- Home

- »

- Advanced Interior Materials

- »

-

Ozone Generators Market Size, Share, Industry Report, 2033GVR Report cover

![Ozone Generators Market Size, Share & Trends Report]()

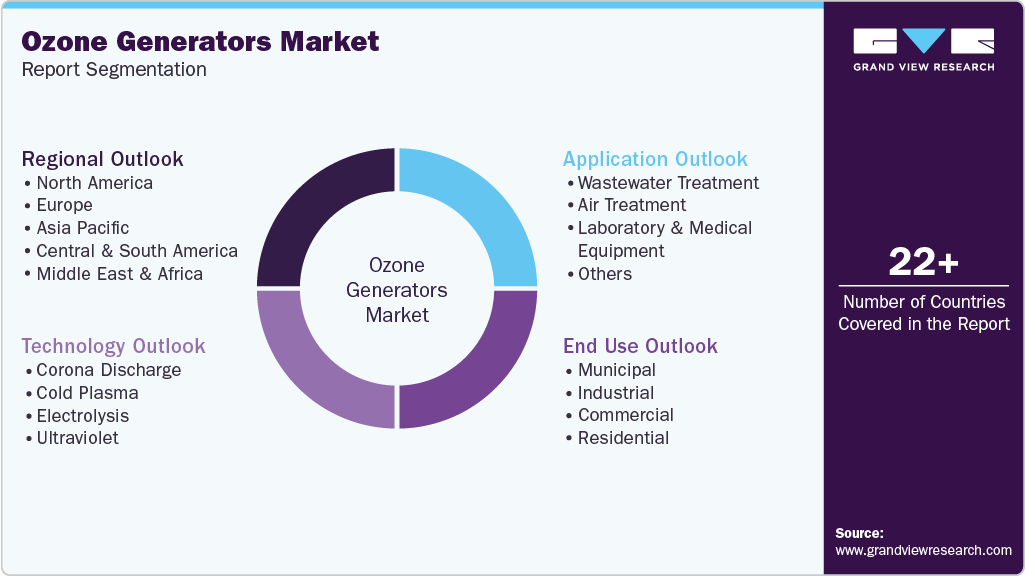

Ozone Generators Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Corona Discharge, Cold Plasma, Electrolysis, Ultraviolet), By Application, By End Use (Municipal, Industrial, Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-725-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ozone Generators Market Summary

