- Home

- »

- Medical Devices

- »

-

Ophthalmic Drug Delivery Systems Market Size Report, 2030GVR Report cover

![Ophthalmic Drug Delivery Systems Market Size, Share & Trends Report]()

Ophthalmic Drug Delivery Systems Market (2026 - 2030) Size, Share & Trends Analysis Report By Technology (Eye Drops, Contact Lenses), By Delivery Route, By Production Technology, By Material, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-917-7

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ophthalmic Drug Delivery Systems Market Summary

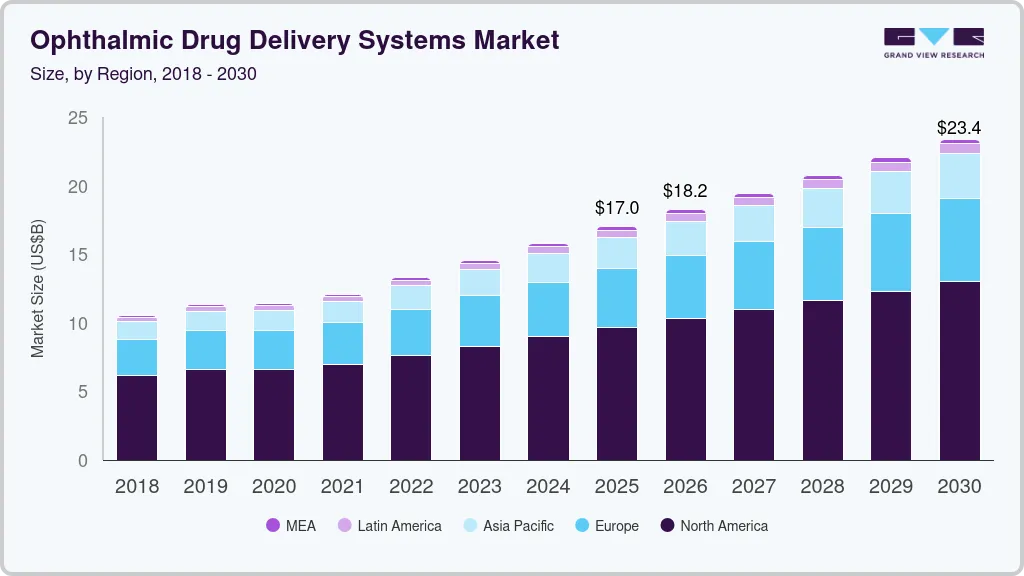

The global ophthalmic drug delivery systems market size was estimated at USD 16.99 billion in 2025 and is projected to reach USD 23.36 billion by 2030, growing at a CAGR of 6.6% from 2026 to 2030. The rising prevalence of eye disorders, including cataracts, glaucoma, and age-related macular degeneration, is a key driver for expanding the ophthalmic drug delivery systems industry.

Key Market Trends & Insights

- The North America ophthalmic drug delivery systems market dominated the market, accounting for a 56.91% share in 2024.

- The U.S. ophthalmic drug delivery systems market is experiencing strong growth.

- Based on delivery route, the intraocular segment dominated the market and accounted for a 54.06% share in 2024 due to its ability to directly provide targeted and sustained drug release into the eye.

- Based on production technology, the formulation segment held the largest market share of 22.16% in 2024.

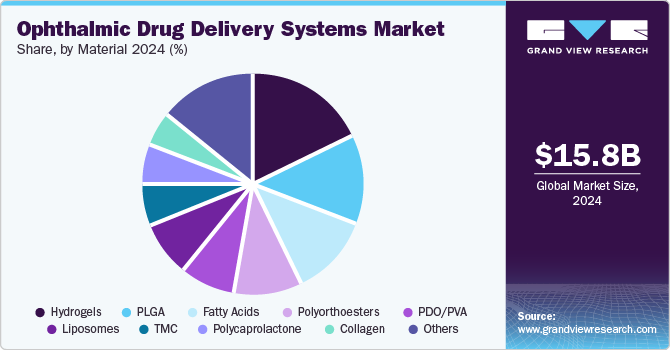

- Based on material, the hydrogels dominated the market with the largest revenue share of 17.32% in 2024 due to their ability to provide controlled and sustained drug release.

