- Home

- »

- Consumer F&B

- »

-

Oyster Sauce Market Size, Share And Growth Report, 2030GVR Report cover

![Oyster Sauce Market Size, Share & Trends Report]()

Oyster Sauce Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Commercial, Household), By Distribution Channel (Convenience Stores, Supermarkets/Hypermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-626-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oyster Sauce Market Size & Trends

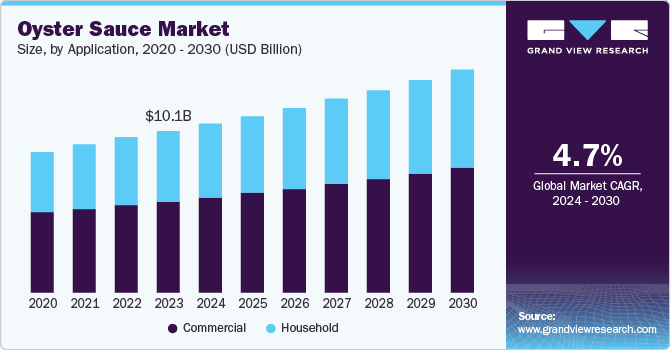

The global oyster sauce market size was valued at USD 10.14 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. Increasing consumer demand for umami-rich and savory flavors in culinary applications worldwide is fueling growth. Oyster sauce, commonly used in Asian cooking, is valued for its savory-sweet taste made from additional seasonings, soy sauce, and oysters. This flexible condiment is commonly used to enhance flavors in marinades, stir-fries, and dipping sauces, making it popular not only in Asia but also in global markets where Asian cuisine is widely enjoyed. Moreover, the rise can be credited to the rising worldwide appeal for Asian food, the special taste and adaptability of oyster sauce in different cooking uses, and the increasing need for easy-to-use cooking products. The combination of these factors, along with the increasing number of consumers and the growth of the food service and retail industries, is expected to boost the oyster sauce market in the predicted time frame.

In addition, the global oyster sauce market is experiencing growth due to the rising trend of ethnic cuisines and the need for easy-to-prepare meals in Western countries. Oyster sauce is popular among busy consumers for its convenience and ability to add depth and complexity to dishes, making it a favored option for those seeking quick and flavorful meal choices. Moreover, in response to the shift towards healthier eating habits and clean-label products, manufacturers are now offering oyster sauces with lower sodium levels and without any artificial additives, catering to the preferences of health-conscious consumers for instance oyster sauce, commonly used in Asian dishes, is made from oysters and is low in calories, fat-free, and rich in calcium for strong bones.

Furthermore, oyster sauce is essential in Japanese, Thai, Chinese, Vietnamese, Malaysian and Indonesian cooking. The product gaining in fame because of its delicious taste, making it a perfect addition for enhancing various meats and vegetables. This is expected to increase the product demand during the forecast period as well. The increasing amount of online grocery service providers is also anticipated to support the growth of the market.

In the oyster sauce market, there is tough competition among top companies that are always introducing new products to meet various consumer preferences, shaping the competitive market. Moreover, the global oyster sauces market is being driven even further by the growing accessibility of Asian ingredients and flavors due to increasing globalization and urbanization. The increasing interest in diverse flavors and global cuisine is projected to boost the popularity of oyster sauces, leading to growth and advancement in the market in the future.

Application Insights

The commercial segment dominated the market in 2023 due to the rapid growth of the food service industry. Oyster sauce is a versatile flavor enhancer for a variety of menus in hotels, restaurants, and catering services. The growing global popularity of Asian cuisines has driven the need for authentic ingredients such as oyster sauce in professional kitchens. Furthermore, the operational needs of these establishments are well-matched with the convenience and uniformity provided by commercial-grade oyster sauce products. Moreover, the increasing popularity of food delivery and takeout services has also played a role in the sector's expansion, with restaurants requiring a sufficient amount of resources to keep up with the higher demand from customers. Together, these factors have driven the commercial sector to become a dominant force in the oyster sauce market.

Household is projected to grow at the fastest CAGR over the forecast period due to factors such as changing lifestyles, higher disposable incomes, and a preference for healthier and customizable meal choices. In addition, the increasing impact of food bloggers, cooking shows, and social media platforms has encouraged consumers to try different types of food, such as Asian-influenced meals that prominently use oyster sauce. Moreover, the segment's strong growth has been boosted by the increased availability of a larger variety of oyster sauce products designed to suit home cooking preferences, including convenient packaging and different flavor options.

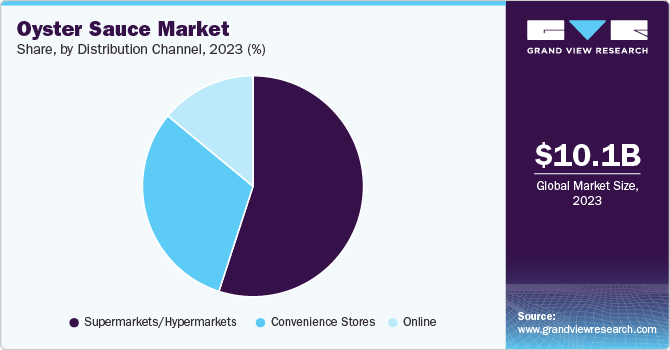

Distribution Channel Insights

Supermarkets/hypermarkets dominated the market in 2023, providing a variety of brands and types in one convenient location. These big retail companies utilize their large customer base and physical presence to make oyster sauces easily accessible and visible, ultimately impacting consumer buying choices with appealing presentations and deals. These major retailers provide a variety of items, such as various cooking ingredients, making them convenient shopping destinations for customers. In addition, these stores have special sections for ethnic foods, meeting the increasing need for Asian cuisines and their relevant sauces.

