- Home

- »

- Medical Devices

- »

-

Oral Syringes Market Size And Share, Industry Report, 2030GVR Report cover

![Oral Syringes Market Size, Share & Trends Report]()

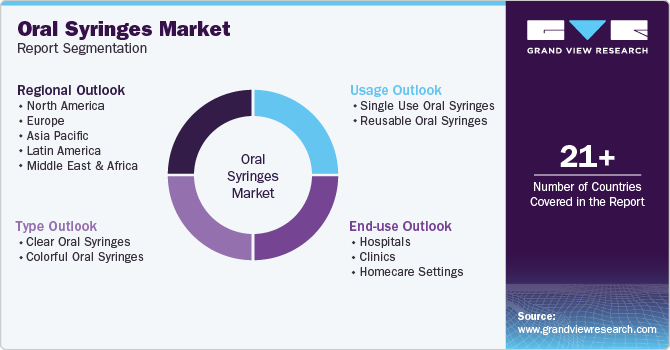

Oral Syringes Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Clear Oral Syringes, Colorful Oral Syringes), By Usage (Single Use Oral Syringes, Reusable Oral Syringes), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-704-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Oral Syringes Market Size & Trends

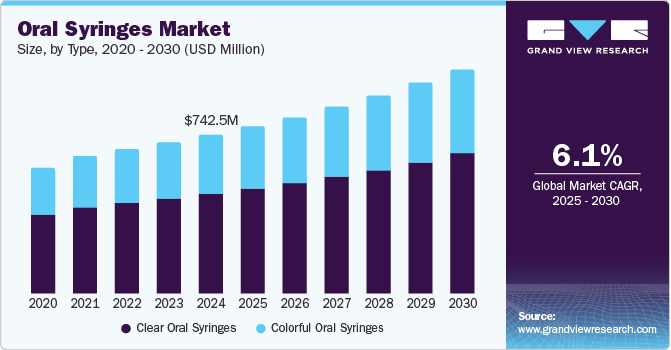

The global oral syringes market size was estimated at USD 742.5 million in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2030. The increasing prevalence of chronic diseases, such as diabetes, cardiovascular diseases, cancer, and respiratory disorders, is leading to a high demand for medication. These conditions often require regular and accurate medication administration, making oral syringes essential for delivering precise doses of liquid medicines. The increasing number of patients suffering from chronic illnesses is driving the need for oral syringes in both healthcare facilities and home healthcare settings.

As more patients rely on liquid medications for their treatment, the demand for oral syringes continues to grow. The increasing focus on patient safety and dosage accuracy also fuels the market for oral syringes. Overall, the rise in chronic disease rates significantly contributes to the growth of the oral syringes industry.

The aging population is a major factor driving the demand for oral syringes. This population is more likely to develop chronic health conditions, which often require regular medication. Many elderly individuals have difficulty swallowing pills, which makes liquid medications more suitable. Oral syringes are preferred in these cases as they provide a more accurate and easier way to administer the required doses of medication. This growing need for precise and safe medication delivery contributes to the growth of the oral syringes industry.

In addition, pediatric and geriatric patients often need liquid medications as they have difficulty swallowing pills. Oral syringes are commonly used to ensure these patients receive precise doses of medication. The increasing number of both young and elderly patients worldwide is driving the demand for oral syringes. As this population grows, the need for accurate and easy-to-use medication delivery methods continues to rise. This trend is significantly contributing to the growth of the oral syringes industry.

Type Insights

The clear oral syringes segment dominated the market with a revenue share of 62.9% in 2024, which can be attributed to their widespread use in healthcare settings where visibility and precision are crucial for medication administration. Clear syringes allow healthcare professionals and caregivers to easily monitor the medication levels, which is essential for ensuring accurate dosing. Their cost-effectiveness and higher adoption rates for pediatric and geriatric care further enhance their market presence. The increasing prevalence of chronic diseases and the necessity for precise medication delivery systems significantly contribute to the sustained demand for clear oral syringes.

