- Home

- »

- Advanced Interior Materials

- »

-

Packaging Paper Market Size & Trends Analysis Report, 2030GVR Report cover

![Packaging Paper Market Size, Share & Trends Report]()

Packaging Paper Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Kraft Liners, Testliners, Fluting Papers, Other Products), By Region (APAC, CSA, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-510-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Packaging Paper Market Summary

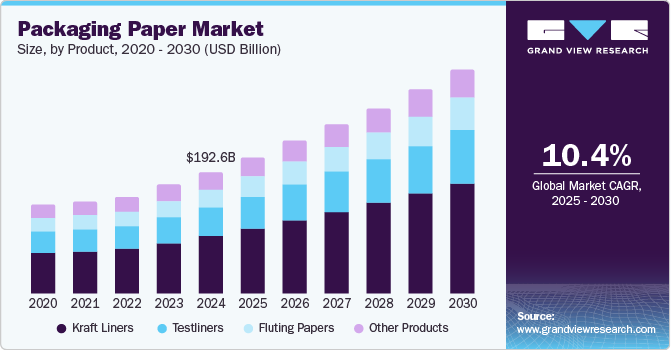

The global packaging paper market size was estimated at USD 192,629.0 million in 2024 and is projected to reach USD 354,529.2 million by 2030, growing at a CAGR of 10.4% from 2025 to 2030. The market growth can be attributed to the increasing global focus on sustainability and environmental concerns.

Key Market Trends & Insights

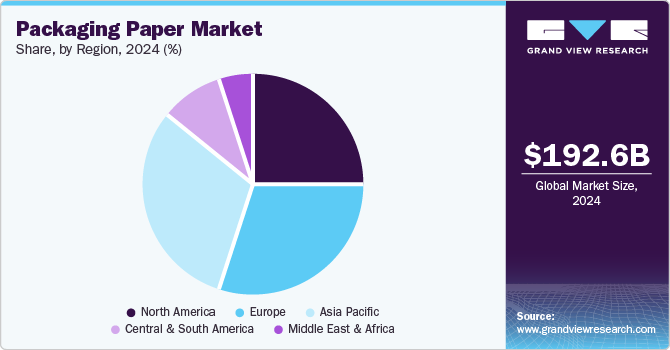

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, kraft liners accounted for a revenue of USD 103,093.5 million in 2024.

- Kraft Liners is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 192,629.0 Million

- 2030 Projected Market Size: USD 354,529.2 Million

- CAGR (2025-2030): 10.4%

- Asia Pacific: Largest market in 2024

Governments, businesses, and consumers are shifting away from plastic-based packaging due to its negative environmental impact, favoring biodegradable and recyclable alternatives like kraft paper, testliner, and fluting paper. Furthermore, stricter regulations on single-use plastics, such as the EU’s ban on plastic packaging for certain products, have further accelerated the adoption of paper-based solutions. As brands seek to align with sustainability goals, the demand for paper packaging continues to rise across industries like food & beverage, e-commerce, and consumer goods.

Governments and private companies are investing heavily in recycling technologies and waste management solutions to support a circular economy. The paper industry is benefiting from improved recycling processes that allow to produce high-quality recycled paper packaging materials, reducing dependency on virgin pulp. Advanced paper mills are adopting energy-efficient and water-saving techniques to enhance sustainability while meeting the rising demand. The push for a circular economy is making packaging paper a preferred choice in industries aiming to reduce their carbon footprint and enhance corporate social responsibility initiatives.

In addition, the booming e-commerce industry has significantly contributed to the growth of the packaging paper industry. With the rise in online shopping, there is a growing need for protective, lightweight, and sustainable packaging materials. Corrugated boxes and paper-based fillers are widely used in e-commerce shipments, offering durability and cost-effectiveness. As companies like Amazon and Alibaba expand their global logistics networks, the demand for high-quality packaging paper continues to increase. Additionally, retailers are prioritizing branding through customized and printed paper packaging, further fueling market growth.

