- Home

- »

- Distribution & Utilities

- »

-

Pad-Mounted Switchgear Market Size, Industry Report, 2030GVR Report cover

![Pad-Mounted Switchgear Market Size, Share & Trends Report]()

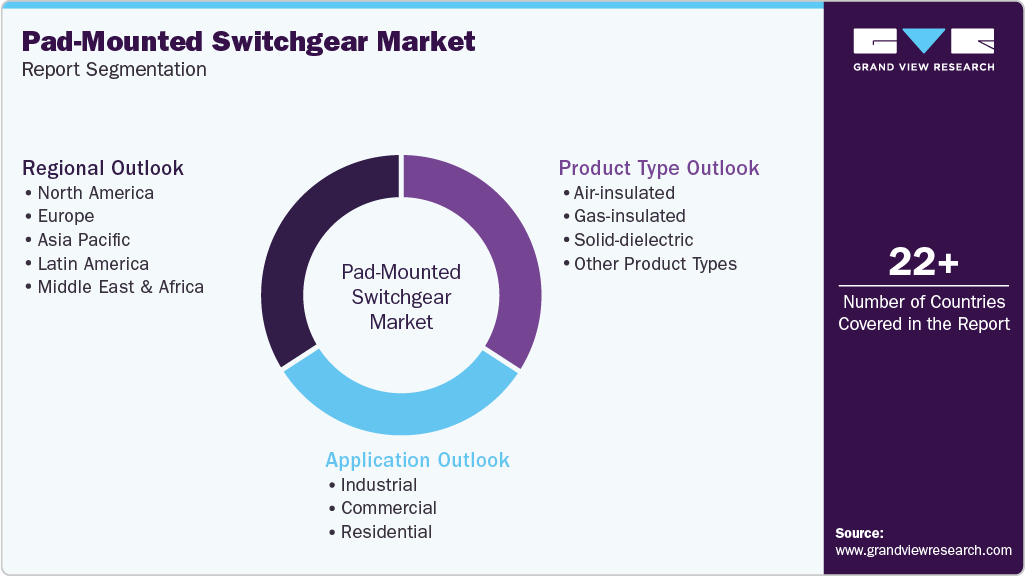

Pad-Mounted Switchgear Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Air-Insulated, Gas-Insulated, Solid-Dielectric), By Application (Industrial, Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-378-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pad-Mounted Switchgear Market Summary

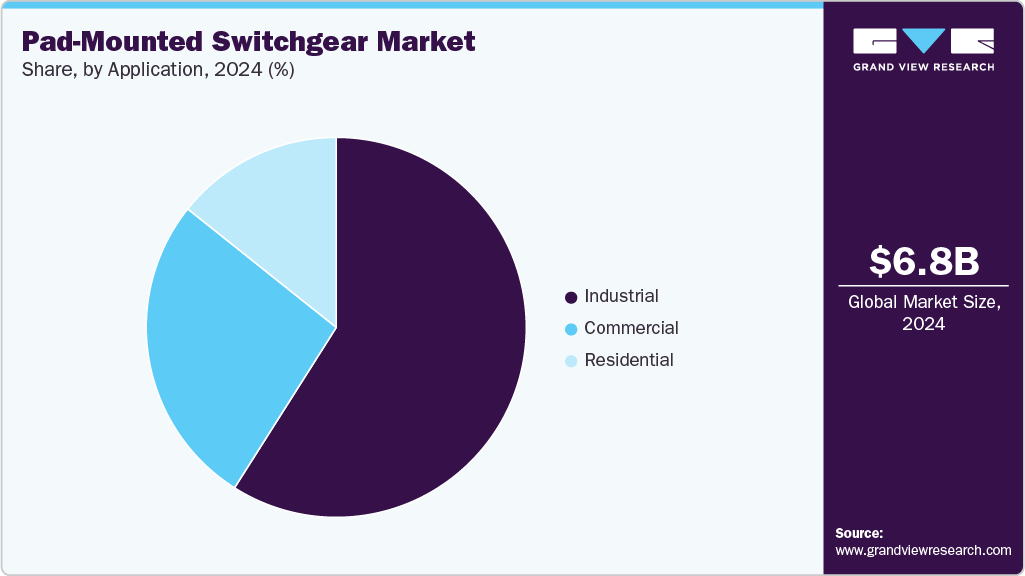

The global pad-mounted switchgear market size was valued at USD 6.79 billion in 2024 and is projected to reach USD 9.37 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2030. This growth is attributed to the rising adoption of renewable energy sources like solar and wind, which drives the need for efficient and reliable distribution infrastructure, including pad-mounted switchgear.

