- Home

- »

- Medical Devices

- »

-

Orthodontic Headgear Market Size, Industry Report, 2033GVR Report cover

![Orthodontic Headgear Market Size, Share & Trends Report]()

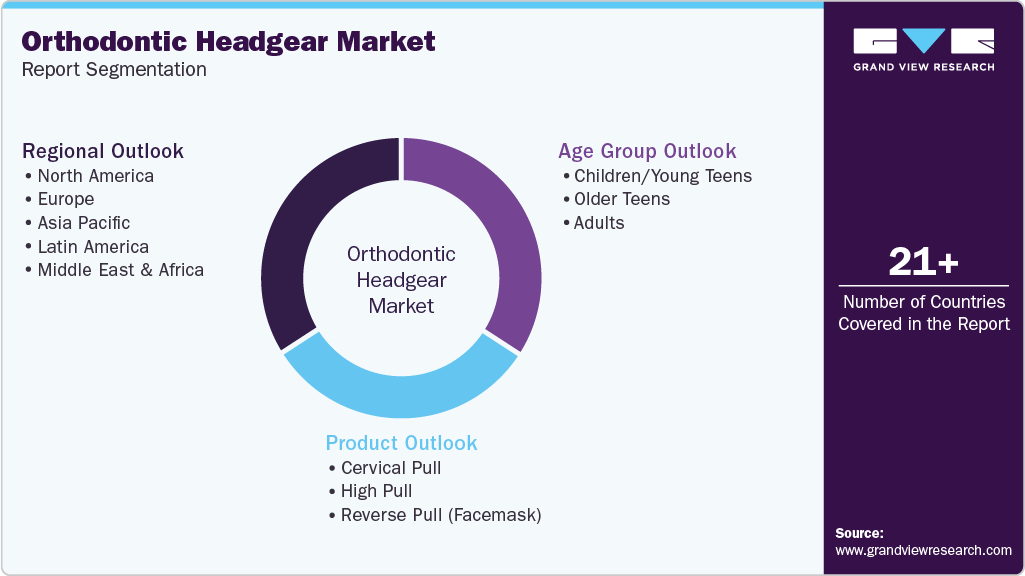

Orthodontic Headgear Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cervical Pull, High Pull, Reverse Pull (Facemask)), By Age Group (Children/Young Teens, Older Teens, Adults), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-753-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Orthodontic Headgear Market Summary

