- Home

- »

- Pharmaceuticals

- »

-

Parenteral Nutrition Market Size And Share Report, 2030GVR Report cover

![Parenteral Nutrition Market Size, Share & Trends Report]()

Parenteral Nutrition Market (2024 - 2030) Size, Share & Trends Analysis Report By Nutrient Type (Carbohydrates, Parenteral Lipid Emulsion), By Stage Type, By Indication, By Sales Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-867-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Parenteral Nutrition Market Summary

The global parenteral nutrition market size was estimated at USD 7.11 billion in 2023 and is projected to reach USD 10.68 billion by 2030, growing at a CAGR of 6.01% from 2024 to 2030. Development of technically advanced parenteral nutrition (PN) products with barcode assistance, growing preference for PN over enteral nutrition in COVID-19 patients, shorter hospital stays, and the reduced risk of infection are some of the factors boosting the product demand, thereby driving the market growth.

Key Market Trends & Insights

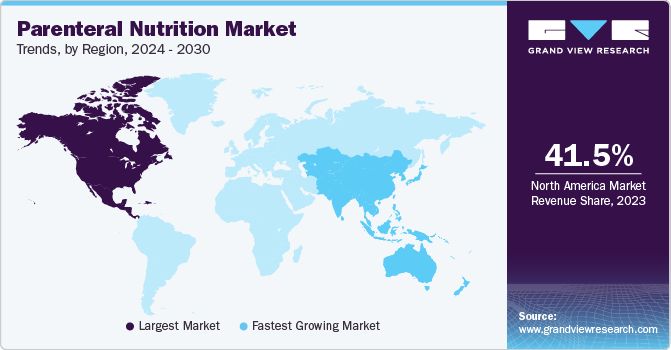

- The North America caustic soda market dominated the global industry with a 41.5% share in 2023.

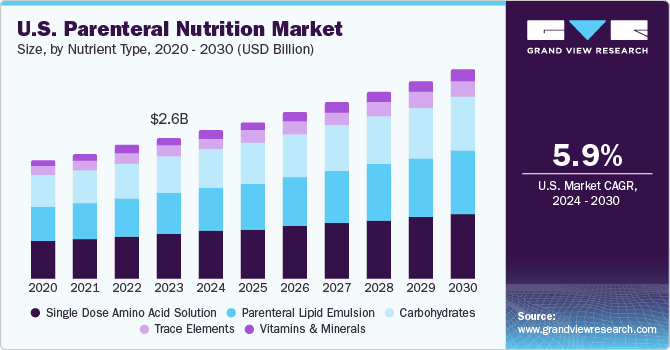

- The parenteral nutrition market in the U.S. is expected to grow at a CAGR of 5.92% over the forecast period.

- By nutrient type, the single-dose amino acid solution segment accounted for the largest market share of 30.7% in 2023.

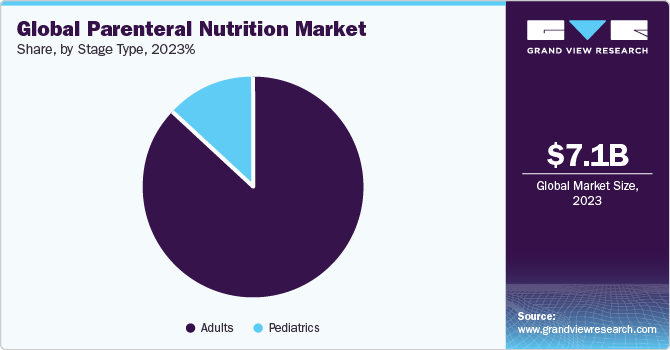

- By stage type, the adult segment held the largest market share of 87.1% in 2023.

- By indication type, the cancer segment dominated the market with a share of 17.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.11 Billion

- 2030 Projected Market Size: USD 10.68 Billion

- CAGR (2024-2030): 6.01%

- Europe: Largest market in 2023

According to the ASPEN20 Virtual Conference, providing appropriate nutrition to adults with COVID-19 remained a priority for optimizing outcomes. This included overcoming various challenges amid the pandemic, such as a shortage of PN products due to a disrupted supply chain.

