- Home

- »

- Consumer F&B

- »

-

Saffron Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Saffron Market Size, Share & Trends Report]()

Saffron Market (2026 - 2033) Size, Share & Trends Analysis Report By Grade (Grade-I, Grade-II, Grade-III, Grade-IV), By Type, By Form (Liquid, Powder, Stigma, Petals, Stamen), By Product, By Distribution, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-471-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Saffron Market Summary

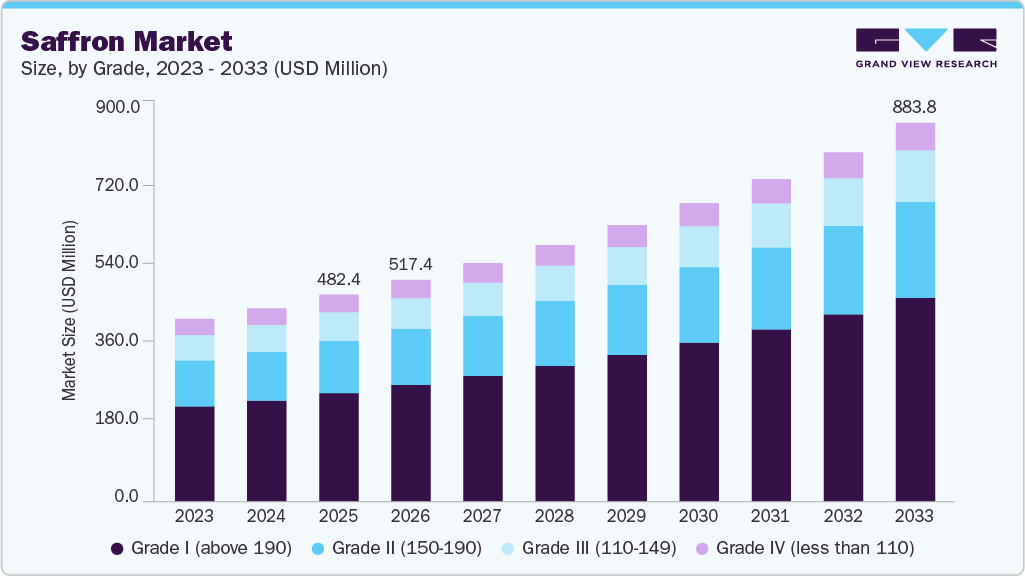

The global saffron market size was estimated at USD 482.4 million in 2025 and is projected to reach USD 883.8 million by 2033, growing at a CAGR of 7.9% from 2026 to 2033. Increasing demand for saffron in cosmetic & medical applications is expected to be a key driving factor for the market over the forecast period.

Key Market Trends & Insights

- Middle East and Africa held the largest revenue share of 54.2% in 2025.

- UAE is expected to expand at a significant CAGR during the forecast period.

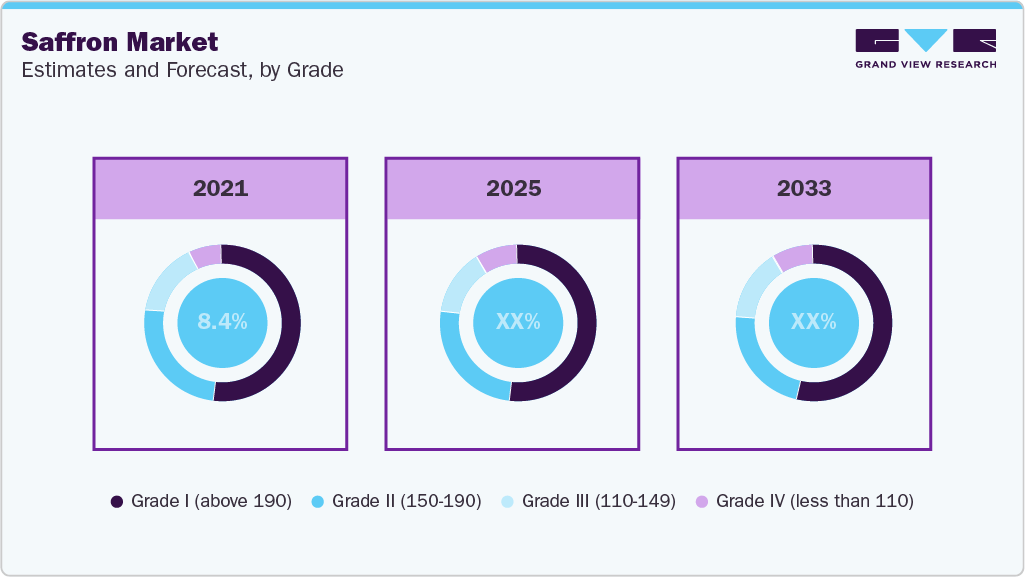

- By grade, in the global market, the finest quality available is categorized as Grade I, which generated more than 52.4% of the total revenue in 2025.

