- Home

- »

- Consumer F&B

- »

-

Organic Tea Market Size & Share, Industry Report, 2030GVR Report cover

![Organic Tea Market Size, Share & Trends Report]()

Organic Tea Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Camellia Sinensis, Herbal), By Taste (Flavored, Plain), By Form (Tea Bag, Liquid), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-937-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Tea Market Summary

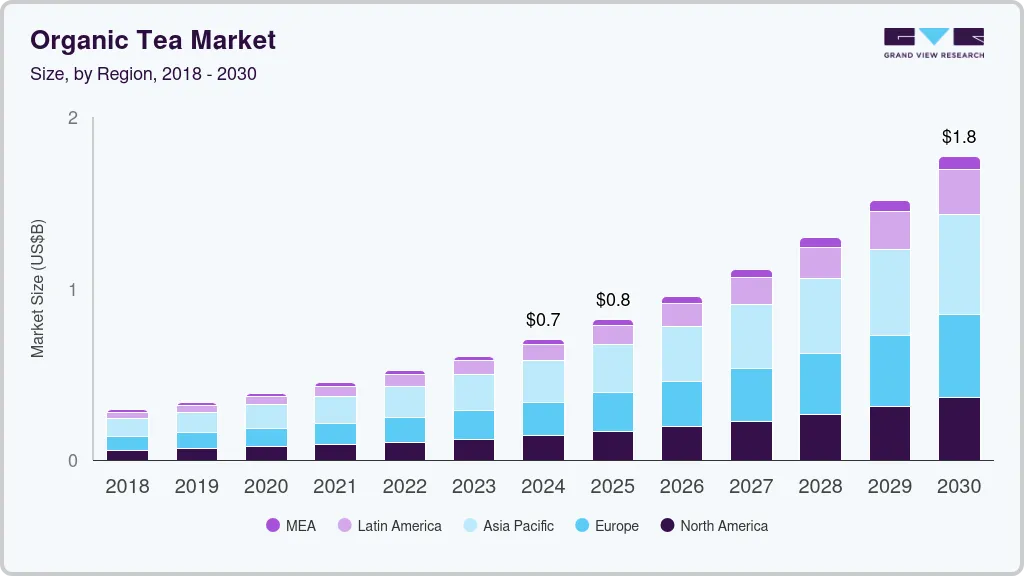

The global organic tea market size was estimated at USD 704.7 million in 2024 and is projected to reach USD 1,770.0 million by 2030, growing at a CAGR of 16.6% from 2025 to 2030. Increasing consumer awareness about the health benefits of organic tea, such as its high antioxidant content and absence of harmful chemicals, is a major driver.

Key Market Trends & Insights

- Asia Pacific organic tea industry dominated the global market with the largest revenue share of 34.5% in 2024.

- The U.S. organic tea industry is expected to grow significantly over the forecast period.

- By product, camellia sinesis dominated the market with the largest revenue share of 76.0% in 2024.

- By taste, plain taste dominated the market with the largest revenue share in 2024.

- By form, leaf & powder dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 704.7 Million

- 2030 Projected Market Size: USD 1,770.0 Million

- CAGR (2025-2030): 16.6%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

The rising trend of health and wellness and the growing preference for natural and organic products are significantly boosting demand. Furthermore, growing consumer demand for healthy drinks is anticipated to drive market growth.

The expanding middle class, particularly in emerging economies, with higher disposable incomes and an inclination towards premium products, is propelling market growth. The influence of tea culture and traditions in various regions, coupled with the introduction of innovative flavors and blends, is attracting a broader consumer base. Furthermore, the increasing availability of organic tea through various retail channels, including e-commerce, is making it more accessible to consumers.

The aforementioned health benefits are expected to increase the adoption of these products among health-conscious consumers in the near future. Demand for products with low caffeine content has been increasing. The trend has strongly influenced the market growth. Decaffeinated organic tea has been taking a sweep on the market. These products contain less than 2.5% of caffeine, which is beneficial for people suffering from sleep deprivation and disturbance. Over the past few years, the industry has witnessed an increased number of manufacturers selling decaffeinated variants of organic tea. For instance, Twining and Company Limited, a U.K.-based tea company, sells decaffeinated green tea bags, which offer a smooth and balanced combination of taste and flavor.

Product Insights

Camellia sinesis dominated the market with the largest revenue share of 76.0% in 2024. The rich heritage and widespread popularity of teas made from camellia sinensis significantly boost consumer demand. These teas are renowned for their distinct flavors, aroma, and numerous health benefits, such as high antioxidant content and potential to reduce the risk of chronic diseases. The increasing awareness of these health benefits and the rising trend toward natural and organic beverages are driving consumers to choose organic versions of their favorite teas. Additionally, the expanding availability of organic camellia sinensis teas through various retail channels, including specialty tea shops, supermarkets, and online platforms, is enhancing their accessibility. The introduction of innovative blends and the growing interest in tea culture and rituals further contribute to the substantial revenue share of camellia sinensis in the organic tea market.

