- Home

- »

- Next Generation Technologies

- »

-

Optical Character Recognition Market Size Report, 2030GVR Report cover

![Optical Character Recognition Market Size, Share & Trends Report]()

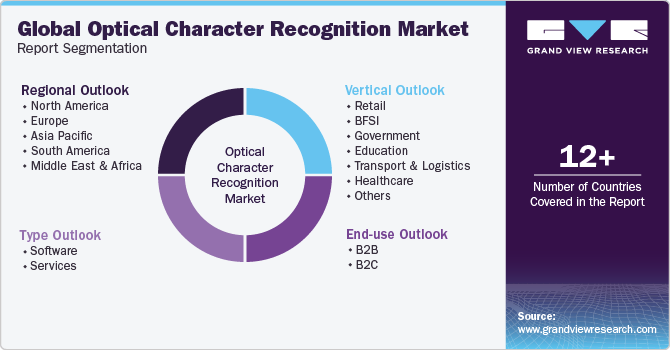

Optical Character Recognition Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Software, Services), By Vertical (BFSI, Retail, Transport And Logistics), By End-use (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-210-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Optical Character Recognition Market Summary

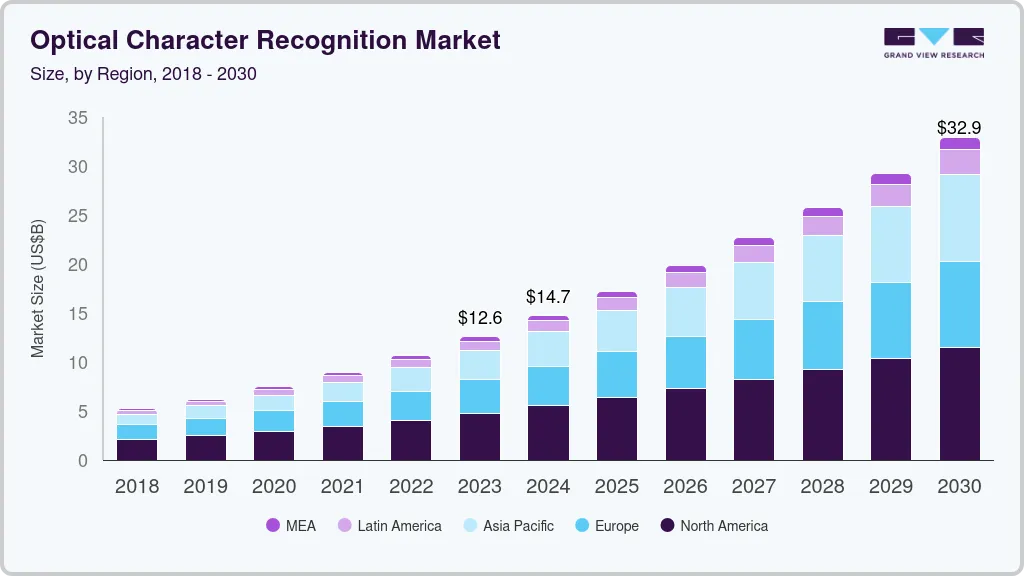

The global optical character recognition market size was estimated at USD 10.62 billion in 2022 and is projected to reach USD 32.90 billion by 2030, growing at a CAGR of 14.8% from 2024 to 2030. Optical character recognition (OCR) technology converts printed and physical documents into machine-readable texts.

Key Market Trends & Insights

- North America dominated the market in 2022, accounting for over 37% share of the global revenue.

- Asia Pacific is expected to exhibit the highest CAGR in the forecast period.

- By type, the software segment led the market in 2022, accounting for above 81% share of the global revenue.

- By vertical, the BFSI segment led the market in 2022, accounting for above 19% share of the global revenue.

