- Home

- »

- Consumer F&B

- »

-

Organic Coffee Market Size, Share & Growth Report, 2030GVR Report cover

![Organic Coffee Market Size, Share & Trends Report]()

Organic Coffee Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Arabica, Robusta), By Flavor (Flavored, Unflavored), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-473-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Coffee Market Summary

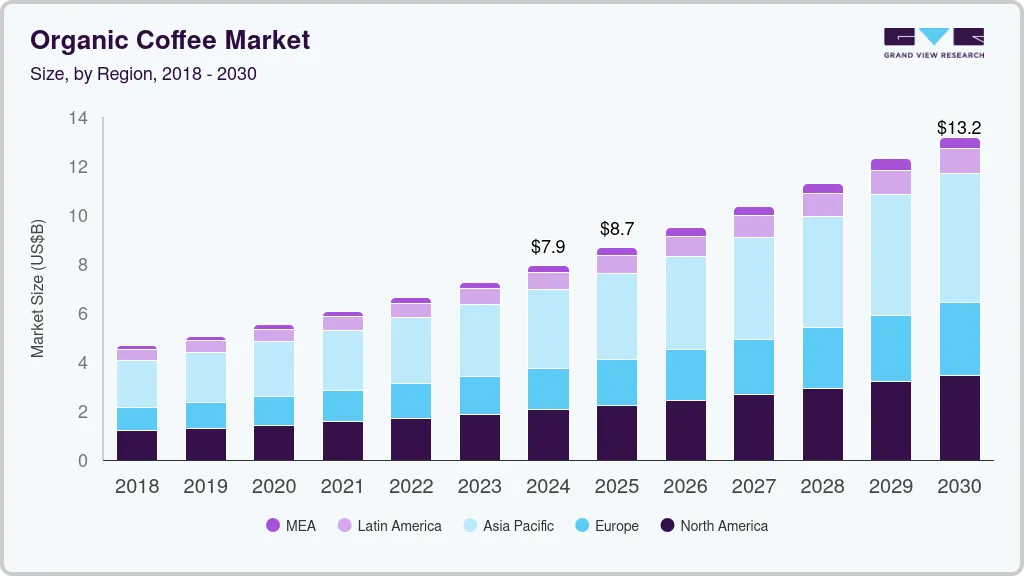

The global organic coffee market size was estimated at USD 7.92 billion in 2024 and is projected to reach USD 13.16 billion by 2030, growing at a CAGR of 8.7% from 2025 to 2030. The market is rising due to several key factors and trends that are driving its increased consumption. One of the primary reasons is the growing focus on health and wellness.

Key Market Trends & Insights

- he Asia Pacific organic coffee market accounted for a revenue share of 40.5% in 2023.

- The organic coffee market in North America is expected to grow at a CAGR of 8.6% from 2024 to 2030.

- By type, arabica organic coffee accounted for a revenue share of 76.5% in 2023.

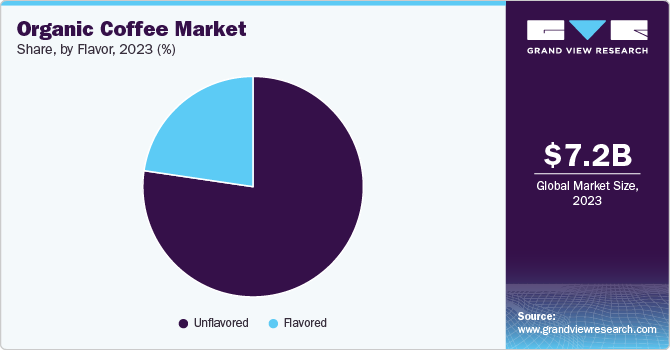

- By flavor, unflavored organic coffee accounted for a revenue share of 77.4% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 7.92 Billion

- 2030 Projected Market Size: USD 13.16 Billion

- CAGR (2025-2030): 8.7%

- Asia Pacific: Largest market in 2023

Consumers are becoming more health-conscious and looking for products that are perceived to be healthier. Organic coffee, free from synthetic pesticides, fertilizers, and GMOs, fits into this trend as a cleaner and more natural option, attracting health-conscious individuals seeking healthier alternatives to conventionally grown coffee.

Environmental concerns are another major driver behind the rising demand for organic coffee. More consumers are becoming aware of the environmental impact of their purchases and are actively seeking products that are sustainably produced. Organic coffee farming practices prioritize soil health, biodiversity, and reduced chemical usage, aligning with the values of eco-conscious consumers who want to support environmentally friendly agriculture.

The rise in ethical consumerism is also fueling the market. Many consumers now prefer products that are ethically sourced, and organic coffee is often associated with fair trade and responsible farming practices. This connection to social and economic justice, particularly for small-scale coffee farmers, makes organic coffee more appealing to those willing to pay a premium for products that align with their ethical beliefs.

