- Home

- »

- Homecare & Decor

- »

-

Paper Straw Market Size & Share, Industry Report, 2030GVR Report cover

![Paper Straw Market Size, Share & Trends Report]()

Paper Straw Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Virgin Paper, Recycled Paper), By Product (Non-Printed, Printed), By Length, By Diameter, By Sales Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-155-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Paper Straw Market Summary

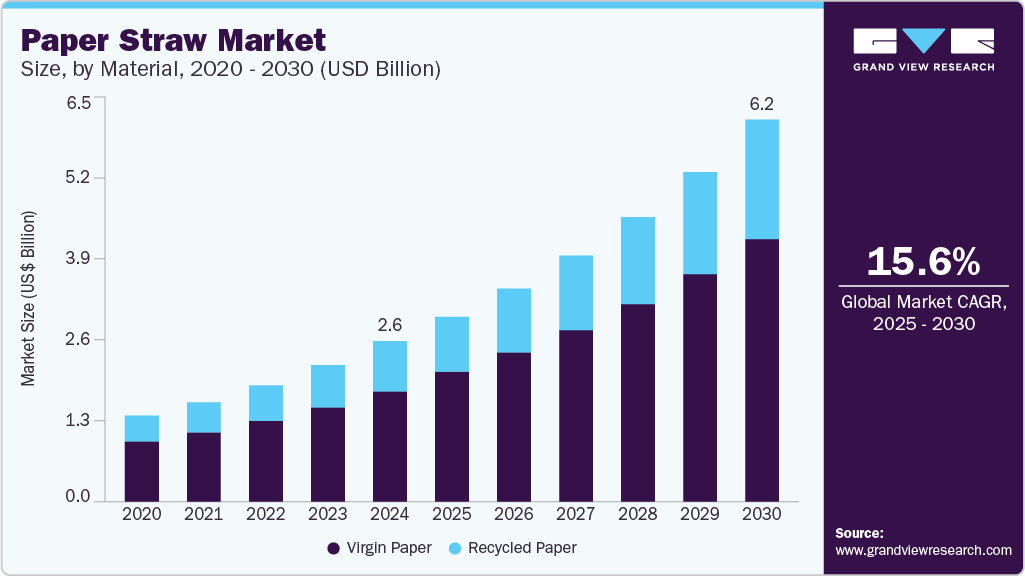

The global paper straw market size was estimated at USD 2,592.0 million in 2024 and is expected to reach USD 6.17 billion by 2030, growing at a CAGR of 15.6% from 2025 to 2030. The key factors driving the paper straw industry are the increasing awareness of plastic pollution, government regulations, the preference for sustainable packaging, the growth in the food service industry, and consumer demand for eco-friendly alternatives.