Market Size & Forecast

- 2025 Market Size: USD 16.99 Billion

- 2030 Projected Market USD 23.36 Billion

- CAGR (2026-2030): 6.6%

- North America: Largest market in 2024

According to the CDC, in 2022, approximately 12 million people aged 40 and older in the U.S. suffer from vision impairment, with around one million experiencing blindness. On a global scale, the situation is comparable, as the World Health Organization reports that over 2.2 billion people worldwide are affected by eye and vision problems. Furthermore, increasing demand for targeted drug delivery technologies and recent advancements that improve bioavailability upon administration fuel market growth.

One key driver of market growth is the development of advanced drug delivery systems that enhance the bioavailability of therapeutics. Traditional eye drops often suffer from limited absorption, leading to suboptimal treatment results. New technologies, including sustained-release formulations, nanoparticles, and hydrogels, address these challenges by improving drug retention and efficacy. These innovations increase patient compliance and expand the therapeutic potential for various ocular conditions. By overcoming delivery barriers, such advancements are shaping the future of ophthalmology and contributing significantly to the market’s expansion.

The rising demand for targeted drug delivery systems is another factor boosting the ophthalmic drug delivery systems industry. Targeted therapies ensure that medications are delivered directly to the affected area, minimizing systemic side effects and improving treatment precision. This approach particularly benefits chronic eye diseases, such as diabetic retinopathy and macular degeneration, where localized treatment is crucial. As awareness of these benefits grows among healthcare providers and patients, the adoption of targeted drug delivery systems is steadily increasing, further driving market growth and enhancing treatment outcomes.

Supportive regulatory frameworks and market trends are also positively influencing market growth. Regulatory bodies increasingly approve novel drug delivery methods prioritizing patient safety and efficacy. Additionally, pharmaceutical companies invest heavily in research and development to meet the rising demand for effective ophthalmic treatments. Partnerships between biotech firms and research institutions further accelerate innovation in the field. Together, these factors create a favorable environment for market expansion, ensuring that advanced ophthalmic drug delivery solutions become widely available and accessible to address the growing global burden of eye disorders.

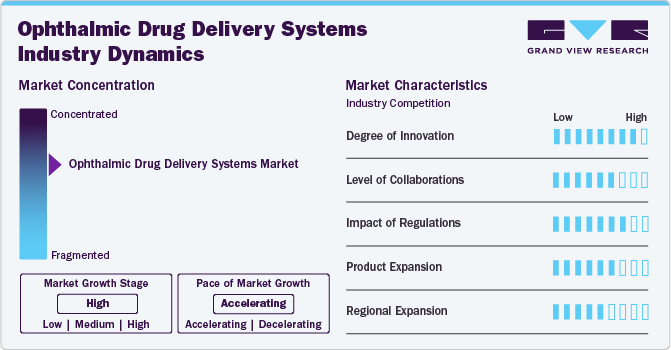

Market Concentration & Characteristics

The ophthalmic drug delivery systems industry is marked by a high degree of innovation driven by advancements in technology and research. Novel systems such as sustained-release implants, nanotechnology-based carriers, and microneedle patches transform traditional delivery methods. These innovations address challenges like poor bioavailability and low patient adherence, enhancing therapeutic outcomes for ocular diseases. In April 2024, Viatris Inc. announced the U.S. commercial launch of RYZUMVI 0.75%. This solution is designed to treat pharmacologically-induced mydriasis caused by adrenergic agonists, such as phenylephrine, or parasympatholytic agents, like tropicamide, in the U.S. Companies are also exploring biodegradable materials and gene therapy delivery platforms, reflecting a strong focus on precision and sustainability. This continuous innovation fosters growth and improves patient-centric care in ophthalmology.

The market is witnessing heightened merger and acquisition (M&A) activity, driven by companies aiming to expand their product portfolios and strengthen market positions. Strategic collaborations between pharmaceutical giants and innovative startups are accelerating the development of advanced delivery technologies, such as sustained-release systems and nanotechnology-based platforms. These M&As foster innovation, improve R&D capabilities, and enhance global market reach. The trend highlights the industry's competitive dynamics and addresses unmet ocular disease management needs.

