- Home

- »

- Medical Devices

- »

-

Operating Room Equipment Market, Industry Report, 2030GVR Report cover

![Operating Room Equipment Market Size, Share & Trends Report]()

Operating Room Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Anesthesia, Endoscopes, Electro Surgical Devices, Surgical Imaging), By End Use, By Region, And Segment Forecast

- Report ID: GVR-1-68038-503-8

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Operating Room Equipment Market Summary

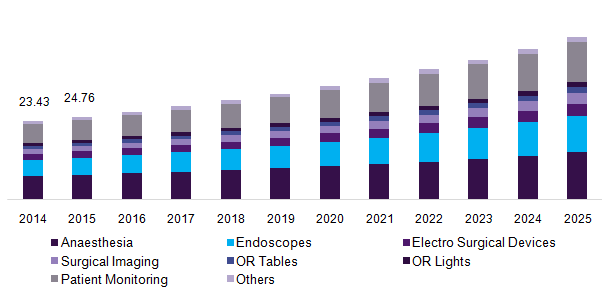

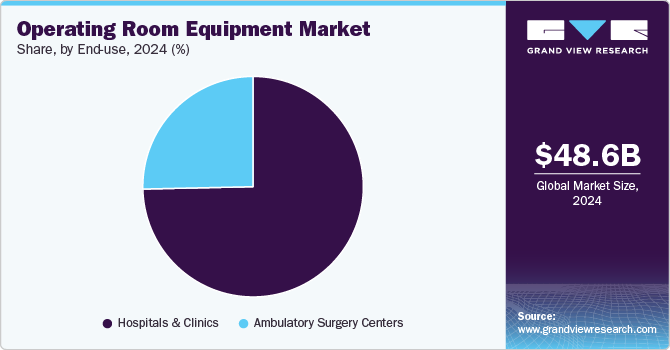

The global operating room equipment market size was estimated at USD 48.61 billion in 2024 and is projected to reach USD 75.39 billion by 2030, growing at a CAGR of 7.8% from 2025 to 2030. The growth of the market is attributed to factors such as the rising number of hospitals & ambulatory surgery centers, the growing incidence of chronic diseases requiring surgeries, and technological innovations in medical devices.

Key Market Trends & Insights

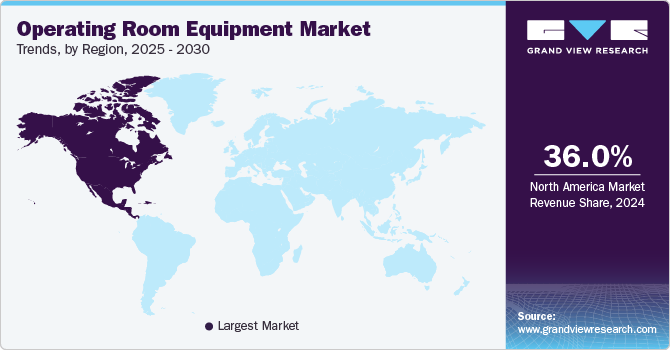

- North America operating room equipment market dominated the global industry in 2024 and accounted for the largest revenue share of 36.02%.

- The operating room equipment market in the U.S. held the largest share in 2024.

- By product, the anaesthesia segment dominated the market in 2024 and accounted for the largest revenue share of 54.59%.

- By end use. the hospital management systems segment held the largest share of 74.66% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 48.61 Billion

- 2030 Projected Market Size: USD 75.39 Billion

- CAGR (2025-2030): 7.8%

- North America: Largest market in 2024

In addition, healthcare infrastructure, rising healthcare expenditures, increase in the number of surgeries and rising demand for minimally invasive surgeries are contributing to the growth of the market.