- By end-use, the B2B segment led the market in 2022, accounting for over 78% share of the global revenue

Market Size & Forecast

- 2022 Market Size: USD 10.62 Billion

- 2030 Projected Market Size: USD 32.90 Billion

- CAGR (2024-2030): 14.8%

- North America: Largest market in 2023

It extracts scanned papers, image-only pdfs, and camera images and repurposes them. OCR software extracts letters from images and translates them into words and then sentences, allowing access to alter the original text. BFSI, healthcare, retail, tourism, logistics, transportation industry, government, manufacturing, and other sectors also have wide adoption for OCR technology. The OCR market growth is primarily driven by improvement in productivity and a rise in the penetration of automatic content recognition systems. For instance, in July 2022, DataPost Pte. Ltd., a global player in data security and automation, announced the launch of DataVio, a cloud-based solution. The new solution uses optical character recognition (OCR) technology, enabling data to be extracted from written or printed text from an image or a scanned document. DataVio helps businesses to automate the extraction and processing of data from documents.

Digitalization in business organizations has made all processes faster and more accessible. As companies witness technological advancements, data is becoming a critical element for growth. When data is converted to digital form, it can be processed by computers and various devices with computing capacity, and this data is easy to share, access, and store. Companies established before digitalization became a norm in the enterprise sector have also started using tools, such as optical character recognition (ocr) software, to convert their physical data into digital form. The technology also finds increasing application in BFSI and the healthcare sectors for creating digital copies of checks, invoices, and other documents. For instance, in February 2022, Alfa-Bank, Russia's largest private bank incorporated Smart Engines, a software development company's computer-vision document scanning capabilities into its mobile banking application. The app enables users to update their ID documents remotely, eliminating the necessity to visit an office to perform the task.

The OCR technology is also being widely used for converting information available in text form into speech with the help of text-to-speech technologies, thus making it accessible to blind and visually impaired individuals. Other applications of the technology include sorting out letters at post offices and documents in law firms and courts, preserving historical and cultural texts, personal identification, and processing invoices, orders, and other documents. For instance, in May 2022, OCR Canada, a provider of automated identification data capture products and services, announced the acquisition of Day 2 Mobility Inc., a telecommunications company. Clients will still experience the benefits of a single point of connection with telecom carriers, policy development, and the finest support services.

Numerous benefits of optical character recognition technology have helped companies save time spent on entering data manually in computers, enhancing work management, reducing the cost of converting documents into digital form, and reducing manual errors, among others. It also offers other benefits such as improved customer service and increased document security, significantly propelling demand across industries, including BFSI and retail. Increased focus of cognitive solution developers on integrating advanced technologies to improve accuracy is also expected to significantly drive market growth in the near future. For instance, Envision, a smartphone app that helps blind and low-vision users, introduced AI-powered smart glasses helping visually impaired and blind users to have hands-free access and make everyday life more accessible. These smart glasses will have optical character recognition capability.

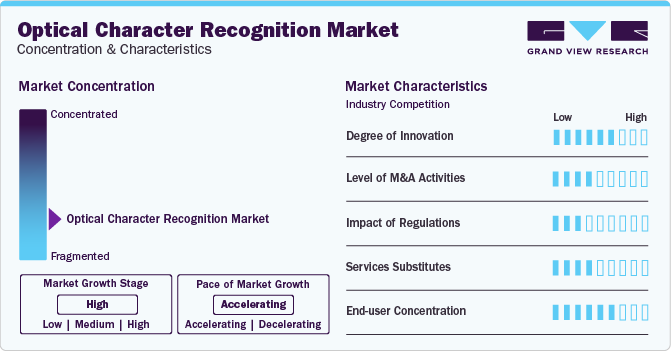

Market Concentration & Characteristics

The degree of innovation for optical character recognition technology is expected to grow considerably over the forecast period owing to the rising integration of machine learning and artificial intelligence with the OCR systems to process and interpret large volumes of data. Additionally, these technologies have enabled OCR systems to adapt and learn new fonts, layouts, and styles, thereby making them more versatile for business use cases.

The merger and acquisition (M&A) activities in the global optical character recognition market are considered at a moderate level of the industry's rapid evolution. Several prominent players have managed to develop in-house advanced technical capabilities which enable them to maintain their significant share in the competitive market. However, with the emergence of artificial intelligence and advanced data analytics tools coupled with a rising inclination of enterprises on cloud and edge computing-based platforms, the key players are expected to make strategic decisions on acquiring or merging with emerging companies with advanced capabilities.

