- Home

- »

- Next Generation Technologies

- »

-

Passive Authentication Market Size & Share Report, 2030GVR Report cover

![Passive Authentication Market Size, Share & Trends Report]()

Passive Authentication Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment, By Organization Size, By Function, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-388-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Passive Authentication Market Summary

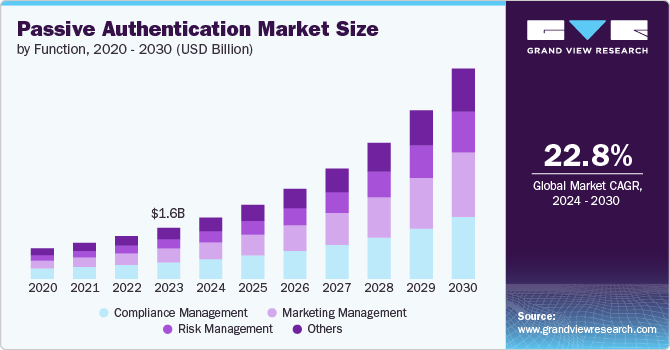

The global passive authentication market size was estimated at USD 1.64 billion in 2023 and is projected to reach USD 6.77 billion by 2030, growing at a CAGR of 22.8% from 2024 to 2030. Traditional password-based authentication is vulnerable to hacking and data breaches.

Key Market Trends & Insights

- The North America dominated the passive authentication market with a revenue share of 39.0% in 2023.

- The Asia Pacific is anticipated to register at the fastest CAGR over the forecast period.

- Based on organization size, the large enterprises segment led the market with the largest revenue share of 64.6% in 2023.

- Based on function, the compliance management segment led the market with the largest revenue share of 32.52% in 2023.

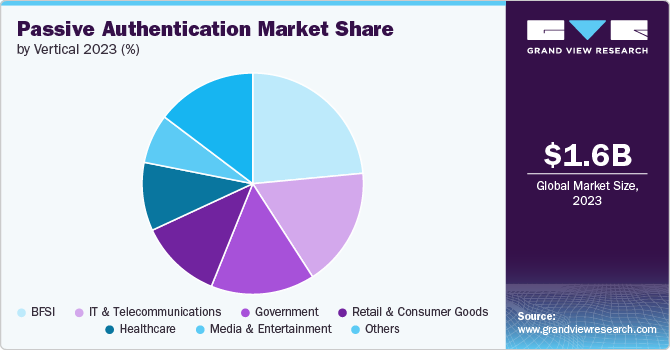

- Based on vertical, the BFSI segment led the market with the largest revenue share of 23.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.64 Billion

- 2030 Projected Market USD 6.77 Billion

- CAGR (2024-2030): 22.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Passive authentication offers a more robust security approach by verifying users based on their inherent characteristics or device behavior, making it difficult for unauthorized access. Various factors, such as increasing demand for enhanced security, growing need for frictionless user experience, stringent data privacy regulations, advancements in biometric technology, and growing awareness of security threats, are primarily driving the market growth. Moreover, the focus on user convenience and the rise of cloud-based solutions are also driving the market forward.

Users are increasingly demanding seamless and convenient login experiences. Passive authentication eliminates the need for remembering and entering complex passwords, improving user experience and satisfaction. Moreover, cloud-based passive authentication solutions are becoming more accessible due to their scalability, cost-effectiveness, and ease of deployment. This makes them accessible to a wider range of organizations. In addition, as cyber threats become more prevalent, organizations are becoming more aware of the need for stronger security measures. Passive authentication is used to improve security and prevent unauthorized access.

Various regulations such as, General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA), mandate strong user authentication to protect sensitive data. Passive authentication can help organizations comply with these regulations. Moreover, biometric authentication, a form of passive authentication, is becoming increasingly sophisticated and reliable. This is leading to wider adoption of passive authentication solutions that utilize fingerprint, facial recognition, or iris scans for user verification.Thus, these factors, combined with the ongoing development of new technologies, are expected to continue fueling the market growth in the forecasted period.

Component Insights

Based on component, the solution segment led the market with the largest revenue share of 72.5% in 2023. Passive authentication solutions can be integrated with user behavior analytics tools to create a more comprehensive security profile. This allows for identifying unnatural behavior patterns that might indicate unauthorized access attempts. Moreover, passive authentication solutions can seamlessly integrate with existing security infrastructure, making them easier to adopt and deploy within organizations. Furthermore, passive authentication solutions are becoming more customizable, allowing organizations to tailor the level of security to their specific needs and risk tolerance.