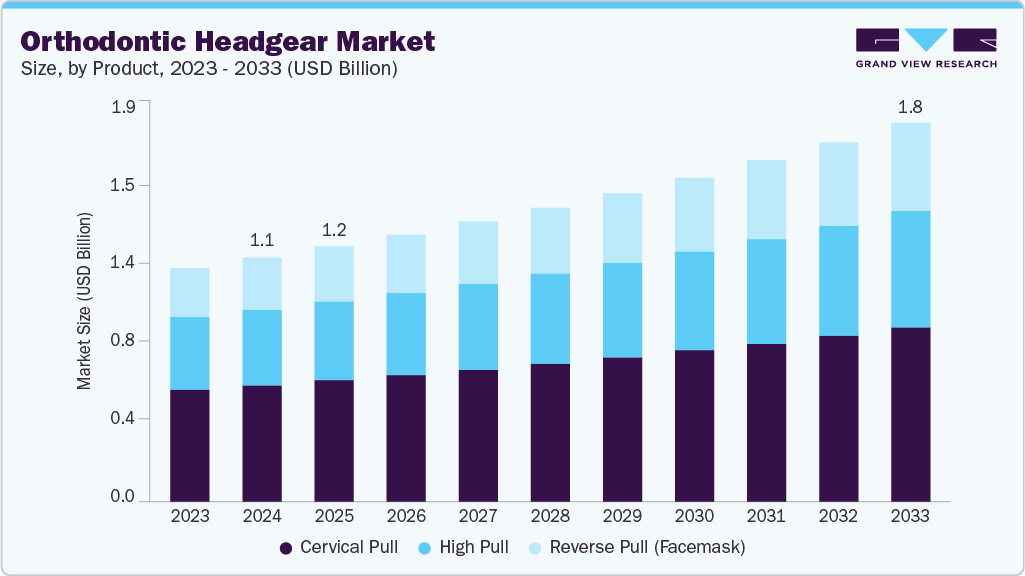

The global orthodontic headgear market size was estimated at USD 1.14 billion in 2024 and is projected to reach USD 1.78 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. Key drivers of the orthodontic headgear market include the growing prevalence of malocclusions and dental disorders, rising awareness about dental issues and treatments, and technological advancements and innovations in orthodontic headgear.

Key Market Trends & Insights

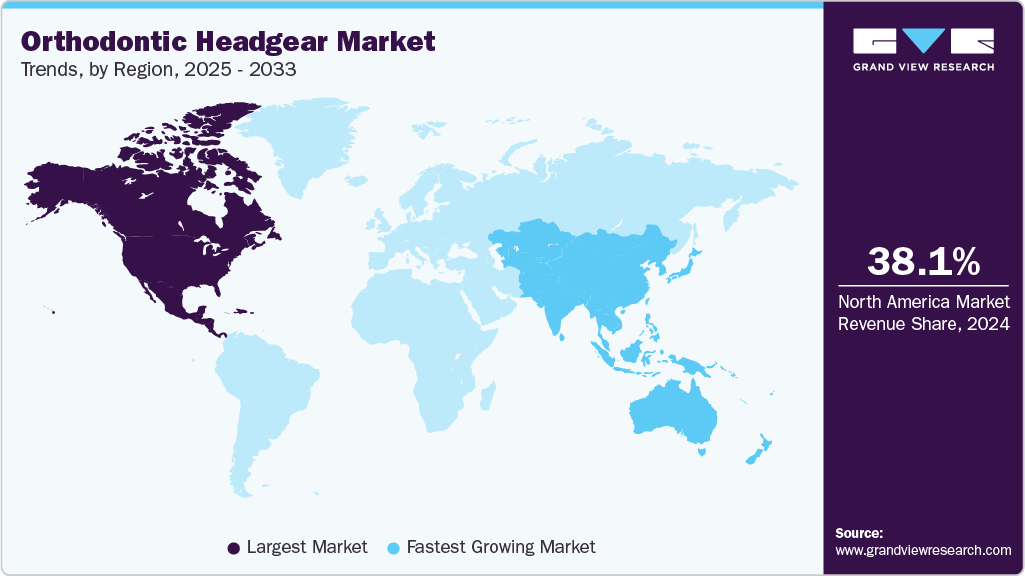

- North America dominated the orthodontic headgear market with the largest revenue share of 38.1% in 2024.

- By product, the cervical pull segment dominated the market, accounting for the largest revenue share of 47.78% in 2024.