Moreover, growing coffee consumption among Gen Z is another significant factor contributing to the rise of the market. Gen Z consumers are not only highly health-conscious but also deeply concerned about environmental and social issues. They tend to prioritize sustainability, transparency, and ethical sourcing when making purchasing decisions. Organic coffee, which aligns with their values of eco-friendliness and ethical consumerism, has become increasingly popular among this younger generation. In addition, Gen Z’s desire for customization and unique experiences is driving the demand for a variety of flavored organic coffees, further boosting the market.

The trend toward flavored coffee is also playing a key role in expanding the organic coffee market. As consumers seek more variety and personalization in their coffee experience, the availability of organic coffee with innovative flavors—ranging from vanilla, caramel, and hazelnut to more exotic options—has grown. These flavor innovations cater to evolving consumer tastes, especially among younger consumers who enjoy experimenting with their coffee preferences. Flavored organic coffee offers a blend of health consciousness, sustainability, and indulgence, making it an attractive option for a broader audience.

Type Insights

Arabica organic coffee accounted for a revenue share of 76.5% in 2023. Arabica beans are known for their smoother, more nuanced flavor profile compared to other coffee varieties, such as Robusta. When grown organically, these beans retain their natural flavors without the interference of synthetic chemicals, making them highly desirable for coffee enthusiasts who prioritize taste. Organic Arabica coffee appeals to health-conscious consumers who are looking for a cleaner product free from pesticides and harmful chemicals. Arabica beans, with their lower caffeine content and higher antioxidant levels compared to Robusta, offer additional health benefits, aligning with the demand for healthier options.

Robusta organic coffee is expected to grow at a CAGR of 9.3% from 2024 to 2030. Robusta beans naturally contain more caffeine than Arabica, which appeals to consumers seeking a stronger, more intense coffee experience. Organic Robusta coffee offers the added benefit of being free from synthetic chemicals, making it an attractive choice for those wanting a bold, energizing brew without compromising on health. Robusta beans are often used in espresso blends due to their strong flavor and rich crema. As the popularity of espresso-based drinks continues to grow, the demand for organic Robusta beans is rising, especially among coffee aficionados who seek both quality and sustainability in their espresso.

Flavor Insights

Unflavored organic coffee accounted for a revenue share of 77.4% in 2023. Many coffee enthusiasts prefer the traditional, unflavored coffee experience, valuing the authenticity and simplicity of black coffee. The growing interest in artisanal and specialty coffee has led more people to seek out unflavored organic options, appreciating the craftsmanship behind the cultivation and roasting of high-quality beans. Health-conscious consumers are increasingly opting for unflavored organic coffee because it is free from synthetic chemicals, pesticides, and artificial ingredients. This clean and natural choice appeals to those seeking a healthy, unprocessed beverage that aligns with their wellness goals.

Flavored organic coffee are expected to grow at a CAGR of 9.5% from 2024 to 2030. Consumers, especially younger demographics, are seeking more personalized and diverse coffee experiences. Flavored organic coffee offers a wide range of options, such as vanilla, caramel, hazelnut, and more exotic flavors, allowing drinkers to enjoy unique and tailored tastes that enhance their overall coffee experience. As health-conscious consumers look for products that offer indulgence without compromising on natural ingredients, flavored organic coffee provides a guilt-free option. These coffees often use natural flavorings rather than artificial additives, aligning with the growing demand for clean-label products.

Distribution Channel Insights

Sales through offline stores accounted for a revenue share of 81.7% in 2023. Offline stores allow customers to engage with organic coffee products firsthand, offering opportunities for tasting and sampling. This sensory experience helps consumers make informed decisions about flavors, quality, and brand, encouraging immediate purchases. As the popularity of organic coffee rises, more specialty coffee shops and cafes are offering organic options. These establishments often emphasize quality and sustainability, driving consumers who value these aspects to purchase organic coffee directly from brick-and-mortar locations.

Sales through online is expected to grow at a CAGR of 9.3% from 2024 to 2030. Online shopping offers unmatched convenience, allowing consumers to browse, compare, and purchase organic coffees from the comfort of their homes. This ease of access eliminates the need to visit physical stores, making it easier for gamers to find and buy the latest models or specific features they’re interested in. The availability of detailed type descriptions, reviews, and ratings further aids consumers in making informed purchasing decisions. Online shopping platforms provide access to customer reviews and ratings, which can be highly influential in the purchasing decision. Gamers often rely on feedback from other users to gauge the performance, durability, and features of organic coffees before making a purchase.

Regional Insights

The organic coffee market in North America is expected to grow at a CAGR of 8.6% from 2024 to 2030. Consumers in North America are increasingly focused on healthier lifestyle choices, and organic coffee, free from synthetic pesticides and chemicals, fits into their pursuit of clean and natural products. The desire to avoid harmful additives is driving more people to choose organic coffee over conventional options. North American consumers are becoming more environmentally aware and prefer products that promote sustainability. Organic coffee farming supports biodiversity, reduces pollution, and uses eco-friendly practices, making it an appealing option for those concerned about environmental impact.

