Type Insights

The video-on-demand segment accounted for the largest revenue share of 73.2% of the total market revenue in 2022. The growth can be attributed to the easy accessibility of videos over the cloud, which gives freedom to stream videos in real-time from any location. Another factor contributing to the growth of the video-on-demand space is the chance to optimize revenue from ads by delivering more relevant ad copy per user interest. Publishers are streaming dynamic ads based on the users' past keyword searches to execute the strategy.

The live video streaming segment is expected to expand at the fastest CAGR of 28.7% during the forecast period. Live video streaming is becoming increasingly popular as many sports streaming events are featuring customized chat room functionality to attract more subscribers. For instance, in the 2020 Indian Premier League, the thirteenth season of the Twenty20 cricket (T20) league, Disney + Hotstar enabled spectators to join a virtual community to watch matches together using an interactive emoji stream. In addition, the increasing number of users over live video game streaming platforms, such as Twitch, HitBox, Beam, and Azubu, are fueling the segment's growth. Gaming platform vendors are using this trend to expand their revenue sources, such as ad-based streaming, paid subscriptions, and the sales of badges.

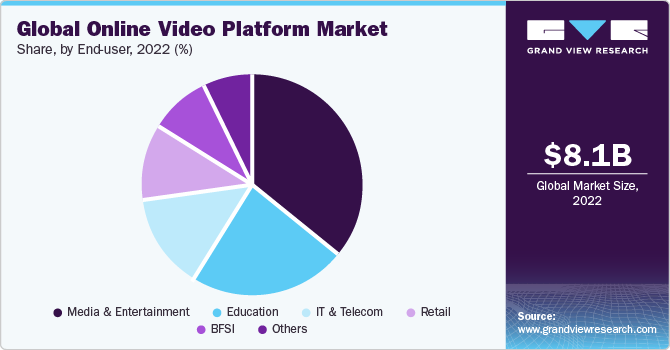

End-user Insights

The media & entertainment segment accounted for the largest revenue share of 36.2% in 2022. The segment has recorded significant growth due to a surge in internet connectivity on mobile phones and increased investments across the globe in improving the OTT infrastructure. Furthermore, the rise in investments in live-streaming sports events is expected to play an important role in developing the media & entertainment industry.

The retail segment is expected to expand at the fastest CAGR of 22.8% during the forecast period. The retail segment's growth is attributed to the online video platform becoming an increasingly important tool for businesses to connect with customers and drive sales. Videos showcase products, educate customers about products, and create a more engaging and immersive shopping experience. In addition, the rise of live streaming provides retailers with a new way to connect with customers in real time. As a result of these trends, the retail segment is expected to continue to grow significantly in the OVP market.

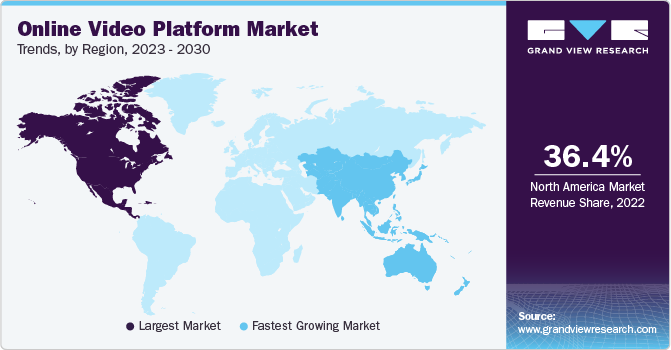

Regional Insights

North America accounted for the largest revenue share of 36.4% in 2022 in the online video platform market. The promising growth of the region is likely to continue in the upcoming years with the introduction of advanced 5G network technology, making online video platforms quicker and more agile. Moreover, an increasing number of U.S. enterprises are using online video platforms to promote their products and services to improve their brand identity.