Key Market Trends & Insights

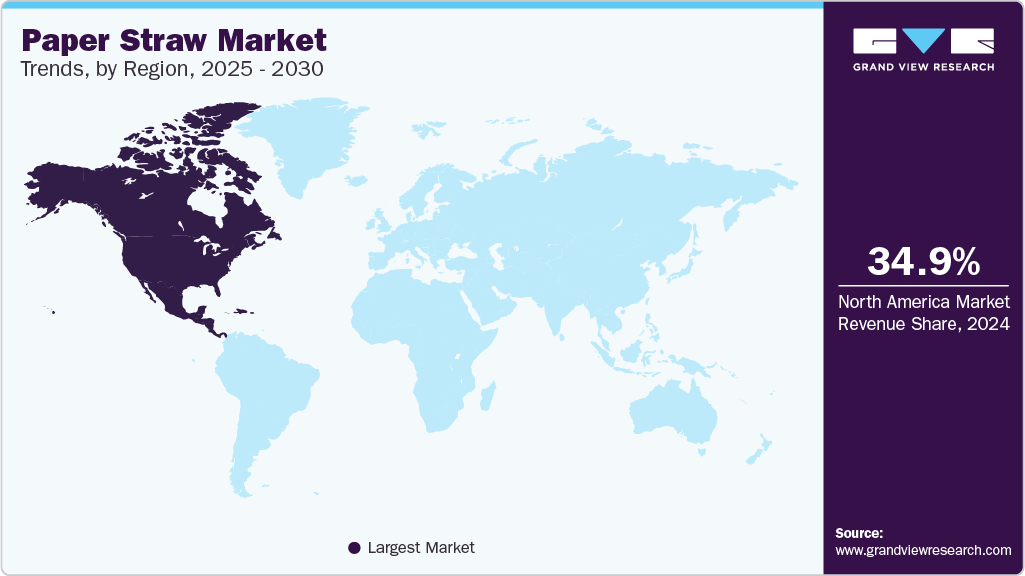

- The North America region held a significant market share of 34.89% in 2024.

- By material, the virgin paper segment held a significant market share of 68.72% in 2024.

- By product, the non-printed segment held a market share of 56.93% in 2024.

- By length, the 7.75-8.5 inches segment held a significant market share of 30.35% in 2024.

- By diameter, the 0.196 - 0.25 inches segment held the largest market share of 34.42% in 2024.

Market Size & Forecast

- 2024 Market Size:USD 2,592.0 Million

- 2030 Projected Market Size: USD 6.17 Billion

- CAGR (2025-2030): 15.6%

- North America: Largest market in 2024

As the global focus on sustainability intensifies, the paper straw industry is expected to continue its growth over the forecast period. For instance, in October 2022, McDonald's Japan, a fast-food chain, adopted paper straws and wooden utensils and phased out plastic products at approximately 2,900 locations across Japan. McDonald's has already replaced plastic products in the UK as part of a strategic initiative to minimize the environmental impact of plastic waste and increase the use of renewable materials.

As the global focus on sustainability intensifies, the paper straw industry is expected to continue its growth over the forecast period.

For instance, in October 2022, McDonald's Japan, a fast-food chain, adopted paper straws and wooden utensils and phased out plastic products at approximately 2,900 locations across Japan. McDonald's has already replaced plastic products in the UK as part of a strategic initiative to minimize the environmental impact of plastic waste and increase the use of renewable materials.

