- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Packaging Coatings Market Size, Industry Report, 2033GVR Report cover

![Packaging Coatings Market Size, Share & Trends Report]()

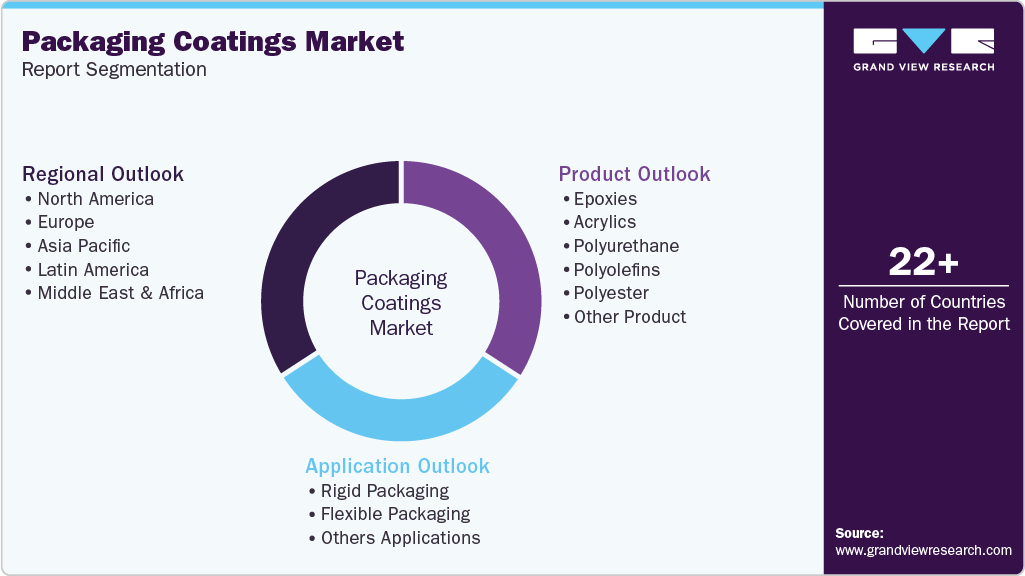

Packaging Coatings Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Epoxies, Acrylics, Polyurethane, Polyolefins, Polyester), By Application (Rigid Packaging, Flexible Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-255-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Packaging Coatings Market Summary

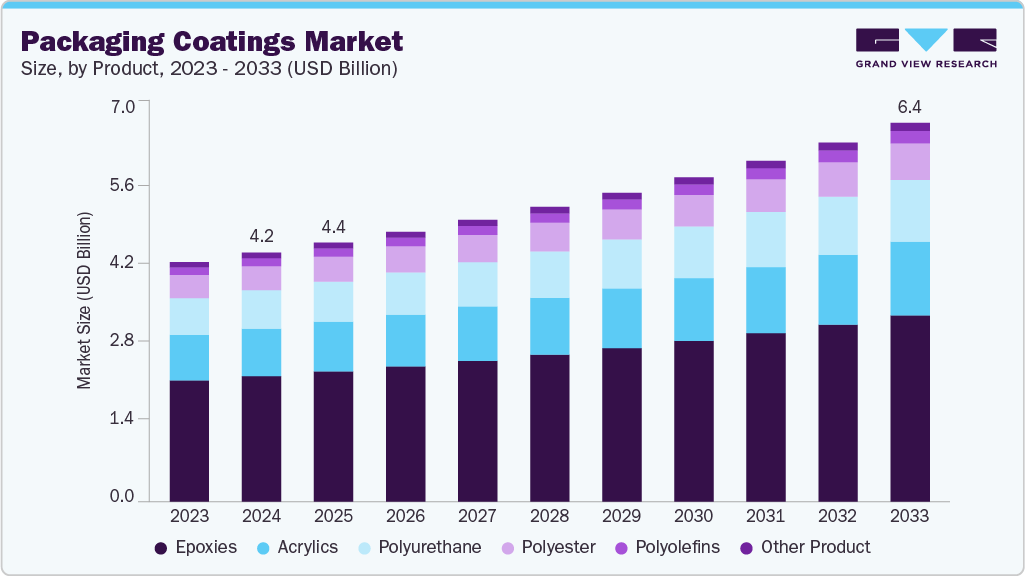

The global packaging coatings market size was estimated at USD 4,234.7 million in 2024 and is projected to reach USD 6,448.1 million by 2033, growing at a CAGR of 4.9% from 2025 to 2033. The market demand for packaging coatings is increasing for their application in flexible packaging coatings.

