- Home

- »

- Medical Devices

- »

-

Oral Solid Dosage CDMO Market, Industry Report, 2033GVR Report cover

![Oral Solid Dosage CDMO Market Size, Share & Trends Report]()

Oral Solid Dosage CDMO Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Tablets, Capsules, Powder, Granules), By Mechanism, By Drug Potency, By Service, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-587-6

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oral Solid Dosage CDMO Market Summary

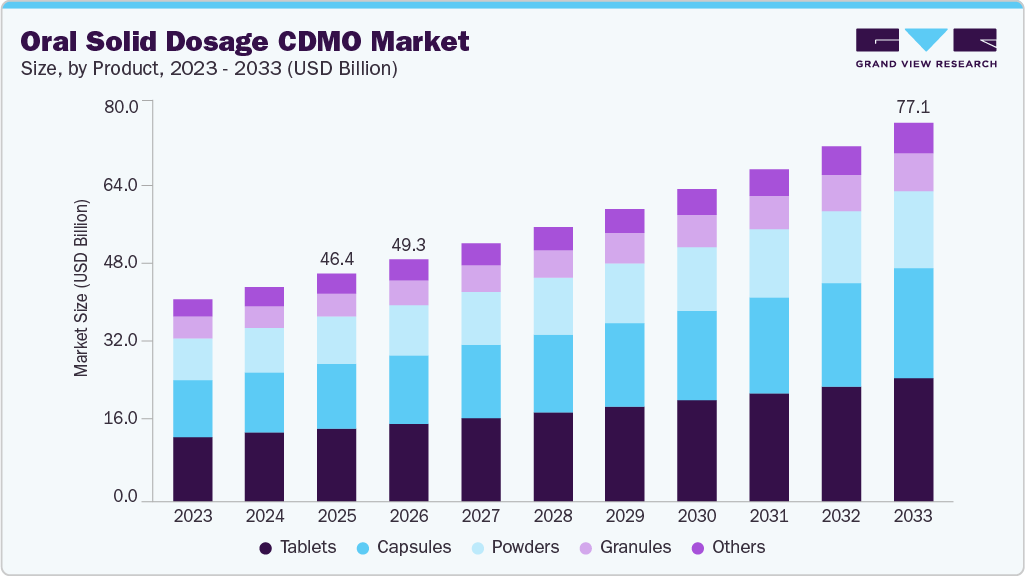

The global oral solid dosage CDMO market size was estimated at USD 46.37 billion in 2025 and is projected to reach USD 77.06 billion by 2033, growing at a CAGR of 6.58% from 2026 to 2033. The market growth is driven by a rising demand for cost-efficient drug development, increasing outsourcing by pharmaceutical and biotech companies, and growing consumption of tablets and capsules for chronic and lifestyle diseases, owing to ease of administration and precise dosage, which enhances the requirement for oral solid dosage CDMO services.

Key Market Trends & Insights

- The Asia Pacific oral solid dosage CDMO market held the largest share of 36.89% of the global market in 2024.

- The oral solid dosage CDMO in China is expected to grow significantly over the forecast period.

- Based on product, the tablet segment held the largest market share of 32.05% in 2024.

- Based on mechanism, controlled release segment held the highest market share in 2024.

- Based on service, contract development dominated with largest revenue share in 2024.

- Based on end use, the medium & small-sized companies segment held the highest market share in 2024 and is anticipated to witness the fastest growth over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 43.37 Billion

- 2033 Projected Market Size: USD 77.06 Billion

- CAGR (2025-2033): 6.58%

- Asia Pacific: Largest market in 2025

- Europe: Fastest growing market

Other factors contributing to market growth include the expansion of generic drugs, patent expiries, and the need for flexible manufacturing capacity. Most companies rely on CDMOs to access advanced formulation capabilities, scale up production efficiently, and meet stringent regulatory and quality requirements. In addition, technological advancement and increased reliance on CDMOs for end-to-end OSD development and manufacturing services are expected to drive the market.

The growing prevalence of chronic and infectious diseases is a significant factor driving the demand for novel therapies. In addition, the growing geriatric population is contributing to the rising incidence of chronic diseases, further supporting the demand for novel therapies. Another factor contributing to market growth is adverse drug reactions to existing drugs, which have increased the demand for novel treatment options.

Moreover, several solid dosage forms are currently available on the market due to ongoing advancements in drug delivery technology, rising investments by contract development and manufacturing organizations (CDMOs) to expand OSD development, and increasing demand for novel therapies, all of which further contribute to market growth.