U.S. Organic Coffee Market Trends

The U.S. organic coffee market is facing intense competition and innovation. Organic coffee is often associated with fair trade and ethical sourcing practices, which resonate with consumers who prioritize social responsibility. Many North Americans are willing to pay a premium for coffee that supports fair wages and better working conditions for farmers, aligning with their ethical values. The growing trend of artisanal and specialty coffee in North America has led to increased demand for high-quality, premium products. Organic coffee, often seen as a superior, naturally produced option, fits well into the specialty coffee market, further fueling its popularity among coffee aficionados.

Europe Organic Coffee Market Trends

The organic coffee market in Europe is expected to grow at a CAGR of 9.6% during the forecast period. European consumers are becoming more health-conscious, seeking out products that are free from synthetic pesticides, chemicals, and genetically modified organisms (GMOs). Organic coffee, which is perceived as a healthier and more natural choice, aligns with this growing preference for clean and wholesome products. Additionally, the European market has seen a significant expansion of organic products in mainstream supermarkets, specialty stores, and coffee shops. Increased accessibility and awareness of organic coffee, combined with marketing efforts promoting its benefits, have contributed to the growing consumption of organic coffee across the region.

Asia Pacific Organic Coffee Market Trends

The Asia Pacific organic coffee market accounted for a revenue share of 40.5% in 2023. The rapid growth of café culture and the popularity of premium, artisanal coffee in urban centers across Asia Pacific have increased demand for specialty and organic coffee. As more people, particularly younger generations, embrace coffee as a lifestyle beverage, the demand for organic coffee options has surged in response to changing consumer tastes. With growing awareness about sustainability and environmental protection in the region, consumers are gravitating toward products that promote eco-friendly practices. Organic coffee, grown using sustainable farming methods that reduce environmental harm, resonates with environmentally conscious consumers.

Key Organic Coffee Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality product.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Organic Coffee Companies:

The following are the leading companies in the organic coffee market. These companies collectively hold the largest market share and dictate industry trends.

- Equal Exchange Co-op

- Allegro Coffee Company

- Jim’s Organic Coffee

- Counter Culture Coffee

- Death Wish Coffee Co.

- Starbucks Corporation

- Grupo Nutresa S.A.

- The J.M. Smucker Company

- Keurig Dr Pepper Inc.

- Nestlé S.A.

Recent Developments

-

In March 2024, Nespresso Professional introduced a new Brazil Organic coffee to expand its Origins range. The Brazil Organic coffee features a smooth and balanced flavor profile with notes of chocolate and nuts, making it an excellent choice for various coffee applications in professional settings. The launch of this organic coffee aligns with Nespresso's commitment to sustainability and responsible sourcing. The beans are cultivated using organic farming practices, ensuring minimal environmental impact while supporting local farmers.

-

In March 2024, Chameleon Organic Coffee announced the launch of its new ready-to-drink cold-brew cans, expanding its offerings in the ready-to-drink category. These eight oz. cans are crafted with 100% organic beans and come in four distinct flavors, including both sweetened and unsweetened options. Designed for convenience, the shelf-stable format allows customers to enjoy sustainably sourced coffee on the go.

Organic Coffee Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.66 billion

Revenue forecast in 2030

USD 13.16 billion

Growth rate

CAGR of 8.7% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Equal Exchange Co-op; Allegro Coffee Company; Jim’s Organic Coffee; Counter Culture Coffee; Death Wish Coffee Co.; Starbucks Corporation; Grupo Nutresa S.A.; The J.M. Smucker Company; Keurig Dr Pepper Inc.; Nestlé S.A.

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Coffee Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic coffee market report based on type, flavor, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Arabica

-

Robusta

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored

-

Unflavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global organic coffee market size was estimated at USD 7.24 billion in 2023 and is expected to reach USD 7.92 billion in 2024.

b. The global organic coffee market is expected to grow at a compounded growth rate of 8.8% from 2024 to 2030 to reach USD 13.16 billion by 2030.

b. Robusta organic coffee are expected to growth with a CAGR of 9.3% from 2024 to 2030. Robusta beans are often used in espresso blends due to their strong flavor and rich crema. As the popularity of espresso-based drinks continues to grow, the demand for organic Robusta beans is rising, especially among coffee aficionados who seek both quality and sustainability in their espresso.

b. Some key players operating in organic coffee market include Grupo Nutresa S.A., The J.M. Smucker Company, Keurig Dr Pepper Inc., Nestlé S.A., and others.

b. Key factors that are driving the market growth include rising coffee consumption and increasing café culture among youngsters

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.