Key Market Trends & Insights

- Asia Pacific dominated the packaging coatings market with the largest revenue share of 42.5% in 2024.

- China held over 62.4% revenue share of the Asia Pacific packaging coatings market.

- By product, epoxy packaging coatings dominated the market with a revenue share of 50.4% in 2024.

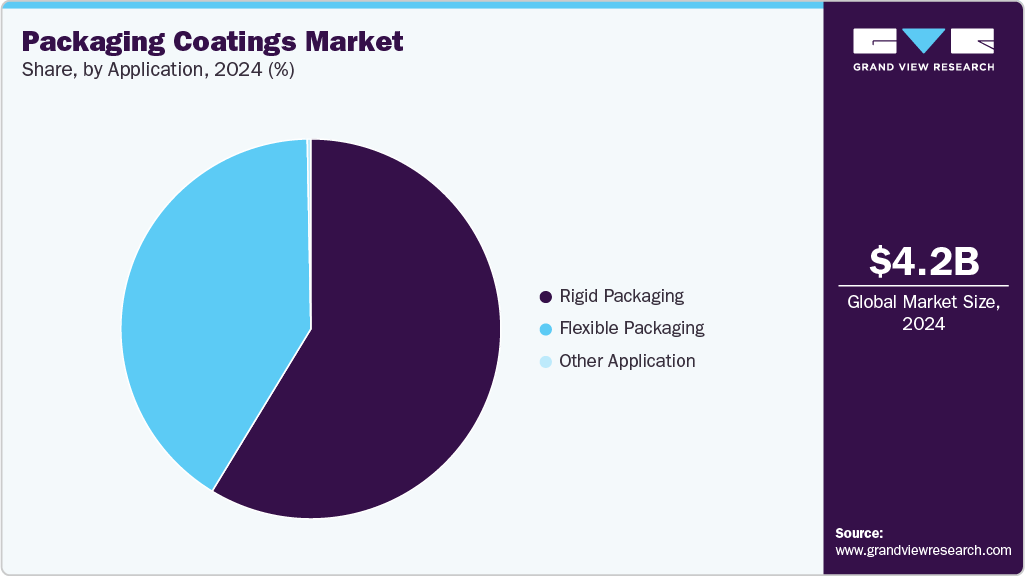

- By application, rigid packaging dominated the packaging coatings market with a revenue share of 58.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,234.7 Million

- 2033 Projected Market Size: USD 6,448.1 Million

- CAGR (2025-2033): 4.9%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

These products offer enhanced adhesion, durability, and resistance properties, making them ideal for various industries, including food and beverage packaging. The rise of the e-commerce industry is another significant driving factor. With the growth of online shopping, there is a higher demand for protective coatings for packaging materials to ensure the safe delivery of products. In addition, the increased demand for sustainable packaging solutions has also played a role in driving the market growth. Companies are focusing on developing eco-friendly alternatives to meet regulatory requirements and consumer preferences.Technological advancement and extensive research and development activities have contributed to market growth as well. These efforts aim to develop more effective and sustainable coating for various consumer goods products. Furthermore, global industrialization and urbanization have created a higher demand for packaged products, which in turn drives the market growth of the products.

Regulatory considerations also impact on the market for products. Increasing regulations related to harmful chemicals, such as volatile organic compounds (VOCs), can affect the market. However, companies have quickly adapted to various eco-friendly alternatives to comply with these regulations.

