- Home

- »

- Plastics, Polymers & Resins

- »

-

Organic Substrate Packaging Material Market Report, 2033GVR Report cover

![Organic Substrate Packaging Material Market Size, Share & Trends Report]()

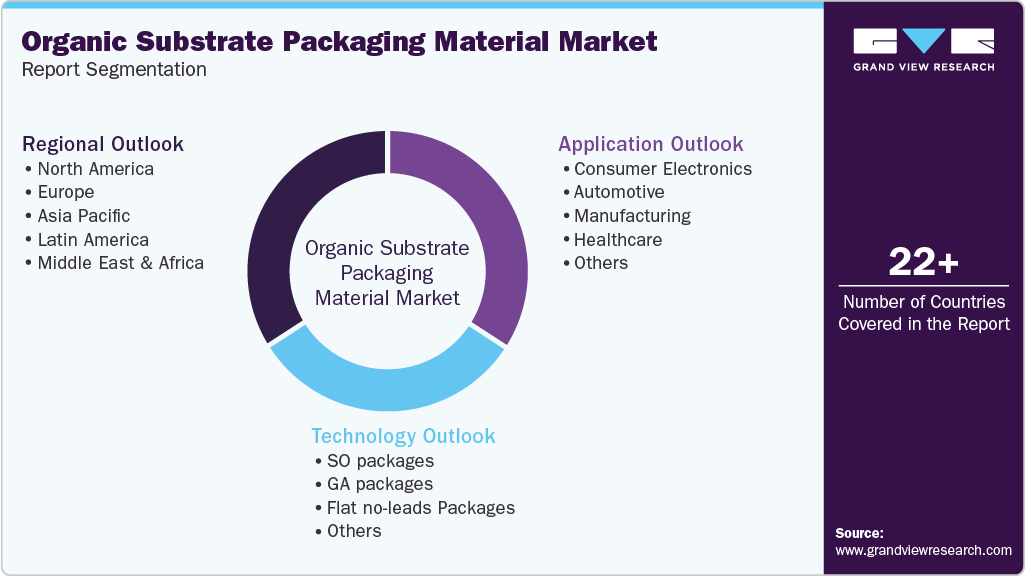

Organic Substrate Packaging Material Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (SO packages, GA packages, Flat no-leads packages), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-649-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Substrate Packaging Material Market Summary

