- Home

- »

- Medical Devices

- »

-

Ophthalmic Photocoagulator Market Size Report, 2021-2028GVR Report cover

![Ophthalmic Photocoagulator Market Size, Share & Trends Report]()

Ophthalmic Photocoagulator Market Size, Share & Trends Analysis Report By Application (Diabetic Retinopathy, Glaucoma, Macular Edema), By Wavelength (Green Scan, Multicolor Scan), By End Use, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-489-7

- Number of Report Pages: 210

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

Report Overview

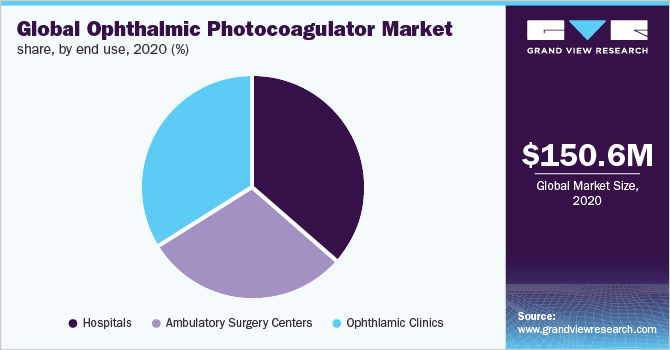

The global ophthalmic photocoagulator market size was valued at USD 150.6 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.7% from 2021 to 2028. The rise in the prevalence of ocular disorders, diabetes, and age-related ophthalmic complications and the global impact of COVID-19 on eye health are major contributors to the market growth. Photocoagulation is a preferred therapy above others, such as drugs and surgery, since it is a reasonably safe, quick, and painless process. The expanding geriatric population is driving the demand for ophthalmic lasers as this population is more susceptible to developing age-related ophthalmic complications. According to the National Institute on Aging (NIA), the geriatric population would be about 72 million individuals by 2030. The rising prevalence of diabetes and diabetes-related blindness is expected to drive the market. According to the WHO, the number of people with diabetes increased to 422 million in 2014 from 108 million in 1980.

COVID-19 has had a profound impact on the healthcare system and has interfered with various routine medical practices, including ophthalmology. This is because ophthalmology requires close contact during an examination and treatment, which, in turn, increases the risk of infection. Additionally, patients visiting the ophthalmology clinics are high-risk individuals and are prone to infections. These factors are expected to restrict the adoption of various ophthalmology procedures, such as photocoagulation, thus expected to hinder the market growth.

Advancements in laser technology such as pattern scanning lasers, color configuration, high contrast, slit lamps, conventional therapy with single pulses and spot sequences, gentle therapy with short pulses, and automated positioning of the scan pattern to the next region to undergo photocoagulation are expected to drive the market. These advancements help in providing faster, safer, more precise, less painful, and customized treatment strategies for optical diseases. Besides this, other factors like intensive R&D in the laser eye-care segment, rising concerns for vision-health management, and an increase in the number of ophthalmic clinics and hospitals, among others, are all contributing to the market expansion. However, the associated risk of vision loss during photocoagulation, incorrect device handling, the lack of understanding about modern procedures, the lack of enhanced diagnostics in underdeveloped countries, and costly medical equipment maintenance costs are likely to hinder the market growth.

Application Insights

The diabetic retinopathy segment held the largest share of 28.2% in 2020 and is expected to grow at the fastest rate over the forecast period. The prevalence rate as per the American Academy of Ophthalmology, 2019 for retinopathy for all adults with diabetes aged 40 worldwide has been estimated at 34.6% (93 million people). As the Indian Institute of Public Health-Hyderabad(IIPH-Hyderabad) reports, owing to lifestyle changes, more young adults and adolescents are developing diabetes. These individuals are particularly at risk of diabetic complications, such as diabetic retinopathy (DR) and diabetic macular edema (DME). In patients with diabetic retinopathy, laser photocoagulation has significantly improved the visual outcome. The high prevalence of diabetic retinopathy and its expected increase during the forecast period are expected to drive the need for advanced photocoagulators for its treatment.

Age-related macular degeneration (AMD) held a significant share in 2020. The rising prevalence of retinal problems, the growing elderly population, and increased research and development spending are all expected to drive the macular degeneration therapy market. Dry AMD and wet AMD are the two types of AMD. Only the wet type has abnormal blood vessel development. Laser photocoagulation is only an option for certain people with wet type AMD. In rare cases, it also results in total blindness, thus hindering the segment growth during the forecast period.

