- Home

- »

- Consumer F&B

- »

-

Packaged Salad Market Size & Share, Industry Report, 2033GVR Report cover

![Packaged Salad Market Size, Share & Trends Report]()

Packaged Salad Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Vegetarian, Non-Vegetarian), By Processing (Organic, Conventional), By Type (Packaged Greens, Packaged Kits), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-892-3

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Packaged Salad Market Summary

The global packaged salad market size was estimated at USD 13,465.0 million in 2024 and is projected to reach USD 25,966.3 million by 2033, growing at a CAGR of 7.7% from 2025 to 2033. An increasing emphasis on health and wellness has prompted consumers to seek nutritious meal options, making packaged salads the preferred choice for health-conscious individuals.

Key Market Trends & Insights

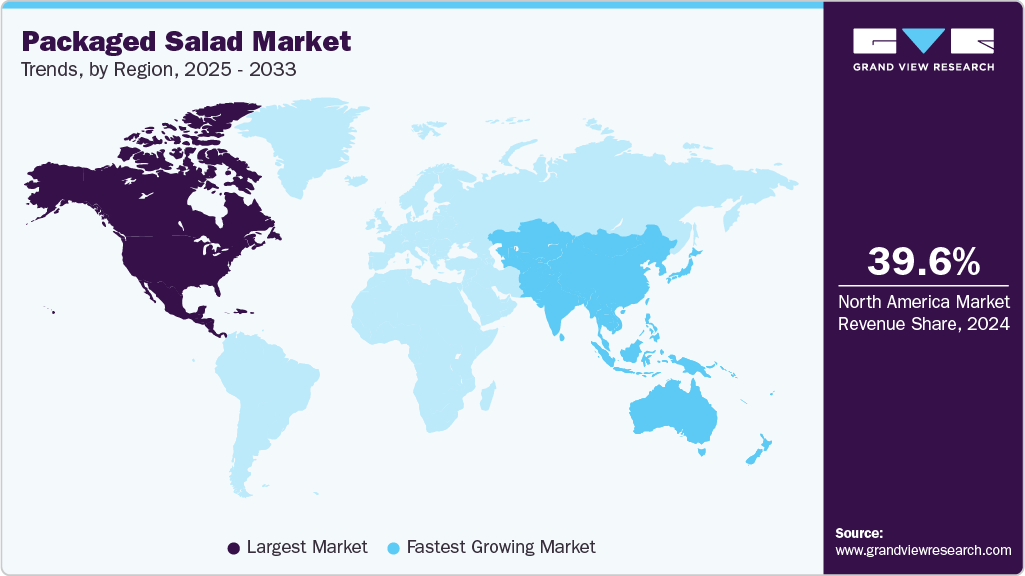

- North America held the largest share of the packaged salad market in 2024, accounting for 39.59%.

- The U.S. led the North America packaged salad industry in 2024, holding the largest revenue share of 76.61%.

- By product, the vegetarian packaged salad segment held the largest revenue share of 67.94% in 2024.

- By processing, the conventional packaged salad market segment accounted for the largest revenue share of 67.06% in 2024.

- By type, the packaged salad greens market segment accounted for the largest revenue share of 62.60% in 2024.

Key Market Trends & Insights

- 2024 Market Size: USD 13,465.0 Million

- 2033 Projected Market Size: USD 25,966.3 Million

- CAGR (2025-2033): 7.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to Chicago-based Circana’s National Eating Trends, each U.S. consumer ate about 39 salads during the 12 months ending in February, a 4% increase from last year. Furthermore, packaged salads, being pre-washed and pre-cut, save consumers time and effort in meal preparation. This convenience factor is expected to drive the growth of the packaged salad industry.Rising health consciousness among consumers, along with increasing awareness of the numerous health benefits associated with fruits and leafy vegetables, has been driving the packaged salad market globally. In recent years, there has been a noticeable shift in consumer preferences towards choosing fruits and other fresh, unprocessed ingredients over fast foods and packaged snacks. The increasing emphasis on weight management, a response to the growing levels of obesity worldwide, drives this trend. Fruits and vegetables, with their naturally low calorie content, are emerging as a popular choice for health-conscious individuals seeking effective weight management solutions.