The growing concerns for data security and the rising focus of government authorities on implementing stricter regulations have been observed as challenging factors limiting market growth. However, the growing prevalence of cybersecurity and advanced software 2.0 platforms that foster data security is expected to overcome this challenge over the forecast period. Thus, the impact of regulations is estimated to be on the lower side as compared to the industry’s rapid growth.

The optical character recognition technology has moderate chances of a substitute technology to take over. However, increasing developments in Generative AI and multi-modal AI technologies that provide seamless data interpretation facilities are poised to enable software providers to focus more on increasing such applications.

The end-user concentration is estimated to be at a moderate level, considering the rising number of industry-specific applications in the optical character recognition market. The end-user concentration is expected to expand across several verticals in the coming years due to the growing prevalence of the technology in daily business processes.

Type Insights

The software segment led the market in 2022, accounting for above 81% share of the global revenue. The OCR software segment can be divided into desktop-based OCR, cloud-based OCR, mobile-based OCR, and others. The growing need to digitize and reduce the dependence on physical documents to save cost, energy, and time has aided the expansion of the software segment. Further, the market has grown due to the increased adoption of augmented reality in platforms like healthcare, BFSI, and retail. For instance, in February 2022, nRoad, a U.S.-based company, launched its new product Convus, an AI OCR platform for organizations to overcome the challenges of extracting from unstructured data, such as photos, audio, videos, and text-based documents. This partnership would let Smart Engine deliver high-end document recognition, increasing form-filling productivity by automatically retrieving data from documents. It also includes next-generation biometric passports with smart engine identification scanning and Green Engine Technology.

The services segment is expected to exhibit the highest CAGR in the forecast period. Business owners outsource their data extraction services to get synthesized information and utilize it for better decision-making. There are numerous companies offering outsourcing services for optical character recognition operations. For instance, Data entry Inc. offers OCR cleanup services with a wide range of outsourcing OCR services, such as OCR bulk volumes, OCR database cleanup, OCR data conversion cleanup, and OCR error control. For instance, in February 2022, nRoad, a U.S.-based company, launched its new product Convus, an OCR AI-enabled platform for organizations to overcome the challenges of extracting from unstructured data, such as photos, audio, videos, and text-based documents. Other implications of this tool include searching regulatory and legal documents for investments, reducing fraud risk during the loan process, intelligent contract verification, and detecting violations in the contract.

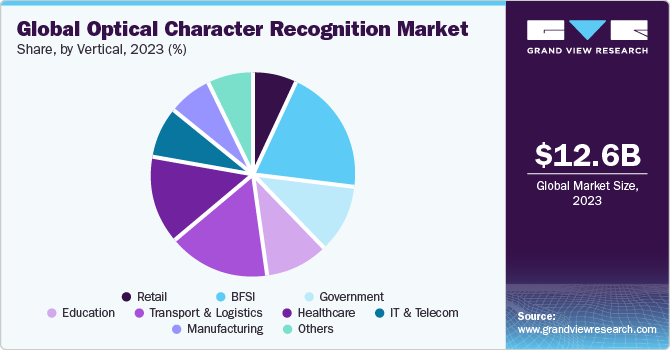

Vertical Insights

The BFSI segment led the market in 2022, accounting for above 19% share of the global revenue. The growth can be attributed to the use of OCR, optimizing performance, and automating time-consuming operations for financial services, it helps in document scanning, credit card scanning, data entry to transform all the data into a format that a computer can recognize and understand. For instance, Appzillon, i-exceeds low code digital platform, provides digital banking solutions for banks and financial institutions. For another instance, Citigroup. Inc., U.S.-based banking and financial services corporation, uses Appzillon's banking solution to improve its process efficiency in corporate banking solutions. It simplifies and enhances the customer experience with its rich user experience with new advancements in the digital platform.