The number of surgical procedures performed globally are rising due to the growing and aging population. Surgical care is vital for the management of various medical conditions such as injuries, cardiovascular diseases, cancers, obstructed labor, malignancy, infections, cerebrovascular diseases, mental illnesses, and many others. According to an article published in the MEDIRES journal in January 2024, around 234.2 million surgical procedures are performed globally annually. The changing lifestyle and unhealthy diet have led to an increase in the prevalence of various chronic diseases that increases the demand for surgical procedures worldwide. In addition, injuries account for a large amount of disease burden and are expected to rise in the coming years.

Furthermore, rising investments in the development of operating-room equipment are expected to drive market growth over the forecast period through the launch of innovative products. For instance, in August 2024, Getinge launched two innovative products aimed at enhancing surgical efficiency and safety: the Maquet Corin operating table and the Maquet Ezea surgical light. The launch of these products represents Getinge's commitment to improving operational efficiency in healthcare settings while prioritizing patient safety and ease of use for medical professionals. These innovations are expected to significantly enhance workflow in operating rooms across various clinical environments. Stéphane Le Roy, President Surgical Workflows at Getinge, said:

“Maquet Corin advances crucial aspects for surgical teams. Its flexibility and user-friendly design save time by enhancing communication and cooperation among staff. Additionally, its smart sensor-based safety features protect both OR personnel and equipment.”

Worldwide Establishment of New Operating Rooms/Surgical Centers

Country

Year

Month

Event

U.S.

2025

February

The HCA Florida Mercy Hospital unveiled four new operating rooms to leverage its capacity to serve new patients. Three of these new operating rooms are established for orthopedic procedures, and the fourth room is a state-of-the-art hybrid room designed for cardiac and vascular procedures.

Philippines

2025

February

The Manila Doctors Hospital upgraded its existing operating rooms and expanded its capacity by constructing four new operating rooms, bringing the total number of ORs to 14.

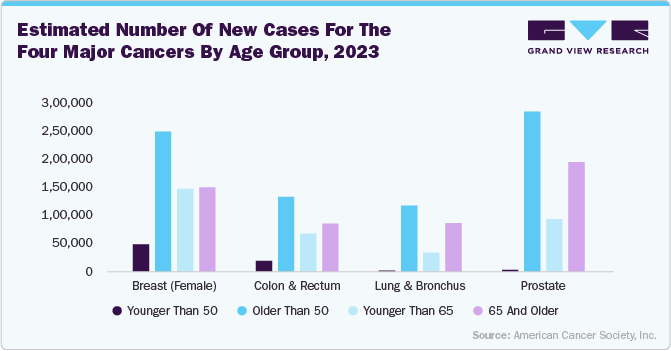

Furthermore, according to the U.S. Department of Health and Human Services, it was estimated, an estimated 2,001,140 new cases of cancer will be diagnosed in the U.S. and 611,720 people will die from the disease in 2024. In the U.S., breast cancer cases affect women at a rate of 264,000 each year, while cases in men stand at around 2,400 as per The Centers for Disease Control and Prevention (CDC). The number of surgeries being performed to treat these diseases is expected to result in high demand for operating room equipment.

Moreover, governments and private organizations are investing in healthcare infrastructure improvements, including operating room technologies. These funding initiatives aim to modernize healthcare facilities and support the adoption of OR equiment that can be used to perform complex surgical procedures. In January 2025, VitVio, a London-based healthcare technology startup, successfully raised USD 2.05 million in pre-seed funding aimed at developing AI-powered operating rooms for hospitals. This funding round was led by LDV Capital, with participation from Bek Ventures, Tiny Supercomputer Investment Company, and various angel investors. The investment reflects growing confidence in the potential of artificial intelligence to enhance surgical efficiency and patient outcomes.