The herbal tea segment is expected to grow at the fastest CAGR of 17.6% over the forecast period. Increasing consumer awareness of the health benefits associated with herbal teas, such as improved digestion, enhanced relaxation, and boosted immunity, is significantly boosting demand. Herbal teas, made from various plants, herbs, and spices, are often perceived as natural remedies for various health issues, attracting health-conscious consumers. The rising trend of wellness and holistic health and the growing preference for caffeine-free beverages are further propelling market expansion. The introduction of innovative herbal tea blends and flavors is also attracting a broader consumer base. Additionally, the expanding availability of herbal teas through various retail channels, including online platforms, is making them more accessible to consumers.

Taste Insights

Plain taste dominated the market with the largest revenue share in 2024. Plain organic tea, made from the camellia sinensis plant, offers a pure and authentic tea experience that is highly valued by tea enthusiasts. The absence of added flavors allows consumers to fully appreciate the natural taste and aroma of the tea leaves. Additionally, the increasing awareness of the health benefits associated with plain organic tea, such as its high antioxidant content and potential to support heart health and weight management, is significantly boosting demand. The simplicity and purity of plain tea appeal to health-conscious consumers who prefer natural and unadulterated products.

The flavored segment is expected to grow at the fastest CAGR over the forecast period. The increasing consumer demand for variety and innovative flavors in their beverages is a major driver. Flavored organic teas, which include options such as chamomile, mint, ginger, jasmine, and fruit-infused teas, offer an exciting range of tastes that cater to diverse palates. Additionally, the rising trend of wellness and health-consciousness is encouraging consumers to explore flavored teas that provide additional health benefits, such as enhanced relaxation, improved digestion, and boosted immunity. The availability of a wide range of flavored organic teas through various retail channels, including specialty tea shops, supermarkets, and online platforms, is making these products more accessible to a broader audience.

Form Insights

Leaf & powder dominated the market with the largest revenue share in 2024. Leaf and powder forms of organic tea are highly valued for their purity and concentrated flavor, appealing to tea enthusiasts who seek an authentic tea experience. These forms are also preferred for their versatility, allowing consumers to prepare tea according to their preferences, whether it is a strong brew or a light infusion. Additionally, the health benefits associated with whole-leaf and powdered organic tea, such as high antioxidant content and the absence of additives, are significantly boosting demand. The availability of a wide range of leaf and powder organic tea varieties, including premium and specialty teas, through various retail channels, further enhances their accessibility to consumers.

Tea bag is expected to grow at the fastest CAGR over the forecast period. The convenience and ease of use that tea bags offer are major drivers, as they allow consumers to quickly and effortlessly brew a cup of tea without the need for additional equipment. The rising trend of on-the-go lifestyles and the demand for quick and hassle-free beverage solutions are propelling the popularity of tea bags. Additionally, the wide variety of flavors and blends available in tea bag form caters to diverse consumer preferences, further boosting demand. The growing awareness of the health benefits associated with tea consumption, including its antioxidant properties and potential to promote overall well-being, is also contributing to the market expansion.

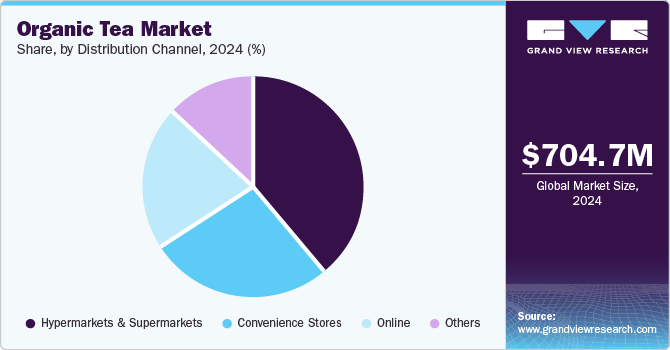

Distribution Channel Insights

Hypermarkets & supermarkets dominated the market with the largest revenue share in 2024. Hypermarkets and supermarkets offer a convenient one-stop shopping experience, allowing consumers to purchase various products, including organic tea, in a single trip. The extensive shelf space and strategic product placement in these large retail outlets make organic tea easily accessible to a broad range of consumers. Additionally, well-established retail chains with multiple locations in urban and suburban areas ensure wide availability and easy accessibility of organic tea products. Promotional activities, such as discounts, in-store sampling, and loyalty programs, further attract consumers to purchase organic tea from these outlets.

The online channel is expected to grow at the fastest CAGR over the forecast period. The increasing popularity of e-commerce platforms and their convenience make it easier for consumers to purchase organic tea from the comfort of their homes. Online platforms provide various options, detailed product descriptions, customer reviews, and ratings, helping consumers make informed decisions. Additionally, the influence of digital marketing and social media advertising is effectively reaching a broader audience, boosting online sales. Exclusive online discounts, promotions, and subscription services further incentivize consumers to shop for organic tea online. The rise of health-conscious consumers seeking natural and organic products is also contributing to the growth of the online channel.