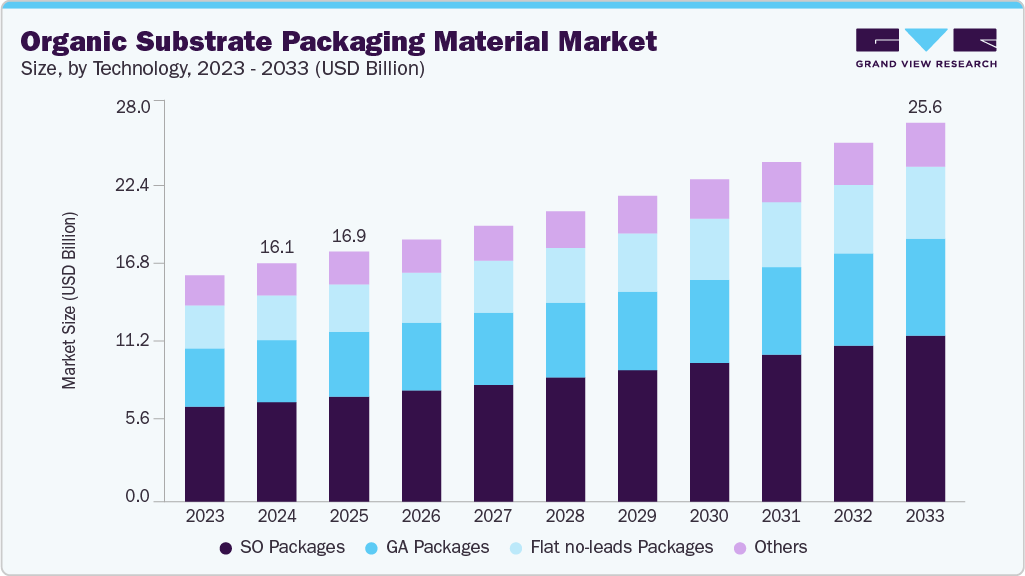

The global organic substrate packaging material market size was estimated at USD 16.08 billion in 2024 and is anticipated to reach USD 25.62 billion by 2033, growing at a CAGR of 5.3% from 2025 to 2033. The market is driven by the growing demand for compact, high-performance electronic devices and the rapid expansion of the consumer electronics and automotive sectors.

Key Market Trends & Insights

- Asia Pacific dominated the organic substrate packaging material market with the largest revenue share of over 62.0% in 2024.

- The organic substrate packaging material market in the U.S. is expected to grow at a substantial CAGR of 5.9% from 2025 to 2033.

- By technology, the SO packages segment is expected to grow at a considerable CAGR of 5.8% from 2025 to 2033 in terms of revenue.

- By application, the automotive segment is expected to grow at a considerable CAGR of 5.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 16.08 Billion

- 2033 Projected Market Size: USD 25.62 Billion

- CAGR (2025-2033): 5.3%

- Asia Pacific: Largest Market in 2024

- North America: Fastest Market in 2024

Additionally, advancements in semiconductor packaging technologies are boosting the adoption of organic substrates over traditional materials. One of the primary drivers of the global organic substrate packaging material market is the growing demand for advanced semiconductor packaging technologies such as System-in-Package (SiP), Flip Chip, and Fan-Out Wafer Level Packaging (FOWLP). These technologies require high-performance substrates that can handle higher I/O densities, miniaturization, and faster signal transmission. Organic substrates, made primarily from resin-coated copper, BT resin, and ABF materials, are cost-effective and offer reliable performance for these next-generation chipsets. For instance, the rise of 5G base stations and AI accelerators, companies such as Samsung and Intel are increasing their use of organic substrates for multi-die packaging.

Additionally, the rapid expansion of consumer electronics and mobile devices, especially in emerging economies, is contributing to market growth. Smartphones, tablets, wearable devices, and smart home technologies are integrating more complex and compact integrated circuits, which drives the need for high-layer-count organic substrates. With Apple’s ongoing integration of custom SoCs (e.g., M-series chips) and Android device makers pushing AI-enhanced processors, the demand for compact, thermally stable, and cost-effective organic substrate materials is intensifying. These trends are pushing substrate manufacturers to scale up production while investing in advanced materials like Ajinomoto Build-up Film (ABF).

Moreover, the automotive electronics sector is experiencing global growth, driven especially by the rapid shift toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Automotive chips need to be robust, thermally stable, and reliable, making organic substrates an ideal choice for Electronic Control Units (ECUs), battery management systems, and infotainment devices. Major automotive OEMs and Tier-1 suppliers are increasingly collaborating with semiconductor packaging firms to source organic substrates tailored for harsh environmental conditions. For example, Bosch and Continental are driving demand through their focus on EV powertrain electronics and autonomous driving modules, indirectly fueling the organic substrate market.