Growing inclination towards convenience foods is a significant driver of the packaged salad industry. Convenience has become paramount in consumers' food choices due to evolving lifestyles and busy schedules. According to Chicago-based Circana’s National Eating Trends, most salads (56%) are consumed at dinner, followed by lunch (39%). Salads serve as a main dish 52% of the time and as a side dish or appetizer 47% of the time. Packaged offerings from some major produce suppliers make it easy and convenient for consumers to make their own salads.

The increasing working population, especially working women, is also anticipated to drive the market. The young and working-class population does not want to compromise on health, flavor, or taste despite their busy schedules. This shift in consumer behavior has led to an increasing demand for easily accessible and ready-to-eat options, and packaged salads perfectly fit this criterion.

One of the primary reasons for the popularity of packaged salads is the time-saving aspect. With packaged salads, consumers can quickly assemble a healthy and fresh meal without the need for extensive washing, chopping, or food preparation. This convenience resonates with working professionals, students, and busy families who often struggle to find the time to prepare a nutritious meal from scratch. Packaged salads offer a hassle-free way to incorporate more vegetables into one's diet, and this time-saving feature is driving the packaged salad industry’s growth.

Based on consumer trends and preferences, Dole has introduced new kits, including the Creamy Greek Chopped Kit, Sweet Corn Chopped Kit, and a twist on the classic Italian sandwich with the Chopped Italian Sub Salad Kit, Austin said. Moreover, according to Chicago-based Datassential, 88.7% of restaurant menus feature salads, ranging from 77.1% in quick-serve restaurants to 96.9% in fine dining establishments.

Consumer Insights for the Packaged Salad Market

Product Insights

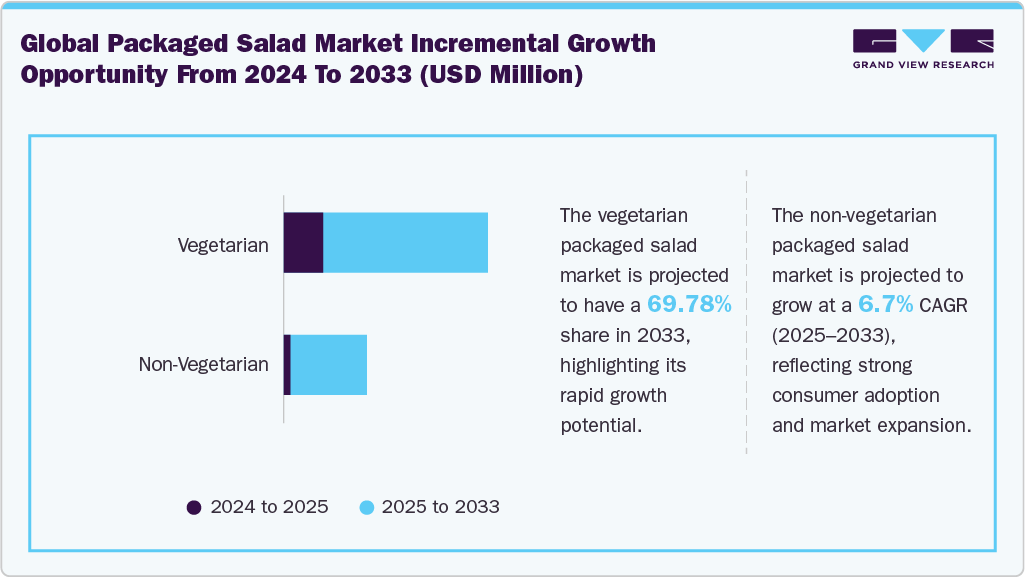

The vegetarian packaged salad market segment accounted for the largest revenue share of 67.94% in 2024. Factors such as a rise in the number of vegan and vegetarian population is fueling the demand for vegetarian packaged salads. The increasing emphasis on health and wellness has led many consumers to seek healthier food options. Packaged salads are often considered a nutritious choice, as they typically consist of fresh vegetables and greens rich in essential vitamins, minerals, and fiber.

The non-vegetarian packaged salad industry segment is projected to grow at a significant CAGR of 6.9% from 2025 to 2033. The shifting consumer focus towards protein-enriched diets to achieve their desired body figure or shape has been contributing to the worldwide demand for non-vegetarian packaged salads. Brands offering non-vegetarian packaged salads typically market their products as a wholesome choice for today's active lifestyle. In May 2023, the U.S.-based Local Bounti Corporation, a controlled environment agriculture (CEA) company, announced the expansion of its grab-and-go salad kit line.

