- Home

- »

- Plastics, Polymers & Resins

- »

-

Packaging Adhesives Market Size & Share Report, 2025GVR Report cover

![Packaging Adhesives Market Size, Share & Trends Report]()

Packaging Adhesives Market (2019 - 2025) Size, Share & Trends Analysis Report By Technology (Water-Based, Solvent-based), By Application (Boxes & Cases, Labeling), By Region And Segment Forecasts

- Report ID: GVR-1-68038-658-5

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industry Insights

The global packaging adhesives market size was valued at USD 10.69 billion in 2018 and is expected to grow at a CAGR of 5.8% from 2019 to 2025. The market growth is majorly driven by rising demand from packaged food & beverages sector owing to the growing population, increasing disposable incomes, and changing consumer dietary requirements.

The packaged food & beverage products primarily include convenient ready-to-eat food products, cake mixes, frozen meals, and snacks. The growing demand for these products is projected to propel manufacturers to increase their production capacity, which is likely to fuel the market growth over the forecast period.

Growing demand for flexible packaging in the food & beverage sector is anticipated to be a positive factor for the market growth. Food & beverage products are perishable and tend to change their flavor and color within a short span of time. Flexible packaging offers a higher shelf life compared to conventional hot-fill packaging. It eliminates the need for refrigeration, which makes it convenient for consumers to store products. The innovative processing methods developed for increasing the shelf life of food products is propelling the growth of packaged food industry. This is likely to augment the market growth over the forecast period.

Pharmaceutical industry is another major end-user of the market. Technological innovations, increasing consumer concerns about health, and rising disposable incomes have resulted in the rapid growth of the global pharmaceutical industry over the past few decades and this trend is anticipated to continue over the projected period.

Packaging plays an important role in the pharmaceutical industry, as, it maintains the sterility of products and offers protection to medicines against contaminants, bacteria, and microorganisms. Growing demand for packaging in the pharmaceutical industry is likely to boost the product consumption over the forecast period.

Technology Insights

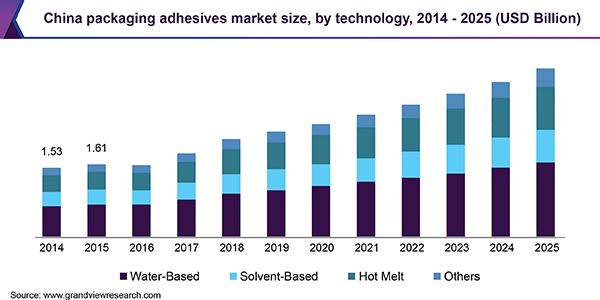

Based on technology, the market is segmented into water-based, solvent-based, hot melt, and others. Water-based was the largest technology segment in 2018, accounting for a volume share of 46.2%. They exhibit improved moisture resistance over other adhesives and are directly water-soluble. The most commonly used water-based adhesives in several industrial applications are PVA, gluten, starch, skin, and casein. Technological advancements have created a vast application scope for these products

There are two general types of water-based adhesives: solutions and latexes. Solutions are manufactured from materials that are soluble only in water or in alkaline water such as starch, dextrin, blood albumen, methylcellulose, and polyvinyl alcohol. Latex is a stable dispersion of a polymeric material in a substantially aqueous medium. Latex can replace solvent-based more quickly than solution adhesives.

Solvent-based segment is anticipated to grow at a CAGR of 4.9% from 2019 to 2025, in terms of volume. The products are produced by blending an adhesive material with a suitable solvent to generate an appropriate adhesion polymer solution. These high-performance products are created using a polymer with a stable molecular structure, which complements the chosen solvent. However, growing environmental concerns over VOC emissions is anticipated to hinder the growth of solvent-based adhesives over the forecast period.

Hot-melt segment is expected to register the highest growth rate of 6.0%, in terms of revenue, over the forecast period. These products are widely utilized in packaging applications owing to their exceptional inherent characteristics such as immediate bonding. Unlike water-based and solvent-based, hot-melt solutions are ideal for packaging products, which require rapid bond formations. Ease of use and fast processing are other key benefits offered by them.

Application Insights

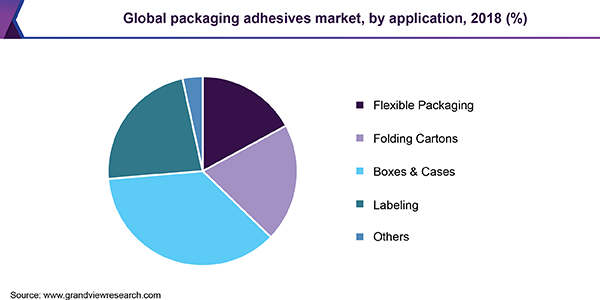

Based on application, the packaging adhesives market has been segmented into flexible packaging, folding cartons, boxes & cases, labeling, and others. Flexible packaging segment is expected to register a CAGR of 5.9%, in terms of volume, over the forecast period. Adhesives used in flexible packaging are efficient in various processes including heat & cold seal, lidding, lamination, blister packaging, horizontal flow packaging, and fill packaging. The demand for flexible packaging is attributable towards the growing demand from food & beverage industry

Labelling is expected to register the fastest growth rate of 6.0%, in terms of revenue, over the forecast period. Water-based adhesives are gaining prominence in the labelling segment, on account of their environment-friendly nature. They are formulated through natural and soluble synthetic polymers for labelling and bonding applications. In the packaging industry, clear labels have been replacing inks in the tagging of containers. The increasing demand for labels is anticipated to propel the product demand over the coming years.