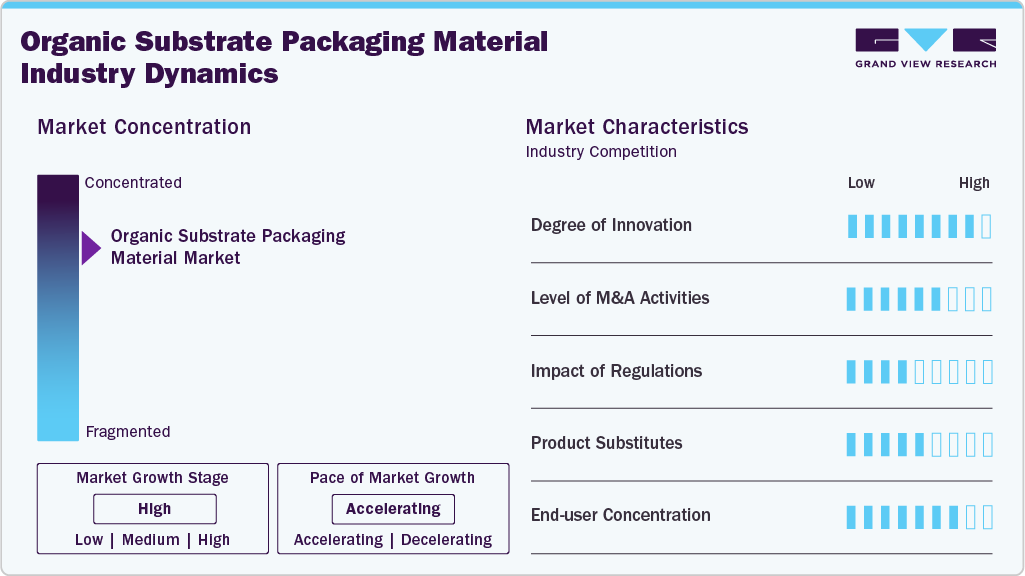

Market Concentration & Characteristics

The organic substrate packaging material market is capital-intensive, requiring significant investment in manufacturing facilities, cleanrooms, photolithography, and advanced lamination equipment. Moreover, it is driven by rapid technological evolution, demanding continuous R&D in substrate materials, miniaturization, and thermal/electrical performance. Key players invest heavily in next-gen substrate innovation to meet rising demands from AI, HPC, and 5G chipmakers.

The market is closely tied to the semiconductor ecosystem, especially OSATs (Outsourced Semiconductor Assembly and Test) and IDM (Integrated Device Manufacturer) companies. Demand fluctuations in end-use industries such as consumer electronics, automotive, and telecom directly affect substrate material consumption. For example, when smartphone makers ramp up new chip production cycles, demand for ABF substrates spikes.

Organic substrate production is highly concentrated in East Asia (Japan, South Korea, Taiwan, China), making the supply chain susceptible to geopolitical tensions, trade restrictions, and raw material availability. Additionally, upstream dependency on high-performance resins and copper foils adds another layer of vulnerability.

Technology Insights

The SO packages segment recorded the largest market revenue share of over 41.0% in 2024 and is expected to grow at the fastest CAGR of 5.9% during the forecast period. They are commonly used for integrated circuits in consumer electronics, automotive, and industrial applications due to their cost efficiency and space-saving design. The growth of the consumer electronics and automotive sectors, especially with the rise of compact electronic control units (ECUs), is driving demand for SO packages. Their ease of assembly on printed circuit boards (PCBs) and cost-effective production make them preferred choice in high-volume applications, particularly in smartphones, infotainment systems, and household electronics.

GA packages, including Ball Grid Array (BGA) and Chip Grid Array (CGA), offer higher input/output (I/O) density and better electrical performance than traditional leaded packages. These are widely used in high-performance computing, telecommunications, and gaming systems. The demand for high-speed data processing and miniaturization in advanced computing devices is a significant driver. GA packages allow for more connections and better thermal performance, aligning with industry needs for AI chips, 5G infrastructure, and data center equipment. The push for enhanced signal integrity in densely populated circuits further boosts adoption.

