- Home

- »

- Healthcare IT

- »

-

Ophthalmology PACS Market Size And Share Report, 2030GVR Report cover

![Ophthalmology PACS Market Size, Share & Trends Report]()

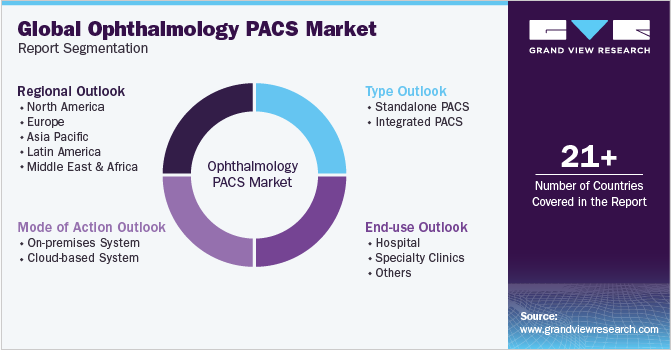

Ophthalmology PACS Market Size, Share & Trends Analysis Report By Type (Integrated, Standalone), By Mode Of Action (Cloud-based, On-premise), By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-659-2

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

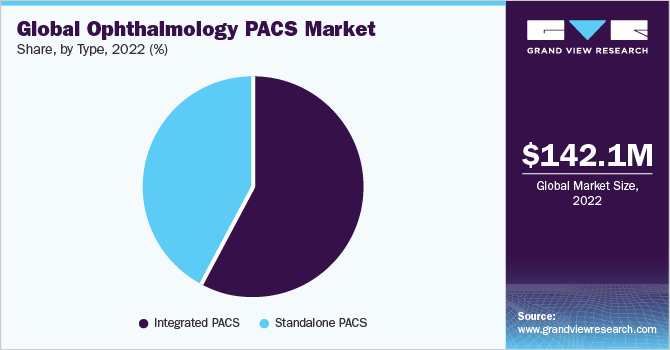

The global ophthalmology picture archiving and communication system market size was estimated at USD 142.1 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. Key drivers attributing to the market growth include the increasing adoption of teleophthalmology solutions due to the lack of skilled ophthalmologists and optometrists. Moreover, significant growth in Information Technology (IT) and its rising impact on ophthalmology practices are anticipated to drive the growth of the industry.

Furthermore, the high prevalence of diabetes and diabetic eye diseases, such as Diabetic Macular Edema (DME), diabetic retinopathy, cataracts, and glaucoma, is likely to boost the market growth, for instance, as per a study conducted by the Centers for Diseases Control and Prevention (CDC) in June 2022, 37.3 million Americans have diabetes, approximating 11.3% of the total population.

Increasing ophthalmic disease burden, high unmet medical needs in emerging economies, and increased public and private healthcare expenditure to improve vision care practices are expected to fuel the demand further. Moreover, the rising demand for early and accurate detection methods is expected to propel market growth in the coming years.

Electronic Health Record (EHR) and Electronic Medical Record (EMR) systems provide complete and accurate information to healthcare service providers, helping improve diagnosis and reducing medical errors. Thus, government organizations taking initiatives to encourage the adoption of EHR and EMR will further fuel the usage of ophthalmic picture archiving and communication systems (PACS).

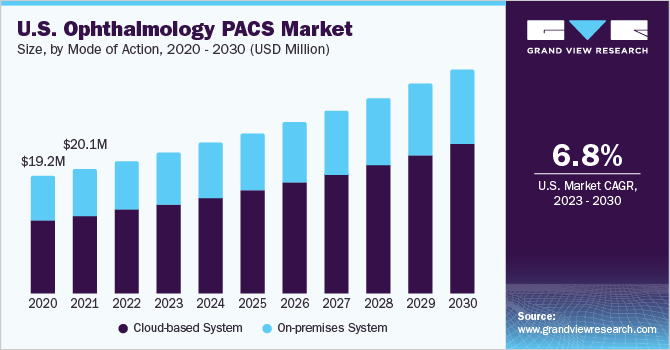

Mode of Action Insights

The cloud-based system segment is anticipated to register the highest CAGR during the forecast period. The cloud-based systems allow physicians to access medical records at any time and from anywhere. Thus, healthcare providers worldwide are now using these systems for distributing images, delivering reports, imaging studies, and providing redundant data storage.

In addition, companies are focusing on merger and acquisition activities to deliver novel product lines. For instance, in April 2018, Topcon Healthcare Solutions, a subsidiary of Topcon Corporation, acquired KIDE Systems, a Finland-based company. Through this acquisition, Topcon added KIDE OPTOFLOW, a cloud-based ophthalmic solution to its portfolio.

End-use Insights

The hospitals segment dominated the market in 2022 and is expected to grow at a rapid rate over the forecast period owing to the government initiatives to increase the adoption of systems in hospitals in developed & developing economies. According to The Office of National Coordinator for Health Information Technology (ONC), approximately 78% of office-based physicians and 96% of non-federal acute care hospitals have adopted a certified EHR.

The new product launches and mergers & acquisitions in the market are further expected to fuel the market growth. In July 2021, Topcon Corporation announced the acquisition of VISIA Imaging S.r.l with the aim to increase the synergies between the companies to create better ophthalmic solutions by expanding and strengthening Topcon Corporation’s portfolio.

Type Insights

The integrated systems segment held the largest revenue share of 58.3% in 2022 and is expected to grow at the fastest CAGR of 7.6% over the forecast period. These systems integrate clinical applications, such as data integration, functional integration, context integration, and presentation integration. Thus, the systems used with diagnostic devices allow physicians to review patient reports and diagnosis outcomes from anywhere and anytime.

