- Home

- »

- Consumer F&B

- »

-

Organic Chocolate Confectionery Market Report, 2021-2028GVR Report cover

![Organic Chocolate Confectionery Market Size, Share & Trends Report]()

Organic Chocolate Confectionery Market Size, Share & Trends Analysis Report By Type (Milk, Dark), By Product (Molded Bars, Chips & Bites), By Distribution Channel (Online, Super/Hypermarkets), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-435-9

- Number of Report Pages: 185

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

Report Overview

The global organic chocolate confectionery market size was valued at USD 824.1 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2021 to 2028. Increasing preference for healthy food products is a major factor contributing to the growth of the market. Chocolate confectionery manufacturing companies conduct several marketing & promotional activities to increase the outreach of their products. The COVID-19 outbreak has disrupted the market. The consumption of mainstream chocolate was nearly stable; however, the craft chocolate segment witnessed difficulties during the time. The global recession in 2020 affected the purchasing power of consumers. As per a report published by the National Confectioners Association in October 2020, seasonal demand for confectionery declined in the U.S. due to the pandemic.

As chocolate confectioneries are often consumed out of home or on the go, the sales of these products declined initially in 2020. Factors, such as growing consumerism and rising disposable incomes further strengthen the growth of the market. Besides, several market players have adopted strategies of branding their chocolate confectionery items in innovative ways, such as healthy variants.

Moreover, attractive product packaging, creative branding activities, and promotional events raise customer appetite for these chocolates. In addition, in this market, marketing campaigns aimed at children are gaining traction. Increasing awareness of the nutritive value of cocoa-rich chocolate is one of the several factors driving the market. Iron, magnesium, copper, and other minerals, such as potassium, phosphorous, and zinc, are abundant in dark chocolate.

Furthermore, dark chocolate is high in antioxidants, which help protect the skin from the sun's harmful rays. Consumers in both developed and developing countries are becoming more health-conscious, thus, the demand for organic foods that are free of synthetic additives is on the rise. Furthermore, e-commerce has widened the opportunity for the producers by providing them an extensive selling distribution channel.

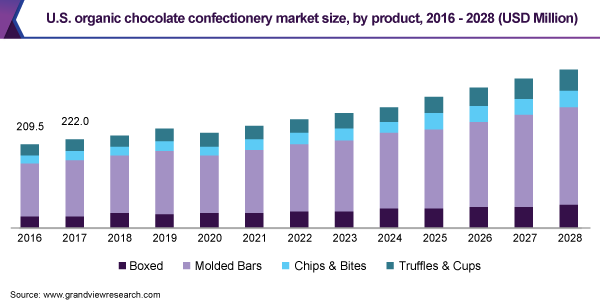

Product Insights

The boxed segment accounted for the highest revenue share of more than 62% in 2020 and is expected to register a CAGR of 6.9% over the forecast period from 2021 to 2028. Organic boxed assortments are one of the most popular gift options across the globe. A large number of consumers prefer gifting luxurious boxed chocolates for various occasions. Therefore, factors, such as packaging aesthetics, craftsmanship, quality & origin of cocoa, and flavors, play important role in influencing the buying decision of consumers.

However, the chips & bite segment is projected to register the fastest growth rate during the forecast period. Consumers in developed countries, such as the U.S., are opting for organic chocolate confectionery bites to limit their confectionery consumption; thus, increasing interest in reducing the portion size has opened up growth opportunities for the manufacturers to innovate in Smaller Stock-Keeping Units (SKUs).

Distribution Channel Insights

The supermarkets/hypermarkets distribution channel segment accounted for a revenue share of more than 51% in 2020. Because of the shopping experience provided by these stores, many customers prefer to purchase organic chocolate confectionery from hypermarkets and supermarkets. Physical verification of the product, along with expert assistance, is a significant factor in the development of this segment. In addition, shoppers often purchase confectioneries impulsively at the checkout points of hypermarkets & supermarkets.

The online segment is expected to register the fastest CAGR of 9.4% from 2021 to 2028. The segment includes e-commerce sites and company websites. The convenience of shopping provided by online distribution channels is expected to drive the segment growth. Transactions have become much simpler due to simple payment systems that comply with the regulatory requirements of various countries. Major manufacturers focus on online distribution channels to attract new consumers.

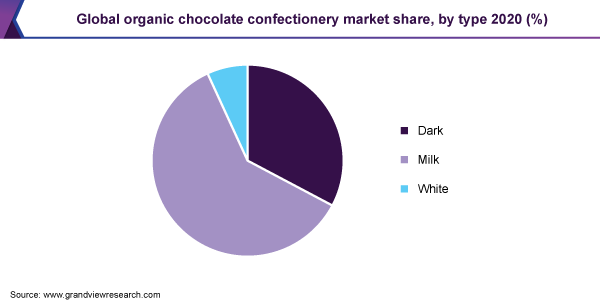

Type Insights

The organic milk type segment accounted for the highest revenue share of over 59% in 2020 and is estimated to grow at a steady CAGR from 2021 to 2028. The use of milk chocolate bars has become extremely popular in cooking and baking. The product is a popular ingredient in a variety of cakes, pastries, and confections. Cakes, vegetables, and nuts are also coated with it.