The colorful oral syringes segment is projected to grow at the highest CAGR of 6.3% over the forecast period, fueled by their increasing popularity in pediatric care, where engaging designs help alleviate anxiety associated with medication administration. Colorful syringes attract children's attention and facilitate easier identification of medications, thereby improving compliance among young patients. As awareness about making healthcare less intimidating for children rises, the demand for colorful oral syringes is expected to increase significantly.

Usage Insights

The reusable oral syringes segment dominated the market with the largest revenue share in 2024, driven by growing environmental concerns and the push toward sustainable healthcare practices. Reusable syringes offer cost-saving benefits over time, making them an attractive option for healthcare facilities and homecare settings. Their ability to reduce medical waste aligns with the increasing emphasis on eco-friendly solutions in healthcare, thereby driving their adoption among environmentally conscious consumers and institutions.

The single use oral syringes segment is projected to grow at the highest CAGR over the forecast period due to heightened awareness regarding infection control and patient safety. Single-use syringes minimize the risk of cross-contamination. They are preferred in various medical settings, particularly during outpatient procedures and homecare environments. The convenience they offer, along with regulatory support for disposable medical devices, contributes significantly to their anticipated growth.

End-use Insights

The hospitals segment dominated the market with the largest revenue share in 2024, driven by an increasing number of hospital admissions and a rising prevalence of chronic diseases requiring regular medication. Hospitals prioritize accurate medication delivery systems to ensure patient safety and treatment efficacy, making oral syringes a critical component of their medical supply inventory. In addition, hospital infrastructure and technology advancements further boost this segment's growth as healthcare providers seek reliable medication administration tools.

The homecare settings segment is expected to grow at the highest CAGR over the forecast period, which can be attributed to a growing preference for at-home care solutions among patients recovering from illnesses or surgeries. The trend toward c has been accelerated by an aging population that requires ongoing medical support without frequent hospital visits. Oral syringes are essential for ensuring that patients receive accurate dosages of liquid medications at home, thus enhancing their quality of life and adherence to treatment regimens.

Regional Insights

North America oral syringes market held the highest revenue share of 40.6% in 2024, driven by a robust healthcare infrastructure and high levels of health awareness among consumers. The region's advanced medical facilities emphasize precision in medication administration, leading to increased demand for oral syringes. Furthermore, rising pediatric cancer cases necessitate effective drug delivery systems, driving growth in this market segment.

U.S. Oral Syringes Market Trends

The U.S. oral syringes market dominates North America with a significant revenue share in 2024 due to an increasing incidence of chronic diseases and a strong focus on patient safety standards. The country's established pharmaceutical sector supports innovation in syringe design and functionality, catering to diverse patient needs across various demographics. Moreover, public awareness campaigns emphasizing proper medication administration techniques contribute positively to market expansion.

Europe Oral Syringes Market Trends

Europe oral syringes market is expected to maintain a significant share in 2024, largely due to regulations that ensure the safety and effectiveness of medical devices. This regulatory environment raises a commitment to enhancing patient outcomes through advanced healthcare solutions, thereby increasing the demand for reliable medication delivery systems such as oral syringes. In addition, ongoing investments in healthcare infrastructure are driving innovations that improve syringe design and usability. Therefore, the market is set for growth, reflecting the region's focus on delivering high-quality healthcare products.

Asia Pacific Oral Syringes Market Trends

Asia Pacific oral syringes market is anticipated to register the highest CAGR of 7.0% over the forecast period, which can be attributed to increasing cancer cases and growing health awareness initiatives across the region. The demand for effective drug administration tools is heightened by an increase in pediatric oncology cases that require precise dosing methods. Therefore, as healthcare systems evolve and improve access to quality medical care, the need for reliable oral syringes will continue to expand.

The China oral syringes market dominates the Asia Pacific with a significant revenue share in 2024 due to alarming statistics regarding childhood cancer diagnoses each year. With approximately 40,000 new cases identified annually, there is an urgent need for efficient medication delivery systems tailored for pediatric patients. According to a report published in Frontiers in Public Health in 2022, approximately 45,601 new cases of childhood cancer were identified in 2019 in China, underscoring a significant health crisis that necessitates effective medication delivery systems for pediatric patients. This growing health crisis drives demand for oral syringes that ensure accurate dosing while accommodating young patients needs during treatment.