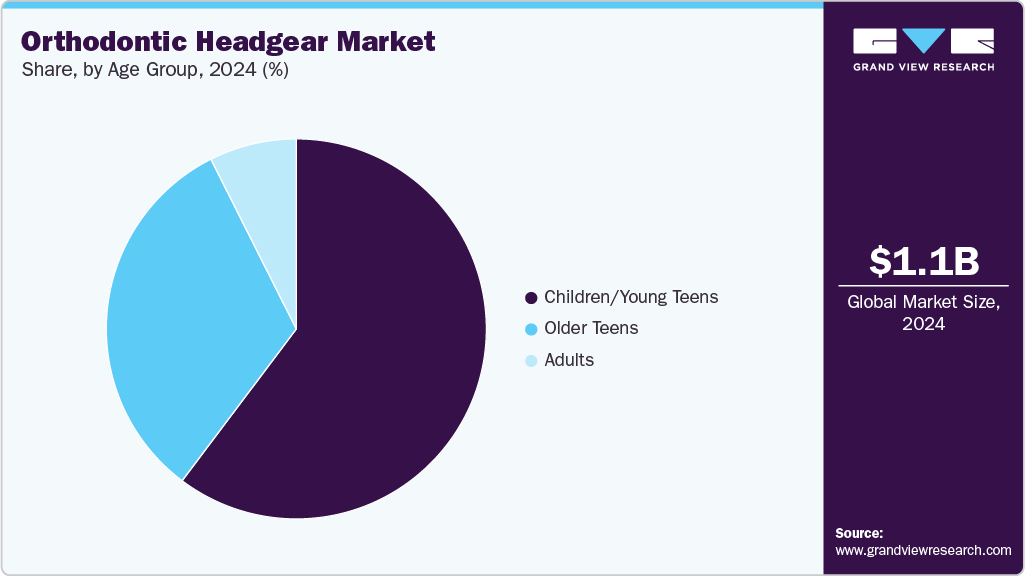

- By age group, the children/young teens segment led the market with the largest revenue share of 60.26% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.14 Billion

- 2033 Projected Market Size: USD 1.78 Billion

- CAGR (2025-2033): 5.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing burden of dental issues such as malocclusion is anticipated to drive the demand for orthodontic headgear. According to data published by the Cleveland Clinic in August 2025, malocclusion is a common dental problem impacting approximately 56% of individuals worldwide. This high burden of malocclusion highlights the growing demand for orthodontic headgear, which can be used to treat malocclusions like Class II and Class III.

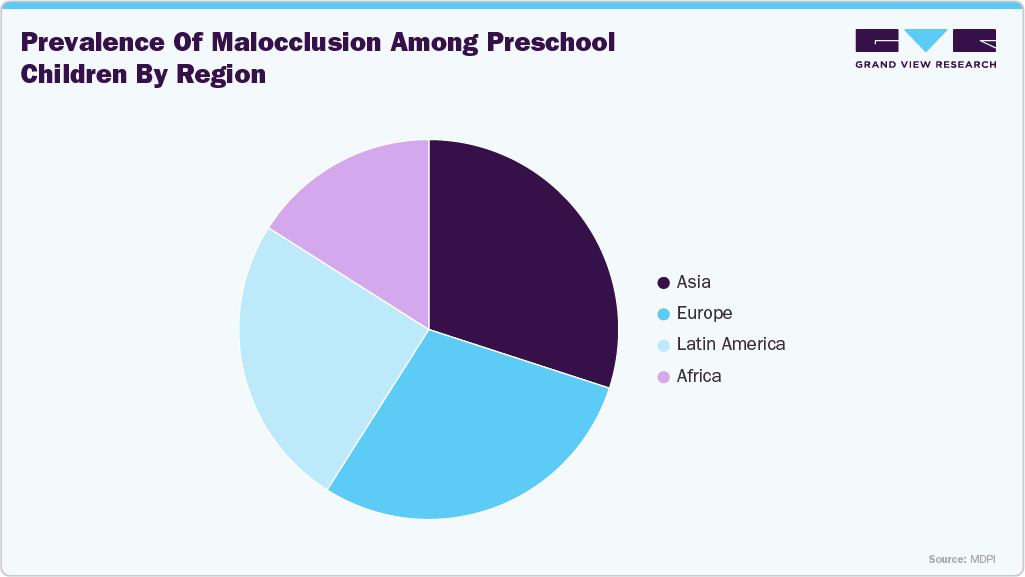

In addition, the prevalence of malocclusions differs significantly across different regions and age groups, impacting the demand for orthodontic headgear. According to a May 2024 study published by MDPI, malocclusion rates among preschool children globally range widely, from 28.4% to 83.9%, with over half of these rates exceeding 50%. Asia and Europe exhibit the highest prevalence, at approximately 61.81% and 61.50% respectively, followed by South America (52.69%) and Africa (32.50%). This considerable burden of malocclusion in Asia and Europe drives a growing need for effective orthodontic treatments, including headgear, to correct jaw and teeth alignment issues early in life. As a result, these regions represent significant growth markets for orthodontic headgear manufacturers and service providers, supported by increasing awareness and healthcare accessibility.