Processing Insights

The conventional packaged salad market segment accounted for the largest revenue share of 67.06% in 2024. Packaged salads processed through conventional farming methods differ from those produced through organic farming methods. The National Organic Program, a federal regulatory framework in the U.S., places limitations on the use of genetically modified organisms (GMOs), while conventionally processed packaged salads may include GMOs. Generally, conventionally produced salads are more affordable than their organic counterparts because conventional farming tends to be less costly than organic farming.

The organic packaged salad industry segment is projected to grow at the fastest CAGR of 8.7% from 2025 to 2033. Organic processing systems adhere to precise production standards to attain sustainable agroecosystems that are economically, ecologically, and socially viable. Organically processed packaged salads receive proper certification from an authorized regulatory body. The criteria for organic processing of packaged salads differ from those of conventionally processed items in their reduced reliance on external inputs for preservation and their avoidance of synthetic ingredients and chemicals.

Type Insights

The packaged salad greens market segment accounted for the largest revenue share of 62.60% in 2024. Packaged greens have been gaining popularity due to their raw taste, which is not enhanced by the addition of any seasoning, dressing, or condiment. Growing consumer preference for raw, packaged salads has encouraged key players, as well as new entrants, to launch a number of products in the global market. Consumers across the globe are increasingly adopting packaged greens in order to cut down their intake of extra calories, sugar, and fat. Such types of consumer preferences are driving the demand for packaged greens in the global market.

The packaged salad kits industry segment is projected to grow at the fastest CAGR of 8.1% from 2025 to 2033. As the number of single-person households continues to rise, many individuals living alone encounter challenges in maintaining a healthy diet. Busy lifestyles often lead them to rely on fast food and restaurant meals, which are typically considered detrimental to long-term health. Consequently, individuals who live alone or those with limited time for meal preparation have been exploring healthier alternatives, such as packaged salad kits, which offer a nutritious and tasty option.

Distribution Channel Insights

The packaged salad sales through offline channels accounted for the largest revenue share of 79.07% in 2024. Supermarkets and hypermarkets are prominent distribution channels for packaged salads worldwide. Target and Walmart continue to dominate this space. Unlike grocery stores, orders placed through supermarkets and hypermarkets are typically larger in quantity. While grocery stores help packaged salad brands stay customer-focused, supermarkets and hypermarkets allow brands to increase sales by providing access to a considerably larger customer base.

The packaged salad sales through online channels are projected to grow at a significant CAGR of 10.1% from 2025 to 2033. The packaged salad market is yet to adopt e-commerce as widely as other sectors, such as household products and consumer electronics. The perishable nature of packaged salads, with unique logistics and storage requirements, is a key factor slowing down the distribution of these products through online and e-commerce channels. However, recent consumption patterns and shifting shopper sentiments indicate that the online category is poised for robust growth.

Regional Insights

The North America packaged salad market accounted for a revenue share of 39.59% in 2024. The regional market is experiencing notable growth, driven by the growing awareness among North American consumers regarding the importance of a healthy diet. This has led to an increase in the consumption of more fruits and vegetables. Salads are considered a convenient way to incorporate fresh vegetables into daily meals, contributing to the increased demand for packaged salads in the region.

U.S. Packaged Salad Market Trends

The U.S. led the North America packaged salad industry in 2024, holding the largest revenue share of 76.61%. Growing demand for packaged salads has inspired the launch of new products in the region. For instance, Fresh Express, a U.S.-based consumer packaged salad manufacturer, introduced its newest salad kit, French Blue Cheese, along with three new offerings in its best-selling line of chopped salad kits: Smokehouse, French Bistro, and Twisted Caesar Enchilada. These additions expand its line of more than 100 fresh and convenient salad kits and blends.

Europe Packaged Salad Market Trends

Europe held a significant market share in the global packaged salad industry in 2024. The growing demand for healthy and convenient food products, along with a rising emphasis on sustainably sourced products, are key factors driving the regional market. The fast-paced lifestyles of many Europeans have led to a surge in demand for convenient, ready-to-eat food options. Packaged salads are a convenient choice for individuals with busy schedules, as they offer a healthy meal solution that requires minimal preparation. This has led to several companies launching salad kits in the region.

The UK packaged salad market is witnessing lucrative growth. The availability of various-sized salad kits helps consumers purchase the required number of kits and prevent wastage, a common challenge when purchasing fresh raw salad ingredients. Moreover, the availability of a wide range of salad brands, such as Florette, Tesco, and Morrisons, in the UK has been influencing consumers to purchase these products. Advancements in technology are also anticipated to drive the market growth.

