- Home

- »

- Medical Devices

- »

-

Orthopedic Soft Tissue Repair Market Size, Share Report 2030GVR Report cover

![Orthopedic Soft Tissue Repair Market Size, Share & Trends Report]()

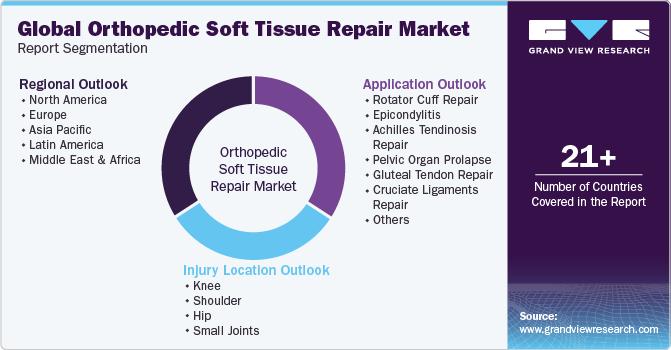

Orthopedic Soft Tissue Repair Market Size, Share & Trends Analysis Report By Application (Rotator Cuff Repair, Epicondylitis), By Injury Location (Knee, Shoulder), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-169-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Orthopedic Soft Tissue Repair Market Trends

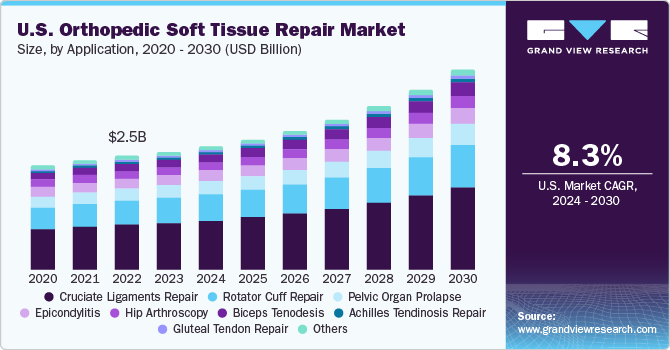

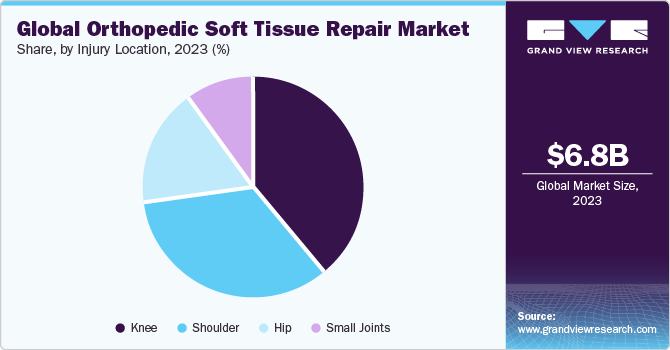

The global orthopedic soft tissue repair market size was valued at USD 6.80 billion in 2023 and is expected to grow at a CAGR of 8.8% from 2024 to 2030. Increasing incidence of soft tissue injuries due to growth in obesity rate, trauma & accidents, sports & physical activity injuries, and rising geriatric population are expected to propel the market growth over the forecast period. In addition, innovations in new therapies & devices, growing R&D activities, healthcare awareness & per capita expenditure with a lack of substitutes for soft tissue repair therapies are other factors expected to drive the demand for orthopedic soft tissue repair. For instance, according to OECD Health at a Glance 2023 Country Note, the UK spends USD 5493 per capita on health.

Moreover, introducing advanced technologies, such as bioprinting, biological meshes, biofabrication, and tendon repair systems, is expected to bolster market growth. For instance, in May 2022, CoNextions Medical launched ‘CoNextions TR, which provides a fast surgical process, stronger repair strength, and quicker patient recovery compared to current suture-approach soft tissue repair procedures. Furthermore, the company is introducing its system across the U.S. This innovative device will be distributed through a well-established network of orthopedic distributors.