Technological and product advancements in the segment will further boost growth in the near future. For instance, in November 2015, Heidelberg Engineering launched the SPECTRALIS glaucoma and retina imaging platform. Features offered by integrated systems, such as easy interpretability, good user interface, data portability, security, cost-effectiveness, and ease of deployment, will further fuel demand for this segment in the near future.

In August 2020, Topcon Healthcare announced the launch of Aladdin-M, which combines corneal topography, optical biometry, and pupillometry in the U.S. The product is convenient to use and is expected to assist in combating the global myopia epidemic. The launch of such products is expected to add to the market growth.

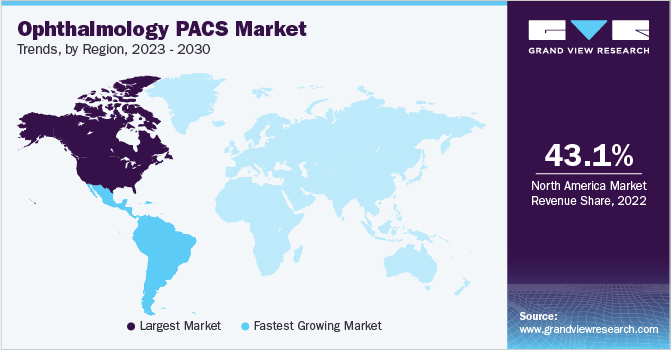

Regional Insights

North America led the overall market in 2022 with a revenue share of 43.1%, owing to the presence of well-developed healthcare infrastructure, government funding, and high public and private expenditure in the healthcare sector. The rising ophthalmic disease burden is expected to further fuel the region’s growth. According to a study by the National Institutes of Health (NIH), in 2014, the annual economic burden of eye disease, vision loss, and other disorders was around USD 139 billion in the U.S. According to Cleveland Clinic, approximately 3.4 million adults above age 40 in the U.S. are legally blind.

Latin America is expected to be the fastest-growing region, with a CAGR of 8.2% over the forecast period. Increasing awareness regarding various diseases and treatments coupled with government initiatives to encourage development in the health infrastructure is likely to boost the growth in this region. According to a study published in the National Library of Medicine in November 2022, approximately 82% of health facilities in Brazil had adopted electronic systems for recording information by 2019.

Asia Pacific is expected to register significant growth during the forecast period. The healthcare sector in this region is expected to witness lucrative growth owing to high budget allocation to improve healthcare outcomes, reduce disease burden, and address the high unmet clinical needs. Moreover, government initiatives encouraging the usage of EHR and EMR will further fuel market growth. For instance, ‘Electronic Health Records Standards and Guidelines’ set by the Indian government and The Digital India Healthcare initiatives have uplifted the adoption of EHR in the country.

Key Companies & Market Share Insights

The key companies focus on new product launches and M&A to deliver innovative product portfolios. For instance, in August 2015, IBM Corp. acquired Merge Healthcare. Through the acquisition, IBM combined Merge Healthcare’s medical imaging management platform with Watson’s cloud-based healthcare computing system to deliver an advanced portfolio in the market.

In April 2021, Carl Zeiss Meditec acquired two surgical equipment manufacturers, Kogent Surgical and Katalyst Surgical, to help scale the business and offer better surgical solutions, including for ophthalmic medical conditions.

Moreover, technological advancements and consistent system upgrades through R&D are other strategies adopted by these companies. For instance, in March 2016, ScImage Inc. launched the PicomSentry application that enables users to utilize PICOM365 PACS with plug-and-play convenience. PicomSentry enables the safe transfer and acquisition of DICOM and non-DICOM reports, HL7 messaging, and patient studies between Picom365 Cloud PACS. Some prominent players in the global ophthalmology PACS market include:

-

Carl Zeiss Meditec AG

-

Topcon Corporation

-

Heidelberg Engineering GmbH

-

Sonomed Escalon

-

Visbion

-

EyePACS, LLC

-

VersaSuite

-

Merge Healthcare Inc (IBM Watson Health)

-

ScImage, Inc.

Ophthalmology PACS Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 151.9 million

Revenue forecast in 2030

USD 248.6 million

Growth rate

CAGR of 7.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, mode of action, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Carl Zeiss Meditec AG; Topcon Corporation; Heidelberg Engineering GmbH; Sonomed Escalon; Visbion; EyePACS, LLC; VersaSuite; Merge Healthcare Inc. (IBM Watson Health); ScImage, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmology PACS Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global ophthalmology PACS market report based on type, mode of action, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone PACS

-

Integrated PACS

-

-

Mode of Action Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises System

-

Cloud-based System

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ophthalmology PACS market size was estimated at USD 142.1 million in 2022 and is expected to reach USD 151.9 million in 2023.

b. The global ophthalmology PACS market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 246.8 million by 2030.

b. North America dominated the ophthalmology PACS market with a share of over 43.0% in 2022. This is attributable to the presence of well-developed healthcare infrastructure, government funding, and high public and private expenditure in the healthcare sector.

b. Some key players operating in the ophthalmology pacs market include Carl Zeiss Meditec AG; Topcon Corp.; Merge Healthcare, Inc. (IBM Watson Health); Heidelberg Engineering GmbH; Visbion Ltd.; Sonomed Escalon; EyePACS, LLC; VersaSuite; and ScImage, Inc.

b. Key factors that are driving the ophthalmology pacs market growth include increasing adoption of teleophthalmology solutions, growth in Information Technology (IT) and its rising ophthalmology practice, prevalence of ophthalmic disease and increased public and private healthcare expenditure to improve the vision care practice.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."