Regulations significantly influence the ophthalmic drug delivery systems industry, ensuring product safety, efficacy, and quality. Stringent guidelines from regulatory bodies like the FDA and EMA govern the approval of novel delivery technologies, encouraging manufacturers to adhere to high standards. These regulations promote innovation while ensuring patient safety. However, complex compliance processes can delay market entry for new products. Despite this, regulatory frameworks provide a structured pathway for innovation, fostering trust among stakeholders and contributing to the market's sustainable growth.

Product expansion is a key growth strategy in the ophthalmic drug delivery systems industry, driven by rising demand for innovative and effective treatment solutions. Companies are diversifying their portfolios with advanced formulations such as sustained-release implants, biodegradable systems, and nanotechnology-based carriers. For instance, in October 2023, Orasis Pharmaceuticals, a leading emerging company in ophthalmic solutions, announced that the FDA approved QLOSI 0.4% for the treatment of presbyopia in adults, marking a significant milestone in reshaping vision care possibilities. These innovations address limitations of traditional methods, like poor bioavailability and patient compliance, while targeting a wider range of ocular conditions. Strategic launches and R&D investments fuel this expansion, enabling manufacturers to cater to evolving patient and healthcare provider needs.

Rising healthcare infrastructure, increasing awareness of ocular diseases, and growing demand for advanced treatments are boosting market penetration in regions like Asia-Pacific, Latin America, and the Middle East. Simultaneously, manufacturers enhance distribution networks and collaborate with local partners to meet region-specific needs. This geographic diversification enables companies to tap into new patient populations and accelerate global market growth.

Technology Insights

The eye drops segment dominated the market in terms of revenue share of 20.37% in 2024. This is driven by their widespread use, ease of administration, and cost-effectiveness in treating various eye conditions, including dry eye, glaucoma, and infections. Advances in formulation, such as preservative-free options and improved bioavailability technologies, enhance therapeutic outcomes and patient compliance. In June 2023, Novaliq GmbH, a biopharmaceutical company specializing in first- and best-in-class ocular therapies, announced that the FDA had approved VEVYE 0.1% for treating the signs and symptoms of dry eye disease. The increasing prevalence of ocular diseases and rising adoption of self-care practices fuel this segment’s global expansion.

The micro-electromechanical segment is anticipated to grow at the fastest CAGR of 7.28% due to its ability to provide precise, controlled, and targeted drug delivery. MEMS technology enables the development of miniature, implantable devices that can deliver drugs at controlled rates, enhancing treatment outcomes for chronic ocular conditions. The increasing demand for innovative, minimally invasive, and patient-compliant solutions drives the adoption of MEMS devices. Additionally, ongoing MEMS technology advancements are expected to fuel market growth further and expand therapeutic options.

Delivery Route Insights

The intraocular segment dominated the market and accounted for a 54.06% share in 2024 due to its ability to directly provide targeted and sustained drug release into the eye. This route is particularly effective for treating serious ocular conditions such as diabetic retinopathy, macular degeneration, and glaucoma. Intraocular injections offer enhanced bioavailability and improved therapeutic outcomes compared to traditional eye drops. The growing prevalence of these eye diseases, combined with advancements in injection technologies, is driving the expansion of this segment.

The intravitreal segment is anticipated to grow at the highest CAGR of 8.37% from 2025 to 2030. Intravitreal injections deliver drugs directly into the vitreous body, ensuring targeted and sustained drug release for enhanced therapeutic outcomes. With the increasing prevalence of retinal disorders and advancements in injectable biologics, the demand for intravitreal therapies is rising, fueling the segment's growth and expanding patient treatment options.

Production Technology Insights

The formulation segment held the largest market share of 22.16% in 2024. This is due to the increasing adoption of topical eye drops, which use formulation technology. Moreover, the increasing usage of formulations in ocular inserts and contact lenses that deliver drugs and can imbibe formulations has also contributed to the segment's dominance.

The 3D printing segment is expected to grow at the fastest CAGR of 7.74% over the forecast period. Although currently, the application of 3D printing in ophthalmology is limited, it represents enormous potential, especially for generating ocular tissues, including sclera, corneas, and others. In addition, 3D printing enables the cost-effective design and production of instruments that aid in the early detection of common ocular conditions, 3D-printed intraocular implants and contact lenses, and diagnostic and therapeutic devices built specifically for individual patients to improve the overall treatment procedures. Thus, the advantages and potential that 3D printing represents are the primary factors contributing to its fast growth.