The industry is driven by the growing pressure on hospitals to manage costs while delivering high-quality care. Integrated operating room solutions present substantial cost-saving opportunities by enhancing resource utilization, shortening operation times, and decreasing surgical complications. This economic motivation encourages hospitals to invest in advanced technological devices. Solutions such as ENDOALPHA from Olympus Corporation contribute to reduced surgical durations, enhanced patient safety, and expedited recovery. As the complexity of advanced surgeries escalates, hospitals are increasingly adopting technological innovations in the operating room, including innovative and advanced surgical instruments, digital imaging diagnostics, robotic 3D imaging, surgical robots, and virtual reality technologies.

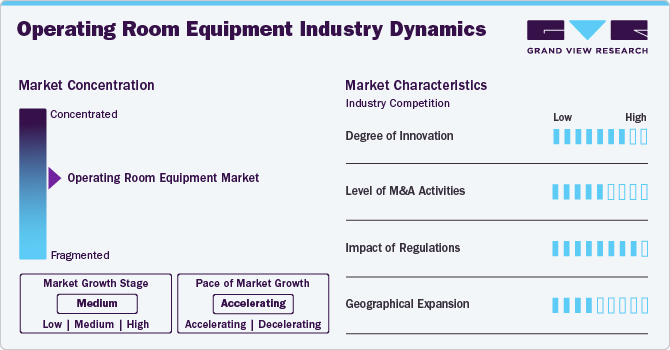

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, impact of regulations, level of merger & acquisition activities, and geographic expansion.

The degree of innovation is notably high, driven by continuous technological advancements, growing patient demand for minimally invasive procedures, and the need for improved diagnostic accuracy and therapeutic outcomes. Companies are investing heavily in research and development to introduce equipment integrated with digital solutions. For instance, in April 2024, the MOLLI OncoPen is a minimal invasive surgical tool designed by MOLLI Surgical to enhance precision in breast cancer surgery. It resembles a pen and integrates with the MOLLI 2 System. The OncoPen helps surgeons accurately target and remove cancerous lesions by using a small MOLLI Marker placed near the tumor beforehand. During surgery, it offers real-time 3D guidance on the MOLLI Tablet to locate the lesion precisely.

Several key market players are devising business growth strategies in the form of mergers and acquisitions. Through M&A activity, these companies can expand their business. For instance, In April 2024, Stryker Corporation announced the completion of its acquisition of mfPHD. This strategic move is aimed at enhancing Stryker's offerings in modular wall systems for healthcare facilities, specifically hospitals and ambulatory surgery centers. The acquisition aligns with Stryker's broader enterprise strategy to expand its product offerings while emphasizing turn-key operating room (OR) initiatives.

The industry is regulated by a variety of national and international standards, such as those set by the FDA in the U.S. and the EMA in Europe. Manufacturers must demonstrate compliance with safety and performance criteria, often through clinical testing, to ensure their medical devices are safe and effective before they can be marketed.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. In June 2023, STERIS announced its acquisition of surgical instrumentation assets from Becton, Dickinson and Company (BD) for a total consideration of USD 540 million. This strategic move is aimed at expanding STERIS's portfolio in the healthcare sector, particularly in surgical instruments, which are critical for various medical procedures.

Product Insights

The anaesthesia segment dominated the market in 2024 and accounted for the largest revenue share of 54.59%. Anaesthesia is essential for surgeries across all disciplines-from general and cardiovascular surgery to orthopaedics, oncology, and neurosurgery. Every operating room must be equipped with anaesthesia workstations, ventilators, gas delivery systems, and patient monitoring tools. Moreover, a growth in the number of Ambulatory Surgical Centers (ASCs) and outpatient surgeries has increased the demand for compact and portable anaesthesia systems. Furthermore, companies are launching new products to expand their global footprint. For instance, in April 2025, Dräger launched the Atlan A100 anesthesia workstation in India, aimed at enhancing perioperative care. This system incorporates advanced lung protective ventilation, low-flow anesthesia capabilities, and measures to prevent infections, representing a notable advancement in anesthesia technology for healthcare providers.