Online channels are expected to register the fastest CAGR during the forecast period. This fast expansion is fueled by the growing trend of online shopping and the rising demand for easy shopping experiences. More consumers are choosing to buy groceries and condiments such as oyster sauce through online platforms. In addition, the easy access to high-speed internet and the prevalence of smartphones has made online shopping more convenient. Moreover, the increase in online sales can be attributed to the broader selection of competitive prices, products, and convenience of home delivery provided by online retailers.

Regional Insights

North America's oyster sauce market is anticipated to witness significant growth in the coming years due to the rise in demand for Asian foods, especially Thai and Chinese. This trend has been influenced by a rising multicultural population and the growing popularity of trying out various flavors. Moreover, the strong retail industry in the area, including grocery stores and e-commerce sites with a variety of Asian food items, has made it convenient for customers to purchase oyster sauce.

U.S. Oyster Sauce Market Trends

The U.S. oyster sauce market dominated North America in 2023. The region boasts a diverse population with a growing preference for international flavors, leading to the market's growth. The extensive retail infrastructure, including hypermarkets, supermarkets, and online platforms, guarantees accessibility to oyster sauce.

Asia Pacific Oyster Sauce Market Trends

The Asia Pacific oyster sauce market dominated the global market and accounted for a revenue share of 57.16% in 2023. influenced by a mix of economic, cultural, and culinary factors. The region is known for originating many dishes that use oyster sauce, resulting in a strong consumer preference for it. Countries such as Thailand, Korea, China, and Indonesia, renowned for their diverse culinary heritages, are the main hubs for oyster sauce consumption. Furthermore, the growing middle class in numerous Asian nations has resulted in higher disposable incomes, enabling customers to try out a broader selection of flavors and ingredients, such as high-end oyster sauce options. The strong food service sector in the area, consisting of many dining establishments, continues to drive demand. Moreover, the increasing demand for Asian food worldwide has led to a surge in demand for genuine components such as oyster sauce, driving Asia Pacific's dominant position in the industry.

The China oyster sauce market held a substantial market share in 2023, the significant consumption is driven by deep-rooted culinary traditions and a strong preference for authentic flavors. Additionally, the trend towards urban living and evolving lifestyles has resulted in a greater dependence on convenient condiments. In addition, the market's growth is largely driven by the extensive network of restaurants and eateries within the country's vibrant food service sector.

Europe Oyster Sauce Market Trends

Europe's oyster sauce market held considerable share in 2023 due to growing interest in Asian cuisines, specifically Chinese and Thai and the increasing number of diverse cultures and the demand for varied culinary adventures are driving the growth. In addition, the growth of the food service sector, including an increasing number of Asian dining establishments, has generated a large market. Furthermore, the growing accessibility of Asian ingredients in grocery stores and specialty shops has simplified the process for individuals to add oyster sauce to their culinary creations at home.

The U.K. oyster sauce market is expected to grow rapidly in the coming years. The increasing amount of Asian eateries and delivery services have introduced a broader audience to the diverse uses of oyster sauce. Furthermore, the market's growth has been fueled by the increase in home cooking and the demand for easy-to-use flavor enhancements.

Key Oyster Sauce Company Insights

Some key companies in the oyster sauce market include Ajinomoto Co., Inc., Kikkoman Corporation, Lee Kum Kee, and others. Key players are undertaking strategies, including partnerships and new launches.

-

KAKUSAN SHOKUHIN offers various oyster sauce and oyster extract products like OYE-J, OYJU-KSJ, RUBY-20, and OYJU-J to meet different consumer tastes.

Key Oyster Sauce Companies:

The following are the leading companies in the oyster sauce market. These companies collectively hold the largest market share and dictate industry trends.

- Ajinomoto Co., Inc.

- Foshan Haitian Flavoring & Food Co. Ltd.

- Kikkoman Corporation

- Lee Kum Kee

- AB World Foods

- Nestlé

- MOTHER’S BEST

- Wing Soon Food Manufacturer Pte Ltd.

- KAKUSAN SHOKUHIN

- Ong's Food Industries Pte. Ltd.

Recent Developments

-

In June 2023, Nestle Thailand announced the launch of 2 low sodium cooking sauces to help reduce consumers’ sodium intake in Thailand. Consumers can opt for lower sodium alternatives such as Maggi Oyster Sauce 60% less sodium and Maggi Cooking Sauce 40% less sodium.

-

In May 2022, Kikkoman Corporation introduced Kikkoman Oyster Flavoured Sauce, suitable for both non-vegetarians and vegetarians in India.

Oyster Sauce Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.60 billion

Revenue forecast in 2030

USD 13.96 billion

Growth Rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, Distribution Channel, and Region.

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, China, Japan, India, South Korea, Australia, New Zealand, Brazil, and South Africa

Key companies profiled

Ajinomoto Co., Inc.; Foshan Haitian Flavoring & Food Co.Ltd.; Kikkoman Corporation; Lee Kum Kee; AB World Foods; Nestlé; MOTHER’S BEST; Wing Soon Food Manufacturer Pte Ltd.; KAKUSAN SHOKUHIN; Ong's Food Industries Pte. Ltd.;

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oyster Sauce Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oyster sauce market report based on, application, distribution channel, and region.

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Household

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Convenience Stores

-

Supermarkets/Hypermarkets

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.