- Home

- »

- HVAC & Construction

- »

-

Outdoor Power Equipment Market Size, Share Report, 2030GVR Report cover

![Outdoor Power Equipment Market Size, Share, & Trends Report]()

Outdoor Power Equipment Market Size, Share, & Trends Analysis Report By Power Source (Gasoline, Battery, Electric Corded), By End-use (Residential, Commercial/ Government), By Type, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-973-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

Report Overview

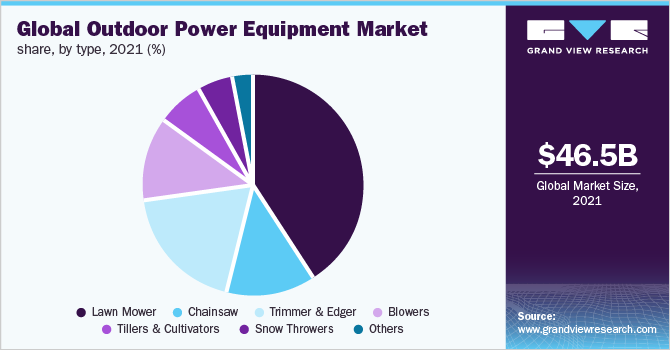

The global outdoor power equipment market size was USD 46.53 billion in 2021 and is expected to reach USD 76.61 billion by 2030, expanding at a CAGR of 5.9% from 2022 to 2030. The market growth can be credited to increasing demand for cordless outdoor power equipment as people are inclining more toward greater flexibility and portability.

Furthermore, the technological advancements of several companies in outdoor power equipment are also expected to drive market growth. For instance, in February 2020, Robert Bosch GmbH launched Indego M 700 and Indego M+ 700, two autonomous lawn mowers. These two connected lawn mowers feature 18 V lithium batteries with brushless DC motors that can cut of medium size gardens up to 700 square meters on a single charge.

The increasing urbanization, disposable income, and infrastructure activities coupled with rising demand for the landscaping services are the factors expected to augment growth of the outdoor power equipment market. Furthermore, growing awareness of environmental issues leads to increasing adoption of the outdoor power equipment using lithium-ion batteries, as they are environment friendly and maximize energy output. Several companies are focused on innovation in lithium-ion batteries. For instance, in 2021, Techtronic's Industries started using red lithium-ion batteries for its cordless power tools, as they work faster and deliver more than expected from the battery's life.

The gardening trend has increased rapidly, mainly among younger generations. Most young people are inclined toward growing vegetables, fruits, and herbs. As young people are more likely to live in smaller yard lots, the type of equipment, plant and tools they require should work in tighter spaces. The gardening and lawn industry is changing to adapt to various consumer requirements by launching equipment that is lighter in weight and makes work comfortable.

Furthermore, the growing popularity of home improvement projects bodes well for the growth of the outdoor power equipment and garden tools market during the forecast period. Companies such as The Toro Company, Husqvarna, ANDREAS STIHL AG & Co. KG, and others gained profits from the stay-at-home trend due to the pandemic, which has extended the gardening season.

The pandemic in 2020 did cast a gloomy outlook on almost all industries, worldwide. The outbreak of COVID-19 impacted market growth during the initial few months of 2020. However, in later months, demand for various outdoor power equipment has witnessed strong growth with the resumption of operations in multiple industries. A considerable increase in the market for Do-it-yourself (DIY) equipment and do-it-for-me (DIFM) services in the commercial and residential segments are expected to drive market growth.

For instance, according to the Outdoor December forecast report in 2021, the commercial lawn mower grew by more than 15.0 % in 2020, with shipping of nearly 7.7 billion units. Furthermore, rising concern about the gasoline fumes and engine noise due to the COVID-19 has also increased the demand for energy-efficient outdoor power equipment.

Although the prospects look promising, the industry is still faced with several challenges regarding high maintenance costs. For accurate operations, one must inspect outdoor power equipment at various intervals. The factors to be reviewed regularly include inspecting cords, checking for damaged switches, sharpening, oiling, and other repairs needed for properly working of the equipment. Hence, the maintenance cost of outdoor power equipment is relatively high, which is expected to hamper the market’s growth.