The endoscopes segment is expected to grow at the fastest CAGR over the forecast period. Increasing awareness regarding earlier detection of diseases through minimally invasive surgical procedures, the adoption of various distribution strategies, and the growing prevalence of chronic disorders are some of the major factors driving market growth. Furthermore, technological advancements significantly impacted the field of disposable endoscopic devices, driving innovation and improving patient care.

These advancements have led to developing more advanced and sophisticated disposable endoscopes, offering enhanced imaging capabilities, improved maneuverability, and ease of use. For instance, in September 2024, Olympus Corporation received U.S. FDA 510(k) approval for its CADDIE computer-aided detection (CADe) device, a cloud-based AI technology developed to help gastroenterologists during colonoscopy procedures to detect colorectal polyps.

End Use Insights

The hospital management systems segment held the largest share of 74.66% in 2024, owing to its wide applications in ORs. Hospitals are emphasizing upgrading operation theatres because they are one of the greatest revenue-generating sources. Growth is also anticipated to be fueled by the rising geriatric population, increase in the burden of diseases, increase in healthcare expenditures, demand for hybrid operating rooms, and rising investments in infrastructure and cutting-edge technologies for effective results.

For instance, in January 2023, the Galilee Medical Center announced the opening of a smart room for managing inventory in OR through a partnership between Autonomi Company and Israeli group purchasing organization Sarel. Furthermore, in February 2022, Canada’s Alberta province government invested USD63.5 million for 11 new operating rooms at Calgary's Foothills hospital. The 11 new operating rooms are in addition to the 32 existing operating rooms at the northwest Calgary hospital. They will allow up to 7,000 more surgeries each year.

The ambulatory surgical centers systems segment is expected to grow at the fastest CAGR over the forecast period. Ambulatory surgery is being increasingly performed in developed countries. The shortage of beds in hospitals and scarce economic resources are expected to boost the growth of this segment. However, the high initial and maintenance cost of OR equipment is hampering segment growth. The development of various medical devices that aid in performing minimally invasive surgeries is allowing physicians to carry out a greater number of surgical procedures on a day-care basis. The availability of technologically advanced I-ORs has contributed largely to the improvement of day-care surgery.

Regional Insights

North America operating room equipment market dominated the global industry in 2024 and accounted for the largest revenue share of 36.02%. This growth is attributed to the increasing demand for surgical automation. Major factors attributed to the market growth are the rise in demand for efficient healthcare services, an increase in the need to reduce healthcare expenditure, and effective EHR implementation by healthcare organizations. Furthermore, the presence of established players in the market, technologically advanced HCIT, and funding to improve OR infrastructure are other factors propelling the market growth.

U.S. Operating Room Equipment Market Trends

The operating room equipment market in the U.S. held the largest share in 2024 due to technological advancements and recent approvals received for technological devices. Manufacturers are investing in R&D to obtain approvals for new products for commercialization. For instance, in October 2024, Olympus Corporation announced a strategic partnership with Proximie, a global health technology company, aimed at revolutionizing the digitization of operating rooms. This collaboration is significant as it seeks to enhance patient care and improve clinical practices through advanced telecollaboration technologies.

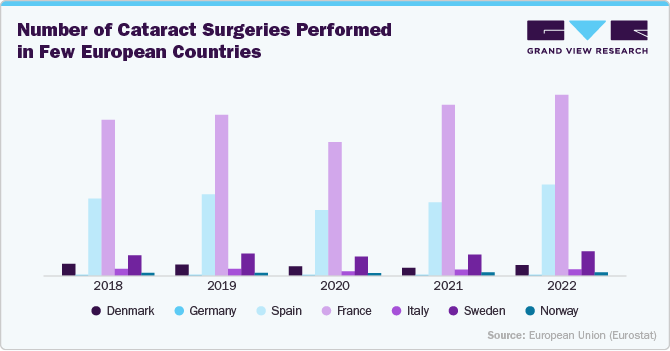

Europe Operating Room Equipment Market Trends

Europe operating room equipment market is expected to register considerable growth during the forecast period. UK, Germany, Italy, France, and Spain are the main markets in this region. The increasing geriatric population in developed countries, such as the UK, Germany, Italy, and France, is one of the factors expected to drive growth over the forecast period.