Moreover, the rising prevalence of chronic conditions, particularly cancer and malnutrition, alongside increasing natality rates, serve as significant drivers for market growth, exerting a high impact. Increasing natality rate is anticipated to emerge as a prominent growth driver. Numerous benefits accompany PN, including ease of use, stimulation of stomach blood flow, efficient nutrient delivery, and preservation of muscle catabolism. Globally, various health awareness campaigns, with a particular emphasis on nutrition, are underway, along with diverse initiatives promoting health and social care, expected to bolster market growth. For example, India observed POSHAN Maah in September 2023, mirroring the Government of India's flagship program, POSHAN Abhiyaan, aimed at raising awareness and enhancing nutritional outcomes for pregnant women, children under six years of age, and lactating mothers.

PN also has applications for infants and children suffering from a disease or medical condition, thereby requiring special nutritional management. Specialized Nutrition Europe (SNE) estimated that nearly 300,000 EU children are anticipated to require medical nutrition for their special medical needs in early life stages, which supports growth and development. The study further reveals that about 40% of hospitalized adult patients are malnourished and need medical nutrition to manage the disease-related malnutrition condition, thereby reducing the duration of hospital stay. PN lowers the infection risk and underdevelopment, thereby promoting its adoption worldwide.

Many premature babies experience low weight and underdeveloped immunity, placing them at significant risk. There is extensive focus from individuals and healthcare authorities on reducing mortality associated with preterm birth, which drives the utilization of parenteral lipid emulsions. According to the U.S. Centers for Disease Control and Prevention (CDC), the preterm birth rate in the country was approximately 10.4% in 2022. In addition, during the same period, the preterm birth rate for African American women was around 14.6%. These elevated preterm birth rates are expected to bolster market expansion.

The increasing prevalence of chronic conditions, notably cancer, is driving product demand globally. Parenteral nutrition facilitates the administration of essential nutrients, aiding in maintaining strength, energy, and hydration levels in cancer patients across all stages, from diagnosis to recovery. According to the World Health Organization (WHO), approximately 20 million people were diagnosed with cancer in 2022, resulting in around 9.7 million deaths. In addition, the WHO reports indicate that about 1 in every 5 individuals develop cancer in their lifetime, with 1 in 12 women and 1 in 9 men succumbing to the disease.

Moreover, changing reimbursement landscapes and emerging trends aimed at facilitating product adoption are poised to fuel market growth over the forecast period. In response to the challenges posed by the COVID-19 pandemic, various health plans have been introduced in the U.S. The immediate implementation of reforms in the Value-based Insurance Design (V-BID) model by the Centers for Medicare & Medicaid Services (CMS) ensures affordable and streamlined access to critical clinical services. Consequently, the COVID-19 pandemic has had a positive impact on the market, and it is expected to bolster product adoption in the coming years.

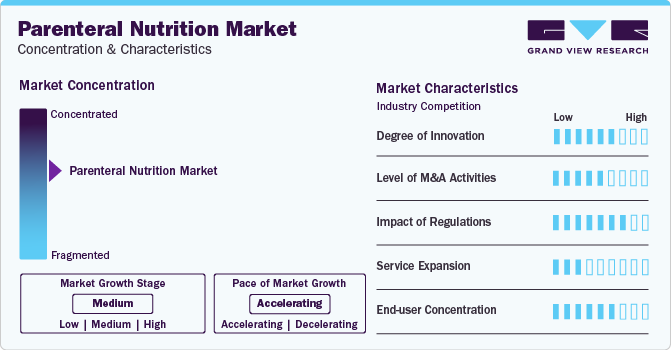

Market Concentration & Characteristics

The market growth is moderate, and the pace of its growth is accelerating. The market is characterized by the growing aging population, increasing focus on the development of advanced parental nutrition, evolving government policies and regulations, and increasing prevalence of chronic diseases.

The market is characterized by a medium degree of innovation owing to the increasing focus on the development of technologically advanced solutions owing to the increasing demand for PN in different age groups. Key players are implementing strategic initiatives, such as product launches, geographical expansion, mergers and acquisitions, collaborations, partnerships, and R&D activities, to strengthen their market presence. For instance, in September 2020, Baxter introduced its Clinimix and Clinimix E formulations in the U.S., which offer high protein in a multi-chamber bag, allowing clinicians better convenience in meeting patients' nutritional goals.

Regulations play a crucial role in the parental nutritional market. According to the Federal Food, Drug, and Cosmetic Act (FD&C Act), for a product to be classified as a medical food, it must be labeled for the dietary management of a specific disease condition with discrete nutritional requirements and must be intended for oral or tube feeding. In addition, the product must be intended for use under specific medical supervision. Market players must comply with the regulations of regulatory bodies.