Material Insights

The hydrogels dominated the market with the largest revenue share of 17.32% in 2024 due to their ability to provide controlled and sustained drug release. Hydrogels offer superior biocompatibility, moisture retention, and ease of application, making them ideal for treating dry eye disease and other ocular conditions. Their ability to enhance drug absorption and improve patient compliance drives increased adoption. For instance, in June 2024, Bausch + Lomb launched its INFUSE for Astigmatism daily disposable contact lenses. These silicone hydrogel lenses are designed to deliver stable vision and maintain eye comfort for up to 16 hours, thanks to a unique blend of osmoprotectants, electrolytes, and moisturizers. Made from Kalifilcon A, the lenses offer 55% moisture content and exceptional breathability with an oxygen permeability of 107 Dk/t and a low modulus to enhance overall comfort for wearers. Ongoing innovations in hydrogel formulations, such as those incorporating nanotechnology, are expected to accelerate market growth in the coming years further.

Polycaprolactone is projected to experience significant growth over the forecast period. PCL is increasingly being used to develop controlled-release drug delivery devices, such as implants and nanoparticles, for the treatment of chronic eye conditions like glaucoma and macular degeneration. Its slow degradation rate allows for sustained drug release, improving therapeutic efficacy and reducing the need for frequent administration. As a result, the PCL segment is expanding, driven by innovations in ophthalmic treatments and patient-centric solutions.

Regional Insights

North America ophthalmic drug delivery systems market dominated the market, accounting for a 56.91% share in 2024. The high prevalence of dry eye syndrome, driven by an aging population and increased screen time, plays a significant role in market growth. The region benefits from advanced healthcare infrastructure, facilitating the swift adoption of innovative treatments and diagnostic technologies. Furthermore, the strong presence of major pharmaceutical companies and high levels of consumer awareness contribute to the continued market expansion.

U.S. Ophthalmic Drug Delivery Systems Market Trends

The U.S. ophthalmic drug delivery systems market is experiencing strong growth, driven by the increasing prevalence of eye disorders like dry eye disease and glaucoma. Advancements in drug delivery technologies, such as sustained-release systems and targeted therapies, are enhancing treatment efficacy. Additionally, rising patient awareness and adoption of innovative treatments are further accelerating market expansion.

Europe Ophthalmic Drug Delivery Systems Market Trends

The ophthalmic drug delivery systems market in Europe is anticipated to experience notable growth, fueled by the high prevalence of vision impairment. According to the WHO, around 90 million people in Europe, or 9% of the population, experience some form of vision loss or blindness. This drives demand for advanced treatments, enhancing market growth through innovative drug delivery technologies and increased healthcare access.

The UK ophthalmic drug delivery systems market is influenced by various factors, including the rising incidence of eye diseases, such as glaucoma and macular degeneration. Key factors include advancements in drug delivery technologies, an aging population, increasing healthcare investments, and the adoption of innovative treatments, driving demand for more effective and targeted therapies. According to a report by The Royal College of Ophthalmologists in June 2022, more than 700,000 people in the UK are affected by glaucoma.

The ophthalmic drug delivery systems market in Germany is growing due to the rising incidence of eye conditions and innovative advancements in drug delivery technologies. Innovations such as sustained-release implants, nanotechnology-based carriers, and injectable therapies drive market growth, offering more effective and precise treatments for ocular diseases and enhancing patient outcomes.

Asia Pacific Ophthalmic Drug Delivery Systems Market Trends

The ophthalmic drug delivery systems market in Asia Pacificis experiencing significant growth due to a large aging population, increasing prevalence of eye diseases, and improving healthcare infrastructure. Rising awareness of advanced treatments and growing demand for targeted therapies further expand the market. Additionally, significant investments in healthcare are contributing to the adoption of innovative drug delivery technologies.

China ophthalmic drug delivery systems market is witnessing innovation driven by the high incidence of eye diseases. According to the China Dry Eye Expert Consensus (2020), 21-30% of the population suffers from dry eye disease (DED), which affects approximately 400 million people. This large patient pool, coupled with advancements in drug delivery technologies, is fueling market expansion.

The ophthalmic drug delivery systems market in Japan is growing due to the increasing prevalence of age-related eye conditions, such as glaucoma and macular degeneration. With advanced healthcare infrastructure, strong government support, and a focus on innovative drug delivery solutions, Japan is adopting new therapies, driving market expansion, and improving patient outcomes.