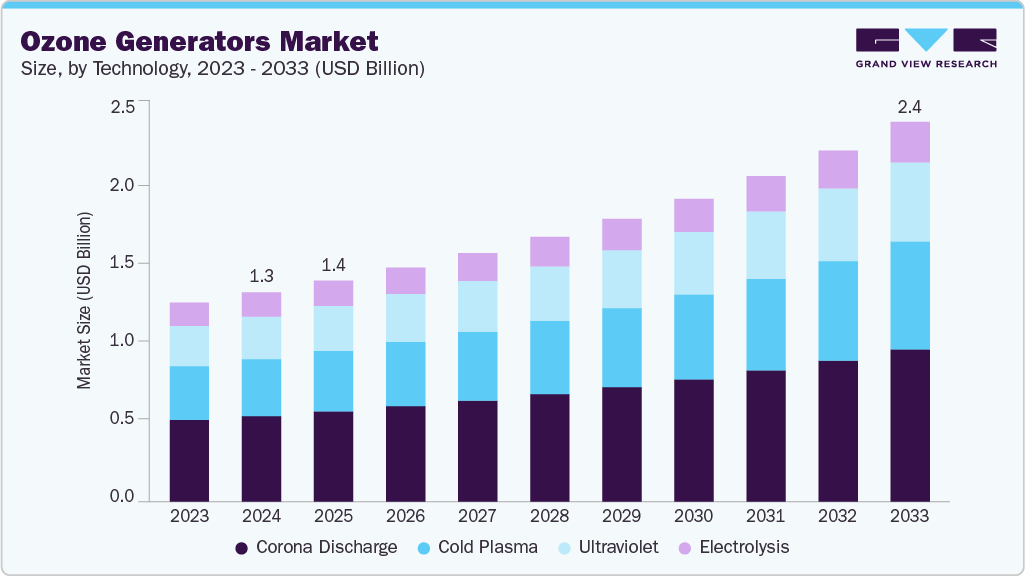

The global ozone generators market size was estimated at USD 1,325.5 million in 2024 and is anticipated to reach USD 2,406.0 million by 2033, growing at a CAGR of 7.0% from 2025 to 2033. Market growth is primarily driven by increasing concerns over air and water pollution, stricter environmental regulations, and rising demand for effective disinfection technologies across healthcare, municipal, and industrial sectors.

Key Market Trends & Insights

- North America dominated the ozone generators market with the largest revenue share of 32.2% in 2024.

- The ozone generators market in Mexico is expected to grow at a significant CAGR of 8.3% from 2025 to 2033.

- By technology, the cold plasma segment is projected to expand at a considerable CAGR of 7.5% from 2025 to 2033 in terms of revenue.

- By application, the air treatment segment is expected to grow at a rapid CAGR of 9.4% from 2025 to 2033 in terms of revenue.

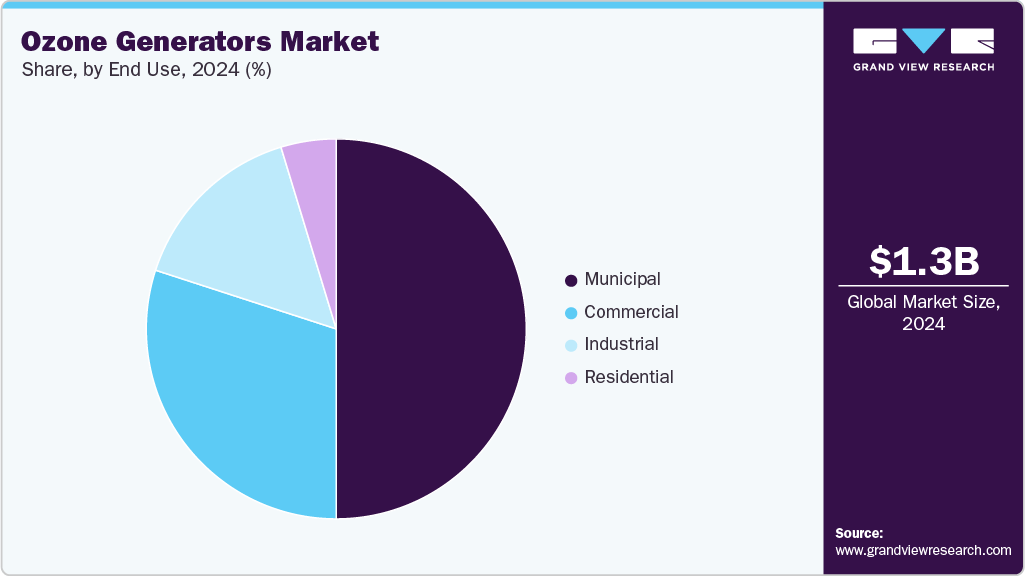

- By end use, the commercial segment is projected to expand at a fast-paced CAGR of 9.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1,325.5 Million

- 2033 Projected Market Size: USD 2,406.0 Million

- CAGR (2025-2033): 7.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

The growing use of ozone in water treatment, food processing, and HVAC systems, along with heightened awareness of pathogen control and indoor air quality, is further fueling adoption worldwide. In addition, technological advancements in ozone generation systems-such as energy-efficient corona discharge methods, compact modular designs, and automated control features-are enhancing system performance and ease of integration across various industries. The increasing shift toward chemical-free disinfection solutions, especially in water treatment and food processing, is further strengthening the market outlook. As industries and municipalities seek sustainable alternatives to chlorine and other conventional methods, ozone generators are gaining traction for their effectiveness, eco-friendliness, and minimal by-product formation.