Key Market Trends & Insights

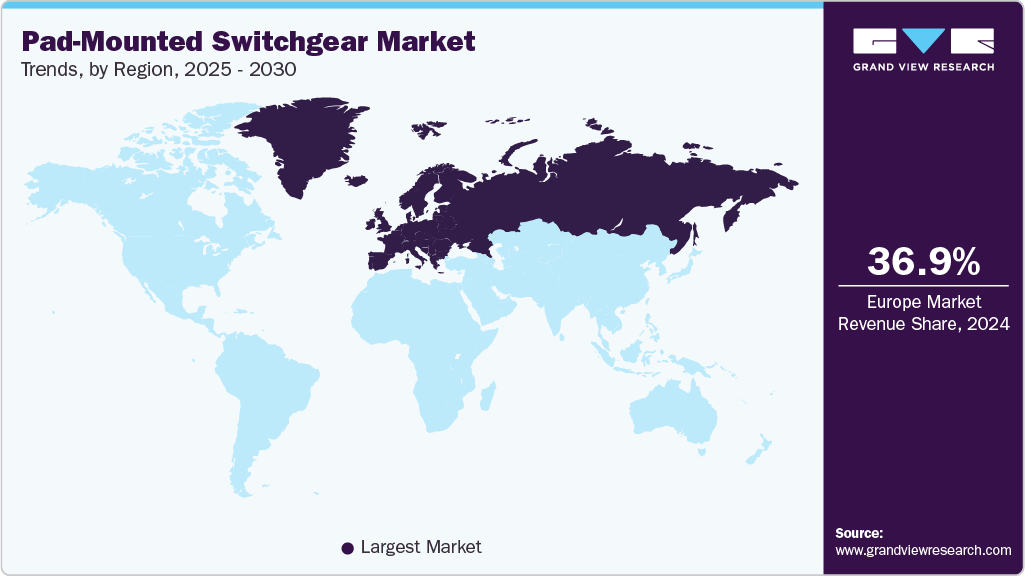

- Europe’s pad-mounted switchgear market dominated the pad-mounted switchgear industry with 36.9% of the revenue share in 2024.

- The pad-mounted switchgear market in the U.S. is expected to grow at a CAGR of 5.7% over the forecast period.

- On the basis of application, industrial accounted for the largest revenue share of 59.0% in 2024.

- Based on product type, the gas-insulated accounted for the largest revenue share of 43.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.79 Billion

- 2030 Projected Market Size: USD 9.37 Billion

- CAGR (2025-2030): 5.5%

- Europe: Largest market in 2024

Furthermore, pad-mounted switchgear offers safer operations compared to conventional open-air substations, reducing the risk of electrical hazards and minimizing environmental impact.There is a growing emphasis on grid modernization and infrastructure development. Governments and utility providers worldwide are investing in smart grid technologies to improve efficiency, minimize outages, and enhance energy distribution. Pad-mounted switchgear is a vital component in modern power grids because it can integrate smart monitoring systems and automation. The increasing adoption of renewable energy sources, such as solar and wind power, has fueled the demand for advanced switchgear solutions to support clean energy transmission.

Technological advancements in manufacturing technologies are expected to provide new product growth opportunities. For example, integrating pad-mounted switchgear with smart grid technologies presents opportunities for enhanced monitoring, control, and operational efficiency within distribution networks. Furthermore, the development of compact and more efficient product designs can further drive market growth and open up new application areas.

Product Type Insights

Gas-insulated accounted for the largest revenue share of 43.1% in 2024, primarily due to its superior reliability, compact design, and enhanced safety features. The growing preference for gas-insulated technology is driven by its ability to function efficiently in harsh environmental conditions while minimizing maintenance requirements. Urbanization and the increasing electricity demand have led to expanding power distribution networks, further accelerating the adoption of gas-insulated switchgear. Additionally, advancements in eco-friendly insulating gases and government initiatives promoting sustainable energy infrastructure have contributed to its rising popularity.

The air-insulated segment is expected to grow at a CAGR of 5.4% from 2025 to 2030. It is mainly designed for outdoor installation and are often used in substations, industrial facilities, and residential areas. Furthermore, air-insulated product type is considered more cost effective when compared to gas-insulated. However, it is susceptible to pollution and moisture, which requires periodic maintenance. On the other hand, solid-dielectric pad-mounted switchgear uses solid materials like epoxy resin or silicone rubber for insulation. This type of switchgear is gaining popularity due to its environmental friendliness and safety features.