Furthermore, technological advancements in the development and bulk manufacturing of OSD forms are among the key factors supporting the fast-track commercialization of these products. In addition, the pharmaceutical/biopharmaceutical & nutraceutical industries are focusing on developing OSD forms owing to their convenient consumption, ease of handling, and patient adherence. Moreover, advancements in technology and materials of OSD products are expected to boost the demand for these formulations. The requirement for patient-centric dosage forms has increased in the past few years to improve medication adherence. Thus, the integration of advanced technologies in facilities enables enhanced manufacturing and development capabilities with reduced costs and time.

3D printing in OSD manufacturing enables precise control over drug release and the creation of customized dosage forms, thereby addressing patient-specific needs. This technology supports complex designs, enhancing flexibility in drug development. Controlled-release advancements improve delivery, fostering sustained efficacy and compliance. Digital technologies and data analytics further streamline process monitoring and quality control, making CDMO solutions more transparent and data-driven, further supporting the market. Such factors are expected to drive the market.

Opportunity Analysis

The oral solid dosage (OSD) CDMO market presents robust growth opportunities driven by increasing outsourcing trends, cost pressures, and evolving formulation complexity in the pharmaceutical industry. OSD forms, including tablets and capsules, remain the most widely prescribed drug formats globally, accounting for over 50% of total pharmaceutical consumption. As pharmaceutical companies seek to streamline operations and focus on core competencies such as drug discovery and commercialization, they increasingly outsource manufacturing to CDMOs with specialized expertise in OSD technologies. This shift is further increased by growing demand for lifecycle management services, such as reformulation, modified-release profiles, fixed-dose combinations, and pediatric or geriatric dosage adaptations.

In addition, emerging markets in the Asia-Pacific and Latin America offer cost advantages and expanding regulatory capabilities, creating regional hubs for global supply chains. Furthermore, the increasing number of small and virtual biopharma companies, lacking in-house manufacturing infrastructure, has heightened the demand for comprehensive end-to-end CDMO partnerships. In addition, regulatory pressure in developed markets favors CDMOs with strong compliance track records and global GMP certifications. Technological advancements such as continuous manufacturing, high-potency containment, and 3D printing are unlocking new niches for innovation-focused CDMOs.

The generic and over-the-counter (OTC) further presents scalable opportunities, especially in high-volume markets like India, Brazil, and Eastern Europe. Amid rising drug shortages and geopolitical shifts, CDMOs that offer agility, dual-sourcing capabilities, and local-market supply solutions are gaining competitive traction. Looking forward, OSD-focused CDMOs that invest in flexible manufacturing lines, digital integration, and late-stage development services are well-positioned to capture long-term growth across both mature and emerging markets. Strategic collaborations, capacity expansion, and regulatory readiness will be key enablers for success in the evolving OSD CDMO landscape.

Technological Advancements

The OSD CDMO market is experiencing significant technological advancements, enhancing drug development and manufacturing processes. Continuous manufacturing has emerged as a pivotal innovation, enabling uninterrupted production flows that improve efficiency, consistency, and cost-effectiveness. This approach reduces transfer steps and contamination risks by integrating multiple unit operations into a single process. In addition, 3D printing technologies, particularly 3D screen printing, are revolutionizing personalized medicine by allowing precise control over drug composition and dosage, thereby facilitating the production of tailored medications tailored to individual patient needs.

Advanced drug delivery systems, such as Self-Microemulsifying Drug Delivery Systems (SMEDDS), are improving the bioavailability of poorly soluble drugs, enhancing therapeutic efficacy. Furthermore, the integration of digital tools, such as predictive modeling and automation platforms, accelerates formulation development, thereby reducing time and resource requirements. These digital advancements enable rapid optimization of tablet formulations, ensuring critical quality attributes are met efficiently.

Pricing Model Analysis

In the oral solid dosage CDMO industry, pricing models play a pivotal role in aligning client expectations with service delivery, risk-sharing, and long-term collaboration. Four key pricing structures commonly employed are milestone-based, value-based, fixed-fee, and subscription/retainer models. This pricing model offers strategic benefits that vary according to project complexity, client size, and engagement duration.