- By product, the food & beverage segment led the global market with a revenue share of 58.3% in 2025.

- By type, the traditional type led the global market with a revenue share of 63.2% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 482.4 Million

- 2033 Projected Market Size: USD 883.8 Million

- CAGR (2026-2033): 7.9%

- Middle East & Africa: Largest market in 2025

- Asia Pacific: Fastest growing market

Key technologies used in processing include image processing technology, pilot scale, and an electric nose. The process of separating stigmas has been done manually so far, however, using the image processing method to separate stigmas is less time-consuming. ISO Standard 3632 is the requirement that concerns merely the measurement of the quality. Adulteration has been growing rapidly in recent years owing to the high price and increased demand in the global market. The adulteration includes the mixing of products that look similar to saffron.The market is expected to exhibit a low threat of new entrants on account of the extensive portfolio offered and distribution network operated by existing players, which results in a high entry barrier for new entrants. Besides, the high switching cost for the buyers makes it difficult for new players to gain a significant market share, thereby lowering the threat of new entrants.

The adulteration results in variations in the quality of the product and the consequent variation in prices. The standard comprises 2 parts, ISO 3632-1 and ISO 3632-2, which identify the test methods for various classifications of dried, cut threads, powders, and threads. The main purpose of the standards is to test the strength of flavor, scent, and color of saffron, which helps protect consumers from purchasing a fake product that is expensive as well as has no food value.

The U.S. has witnessed increasing demand over the past few years owing to the growing awareness among consumers about the medicinal properties and health benefits of saffron. The trade between Iran and the U.S. witnessed a surge after the U.S. revoked trade restrictions that were imposed on imports from Iran. Growers in the U.S. have been increasingly investing in cultivation. The growers from the states, such as Vermont, Pennsylvania, and Washington, have been taking initiatives with an aim to increase the product’s cost-effective domestic supply.

The saffron derivative market, including saffron oil, extracts, powder, and other forms such as crocin, safranal, etc., is expected to witness growth in the coming years due to the growing demand for natural ingredients, gourmet & culinary applications, pharmaceutical & research use, and other uses.

Grade Insights

The Grade I (above 190) segment accounted for the largest revenue share of 52.4% of the saffron market in 2025 and is expected to grow at the fastest CAGR over the forecast period. This segment includes two types of saffron: Negin and Sargol. Negin typically has an ISO reading of over 270, while Sargol's ISO reading ranges from 260 to 270. The reason for the Grade I segment's dominance is due to the excellent coloring, flavoring strengths, and aroma of its products. These characteristics make Grade I saffron highly desirable for premium culinary applications, fragrances, and personal care products. Its high coloring and flavoring strength make it ideal for use in these premium products.

The Grade II (ISO 150-190) saffron segment is projected to grow significantly over the forecast period due to its balanced combination of quality and affordability. As saffron use expands from luxury occasions to regular household and restaurant consumption, demand is rising for grades suitable for everyday use. Grade II saffron is genuine and safe, with slightly lower potency than premium grades, red threads with minor yellow portions, a crocin value between 150 and 190, and a mild to moderate aroma. Its mid-range pricing makes it widely accessible, especially in price-sensitive markets such as India.

Type Insights

The traditional type segment dominated the saffron market with the largest revenue share in 2025. The market for traditional saffron is driven by its unique flavor, aroma, and color, which make it a highly valued ingredient in cooking, cosmetics, and traditional medicine. In addition to its culinary uses, saffron has been used for centuries in traditional medicine to treat a variety of ailments, including depression, anxiety, and menstrual cramps. It is also used in cosmetics for its skin-brightening properties.

The organic type segment of the saffron market is expected to grow at the fastest CAGR over the forecast period. The organic saffron market is growing at a rapid CAGR due to the growing demand for natural and healthy food products. Organic saffron is produced using natural methods of cultivation that do not involve the use of synthetic fertilizers or pesticides. This makes it a healthier and more environmentally friendly choice for consumers.