The threat of substitutes for PN is expected to be low as it serves as a go-to solution for patients with critically compromised digestive systems. Similarly, the ongoing developments in the market are expected to boost product demand. Moreover, it offers a customizable way of delivering nutrients to the patient based on specific needs.

The end-user concentration is significantly high owing to the limited patient pool of PN, such as patients with critical medical conditions, pregnant women, premature infants, etc. Moreover, the requirement for professional assistance in PN further contributes to its market concentration.

Nutrient Type Insights

The single-dose amino acid solution segment accounted for the largest market share of 30.7% in 2023. This can be attributed to the increased usage of amino acid solutions, which can be related to a rise in the influx of regulatory-approved solutions. Moreover, newly available amino acid solutions possess fewer side effects, thereby enhancing patient benefits. Aminosyn (by Hospira, Inc.) and Nirmin (by Nirlife Pharma) are a few of the single-dose amino acid solutions available in the market. Formulations of mixed amino acids provide essential and nonessential amino acids; hence, the standard component acts as comprehensive PN for overall biological functioning.

The parenteral lipid emulsion segment is anticipated to register the fastest growth during the forecast period. Parenteral lipid emulsions have potential benefits as a drug delivery vehicle. It is mainly used to administer drugs that prevent thrombophlebitis and reduce irritation & pain. Moreover, the development of hybrid parenteral lipid emulsions using mixed lipid emulsions of fish and olive oil is boosting the adoption of PN, owing to its advantages, such as shorter hospital stays and reduced risk of infection.

Stage Type Insights

The adult segment held the largest market share of 87.1% in 2023. This can be attributed to the high adult population, which has led to an increased prevalence of chronic disorders, such as Alzheimer’s disease, sarcopenia, cancer, and diabetes. According to the WHO, the population of people aged above 60 years is expected to increase from 1 billion in 2020 to 1.4 billion in 2030. This is expected to drive market growth as these formulas are frequently used by patients who are unable to consume food and nutrients naturally. Moreover, increasing PN adoption by pregnant women is significantly contributing to the segment’s growth. Severe malnutrition in pregnant women is associated with factors, such as intrauterine growth restriction, preterm delivery, congenital malformations, low birth weight, and perinatal mortality.

Thus, PN is advisable for pregnant women whose nutritional requirements are not fulfilled by enteral intake. Moreover, the adoption of fat emulsion as part of total PN is increasing for pregnant women. The pediatric segment is anticipated to witness lucrative growth from 2024 to 2030 owing to increased consumption of PN among preterm neonates in their initial life after birth. This is due to their intolerance to full enteral nutrition, and the benefits of PN, which provides a relatively safe means for preventing nutritional deficiency. Moreover, increasing prevalence of preterm births has significantly contributed to the segment’s growth. According to Tommy’s organization, 7.6% of births in England and Wales were preterm in 2021, up from 7.4% in 2020.

Indication Type Insights

The cancer segment dominated the market with a share of 17.6% in 2023. Parenteral nutrition is crucial for addressing the nutritional needs of cancer patients, particularly in combating malnutrition, which significantly impacts their quality of life and survival rates. It is estimated that up to 20% of oncology patients succumb to the effects of malnutrition rather than the cancer itself, underscoring the growing demand for PN among these patients. In addition, PN aids in tissue repair and healing, helps maintain weight and muscle mass, supports immune function, and enhances tolerance to cancer treatments. This is expected to drive segment growth over the forecast period.

The dysphagia segment is anticipated to witness the fastest growth rate from 2024 to 2030 due to its rising prevalence. According to an article published in MDPI in 2022, the prevalence of dysphagia among elderly nursing home residents was around 58.69%, which was evaluated by the Standard Swallowing Assessment (SSA). Also, the prevalence of dysphagia in combined community-dwelling elderly was around 30.52%. Furthermore, aspiration pneumonia due to dysphagia is a major complication of this condition, which boosts the need for PN.

Sales Channel Insights

The institutional sales channel segment dominated the market with a share of 48.1% in 2023 owing to the increasing chronic disease population and growing number of private and public healthcare institutions. In addition, PN is often delivered in specialized care setting under the guidance of healthcare professionals, which further contributes to segment growth. The online sales channel segment is expected to witness the fastest growth rate from 2024 to 2030 owing to a shift in the trend toward direct selling to customers via e-commerce platforms.

