- Home

- »

- Medical Devices

- »

-

Oral Care Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Oral Care Market Size, Share & Trends Report]()

Oral Care Market Size, Share & Trends Analysis Report, By Product (Toothbrush, Toothpaste, Mouthwash/Rinse, Denture Products, Dental Accessories), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-478-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Oral Care Market Size & Trends

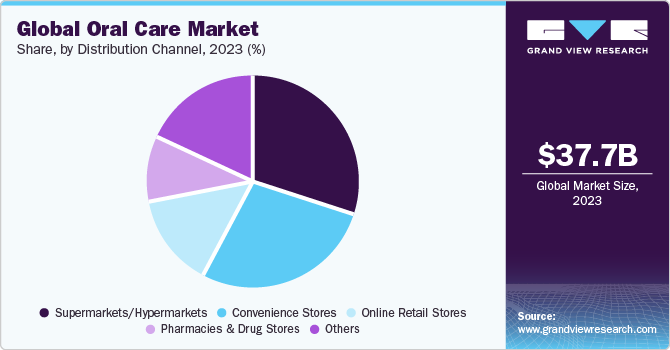

The global oral care market size was estimated at USD 37.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030. Some of the key factors driving the market growth are the increasing prevalence of dental diseases, the ageing population susceptible to dental caries, unhealthy food habits, and product innovation. For instance, the WHO 2022 report projected that oral diseases affect close to 3.5 billion people globally.

The COVID-19 pandemic, which is now endemic in major regions, had a significant impact on the market. The initial impact of the onset of lockdowns across major countries presented challenges in the global market. For instance, in May 2020, Colgate-Palmolive announced that they faced production challenges due to lockdowns imposed by the Government of India. Furthermore, Johnson & Johnson reported that its Listerine mouthwash sales rose by nearly 10.8% in the second quarter, reflecting a positive COVID impact.

The rising prevalence of dental caries is a key driver for the market. According to the Journal of the American Dental Association, in April 2022, more than 20% of U.S. adults had untreated dental caries. This study's results were representative of 193.5 million adults in the U.S. Consequently, the study highlighted that prevalence of oral caries was significantly higher in adults suffering from poverty or had an income deficit. Additionally, the WHO Global Oral Health Report published in 2022 highlighted that nearly 3.5 billion people across the world suffer from oral diseases, of which 75% are living in middle-and-low-income countries.

Product innovation in the global market is expected to sustain growth throughout the forecast period. For instance, in August 2023, Water Pik, Inc. launched a Sensonic electric brush, which had specially designed bristles to cohesively brush tooth surfaces. Moreover, the product has a rechargeable battery that can last for at least four weeks. Furthermore, in October 2023, BURST Oral Care launched two products, Pro Sonic Toothbrush and Curve Sonic Toothbrush. The product includes features such as a high-end LED screen, responsive software, and a rechargeable battery. In addition, this product was designed with the help of professional dentists.

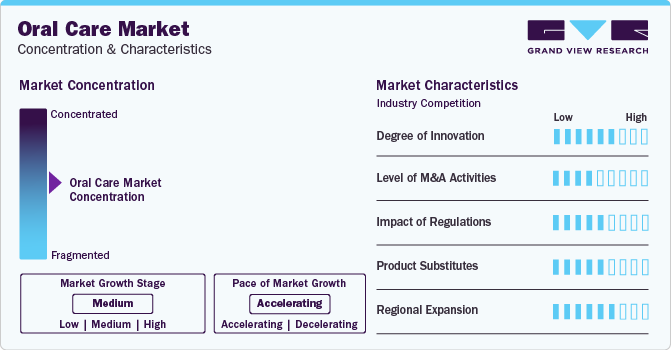

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to rapid product advancements. For instance, in January 2024, Oclean X Ultra was announced at the CES 2024 tradeshow. The product features a Maglex motor which has a PowerClean algorithm capable of providing 84,000 movements per minute. In addition, the product provides real-time feedback on brushing techniques to reduce dental caries and other issues.