Asia Pacific is expected to expand at the fastest CAGR of 22.8% during the forecast period. The regional market is expected to benefit from the rising scope of video-on-demand and live-streaming videos over online video platforms in the media & entertainment area as internet penetration continues to increase across the region.

User-generated video content on free video hosting platforms such as YouTube is becoming highly popular on the online video platform. The Asia Pacific region is expected to be the biggest beneficiary of the trend as the region has the largest population globally, and the growing internet penetration across the region is fueling the number of online video users. In addition, the availability of live video streaming facilities on social media sites such as Facebook and LinkedIn is also boosting the total number of users over online video platforms.

Key Companies & Market Share Insights

Vendors in the market focus on initiatives such as collaborations, acquisitions, mergers, and partnerships. For instance, in April 2023, Akamai, a U.S.-based content delivery network company, introduced new cloud-based streaming video computing capabilities for the 2023 NAB Show. These features were intended to assist OTT operators in providing higher-quality, more tailored video experiences to users and lower, more predictable operational costs & improved content monetization efforts. Akamai also announced changes to its Common Media Client Data (CMCD) specification and the addition of new Qualified Computing Partners to its program.

Key Online Video Platform Companies:

- Akamai Technologies

- Brightcove Inc.

- Comcast Cable Communications Management, LLC

- Endavo Media.

- Frame.io, Inc.

- Kaltura, Inc.

- Limelight Networks

- Longtail Ad Solutions, Inc. (JW PLAYER)

- MediaMelon Inc

- Ooyala Inc. (Telstra)

- Panopto

- SpotX, Inc.

- Wistia Inc. Inc.

Recent Developments

-

In April 2023, Brightcove Inc. partnered with Play Media, a media accessibility platform. The partnership allows customers to access and request accessibility services such as closed captioning, live captioning, audio description, and video localization directly from their existing video production workflow.

-

In February 2023, Brightcove Inc., a streaming technology company, introduced Brightcove Communications Studio. The studio provides various features, including immersive streaming, secure viewing, live and on-demand content, an easy-to-use video management and publishing interface, with multilingual support, and interactive aspects.

-

In October 2022, Adobe acquired Frame.io, a cloud-based video review and collaboration platform. The acquisition allowed Adobe to integrate Frame.io's features into its video editing software, such as Adobe Photoshop, Adobe Premiere Pro, and Adobe After Effects, which allows users to collaborate easily on video projects and accelerate the creative process.

Online Video Platform Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.39 billion

Revenue forecast in 2030

USD 35.15 billion

Growth Rate

CAGR of 20.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, streaming type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Akamai Technologies; Brightcove Inc.; Comcast Cable Communications Management, LLC; Endavo Media.; Frame.io, Inc.; Kaltura, Inc.; Limelight Networks; Longtail Ad Solutions, Inc. (JW PLAYER); MediaMelon Inc.; Ooyala Inc. (Telstra); Panopto; SpotX, Inc.; Wistia Inc. Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Video Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global online video platform market report based on component, type, streaming type, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Video processing

-

Video management

-

Video distribution

-

Video analytics

-

Others

-

-

Streaming Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Live streaming

-

Video on demand

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Media & entertainment

-

BFSI

-

Retail

-

Education

-

IT and telecom

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global online video platform market size was estimated at USD 8.09 billion in 2022 and is expected to reach USD 9.39 billion in 2023.

b. The global online video platform market is expected to grow at a compound annual growth rate of 20.7% from 2023 to 2030 to reach USD 35.15 billion by 2030.

b. North America dominated the online video platform market with a share of 36.4% in 2022. This is attributable to the rise in the adoption of video streaming services, and increasing internet penetration across the region.

b. Some key players operating in the online video platform market include Akamai Technologies, Brightcove Inc., Comcast Cable Communications Management, LLC, Conviva, Endavo Media., Frame.io, Inc., Kaltura, Inc., Limelight Networks.

b. Key factors that are driving the online video platform market growth include rising adoption of e-learning and increasing penetration of video streaming services in developing countries including China, India, amongst others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.