However, volatility in raw material prices, particularly pulp and recycled paper, poses a challenge to the industry's growth. The prices of wood pulp and other raw materials fluctuate due to factors such as deforestation regulations, trade restrictions, and supply chain disruptions. Additionally, geopolitical tensions and the increasing cost of transportation have impacted on the availability and affordability of raw materials. These price fluctuations make it difficult for manufacturers to maintain stable production costs and profit margins, leading to potential price increases for end-users.

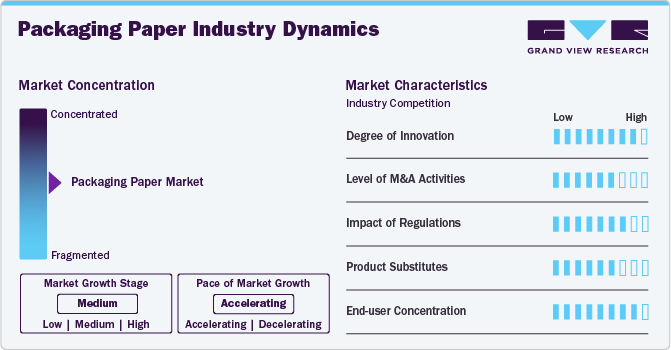

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The market is marked by a moderate level of innovation, driven by advancements in sustainable materials, barrier coatings, and lightweight yet durable paper solutions. Companies are developing biodegradable and compostable alternatives to plastic-coated paper, using plant-based coatings and water-resistant additives to enhance functionality while maintaining recyclability. Additionally, digital printing technologies have enabled customization and branding on paper packaging, increasing its appeal to businesses looking for eco-friendly yet visually appealing solutions.

The industry is characterized by a steady level of M&A activities as key players seek to expand their global presence, improve production capabilities, and secure raw material supply. Large paper manufacturers are acquiring smaller, specialized firms to enhance their sustainable packaging portfolios, while vertical integration strategies are helping companies manage supply chain disruptions.

Stringent environmental regulations are significantly shaping the packaging paper industry, particularly with bans on single-use plastics. Governments worldwide, especially in Europe, North America, and parts of Asia, are implementing policies promoting sustainable forestry practices and restricting deforestation-linked paper production. Compliance with food safety standards also affects coated paper and food-grade packaging, requiring innovation in chemical-free barrier solutions.

The degree of product substitution is moderate, owing to the availability of biodegradable plastics, molded fiber, glass, and reusable metal containers. While paper packaging is preferred for its recyclability and lower carbon footprint, its limitations in water resistance and durability make alternatives attractive for industries like food & beverage and pharmaceuticals. In addition, innovations in bio-based films and compostable polymers continue to challenge paper-based solutions in high-performance packaging applications.

The packaging paper industry serves a diverse range of industries, but certain sectors dominate demand. The food & beverage industry remains the largest consumer, driven by the need for sustainable takeaway packaging, carton boxes, and paper wraps. The e-commerce sector is another major driver, with growing demand for corrugated boxes, fillers, and lightweight protective packaging. Additionally, retail, healthcare, and personal care industries contribute significantly, particularly with the shift toward premium and branded paper packaging.

Product Insights

Kraft liner dominated the market with 47.4% of revenue in 2024 owing to its high strength, durability, and excellent printability. Moreover, it is primarily used as the outer layer of corrugated boxes, providing structural integrity and protection for goods during transportation and storage. Made from virgin or recycled fibers, kraft liners offer superior resistance to moisture and mechanical stress, making it ideal for heavy-duty packaging applications, especially in industries like e-commerce, food & beverage, and industrial packaging.

The global market for testliners is expected to experience significant growth with a CAGR of 10.6% from 2025 to 2030. Testliner is a cost-effective alternative to kraft liner, primarily made from recycled fibers and used as an outer or intermediate layer in corrugated board production. While it may not have the same strength as kraft liner, testliner offers good printability and sufficient durability for most packaging applications, making it an ideal choice for industries that require high-volume, lightweight, and budget-friendly solutions.

