- Home

- »

- Biotechnology

- »

-

Organ-on-a-Chip Market Size, Share & Trends Report, 2030GVR Report cover

![Organ-on-a-Chip Market Size, Share & Trends Report]()

Organ-on-a-Chip Market Size, Share & Trends Analysis Report By Products & Service (Products, Service), By Application (Drug Discovery, Toxicology Research), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-148-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Organ-on-a-Chip Market Size & Trends

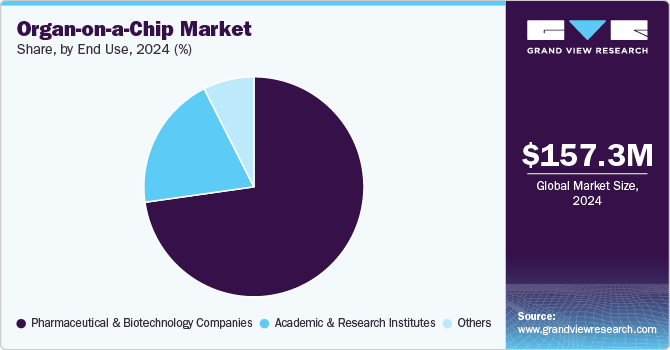

The global Organ-on-a-chip market size was estimated at USD 157.3 million in 2024 and is expected to grow at a CAGR of 35.11% from 2025 to 2030. Market growth can be attributed to the increasing demand for alternatives to animal testing in drug discovery and toxicological studies. Advancements in microfluidic technology, coupled with an increasing focus on personalized medicine and precision healthcare, are likely to fuel market growth. Moreover, the rise in research funding, collaborations between academia & industry, and regulatory support for Organ-on-a-chip (OOC) technologies can propel the market over the forecast period.

The pandemic accelerated the adoption of telemedicine and remote monitoring solutions to reduce the risk of exposure to the virus in healthcare settings. Microfluidic devices such as OOC devices, integrated with sensors and wireless communication technologies, were explored for remote monitoring of patient health parameters, early detection of COVID-19 symptoms, and management of chronic diseases, contributing to the expansion of telehealth services.

Furthermore, the urgent need for reliable & rapid diagnostic tests for COVID-19 led to a high demand for biochip-based diagnostic solutions and, thus, microfluidics systems. For instance, in June 2022, Draper developed the first lung on a chip model, PREDICT96-ALI, capable of predicting the response to COVID-19 antiviral treatments by accurately modeling the human lung's interaction with SARS-CoV-2, showcasing the potential of OOC technology in accelerating drug development for emerging diseases.

In addition, organ-on-a-chip technology revolutionizes in-vitro modeling by providing more physiologically relevant platforms for studying human biology, disease mechanisms, and drug responses. These microfluidic devices mimic the architecture and function of human organs, offering numerous advantages over traditional in vitro models. For instance, in June 2023, Emulate, Inc. introduced the Emulate Chip-A1 Accessible Chip, advancing its Organ-Chip technology to enhance in-vitro modeling. This high-throughput, membrane-free microfluidic Blood-Brain Barrier (BBB) on a-chip model offers a more human-relevant system for studying neuroinflammation and evaluating therapeutic strategies. Its sophisticated imaging capabilities are particularly useful for examining drug candidates to reduce immune cell infiltration and promote BBB restoration. Thereby anticipated to propel the demand for organ-on-a-chip over the forecast period.

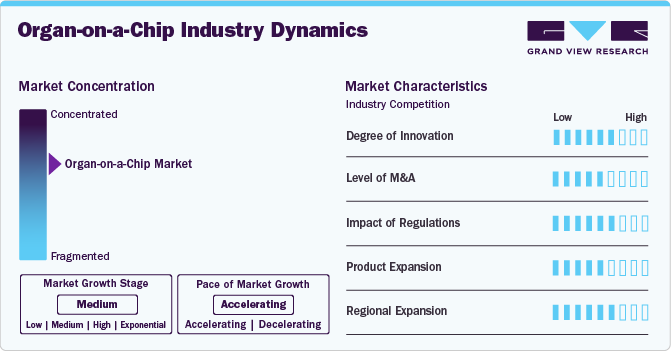

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. This growth is fueled by increasing demand for more accurate and efficient alternatives to traditional drug testing and toxicology methods. Key drivers include advancements in microfluidic technologies, growing investments in healthcare R&D, and the rising need for personalized medicine.