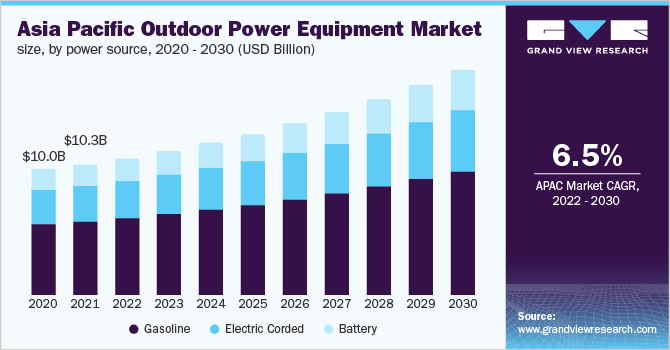

Power Source Insights

The power source segment has been segregated into gasoline, battery, and electric corded. The gasoline segment accounted for 56.8% market share in 2021and is expected to witness a drop in demand because of gas fumes and noise produced. Various government regulations have been enacted to address gasoline-powered sources' environmental issues. For instance, California is expected to implement laws banning gas-powered chainsaws, lawnmowers, and leaf blowers will be in effect as early as 2024.

Meanwhile, the battery power source segment is estimated to expand at a CAGR exceeding 6.9% during the forecast period. The battery-powered source segment is expanding due to the lower shipping costs, lighter than gasoline alternatives, and is more affordably purchased online. Furthermore, various online retailers are adjusting their inventory to optimize new government rules and regulations for developing electric outdoor power equipment products.

End-use Insights

The end-use segment has been segregated into the commercial and residential sectors. The residential segment accounted for more than 49.37%market share in 2021. The growing inclination of residential users towards investing more time in gardening and outdoor is expected to drive demand for outdoor power equipment. Furthermore, the rising sales of DIY outdoor power equipment due to the pandemic are likely to drive the segment growth.

The commercial segment is expected to grow at a CAGR of 5.3% during the forecast period. The rising number of smart cities owing to increasing urbanization is expected to drive segment growth. According to a report published by World Urbanization Prospects in 2019 by the UN Department of Economic and Social Affairs (UN DESA), the current urban population, which is 55.7%, is anticipated to increase to 68.4% in 2050, globally. Furthermore, with the rising number of golf players coupled with a growing number of golf club facilities, demand for the various outdoor power equipments is expected to increase for the commercial segment.

Equipment Insights

The equipment segment has been segregated into a lawn mower, chainsaw, trimmer & edger, blowers, tiller & cultivators, snow throwers, and others. The chainsaw segment is estimated to grow at a CAGR of 7.2% during the forecast period. A chainsaw is a handheld, portable mechanical device mainly used to cut wood and wood-related products. The increasing deforestation rate for various infrastructure activities is expected to drive market growth. Furthermore, the rising demand for interior décors such as wood-based flooring, roofing, panels, and more are augmenting the use of chainsaws in various furniture applications.

The lawn mower segment captured the largest market share and is expected to expand at a CAGR of 6.2% during the forecast period. Several companies are focused on introducing various robotic mowers due to the rising demand for technologically advanced mowers. Furthermore, the latest automated lawn mowers are equipped with GPS tracking and remote controls, making it easier for the user to operate, monitor, and track the mower. In addition, changing consumer behavior in its spending power and aesthetic appeal for their gardening space is also expected to boost the market's growth.

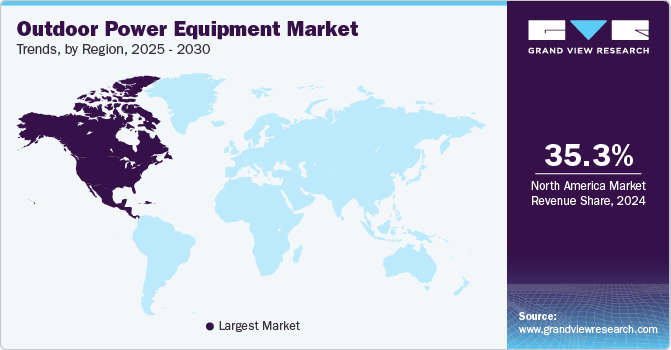

Regional Insights

The North American market accounted for 34.91% share of the overall market in 2021. The regional market’s growth is attributed to North America’s larger geographical area compared to its population, which leads to more gardens and lawns in the region. This led to increased demand for outdoor power equipment in the region. Furthermore, rising investment by the government in infrastructure is expected to drive the region’s growth. For instance, in 2022, the Canadian government provided USD 1.5 billion for the Canada Mortgage and Housing Corporation to expand the rapid housing initiative of building houses.