Germany operating room equipment market is anticipated to register a significant growth rate during the forecast period. Factors such as increasing adoption of minimally invasive surgeries, introduction of advanced products, and other business activities, such as mergers & acquisitions, are expected to contribute to growth of the market in Germany. For instance, in March, 2024, Eurazeo announced that it had signed an agreement to sell all the share capital of Peters Surgical to Advanced Medical Solutions Group plc (AMS). The agreement entails a complete transfer of ownership of Peters Surgical, which specializes in surgical products and has a strong market presence in Europe and beyond. The sale is part of Eurazeo's strategy to optimize its portfolio by divesting from certain assets while focusing on others that align more closely with its long-term investment goals.

Asia Pacific Operating Room Equipment Market Trends

Asia Pacificoperating room equipment market is anticipated to be the significantly growing region. Healthcare spending in the region has significantly increased, enabling investments in advanced medical technologies and improvements in infrastructure. This trend is particularly evident in countries such as China and India, where rising economic strength and government initiatives are promoting the adoption of operating room equipment. The integration of advanced technologies such as robotic surgery and telemedicine further supports this growth by improving surgical precision and reducing recovery times.

Japan operating room equipment market held the largest share in 2024. This is attributed to technological advancements, rising inclination for minimally invasive surgeries, increasing penetration for treatment & diagnosis, investment by global players, ongoing R&D, and presence of key manufacturers. For instance, in November 2024, Stille AB launched the imagiQ3, a next-generation C-arm table, during the Radiological Society of North America (RSNA) conference. This innovative product represents a significant advancement in surgical imaging technology, building on the legacy of its predecessors while introducing new features designed to enhance operational efficiency and patient safety.

Latin America Operating Room Equipment Market Trends

Latin America operating room equipment market is expected to register significant growth during the forecast period. The primary driver is the increasing demand for advanced healthcare technologies, which is spurred by a growing prevalence of chronic diseases and a rising number of surgical procedures across the region. As hospitals strive to improve patient outcomes and operational efficiency, they are increasingly adopting operating room products that facilitate better communication, data management, and workflow optimization. Furthermore, government initiatives aimed at improving healthcare services and funding for health information technology (HCIT) infrastructure are also contributing to the robust development of the ORI market in Latin America.

Brazil operating room equipment market accounted for a major share of Latin America in 2024. A large population suffering from chronic diseases, coupled with rapid development of technologically advanced devices, is expected to increase the market penetration of operating room equipment in the coming years. In September 2024, Purple Surgical, launched its operations in Brazil. This strategic move is aimed at expanding the company's presence in the Latin American market, which is increasingly recognized for its growing healthcare sector and demand for high-quality medical supplies.

Middle East And Africa Operating Room Equipment Market Trends

MEA operating room equipment market is expected to register considerable growth during the forecast period. There is a significant increase in healthcare expenditure across the region, with countries such as Kuwait, Saudi Arabia, and the UAE investing heavily in advanced healthcare technologies to improve patient outcomes and operational efficiency. This investment is largely fueled by a rising geriatric population and an increasing prevalence of chronic diseases, which necessitate more surgical procedures.

The operating room equipment market in UAEis experiencing significant growth during the forecast period. This growth is primarily driven by the growing product innovations and improvements. For instance, in January 2025, RAIN Technology ME LTD announced a significant leadership transition with the appointment of Abbes Seqqat as the new CEO. This change is part of RAIN's strategic efforts to enhance its presence in the UAE and globally launch its innovative surgical voice assistant, Orva. Seqqat succeeds Nithya Thadani, who has led the company since 2017 and will continue to contribute as a member of the Board of Directors.