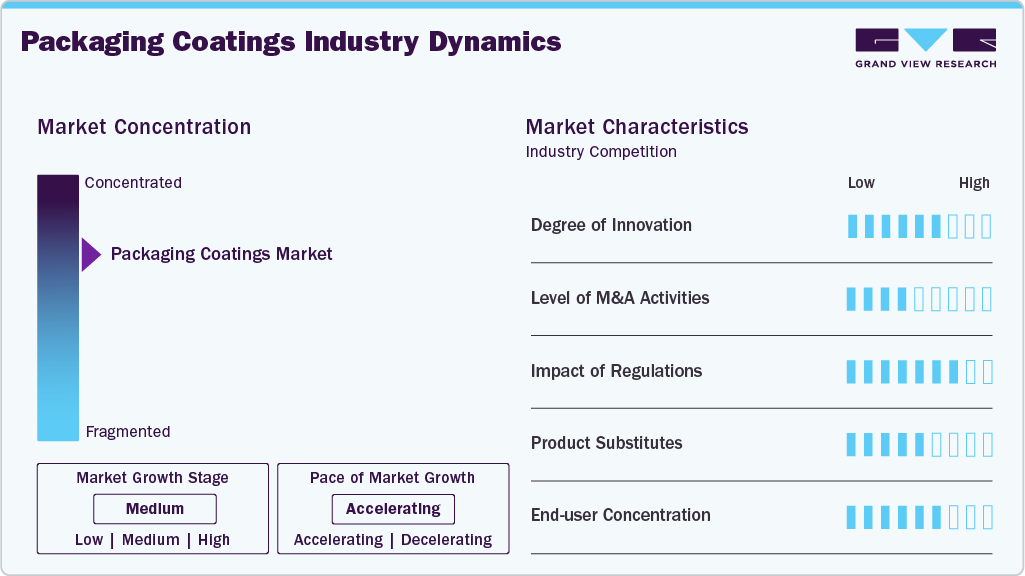

Market Concentration & Characteristics

The market exhibits characteristics of a moderately concentrated market. In the case of packaging coatings, a handful of key companies dominate the market, leading to a concentrated competitive landscape. These companies have established strong brand recognition, extensive distribution networks, and advanced technological capabilities, which act as barriers to entry for new players.

The competitive market landscape is characterized by intense rivalry among the major players. These companies compete based on factors such as product quality, innovation, pricing strategies, and customer service. Competition drives continuous improvement and innovation in products, benefiting consumers with a wider range of options and improved product performance.

Regulatory factors also play a significant role in shaping the market. Governments and regulatory bodies impose various regulations and standards to ensure the safety and sustainability of packaging materials. Compliance with these regulations is crucial for companies operating in the market. In addition, environmental concerns and the growing demand for sustainable packaging solutions have led to the development of eco-friendly coatings that meet regulatory requirements and consumer preferences.

Other factors that influence the product market include technological advancements and research and development activities. Companies invest in research and development to enhance the performance and functionality of coatings, such as improving barrier properties, adhesion, and durability. Technological advancements also enable the development of innovative coatings that cater to specific packaging requirements, such as temperature-sensitive products or high-barrier applications.

Product Insights

Epoxies packaging coatings segments dominated the packaging coatings market with a revenue share of 50.4% in 2024, due to their strong adhesion, chemical resistance, and durability properties. Epoxy products have been used in food packaging to provide a protective layer that separates the food or drink from the metal used to make cans. This helps prevent corrosion and maintains the safety, freshness, and nutritional value of the contents. Epoxy products also contribute to the longer shelf life of canned food, allowing consumers to store food for extended periods. In addition, epoxies are used in glass packaging to protect metal lids from corrosion.

Polyurethane packaging coatings segments are expected to grow fastest with a CAGR of 5.6% from 2025 to 2033, for their excellent flexibility, chemical resistance, and moisture resistance. They are used in products to provide a protective and durable layer that can withstand various environmental conditions. Polyurethane coatings offer good adhesion, impact resistance, and weather ability, making them suitable for applications such as food packaging, beverage cans, and Other Application materials.

Application insights

Rigid packaging applications dominated the packaging coatings market with a revenue share of 58.7% in 2024, attributed to its preference for products that require strong protection and a higher perceived value. It is commonly used for high-end beverages, spirits, perfumes, and specific beauty and health products. Glass packaging, in particular, is associated with a premium image and is favored for certain products. Rigid packaging also offers excellent barrier properties, ensuring the preservation and freshness of the contents. The global rigid packaging market is predicted to reach a significant value by 2024, indicating its continued importance in the consumer-packaged goods (CPG) industry.

Flexible packaging applications of packaging coatings are expected to grow fastest at a CAGR of 5.2% from 2025 to 2033, due to their lower cost and environmental impact compared to rigid packaging. Flexible pouches, for example, have become increasingly popular for food packaging due to their resealable nature, low environmental impact, and cost-effectiveness. They are commonly used for packaging products like granola, energy drinks, coffee, soups, snacks, and various other food items. The demand for flexible packaging is driven by factors such as convenience, lightweight design, and the ability to extend the shelf life of products.

Regional Insights

The Asia Pacific packaging coatings marketdominated with a 42.5% share in 2024. This high share of this segment can be attributed to the demand for packaging coatings in the Asia Pacific region is robust, driven by several key factors that contribute to its dominance in the global market. The region's market dominance is evident through its largest consumption and demand for packaging coatings. This demand is primarily fueled by the increasing need for flexible packaging coatings, particularly in the food and beverage packaging sector. In addition, the surge in demand for packaged food & beverage and consumer goods has significantly contributed to the high adoption of the products in the region.