In the market, the merger & acquisition activities are moderate owing to the growing interest of larger pharmaceutical and biotechnology companies in acquiring innovative startups and smaller firms with advanced organ-on-a-chip technologies. These acquisitions are driven by the need to enhance drug discovery and testing capabilities, reduce development timelines, and integrate more predictive models into the research process.

There is a significant impact of regulations on the market. Regulatory authorities are emphasizing increased validation, standardization, and integration of organ-on-a-chip platforms into drug development processes, promoting more humane and effective testing methods.

The market currently exhibits a moderate level of product expansion. This is attributed to the growing focus on refining and optimizing existing organ models, such as liver, lung, and heart-on-a-chip, rather than developing entirely new products. Companies are investing in improving the accuracy, scalability, and functionality of these models to better mimic human organ systems for drug testing and disease modeling.

The market currently demonstrates a moderate to high level of regional expansion. This is attributed to the increasing adoption of organ-on-a-chip technology across various geographies, driven by growing investments in healthcare innovation and biomedical research. North America and Europe have been early adopters, but regions like Asia Pacific and the Middle East are rapidly catching up due to rising government support, collaborations with global research institutions, and a surge in demand for advanced drug testing methods. Additionally, regional expansion is further fueled by the growing need to improve clinical trial accuracy and reduce dependence on animal testing, leading to a wider global footprint for the industry.

Products & Service Insights

The services segment accounted for the largest revenue share of 52.18% in 2024. Segment growth can be attributed to its ability to provide specialized expertise, cost-effectiveness, and comprehensive solutions. Service providers offer in-depth knowledge and experience, allowing companies to access cutting-edge technology without heavy investment.

The products segment is projected to witness the fastest CAGR of 36.34% over the forecast period. Organ on a chip (OOC) devices are revolutionizing biomedical research by providing more accurate models of human organs. Liver on a chip mimics the liver's function, aiding in drug metabolism and toxicity studies. Lung on a chip replicates airway physiology, facilitating respiratory disease research. Intestine on a chip model’s intestinal barrier function, crucial for studying gut diseases and drug absorption. Thus, propelling the growth of the segment over the forecast period.

Application Insights

The drug discovery dominated the market with a revenue share of 62.78% in 2024 due to its key role in advancing preclinical testing. OOC technology offers more physiologically relevant models, enhancing the accuracy and predictive value of drug testing. Its ability to mimic human organ functions in vitro enables researchers to assess drug efficacy, toxicity, and metabolism more effectively than traditional methods.

The toxicology segment is projected to witness the fastest CAGR over the forecast period. Toxicology research in the organ-on-a-chip market can revolutionize safety assessment by replicating human organ functions on microfluidic platforms. These chips mimic physiological conditions, offering insights into drug-induced toxicity without relying solely on animal testing. Thus, propelling the growth of the segment over the forecast period.

End Use Insights

The pharmaceutical & biotechnology companies segment dominated the market and accounted for the largest revenue share of 72.76% in 2024. Segment growth can be attributed to substantial investments in R&D by these companies. They rely on innovative technologies, including OOCs, to streamline drug development processes and mitigate risks associated with traditional preclinical testing methods. This will likely drive OOC technology adoption within the pharmaceutical and biotechnology sectors, propelling market growth.

The academic & research institutes segment is expected to witness the fastest CAGR over the forecast period. They advance technology, validate applications, train professionals, collaborate with industry players, receive government funding, disseminate research, and create startups. Thus, it is anticipated that the demand for organ-on-a-chip technologies and models will increase in research and academic institutes and boost the segment's growth.