Glaucoma is another important application segment, which occurs when the nerve connecting the eye and the brain is injured, usually as a result of excessive eye pressure. According to the WHO, glaucoma accounts for 4.5 million cases of blindness globally. Age is a significant predictor of glaucoma prevalence. In the United States, glaucoma, also known as "Silent Thief of Sight", is the second-leading cause of blindness (behind macular degeneration). Lasers are used to enhance slow blood outflow, treat internal aqueous flow obstructions, and reduce slow blood production in glaucoma patients. This is expected to propel the segment growth.

The build-up of fluid in the macula, which is located in the center of the retina, is known as macular edema. The macula swells and thickens as a result of fluid build-up, causing vision distortion. One out of every fourteen people with diabetes suffers from diabetes-related macular edema. According to the International Diabetes Federation, diabetes macular edema affects more than 28 million individuals worldwide. The growing adoption of photocoagulation for the treatment of macular edema is expected to contribute to the overall market growth.

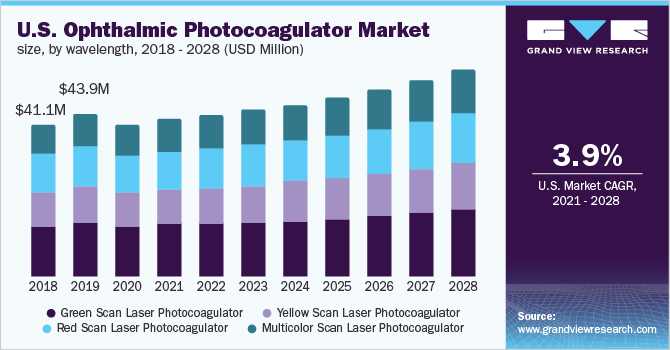

Wavelength Insights

The green scan laser photocoagulator segment dominated the market and held a share of 33.4% in 2020. The green laser wavelength (532 nm) is considered to be a standard laser as it offers versatile applications and excellent absorption. The pigmented tissue of the eye absorbs the green light, which may be utilized to treat a number of ophthalmic conditions, including glaucoma, age-related macular degeneration, and diabetic retinopathy. As a result, the green laser is frequently employed.

The multicolor scan laser photocoagulator segment is expected to grow at the fastest rate of 5.3% during the forecast period. The multicolor scan laser allows the selection of multiple wavelengths in one versatile machine, making it easier for the surgeons. 577 nm yellow, 532 nm green, and 647 nm red are the most often used wavelengths and combinations of any two or all three wavelengths at the same time. Additionally, market players are developing a multicolor scan laser photocoagulator for treating retinal diseases, which is expected to contribute to the segment growth.

The yellow scan laser photocoagulator (577 nm) is considered to be the safest. The yellow laser marks a turning point in the treatment of diabetic retinopathy since it has proven to be far more successful and safe than traditional green lasers. This is because, in comparison to green laser, the pigment in the macula absorbs only a little amount of yellow wavelength, which is expected to propel the segment growth. However, less awareness regarding the yellow scan photocoagulator and its advantages may hinder its adoption during the forecast period.

End-use Insights

Hospitals held the largest share of 36.4% in 2020 due to the extensive use of ophthalmic lasers in hospital settings. Furthermore, the growing number of hospitals in emerging countries, the improvement of existing eye care infrastructure at government medical colleges and district hospitals, and the construction of new eye care infrastructure are expected to aid the segment growth.

Ambulatory surgical centers are anticipated to grow at the fastest rate during the forecast period. Ambulatory surgical centers are expected to gain popularity in the years to come due to the convenience, closeness, and reduced costs for patients and insurance. Ambulatory surgical centers may also provide more convenience to patients than hospital OPDs, such as the option to schedule surgery more rapidly.

The ophthalmic clinics segment is projected to witness considerable growth over the forecast period. The key drivers of the segment include the rising incidence of eye disorders and diabetes and the increasing number of geriatric patients. However, the availability of qualified experts to cope with the complexity involved in the use of ophthalmic lasers is projected to hinder the market expansion.

Regional Insights

North America dominated the market by capturing a share of 34.0% in 2020. Chronic eye illnesses such as age-related macular edema, diabetic retinopathy, and glaucoma are becoming more common as a result of high stress and unhealthy lifestyles, which are high-impact key drivers for the North American market. According to the International Diabetes Federation (IDF), the U.S. has the highest diabetes rate among 38 developed countries, with approximately 30 million people suffering from the disease. Moreover, the rapidly expanding elderly population base in North America is expected to contribute to the market growth in the region. By 2015, there were more than 46 million older individuals aged 65 and more; by 2050, that number is anticipated to rise to over 90 million.