These bars are also available in different variants and include ingredients, such as almonds, honey, caramel, and nougat; which are extremely popular with customers. The organic dark chocolate confectionery segment is expected to register the fastest CAGR of 7.1% over the forecast period from 2021 to 2028. The worldwide movement of veganism has had a major impact on the adoption of these products. Moreover, due to their ease of use and availability, these variants have become extremely common in recent years.

Regional Insights

Europe accounted for the largest revenue share of over 42% in 2020. The markets in France and Belgium have been witnessing considerable growth in the recent past. The regional market growth is driven by increased production of artisanal chocolates, constant innovations in terms of flavors, and in-store promotions. Consumers are looking for high-quality products that are good for their health and the environment.

North America is expected to register a CAGR of 6.7% from 2021 to 2028. Rising awareness levels about health benefits associated with the consumption of the product, along with increasing interest in premium and seasonal chocolates, have been driving the regional market. Over the past few years, organic and fair-trade-certified food products have been gaining immense traction among consumers in North America.

Key Companies & Market Share Insights

The global market is characterized by the presence of a few well-established companies and several small- and medium-scale companies. Mergers and acquisitions are one of the key strategic initiatives adopted by the market players. Some of the key companies operating in the global organic chocolate confectionery market include:

-

Pascha Chocolate Co.

-

Theo Chocolate, Inc.

-

Rococo Chocolates London Ltd.

-

Pana Organic

-

Original Beans

-

Doisy And Dam

-

Green and Black’s

-

Lake Champlain Chocolates

-

Love Cocoa

-

Daylesford Organic Ltd.

-

K'UL CHOCOLATE

-

Seed & Bean

-

Taza Chocolate

-

Alter Eco

-

Equal Exchange Coop.

Organic Chocolate Confectionery Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 885.0 million

Revenue forecast in 2028

USD 1,397.6 million

Growth rate

CAGR of 6.8% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2021 to 2028

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Mexico; Canada; Germany; U.K.; France; Switzerland; Russia; The Netherlands; Italy; Spain; Sweden; Denmark; Belgium; China; Japan; South Korea; Australia; Brazil; South Africa; Saudi Arabia; Israel

Key companies profiled

Pascha Chocolate Co.; Theo Chocolate, Inc.; Rococo Chocolates London Limited; Pana Organic; Original Beans; Doisy And Dam; Green And Black's; Lake Champlain Chocolates; Love Cocoa; Daylesford Organic Limited; K'UL CHOCOLATE; Seed & Bean; Taza Chocolate; Alter Eco; Equal Exchange Coop.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global organic chocolate confectionery market report on the basis of product, type, distribution channel, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2016 - 2028)

-

Boxed

-

Molded Bars

-

Chips & Bites

-

Truffles & Cups

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2016 - 2028)

-

Milk

-

Dark

-

White

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2016 - 2028)

-

Supermarkets/Hypermarkets

-

Online

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Switzerland

-

Russia

-

The Netherlands

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Belgium

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global organic chocolate confectionery market size was estimated at USD 824.1 million in 2020 and is expected to reach USD 885.0 million in 2021.

b. The global organic chocolate confectionery market is expected to grow at a compound annual growth rate of 6.8% from 2021 to 2028 to reach USD 1,397.6 million by 2028.

b. The boxed segment accounted for the highest revenue share of more than 62% in 2020 and is expected to register a CAGR of 6.9% over the forecast period from 2021 to 2028 in the organic chocolate confectionery market.

b. The supermarkets/hypermarkets distribution channel segment accounted for a revenue share of more than 51% in 2020 in the organic chocolate confectionery market.

b. The organic milk type segment accounted for the highest revenue share of over 59% in 2020 and is estimated to grow at a steady CAGR from 2021 to 2028 in the organic chocolate confectionery market.

b. Europe dominated the organic chocolate confectionery market with a share of 42% in 2020. The organic chocolate confectionery industry in France and Belgium has been witnessing considerable growth in the recent past. Sales of these organic chocolate confectioneries in Europe have been boosted by increased production of artisanal chocolates, product innovations, new flavors, and in-store promotions.

b. Some key players operating in the organic chocolate confectionery market include Pascha Chocolate Co., Theo Chocolate, Inc., Rococo Chocolates London Limited, Pana Organic, Original Beans, Doisy And Dam, and Green and Black's.

b. Increasing preference for healthy food products is a major factor contributing to the growth of the organic chocolate confectionery market. Chocolate confectionery manufacturing companies conduct several marketing & promotional activities to increase the outreach of their products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."