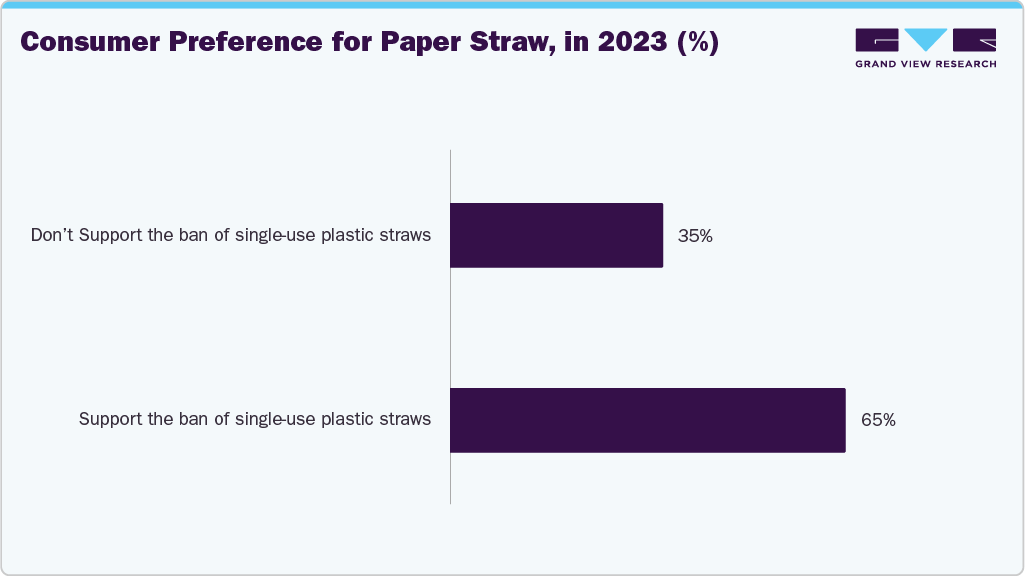

Growing awareness about the detrimental environmental impact of single-use plastic items, including plastic straws, has led to a shift in consumer preferences towards more sustainable alternatives. Paper straws have gained popularity as a viable eco-friendly option, as they are biodegradable, compostable, and renewable. H.B. Fuller Company surveyed in May 2021 to understand the consumer attitude toward paper straws. It reported that 65% of consumers supported the ban on single-use plastic straws; this sentiment can lead to an increased demand for alternative options, such as paper straws, as consumers actively seek out more sustainable choices.

The foodservice industry, including restaurants, cafes, and fast-food chains, is a significant consumer of single-use straws. According to the National Restaurant Association, the industry is expected to project USD 997 billion in 2023. With the increasing consumer demand for sustainable and eco-friendly practices, foodservice chains are transitioning to paper straws as an alternative to plastic. The increased adoption of paper straws has significantly increased the paper straw industry's growth.

Increasing government regulations on banning plastic products in the foodservice and processing industry are expected to drive market growth. For instance, violating the single-use plastic ban in China can result in a penalty between USD 1,400 and USD 14,200. Similarly, in India, under the 1986 Environment Protection Act, a lawbreaker could face a penalty of USD 1,249.6 or be jailed. Such strict government regulation of significant industries would likely drive market growth. Several leading FMCG companies, including Dabur ParleAgro, and other foodservice providers, including Starbucks, Coffee Company, McDonald's, and others, have already adopted paper straws at several locations.

The paper straw industry has witnessed significant product innovation and a rise in the availability of different types and designs of paper straws. Manufacturers are producing paper straws that are durable, functional, and visually appealing to enhance the consumer experience. This has stimulated the industry's growth by providing consumers with more options and encouraging wider adoption of paper straws.

For instance, in September 2021, H.B. Fuller Company introduced a new adhesive under its SwiftTak brand to meet the increasing demand for paper straws in India. The UK-based Billerud Packaging also collaborated with The Paper Straw Co. to launch the 180°U-Bend paper straw suitable for single drink cartons. Moreover, increasing efforts by manufacturers to enhance the material's overall performance also influence the demand for paper straws.

Consumer Surveys & Insights

Consumers increasingly prefer paper straws over plastic straws due to environmental concerns, regulatory influences, and shifting social values. Many local and national governments have banned or restricted single-use plastics, including straws, in response to pollution concerns. Consumers adapt to these changes, and companies switching to paper straws are often considered compliant and responsible. Brands like Starbucks, McDonald’s, and Disney have publicly committed to phasing out plastic straws, influencing public perception. When large companies make the switch, it reinforces the norm and validates paper straws as the better choice. Using paper straws is increasingly seen as a sign of environmental responsibility, especially among younger, more eco-conscious consumers.

A survey conducted by H.B. Fuller involving 1,400 adults from Spain, Italy, France, the UK, Canada, and the U.S. revealed that 65% support banning single-use plastic straws. However, 47% reported experiencing issues with paper straws unraveling during use, highlighting the need for improved durability. Innovations such as H.B. Fuller’s water-resistant adhesives have made paper straws more durable and user-friendly, addressing early complaints like sogginess or falling apart in drinks.

Age Group

Insights

18-34 (Gen Z & Millennials)

- Strongest support for eco-friendly alternatives.

- Willing to pay more for sustainable products.

- Influenced by social media and brand activism.

- Often demand both function and sustainability.

35-54 (Gen X)

- Moderate support for paper straws.

- Preference depends more on quality and durability.

- Increasingly environmentally aware, especially parents.

55+ (Boomers and older)

- Surprisingly, there is high support for bans (as high as 76% in some polls).

- May have traditional preferences but are supportive of public policy around sustainability.