Form Insights

The stigma form led the global market with the largest revenue share in 2025. Saffron stigmas are the pure, unprocessed threads of the Crocus sativus flower. They are the form used for ISO 3632 quality testing, making them the preferred choice for buyers seeking assured grade, potency, and origin. The stigma form contains the highest concentrations of key quality compounds such as crocin (colour), safranal (aroma), and picrocrocin (taste), which directly determine market value and pricing. As a result, the stigma form remains the most valued segment in the global saffron market, commanding premium prices and setting a benchmark for quality standards.

The market for liquid form is expected to witness the fastest CAGR over the projected period. Saffron liquid is an extract of saffron spice that is used in a variety of ways for its unique flavor, aroma, and color. It is often used in cooking to add a distinctive flavor to dishes and is particularly popular in Mediterranean and Middle Eastern cuisine. Saffron liquid is also used in traditional medicine as it is believed to have various health benefits, including anti-inflammatory and antioxidant properties. In addition to its culinary and medicinal uses, saffron liquid is also used in the perfume industry to add a unique and exotic aroma to fragrances. It is also used in the textile industry to dye fabrics and give them a bright yellow or orange color.

The petals' form is expected to grow rapidly in the coming years. Petals are often used in traditional medicine and herbal remedies, as they are believed to have several health benefits, such as reducing inflammation and improving mood. In addition, the use of saffron petals is in the production of natural dyes. Saffron petals contain a yellow-orange pigment called crocin, which can be extracted and used to color fabrics and other materials.

The saffron extract market is projected to grow over the coming years across food, cosmetic, nutraceutical, and pharmaceutical applications due to rising demand for natural, health-oriented ingredients

Product Insights

The food & beverage segment dominated the saffron market with the largest revenue share in 2025. Saffron is widely used as a premium spice to enhance flavor, color, and aroma in culinary products. Its growing popularity among chefs, restaurants, and home cooks, combined with the rising demand for natural and high-quality ingredients, has driven strong sales in this segment. In addition, saffron’s use in ready-to-eat foods, beverages, and gourmet products further contributed to its leading revenue share. In June 2023, India’s NV Group and SMOKE LAB Vodka announced the launch of SMOKE LAB Saffron Vodka in the U.S., combining premium Indian vodka with rare Kashmiri saffron.

The cosmetics segment is projected to record the fastest CAGR from 2026 to 2033. Saffron’s antioxidant, anti-inflammatory, and skin-brightening properties, due to its high crocin and safranal content, have made it a highly valued ingredient in premium skincare and haircare products. It is increasingly used in anti-aging creams, serums, and hair treatments, appealing to consumers seeking effective, natural solutions. The growing preference for clean and organic beauty products, along with a shift away from synthetic chemicals, has driven strong demand among millennials and Gen Z, who prioritize sustainability and natural formulations.

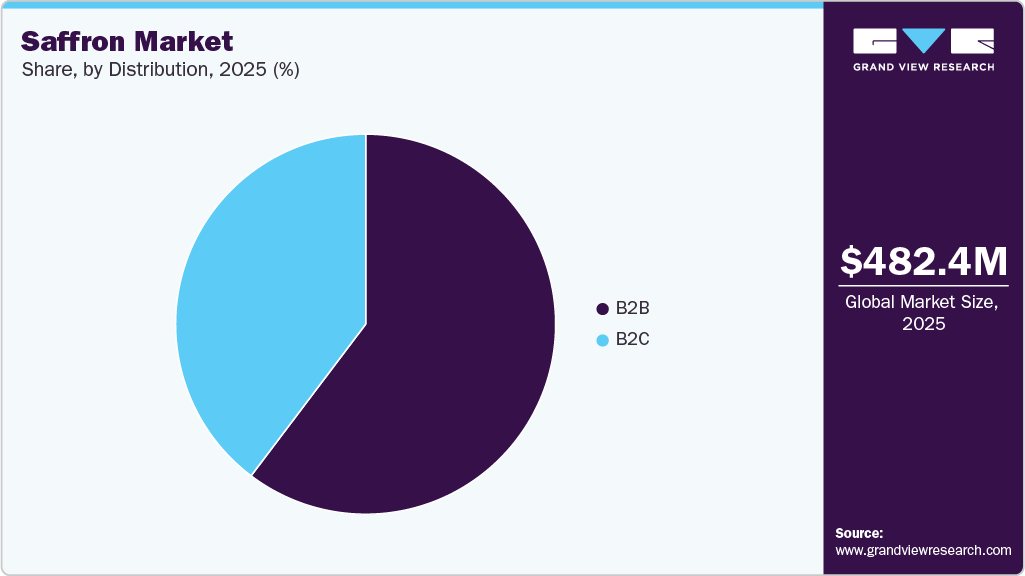

Distribution Insights

The B2B distribution segment dominated the global saffron market in 2025. The growing trend of using saffron as a natural coloring and flavoring agent in food and beverages is particularly contributing to the expansion of the market for saffron in the B2B distribution channel.