Key Oral Syringes Company Insights

Some key companies operating in the market include Baxter, Becton, Dickinson and Company (BD.), Medtronic, Terumo Medical Corporation, and B. Braun SE. Companies are undertaking strategic initiatives, such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands in the oral syringes market.

-

Baxter provides various products designed for the oral syringes market, prioritizing safety and accuracy in medication delivery. Its ExactaMed oral dispensers are available in different capacities, such as 0.5 mL, 3 mL, and 10 mL, and come in clear and amber polypropylene options. These dispensers feature easy-to-read markings for precise dosing and include self-righting tip caps to prevent incorrect administration routes.

-

Medtronic provides a range of products for the oral syringes market. Its oral tip syringes are designed for single use and feature clear measurement markings for accurate dosing and a smooth oral tip connector for easy administration. Available in sizes ranging from 0.5 mL to 20 mL, these DEHP and latex-free syringes make them suitable for sensitive populations, including children and individuals with allergies.

Key Oral Syringes Companies:

The following are the leading companies in the oral syringes market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter

- BD (Becton, Dickinson and Company)

- Medtronic

- Terumo Medical Corporation

- B. Braun SE

- Thermo Fisher Scientific Inc.

- Comar

- Neelkanth Polymer Industries.

- Changzhou Medical Appliances General Factory Co., Ltd

Recent Developments

-

In September 2024, BD. launched Neopak XtraFlow Glass Prefillable Syringe and the expansion of its Neopak Glass Prefillable Syringe Platform. The new syringe featured an 8-millimeter length needle and a thinner wall cannula, which optimized the delivery of higher-viscosity drugs while reducing both injection force and time. This development aimed to enhance the usability of biological therapies and address key needs in the market.

-

In August 2022, Baxter announced that it received U.S. FDA clearance for the Novum IQ Syringe Infusion Pump, which features the advanced Dose IQ Safety Software. This innovative pump was designed to enhance patient safety and improve medication delivery accuracy in healthcare settings.

Oral Syringes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 782.1 million

Revenue forecast in 2030

USD 1,050.3 million

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type,usage, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, Netherlands, Switzerland, Belgium, Russia, Japan, China, India, South Korea, Australia, Thailand, Malaysia, Philippines, Singapore, Indonesia, Brazil, Argentina, Colombia, Chile, South Africa, Saudi Arabia, UAE, Kuwait, Israel, Egypt.

Key companies profiled

Baxter; BD.; Medtronic; Terumo Medical Corporation; B. Braun SE; Thermo Fisher Scientific Inc.; Comar; CODAN Limited.; Neelkanth Polymer Industries.; Changzhou Medical Appliances General Factory Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oral Syringes Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global oral syringes market report based on type, usage, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Clear Oral Syringes

-

Colorful Oral Syringes

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Use Oral Syringes

-

Reusable Oral Syringes

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Homecare Settings

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

Netherlands

-

Switzerland

-

Belgium

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Malaysia

-

Philippines

-

Singapore

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Israel

-

Egypt

-

-

Frequently Asked Questions About This Report

b. North America dominated the oral syringes market with a share of 40.6% in 2024. This is attributable to the advanced healthcare system and the growing prevalence of chronic diseases in the country.

b. Some key players operating in the oral syringes market include Becton, Dickinson and Company; Braun Melsungen AG, Medtronic, Amcor Limited, Smiths Medical, NIPRO Corporation, Gerresheimer AG, and Terumo Corporation.

b. Key factors that are driving the market growth include rising pediatric population, easy usability, and increasing prevalence of chronic diseases in the geriatric population.

b. The global oral syringes market size was estimated at USD 742.5 million in 2024 and is expected to reach USD 782.1 million in 2025.

b. The global oral syringes market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 1,050.3 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.