The growing incidence of sports-related injuries and rapid growth in the number of athletes are significant factors propelling the market throughout the forecast period. Sports activities are also the leading cause of soft tissue injuries globally. Athletes are prone to anterior cruciate ligament (ACL) injuries, which can hinder their mobility. For instance, according to data published by ASPEN INSTITUTE in November 2023, the National ACL Injury Coalition examined injury statistics across 12 significant sports for both girls and boys over five three-year intervals from 2007 to 2022, with data provided by certified athletic trainers through the High School RIO monitoring system. From the first to the fifth period, the yearly average rate of ACL injuries surged by 25.9% to 7.3 injuries per 100,000 athlete exposures. Currently, ACL injuries account for over 14% of all knee-related injuries. Thus, the rise in the number of ACL injuries fuels market growth.

The growing geriatric population fuels the market growth as aging causes critical changes in the skeletal and neuromuscular systems, which may lead to arthritis, weakened ligaments, and ACL tears. An increase in the geriatric population has led to a rise in global demand for soft tissue repair surgeries. Currently, the geriatric population is growing rapidly. For instance, according to the United Nations Department of Economic and Social Affairs 2023 report, from 2021 to 2050, the population aged 65 or above in Central and Southern Asia and Eastern and South-Eastern Asia is expected to rise by more than 540 million, accounting for more than 60% of the global increase. Thus, the need for acute and long-term healthcare services is increasing, which is expected to drive the orthopedic soft tissue repair market.

Furthermore, increasing investments in R&D, collaborations with other industry players, geographic expansions, and new product launches are among the key strategies adopted by key companies to gain a competitive edge in the market. For instance, Miach Orthopaedics, Inc., a developer of bio-engineered surgical implants for connective tissue repair, launched BEAR Implant in the U.S. for ACL tears.

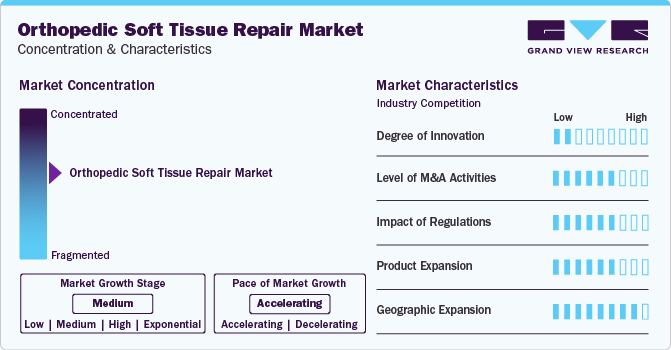

Market Concentration & Characteristics

The ongoing advancements and innovations in the field of orthopedic surgeries has significantly transformed treatment of orthopedic conditions and injuries. New tools and technologies for the surgery of soft tissue injuries and its repair are being developed every year around the world. The development and use of advanced biomaterials by the manufacturers has led to the creation of devices that can better mimic the natural tissue environment, promoting faster healing and reduced complications. For instance, in May 2022, Ortho Regenerative Technologies Inc., a clinical-stage orthobiologics company, received the U.S. Patent and Trademark Office for its ORTHO-R soft tissue repair platform.

The market is characterized by a high level of merger and acquisition (M&A) activity by the key players, owing to several factors, including product launches, competing for product approvals, and collaborations with other players to cater to the growing demand for orthopedic soft tissue repair devices and to maintain a competitive edge in the market. For instance, in January 2023, Zimmer Biomet Holdings, Inc., a medical technology company, agreed to acquire Embody, Inc., a privately held medical device company. This acquisition includes a complete portfolio of Embody's collagen-based biointegrative solutions to aid in the recovery of orthopedic soft tissue injuries, such as the TAPESTRY RC, an arthroscopic implant system for rotator cuff repair, and the TAPESTRY biointegrative implant for tendon healing.

Stringent government regulation on orthopedic devices may restrict the manufacturing facilities and post-market distribution of orthopedic devices. Manufacturers must obtain approval for their products before they can be marketed and used on patients. This process typically involves stringent rules and regulations to ensure the devices meet safety and efficacy standards. For instance, in the U.S., a soft tissue repair devices manufacturer can’t market product directly without the Pre-market approval (PMA) from the U.S. FDA. Further, these devices fall under the class III type, which has highly stringent guidelines that restrict market growth.