The Asia Pacific market is expected to register a 6.5% CAGR during the forecast period. The significant growth rate of the region is due to rising disposable income and changing lifestyles in various developing countries such as India and China. Furthermore, increasing annual events such as the Indian Premier League (IPL), World Baseball Classic, Asian Games, and various other sports activities are expected to boost the requirement for outdoor power equipment to enhance sports stadiums and fields.

Key Companies & Market Share Insights

The market is fragmented and characterized by high competition with companies such as Makita Corp, Techtronic Industries Ltd, Robert Bosch, Ariens Company, and more. These companies focus on acquisitions, launching innovative products, and investing in research and development. For instance, in January 2020, The Toro Company announced the acquisition of Venture Products, Inc., an articulating turf, snow, and ice management equipment. The acquisition was carried out to expand its business in the professional market.

Several companies focus on providing cost-effective and ergonomic products as an integral part of their product offerings. Similarly, In January 2022, Robert Bosch GmbH launched Keo a cordless garden saw. Keo is one of the products of 18V Power for All System, the alliance formed with Husqvarna Group. The product is acquainted with a powerful interchangeable battery pack with replaceable saw blades designed for DIY applications. Some of the prominent players in the global outdoor power equipment market include:

-

Husqvarna AB

-

Makita Corp

-

Honda Motors Co. Ltd

-

Briggs & Stratton Corp.

-

Andreas Stihl AG & Company KG

-

MTD Holdings Inc.

-

Stanley Black and Decker Inc.

-

Andreas Stihl AG & Company KG

-

CHERVON (China) Trading Co., Ltd

-

Techtronic Industries Ltd.

-

Yamabiko Corporation

-

Robert Bosch

-

AL-KO Kober Group

-

Ariens Company

-

The Toro Company

-

Deere & Company

Outdoor Power Equipment Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 48.59 billion

Revenue forecast in 2030

USD 76.61 billion

Growth rate

CAGR of 5.9 % from 2022 to 2030

Market demand in 2021

119,671.7 thousand units

Volume forecast in 2030

176,769.2 thousand units

Volume growth rate

4.5%

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million, volume in units, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Power source, end-use, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Netherlands; Denmark; Finland; Spain; Russia; China; India; Japan; South Korea; Singapore; Australia; Latin America; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Husqvarna AB; Makita Corp; Honda Motors Co. Ltd; Briggs & Stratton Corp.; MTD Holdings Inc.; Stanley Black and Decker Inc.; Andreas Stihl AG & Company KG; CHERVON (China) Trading Co., Ltd; Techtronic Industries Ltd.; Yamabiko Corporation; Ariens Company; The Toro Company; Andreas Stihl AG & Company KG; Deere & Company; Robert Bosch; AL-KO Kober Group

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Outdoor Power Equipment Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends from 2018 to 2030 in each sub-segment. For this study, Grand View Research has segmented the global outdoor power equipment market report based on power source, end-use, type, and region:

-

Power Source (Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Battery

-

Electric Corded

-

-

End-use (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial/ Government

-

-

Type (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Lawn Mower

-

Walk-Behind Lawn Mowers

-

Ride-on Lawn Mowers

-

Robotic Lawn Mowers

-

Zero -Turn Mowers

-

-

Chainsaw

-

Trimmer & Edger

-

Trimmers & Brush Cutter

-

Hedge Trimmers

-

Walk-Behind Edgers & Trimmers

-

-

Blowers

-

Snow

-

Leaf

-

-

Tillers & Cultivators

-

Snow Throwers

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Netherlands

-

Denmark

-

Finland

-

Spain

-

Russia

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global outdoor power equipment market size was estimated at USD 46,530.20 million in 2021 and is expected to reach USD 48,593.10 million in 2022.

b. The global outdoor power equipment market is expected to grow at a compound annual growth rate of 5.9% from 2022 to 2030 to reach USD 76,605.6 million by 2030.

b. The lawn mower segment dominated the equipment type outdoor power equipment market and accounted for 44.87% of the global revenue share in 2021.

b. Asia Pacific is expected to emerge as the fastest-growing regional market for outdoor power equipment through 2030. The significant growth rate of the region is due to rising disposable income and changing lifestyles in various developing countries such as India and China.

b. Key factors that are increasing demand for cordless outdoor power equipment as people are more inclining toward greater flexibility and portability, rising demand for landscaping services, and growing awareness of environmental issues leads to increasing adoption of outdoor power equipment using lithium-ion batteries.

b. Some key players operating in the outdoor power equipment market include Makita Corp, Stanley Black and Decker Inc., Techtronic Industries Ltd., Robert Bosch, Deere & Company, and Husqvarna AB.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."