- Less likely to use straws altogether.

Trump Tariff Impact

In early 2025, the U.S. imposed new tariffs: 25% on imports from Canada and Mexico, and 10% on goods from China, effective February 1. By April, the policy escalated, introducing a 10% baseline tariff on all imports and additional “reciprocal tariffs” of up to 34% on Chinese goods. These measures increased costs for raw materials and finished goods in the paper products industry, affecting supply chains. Despite these challenges, paper straw manufacturers are leveraging their commitment to sustainable manufacturing and advanced production capabilities to navigate the tariff landscape. For instance, Yiyi Packing, an Eco-Friendly Paper Straws manufacturer, houses 10 advanced production lines in its 3,000m² factory in China, enabling efficient production of FDA-compliant, food-grade paper straws. This efficiency helps absorb some tariff-induced costs, allowing the company to offer competitive pricing.

The global demand for eco-friendly products remains strong, driven by consumer preferences and stricter environmental regulations in the EU and the US. Manufacturers are focusing on biodegradable, food-grade paper straws, aligning with these trends, making them an attractive option for businesses like bubble tea shops, coffee chains, and hotels seeking sustainable solutions. Manufacturers emphasize reliability and scalability, ensuring they can meet large orders without compromising quality. Their focus on sustainable manufacturing reduces environmental impact and maintains cost efficiency, which is crucial in the current trade environment.

Material Insights

Based on material, the virgin paper segment held a significant market share of 68.72% in 2024. It is attributed to the overall advantage the paper offers for developing paper straw, including a better absorbency rate, excellent quality, and efficiency to withstand for a longer time. Such factors influence manufacturers to use virgin paper. In addition, virgin paper is safer and contains zero bacteria compared to recycled paper. According to a study by Laval University, it was discovered that the tested recycled paper had bacterial concentrations that were 100-1,000 times higher than those of the virgin wood pulp. While the levels of bacteria found probably wouldn't impact healthy people much, they do present a risk to small children or those with compromised immune systems.

The recycled paper segment is expected to grow at a CAGR of 16.9% over the forecast period. As paper can be recycled four to five times, recycled paper is also thought of as the greenest alternative because it requires less energy and water. It emits fewer carbon emissions during the process than virgin paper, which results in less waste going to landfills. The efforts to improve the quality of recycled paper and technological and manufacturing advancements are expected to drive the recycled paper used in paper straws over the forecast period.

Product Insights

Based on product, the non-printed paper straw held a market share of 56.93% in 2024. Non-printed paper straws offer several advantages that make them a desirable choice for environmentally conscious consumers and industries. The absence of ink or color pigments on the paper makes recycling easier and ensures that no additional chemicals or toxins are released during decomposition. Such factors are expected to drive the growth of the non-printed segment in the paper straw industry.

Printed paper straw sales is expected to grow at a significant CAGR of 16.3% from 2025 to 2030. It is attributed to the availability of printed straws in various colors, patterns, and branding elements, allowing end-users to create a unique and visually appealing experience for their customers. The innovation and development of printing technology and increasing consumer demand for aesthetics and patterns in paper straws would likely drive the printed paper straw segment growth over the forecast period.

Length Insights

Based on length, the paper straw with a length of 7.75-8.5 inches held a significant market share of 30.35% in 2024. This length range is commonly chosen for tall or large-sized beverages such as iced teas, cold coffees, smoothies, and oversized cups. The longer length allows the straw to reach the bottom of the container, ensuring a convenient and comfortable drinking experience. The growing demand for such beverages in the food service industry drives growth.

The paper straw with a length <5.75 inches is expected to grow at a CAGR of 16.3% over the forecast period. This is attributed to the increased demand for small packaged drinks and several food and beverage manufacturers' growing offerings of such materials.

Diameter Insights

Based on diameter, the 0.196 - 0.25 inches segment held the largest market share of 34.42% in 2024. This diameter range is commonly used in every size of straw as it provides a better drinking experience and is suitable for every type of drink, including thick and regular.