Product expansion in orthopedic soft tissue repair refers to the manufacturers introducing new products, services, or technologies that aim to improve the overall durability, fit-to-the-bone surface compatibility, and cost-effectiveness of soft tissue repair processes. For instance, in May 2022, Paragon 28 Inc. expanded its hammertoe and soft tissue product range by launching its enhanced TenoTac 2.0 Soft Tissue Fixation System. This innovative system employs an implant with titanium thread and a straightforward insertion technique to accurately fix soft tissue to bone, effectively addressing toe contracture issues. The TenoTac 2.0 implant has been optimized to provide better soft tissue capture, streamlined tensioning, and an improved fit to the bone surface, ultimately enhancing the device's overall performance. Furthermore, such expansion can be driven by factors such as advancements in technology and changing customer demands.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. For instance, in January 2024, Heron Therapeutics Inc., a commercial-phase biotechnology company, recently obtained approval from the FDA for its supplemental New Drug Application (NDA) regarding ZYNRELEF, a unique combination of bupivacaine and meloxicam in an extended-release form. This approval extends the scope of ZYNRELEF's applications to encompass soft tissue and orthopedic surgical procedures. Before this expansion, ZYNRELEF was authorized for total joint arthroplasty surgeries in elder patients.

Application Insights

The cruciate ligament repair segment accounted for the largest market share of 40.16% in 2023. It is attributed to the increasing incidence of ACL injuries during sporting activities. Soccer and baseball players commonly suffer such types of injuries. According to U.S. News and World Report, NYU Langone Hospitals conducts over 34,000 orthopedic procedures. Moreover, according to the American Journal of Sports Medicine, the incidence of ACL injury is 68.6/100,000 individuals per year. The rise in sports activities leads to increased sports injuries among athletes, further propelling the demand for improved soft tissue repair products.

This segment is also anticipated to register the fastest growth over the forecast period. Injuries to the ACL account for 40% to 50% of all knee ligament injuries. The increasing incidence of knee injuries and the introduction of innovative & technologically advanced products that are cost-effective and patient-friendly are among the major factors likely to drive the adoption of these surgeries. Moreover, an increase in awareness about potential threats of developing arthritis from uncorrected ACL tears and injuries is expected to push patients to opt for either invasive or minimally invasive surgeries.

Injury Location Insights

The knee segment dominated the market in terms of revenue in 2023 with a share of 38.92%, owing to the greater applicability & acceptability of soft tissue repair surgeries and increasing adoption of treatment options in developed & emerging countries. Soft tissue knee injuries are one of the most common musculoskeletal disorders, with the increasing prevalence of knee tissue tears, wear downs, or impairments related to sports injuries, age-related issues, trauma, and accidents. According to WHO, approximately 73% of individuals living with osteoarthritis are over the age of 55 years, and 60% are female. Osteoarthritis affects around 365 million people globally. In addition, the acceptance and affordability of available treatment options are expected to further drive market growth.

The hip segment is anticipated to grow fastest over the forecast period. Its rapid growth can be attributed to the increasing incidence of hip joint dysfunction caused by soft tissue injuries. For instance, according to the OECD, in 2021, Finland, Germany, Switzerland, and Austria had the highest hip replacement rates. The OECD averages are 172 per 100 000 population for hip replacement. Thus, this segment is gaining attention and driving market players to innovate devices & therapies to provide adequate treatment.