Milestone-based pricing is widely used for complex development or scale-up projects. Payments are linked to the achievement of defined technical or regulatory milestones, helping to mitigate risk for both CDMOs and sponsors. This model fosters accountability but can lead to negotiation complexity and extended timelines if milestone definitions are ambiguous. Value-based pricing is gaining traction as CDMOs aim to align compensation with the therapeutic or commercial value they help generate. This model ties pricing to improved bioavailability, faster time-to-market, or higher yields. It rewards innovation and performance but requires sophisticated metrics and trust between partners.

The fixed-fee model offers predictability, particularly for standardized tasks such as tablet compression or batch manufacturing. It simplifies sponsor budgeting and reduces administrative overhead, though it can disincentivize flexibility and innovation in long-term projects. The subscription or retainer model is emerging for clients seeking ongoing development or manufacturing support. This approach involves recurring monthly or quarterly fees, enabling steady resource allocation and long-term partnership. While beneficial for capacity planning, it may be less suitable for clients with sporadic or project-based needs.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating, characterized by an increasing number of M&A activities, the impact of regulations, service expansions, and regional expansions.

The oral solid dosage CDMO industry is characterized by a high degree of innovation driven by continuous advancements in manufacturing technology, such as 3D printing, process analytical technology (PAT, and machine learning. Moreover, market participants are focusing on developing novel solutions and methodologies to improve the efficiency and effectiveness of product development processes, including personalized medicine, advanced drug delivery systems, and novel solutions.

High impact of regulations on the oral solid dosage CDMO industry. The OSD CDMO market is highly influenced by regulatory requirements enforced by several regulatory authorities, such as the U.S. FDA and the EMA, among others. Stringent regulations regarding development and manufacturing standards, quality control, and documentation significantly impact overall market dynamics.

The medium level of M&A in the oral solid dosage CDMO industry is driven by the growing need for companies to expand their capabilities, geographic presence, and service offerings. For instance, in April 2023, NextPharma acquired a chewable tablets manufacturing facility from Takeda in Norway. This acquisition expanded the company’s operational capabilities in the market.

Several industry participants are undertaking collaborations and partnerships with pharmaceutical companies, research institutions, and technology providers to accelerate service expansions. For instance, in January 2023, Ethicann and Catalent collaborated for the development of Ethicann’s clinical drug pipeline by using Catalent’s ODT technology. Further, Investments in innovative technologies such as continuous manufacturing, automation, and data analytics enable CDMOs to offer better efficiency and cost-effective solutions to their clientele, thereby driving overall market growth.

The oral solid dosage CDMO industry is characterized by a medium impact of regional expansion driven by factors such as chronic disease burden, increasing healthcare expenditures, and high demand for OSD. Several service providers are broadening their presence in emerging markets such as the Asia Pacific and Latin America by establishing manufacturing and R&D facilities and strategic alliances with domestic players to gain market access and new revenue growth avenues.

Product Insights

In 2024, the tablet segment held the largest market share, accounting for a revenue share of 32.05%. The segment growth is driven by its broad applicability, diverse formulations, patient preference, and global acceptance. The growing integration of technological advancements, such as continuous manufacturing and 3D printing, among facilities is expected to enhance segment growth by improving the efficiency of overall manufacturing processes. Moreover, strategic initiatives by key players, such as capacity expansion, partnerships, and collaborations, are projected to fuel market growth in the near future. For instance, in April 2023, Thermo Fisher Scientific expanded the capabilities of its France site to incorporate early development activities for oral solid dose therapies, including tablets, capsules, and granules. This enabled the company to seamlessly cater to customers’ workflow, from the initial stages of drug development to commercial manufacturing.

On the other hand, the capsules segment is expected to grow at the fastest CAGR over the forecast period. The segment growth is driven by its advantages, such as easy swallowing, faster disintegration, taste masking, and improved absorption. Increased demand for encapsulated formulations, fueled by the growth of the global pharmaceutical sector, is driving the need for specialized CDMOs that efficiently deliver high-quality, customized hard gelatin capsules.

Mechanism Insights

In 2024, controlled release held the largest revenue share due to improved patient compliance, enhanced efficacy and safety, and reduced frequency of administration are some significant factors expected to drive the segment during the forecast period. Besides, a growing number of CDMOs and CMOs are now providing controlled-release oral solid dosage development and manufacturing services. This further supports meeting the rising chronic disease burden and is expected to fuel segmental growth. Furthermore, technological innovations in controlled-release mechanisms, such as multiparticulate systems and osmotic release, are also driving segment demand.

