- Home

- »

- Animal Health

- »

-

Ovine And Caprine Artificial Insemination Market Size ReportGVR Report cover

![Ovine And Caprine Artificial Insemination Market Size, Share & Trends Report]()

Ovine And Caprine Artificial Insemination Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (Equipment & Consumables, Semen), By Procedure, By Sector, By Animal Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-065-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ovine And Caprine Artificial Insemination Market Summary

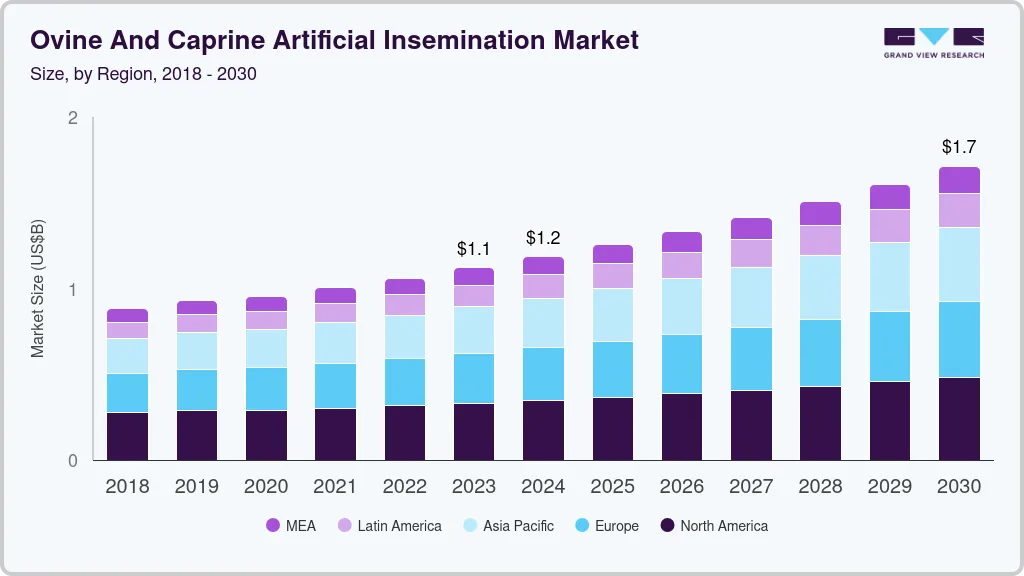

The global ovine and caprine artificial insemination market size was estimated at USD 1.12 billion in 2023 and is projected to reach USD 1.71 billion by 2030, growing at a CAGR of 6.3% from 2024 to 2030. The unlimited breeding selection, access to a wide variety of ram (male sheep) and buck (male goat) at a relatively lower price, reduced risk of ruminant diseases that spread through sexual contact, and more mating per buck or ram are some of the key factors driving this market.

Key Market Trends & Insights

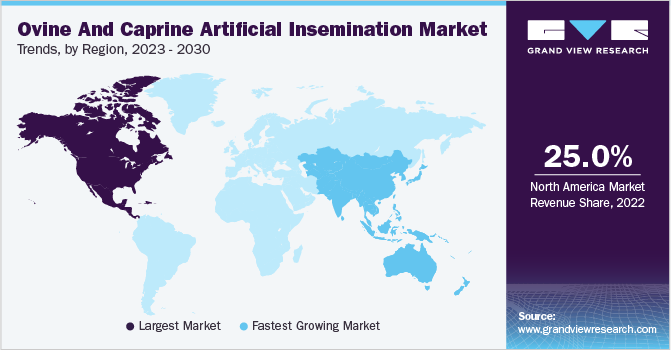

- The North America held more than a 25% share of the ovine & caprine artificial insemination market in 2022.

- The Asia Pacific region is estimated to grow at the fastest CAGR of 7% in the projected timeline.

- Based on sector, the meat sector segment held the dominant share of over 40% in 2022.

- Based on animal type, the ovine/sheep segment dominated the market with a share of over 55% in 2022.