Regional Insights

North America organ on a chip market has dominated the global market, with a revenue share of 51.97% in 2024. The region has robust investments in biomedical research, a strong presence of key players, and supportive regulatory frameworks. In addition, the region's emphasis on innovative drug development and personalized medicine fostered advancements in OOC technology. Thereby propelling the demand for the organ-on-a-chip market in the region over the forecast period.

U.S. Organ-on-a-Chip Market Trends

The organ-on-a-chip market in the U.S. is expected to grow over the forecast period. In September 2024, researchers at The Ohio State University developed a "ventilator on a chip" model to study lung damage. Their findings indicate that the repeated collapse and reopening of air sacs, which causes shear stress, is the most harmful form of injury. This new device enables real-time detection of lung damage at the cellular level.

Europe Organ on a Chip Market Trends

The European organ-on-a-chip market is experiencing significant growth, driven by a developed infrastructure, which is anticipated to significantly boost medical research prospects in the region.

The UK organ-on-a-chip market is expected to grow over the forecast period. In March 2024, a team of bioengineers at Queen Mary, led by Professor Hazel Screen, received a £7 million (USD 7.66 million) grant to establish an EPSRC Centre for Doctoral Training (CDT) focused on training the next generation of scientists and bioengineers in OOC technologies.

The organ-on-a-chip market in France is expected to grow over the forecast period. The French government is actively backing initiatives that support ethical research, reducing the need for animal testing.

Germany organ-on-a-chip market is expected to grow over the forecast period. OOC technology can potentially model human biology for lungs, but it currently lacks a vascular system. In June 2024, bioengineers from the Institute of Biomedical Engineering began a three-year fellowship at the Max Delbrück Center in Berlin-Buch to address this issue.

Asia Pacific Organ-on-a-Chip Market Trends

Asia Pacific organ-on-a-chip market is anticipated to grow at the fastest rate of 29.11% over the forecast period. This growth is primarily attributed to increasing investments in healthcare research and development, a growing presence of pharmaceutical companies, and government initiatives to promote advanced medical technologies. Countries like China, Japan, and South Korea are driving innovation in the field of microfluidics and tissue engineering, enhancing the region's adoption of organ-on-a-chip technology for drug discovery, toxicology studies, and personalized medicine applications.

The organ-on-a-chip market in China is expected to grow over the forecast period. According to a press release in July 2024, Chinese researchers and biotechnology companies are advancing the development of organs-on-chips that mimic human lungs, livers, skin, and tumor metastasis. These transparent, rubber-like devices, which range in size from a fingernail to a bank card, contain 3D models of organs made from cultured cells encased in silicone and polymer materials.

Japan organ-on-a-chip market is expected to grow over the forecast period. In February 2024, researchers at the RIKEN Center for Biosystems Dynamics Research developed a blood-brain barrier model using a “Tissue-in-a-CUBE” system made from human cells. This small cubic structure could advance drug discovery and be an alternative to animal testing in preclinical studies.

The organ-on-a-chip market in India is expected to grow over the forecast period. According to a press release in September 2024, the Government of India launched the ‘BioE3’ policy in August 2024 to promote innovation in the biotechnology sector by establishing biomanufacturing facilities, bio-AI hubs, and bio-foundries. A major focus of the policy is precision therapeutics, which tailors drugs to meet individual patient needs.

Middle East & Africa Organ-on-a-Chip Market Trends

The Middle East & Africa organ-on-a-chip market is expected to experience substantial growth over the forecast period. This growth can be attributed to increasing healthcare investments, rising demand for advanced diagnostic and research technologies, and a growing focus on improving healthcare infrastructure. Governments in the region are actively encouraging the adoption of innovative technologies to enhance medical research and drug development. Additionally, collaborations between regional academic institutions and global pharmaceutical companies foster organ-on-a-chip technology advancements, further accelerating their adoption in toxicology testing, drug screening, and disease modeling.