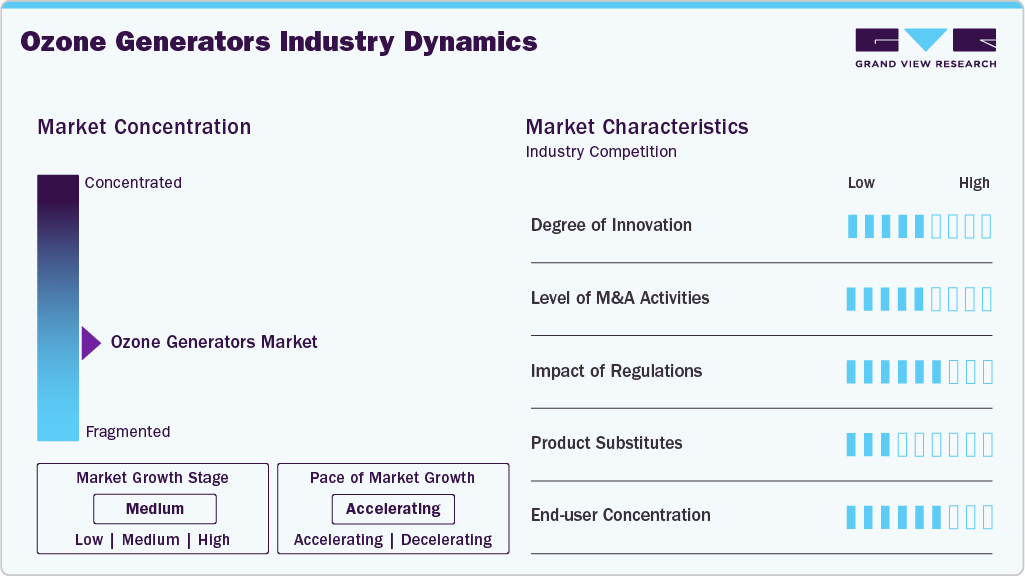

Market Concentration & Characteristics

The global ozone generators market is moderately concentrated, with a mix of established multinational manufacturers and regional suppliers. Leading players maintain significant market share through advanced ozone generation technologies, broad application expertise, and global distribution networks. However, smaller regional firms and equipment integrators add to competitive fragmentation, particularly in emerging markets. This dynamic creates an environment where innovation, cost-efficiency, and regulatory compliance drive market competitiveness.

The ozone generators market is experiencing steady innovation, primarily driven by demand for energy-efficient, low-maintenance, and high-output systems across water treatment, air purification, and industrial sanitation applications. Advancements in corona discharge and dielectric barrier technologies, as well as integration with smart control systems and IoT platforms, are gaining momentum. Manufacturers are investing in R&D to improve system reliability, reduce ozone leakage, and comply with evolving emission and safety standards.

Mergers and acquisitions are increasingly common as major players look to strengthen their product portfolios and geographic footprint. Strategic acquisitions of niche technology firms or regional equipment providers help global brands offer turnkey solutions and enter new industrial verticals. This consolidation supports standardization, economies of scale, and quicker deployment of advanced ozone systems across varied end-user segments.

Environmental and safety regulations play a critical role in shaping the ozone generators market. Regulatory frameworks set by agencies such as the EPA, OSHA, and EU REACH dictate safe ozone exposure levels, equipment design, and application-specific guidelines. Compliance with these standards is essential to avoid operational restrictions, liability risks, and reputational impact, making regulatory alignment a key factor in product development and market entry strategies.