The market for the B2C distribution channel is expected to witness the fastest CAGR during the projected period. Growth is due to increasing availability of saffron products through online retail channels, the growing popularity of saffron-based supplements and dietary products, and the increasing use of saffron in the cosmetics and personal care industries. In addition, the rise of e-commerce platforms has made it easier for consumers to purchase saffron products directly from manufacturers, leading to increased competition and lower prices.

Regional Insights

North America saffron market is expected to experience strong growth over the forecast period. Saffron is becoming increasingly popular in North America due to its various health benefits. Modern lifestyles have resulted in anxiety attacks becoming increasingly common among adults, and saffron is highly effective in treating them. Saffron tablets contain bioactive compounds such as Crocin, which possess several medicinal properties and health benefits.

U.S. Saffron Market Trends

The U.S. dominated the North American saffron market with the largest share in 2025. A strong preference for organic, natural ingredients aligns with premiumization trends in culinary, pharmaceutical, cosmetic, and nutraceutical applications, supported by well-established industries and high disposable incomes. Domestic cultivation in states such as California, Vermont, Pennsylvania, and Washington has enhanced cost-effective saffron supply.

Europe Saffron Market Trends

The European saffron market is expected to experience strong growth over the forecast period. The increasing awareness of the health benefits of saffron, coupled with the rising demand for organic and natural products, is driving the growth of the market in Europe. As a result, there is a growing demand for high-quality saffron from consumers, which is fueling the growth of the market in Europe.

According to an article published on BIOPRO Baden-Württemberg GmbH, a German start-up, Innovation Matters, is developing a robot-assisted process for saffron cultivation. The robot, named Oscar, can detect and cut flowers, but the extraction of saffron threads still needs to be done by hand. Germany could potentially become a net exporter of saffron. The company plans to make test products available soon and collect data from real customers.

Asia Pacific Saffron Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 8.2% over the forecast period. The market for saffron in Asia Pacific is driven by a variety of factors, including its cultural and historical significance, its use in traditional medicine and culinary applications, and its increasing popularity as a premium ingredient in luxury products. In many Asian countries such as India and China, saffron has been used for centuries in traditional medicine for its various health benefits, such as improving digestion, treating respiratory ailments, and reducing inflammation. It is also believed to have mood-enhancing properties and is used in Ayurvedic medicine and other traditional healing systems.

Middle East & Africa Saffron Market Trends

Middle East and Africa held the largest revenue share of 54.2% in 2025. This is attributable to the increasing demand for its use in traditional cuisine. Saffron is an essential ingredient in many dishes in the region, such as biryanis, pilafs, and tagines, and it is also used to flavor sweets and desserts. The spice is a symbol of hospitality and is often served to guests as a sign of respect. Another factor driving the saffron industry in the region is its medicinal properties. Saffron has been used for centuries in traditional medicine to treat a range of ailments, including depression, anxiety, and insomnia. It is also believed to have antioxidant and anti-inflammatory properties and may help to lower blood pressure and cholesterol levels.

In February 2025, Jebel Ali Free Zone (Jafza) partnered with Haldiram’s to set up one of the GCC’s largest saffron processing plants in Dubai. Kesar Expert & Packers will manage the facility, which is set to start operating in March 2025 and will meet BRCGS quality standards.