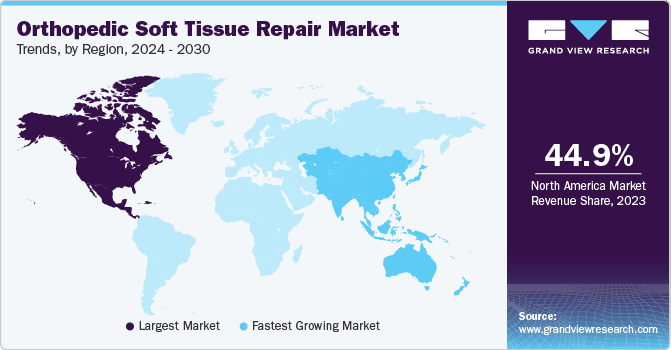

Regional Insights

The orthopedic soft tissue market in North America accounted for the largest market share of 44.85% in 2023 due to the rising incidence of sports injuries and the growing number of knee arthroscopies performed in the region. For instance, as per an article published by the Osteoarthritis Research Society International, out of 1 million knee arthroscopies performed annually in the U.S., 700,000 involved the meniscus. In addition, according to the National Safety Council of the U.S., sports and recreational injuries increased by 20% in 2021 and 12% in 2022. Another key factor driving regional growth is rising healthcare expenditure and investments in healthcare infrastructure. Increasing healthcare spending can help make expensive soft tissue repair surgeries more affordable.

U.S. Orthopedic Soft Tissue Market Trends

The orthopedic soft tissue market in the U.S. accounted for the largest market share in North America in 2023. Owing to the presence of several key market players in the country focusing on novel innovations and product launches, coupled with the rising geriatric population and the growing incidence of sports-related injuries. According to the American Academy of Orthopedic Surgeons, approximately 200,000 ACL injuries occur annually. This number is only expected to increase in the coming years. Furthermore, the presence of manufacturers such as Arthrex Stryker Corporation, Integra Lifesciences Corporation, and others, which are constantly involved in devising strategic initiatives and new product launches in the region, fuel the market growth. For instance, in August 2021, Orthopaedic Implant Company introduced its DRPX wrist fracture plate, which had previously gained FDA approval. This innovative product features type II anodized titanium, along with a low-profile plate and screw design, to minimize the potential for soft tissue interference during surgical procedures. Thus, such factors are poised to keep the demand for orthopedic soft tissue repair devices in the region.

Canada orthopedic soft tissue repair market is anticipated to register the fastest CAGR in North America during the forecast period. This growth is attributable to the increase in soft tissue injuries due to recreational activities coupled with the aging population. For instance, according to the data published by Statistics Canada in July 2023, it is estimated that around 7,330,605 people are 65 years of age or older in Canada, which accounts for 18.9% of the total population. Furthermore, the prevalence of wear and tear of ligaments and degeneration of soft tissue increases with age, and often, physical therapy or surgical intervention is required, which is one of the key factors fueling the market growth in the country.

Europe Orthopedic Soft Tissue Market Trends

The orthopedic soft tissue repair market in Europe is anticipated to register a significant growth rate during the forecast period. The market is driven by the presence of key players focusing on innovation, strategic collaborations, and product enhancements to maintain their position. Moreover, factors such as an aging population, increased prevalence of sports-related injuries, and advancements in surgical techniques and materials such as Tissue Patch, xenograft, and biological mesh fuel the market growth.

The UK orthopedic soft tissue repair market is anticipated to register the fastest growth rate in Europe during the forecast period. Owing to the increasing number of soft tissue injuries, a bioengineered, synthetic patch is anticipated to strengthen the market growth in the country. Manufacturers and government organizations are often involved in partnerships to bring novel treatment settings to the country. For instance, in February 2023, James Lind Alliance came into partnership with the British Association for Surgery of the Knee (BASK), British Orthopaedic Association (BOA), and British Orthopaedic Sports Trauma and Arthroscopy Association (BOSTAA) to manage patients on the soft tissue knee injuries issue in the country. In addition, the growing geriatric population is anticipated to fuel the country’s demand for soft tissue repair products.

The orthopedic soft tissue repair market in Germany is anticipated to register a considerable growth rate during the forecast period. The market growth is attributable to the collaborations between universities and companies to develop innovative products, improve existing technologies, and introduce new biocompatible materials and advanced surgical techniques for soft tissue repair procedures. In addition, the presence of key market players in the country, such as Lifecell Corporation, Johnson & Johnson Services Inc., Smith & Nephew PLC, C.R Bard Inc., Wright Medical, Covidien PLC, and others, boosts market growth.

Asia Pacific Orthopedic Soft Tissue Repair Market Trends

The orthopedic soft tissue repair in Asia Pacific is anticipated to register the fastest CAGR growth over the forecast period, owing to the increasing prevalence of musculoskeletal disorders and rising disposable income. Higher penetration of local manufacturers of medical devices is providing significant growth opportunities for the region's orthopedic soft tissue repair market. Furthermore, the other key factors driving the market are ongoing research in sports medicine and advanced wound management, particularly in Japan & India, as the countries are emerging as hubs for medical tourism. This is due to cost of medical procedures in these countries stands lower than in developed countries in Europe.