Application Insights

Industrial accounted for the largest revenue share of 59.0% in 2024. In the industrial sector, this product finds applications in manufacturing plants, petrochemical facilities, mining operations, and heavy industries such as automotive plants and steel mills. Demand for this product is increasing in this sector due to the growing requirement for robust, reliable, and efficient electrical distribution solutions to support heavy-duty operations and ensure uninterrupted power supply.

The commercial segment is expected to grow at a significant CAGR of 5.8% from 2025 to 2030. The product is used in various commercial properties such as office buildings, retail centers, hotels, hospitality industry, and educational institutions. Increasing construction activities and commercial infrastructure development, coupled with growing emphasis on energy efficiency and sustainability in commercial buildings is expected to further drive market growth across globe.

Regional Insights

Europe's pad-mounted switchgear market dominated the pad-mounted switchgear industry with 36.9% of the revenue share in 2024. The country’s growth driven by extensive infrastructure investments and the modernization of aging power grids. Stringent regulations promoting energy efficiency and transitioning to renewable energy sources have fueled demand for advanced switchgear solutions.

The UK pad-mounted switchgear industry is expected to grow significantly over the forecast period. Rising demand for reliable, efficient power distribution solutions in urban areas and government initiatives promoting sustainable energy are fueling market expansion.

Asia Pacific Pad-Mounted Switchgear Market Trends

Asia Pacific region includes countries such as China, Japan, India, and South Korea which are witnessing rapid urbanization, industrialization, and infrastructure development, driving substantial growth of pad-mounted switchgear market. In addition, expansion of manufacturing and industrial sectors in countries that require robust and efficient electrical distribution systems to support production operations is expected to boost product demand.

North America Pad-Mounted Switchgear Market Trends

The pad-mounted switchgear market in North America is expected to grow at a CAGR of 5.4% over the forecast years. Increasing electricity demand, coupled with advancements in smart grid technology and automation, is fueling the adoption of reliable switchgear solutions across utilities and industries.

U.S. Pad-mounted Switchgear Market Trends

The pad-mounted switchgear market in the U.S. is expected to grow at a CAGR of 5.7% over the forecast period. Expansion of renewable energy capacity requiring reliable grid integration solutions, including pad-mounted switchgear is driving this market growth. Additionally, deployment of smart grid technologies to optimize grid operations and improve energy efficiency in country is expected to support adoption of advanced switchgear solutions over years.

Key Pad-Mounted Switchgear Company Insights

Some of the key companies in the pad-mounted switchgear market include ABB, S&C Electric Company, Eaton, G&W Electric Co., Hubbell; Electro-Mechanical, LLC, TIEPCO, and others.

-

ABB Ltd, a U.S. based company involved in manufacturing of electrical products and services. Product portfolio of the company includes building & home automation, critical power, installation products, machine & motor control, and protection, distribution & control. Repairs, replacement, installation, and consulting are few of the services offered by company. Furthermore, it operates 200 manufacturing facilities in around 100 countries, serving various industries such as manufacturing, aviation, renewable energy, utility, data center, transportation, and building & infrastructure.

-

S&C Electric Company is involved in manufacturing of electricity distribution products. Its products are categorized into automation products - communication, control & software, automation products - switching equipment, cypoxy, fusing equipment - outdoor distribution, fusing equipment - outdoor transmission, fusing equipment - indoor distribution, handling tools, metal-enclosed switchgear - outdoor & indoor distribution, reclosers - outdoor distribution, software, switching equipment - outdoor transmission & substation, switching equipment - overhead distribution, switching equipment - indoor distribution, and switching equipment - underground distribution switchgear.

Key Pad-Mounted Switchgear Companies:

The following are the leading companies in the pad-mounted switchgear market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- S&C Electric Company

- Eaton

- G&W Electric Co.

- Hubbell

- Electro-Mechanical, LLC

- TIEPCO

- Powell Industries

- ENTEC ELECTRIC & ELECTRONIC CO., LTD.

- Scott Manufacturing Solutions, Inc.

Pad-Mounted Switchgear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.15 billion

Revenue forecast in 2030

USD 9.37 billion

Growth Rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina

Key companies profiled

ABB; S&C Electric Company; Eaton; G&W Electric Co.; Hubbell; Electro-Mechanical, LLC; TIEPCO; Powell Industries; ENTEC ELECTRIC & ELECTRONIC CO., LTD.; Scott Manufacturing Solutions, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pad-Mounted Switchgear Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pad-mounted switchgear market report based on product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Air-insulated

-

Gas-insulated

-

Solid-dielectric

-

Other Product Types

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.