- Home

- »

- Consumer F&B

- »

-

Organic Spices Market Size, Share & Trends Report, 2030GVR Report cover

![Organic Spices Market Size, Share & Trends Report]()

Organic Spices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Turmeric, Ginger, Chili, Pepper), By Form (Powder, Whole, Chopped/Crushed), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-507-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Spices Market Summary

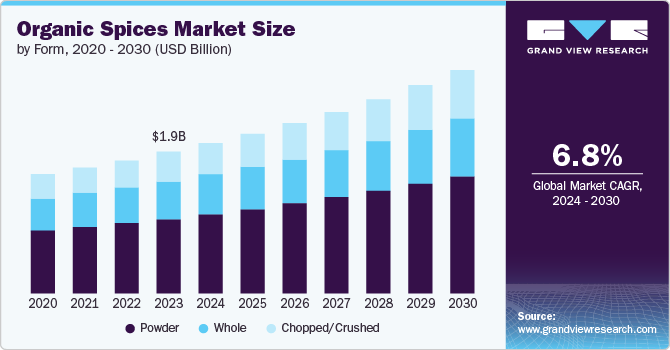

The global organic spices market size was valued at USD 1.89 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. Increased awareness of the benefits of organic spices through social media and the rising popularity of global and fusion cuisines are driving market growth.

Key Market Trends & Insights

- Asia Pacific organic spices market dominated the global organic spices market with a revenue share of 35.0% in 2023.

- By product, the turmeric dominated the organic spices segment with a revenue share of 22.0% in 2023.

- By form, the powdered organic spices led the market with a revenue share of 52.8% in 2023.

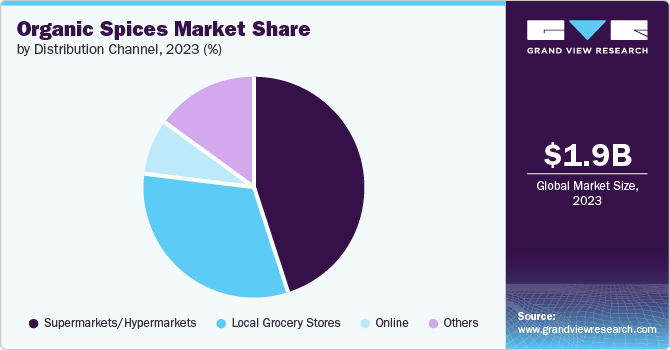

- By distribution channel, the supermarkets/hypermarkets generated the largest revenue share of 44.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.89 Billion

- 2030 Projected Market Size: USD 2.98 Billion

- CAGR (2024-2030): 6.8%

- Asia Pacific: Largest market in 2023

Moreover, increased awareness of the benefits of organic spices through social media and the rising popularity of global and fusion cuisines are driving demand for a variety of spices.

Worldwide industry growth for organic spices is fueled by a triumvirate of drivers, comprising consumer demand, health consciousness, and sustainability imperatives. One of the primary drivers is the growing demand for natural and chemical-free food options, fueled by consumers’ increasing health consciousness. As a result, organic spices are gaining popularity as a perceived healthier alternative to conventional spices. Furthermore, the rising interest in culinary diversity and ethnic flavors is boosting demand for organic spices, as consumers seek to explore new and exotic flavors.

Another key driver is the emphasis on sustainability and ethical consumption. Consumers are increasingly favoring products that promote eco-friendly practices, aligning with their values. Organic farming methods, which prioritize soil health and reduced chemical use, are seen as a way to support sustainable agriculture. Furthermore, government policies and incentives aimed at promoting organic farming are encouraging farmers to adopt these practices, leading to an increase in the supply of organic spices.

Technological advancements are also playing a crucial role in driving the organic spices market. Improvements in logistics and storage have extended the shelf life of organic spices and improved distribution, making them more accessible to consumers. Moreover, ongoing R&D efforts are leading to the introduction of innovative organic spice products that cater to evolving consumer tastes and preferences. As disposable incomes rise, consumers are more willing to pay a premium for organic products, contributing to market growth. The availability of online retail platforms and changes in consumer shopping behavior due to the pandemic have also contributed to the growth of the organic spices market.

Product Insights

Turmeric dominated the organic spices segment with a revenue share of 22.0% in 2023, driven by its superfood status, culinary versatility, and growing demand for natural products. Its scientifically proven health benefits and cultural significance further boost its appeal. With fewer supply chain challenges, organic turmeric availability is more stable, enabling it to meet the increasing demand from health-conscious consumers seeking organic and beneficial foods.

Pepper is expected to register the fastest CAGR of 7.8% over the forecast period. Pepper is a ubiquitous spice, globally available and widely used in various cuisines. Its natural, crushed, and concentrated forms are in high demand due to its versatility. Pepper’s distinctive flavor and aroma have made it a staple in both modern and traditional dishes, driving consumer preference and demand.

Form Insights

Powdered organic spices led the market with a revenue share of 52.8% in 2023. The widespread adoption of powdered spices can be attributed to their ease of measurement, mixing, and incorporation into recipes. Powdered spices’ increased surface area enhances flavor and aroma release, making them a popular choice for cooks. With a longer shelf life than whole spices, powdered varieties offer convenience for consumers, allowing them to make bulk purchases without worrying about expiration dates.

Chopped/crushed organic spices are expected to register the fastest CAGR of 7.6% over the forecast period. Processing spices into chopped/crushed forms liberates their essential oils and flavors, resulting in a superior taste compared to whole spices. This enhanced flavor profile encourages consumers to utilize the products to create delectable recipes, driving demand for premium spice blends. The convenience of pre-chopped organic spices allows for easy incorporation into diverse meal preparations, catering to various tastes and cuisines.