The market is also characterized by a moderate level of merger and acquisition (M&A) activity undertaken by the leading players. This is due to several factors, the rising focus on increasing the company’s products portfolio, the need to consolidate in a rapidly growing market, and the increasing strategic importance of oral care. Several companies are undertaking this strategy to strengthen their portfolio. For instance, in December 2023, Bruush Oral Care Inc. & Arrive Technology Inc. announced a merger to advance and implement the latter’s capabilities in a mailbox-as-a-service platform to facilitate the exchange of goods and services.

The market is also subject to increasing regulatory scrutiny. Several regulatory and government authorities are focusing on establishing guidelines for the safety of topical applications in dental use. For instance, Subchapter D-Drugs for Human Use, within which PART 355 covers anticaries drug products for over-the-counter human use such as toothpaste, mouthwash, and others.

Several companies are expanding their market share. Thus, product expansion in this industry is significant. Companies are including product launches that are safe to swallow and improve oral microbiome health. For instance, in November 2023, Designs for Health, Inc. launched PerioBiotic Silver, a toothpaste with ingredients such as purified silver, coenzyme-Q10 (CoQ10), grape seed extract, and Dental-Lac. Dental-Lac is a lactobacillus ingredient that supports oral microbiome and periodontal health.

Product Insights

Based on product, the toothbrush segment held the market with the largest revenue share of 25.4% in 2023. Manual toothbrushes are the traditional products; however, the introduction of innovative products, such as electric toothbrushes, has increased their adoption. Advanced features, such as rapid and automatic bristle motions, have resulted in a higher adoption of electric toothbrushes. For instance, In January 2024, Laifen Tech launched Laifen Wave Electric Toothbrushes that work on its proprietary technology, Laifen Wave, which provides 3x higher-brushing efficiency.

The toothbrush segment is expected to register the fastest CAGR over the forecast period. The growing adoption of electric and battery-powered toothbrushes is expected to deliver significant growth in the segment. Leading companies are developing an advanced range of manual as well as powered toothbrushes for both adults and children which is expected to drive growth. For instance, in November 2022, quip launched a rechargeable electric toothbrush that can retain its battery for up to three months. Furthermore, the launch of new-age toothpaste in the market is one of the key market trends. Labelling claims such as ethical labelling techniques and cruelty-free vegan ingredients are gaining immense market traction.

Distribution Channel Insights

Based on distribution channel, the supermarkets/hypermarkets segment held the largest market share in 2023. This is due to the wide availability of supermarkets and hypermarkets across the globe. In addition, these stores offer a range of bulk discounts that reduce the cost-pressure on retail stores and consumers. Moreover, these stores are often run by corporations and institutions with immense capital, which drives growth and allows for rapid expansion. For instance, in January 2024, Lidl, a German supermarket chain, announced to open of a store in Queens, New York. By this opening, Lidl achieved its 174th store in the U.S.

The online retail segment is projected to register the fastest CAGR during the forecast period. Key companies such as Walmart, Amazon, Flipkart, and others often give deep discounts on oral care products that drive market growth. In addition, small-scale retailers often depend on online sales and discounts, which further augments their growth. According to an article by Elsevier B.V., in 2023, online shoppers had a higher frequency of shopping than their in-store counterparts. Furthermore, in August 2023, Zepto, an online direct-to-consumer brand in India, raised USD 200 million to expand its geographic reach.

Regional Insights

The Asia Pacific dominated the market with the revenue share of a 40.7% in 2023 and is anticipated to grow at a significant CAGR over the forecast period. This high share is attributable to its large population, which propels the demand for basic oral care products. According to an article by the United Nations Population Fund in July 2022, Asia-Pacific houses more than half of the global population. Two key countries in the region, India and China are two economies with each more than a billion population. Furthermore, product innovation and acceptance of novel products are expected to have a positive impact on the market. For instance, in March 2023, Dabur India launched its charcoal toothpaste range, with its marketing campaign targeted towards millennials and Gen Z.

The China market is expected to grow at the fastest CAGR over the forecast period, due to growing awareness of oral health in the younger generation and government policies to promote good health. The Healthy China 2030 Blueprint was launched, which underlined the importance of developing comprehensive oral care hygiene in the local population.