The preference for online purchase of PN is rising owing to the convenience offered by this sales channel. Although consumed under medical surveillance, these products are intended for long-term nutrition management, resulting in growing sales through e-commerce. Moreover, these channels can offer better accessibility to products that might not be readily available at conventional sales channels. Thus, with the penetration of e-commerce, there is a gradual shift toward the online purchase of enteral nutrition, thereby offering lucrative growth opportunities.

Regional Insights

The parenteral nutrition marketaccounted for the largest share of more than 41.5% in 2023. Key factors responsible for its highest share include high research expenditure by private entities & government agencies in the healthcare sector, technologically advanced medical devices, and collaborations among the medical device industry, regulatory authorities, universities, and others. In addition, the growing prevalence of various chronic diseases, such as cancer and malnutrition, in the region is significantly contributing to the demand for PN in this region. For instance, according to the American Cancer Society, 1.9 million new cancer cases and 609,360 cancer deaths were estimated in the U.S. in 2022.

U.S. Parenteral Nutrition Market Trends

The parenteral nutrition market in the U.S. is expected to grow at a CAGR of 5.92% over the forecast period. This can be attributed to the increasing geriatric population, technological advancements, and compatible regulatory frameworks in the country. Moreover, several market players are developing solutions to enhance their presence in the U.S. market. For instance, in May 2024, Baxter announced U.S. FDA approval for the expanded indication of Clinolipid, allowing its use in pediatric patients, including term and preterm neonates. Clinolipid has been available for adults in the U.S. since 2019 and is now approved for use across all age groups. “Improving patient outcomes inspires our work every day, and we are proud to continue to address the unique nutritional needs of neonatal and pediatric patients through innovative products and therapies. Expanding access to Clinolipid for this critical and vulnerable patient population offers clinicians’ versatility in choosing the product that best meets their patients’ needs when it matters most.”- Cecilia Soriano, President of Baxter’s Global Infusion Therapies and Technologies Division.

Canada Parenteral Nutrition Market Trends

The Canada parenteral nutrition market is anticipated to grow at a significant rate owing to a rise in the number of people suffering from malnutrition who require enteral nutrition support. Moreover, increasing number of initiatives to decrease the prevalence of malnutrition in the country supports market growth. For instance, Canada has established the Canadian Malnutrition Task Force, which carries out several conferences and spreads education about malnutrition in several parts of the country. Such initiatives are expected to increase the awareness of malnutrition in the country, thereby contributing to market growth.

Asia Pacific Parenteral Nutrition Market Trends

The parenteral nutrition market in Asia Pacific is anticipated to register the fastest CAGR during the forecast period. The rising demand for cost-effective treatments and growing prevalence of chronic diseases due to unhealthy eating habits are some of the factors expected to drive Asia Pacific regional market growth. Moreover, low awareness about nutrition and increasing population coupled with poverty in the region are leading to malnutrition, which is driving the demand for PN in the region.

The Japan parenteral nutrition market is expected to grow significantly over the forecast period. This can be attributed to the rapidly increasing geriatric population of the country. According to the data published by the World Economic Forum in September 2023, more than 1 in every 10 people in the country were aged above 80 years, and around 1/3rd of the country’s population, i.e. 36.23 million people, were aged above 65 years. This rise in the geriatric population is expected to drive domestic market growth.

The parenteral nutrition market in China held a significant market share in 2023 owing to factors, such as increasing geriatric population, rising healthcare expenditure, and growing prevalence of cancers, in the country. According to the World Bank data, the per capita healthcare expenditure of China has increased from 393.78 USD in 2015 to 583.43 in 2020. This trend of increasing per capita healthcare expenditure can contribute to market growth. In addition, the growing incidence of preterm births and malnutrition is driving the adoption of PN, thereby fueling market growth.

The India parenteral nutrition market is expected to witness significant growth driven by a rise in the cases of malnutrition and diabetes. According to a study published by the Indian Council of Medical Research India Diabetes (ICMR INDIAB) in 2023, around 101 million people in the country had diabetes. In addition, the Indian government is undertaking significant initiatives to create awareness about malnutrition in the country, which is expected to fuel market growth.