The <0.15-inch diameter is expected to grow at the fastest CAGR of 16.4% during the forecast period. Cost-effectiveness and the growing use of standard drinks like soda, water, and iced tea are the key factors expected to fuel the growth of these straws.

Sales Channel Insights

Based on the sales channel, paper straw sales through the B2B channel held a market share of 68.00% in 2024. Environmental concerns, government regulations, and corporate sustainability initiatives drive the growth of the B2B sales channel in the paper straw industry. The foodservice and processing industries are the major buyers of paper straws from B2B sales channels.

The large food processing industries, such as FMCG and agro-food companies, including Mother Dairy, Fruit & Vegetable PVT, Ltd., and Amul, have removed integrated plastic straws from their small tetra packs of juice and milk and replaced them with paper straws. For instance, ParleAgro started incorporating paper straws in its popular brands, Fruity and Apple Fizz. These industries prefer to directly make bulk orders from the manufacturer of paper straws, as it provides a cost-benefit compared to purchasing from B2C channels. Such factors drive the B2B segment growth in the paper straw industry.

Paper straw sales through the B2C channel are expected to grow at a CAGR of 16.2% over the forecast period, owing to the growing awareness and concern about plastic pollution. This has led to increased consumer demand for sustainable packaging as an eco-friendly alternative, driving the growth of the B2C market. As per a report by Drapers, in January 2023, consumer demand for sustainable packaging increased to 81% in the UK. All these factors drive the sales of paper straws through the B2C sales channel.

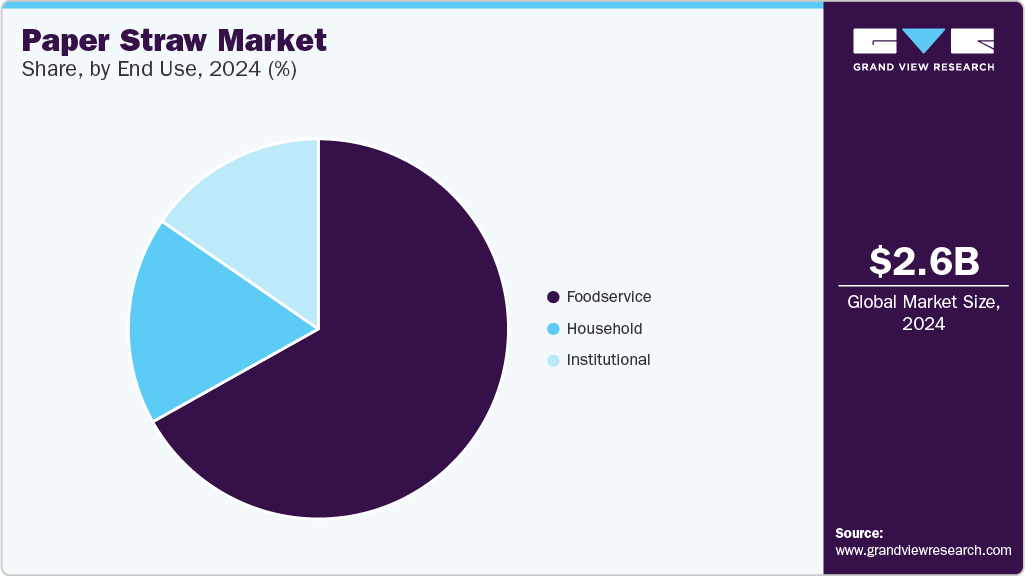

End Use Insights

Based on end use, the foodservice segment held a market share of 64.05% in 2024. The growth of this industry has led to an increase in the number of outlets that serve beverages, which in turn has created a higher demand for straws. Changing consumer preferences and the impact of regulation influence this segment to adopt sustainable packaging materials, increasing the need for paper straws.