On the other hand, the immediate release segment is expected to grow at the fastest CAGR over the forecast period, driven by increasing demand for rapid drug absorption and the onset of action among patients, fueling segment growth. In addition, continuous advancements in formulation technologies and manufacturing processes offer CDMOs the opportunity to develop immediate-release drugs with enhanced bioavailability and therapeutic efficacy. Besides, the expanding pharmaceutical outsourcing trend and the outsourcing of immediate-release drug manufacturing by pharmaceutical companies to CDMOs are driving the growth of this market segment. Such factors are expected to drive the market growth over the estimated time period.

Drug Potency Insights

The low-potency drugs segment dominated the market in 2024. Increasing requirements for low-potency oral solid dosage manufacturing processes and growing innovation of new drugs drive this segment. These processes are relatively easier than highly potent or complex formulations. As a result, there is a consistently high demand for CDMOs specializing in producing low-potency oral solid dosage forms. The segment encompasses a wide range of therapeutic areas and patient populations. Besides, most CDMOs are focusing on offering cost-effective manufacturing solutions, further meeting the diverse needs of pharmaceutical companies. The broad applicability of low-potency oral solid dosage forms across various categories results in a diverse customer base for CDMOs specializing in this segment, further contributing to market growth.

On the other hand, the high-potency drugs segment is expected to witness the fastest growth over the forecast period. The increasing demand for oncology drugs is driven by the growing prevalence of cancer cases worldwide and the rising need for more targeted and personalized therapies. This has led pharmaceutical companies to focus on developing highly potent drugs to address unmet medical needs in oncology. This has led to a surge in outsourcing to specialized CDMOs with the expertise and infrastructure required for safe handling & production of these potent compounds, enabling expedited development & commercialization of innovative oncology therapies. For instance, in June 2023, a CDMO named Aenova opened a new facility for producing highly potent APIs in Germany, which enabled the company to increase its development and production capacities for cytostatics and cytotoxics to meet the growing market demand for these ingredients.

Service Insights

On the basis of the service segment, the contract development segment dominated the market in 2024. Segment growth is driven by increasing requirements for early-stage formulation, analytical method development, stability testing, and bioequivalence work, which necessitate highly specialized scientific expertise and advanced laboratory infrastructure; thus, many pharmaceutical companies prefer to outsource rather than build in-house capabilities. Regulatory requirements from agencies like the FDA and EMA (e.g., ICH M13 bioequivalence guidance for solid oral forms) further push drug sponsors to rely on experienced development partners to ensure compliance.

The contract manufacturing segment is expected to witness the fastest growth, driven by a growing pharmaceutical pipeline, expanding large-volume commercial production of tablets and capsules as more drugs progress beyond development. Besides, companies are increasingly outsourcing manufacturing to avoid high capital costs, gain supply-chain flexibility, and access specialized high-potency or continuous manufacturing technologies. Such factors are expected to drive the market growth.

End Use Insights

The medium & small-sized companies segment dominated the global market in 2024 and is anticipated to witness the fastest growth over the forecast period. The segment growth is attributed to the increasing number of small & medium-sized companies outsourcing their production work to CDMOs and CMOs. Medium and small-sized pharmaceutical companies have limited resources and capabilities in formulation development, process optimization, and manufacturing of oral solid dosage forms. Outsourcing allows them to access specialized expertise, advanced technologies, and state-of-the-art facilities offered by CDMOs without significant upfront investment. Increasing strategic initiatives by business players is another key factor contributing to segment growth. In August 2021, Recro Pharma, Inc., also known as Societal CDMO, acquired IRISYS, a U.S.-based CDMO involved in oral solid dosage contract development and manufacturing. This acquisition broadened the company’s business capabilities to cater to a diverse client base and financial position.

The large-sized companies segment is expected to witness the fastest growth, driven by an increasing number of large-sized companies outsourcing their production work to CDMOs and CMOs. Large pharmaceutical companies have numerous resources and capabilities in formulation development, process optimization, and the manufacturing of oral solid dosage forms. Outsourcing allows them to access specialized expertise, advanced technologies, and state-of-the-art facilities offered by CDMOs without significant upfront investment. By partnering with CDMOs, these companies can leverage variable cost structures, optimize resource utilization, & reduce overall operational expenses, enabling them to allocate resources more efficiently and focus on core business activities.