The transport & logistics segment is expected to showcase lucrative growth over the forecast period. OCR helps the transport & logistics industry to enable machine-readable data capturing and boost paperless productivity. The transport & logistics industry leverages OCR solutions in multiple ways, such as automating transport order processing, transport document recognition, and saving time by digitizing the expedition process. Character recognition is anticipated to continue finding applications across various industries in the near future. For another instance, in the travel industry, OCR helps in data storage and security purpose, thereby scanning the passport to save personal data while booking tickets. Rather than noting it down physically, OCR makes the work easy by reducing costs. Besides, Rossum. AI-powered OCR uses OCR machine learning and AI to capture data. It recognizes the invoices and allows the account payable professionals to liberate themselves from the monotonous grind of manually extracting invoices.

End-use Insights

The B2B segment led the market in 2022, accounting for over 78% share of the global revenue. The B2B segment is anticipated to witness substantial growth over the forecasted period. The growth is attributed to various businesses' adoption of software solutions to combine optical recognition technology with intelligent features to allow customers to extract data from archived forms. It will enable companies to organize their data digitally and make it usable and accessible. In addition, it eliminates the manual data entry process. For instance, in October 2021, Tata CLiQ., a Tata Groups e-commerce platform, uses Adobe to scale its business and offer a personalized shopping digital experience in its mobile application and website.

The B2C segment is expected to showcase moderate growth over the forecast period. Business organizations are using OCR for information retrieval using searchable PDF format. Such software allows the conversion of image-only PDF files and paper documents into searchable files, including an invisible overlay containing searchable text to the scanned bitmap image of the paper document. It enables using a digital file system as a searchable database to find names, phrases, and keywords to help locate the information needed. Furthermore, government firms and officials use OCR solutions to scan legal documents, including driver’s licenses, insurance certificates, passports, and vehicle number plates.

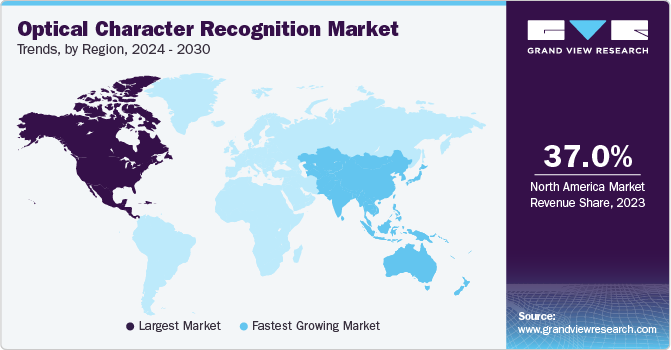

Regional Insights

North America dominated the market in 2022, accounting for over 38% share of the global revenue. This can be attributed to the presence of leading market players in the U.S. and the early adoption of new technology in businesses, contributing to the region’s dominance. For instance, in October 2021, AlphaSense Inc., a U.S.-based market intelligence company, raised a Series C funding round of USD 180 Million, bringing its total funding to USD 263 Million. Besides, in July 2021, CognitiveScale, an AI-powered digital system, released its latest technology, a Cortex Fabric 6, a low code developer platform for transformation, automation, and augmentation of digital experiences. This technology would enable businesses to build reliable AI applications more affordable and faster.

Asia Pacific is expected to exhibit the highest CAGR in the forecast period. The growth can be attributed to the significantly increasing investments in AI and related technologies. The growing technology industry in the emerging economies of Asia Pacific is particularly promoting the adoption of solutions with OCR capabilities. For instance, in January 2022, Axera Tech, a Chinese AI startup, has closed its Series A++ funding round worth USD 125.9 million to expand its business and develop AI vision processor chips. The company’s core product is widely used for smart retail, smart cities, smart homes, and smart communities. Besides, in January 2022, AIMMO., a Korean AI startup, has raised a Series A funding round worth USD 12 million to advance its technology and expand its business globally towards data labeling. The company is mainly focusing on autonomous driving and smart city.