Drivers, Opportunities & Restraints

Rising concerns over air and water pollution, along with growing awareness of microbial contamination in public and industrial environments, are major factors fueling demand for ozone generators. As urbanization and industrial activity intensify, the need for effective, chemical-free disinfection and purification solutions becomes critical. Increasing consumer focus on indoor air quality and hygiene, especially in healthcare and commercial facilities, is further driving market growth. In parallel, stringent environmental and occupational safety regulations are prompting industries to adopt ozone-based systems for compliance and sustainability goals.

Technological advancements in ozone generation efficiency, miniaturization, and automation are creating significant growth opportunities across applications such as water treatment, food sanitation, and HVAC disinfection. Emerging markets in Asia Pacific, Central & South America, and parts of Africa offer strong potential due to expanding infrastructure and increasing investments in public health and environmental protection. The shift toward green technologies and reduced chemical usage further supports the adoption of ozone systems in industrial, municipal, and residential sectors.

However, the high initial cost of advanced ozone generators and associated safety equipment can limit adoption, particularly among small businesses and cost-sensitive regions. Regulatory variations related to ozone emissions and exposure limits across countries pose challenges for global market players. In some areas, limited technical expertise and a lack of awareness regarding ozone’s capabilities hinder adoption and safe operation. These factors, combined with operational safety concerns, can restrain market growth despite rising demand.

Technology Insights

The corona discharge segment led the market and accounted for 40.9% of global revenue share in 2024. This dominance is attributed to its efficiency, scalability, and cost-effectiveness in generating high concentrations of ozone for diverse applications. Corona discharge systems are widely used in municipal water treatment, industrial oxidation processes, and air purification due to their reliable output and compatibility with automation. Their ability to produce ozone on-site without chemical additives aligns well with growing regulatory and environmental demands, reinforcing their market leadership.

The cold plasma segment is witnessing significant growth due to its advanced capabilities in generating ozone with lower energy consumption and minimal heat output. This technology is gaining traction in applications that require controlled and low-temperature ozone production, such as food surface sanitation, medical device sterilization, and sensitive air purification environments. The rising demand for compact, efficient, and low-maintenance systems is supporting adoption, particularly in healthcare and food processing sectors. As concerns around chemical residues and thermal degradation grow, cold plasma ozone generators offer a promising alternative by enabling effective disinfection without compromising product integrity.

Application Insights

The wastewater treatment application segment accounted for 42.9% of the global revenue share in 2024, making it the largest contributor to the ozone generators market. Ozone is widely used in municipal and industrial wastewater treatment due to its powerful oxidation properties, which effectively eliminate organic contaminants, pathogens, and emerging pollutants without leaving harmful residues. Stringent environmental regulations around effluent discharge, particularly in North America and Europe, are driving widespread adoption of ozone-based disinfection systems.

The air treatment segment is growing significantly, fueled by rising concerns over indoor air quality in commercial, residential, and industrial settings. Increasing urban pollution, the spread of airborne pathogens, and post-pandemic hygiene awareness are prompting demand for ozone generators in HVAC systems, cleanrooms, and healthcare facilities. Ozone’s ability to neutralize odors, mold, and volatile organic compounds (VOCs) makes it a preferred choice for air purification.

End Use Insights

The municipal segment continues to dominate the ozone generators market, accounting for 50.0% of global revenue in 2024, driven by long-standing use in large-scale water and wastewater treatment. Regulatory approval, proven efficacy, and the ability to reduce chemical usage make ozone systems a preferred choice for public utilities aiming to meet strict discharge standards.

The commercial segment is expanding steadily, fueled by demand for air and surface disinfection in settings such as hotels, offices, gyms, and retail spaces. Businesses are adopting compact, automated ozone systems to improve hygiene, reduce chemical costs, and meet rising expectations for indoor air quality and environmental safety.

Regional Insights

The North America ozone generators market led the global revenue share accounting for 32.2% of the share in 2024 driven by strict environmental regulations and strong infrastructure for air and water treatment. Agencies such as the EPA and OSHA enforce stringent ozone emission and exposure standards, pushing industries to adopt compliant technologies. High awareness of public health and sustainability, along with a strong base of key manufacturers, supports regional growth.