In addition, the growing awareness about dental disorders, such as overbite, overjet, and underbite, is anticipated to drive the demand for orthodontic headgear. Increased awareness of these conditions can boost early diagnosis and treatment, contributing to the expansion of the market. Government agencies, nonprofit organizations, and industry stakeholders are launching awareness campaigns to educate the public about orthodontic issues and the importance of timely intervention.

For instance, in June 2024, the American Association of Orthodontists (AAO) highlighted the success of its all-digital Consumer Awareness Program, which promotes orthodontists as specialized healthcare providers and encourages the public to seek in-person consultations. The campaign was a milestone achievement, attracting over 10 million website visitors in 2023-2024. Such large-scale initiatives significantly enhance consumer understanding of orthodontic conditions and available treatments, propelling market growth.

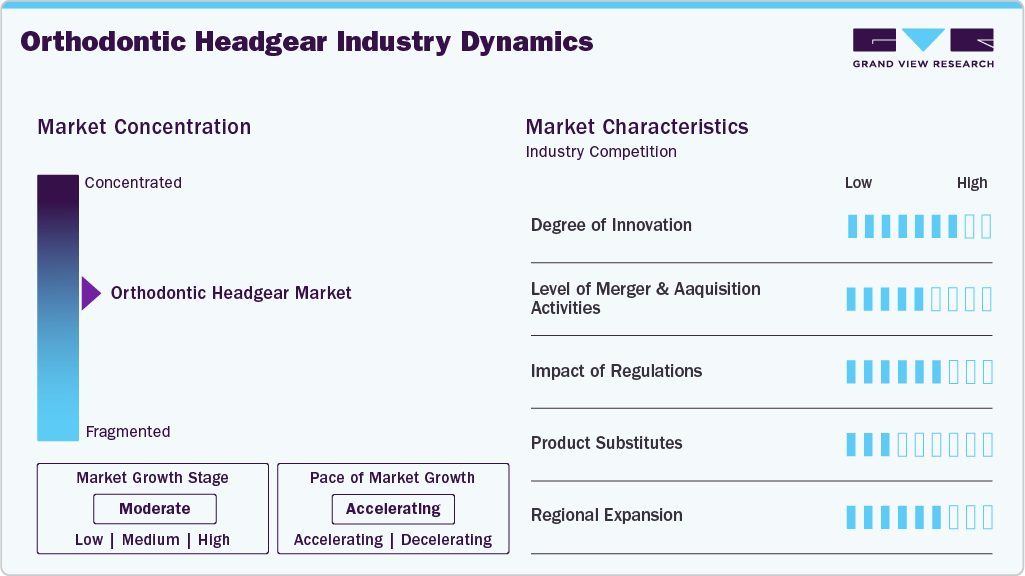

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The orthodontic headgear market is characterized by high growth owing to the rising prevalence of dental disorders and growing awareness about orthodontic treatments.

Industry stakeholders are increasingly focusing on advancements in design and materials. Modern headgear has evolved significantly from traditional models, featuring slimmer profiles with thin wires and minimal structural components to enhance comfort and aesthetics. Besides design improvements, more research is being done to integrate headgear with other orthodontic devices to enhance treatment results. For instance, a study published by MDPI in November 2022 demonstrated that the combined use of high-pull J-hook headgear and the Simple Bite Jumping Appliance (SBJA) was effective in correcting gummy smiles in Class II patients with vertical maxillary excess during their growth phase.

Regulatory bodies such as the U.S. FDA and the European Union oversee the approval and classification of orthodontic headgear. For instance, the FDA has classified extraoral orthodontic headgear as a Class II medical device under section 872.5500 of the Code of Federal Regulations.

Orthodontic headgear manufacturers have the opportunity to expand into regional markets, particularly in Asia and Europe. These regions have high prevalence of dental disorders, such as malocclusions. These regions offer growth opportunities due to increased awareness of orthodontic treatments and rising healthcare expenditures. Companies can establish a strong presence in these markets and enhance accessibility.