The organ-on-a-chip market in Saudi Arabia is expected to grow over the forecast period. The expanding veterinary sector may drive demand, as this technology can improve testing for veterinary drugs. Despite challenges like high costs and the need for specialized expertise, collaboration between local universities and international firms could accelerate market adoption.

Kuwait organ-on-a-chip market is expected to grow over the forecast period. The country's increasing focus on advancing its healthcare and biomedical research sectors drives the market. Kuwait is investing in modernizing its healthcare infrastructure and promoting innovation in medical research, including cutting-edge technologies like organ-on-a-chip for drug discovery, toxicology testing, and personalized medicine.

Key Organ-on-a-Chip Company Insights

The market players operating in the market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Organ-on-a-Chip Companies:

The following are the leading companies in the organ-on-a-chip market. These companies collectively hold the largest market share and dictate industry trends.

- Emulate, Inc.

- MIMETAS B.V.

- Valo Health

- Nortis, Inc.

- AxoSim

- BICO - THE BIO CONVERGENCE COMPANY

- CN Bio Innovations Ltd

- The Charles Stark Draper Laboratory, Inc.

- SynVivo, Inc.

- AlveoliX AG

Recent Developments

-

In April 2024, CN Bio secured USD 21 million in Series B funding from Bayland Capital and CN Innovations Holdings Ltd to expand its product development & scaling, meeting the rising demand for organ on a chip solutions and driven by improved drug R&D efficiency and legislative changes like the US FDA Modernization Act 2.0.

-

In March 2024, MIMETAS joined the Centre for Animal-Free Biomedical Translation (CPBT), which received USD134.78 million from the Dutch National Growth Fund to advance animal-free biomedical innovations.

-

In October 2023, AxoSim acquired Stemonix’s microBrain technology, expanding its human organoid platforms for neurological drug discovery, and integrating the microBrain platform with existing NerveSim and BrainSim technologies to enhance research capabilities in neurological disorders.

Organ-on-a-Chip Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 211.6 million

Revenue forecast in 2030

USD 952.4 million

Growth rate

CAGR of 35.11% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products & service, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Emulate, Inc.; MIMETAS B.V.; Valo Health; Nortis, Inc.; AxoSim; BICO - THE BIO CONVERGENCE COMPANY; CN Bio Innovations Ltd; SynVivo, Inc.; The Charles Stark Draper Laboratory, Inc.; AlveoliX AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organ on a Chip Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organ-on-a-chip market report based on products & service, application, end use, and region.

-

Products & Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Products

-

Instrument

-

Devices

-

Liver-on-a-Chip

-

Lung-on-a-Chip

-

Intestine-on-a-Chip

-

Kidney-on-a-Chip

-

Heart-on-a-Chip

-

Others

-

-

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drug Discovery

-

Toxicology Research

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global organ-on-a-chip market size was estimated at USD 157.3 million in 2024 and is expected to reach USD 211.6 million in 2025.

b. The global organ-on-a-chip market is expected to grow at a compound annual growth rate of 35.11% from 2025 to 2030 to reach USD 952.4 million by 2030.

b. North America dominated the organ-on-a-chip market with a share of 51.97% in 2024. This is attributable to rising healthcare research coupled with presence of several key players in the region.

b. Some key players operating in the organ-on-a-chip market include Emulate, Inc.; MIMETAS B.V.; Valo Health; Nortis, Inc.; AxoSim; BICO - THE BIO CONVERGENCE COMPANY; CN Bio Innovations Ltd; SynVivo, Inc.; The Charles Stark Draper Laboratory, Inc.; AlveoliX AG

b. The growth of the organ-on-a-chip market can be attributed to the increasing prevalence of chronic diseases which necessitates faster drug discovery techniques, increasing demand for drug toxicity detection, technological advancement, and rising product launches by key market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."