Japan orthopedic soft tissue repair market is expected to grow significantly over the forecast period due to the increasing prevalence of traumatic and accidental injuries and the rising demand for effective surgical solutions. The market is supported by a competitive landscape with key players implementing various strategies, such as product launches, to enhance their market presence. For instance, in January 2022, Smith+Nephew announced the expansion of its Next-Gen handheld robotics platform, CORI Surgical System, in Japan. This expansion aims at providing robotic-assisted surgery with minimal set-up time and portability during various surgeries, including knee surgery.

The orthopedic soft tissue repair market in India is anticipated to grow significantly over the forecast period owing to the increasing geriatric population in the country, as they are more prone to degenerative conditions affecting soft tissue injuries. Furthermore, the demand for minimally invasive treatments is projected to fuel the market. The market includes techniques and products used during surgical procedures for soft tissue injuries, such as rotator cuff and cruciate ligament repair promoting healing. Key players in the market, which also operates in India, include Smith & Nephew, Arthrex, Stryker Corporation, Integra Life Sciences Corporation, and others involved in strategic initiatives to gain market share. For instance, in July 2023, Smith & Nephew introduced its REGENETEN Bioinductive Implant in India for rotator cuff procedures.

Latin America Orthopedic Soft Tissue Repair Market Trends

The orthopedic soft tissue repair market in Latin America is anticipated to grow considerably over the forecast period due to the aging population, sedentary lifestyles, and increased obesity rates contributing to a higher incidence of musculoskeletal disorders, including those affecting soft tissues. Favorable government support and growing collaborations between private and public stakeholders in the country are boosting market growth. For instance, in December 2023, a significant collaboration was initiated among the Pan American Health Organization (PAHO), the Inter-American Development Bank (IADB), and the World Bank (WB). This alliance, named Alliance for Primary Health Care in Latin America, aims to bolster investment, innovation, and the implementation of policies and initiatives. The primary objective of this partnership was to drive transformative changes in the region's health systems, with a strong emphasis on primary healthcare.

Brazil orthopedic soft tissue repair market dominated the Latin America market in 2023 in terms of revenue share. Growing focus on sports and physical activity in the country drives market growth. For instance, a study published in NIH titled "Injuries and complaints in the Brazilian national men's volleyball team: a case study" in 2023 reported that of 41 players on the team during the study period, 12 experienced a total of 28 injuries, and 38 players reported 402 complaints in total. Thus, the rise in injury incidents is expected to further boost market growth.

Middle East & Asia Orthopedic Soft Tissue Market Trends

The orthopedic soft tissue repair market in MEA is anticipated to grow lucratively over the forecast period. The growing number of sports medicine centers in developing and developed economies primarily focuses on early diagnosis and prevention of sports-related injuries. In addition, many global manufacturers have extended their distribution channels to the region. For instance, in May 2019, CollPlant collaborated with Arthrex to renew its distribution agreement. Arthrex continues as the distributor of CE Marked Vergenix STR, a treatment for tendinopathy, in Europe, the Middle East, India, and a few African nations. This collaboration aims to expand the accessibility and availability of innovative regenerative medicine solutions for patients in this region.

The orthopedic soft tissue repair market in UAE is anticipated to grow considerably over the forecast period. According to recent studies published in June 2023, the prevalence of ACL tears in the UAE is estimated at 31%. Various prevention training programs (PTPs) are aligned to reduce the burden in the country. In a recent development in March 2024, Lifespan Sports Medicine Center Clinic LLC announced a joint venture with Digital Inc., Canada. This collaboration aims to launch a membership-based and comprehensive longevity program named ‘Health Span’ in Dubai. This partnership aims to redefine the concept of healthy living and promote preventive measures through a personalized program that will further assist patients in rehabilitation and diagnostics solutions.