Product Insights

The cervical pull segment held the largest share of 47.78% in the orthodontic headgear market in 2024. This headgear is used to correct overbites and overjet. The high burden of the population suffering from overbites is anticipated to drive the segment growth. According to the data published by Flower Mound Orthodontics in August 2024, about 70% of individuals have some degree of overbite, with a substantial portion having mild to moderate issues.

The reverse pull (facemask) segment is projected to experience the fastest growth during the forecast period. This type of headgear is primarily used to correct underbites and crossbites. It features a face frame connecting to pads on the forehead and chin. When combined with braces, reverse pull headgear can align the upper and lower jaws, significantly reducing the need for surgical intervention later. These therapeutic advantages are expected to drive strong growth in this segment over the coming years.

Age Group Insights

The children/young teens segment led the market with a total revenue share of 60.26% in 2024. It is also anticipated to witness the fastest growth over the forecast period. This dominance and growth can be attributed to organizations and healthcare institutions recommending orthodontic headgear treatments for children and young teens experiencing overbite, underbite, and crossbite issues. For instance, an article published by the Schaefer Dental Group in July 2025 states that orthodontic headgear is most commonly recommended for children aged 7 to 13, when their jaws are still developing and are most responsive to change.

The older teens segment is expected to witness significant growth in the orthodontic headgear market. This growth can be attributed to several factors, including the increasing self-awareness and concern about facial aesthetics during adolescence. Moreover, peer influence and social media exposure encourage treatment adoption among older teens.

Regional Insights

North America orthodontic headgear market dominated the global market and accounted for the largest revenue share of 38.1% in 2024. The regional market is driven by the growing focus of organizations on increasing awareness about dental treatments and the availability of a large patient population suffering from oral disorders. Furthermore, the ongoing reforms in coverage of dental services in Canada are anticipated to impact the regional market growth. Health Canada has revealed that in 2025, some orthodontic services likely to be added to the Canadian Dental Care Plan (CDCP).

U.S. Orthodontic Headgear Market Trends

The U.S. orthodontic headgear market is expected to grow significantly. Several factors, such as the growing burden of dental disorders, the presence of several industry players, and the increasing health spending in the U.S., are anticipated to support the adoption of orthodontic headgears. For instance, according to the data published by the Centers for Medicare & Medicaid Services in December 2024, the U.S. health care spending increased 7.5 percent in 2023, reaching USD 4.9 trillion or USD 14,570 per person.

Europe Orthodontic Headgear Market Trends

The European orthodontic headgear market is growing due to increasing awareness of dental aesthetics, a rising prevalence of malocclusion, and growing demand for non-invasive dental treatments. Advancements in dental technology and rising disposable incomes further support regional market growth.

The UK orthodontic headgear market is anticipated to grow significantly. This growth can be attributed to the rising dental health awareness and the growing number of individuals undergoing orthodontic treatment. Moreover, advancements in headgear design and materials enhance patient comfort and compliance. In addition, NHS support for dental care and a strong network of dental professionals further propel market growth in the UK.

Orthodontic headgear market in France is witnessing significant growth, driven by an increasing prevalence of orthodontic issues among adolescents, and broader acceptance of corrective treatments. Technological advancements have led to more comfortable headgear solutions. Moreover, strong support from the public healthcare system and a well-established network of skilled dental professionals significantly enhance market growth across the country.

Asia Pacific Orthodontic Headgear Market Trends

The Asia-Pacific orthodontic headgear market is anticipated to witness the fastest growth, due to a large population base, particularly in China and India, and the high prevalence of malocclusion. Rising awareness of dental aesthetics, growing middle-class income, and increased healthcare spending further fuel demand. Moreover, expanding access to dental care in urban and semi-urban areas supports market growth.

India orthodontic headgear market is expected to witness lucrative growth. Several factors, such as the rising patient awareness, increasing expansion of dental institutions, and a growing prevalence of malocclusion, are supporting the country's market growth. Several dental clinics are being launched. For instance, in June 2025, a new dental and facial surgery clinic was opened at Inamdar Hospital, Pune. Such dental services expansions are expected to drive the country's market growth.