Regional Insights

North America is projected to register a significant CAGR during the forecast period. This growth can be attributed to growing investments in R&D of new drugs by pharmaceutical companies. The growth of the pharmaceutical industry in the U.S. and Canada is a key factor contributing to market growth. In addition, the substantial presence of key industry players and continuous clinical trials is anticipated to drive market growth. Moreover, within North America, the U.S. market held the largest share in the region. Increasing R&D investments, growing drug development costs, expensive raw ingredients, and a rising need for oral solid dosage products are driving numerous pharmaceutical entities in the U.S. to outsource key aspects of the drug development process. Such factors are expected to drive the market.

U.S. Oral Solid Dosage CDMO Market Trends

The oral solid dosage CDMO market in the U.S. is driven by rising demand for tablets and capsules, increasing prevalence of chronic diseases, and greater outsourcing by pharmaceutical companies to reduce operational costs. Besides, most of the CDMOs are benefiting from expanding generic drug production, the need for specialized formulation capabilities, and stricter quality standards that encourage reliance on expert partners, which is expected to drive the market growth. In addition, the growing need for tablet manufacturing, increasing focus on cost efficiency, and scalability are further contributing to market growth. Moreover, growing advancements in controlled-release technologies, continuous manufacturing, and flexible production capacity further support market expansion as drug developers seek reliable, compliant, and efficient OSD manufacturing solutions. Such factors are expected to drive the market.

Europe Oral Solid Dosage CDMO Market Trends

The oral solid dosage CDMO market in Europe is anticipated to experience significant growth due to the presence of key pharmaceutical companies. The country is driven by a robust pharmaceutical sector, comprising numerous companies engaged in drug discovery, development, and manufacturing. These CDMOs are investing in upgrading existing capabilities to meet the rising demand, divesting their business segments to increase focus on expanding their market reach within the region. Such factors are expected to drive the market.

Germany oral solid dosage CDMO market held the largest share in 2024. This market is driven by robust Technological advancements in pharmaceutical drug product development by CDMOs in the region, which is a significant factor responsible for market growth. The OSD CDMO industry significantly benefits from robust R&D initiatives, advanced early innovation medicine platforms, and numerous clinical trials targeting various disease challenges, which is expected to drive the market growth.

The oral solid dosage CDMO market in the UK is anticipated to grow over the forecast period. This growth is primarily due to the presence of numerous multinational CDMOs in the country. Moreover, the pharmaceutical manufacturers in the UK are focusing on the innovation of various high-value tablet forms in bulk, which has created a demand for oral solid dosage CDMOs in the country. Such factors are expected to drive the market growth.

Asia Pacific Oral Solid Dosage CDMO Market Trends

The oral solid dosage CDMO market in the Asia Pacific held the largest market share, at 36.76%, in 2024. This growth can be attributed to various factors, including India and China being major OSD CDMO players that offer competitively low prices compared to other regions. Generic drug manufacturing, bolstered by patent expirations, is the second-largest revenue source in the Asia Pacific. Growth in countries such as India and China has been driven by improved social insurance, better economic conditions, and increased manufacturing capacities, distinguishing the region from others in both scale and expansion. China held the largest market share in the Asia Pacific in 2024. Ongoing pharmaceutical advancements and increasing demand for quality are driving market growth. Such factors are expected to drive the market growth.

Japan oral solid dosage CDMO market is the Asia Pacific region's second-largest. The country is strengthening its position in the market by Rapid advancements in drug delivery technology, such as targeted drug delivery and sustained-release dosage forms. Such factors are expected to drive the market.

The oral solid dosage CDMO market in India is expected to experience significant growth at a significant CAGR during the forecast period. The country has become one of the most preferred sites due to its low costs, the availability of industry experts, the presence of WHO-cGMP-compliant facilities, and its high manufacturing capabilities for generic drugs and cost-effective oral solid dosage packaging solutions. As per June 2023 data by PIB, the country ranks third globally in terms. Such factors are expected to drive the market.

Key Oral Solid Dosage CDMO Company Insights

Market players are undertaking various strategic initiatives, such as the launch of new product innovations, collaborations, partnerships, and mergers & acquisitions, to strengthen their service offering and provide a competitive advantage. For instance, in January 2024, Alcami Corporation acquired Pacific Pharmaceutical Services, Inc., a cGMP pharma storage and services provider. Such an acquisition offered numerous growth opportunities to the company in a significant market.

-

Lonza is a leading global CDMO with over 30 sites in Europe, North America, and Asia. It provides end-to-end services for oral solid dosage drugs, including tablets, capsules, and powders. Moreover, its services include the development of drug formulation, clinical supply, commercial manufacturing, and packaging.