Fluting paper is the wavy, corrugated middle layer of corrugated board, providing cushioning and structural support to packaging. It is designed to absorb shocks and resist compression, making it crucial for protective packaging in industries such as electronics, consumer goods, and automotive. Typically made from semi-chemical or recycled pulp, fluting paper enhances the rigidity of corrugated boxes, ensuring they maintain their shape under pressure. The thickness and density of fluting paper can be adjusted based on packaging requirements, allowing for customization across different applications.

Regional Insights

In 2024, the Asia Pacific packaging paper market was the largest and fastest growing segment. It was valued at USD 59.67 billion in the global market, fueled by rapid urbanization, expanding e-commerce, and increasing sustainability initiatives. Countries like China, India, and Japan are major contributors, with rising demand for corrugated packaging in consumer goods, electronics, and food industries. Government regulations on plastic reduction and improved recycling capabilities are further propelling the market.

The packaging paper market in India is growing at the highest CAGR of 14.2% over the forecast period of 2025 to 2030, due to the rapid growth of e-commerce, organized retail, and increased environmental awareness. The Indian government’s push to reduce plastic waste has led to higher demand for paper-based packaging solutions, particularly in food and consumer goods sectors. Additionally, foreign investments in sustainable packaging innovations are supporting market growth.

China is the largest producer and consumer of packaging paper in Asia Pacific, driven by its dominant manufacturing sector, growing e-commerce industry, and strict environmental policies. In addition, the government’s ban on certain plastic products has accelerated the shift toward paper packaging, increasing demand for kraft liner, fluting paper, and coated paper.

North America Packaging Paper Market Trends

The North American Packaging Paper market had a 25.3% revenue share in 2024, driven by the rise of e-commerce, sustainability regulations, and increasing demand for recyclable materials. The shift away from plastic packaging, particularly in the food and retail industries, has led to higher adoption of kraft liner, testliner, and specialty paper-based solutions. Large retailers and logistics companies are investing in sustainable packaging, further fueling demand.

U.S. Packaging Paper Market Trends

The U.S. dominated the North American packaging paper market due to its large-scale e-commerce operations, stringent environmental regulations, and increasing consumer preference for eco-friendly packaging. Companies like Amazon and Walmart are driving demand for corrugated boxes and biodegradable wrapping solutions, while food and beverage brands are adopting paper-based alternatives to comply with state-level plastic ban.

Europe Packaging Paper Market Trends

In Europe, the demand for packaging paper is driven by strict environmental policies, a well-developed recycling infrastructure, and growing consumer awareness about sustainable packaging. The EU’s push for a circular economy and its ban on single-use plastics has increased the adoption of paper-based alternatives across industries. High demand for kraft liner, testliner, and barrier-coated papers is observed in sectors like e-commerce, food, and pharmaceuticals.

The packaging paper market in the UK is expected to grow at a CAGR of 6.5% over the forecast period. The implementation of Extended Producer Responsibility (EPR) schemes and plastic packaging tax policies has encouraged businesses to adopt recyclable paper alternatives. E-commerce growth, coupled with rising demand for branded and customized packaging, has further fueled market expansion.

Germany packaging paper market is supported by its advanced manufacturing sector, strong environmental regulations, and high recycling rates. The country’s push toward a circular economy has encouraged the use of recycled paper packaging, particularly in retail and food industries. Additionally, investments in innovative paper coatings and fiber-based packaging solutions are enhancing the performance of paper-based materials.

Central & South America Packaging Paper Market Trends

The Central and South American packaging paper market is growing at a CAGR of 10.0% from 2025 to 2030. Demand is expanding due to increasing exports of packaged goods, rising e-commerce penetration, and sustainability-driven packaging reforms. Brazil, Argentina, and Chile are key contributors, with industries like food and beverage and retail transitioning toward paper-based solutions.

Middle East & Africa Packaging Paper Market Trends

The MEA packaging paper market is witnessing gradual growth, driven by increasing investments in retail, logistics, and food packaging. Gulf countries are seeing higher demand for sustainable packaging solutions due to government initiatives promoting eco-friendly practices. However, the market is constrained by limited local production capacities, dependence on imported raw materials, and varying regulatory frameworks across different regions.