Orthodontic headgear market in China is anticipated to experience significant growth. The high incidence of dental disorders among children in China is expected to drive this market expansion. According to a study published by the National Library of Medicine in April 2025, the prevalence of malocclusion was found to be 68.3%, with deep overbite affecting 48.6% of children aged 3 to 5 years in Huizhou, China.

Latin America Orthodontic Headgear Market Trends

The Latin America orthodontic headgear market is anticipated to witness steady growth. This growth is driven by several factors, such as expanding healthcare infrastructure, affordability of orthodontic solutions, and advancements in dental technologies. Moreover, increasing disposable income and improving access to dental care in emerging economies contribute significantly to market expansion.

Middle East & Africa Orthodontic Headgear Market Trends

The orthodontic headgear market in the Middle East and Africa is expected to grow steadily. This growth can be attributed to numerous factors, such as the growing awareness of dental treatments and the rising burden of dental disorders. In addition, increasing investments across the region in developing healthcare infrastructure are expected to support the market growth.

Key Orthodontic Headgear Company Insights

Shenzhen Hannstar Lighting Co., Ltd (Sino Dental Group), Ormco Corporation, Penta Orthodontics, Dentmark, Orthocomfort & Medical Distributors SL, J&J Orthodontics, Modern Orthodontics, G&H Orthodontics, and Ortho Technology are some of the major players in the market. Industry players are actively participating in events and exhibitions while prioritizing the acquisition of regulatory approvals from various bodies to broaden their product reach.

Key Orthodontic Headgear Companies:

The following are the leading companies in the orthodontic headgear market. These companies collectively hold the largest market share and dictate industry trends.

- Shenzhen Hannstar Lighting Co ., Ltd (Sino Dental Group)

- Ormco Corporation

- Penta Orthodontics

- Dentmark

- Orthocomfort & Medical Distributors SL

- J&J Orthodontics

- G&H Orthodontics

- Modern Orthodontics

- Ortho Technology

Recent Developments

-

In September 2025, the Association of Dental Industry and Trade of India (ADITI) organized Expodent Bengaluru 2025, South India's largest dental trade exhibition. The event brings together dental suppliers, manufacturers, and professionals from across the country and abroad.

-

In April 2023, Ormco, a major provider of dental solutions, revealed its refreshed brand identity, which included a new company tagline, logo, and brand colors.

Orthodontic Headgear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.20 billion

Revenue forecast in 2033

USD 1.78 billion

Growth Rate

CAGR of 5.1% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, age group, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Shenzhen Hannstar Lighting Co . Ltd (Sino Dental Group); Ormco Corporation; Penta Orthodontics; Dentmark; Orthocomfort & Medical Distributors SL; J&J Orthodontics; Modern Orthodontics; G&H Orthodontics; Ortho Technology

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthodontic Headgear Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global orthodontic headgear market report based on product, age group and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cervical Pull

-

High Pull

-

Reverse Pull (Facemask)

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Children/Young Teens

-

Older Teens

-

Adults

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthodontic headgear market size was estimated at USD 1.14 billion in 2024 and is expected to reach USD 1.20 billion in 2025.

b. The global orthodontic headgear market is expected to grow at a compound annual growth rate of 5.05% from 2025 to 2033 to reach USD 1.78 billion by 2033.

b. North America dominated the orthodontic headgear market in 2024, with a revenue share of 38.1%. This dominance is driven by the availability of a large patient population suffering from oral disorders across the region.

b. Some key players operating in the orthodontic headgear market include Shenzhen Hannstar Lighting Co., Ltd (Sino Dental Group), Ormco Corporation, Penta Orthodontics, Dentmark, Orthocomfort & Medical Distributors SL, J&J Orthodontics, Modern Orthodontics, G&H Orthodontics, and Ortho Technology.

b. Key factors driving market growth include the growing prevalence of malocclusions and dental disorders, as well as rising awareness about dental issues and treatments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.