Asia Pacific Packaged Salad Market Trends

The Asia Pacific packaged salad industry is expected to grow at the fastest CAGR of 8.6% from 2025 to 2033. The high consumption of vegetables and fruits is expected to boost the demand for packaged salads in this region. Consumers in countries like China and India consume a significant number of vegetables due to their high production and ready availability. Moreover, the increasing popularity of packaged food in these countries has encouraged consumers to explore packaged salads, which offer convenience, health benefits, and time-saving options for working professionals.

Key Packaged Salad Company Insights

Packaged salad manufacturers are dedicated to enhancing their brand image through a continual process of innovation and evolution. They consistently explore novel variations and recipes, revamp their retail displays and packaging, and integrate fresh product offerings to stay at the forefront of their category. According to a 2023 survey conducted by Tasting Table, a select group of brands maintained strong positions in the top five rankings.

These brands are typically found in the fresh sections of U.S. supermarkets, with two of them being exclusive to the store. Some of these brands provide packaged salad kits perfect for preparing and serving at home, the office, or for gatherings. In contrast, others offer ready-to-eat single salads in durable plastic containers.

In the survey, Dole emerged as the clear favorite among participants for producing the best pre-made salads, accounting for a substantial 31.11% of the total responses. Fresh Express came in a close second, making up almost 30% of the votes. Fresh Express is recognized for its salad bowls and bagged salad kits, which are available nationwide. Trader Joe's, described as a "national chain of neighborhood grocery stores," represented a healthy 23.96% of the surveyed participants.

Key Packaged Salad Companies:

The following are the leading companies in the packaged salad market. These companies collectively hold the largest market share and dictate industry trends.

- Bonduelle

- Dolle Food Company Inc.

- Fresh Express, Incorporated

- Earthbound Farm

- Mann Packing Co., Inc.

- organicgirl

- Misionero

- Eat Smart

- BrightFarms, Inc.

- Gotham Greens

Recent Developments

-

In January 2025, Fresh Del Monte Produce, through its Mann Packing division, launched the Newman's Own Salad Kits featuring four culinary-inspired flavours, each crafted with high-quality lettuce.

-

In March 2024, Fresh Express, the brand leader in value-added salads, launched an Asian Apple Salad Kit and a Twisted Caesar Creamy Truffle Caesar Chopped Salad Kit.

-

In June 2023, Taylor Farms launched Mini Chopped Salad Kits, a new product line that offers small single-serve salad kits. The kits come in five flavors, including Citrus Crunch and Pizza Ranch, and are designed to provide a restaurant experience at home or on the go.

Packaged Salad Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 14,294.5 million

Revenue forecast in 2033

USD 25,966.3 million

Growth rate

CAGR of 7.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, processing, type, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; Australia; India; South Korea; Brazil; Saudi Arabia

Key companies profiled

Bonduelle; Dolle Food Company Inc.; Fresh Express, Incorporated; Earthbound Farm; Mann Packing Co., Inc.; organicgirl; Misionero; Eat Smart; BrightFarms, Inc.; Gotham Greens

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Packaged Salad Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global packaged salad market report based on product, processing, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Vegetarian

-

Non-Vegetarian

-

-

Processing Outlook (Revenue, USD Million, 2021 - 2033)

-

Organic

-

Conventional

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Packaged Greens

-

Packaged Kits

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global packaged salad market size was estimated at USD 13,465.0 million in 2024 and is expected to reach USD 14,294.5 million in 2025.

b. The global packaged salad market is expected to witness 7.7% revenue growth from 2025 to 2033 to reach USD 25,966.3 million by 2033.

b. The vegetarian packaged salad market accounted for the largest share of 67.94% of the revenue in 2024 due to rise in the number of vegan and vegetarian population in recent years.

b. The key market players in the packaged salad market includes Bonduelle; Dolle Food Company Inc.; Fresh Express, Incorporated; Earthbound Farm; Mann Packing Co., Inc.; organicgirl; Misionero; Eat Smart; BrightFarms, Inc.; Gotham Greens.

b. Growth in the packaged salad market is being primarily driven by an increasing emphasis on health and wellness has prompted consumers to seek nutritious meal options, making packaged salads the preferred choice for health-conscious individuals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.