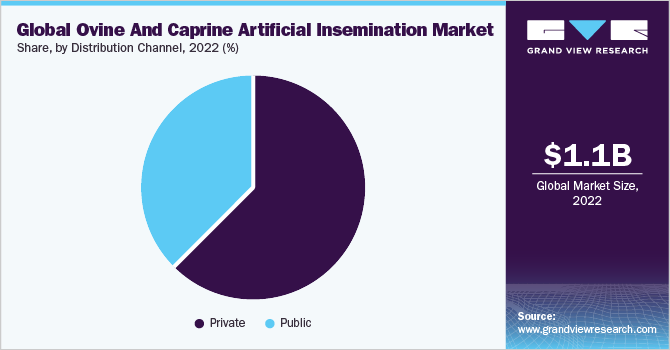

- Based on distribution channel, the private segment held the dominant market share of over 62% by the distribution channel in 2022.

Market Size & Forecast

- 2023 Market Size: USD 1.12 Billion

- 2030 Projected Market USD 1.71 Billion

- CAGR (2024-2030): 6.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

In addition, the producer of goats and sheep can make genetic improvements through Artificial Insemination (AI) by preventing the risk of diseases and economic loss. Ovine breeding through artificial insemination has assumed greater importance, with commendable achievements reported in the U.S., Eastern & Central Europe, and South American regions.The COVID-19 pandemic harmed the market during the year 2020. Most veterinary and livestock hospitals halted artificial insemination activities during the pandemic as it was not considered an emergency treatment. Ovine & Caprine artificial insemination & seminal fluid collection companies faced significant supply chain challenges owing to the increased animal welfare issues, zoonotic measures, and state & nationwide lockdowns. However, several animal husbandries continued their AI activities of collecting, preparing, and storing normal & sexed semen during the period. Considering the up and downside scenarios, the market witnessed a slight dip in growth rate during the year 2020.

Artificial insemination (AI) is one of the most important techniques that improve the genetics of livestock animals. After cattle and swine, ovine & caprine production units are rapidly adopting artificial insemination procedures to reduce the reliance on bought-in male sheep and prevent the potency of disease transmission. The success of AI procedures in ovine & caprine relies on the ability to efficiently collect & cryopreserve/freeze seminal fluid from quality male animals, the appropriate procedure & timing of insemination in ewe and doe (female animals), and the seasonality of animal production.

However, there are a few challenges and restrictions that often limit ovine & caprine AI production, which includes: knowledge of the ovine & caprine reproduction physiology, shortage of trained technicians, difficulties in specific seminal fluid application technique, highly variable results, and cost of liquid nitrogen tanks for cryopreserving seminal fluid. Handling the breeding facilities and low conception rate of AI, as compared to using fertile buck and ram are other limitations faced by ovine & caprine producers. In addition, detecting proper hormonal synchronization of the estrous cycle is very essential to gain successful AI results. However, this process might lead to increased costs and technically skilled workforces.

Solution Insights

In 2022, the services segment generated the largest revenue with about 42% share in the ovine & caprine artificial insemination market. In developing countries, AI activities have gained greater attention in serving as a successful tool for genetic improvement in ovine & caprine species. An article published by the National Library of Medicine in 2019 states that over 500,000 sheep in Australia, more than 60,000 sheep in Spain, about 50,000 sheep in Canada, and over 300,000 sheep in America have been successfully inseminated each year. The number of inseminated animals is significantly growing in small-scale production units owing to the rising awareness among breeders of AI services.

The semen segment by solution in the ovine & caprine artificial insemination industry is growing at the fastest CAGR of 6.6% over the forecast period. According to TNAU, there are three methods approved for semen collection from male caprine & ovine animals: vaginal method, electro-ejaculation, and artificial vagina method. The growing number of government-approved semen collection centers for domestic animals like ovine & caprine is boosting the growth of the segment. For instance, on 16th March 2023, the UK government updatedits list from five to six authorized ovine & caprine semen collection centers available in the country.

