- Home

- »

- Pharmaceuticals

- »

-

Oral Transmucosal Drugs Market Size & Share Report, 2030GVR Report cover

![Oral Transmucosal Drugs Market Size, Share & Trends Report]()

Oral Transmucosal Drugs Market Size, Share & Trends Analysis Report By Product Type, By Route Of Administration, By Indication, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-181-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Oral Transmucosal Drugs Market Trends

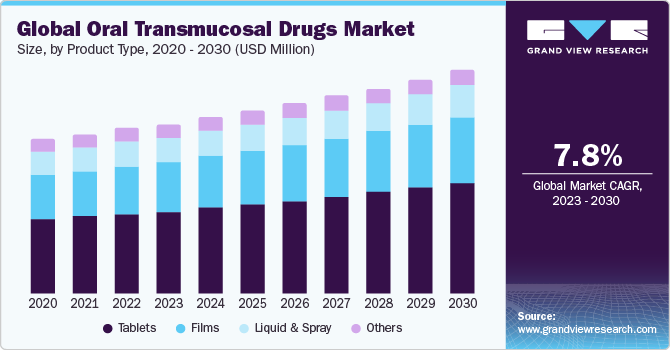

The global oral transmucosal drugs market is expected to grow at a compound annual growth rate (CAGR) of 7.8 % from 2023 to 2030. This growth is attributed to the escalating demand for efficient and rapid drug delivery systems, particularly for medications that necessitate swift absorption into the bloodstream. Oral transmucosal drugs present a more effective and rapid route of administration, rendering them valuable for pain management and certain medical conditions. Moreover, advancements in pharmaceutical formulations and technology have facilitated the creation of innovative oral transmucosal drug products, broadening their applications across various therapeutic areas.

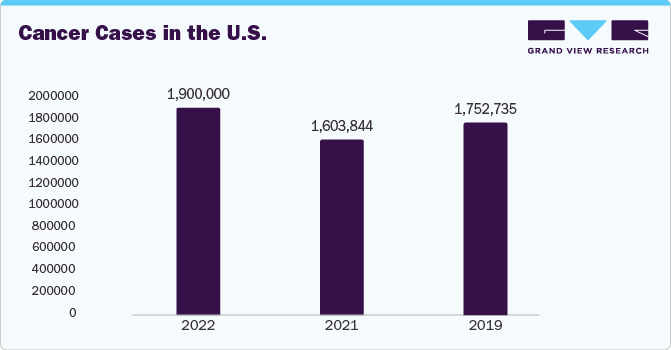

The rising incidence of autoimmune diseases, Parkinson's disease, and cancer is expected to drive the market. Both diseases have witnessed a surge in global prevalence, increasing the demand for oral transmucosal medications. These drugs are favored for circumventing gastrointestinal breakdown and delivering rapid therapeutic effects. For instance, according to the CDC's National Diabetes Statistics Report, the worldwide prevalence of diabetes is projected to reach 37.3 million cases in 2022, with an estimated 11.3% of Americans-equivalent to 37.3 million individuals-affected by the condition. This substantial diabetic population contributes to the heightened demand for transmucosal medications, showcasing the market's growth potential.

Additionally, the market is anticipated to grow due to increased research and new product launches to treat specific diseases. For instance, after completing clearance conditions, Shilpa Medicare Ltd. introduced a pediatric paracetamol oral thin film in India in June 2021. Moreover, as more people need these drugs for pain relief, especially opioids, the market is likely to expand. According to the WHO, in 2021, around 275 million people used medications, and about 62 million used opioids, indicating the growing demand for these treatments.

Product Type Insights

The tablets segment accounted for the largest share in 2022. Tablets are commonly favored for medication administration due to their ease of use, and patients are familiar with them. Innovations, such as tablets that dissolve quickly in the mouth, have made drug absorption more convenient and efficient. An August 2021 research study published in the National Library of Medicine's journal highlighted that older adults often experience decreased salivary output, especially those taking multiple medications, which can increase the risk of dental issues. Tablets are widely used to manage various medical conditions, including pain, and doctors prescribe them in clinical settings and for at-home use. The solid form and adaptability for different drug formulations have made tablets popular among drug manufacturers and healthcare providers, leading to their prominence in the market.