The Japan market is expected to grow at the fastest CAGR over the forecast period, due to rapidly growing aging population susceptible to dental diseases. According to a news article in September 2023, 29.1% of 125 million population in the country is aged over 65.

The India market is expected to grow at the fastest CAGR over the forecast period, due to growing adoption of oral healthcare practices and initiatives undertaken by the government to improve dental hygiene. For instance, in March 2023, the National Oral Health Program was launched to prevent-control-and manage the oral disease burden in India.

The Thailand market is expected to grow at the fastest CAGR over the forecast period, due to the growing healthcare coverage and strategic initiatives undertaken by key players. For instance, in April 2022, Colgate partnered with Shopee in Thailand, Vietnam, and other Southeast Asian countries to increase its technologically advanced oral care product footprint.

North America dominated the market with the largest revenue share in 2023 and it is expected to witness significant CAGR over the forecast period. Some of the key factors driving market growth are increasing oral health awareness, rising trends of dental aesthetics, innovation in product formulations, and growing prominence of preventive healthcare practices through dental care programs. According to the Government of Canada’s article in January 2024, the Canadian Dental Care Plan (CDCP) is expected to ease the financial barriers to access oral healthcare in residents with annual adjusted income of less than CAD 9,000 or who do not have access to dental insurance.

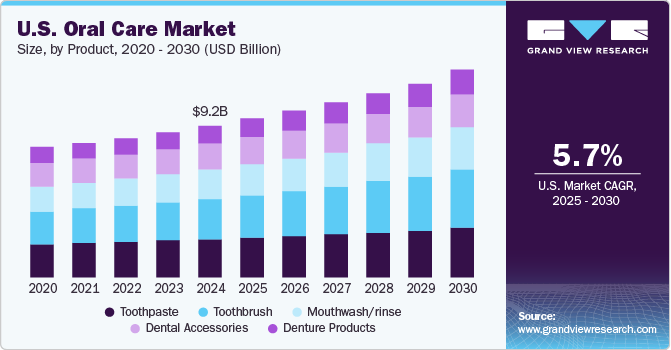

The U.S. market. is expected to grow at the fastest CAGR over the forecast period, due to growing awareness related to preventing dental diseases and an increasing number of product innovations. For instance, in January 2023, the Y-Brush was launched in the U.S. with adult and kid options. Moreover, the product was developed in four years with a team of dentists to meet the recommended brushing standards.

The UK market is expected to grow at the fastest CAGR over the forecast period, due to a growing aging population susceptible to dental diseases. According to the Great British Oral Health Report in 2022, nearly half of the country’s population showcased gum diseases.

The France market is expected to grow at the fastest CAGR over the forecast period, due to heightened consumer awareness around dental hygiene. Moreover, growing product innovation and acceptability towards electric toothbrushes and natural oral care products is expected to have a positive impact on market growth.

The Germany market is expected to grow at the fastest CAGR over the forecast period, due to a developed and well-regulated dental services industry. According to a report, the country has nearly 80,000 licensed dentists, and both public and private healthcare insurance plans primarily cover dental care.

The Saudi Arabia market is expected to grow at the fastest CAGR over the forecast period, due to an increasing burden of oral diseases, an aging population susceptible to gum issues, and technological advancements. According to a report from the United Nations, the country’s geriatric population is expected to increase five-fold between 2020 to 2050, to reach 10.5 million by 2050.

The Kuwait market is expected to grow at the fastest CAGR over the forecast period, due to a growing e-commerce industry in the country, allowing new-age companies to market their oral care range. Furthermore, the growing number of internet users in the country is expected to drive growth. For instance, in 2022, the country had more than four million active internet users.

Key Oral Care Company Insights

Some of the key players operating in the market include Colgate-Palmolive Company, GSK plc., Procter and Gamble, and Johnson & Johnson Services, Inc.