Moreover, the foodservice industry produces a wide range of ready-to-drink products such as juices, smoothies, iced coffees, and other beverages. These products often require straws for convenient consumption. The increasing regulations and worldwide shift towards sustainable packaging are increasing the adoption of paper straws in this industry. For instance, the Coca‑Cola Company stopped distributing plastic drinking straws and stirrers in Australia. It replaced them with biodegradable and recycled paper straws accredited by the Forest Stewardship Council (FSC). Such factors are expected to drive the demand for paper straws in the food processing industry.

Household end use is expected to grow at a significant CAGR of 17.9% over the forecast period. The use of paper straws by individual consumers in domestic settings, typically for personal beverages consumed at home, has seen significant growth due to rising environmental awareness among consumers, who increasingly opt for sustainable alternatives to plastic. Households are purchasing paper straws for family meals, home gatherings, parties, and children's drinks, often influenced by convenience, safety, and eco-friendliness. The growing availability of paper straws through e-commerce and retail channels has further supported this trend, making it easier for consumers to incorporate eco-conscious habits into their daily lives.

Regional Insights

The North America region held a significant market share of 34.89% in 2024. It can be attributed to the increasing availability of paper straws and the high impact of plastic regulations in the United States. Several cities and states in the U.S., including Charleston, New York City, South Carolina, Florida, and Miami Beach, have implemented bans or restrictions on single-use plastic items, including plastic straws, which have accelerated the adoption of paper straws as an alternative. The booming food and beverages industry and the changing consumer preference towards sustainable and plastic-free materials fuel market dominance in the region.

Asia Pacific Paper Straw Market Trends

The paper straw market in Asia Pacific is expected to grow at a significant CAGR of 17.1% over the forecast period. The growing population and increasing awareness about plastic waste's detrimental environmental effects will likely drive the paper straw industry. Increasing government regulations for single-use plastic bans in developed countries, including China and India, also contributed to this growth. Several companies in Japan have started producing and distributing paper straws, including Nippon Paper Industries Co., Ltd., TAKIGAWA CORPORATION, and others, to cater to the demand for paper straws in the Japanese market.

India paper straw market is experiencing notable growth, driven by environmental regulations and a shift in consumer preferences towards sustainable alternatives. This expansion is supported by government initiatives to reduce single-use plastics, prompting domestic and international companies to invest in paper straw manufacturing within the country. For instance, UFlex Limited established India's first U-shaped paper straw production line in Gujarat, equipped with Dutch technology and capable of producing about 2.4 billion straws annually. The increasing demand from the foodservice industry and rising environmental awareness among consumers are expected to further propel the paper straw market's growth in the coming years.

Europe Paper Straw Market Trends

The paper straw market in Europe represents a mature and highly regulated industry, driven by the European Union’s stringent directives to reduce plastic waste. The region was among the first to enforce a comprehensive ban on single-use plastic straws, prompting a swift transition to paper and other sustainable materials. Consumer awareness and support for eco-friendly products are particularly high across European countries, further bolstering demand. In addition, local manufacturers have invested heavily in technology to improve product quality, making Europe a hub for premium paper straw production and innovation within the global market.

Key Paper Straw Company Insights

The paper straw market features various players, which makes it a competitive market. The world's leading companies use partnerships, collaborations, new product launches, and agreements to withstand the intense competition and increase their market share. For instance, in May 2022, SIG India launched various recyclable and sustainable paper straws in multiple dimensions and shapes. Paper from FSC-certified sources (license code: FSC C020428) was used to create SIG's paper straws. In keeping with India's plastic prohibition and as a viable remedy for the severe environmental harm that plastic straws cause, SIG introduced the new Material.

In addition, in August 2021, Novolex acquired Vegware Ltd. to enhance its product portfolio of sustainable brands and cater to the increasing demand for compostable food service packaging.