Procedure Insights

The intrauterine procedure segment dominated the market with over 60% share in 2022. Laparoscopic artificial insemination is an invasive intrauterine procedure that offers the maximum conception rate of up to 90% in ovine & caprine species. This procedure involves the direct deposit of semen into the uterus through an abdominal incision, thereby resulting in satisfactory animal pregnancy rates. As per the Sustainable Agriculture Research and Education Organization, in developed countries like the U.S., intrauterine laparoscopic AI is commonly performed to breed sheep and goats.

Following the intrauterine method, the other procedures, such as cervical and vaginal methods, are significantly considered to inseminate ovine & caprine. Cervical & transcervical methods involve mild restraint to limit the movement of an animal to access the insemination sight easily. Post-cleaning the vulvar region with the aid of a suitable illumination tool, the cervix is located to inject seminal fluid as deeply as possible for a higher conception rate of up to 60%. Owing to its significant pregnancy rate and growing usage because of comparatively lesser cost than laparoscopic, the cervical segment is growing at the fastest CAGR of 7% over the forecast period.

Sector Insights

The meat sector segment held the dominant share of over 40% in 2022. This substantial share is due to the large production and trading of sheep & goats for the meat sector worldwide. In countries such as the U.S., China, and India, sheep are mainly produced through AI for meat & wool purposes. In major markets like the U.S., meat production is considered to be the profit center for ovine breeding. Globally, around 1.5 billion ovine & caprine provides meat & milk yearly, as per the United States Department of Agriculture. As per the same source, around 574 million sheep & 479 million goats are slaughtered each year.

The dairy segment is anticipated to grow at the fastest CAGR of 6.7% over the projected timeline. The dairy sheep industry is concentrated largely in European countries, followed by developing Asian countries. Dairy goats produce approximately 50% more milk than the dairy sheep population. According to the USDA, about 21% of the world’s dairy products come from goats and sheep, with 1.3% to 1.9% of global milk production comes from ovine & caprine. As per the Indian Department of Animal Husbandry & Dairying, artificial insemination is largely benefitting the dairy ovine & caprine units by controlling or preventing venereal diseases possible through natural breeding.

Animal Type Insights

The ovine/sheep segment dominated the market with a share of over 55% in 2022, owing to the large adoption of AI among the population. According to the OIE (World Organization for Animal Health) database, the global sheep population has increased from 1.21 billion in 2017 to 1.29 billion in 2021. The same source indicates that the global goat population grew from 1.05 billion to 1.11 billion from 2017 to 2021. Moreover, artificial insemination in sheep is more intensively used in Western Europe to increase the number of inseminated ewes in the countries.

The goat segment is growing at the fastest CAGR of 6.6% over the forecast period. Dairy goats are largely inseminated in developing countries such as India, China, Southeast Asian countries, and Middle East African countries. As per an article published in the National Library of Medicine, the conception rate of artificially inseminated goats was 70%. Therefore, AI is widely preferred among goat producers as it enables the dissemination of required genetic traits and prevents sexually transmitted diseases.

Distribution Channel Insights

The private segment held the dominant market share of over 62% by the distribution channel in 2022. This is owing to a growing number of private sectors offering cost-effective insemination services and semen collection & storage facilities for ovine & caprine. These centers are very crucial for ovine & caprine artificial insemination as they provide various AI procedures from technically skilled laborers with a range of normal/sexed semen of different geographies. In addition, growing awareness among goat/sheep breeders to adopt AI for a satisfactory production rate is boosting segment growth.

The private distribution channel is also anticipated to grow at the fastest CAGR of 6.4% over the forecast period. On the other side, the public segment holds a significant share owing to the large support provided by local & state governments of developing countries to inseminate sheep/goats. India, for example, has several state governments that offer supportive programs to inseminate ovine & caprine species. Similarly, European Union launched a project on November 2022 to train AI activities in ovine & caprine to aid breeders/producers.