Middle East And Africa Ophthalmic Drug Delivery Systems Market Trends

The ophthalmic drug delivery systems market in the Middle East and Africais expanding due to rising eye disease prevalence and increasing healthcare investments. Innovations in formulations, such as sustained-release implants and nanotechnology-based carriers, enhance treatment efficacy and patient compliance, driving the adoption of advanced drug delivery solutions in the region.

Saudi Arabia ophthalmic drug delivery systems market is growing due to rising demand for advanced treatments for eye disorders like glaucoma, dry eye disease, and macular degeneration. The increasing prevalence of these conditions, along with improving healthcare infrastructure and awareness, is driving the adoption of innovative drug delivery solutions in the country.

Key Ophthalmic Drug Delivery Systems Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their technology and services. Strategies such as expansion activities and partnerships play a key role in propelling market growth.

Key Ophthalmic Drug Delivery Systems Companies:

The following are the leading companies in the ophthalmic drug delivery systems market. These companies collectively hold the largest market share and dictate industry trends.

- Ocular Therapeutix Inc.

- Allergan plc.

- Santen Pharmaceutical Co. Ltd.

- Envisia Therapeutics

- pSivida

- Clearside Biomedical

- Oculis Pharma

- Valeant Pharmaceuticals

- AptarGroup, Inc.

Recent Developments

-

In October 2024, Orasis Pharmaceuticals, an ophthalmic pharmaceutical company, announced that it had successfully completed a USD 78 million financing round to facilitate the introduction of Qlosi, an innovative eye drop designed to treat presbyopia in adults.

-

In September 2024, Eyenovia, Inc., an ophthalmic technology company, announced the U.S. launch and availability of clobetasol propionate ophthalmic suspension, which the FDA has approved for treating post-operative inflammation and pain following ocular surgery.

-

In January 2024, Amneal Pharmaceuticals, Inc. announced the approval and launch of fluorometholone ophthalmic suspension.

Ophthalmic Drug Delivery Systems Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 18.22 billion

Revenue forecast in 2030

USD 23.36 billion

Growth rate

CAGR of 6.6% from 2026 to 2030

Actual data

2018 - 2025

Forecast period

2026 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, delivery route, production technology, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Ocular Therapeutix Inc.; Allergan plc.; Santen Pharmaceutical Co. Ltd.; Envisia Therapeutics; pSivida; Clearside Biomedical; Oculis Pharma; Valeant Pharmaceuticals; AptarGroup, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmology Drug Delivery Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global ophthalmic drug delivery systems market report based on technology, delivery route, production technology, material, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Eye drops

-

Contact lenses

-

Punctal plugs

-

Episcleral Implants

-

Intravitreal Implants

-

Injectable Particulate Systems

-

Iontophoresis

-

Micro-Electromechanical

-

Nano careers

-

Nano microparticles

-

Microneedles

-

Hydrogels

-

Others

-

Total

-

-

Delivery Route Outlook (Revenue, USD Billion, 2018 - 2030)

-

Intraocular

-

Intravitreal

-

Intracameral

-

-

Production Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Electrospinning

-

3D printing

-

Extrusion

-

Formulation

-

Micro patterning

-

Compression molding

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Liposomes

-

Collagen

-

PLA-PEG

-

PDO/PVA

-

Hydrogels

-

TMC

-

Polyorthoesters

-

PLGA

-

Polycaprolactone

-

Fatty acids

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ophthalmic drug delivery systems market size was estimated at USD 15.76 billion in 2024 and is expected to reach USD 16.99 billion in 2025.

b. The global ophthalmic drug delivery systems market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 23.36 billion by 2030.

b. North America dominated the ophthalmic drug delivery systems market with a share of 57.6% in 2024. This is attributable to high R&D investments, the availability of technologically advanced products, and an increase in the prevalence of eye disorders.

b. Some key players operating in the ophthalmic drug delivery systems market include Ocular Therapeutix, Inc., Allergan plc., Santen Pharmaceutical Co. Ltd., Envisia Therapeutics and pSivida

b. Key factors that are driving the ophthalmic drug delivery systems market growth include the rising prevalence of ophthalmic disorders and technological advancements

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.