Key Oral Solid Dosage CDMO Companies:

The following are the leading companies in the oral solid dosage CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza

- Thermo Fisher Scientific Inc.

- Cambrex Corporation

- Catalent Inc.

- Siegrfried Holding AG

- Recipharm AB

- CordenPharma International

- Boehringer Ingelheim

- Piramal Pharma Solutions

- Aenova Group

- Almac Group

- Jubilant Pharmova Limited

- Delpharm

- AbbVie Contract Manufacturing

- Next Pharma AB

- Rubicon Research Pvt. Ltd.

- Quotient Sciences

- SPI Pharma

- DPT Laboratories Ltd.

- Alcami Corporation

Recent Developments

-

In February 2024, Novo Holdings announced the acquisition of Catalent Inc., a prominent CDMO in the healthcare industry. Through this acquisition, Novo Holdings will gain significant market growth opportunities, and Catalent will broaden its operational capabilities.

-

In July 2023, Aenova Group partnered with Galvita to improve the formulation, production, and development of oral dosage forms. This partnership helped to broaden the company’s service offerings in the market.

Oral Solid Dosage CDMO Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 49.31 billion

Revenue forecast in 2033

USD 77.06 billion

Growth rate

CAGR of 6.58% from 2025 to 2033

Base year for estimation

2025

Historical data

2021 - 2023

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, mechanism, drug potency, service, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key company profiled

Lonza; Thermo Fisher Scientific; Cambrex Corporation; Catalent Inc.; Siegrfried Holding AG; Recipharm AB; CordenPharma International; Boehringer Ingelheim; Piramal Pharma Solutions; Aenova Group; Almac Group; Jubilant Pharmova Limited; Delpharm; AbbVie Contract Manufacturing; Next Pharma AB; Rubicon Research Pvt. Ltd.; Quotient Sciences; SPI Pharma; DPT Laboratories Ltd.; Alcami Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oral Solid Dosage Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global oral solid dosage CDMO market report based on product, mechanism, drug potency, service, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Tablets

-

Compressed Tablets

-

Orally Disintegrating Tablets (ODT)

-

Chewable Tablets

-

Bi-layer or Tri-layer Tablets

-

Sublingual or Buccal Tablets

-

Others

-

-

Capsules

-

Hard Gelatin Capsules

-

Soft Gelatin Capsules

-

-

Powders

-

Granules

-

Others

-

-

Mechanism Outlook (Revenue, USD Million, 2021 - 2033)

-

Immediate Release

-

Delayed Release

-

Controlled Release

-

-

Drug Potency Outlook (Revenue, USD Million, 2021 - 2033)

-

High Potent Drugs

-

Moderate Potent Drugs

-

Low Potent Drugs

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Contract Development

-

Contract Manufacturing

-

Packaging and Labelling

-

Regulatory Affairs

-

Logistics & Storage

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Size Companies

-

Medium & Small Size Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global oral solid dosage CDMO market size was estimated at USD 46.37 billion in 2025 and is expected to reach USD 49.31 billion in 2026.

b. The global oral solid dosage CDMO market is expected to grow at a compound annual growth rate of 6.58% from 2026 to 2033 to reach USD 77.06 billion by 2033.

b. Asia Pacific dominated the oral solid dosage CDMO market with a share of 36.89% in 2025. This growth can be attributed to various factors, including India and China being major OSD CDMO players that offer competitively low prices compared to other regions. Growth in countries such as India and China has been driven by improved social insurance, better economic conditions, and increased manufacturing capacities, further contributing to market growth.

b. Some key players operating in the oral solid dosage CDMO market include Lonza, Thermo Fisher Scientific Inc., Cambrex Corporation, Catalent Inc., Siegrfried Holding AG, Recipharm AB ,CordenPharma International, Boehringer Ingelheim, Piramal Pharma Solutions, Aenova Group, Almac Group, Jubilant Pharmova Limited ,Delpharm ,AbbVie Contract Manufacturing, Next Pharma AB, Rubicon Research Pvt. Ltd. ,Quotient Sciences ,SPI Pharma ,DPT Laboratories Ltd. ,and Alcami Corporation

b. Key factors that are driving the market growth include technological advancements in oral solid dosage forms, expansion of manufacturing capacity by CMOs & CDMOs for OSD, increasing demand for novel therapies, and growing demand for one-stop-shop CDMOs among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.