China packaging coatings market held a substantial revenue share of the APAC market in 2024, driven by the increasing demand for flexible packaging coatings and the rising demand for food and beverage packaging. However, it is important to note that increasing regulations are expected to hinder the market's growth. Nevertheless, the swiftly shifting market towards eco-friendly coatings is likely to act as an opportunity in the future.

North America Packaging Coatings Market Trends

The North America packaging coatings market secured 24.9% of the revenue share in 2024, owing to the increasing demand for flexible packaging coatings and rising food and beverage packaging. However, the market is also witnessing fast growth owing to the region's fast-paced economy, changing lifestyles, and consumer inclination toward packaged food and beverages.

U.S. Packaging Coatings Market Trends

The U.S. packaging coatings market remains a vital segment of the coatings industry, supported by strong demand from food, beverage, pharmaceutical, and personal care sectors. These coatings enhance packaging performance by providing chemical resistance, corrosion protection, and improved shelf life. With growing consumer awareness and regulatory pressure, there is a marked shift toward sustainable solutions, such as BPA-free, water-based, and low-VOC coatings.

Leading companies like PPG Industries, Axalta, Sherwin-Williams, and Michelman are investing heavily in R&D to create innovative, eco-friendly products. The rise in e-commerce and convenience packaging has also accelerated the need for functional barrier coatings that ensure product safety and integrity. While the market is mature, it continues to evolve through technological advancement and sustainability-driven demand, ensuring a stable growth outlook for the foreseeable future.

Europe Packaging Coatings Market Trends

The Europe packaging coatings market held 20.0% of the global revenue share in 2024. This demand is driven by increasing consumer preference for sustainable and recyclable packaging materials, strict EU regulations promoting low VOC and BPA-free coatings, and rising demand from the food & beverage and personal care industries. Additionally, the expansion of e-commerce and advancements in coating technologies, such as water-based and UV-curable coatings, further boost the market. Growing emphasis on product shelf-life enhancement, visual appeal, and barrier properties also contributes significantly to the demand for high-performance packaging coatings across the region.

Middle East & Africa Packaging Coatings Market Trends

The Middle East & African packaging coatings market is experiencing strong growth, driven by increasing demand for food and beverage packaging. As urbanization, population growth, and changing consumption patterns fuel the demand for packaged foods and beverages, manufacturers in the region are increasingly adopting advanced coating technologies to enhance product shelf life, safety, and visual appeal.

Packaging coatings, particularly epoxy, acrylic, and polyester-based types, are gaining traction for their ability to provide effective barrier properties, corrosion resistance, and chemical stability, essential for maintaining product integrity during transport and storage in the region’s often harsh climatic conditions. Countries like the UAE, Saudi Arabia, and South Africa are experiencing rising investments in food processing and packaging infrastructure, partly due to growing tourism and a shift toward convenience and ready-to-eat products. This, in turn, is driving the adoption of high-performance packaging coatings that comply with international food safety standards.

Latin America Packaging Coatings Market Trends

The Latin American packaging coatings market is witnessing steady growth, largely driven by demand for advanced materials that enhance product shelf life, aesthetic appeal, and regulatory compliance. Packaging coatings serve critical roles as barrier layers, primers, and protective finishes, resisting moisture, oxygen, chemicals, and mechanical damage.

A prominent example is the adoption of water-based and BPA-free epoxy coatings in Brazil’s canned food industry, where manufacturers aim to meet both health standards and export quality benchmarks. As regional packaging converters and brand owners increasingly seek durable, safe, and compliant coating technologies, the demand for multifunctional packaging coatings continues to rise, reinforcing their pivotal role in Latin America’s packaging evolution.

Key Packaging Coatings Company Insights

Some key players operating in the packaging coatings market include Akzo Nobel NV, BASF SE, Arkema Group, Berger Paints India Limited, and Clariant, among others.

-

Akzo Nobel N.V., headquartered in Amsterdam, Netherlands, is a global leader in the packaging coatings market. It is recognized for its strong heritage in coatings technology, sustainability leadership, and innovation-driven growth. The company offers a comprehensive portfolio of high-performance packaging coatings designed to meet rigorous food safety standards and evolving environmental regulations. These coatings deliver critical functionalities such as corrosion resistance, flexibility, adhesion, chemical inertness, and aesthetics, making them highly suitable for food and beverage cans, aerosol containers, closures, and industrial packaging. Akzo Nobel develops next-generation waterborne, BPA-NI (Bisphenol A non-intent), and solvent-free coatings aligned with global sustainability trends. Its coatings are tailored to comply with stringent international standards, including FDA, EU Framework Regulation, and Swiss Ordinance requirements, ensuring safety and regulatory compliance across global markets.