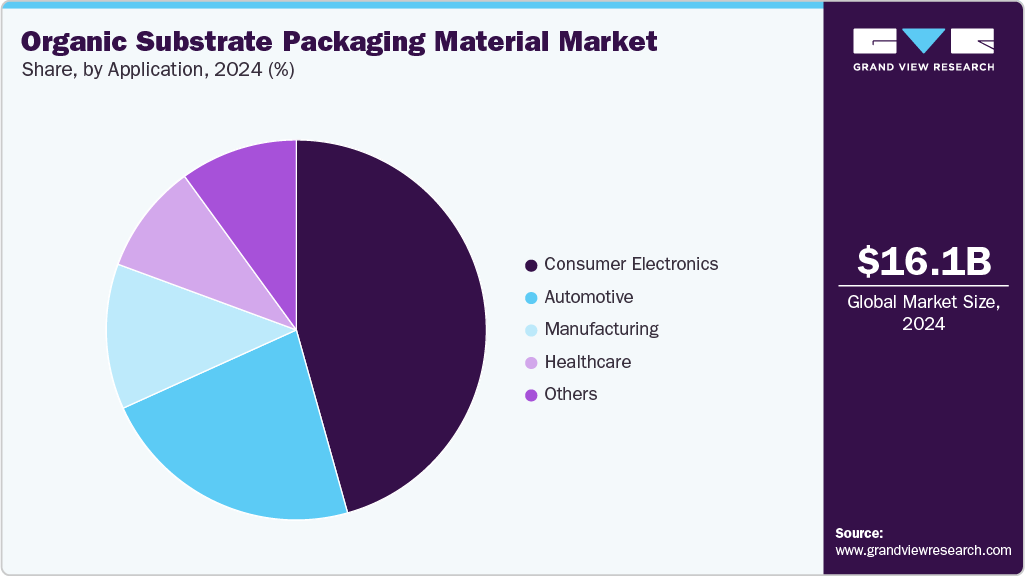

Application Insights

The consumer electronics segment recorded the largest market share of over 45.0% in 2024. Consumer electronics is the dominant application segment for organic substrate packaging materials. These materials are extensively used in smartphones, tablets, laptops, wearables, and gaming devices due to their compact size, high wiring density, and thermal performance. The increasing demand for miniaturized, multifunctional, and high-speed consumer electronic devices is a key driver. The rollout of 5G, advancements in AI and IoT, and higher performance expectations in mobile computing are pushing manufacturers toward high-density packaging substrates.

The automotive segment is projected to grow at the fastest CAGR of 6.0% during the forecast period. In the automotive sector, organic substrate packaging materials are utilized in electronic control units (ECUs), infotainment systems, ADAS, and electric powertrain modules. With the growing adoption of electric vehicles (EVs) and autonomous driving technologies, the integration of electronics in vehicles is rapidly expanding. The shift toward connected and electric vehicles is significantly increasing the electronic content per vehicle. As EVs require high-performance power electronics and battery management systems, the demand for thermally stable, reliable, and compact packaging solutions, such as organic substrates, is rising. Government policies on emission reductions and the development of smart mobility are further accelerating this trend.

Regional Insights

Asia Pacific organic substrate packaging material market dominated the market and accounted for the largest revenue share of over 62.0% in 2024. This positive outlook is due to rapid industrialization, booming electronics manufacturing, and strong demand for advanced packaging solutions. Countries such as China, Japan, South Korea, and Taiwan are major hubs for semiconductor and consumer electronics production, driving the need for high-performance organic substrates. For example, the proliferation of 5G technology, IoT devices, and AI chips in China and South Korea has increased demand for substrates with superior thermal and electrical properties. Additionally, government initiatives such as China’s "Made in China 2025" and India’s semiconductor incentives further boost local manufacturing, accelerating market growth.

North America Organic Substrate Packaging Material Market Trends

North America is expected to grow at the fastest CAGR of 5.9% over the forecast period, owing to technological innovation, high R&D investments, and strong demand from the automotive and aerospace sectors. The U.S.andCanada are home to leading semiconductor companies such as Intel and AMD, which require advanced organic substrates for high-performance computing (HPC) and AI applications. The growing adoption of electric vehicles (EVs) in the U.S. also fuels demand for reliable packaging materials in power electronics. Furthermore, defense and aerospace applications in the region require robust substrates for harsh environments, pushing advancements in materials such as polyimide and liquid crystal polymer (LCP) substrates.