U.S. Ozone Generators Market Trends

The U.S. leads the North American ozone generators market due to its robust regulatory landscape and early adoption of advanced disinfection technologies. Ozone systems are widely used in municipal utilities, healthcare, and food processing. Rising concerns over air and water quality, coupled with increased investment in green infrastructure, reinforce the country’s dominant position.

Europe Ozone Generators Market Trends

Europe holds a significant share of the global ozone generators market, driven by strict environmental regulations and strong adoption across water, air, and food treatment sectors. Countries in Western and Northern Europe lead in deploying ozone systems as part of broader sustainability and pollution control initiatives. Integration with centralized utilities and smart monitoring platforms is growing, while partnerships between local manufacturers and service providers support turnkey solutions. Eastern Europe is emerging as a growth area amid rising infrastructure investments and regulatory alignment.

Germany is a key growth driver in the European ozone generators market, supported by strict environmental policies and advanced infrastructure for industrial and municipal water treatment. Strong regulatory oversight and a focus on sustainable processing in sectors such as food and pharmaceuticals drive demand for ozone systems. High export activity further reinforces the need for effective, compliant disinfection solutions.

The UK ozone generators market is expanding steadily amid increased focus on air and water quality post-Brexit. Regulatory enforcement by agencies such as the Environment Agency and the FSA, combined with growing investment in healthcare and food safety infrastructure, is boosting ozone adoption. Demand for compact, efficient disinfection systems is rising in both public and commercial settings.

Asia Pacific Ozone Generators Market Trends

The Asia Pacific ozone generators market is expected to witness the fastest growth over the forecast period, driven by rising air and water quality concerns in densely populated countries such as China and India. Rapid urbanization, industrial expansion, and increasing adoption of sustainable disinfection methods are fueling demand. Government efforts to strengthen environmental standards and improve public health infrastructure are further supporting market growth. Rising export activity is also pushing industries to adopt globally compliant ozone systems.

China is seeing strong market growth due to heightened regulatory oversight following past contamination issues and pollution concerns. Agencies such as SAMR are enforcing stricter environmental and food safety measures. Urbanization and increased consumption of packaged goods are boosting demand for ozone-based air and water treatment systems across industrial and municipal sectors.

In India, the ozone generators market is expanding rapidly with growing awareness of sanitation and environmental health. The FSSAI and other agencies are promoting safe processing practices, while rising demand for clean water, processed foods, and healthcare infrastructure is driving adoption. Government-led programs supporting pollution control and export readiness further strengthen growth prospects

Central & South America Ozone Generators Market Trends

Central & South America is witnessing steady growth in the ozone generators market, driven by expanding food processing, industrial sanitation, and municipal water treatment sectors. Increasing regulatory pressure and rising export activity are encouraging the adoption of ozone systems across key economies. However, limited infrastructure in some areas continues to pose operational challenges.

Brazil is experiencing notable growth in the ozone generators market due to its large food processing sector and strong export activities. Regulatory authorities such as ANVISA and MAPA have implemented strict food safety standards, increasing demand for reliable disinfection systems. Expansion of major equipment providers and service networks is strengthening market infrastructure. Rising consumer awareness and higher consumption of packaged foods are further fueling this growth.

Middle East & Africa Ozone Generators Market Trends

Middle East & Africa is gradually expanding in ozone generator adoption, supported by growing demand for clean water and air in urban centers. In the UAE, government-backed sustainability initiatives and rising investment in green buildings and smart cities are driving interest in ozone-based air and water purification. Industrial development and tourism growth are also contributing to increased uptake.

The United Arab Emirates (UAE) ozone generators market is experiencing robust growth, largely driven by major investments in wastewater treatment and desalination plants. Government-backed initiatives are a significant factor boosting the demand for ozone systems in water purification and air sanitation.