Chugoku Marine Paints Ltd, HEMPEL A/S, Jotun, and Kansai Paint Co. Ltd. are emerging market participants in the packaging coatings market.

-

Jotun, headquartered in Norway, is an emerging and agile player in the global packaging coatings market. It is renowned for its advanced coating technologies and commitment to sustainability, performance, and aesthetics. With a strong legacy in decorative paints and marine, protective, and powder coatings, Jotun steadily expanded its footprint in metal packaging coatings tailored for food, beverage, and general industrial packaging applications. The company emphasizes innovative, BPA-NI (Bisphenol A non-intent) solutions, corrosion resistance, and superior adhesion to meet the evolving regulatory and consumer demands for safe, durable, and eco-friendly coatings. Leveraging its robust R&D capabilities, global production facilities, and localized technical support teams, Jotun delivers high-performance solutions with consistent quality across Europe, Asia-Pacific, the Middle East, and emerging markets. Its integrated supply chain, sustainability focus, and deep industry expertise position Jotun as a trusted partner for brand owners, converters, and packaging manufacturers in the dynamic global packaging coatings landscape.

Key Packaging Coatings Companies:

The following are the leading companies in the packaging coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel NV

- Axalta Coatings

- BASF SE

- Arkema Group

- Berger Paints India Limited

- Chemetall

- Chugoku Marine Paints Ltd

- DowDuPont

- Evonik Industries AG

- HEMPEL A/S

- Henkel AG & Co. KGaA

- Jotun

- Kansai Paint Co. Ltd

Recent Developments

-

In June 2025, In response to the growing global demand for electric vehicles (EVs) and energy storage systems (ESS), Jotun launched advanced powder coating technologies specifically designed to enhance battery packaging. These coatings offer electrical insulation, thermal management, fire resistance, and corrosion protection, which are key to ensuring battery packs' safety, longevity, and efficiency. Traditionally, battery insulation relied on plastics and liquid paints, but Jotun’s powder coatings provide a more stable, solvent-free, and cost-effective alternative. These are applied to various battery components and enclosures to prevent thermal runaway, corrosion, mechanical damage, and critical battery performance risks.

-

In November 2023, AkzoNobel reinforced its position as a leader in the packaging coatings sector by introducing its Accelstyle line, specifically developed for the exterior of aluminum beverage cans and formulated without bisphenols, styrene, or PFAS. This launch builds on the previous debut of Accelshield 700, a BPx-NI (bisphenol non-intent) internal coating for can ends that meet both FDA and EU regulatory standards. In addition, AkzoNobel is investing significantly in a new environmentally efficient facility in Vilafranca, Spain, which will manufacture bisphenol-free coatings for the EMEA market. Set to become operational by mid-2025, this plant will increase the production of safer, lower-carbon packaging coatings and help drive the industry’s transition away from materials of concern.

Packaging Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,406.2 million

Revenue forecast in 2033

USD 6,448.1 million

Growth rate

CAGR of 4.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America Middle East & Africa

Country scope

U.S.; Canada; Mexico, UK; Germany; Italy; France, Spain, China; India; Japan, South Korea, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

Axalta Coatings; Akzo Nobel NV; BASF SE; Arkema Group; Berger Paints India Limited; Chemetall; Chugoku Marine Paints Ltd; DowDuPont; Evonik Industries AG; HEMPEL A/S; Henkel AG & Co. KGaA; Jotun; Kansai Paint Co. Ltd

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Packaging Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global packaging coatings market report based on product, application, and region

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Epoxies

-

Acrylics

-

Polyurethane

-

Polyolefins

-

Polyester

-

Other Product

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

Rigid Packaging

-

Flexible Packaging

-

Others Applications

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global packaging coatings market size was estimated at USD 4,234.7 million in 2024 and is expected to reach USD 4,406.2 million in 2025.

b. The packaging coatings market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2033 to reach USD 7,420.2 million by 2033.

b. The rigid packaging coatings segment led the market and accounted for the largest revenue share of 58.7% in 2024, attributed to its preference for products that require strong protection and a higher perceived value.

b. Some of the key players operating in the Packaging Coatings Market include Axalta Coatings, Akzo Nobel NV, BASF SE, Arkema Group, Berger Paints India Limited, Chemetall, Chugoku Marine Paints Ltd, DowDuPont, Evonik Industries AG, HEMPEL A/S, Henkel AG & Co. KGaA, Jotun, Kansai Paint Co. Ltd.

b. The growth is attributed to packaging coatings ’increasing for its application for flexible packaging coatings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.