-

Established in 1947 and headquartered in Oshkosh, Wisconsin, Hoffmaster Group, Inc. is a prominent U.S. manufacturer specializing in premium disposable tableware. The company has significantly expanded its footprint in the paper straw market through strategic acquisitions. In 2018, Hoffmaster acquired Aardvark Straws, the sole U.S. producer of paper straws, enhancing its domestic manufacturing capabilities. Furthering its global reach, Hoffmaster acquired The Paper Straw Co. in the UK in 2019, enabling efficient service to the European market.

-

BioPak, an Australian company, is a leading provider of sustainable packaging solutions, including biodegradable and compostable paper straws. Their BioStraws are made from Forest Stewardship Council (FSC) certified paper and are designed to be both recyclable and compostable, aligning with their commitment to environmental responsibility. BioPak's products are utilized by various food and beverage companies, reflecting their significant presence in the market.

Key Paper Straw Companies:

The following are the leading companies in the paper straw market. These companies collectively hold the largest market share and dictate industry trends.

- Hoffmaster Group, Inc.

- Huhtamaki Group

- BioPak

- Novolex

- Footprint

- Matrix pack

- strawland

- Jinhua Suyang Plastic Material Co., Ltd.

- Tetra Laval Group

- Transcend Packaging

Recent Developments

-

In August 2023, Transcend Packaging partnered with specialty lubricants manufacturer Klüber Lubrication to produce paper straws free from mineral oil residues. Using Klüberfood 4DC, a vegetable-based, food-grade lubricant, Transcend packaging eliminates traces of mineral oil aromatic hydrocarbons (MOAH) and mineral oil saturated hydrocarbons (MOSH) from its manufacturing process.

-

In April 2022, UFlex Limited announced its initiative to bring a sustainable change to its fold by setting up India's first U-shaped paper straw manufacturing line for its aseptic liquid packaging business. The manufacturing line is being set up at its existing aseptic liquid packaging plant in Sanand, Gujarat.

Paper Straw Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,984.7 million

Revenue forecast in 2030

USD 6.17 billion

Growth rate (revenue)

CAGR of 15.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, length, diameter, sales channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; France; Germany; Spain; Italy; China; India; Japan; South Korea; Australia & New Zealand; Brazil; Saudi Arabia

Key companies profiled

Hoffmaster Group, Inc.; Huhtamaki Group; BioPak; Novolex; Footprint; Matrix pack; strawland; Jinhua Suyang Plastic Material Co., Ltd.; Tetra Laval Group; Transcend Packaging

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Paper Straw Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global paper straw market report based on material, straw length, diameter, sales channel, end use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Virgin Paper

-

Recycled Paper

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-printed

-

Printed

-

-

Straw Length Outlook (Revenue, USD Million, 2018 - 2030)

-

<5.75 inches

-

5.75-7.75 Inches

-

7.75-8.5 Inches

-

8.5-10.5 Inches

-

>10.5 Inches

-

-

Diameter Outlook (Revenue, USD Million, 2018 - 2030)

-

<0.15 Inches

-

0.15 - 0.196 Inches

-

0.196 - 0.25 Inches

-

0.25 - 0.4 Inches

-

>0.4 Inches

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Institutional

-

Household

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global paper straw market was estimated at USD 2,592.0 million in 2024 and is expected to reach USD 2,984.7 million in 2025.

b. The global paper straw market is expected to grow at a compound annual growth rate of 15.6% from 2025 to 2030 to reach USD 6.17 billion by 2030.

b. North America dominated the paper straw market with a revenue share of 34.89% in 2024 due to the implementation of stringent regulations on single-use plastic in the U.S and Canada and increasing demand for sustainable products.

b. Some of the key players operating in the paper straw market include Hoffmaster Group, Inc., Huhtamaki Group, BioPak, Novolex, Footprint, Matrix pack, strawland, Jinhua Suyang Plastic Materialion Co., ltd., Tetra Laval Group, Transcend Packaging, among others.

b. The key factors driving the global paper straw market are the increasing shift toward bio-based products to reduce dependency on conventional plastic straws, the impact of regulations, and the rapid adoption of sustainable products worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.