Regional Insights

Asia Pacific organic tea industry dominated the global market with the largest revenue share of 34.5% in 2024. The rich tea culture and tradition in countries such as China, India, and Japan play a crucial role in boosting the demand for organic tea. These countries have a long history of tea consumption and production, which is deeply ingrained in their culture and daily life. The increasing awareness of the health benefits associated with organic tea, such as high antioxidant content and the absence of harmful chemicals, is significantly boosting consumer demand. The rising middle class with higher disposable incomes and a greater focus on health and wellness is also propelling market growth. The influence of traditional tea ceremonies and the popularity of various tea blends further contribute to the strong demand for organic tea in the region. The expanding retail infrastructure, including the growth of e-commerce platforms, ensures wide availability and easy accessibility of organic tea products to a broad range of consumers.

Europe Organic Tea Market Trends

Europe organic tea industry held a considerable share in 2024. The increasing consumer awareness about the health benefits of organic tea, such as its antioxidant properties and absence of harmful chemicals, is significantly boosting demand. The strong tradition of tea consumption in countries such as the UK, Germany, and France is also propelling market growth. Additionally, the rising preference for natural and organic products, driven by a growing health-conscious population, is encouraging consumers to choose organic tea over conventional options. The influence of European regulations that ensure high-quality and safe ingredients in organic products further supports market growth.

North America Organic Tea Market Trends

North America organic tea industry is expected to grow at the fastest CAGR of 17.2% over the forecast period. Growing consumer focus on health and wellness is a major driver, as more Americans become aware of the health benefits of organic tea, including its high antioxidant content and potential to support overall well-being. The growing trend of natural and organic product consumption is propelling demand for organic tea. Additionally, the rise of specialty tea shops and cafes across the country, offering a wide variety of organic tea options, is attracting a broad consumer base. The influence of health and wellness influencers on social media, who promote the benefits of organic tea, is further boosting consumer interest and adoption. The availability of organic tea through various retail channels, including supermarkets and online platforms, ensures easy accessibility for a wide range of consumers.

U.S. Organic Tea Market Trends

The U.S. organic tea industry is expected to grow significantly over the forecast period. The rising trend of health-conscious and environmentally friendly lifestyles is encouraging consumers to choose organic tea over conventional options. Additionally, the expanding presence of specialty tea shops, health food stores, and e-commerce platforms is making organic tea more accessible to a broader audience. The influence of digital marketing and social media advertising is effectively reaching a larger consumer base, further driving market growth. The growing preference for natural and sustainably-produced products is also propelling demand for organic tea.

Key Organic Tea Company Insights

Some key companies in the organic tea market include Davidson's Organics, Little Red Cup Tea Co., Numi, Inc., PepsiCo, The Coca Cola Company, and others.

-

Davidson's Organics offers a wide range of organic teas, including black, green, white, oolong, herbal teas, organic herbs, spices, cocoa, and gifts. Teas are sourced directly from small tea producers and disenfranchised farmers worldwide, ensuring high quality and fair trade practices. Davidson's Organics is committed to sustainability and eco-responsibility, offering freshly picked "direct-from-garden" teas that reflect the true character of each blend.

-

Little Red Cup Tea Co. is a small, family-owned company based in Brunswick, Maine. It specializes in traditional Chinese loose-leaf teas, which are certified organic by the USDA, and fair trade by Fair Trade U.S.

Key Organic Tea Companies:

The following are the leading companies in the organic tea market. These companies collectively hold the largest market share and dictate industry trends.

- Davidson's Organics

- Little Red Cup Tea Co.

- Numi, Inc.

- PepsiCo

- The Coca‑Cola Company

- Hain Celestial Group

- Tielka

- Unilever

- Ecotone

- Tata Consumer Products Limited

Recent Developments

-

In December 2024, Carrington Co., an organic food company, launched the first organic tea with compostable and biodegradable packaging. This innovative packaging, which includes the tea bag and its contents, is designed to fully degrade when composted, contributing to a nearly zero carbon footprint.

-

In June 2024, the Gujarat Cooperative Milk Marketing Federation (GCMMF) is poised to enhance its organic product line by introducing Amul Tea, Sugar, and Jaggery. The federation aims to broaden its portfolio by offering 24 organic products, including wheat flour, rice, and pulses.

Organic Tea Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 819.9 million

Revenue forecast in 2030

USD 1,770.0 million

Growth Rate

CAGR of 16.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, taste, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain China; Japan; India; Indonesia; Brazil; Argentina; South Africa; UAE

Key companies profiled

Davidson's Organics; Little Red Cup Tea Co.; Numi, Inc. PepsiCo; The Coca Cola Company; Hain Celestial Group; Tielka; Unilever; Ecotone; Tata Consumer Products Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Tea Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic tea market report based on product, taste, form, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Camelia Sinesis

-

White

-

Black

-

Green

-

Oolong

-

Others

-

-

Herbal

-

-

Taste Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored

-

Plain

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tea Bag

-

Leaf & Powder

-

Liquid

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.