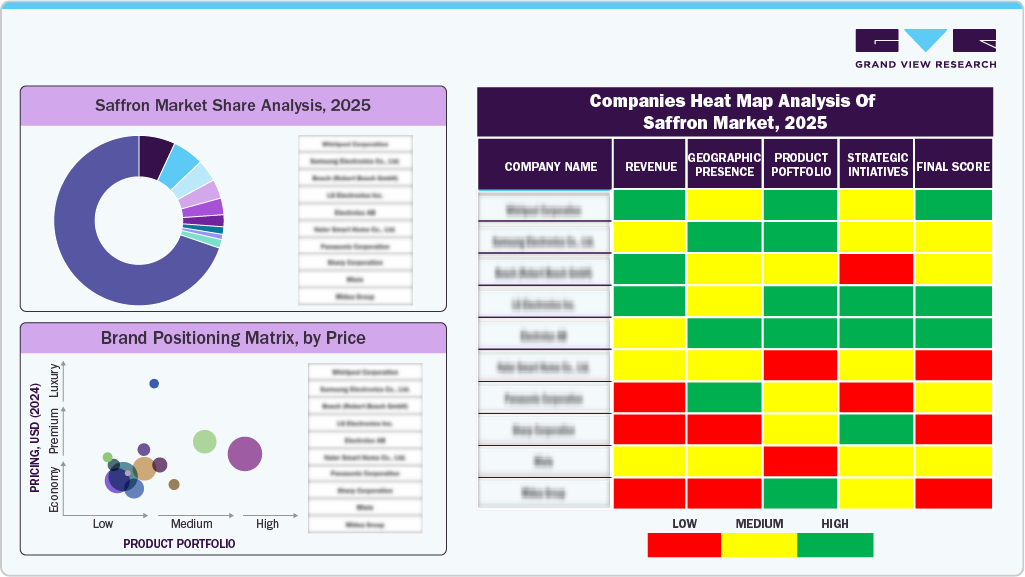

Key Saffron Company Insights

Some of the key players in the saffron market include Esfedan Saffron; Tarvand Saffron Ghaen; and others.

-

Esfedan Saffron is a Persian saffron producer specializing in the development, processing, and global export of premium-quality saffron. The company operates an international network with offices across Europe, the Middle East, and Asia, supplying several thousand kilograms annually to more than 30 countries. The company is recognized for innovation, including proprietary saffron extract and spray products that set new benchmarks in the global saffron industry.

Key Saffron Companies:

The following are the leading companies in the saffron market. These companies collectively hold the largest market share and dictate industry trends.

- Esfedan Saffron

- Tarvand Saffron Ghaen

- Gohar Saffron

- Rowhani Saffron Co.

- Mehr Saffron

- Florasaffron

- Royal Saffron Company

Recent Developments

-

In December 2025, Scientists from Iran and Kashmir launched a collaborative initiative to advance saffron farming, with an Iranian delegation visiting SKUAST-K to share expertise.

-

In October 2025, BioHarvest Sciences Inc. partnered with Saffron Tech to develop and commercialize saffron-based botanical compounds using its unique Botanical Synthesis platform.

-

In August 2023, Tata Consumer Products (TCP) entered the premium Kashmiri saffron market with the launch of Grade 1 saffron under its Himalayan brand.

Saffron Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 517.4 million

Revenue forecast in 2033

USD 883.8 million

Growth rate

CAGR of 7.9% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Grade, type, form, product, distribution, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; Brazil; Argentina; South Africa; UAE; Iran

Key companies profiled

Esfedan Saffron; Tarvand Saffron Ghaen; Gohar Saffron; Rowhani Saffron Co.; Mehr Saffron; Florasaffron; Royal Saffron Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Saffron Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global saffron market report based on grade, type, form, product, distribution, and region:

-

Grade Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Grade I (above 190)

-

Grade II (150-190)

-

Grade III (110-149)

-

Grade IV (less than 110)

-

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Organic

-

Traditional

-

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Liquid

-

Powder

-

Stigma

-

Petals

-

Stamen

-

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Food supplements

-

Cosmetics

-

Personal care products

-

Food & beverage

-

Others

-

-

Distribution Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

B2B

-

B2C

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global saffron market size was estimated at USD 482.4 million in 2025 and is expected to reach USD 517.4 million in 2026.

b. The saffron market is expected to grow at a compound annual growth rate of 7.9% from 2026 to 2033, to reach USD 883.8 million by 2033.

b. The food & beverages segment dominated the saffron market in 2025 with a share of 58.3%.

b. Some of the key players in the saffron market are Esfedan Trading Company, Safran Global Company S.L.U., Tarvand Saffron Co., Saffron Business Company, Gohar Saffron, Rowhani Saffron Co., Mehr Saffron, Flora Saffron, Royal Saffron Company, and Iran Saffron Company.

b. Growing demand for saffron in medical and cosmetic applications is expected to be a key driving factor for the saffron market in the forecast period, given its richness in antioxidants and the several health benefits offered.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.