Europe Organic Substrate Packaging Material Market Trends

Europe’s organic substrate packaging market is propelled by the automotive industry’s shift toward electrification and stringent environmental regulations promoting sustainable materials. Germany, France,and theNetherlands lead in automotive electronics, with companies such as Bosch and Infineon requiring high-reliability substrates for EV power modules and ADAS (Advanced Driver Assistance Systems). Additionally, Europe’s strong medical device industry demands biocompatible organic substrates for implantable electronics. The EU’s focus on reducing electronic waste also drives innovation in recyclable and halogen-free substrate materials, giving European manufacturers a competitive edge in eco-friendly packaging solutions.

Key Organic Substrate Packaging Material Company Insights

The competitive environment of the organic substrate packaging material market is moderately fragmented, with a mix of established players and emerging companies competing based on material innovation, sustainability, and performance efficiency. Key players are leveraging advanced R&D capabilities to develop lightweight, environmentally friendly, and thermally stable substrates to meet rising demand from electronics, automotive, and healthcare sectors. The market is also witnessing increased collaboration between substrate manufacturers and semiconductor firms to develop tailored packaging solutions, particularly for applications in 5G, IoT, and wearable devices.

-

In July 2024, Japan’s Shin-Etsu Chemical launches advanced equipment for semiconductor packaging that leverages a novel dual damascene method, utilizing excimer laser technology to directly form interposer functions within package substrates. This innovation eliminates the need for a separate interposer in chiplet assembly, significantly simplifying the process, enabling finer microfabrication than current mainstream methods, and reducing both costs and capital investment by removing the photoresist step.

-

In September 2024, Onto Innovation Inc. announced the opening of its Packaging Applications Center of Excellence (PACE) in Wilmington, Massachusetts, marking the first facility of its kind in the U.S. dedicated to advancing panel-level packaging (PLP) technologies for 2.5D and 3D chiplet architectures and AI packages.

Key Organic Substrate Packaging Material Companies:

The following are the leading companies in the organic substrate packaging paterial market. These companies collectively hold the largest market share and dictate industry trends.

- Amkor Technology Inc.

- Kyocera Corporation

- Microchip Technology Inc.

- Texas Instruments Incorporated

- ASE Kaohsiung

- Simmtech Co., Ltd

- Shinko Electric Industries Co. Ltd

- LG Innotek Co.Ltd

- AT&S

- Daeduck Electronics Co. Ltd

Organic Substrate Packaging Material Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.89 billion

Revenue forecast in 2033

USD 25.62 billion

Growth rate

CAGR of 5.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Amkor Technology Inc; Kyocera Corporation; Microchip Technology Inc.; Texas Instruments Incorporated; ASE Kaohsiung; Simmtech Co., Ltd; Shinko Electric Industries Co. Ltd; LG Innotek Co. Ltd; AT&S; Daeduck Electronics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Substrate Packaging Material Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global organic substrate packaging material market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million 2021 - 2033)

-

SO packages

-

GA packages

-

Flat no-leads packages

-

Others

-

-

Application Outlook (Revenue, USD Million 2021 - 2033)

-

Consumer Electronics

-

Automotive

-

Manufacturing

-

Healthcare

-

Others

-

-

Region Outlook (Revenue, USD Million 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global organic substrate packaging material market was estimated at around USD 16.08 billion in the year 2024 and is expected to reach around USD 16.89 billion in 2025.

b. The global organic substrate packaging material market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2033 to reach around USD 25.62 billion by 2033.

b. Consumer electronics dominated the end-use segment in 2024 with over 45.0% value share due to the increasing demand for compact, high-performance devices and the rapid advancement in semiconductor integration.

b. The key players in the organic substrate packaging material market include Amkor Technology Inc; Kyocera Corporation; Microchip Technology Inc.; Texas Instruments Incorporated; ASE Kaohsiung; Simmtech Co., Ltd; Shinko Electric Industries Co. Ltd; LG Innotek Co. Ltd; AT&S; and Daeduck Electronics Co., Ltd

b. The market is driven by the growing demand for compact, high-performance electronic devices and the rapid expansion of the consumer electronics and automotive sectors. Additionally, advancements in semiconductor packaging technologies are boosting the adoption of organic substrates over traditional materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.