Key Companies & Market Share Insights

Vendors in the OCR market are integrating their capabilities and delivering advanced software within the hardware and software to enable OCR across business boundaries and meet the need. Besides, vendors are implementing partnerships, mergers, and acquisitions to compete in the market effectively. For instance, in December 2021,Adobe, one of the OCR market leaders and a computer software company, partnered with Microsoft, a U.S.-based tech giant. This partnership will help enterprises enable their customer experience with Microsoft Azure, Adobe Experience Cloud, and Microsoft Dynamics. Further, in April 2021, Microsoft acquired Nuance Communications, an AI and speech recognition-based company, and this acquisition would increase the presence of Microsoft cloud for healthcare. Some of the prominent players in the global optical character recognition market include:

Key Optical Character Recognition Companies:

- ABBYY

- Adobe

- Anyline GmbH

- ATAPY Software

- Captricity Inc.

- Creaceed S.P.R.L.

- CVISION Technologies, Inc.

- Exper-OCR, Inc.

- Google LLC

- International Business Machines Corporation

- IntSig Information Co., Ltd. Corporation

- IRIS S.A.

- LEAD Technologies, Inc.

- Microsoft

- NAVER Corp.

- Nuance Communications, Inc.

- Open Text Corporation

Recent Development

-

In December 2023, Citi, a financial services company, collaborated with Traydstream, a trade documentation solution provider, to offer its clients access to automated trade document processing features as Traydstream modular technology leverages AI and OCR capabilities to their offerings that provide seamless customer experience.

-

In September 2023, Landing AI, a computer vision platform provider, launched Landing AI App Space, an advanced repository of use cases and applications to assist software developers in creating their own Landing AI-based applications. Moreover, with this App Space, users would be able to build applications using OCR capabilities linked with the Landing AI’s platform.

-

In May 2023, ABBYY announced a strategic partnership with Pipefy to deliver an integrated solution that fast-tracks digital transformation initiatives in various industries, including financial services, people operations, and insurance.ABBYY's OCR technology was integrated with Pipefy's process automation capabilities to offer an influential solution that optimizes workflows and processes.

Optical Character Recognition Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.56 billion

Revenue forecast in 2030

USD 32.90 billion

Growth rate

CAGR of 14.8% from 2023 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, vertical, end-use, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

ABBYY; Adobe; Anyline GmbH; ATAPY Software; Captricity Inc.; Creaceed S.P.R.L.; CVISION Technologies, Inc.; Exper-OCR, Inc.; Google LLC; International Business Machines Corporation; IntSig Information Co., Ltd. Corporation; IRIS S.A.; LEAD Technologies, Inc.; Microsoft; NAVER Corp.; Nuance Communications, Inc.; Open Text Corporation.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Optical Character Recognition Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global optical character recognition market report based on type, vertical, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Desktop-based OCR

-

Mobile-based OCR

-

Cloud-based OCR

-

Private

-

Public

-

-

Others

-

-

Services

-

Consulting

-

Outsourcing

-

Implementation & Integration

-

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

BFSI

-

Government

-

Education

-

Transport And Logistics

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

B2B

-

B2C

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global optical character recognition market size was valued at USD 10.62 billion in 2022 and is expected to reach USD 12.56 billion by 2023.

b. The global optical character recognition is expected to grow at a compound annual growth rate (CAGR) of 14.8% from 2023 to 2030 to reach USD 32.90 billion by 2030.

b. North America dominated the optical character recognition market in 2022, accounting for a 38.3% share of global revenue.

b. The prominent players in the OCR market are ABBYY; Adobe; Anyline GmbH; ATAPY Software; Captricity Inc.; Creaceed S.P.R.L.; CVISION Technologies, Inc.; Exper-OCR, Inc.; Google LLC; International Business Machines Corporation; IntSig Information Co., Ltd. Corporation; IRIS S.A.; LEAD Technologies, Inc.; Microsoft; NAVER Corp.; Nuance Communications, Inc.; and Open Text Corporation.

b. Key factors that are driving the OCR market growth include improvement in productivity and a rise in the penetration of automatic recognition systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.