Key Orthopedic Soft Tissue Repair Company Insights

Key participants in the market are witnessing multiple partnerships and mergers & acquisitions to increase their product portfolio, as well as to expand their footprint across new business regions. In addition, companies are focusing on product differentiation and bundling strategies to capture a greater market share

Key Orthopedic Soft Tissue Repair Companies:

The following are the leading companies in the orthopedic soft tissue repair market. These companies collectively hold the largest market share and dictate industry trends.

- Integra Lifesciences Corporation

- Arthrex, Inc.

- Smith & Nephew

- DePuy Synthes

- Stryker Corporation

- ConMed Linvatec

- Zimmer Biomet

- Wright Medical Group N.V.

- Boston Scientific Corporation

- B. Braun SE

Recent Developments

-

In December 2023, Moon Surgical announced its plan to extend its Maestro robot for soft tissue robotic surgery in the U.S. market. This expansion is backed by AI chip leader Nvidia and Johnson & Johnson’s JJDC venture capital arm. Moon Surgical plans to give a competitive edge to established players such as Intuitive Surgical. The company aims to provide surgeons with robot-assisted options, making complex soft tissue surgeries easy.

-

In January 2023, Zimmer Biomet announced the acquisition of Embody, Inc., a medical device company focused on soft tissue healing. The acquisition seeks to leverage and incorporate Embody’s portfolio of collagen-based biointegrative solutions, including products like TAPESTRY RC, designed for arthroscopic implant systems for rotator cuff repair, and TAPESTRY, a biointegrative implant for tendon healing. This integration will bolster Zimmer Biomet's product offerings in the market.

-

In December 2022, Stryker introduced a disposable suture anchor system named Citrefix, which was primarily made from bioresorbable elastomeric material Citregen. When used in surgical operations, its unique chemical and mechanical properties help grafted tissue heal and further promote healthy bone growth.

-

In May 2022, Paragon 28, Inc. launched its Suture Anchor System ‘Grappler’, which is specifically designed to address the problems faced during ligament reconstruction in acute foot and ankle surgeries and soft tissue tensioning. Paragon 28 has developed its acute Grappler anchors in both PEEK and titanium materials. These PEEK anchors come in a single kit, providing all the necessary instruments for the repair process. The anchors are preloaded with sutures and needles and come in sizes 4.5 and 5.5 mm.

-

In January 2021, Smith & Nephew acquired the Extremity Orthopedics business from Integra LifeSciences Holdings Corporation for USD 240 million. This acquisition was expected to bolster the extremities segment’s growth, as well as shoulder replacement and foot & ankle segments.

Orthopedic Soft Tissue Repair Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.14 billion

Revenue forecast in 2030

USD 11.86 billion

Growth rate

CAGR of 8.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, injury location, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Arthrex, Inc.; DePuy Synthes, Inc.; Stryker Corporation; Wright Medical Group N.V.; Zimmer Biomet; ConMed Linvatec; Integra LifeSciences Corporation; Smith & Nephew;Boston Scientific Corporation; B. Braun SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Soft Tissue Repair Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the orthopedic soft tissue repair market report based on application, injury location, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Rotator Cuff Repair

-

Epicondylitis

-

Achilles Tendinosis Repair

-

Pelvic Organ Prolapse

-

Gluteal Tendon Repair

-

Cruciate Ligaments Repair

-

Hip Arthroscopy

-

Biceps Tenodesis

-

Others

-

-

Injury Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Knee

-

Shoulder

-

Hip

-

Small Joints

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic soft tissue market size was estimated at USD 6.8 billion in 2023 and is expected to reach USD 7.14 billion in 2024.

b. The global orthopedic soft tissue repair market is expected to grow at a compound annual growth rate of 8.8% from 2024 to 2030 to reach USD 11.86 billion by 2030.

b. The cruciate ligaments repair segment dominated the orthopedic soft tissue repair market with a share of 40.4% in 2023.

b. Some key players operating in the orthopedic soft tissue repair market include Stryker, Arthrex, Inc., Zimmer Biomet, DePuy Synthes, Inc, CONMED Corporation, and Smith & Nephew plc.

b. Key factors that are driving the orthopedic soft tissue repair market growth include a rise in the number of sports-related injuries and growth in the aging population, obesity rate, and trauma & accidents.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."