Furthermore, the increase in approvals for oral transmucosal tablets is anticipated to drive market growth. In May 2021, Breckenridge Pharmaceutical, Inc. received final approval from the U.S. FDA for its abbreviated new drug application, which covered the 5 mg asenapine sublingual tablets-a product jointly developed by Breckenridge Pharmaceutical, Inc. and MSN Laboratories, Private Limited. These regulatory approvals are projected to augment the market's expansion.

Route of Administration Insights

The sublingual drugs segment held the largest share in 2022. Sublingual drugs provide faster and more efficient medicine delivery than other methods. They work by getting absorbed through blood vessels, which have a rich blood supply and thin mucosa, allowing rapid drug absorption into the bloodstream. This makes sublingual drugs particularly useful for addressing acute medical conditions, such as pain, where quick relief is essential. With continued advances in research and technology in this industry, the sublingual mucosa segment is expected to continue to lead the way in the oral transmucosal medicines market.

Indication Insights

The opioid dependence segment held the largest share in 2022. This growth is due to the rising prevalence of opioid addiction and the demand for more advanced and effective treatment. In July 2023, the NIH published a research article highlighting the increasing issues of opioid use disorder (OUD) and addiction both in the U.S. and worldwide. It revealed that around three million people in the U.S. and around six million globally have dealt with OUD. Moreover, around half a million U.S. people depend on heroin. To address this, oral transmucosal drugs, including sublingual medications, have proven to be reliable for delivering medication to those with opioid dependence. These drugs enable rapid drug absorption through the thin mucosa under the tongue, offering quick relief from withdrawal symptoms and reducing the risk of relapse.

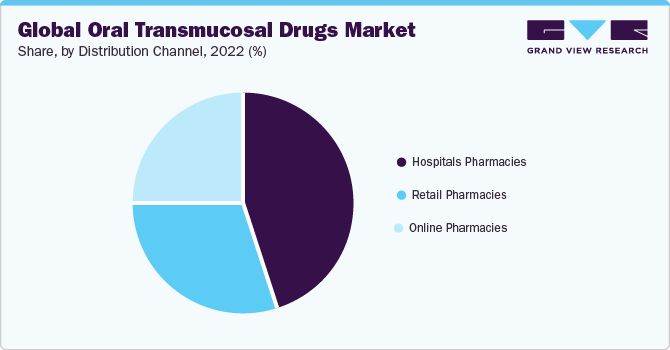

Distribution Channel Insights

Hospital pharmacies accounted for the largest share in 2022. Hospital pharmacies are key players in distributing medications, including oral transmucosal drugs, and offer pharmaceutical services. Healthcare professionals trust these pharmacies to provide medications to patients in a controlled and closely monitored environment. They serve a diverse patient population, including those with acute medical conditions, making them a vital channel for managing such patients' medication needs. This essential role positions hospital pharmacies as dominant in distributing oral transmucosal drugs.

Regional Insights

North America dominated the market in 2022. The growth can be attributed to the high prevalence of target populations afflicted by Parkinson's, Alzheimer's, and dysphagia. Furthermore, the market benefits from the increasing geriatric population and a strong willingness to adopt innovative oral transmucosal drugs. North America's market growth is also supported by proactive regional players and the availability of medications for addressing opioid use disorders, as reported in a 2022 Stat Pearls article. It emphasized the persistent global opioid use disorder and addiction crisis. Additionally, notable developments, such as Aquestive Therapeutics, Inc.'s acceptance of a new drug application for Libervant by the US FDA in July 2021, are expected to fortify the market's expansion in the region.

Key Companies & Market Share Insights

Key players operating in the market are ZIM Laboratories Limited, Sunovion Pharmaceuticals, Inc., C.L.Pharm Co., Ltd., IntelGenx Corp, CURE Pharmaceutical, Seoul Pharmaceuticals, and others. These industry participants consistently engage in novel product development, merger and acquisition activities, and strategic alliances to explore fresh market opportunities.

-

In October 2023, atai Life Sciences successfully completed a Phase 1 study on VLS-01, an inventive oral transmucosal film (OTF) featuring DMT. The study showcased that VLS-01 is well-tolerated and exhibits a favorable safety profile among healthy participants.

-

In May 2022, the European subsidiary of ZIM Laboratories Limited, SIA ZIM Laboratories Limited, obtained marketing authorization from AEPMS for "Sildenafil 50 mg" ODS in Spain.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."