Key Packaging Paper Company Insights

Some of the key players operating in the market include International Paper Company, WestRock Company, Smurfit Kappa Group, Mondi Group, and DS Smith:

-

International Paper Company offers a wide range of products, including renewable fiber-based packaging and pulp products. The company operates in over 24 countries and has a strong presence in the market, offering containerboard, kraft liner, and corrugated packaging solutions.

-

Smurfit Kappa operates over 350 production sites across 36 countries and employs more than 48,000 people. Smurfit Kappa offers a diverse range of packaging solutions, including kraft liner, testliner, and fluting paper, serving various industries such as food and beverage, retail, and e-commerce.

Georgia-Pacific LLC, BillerudKorsnäs AB, Stora Enso Oyj, Oji Holdings Corporation, Nippon Paper Industries Co., Ltd. are some of the emerging market participants in packaging paper industry.

-

Georgia-Pacific, produces a variety of packaging papers, including containerboard and kraft liner, serving industries such as food and beverage, retail, and e-commerce. Georgia-Pacific is committed to sustainability and has implemented various initiatives to reduce its environmental footprint.

-

Stora Enso is provider of renewable solutions in packaging, biomaterials, wooden constructions, and paper. The company produces a variety of packaging papers, including kraft paper, containerboard, and specialty papers, serving industries such as food and beverage, retail, and e-commerce.

Key Packaging Paper Companies:

The following are the leading companies in the packaging paper market. These companies collectively hold the largest market share and dictate industry trends.

- International Paper Company

- WestRock Company

- Smurfit Kappa Group

- Mondi Group

- DS Smith

- Georgia-Pacific LLC

- BillerudKorsnäs AB

- Stora Enso Oyj

- Oji Holdings Corporation

- Nippon Paper Industries Co., Ltd.

Recent Developments

-

In April 2024, International Paper Company announced its intention to acquire UK-based DS Smith for USD 9.90 billion. The European Commission conditionally approved the acquisition in January 2025, with International Paper agreeing to divest five of its plants in Europe. This initiative was aimed at driving profitable growth by strengthening our global packaging business of International Paper Company.

Packaging Paper Market Report Scope

Report Attribute

Details

Market size in 2025

USD 216.11 billion

Revenue Forecast in 2030

USD 354.53 billion

Growth rate

CAGR of 10.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

February2025

Quantitative units

Volume in Million Tons and Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Volume Forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

International Paper Company; WestRock Company; Smurfit Kappa Group; Mondi Group; DS Smith; Georgia-Pacific LLC; BillerudKorsnäs AB; Stora Enso Oyj; Oji Holdings Corporation; Nippon Paper Industries Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Packaging Paper Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global packaging paper market report based on product and region.

-

Product Outlook (Volume, Million Tons; Revenue, USD Million; 2018 - 2030)

-

Kraft Liners

-

Testliners

-

Fluting Papers

-

Other Products

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global packaging paper market size was estimated at USD 192.63 billion in 2024 and is expected to reach USD 216.11 billion in 2025.

b. The global packaging paper market is expected to grow at a compound annual growth rate of 10.4% from 2025 to 2030, reaching USD 354.53 billion by 2030.

b. The kraft liner application dominated the market based on applications and was valued at USD 91.28 billion in 2024 owing to its high strength, durability, and excellent printability. It is primarily used as the outer layer of corrugated boxes, providing structural integrity and protection for goods during transportation and storage.

b. Key players operating in the packaging paper market are International Paper Company, WestRock Company, Smurfit Kappa Group, Mondi Group, DS Smith, Georgia-Pacific LLC, BillerudKorsnäs AB, Stora Enso Oyj, Oji Holdings Corporation, and Nippon Paper Industries Co., Ltd.

b. The key factors driving packaging paper include growing demand for sustainable and eco-friendly packaging, rapid growth in e-commerce and retail, along with the increasing investments in recycling infrastructure and the circular economy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.