Key Operating Room Equipment Company Insights

The market is fairly competitive owing to the presence of a large number of multinational as well as local market players. The market players are adopting various strategies, such as partnerships & collaborations, regional expansion, and service launches, to gain higher market shares. For instance, in August 2022, Affera, Inc. was acquired by Medtronic, an international leader in healthcare technology. Similarly, in December 2021, Baxter International Inc. announced it has completed its acquisition of Hillrom. Some of the prominent players in the operating room equipment market include:

Key Operating Room Equipment Companies:

The following are the leading companies in the operating room equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V

- Medtronic

- Getinge AB

- Stryker Corporation

- Siemens Healthineers AG

- GE HealthCare

- Steris

- Skytron, LLC

- Drägerwerk AG & Co. KGaA,

- Baxter International Inc.

Recent Developments

-

In May 2025, the Olympus Corporation, a global medical technology company, has recently demonstrated its new AI endoscopy solution, OLYSENSE Platform, at the Digestive Disease Week (DDW) annual meeting. The platform features the CADDIE computer-aided detection device, which uses cloud-based AI technology to aid gastroenterologists in suspected polyp detection during colonoscopy procedures.

-

In October 2025, Olympus Corporation announced that it has received CE (Conformité Européenne) approval for three cloud-based artificial intelligence (AI) medical devices. This approval is crucial as it allows these devices to be marketed and used within the European Economic Area, ensuring they meet stringent safety and efficacy standards set by European regulators.

-

In January 2025, JUNE MEDICAL and Aspen Surgical announced a strategic partnership aimed at expanding access to the Galaxy II surgical retractor system across the U.S. market. This collaboration is significant as it combines JUNE MEDICAL's innovative medical devices with Aspen Surgical's extensive distribution network, enhancing the availability of advanced surgical tools in hospitals and surgery centers nationwide.

-

In July 2024, Philips collaborated with the University of Zurich to develop a Visual Patient Avatar to address cognitive overload in operating rooms, enhancing patient safety. This innovative tool displays vital information clearly, helping anesthesiology providers make quicker, more informed decisions, ultimately reducing the risk of errors and improving situational awareness during procedures.

-

In March 2023, Baystate Medical Center (BMC) announced the launch of its latest operating rooms and interventional suites, which are equipped with advanced technological features aimed at enhancing surgical precision and patient care. This initiative is part of BMC's ongoing commitment to improving healthcare delivery through innovation.

Operating Room Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 51.85 billion

Revenue forecast in 2030

USD 75.39 billion

Growth rate

CAGR of 7.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Koninklijke Philips N.V; Medtronic; Getinge AB; Stryker; Siemens Healthineers AG; GE HealthCare; Steris; Skytron LLC; Drägerwerk AG & Co. KGaA; Baxter International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Operating Room Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research Inc. has segmented the operating room equipment market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Anaesthesia

-

Endoscopes

-

Electro Surgical Devices

-

Surgical Imaging

-

OR Tables

-

OR Lights

-

Patient Monitoring

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global operating room equipment market size was estimated at USD 48.61 billion in 2024 and is expected to reach USD 51.85 billion in 2025.

b. The global operating room equipment market is expected to grow at a compound annual growth rate of 7.77% from 2025 to 2030 to reach USD 75.39 billion by 2030.

b. The anesthesia devices segment dominated the global operating room equipment market with a share of 54.59% in 2024.

b. Some key players operating in the operating room equipment market include Koninklijke Philips N.V, Medtronic, Getinge AB, Stryker, Siemens Healthineers AG, GE HealthCare, Steris, Skytron, LLC, Drägerwerk AG & Co. KGaA, and Baxter International Inc.

b. The growth of the market is attributed to factors such as the rising number of hospitals & ambulatory surgery centers, the growing incidence of chronic diseases requiring surgeries, and technological innovations in medical devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.