Asia Pacific is expected to grow at the fastest rate of 6.9% during the forecast period. The increasing incidence of optical diseases, which includes glaucoma, age-related macular degeneration, and diabetic retinopathy, is creating a demand for photocoagulation in this region. The WHO South-East Asia Region has in recent years made significant efforts to increase access to quality eye health services to achieve universal health coverage and ensure no one is left behind. Therefore, the presence of a large patient pool and the growing adoption of ophthalmic procedures, such as photocoagulation for the treatment of optical disorders, are expected to boost the market growth in the APAC region.

Rapidly growing European countries such as the U.K., France, and Germany that have a high per capita income and well-defined healthcare policies are showing increased demand for advanced ophthalmic photocoagulators. This is particularly due to the rise in diabetes-related ocular disorders and glaucoma and the growth of the elderly population. According to the World Health Organization, the European Region has around 60 million individuals with diabetes. As per the NCBI, the number of people with early and late AMD in Europe will be between 14.9-21.5 million and 3.9-4.8 million by 2040. Technological advancements in the region, along with large investments made in healthcare research, are expected to propel the market growth.

Key Companies & Market Share Insights

The market is fragmented with several large and small companies contending. The key players are developing photocoagulators with more choices like color configuration, laser consoles, dual-mode laser cavity, slit lamp optics, and automated positioning of the scan pattern to the next region to undergo photocoagulation to maximize treatment accuracy and efficiency.

To stay competitive in the market, key market players are pursuing different tactics such as mergers and acquisitions, collaborations, and partnerships. For instance, Ellex has been acquired by Quantel Medical, which includes the company's laser technology solutions. These two companies share a history of working together to design and develop advanced technologies for the treatment of glaucoma, cataracts, AMD, and diabetic retinopathy, the leading causes of blindness around the world. Some prominent players in the global ophthalmic photocoagulator market include:

-

Lumenis

-

IRIDEX Corporation

-

Alcon Inc.

-

Quantel Medical

-

NIDEK CO., LTD.

-

Johnson & Johnson Vision Care, Inc.

-

TOPCON CORPORATION

-

Bausch & Lomb Incorporated

-

Meridian Medical Group

Ophthalmic Photocoagulator Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 154.6 million

Revenue forecast in 2028

USD 213.2 million

Growth Rate

CAGR of 4.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, wavelength, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Thailand; South Korea; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Lumenis; IRIDEX Corporation; Alcon Inc.; Quantel Medical; NIDEK CO., LTD.; Johnson & Johnson Vision Care, Inc.; TOPCON CORPORATION; Bausch & Lomb Incorporated; Meridian Medical Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global ophthalmic photocoagulator market report on the basis of application, wavelength, end use, and region:

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Glaucoma

-

Diabetic Retinopathy

-

Age-related Macular Degeneration

-

Macular Edema

-

Others

-

-

Wavelength Outlook (Revenue, USD Million, 2016 - 2028)

-

Green Scan Laser Photocoagulator

-

Yellow Scan Laser Photocoagulator

-

Red Scan Laser Photocoagulator

-

Multicolor Scan Laser Photocoagulator

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Ambulatory Surgery Centers

-

Ophthalmology Clinics

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ophthalmic photocoagulator market size was estimated at USD 150.6 million in 2020 and is expected to reach USD 154.6 million in 2021.

b. The global ophthalmic photocoagulator market is expected to grow at a compound annual growth rate of 4.7% from 2021 to 2028 to reach USD 213.2 million by 2028.

b. North America dominated the ophthalmic photocoagulator market with a share of 34.0% in 2020. This is attributable to the presence of key players, the development of photocoagulators, and the enhancement of ophthalmic care in the region.

b. Some key players operating in the ophthalmic photocoagulator market include Lumenis, IRIDEX Corporation, Alcon Inc., Quantel Medical, NIDEK CO., LTD., Johnson & Johnson Vision Care, Inc., TOPCON CORPORATION, Bausch & Lomb Incorporated, and Meridian Medical Group.

b. Key factors that are driving the ophthalmic photocoagulator market growth include the rising number of optical disorders, technological advancements in photocoagulators, and the growing development of multicolor scan laser photocoagulators.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."