Distribution Channel Insights

Supermarkets/hypermarkets generated the largest revenue share of 44.6% in 2023. Organic spices in supermarkets and hypermarkets offer a vast array of options, sourced from diverse global regions. This variety provides consumers with a competitive advantage, allowing them to select their preferred spices for culinary purposes. Conveniently, these retail outlets enable one-stop shopping, streamlining the purchasing process for consumers seeking organic spices alongside other essential grocery items.

Online distribution channels are expected to register the fastest growth of 8.0% between 2024 and 2030. Online availability of organic spiced products offers a unique advantage, enabling consumers to browse and purchase from the comfort of their own homes. This eliminates the need for physical store visits, expanding the market reach to a global audience. Online platforms also provide valuable information on organic certification, procurement, and production processes, enhancing consumer trust and increasing market share for organic spice producers.

Regional Insights

North America organic spices market is anticipated to witness significant growth in the global organic spices market over the forecast period. This growth can be attributed to increasing consumer awareness of the benefits of a healthy diet, cooking trends, and willingness to try new concepts. The growing demand for organic food products and emphasis on health aspects in consumption are also contributing factors. As a result, consumers are seeking organic spices with curing qualities, fueling market expansion.

U.S. Organic Spices Market Trends

The organic spices market in the U.S. dominated the North America organic spices market in 2023, characterized by a large demographic prioritizing health and wellness, driving demand for organic food and spices. The country’s well-established regulatory framework, governed by the USDA National Organic Program, ensures strict quality control measures for organic products, including spices. This environment fosters trust and confidence among consumers, further propelling the growth of the US organic spices market.

Asia Pacific Organic Spices Market Trends

Asia Pacific organic spices market dominated the global organic spices market with a revenue share of 35.0% in 2023, fueled by its strong reputation as a leading producer and exporter of various spice types. Factors contributing to its popularity include increasing consumer demand for natural products due to growing health awareness; rising interest in exotic flavors and diverse cuisines; favorable government policies promoting organic farming; technological advancements enhancing logistics and storage; and rising disposable incomes leading to increased willingness to pay a premium for organic products.

The organic spices market in China is expected to hold a substantial share of the Asia Pacific organic spices market over the forecast period, aided by the country’s ability to mass-produce a variety of spices in large volumes due to its diverse climate. As a major exporter and rising domestic market driven by health-conscious consumers, China is gaining traction in the Asia Pacific organic spices market.

Europe Organic Spices Market Trends

Europe organic spices market is expected to grow at the fastest CAGR of 7.6% over the forecast period. The European market presents a significant opportunity for organic spices due to its large customer base, high per capita income, and distinct culinary preferences. The growing demand for premium organic products, including spices, is driven by customer willingness to pay a premium for high-quality, sustainable ingredients, making Europe a lucrative market for organic spice sales.

The organic spices market in Germany held a significant market share of the Europe organic spices market in 2023, driven by the country’s strong demand for premium organic food products. With a high level of awareness about health and ecological concerns, German consumers increasingly prioritize natural and organic options, including spices. This trend is expected to continue, presenting a lucrative opportunity for businesses catering to this demand.

Key Organic Spices Company Insights

Some of the key companies in the organic spices market include McCormick & Company, Inc.; Organic Spices Inc.; Paleovalley; and Frontier Co-op.; among others. Key players in the leverage extensive product offerings and distribution networks, while newcomers focus on unique blends and direct sales. To stand out, companies prioritize quality, transparency, and eco-friendliness to meet growing demand for natural and sustainable products.

-

McCormick & Company, Inc. offers a diverse and well-balanced portfolio of flavors to meet the growing demand worldwide. The company’s products include spices, seasoning blends, coating systems, compound flavors, condiments, and more.

-

Frontier Co-op, formerly known as Frontier Natural Products Co-op, is a member-owned cooperative that specializes in sourcing high-quality spices, herbs, and botanical products. Frontier Co-op places a strong emphasis on sustainable sourcing through its Well Earth program.

Key Organic Spices Companies:

The following are the leading companies in the organic spices market. These companies collectively hold the largest market share and dictate industry trends.

- McCormick & Company, Inc.

- Organic Spices Inc.

- Paleovalley

- Frontier Co-op.

- Rapid Organic

- Spicely Organics

- Simply Organic

- Red Monkey Foods

- Curio Spice Company

- Suminter India Organics

Recent Developments

-

In January 2024, Simply Organic awarded USD 150,000 to five U.S. nonprofits in 2024 to address food insecurity, focusing on creative approaches to provide access to healthy, organic food options.

-

In January 2024, McCormick introduced Flavor Maker Seasonings, a new line of 15 blends to inspire home cooks. The collection was launched online and on Amazon.com, with Walmart.com availability soon.

-

In May 2023, Organic Spices Inc. announced its expansion into contract production and private label co-packing services. This strategic move aims to provide enhanced value to its customers by offering a wider range of options and custom solutions.

Organic Spices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.01 billion

Revenue forecast in 2030

USD 2.98 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; South Africa; Saudi Arabia

Key companies profiled

McCormick & Company, Inc.; Organic Spices Inc.; Paleovalley; Frontier Co-op.; Rapid Organic; Spicely Organics; Simply Organic; Red Monkey Foods; Curio Spice Company; Suminter India Organics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Spices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic spices market report based on product, form, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Turmeric

-

Ginger

-

Chili

-

Pepper

-

Cinnamon

-

Nutmeg

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Whole

-

Chopped/Crushed

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Local Grocery Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.