-

Colgate-Palmolive Company specializes in personal care, oral care, home care, and pet nutrition products. Some of the brands offered by the company are Colgate, Palmolive, Softsoap, Mennen, Protex, Kolynos, Irish Spring, Sorriso, Elmex, Ajax, Tom’s of Maine, Axion, Hill’s Science Diet, Suavitel, Soupline, and Hill’s Prescription Diet. The company operates in more than 75 countries, and its products are sold in over 200 countries and territories

-

GSK plc offers nutrition, oral care, skin health, and wellness products. The company has a presence in 115 countries worldwide. The company markets one of the leading product lines of oral care, i.e., Sensodyne. However, in July 2022, GSK exited the consumer healthcare business and founded an independent company, Haleon plc, to manage the portfolio of oral care products, amongst others

Ojook, and Burst are some of the emerging market participants in the market.

-

Ojook is a new-age company with its signature product, a toothpaste from nano-hydroxyapatite (nHA) and bamboo salt. It is marketed as a natural treatment for mouth sores and gum inflammation

-

Burst provides several oral care products for brushing, flossing, whitening, and wellness. The company adopts an omnichannel distribution approach while partnering with influencers to increase its product penetration

Key Oral Care Companies:

The following are the leading companies in the oral care market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these oral care companies are analyzed to map the supply network.

- Colgate-Palmolive Company

- GSK plc

- Johnson & Johnson Services, Inc

- Church & Dwight Co., Inc.

- Procter & Gamble

- Unilever PLC

- GC Corporation

- Lion Corporation

- Henkel AG & Co. KGaA

- Sunstar Suisse S.A.

Recent Developments

-

In November 2023, Lion Corporation launched its new toothpaste range, Dent Health Medicated Toothpaste DX. The toothpaste prevents periodontal diseases and cavities, thus addressing key reasons for tooth loss

-

In September 2023, Lion Corporation launched a range of CLINICA PRO Toothbrush Rubber Heads. The range features rubbery bristles and is available in soft and medium bristle power

-

In August 2023, Brushee, a new-age player in the global market, launched a 3-in-1 product that features a toothbrush, pick, and dental floss, facilitating consumer oral health while travelling

Oral Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 39.9 billion

Revenue forecast in 2030

USD 58.9 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Colgate-Palmolive Company; GSK plc; Johnson & Johnson Services, Inc; Church & Dwight Co., Inc.; Procter & Gamble; Unilever PLC; GC Corporation; Lion Corporation; Henkel AG & Co; KGaA; and Sunstar Suisse S.A

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oral Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global oral care market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Toothbrush

-

Manual

-

Electric (Rechargeable)

-

Battery-powered (Non-rechargeable)

-

Others

-

-

Toothpaste

-

Gel

-

Polish

-

Paste

-

Powder

-

-

Mouthwash/Rinse

-

Medicated

-

Non-medicated

-

-

Denture Products

-

Cleaners

-

Fixatives

-

Floss

-

Others

-

-

Dental Accessories

-

Cosmetic Whitening Products

-

Fresh Breath Dental Chewing Gum

-

Tongue Scrapers

-

Fresh Breath Strips

-

Others

-

Oral Irrigators

-

Countertop

-

Cordless

-

-

Mouth Freshener Sprays

-

-

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Pharmacies and drug stores

-

Convenience Stores

-

Online retail stores

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. The global oral care market size was estimated at USD 37.7 billion in 2023 and is expected to reach USD 39.9 billion in 2024

b. The global oral care market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 58.9 billion by 2030

b. Asia Pacific dominated the oral care market with a share of 40.7% in 2023. This can be attributed to the rising population and growing awareness regarding dental hygiene among the people. In addition, the high prevalence of dental caries in countries such as India is expected to drive the market.

b. Some of the key players in the oral care market are Procter & Gamble Company; Johnson & Johnson Consumer, Inc.; Colgate-Palmolive; GlaxoSmithKline; Church & Dwight Co., Inc.; Dr. Fresh, LLC; Dentaid; Lion Corporation; and Sunstar Suisse S.A.

b. Key factors that are driving the oral care market growth include growing awareness about dental hygiene and the rising prevalence of dental caries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."