Key Ozone Generators Company Insights

Some of the key players operating in the market include Mitsubishi Electric Corporation and TOSHIBA CORPORATION

-

Mitsubishi Electric Corporation is a Japan-based multinational known for its wide portfolio of electrical and electronic equipment. In the ozone generators market, the company offers advanced systems primarily for water and air treatment applications, leveraging its expertise in industrial automation and environmental systems. Its focus on energy efficiency and sustainability supports demand across municipal, commercial, and industrial sectors.

-

Toshiba Corporation is a diversified Japanese conglomerate with strong capabilities in energy systems, infrastructure, and environmental solutions. Toshiba has developed ozone-based technologies for water purification and industrial applications, integrating them into broader environmental control systems. The company’s commitment to clean technology and innovation aligns with global trends in sustainable treatment solutions.

Key Ozone Generators Companies:

The following are the leading companies in the ozone generators market. These companies collectively hold the largest market share and dictate industry trends.

- Mitsubishi Electric Corporation

- TOSHIBA CORPORATION

- DAIKIN INDUSTRIES, Ltd

- Industrie De Nora S.p.A.

- Mellifiq

- Xylem Inc.

- Primozone Production AB

- METAWATER Co., Ltd

- ESCO International

- Ozonetech Systems OTS AB

- Veola

Recent Developments

-

In April 2025, RainHarvest Systems introduced its new Pro Series and M Series ozone generator product lines. The six advanced systems are designed to deliver high-performance water purification across residential, commercial, and industrial applications.

-

In April 2023, Fresh Mouth announced the launch of its new ozone generator, which also functions as a hydrogenated water producer. This generator is designed to safely and efficiently clean and sanitize the mouth. The device generates ozone, which eliminates harmful bacteria, viruses, and fungi responsible for bad breath, gum infections, and other oral health issues.

Ozone Generators Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,400.3 million

Revenue forecast in 2033

USD 2,406.0 million

Growth rate

CAGR of 7.0% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2023

Forecast period

2025 - 2033

Market representation

Revenue in USD million and CAGR from 2025 to 2033

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Segments covered

Technology, end use, application, region

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Australia; Brazil; Argentina; South Africa; UAE

Key companies profile

Mitsubishi Electric Corporation; TOSHIBA CORPORATION; DAIKIN INDUSTRIES, Ltd; Industrie De Nora S.p.A.; Mellifiq; Xylem Inc.; Primozone Production AB; METAWATER Co., Ltd; ESCO International; Ozonetech Systems OTS AB; Veolia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ozone Generators Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country level and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global ozone generators market report on the basis of technology, application, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Corona Discharge

-

Cold Plasma

-

Electrolysis

-

Ultraviolet

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Wastewater Treatment

-

Air Treatment

-

Laboratory & Medical Equipment

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Municipal

-

Industrial

-

Commercial

-

Residential

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ozone generators market size was estimated at USD 1,325.5 million in 2024 and is expected to reach USD 1,400.3 million in 2025.

b. The global ozone generators market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2033 and reach USD 2,406.0 million by 2033.

b. North America led the ozone generators market, accounting for 32.2% of global revenue share in 2024, driven by strict environmental regulations and rising demand for air and water purification systems. Increasing industrial activity and public health initiatives are further supporting adoption across sectors.

b. Mitsubishi Electric Corporation, TOSHIBA CORPORATION, DAIKIN INDUSTRIES, Ltd, Industrie De Nora S.p.A., Mellifiq, Xylem Inc., Primozone Production AB, METAWATER Co., Ltd, ESCO International, Ozonetech Systems OTS AB, and Veolia.

b. Key factors driving the ozone generators market include rising concerns over air and water pollution and growing demand for chemical-free disinfection solutions. Strict environmental regulations and increasing adoption across healthcare, municipal, and industrial sectors are also fueling growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.