Boxes & cases held the largest volume share of 36.4% in 2018. The share is attributable to the growing demand and production of corrugated boxes across the world. Corrugated boxes are lightweight and convenient to manage during packaging, loading & unloading. The raw material required to manufacture corrugated boxes is considerably low cost, which makes them affordable as compared to other alternatives in the market. Being a widespread global business, they are easily available in most regions. The rise in demand for corrugated boxes is anticipated to boost the market growth over the coming years.

Adhesives used in corrugated boxes, folding cartons, bags, and beverage cartons are easy to apply and deliver consistent results. Their uniform thickness ensures strong bonding. They are reliable, high-quality, easy to use, and meet several industry standards. As a result, their usage is increasing rapidly in various industrial applications.

Folding cartons is a significant application segment of the market. In folding cartons, the adhesives exhibit various benefits such as fast initial tack, strong bond, aqueous coating, and fast assembling. The demand for folding cartons is anticipated to grow on account of increasing demand for convenience food products from organized retailing and consumers all around the world. The growing demand for folding cartons is expected to further propel the demand for packaging adhesives during the forecast period.

Regional Insights

In terms of revenue, North America is expected to register a growth rate of 4.6%, during the forecast period. The demand for water-based adhesives is prominent in the region, owing to increasing technological developments, use of bio-based raw materials, and introduction of innovative techniques. In addition, factors like low cost and easy application of water-based adhesives in various ways such as roller-coating, screen-printing, and spraying are anticipated to further increase the product usage in coming years.

Europe held the second largest volume share of the market in 2018. The growing flexible packaging production is propelling the consumption of adhesives in the region. For instance, according to the German Plastics Packaging Industry Association (IK), the production of pouches, carrier bags, and big bags increased by 6.6% and reached 537,000 tons in 2018 from 2017.

Asia Pacific is anticipated to register fastest growth rate of 6.8% in terms of volume, during the forecast period. The growth is attributable to the changing lifestyle, rising disposable income and growing population especially in China and India, which is leading towards increased demand for packaged food. The increasing production of packaged food & beverage in the region is anticipated to augment the market growth in coming years.

China remains the fastest growing country and the largest adhesive producer in Asia Pacific. Increasing number of hospitals and healthcare facilities on account of the growing geriatric population is expected to drive the demand for pharmaceuticals in the country. The growing production for pharmaceuticals in turn is expected to boost the utilization of packaging adhesives in pharmaceutical packaging over the coming years.

Packaging Adhesives Market Share Insights

Global market is fragmented with many players including Hitachi Chemical Company Ltd, 3M Company, Dow ,H. B. Fuller, Henkel AG & Co., Ashland Inc., TOYOCHEM CO., LTD., Dymax Corporation, and Huntsman Corporation. Major players in the market are characterized by strategies such as mergers & acquisitions, capacity expansion, joint ventures, and long term contracts with the end-users to strengthen their market position.

For instance, in October 2017, H.B. Fuller Company acquired Royal Adhesives and Sealants for USD 1,622.7 million. The company produces various adhesives including water-based adhesives that are used in flexible packaging. The acquisition was aimed to expand the company’s reach in North America, Europe, and China.

Recent Developments

-

In April 2023, Dow and Avery Dennison collaborated to launch an innovative hotmelt label adhesive solution that enables polyethylene packaging to be mechanically recycled. This adhesive offers excellent performance in the packaging of chilled applications such as food, and it is the first of its kind in the label market for recycling in the HDPE stream

-

In April 2021, H.B. Fuller announced two groundbreaking compostable adhesive solutions for flexible packaging under its Flextra™ Evolution brand. The two products are Flextra™ Evolution SF1000CP/XR2000CP, a solventless adhesive, and Flextra™ Evolution WB1200CP/XR2200CP, a water-based adhesive

Report Scopes

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Volume in Kilotons, Revenue in USD Million, and CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, and Brazil

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments covered in the reportThis report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global packaging adhesives market on the basis of technology, application, and region:

-

Technology Outlook (Volume, Kilotons, Revenue, USD Million, 2014 - 2025)

-

Water-based

-

Solvent-based

-

Hot melt

-

Others

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2014 - 2025)

-

Flexible packaging

-

Folding cartons

-

Boxes & cases

-

Labeling

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2014 - 2025)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.