Key Parenteral Nutrition Company Insights

Key players are adopting new product development, partnership, and merger & acquisition strategies to increase their market share. Notable players in the parenteral nutrition market include Baxter, Grifols, S.A., Allergan, Otsuka Pharmaceutical Factory, Inc., Actavis Inc., B. Braun Melsungen AG, Fresenius Kabi AG, Vifor Pharma, Sichuan Kelun Pharmaceutical Co., Ltd., and Pfizer Inc. (Hospira Inc.). The development of new drugs by these companies and their entry into untapped markets to expand their reach are anticipated to further stimulate market growth.

Key Parenteral Nutrition Companies:

The following are the leading companies in the parenteral nutrition market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter

- Allergan

- Otsuka Pharmaceutical Factory, Inc.

- Grifols, S.A.

- B. Braun Melsungen AG

- Vifor Pharma

- Fresenius Kabi AG

- Sichuan Kelun Pharmaceutical Co., Ltd.

- Pfizer Inc. (Hospira Inc.)

Recent Developments

-

In June 2022, Fresenius Kabi UK announced the launch of a new website designed to assist healthcare professionals working in the field of PN. This site was developed to guide healthcare professionals through the company’s range of multi-chamber bags and to support product selection for PN in various healthcare settings

-

In November 2020, Otsuka Pharmaceutical Factory launched ENEFLUID injection, a peripheral PN solution that combines fat and water-soluble vitamins with electrolytes, glucose, and amino acids in a dual-chamber bag. This launch aimed to reduce the burden on healthcare settings by providing a comprehensive and convenient nutritional solution

-

In September 2020, Baxter announced the U.S. FDA approval for Clinimix and Clinimix E injections for patients requiring PN with higher protein. This approval expands the company’s portfolio of products offering higher protein formulations

-

In January 2020, Fresenius Kabi concluded its clinical trial for SmofKabiven, a new addition to its range of lipid emulsions. SmofKabiven comprises multiple oils, including fish, soybean, and olive oils, along with medium-chain triglycerides. It also features a separate chamber for amino acids, glucose, and lipids, offering a comprehensive nutritional solution

Parenteral Nutrition Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.52 billion

Revenue forecast in 2030

USD 10.68 billion

Growth rate

CAGR of 6.01% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nutrient type, stage type, indication, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; UAE; South Africa; Saudi Arabia; Kuwait

Key companies profiled

Baxter; Grifols, S.A.; Allergan; Otsuka Pharmaceutical Factory, Inc.; Actavis Inc.; B. Braun Melsungen AG; Fresenius Kabi AG; Vifor Pharma; Sichuan Kelun Pharmaceutical Co., Ltd.; Pfizer Inc. (Hospira Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Parenteral Nutrition Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the parenteral nutrition market report based on nutrient type, stage type, indication, sales channel, and region:

-

Nutrient Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbohydrates

-

Parenteral Lipid Emulsion

-

Single Dose Amino Acid Solution

-

Trace Elements

-

Vitamins & Minerals

-

-

Stage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatrics

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Alzheimer’s

-

Nutrition Deficiency

-

Cancer Care

-

Diabetes

-

Chronic Kidney Diseases

-

Orphan Diseases

-

Dysphagia

-

Pain Management

-

Malabsorption/GI Disorder/Diarrhea

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Retail

-

Institutional

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the parenteral nutrition market with a share of more than 41.5% in 2023. Key factors responsible for its highest market share include high research expenditure by private entities & government agencies in the healthcare sector, technologically advanced medical devices, and collaborations among the medical device industry, regulatory authorities, universities, and others. In addition, the growing prevalence of various chronic diseases, such as cancer and malnutrition, in the region is also significantly contributing to the demand for PN in the region.

b. Some key players operating in the parenteral nutrition market include Baxter; Grifols, S.A.; Allergan; Otsuka Pharmaceutical Factory, Inc.; Actavis Inc.; B. Braun Melsungen AG; Fresenius Kabi AG; Vifor Pharma; Sichuan Kelun Pharmaceutical Co., Ltd.; and Pfizer, Inc. (Hospira Inc.)

b. Key factors that are driving the parenteral nutrition market growth include the growing presence of a large number of malnourished children, a high natality rate around the globe, increasing premature births, and the rising occurrence of cancer.

b. The global parenteral nutrition market size was estimated at USD 7.11 billion in 2023 and is expected to reach USD 7.52 billion in 2024.

b. The global parenteral nutrition market is expected to grow at a compound annual growth rate of 6.01% from 2024 to 2030 to reach USD 10.68 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.