Regional Insights

North America held more than a 25% share of the ovine & caprine artificial insemination market in 2022. The significant availability & usage of artificial insemination techniques, well-equipped & advanced animal husbandry industries, presence of key players in the market, and growing awareness of AI among ovine & caprine producers are some of the factors contributing to the North American market growth. As per TNAU, Government of India, the AI breeding of sheep has made commendable achievements as of late in the U.S. with the main objective of using superior sires against low-performing female animals.

The Europe region holds the second-largest share of the market, closely following North America. This is owing to the large adoption of ovine AI in eastern & central European countries. On the other side, the Asia Pacific region is estimated to grow at the fastest CAGR of 7% in the projected timeline. This is attributable to the large sheep & goat population, increasing disposable income & animal breeding expenditure in key markets, and growing awareness about various sheep/goat AI services in developing countries.

Key Companies & Market Share Insights

The major players in the ovine & caprine AI market are constantly implementing strategic measures such as launching new services, expanding their seminal fluid production or storage facilities, and advancing their infrastructure. NEOGEN Corporation, one of the key market players, expanded its U.S. operation in June 2021 with an investment of about USD 6 million. The expansion is anticipated to enhance their livestock artificial insemination services. Some prominent players in the global ovine and caprine artificial insemination market include:

-

IMV Technologies

-

Zoetis

-

Agtech, Inc.

-

B&D Genetics

-

SEK Genetics

-

Neogen Corporation

-

Jorgensen Laboratories

-

Continental Genetics, LLC

-

Nasco

-

MINITÜB GMBH

Ovine And Caprine Artificial Insemination Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 1.19 billion

The revenue forecast in 2030

USD 1.71 billion

Growth Rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Solution, Procedure, Sector, Animal Type, Distribution channel, Region

Regions covered

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia;

Key companies profiled

IMV Technologies; Zoetis; Agtech, Inc.; B&D Genetics; SEK Genetics; Neogen Corporation; Jorgensen Laboratories; Continental Genetics, LLC; Nasco; MINITÜB GMBH

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ovine And Caprine Artificial Insemination Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global ovine And caprine artificial insemination market based on solution, procedure, sector, animal type, distribution channel, and region:

-

Ovine & Caprine Artificial Insemination Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment & Consumables

-

Semen

-

Normal Semen

-

Sexed Semen

-

Services

-

-

Ovine & Caprine Artificial Insemination Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Intrauterine

-

Vaginal

-

Cervical

-

-

Ovine & Caprine Artificial Insemination Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Meat

-

Dairy

-

Others

-

-

Ovine & Caprine Artificial Insemination Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ovine/Sheep

-

Caprine/Goat

-

-

Ovine & Caprine Artificial Insemination Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Private

-

Public

-

-

Ovine & Caprine Artificial Insemination Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Rest of Asia Pacific

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Rest of the Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global oovine and caprine artificial insemination market size was estimated at USD 1.06 billion in 2022 and is expected to reach USD 1.12 billion in 2023.

b. The global ovine and caprine artificial insemination market is expected to grow at a compound annual growth rate (CAGR) of 6.25% from 2023 to 2030 to reach USD 1.71 billion by 2030.

b. North American region registered the highest market revenue share of about 29% in 2022 owing to the significant availability & usage of artificial insemination techniques, well-equipped & advanced animal husbandry industries, presence of key players in the market, and growing awareness of AI among ovine & caprine producers.

b. Some key players operating in the global ovine and caprine artificial insemination market include IMV Technologies, Zoetis, Agtech, Inc., B&D Genetics, SEK Genetics, Neogen Corporation, Jorgensen Laboratories, Continental Genetics, LLC, Nasco, MINITÜB GMBH, among others.

b. The key factors driving the market growth include the unlimited breeding selection, access to a wide variety of ram and buck at a relatively lower price, reducing the risk of ruminant diseases that spreads through sexual contact, and more mating per buck or ram, among others. In addition, the growing sheep & goat population in developing countries is further supporting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.