The services segment is predicted to foresee at the fastest CAGR over the forecast period. Organizations are increasingly opting for passive authentication services to handle their security needs. Passive authentication services can be integrated with managed security services offerings, providing a comprehensive security solution for organizations lacking the expertise to manage it themselves. Moreover, implementing and maintaining passive authentication solutions can be complex. Passive authentication services offer access to expertise and ongoing support from experienced professionals, making it easier for organizations to adopt and manage these solutions.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 62.72% in 2023. Cloud-based passive authentication solutions can be deployed faster compared to on-premises solutions. This allows organizations to benefit from the technology quicker and experience a faster return on investment (ROI). Moreover, cloud service providers handle automatic updates and security patches, ensuring organizations always have access to the latest features and security fixes. This eliminates the burden of manual updates and reduces the risk of vulnerabilities.

The on-premises segment is anticipated to exhibit at a significant CAGR over the forecast period. On-premises solutions offer greater customization options. Organizations can tailor the passive authentication system to their specific needs and integrate it seamlessly with existing security architecture. This level of control can’t not be achievable with all cloud-based solutions. Various industries, such as BFSI and healthcare, have concerns about relying on an external provider for their authentication needs. On-premises solutions eliminate the risk of potential vulnerabilities introduced through a cloud connection.

Organization Size Insights

Based on organization, the large enterprises segment led the market with the largest revenue share of 64.6% in 2023.Large enterprises handle vast amounts of sensitive data, making them prime targets for cyberattacks. Passive authentication offers a more robust security layer compared to traditional methods, reducing the risk of unauthorized access and data breaches. Moreover, large enterprises generally have larger IT budgets than smaller businesses, which allows them to invest in advanced security solutions like enterprise-grade passive authentication.

The SMEs segment is anticipated to exhibit at the fastest CAGR over the forecast period. SMEs are increasingly becoming targets for cyberattacks. As security threats become more prevalent, SMEs are recognizing the need for stronger authentication methods beyond simple passwords. Passive authentication offers a more secure approach without the burden of complex password management. Moreover, the market is witnessing the emergence of more affordable and scalable cloud-based passive authentication solutions. This makes them more accessible to SMEs with limited IT budgets compared to traditional on-premises solutions.

Function Insights

Based on function, the compliance management segment led the market with the largest revenue share of 32.52% in 2023. Regulations such as GDPR and CCPA mandate strong user authentication to protect sensitive data. Passive authentication solutions can help organizations comply with these regulations by ensuring that only authorized users can access specific data. This reduces the risk of data breaches and hefty fines for non-compliance. Organizations are placing increasing emphasis on improving their overall data security posture. Passive authentication offers a robust layer of security beyond traditional methods, making it difficult for unauthorized individuals to gain access to sensitive data and information systems. This translates to a lower risk of data breaches and associated reputational damage.

The marketing management segment is anticipated to exhibit at the fastest CAGR over the forecast period. The marketing management function allows for targeted campaigns based on specific industry needs and user demographics. By segmenting the market and tailoring messaging accordingly, companies can effectively reach decision-makers in various industries and convince them of the value proposition of passive authentication for their specific needs. Moreover, a marketing strategy can build brand awareness for companies offering passive authentication solutions. This involves establishing them as thought leaders in the security space and highlighting their expertise in the field. Positive customer testimonials and industry recognition can further enhance credibility and drive market growth within the marketing management function segment.

Vertical Insights

Based on vertical, the BFSI segment led the market with the largest revenue share of 23.5% in 2023. BFSI handles huge sensitive financial data, making them prime targets for cyberattacks. Passive authentication offers an additional layer of security by continuously verifying user identity without relying solely on passwords. This can significantly reduce the risk of unauthorized access to accounts and financial information. Moreover, passive authentication offers a convenient way to access accounts without the hassle of complex passwords or multi-factor authentication every time. This can lead to increased customer satisfaction and loyalty.

The retail and consumer goods segment is anticipated to exhibit at the fastest CAGR over the forecast period. Consumers need a smooth and convenient shopping experience, especially in the online space. Passive authentication eliminates the need for remembering complex passwords or constantly entering codes, streamlining the login and checkout process. This can lead to increased customer satisfaction, loyalty, and potentially higher conversion rates. Retailers face significant losses due to fraudulent activities. Passive authentication techniques like behavioral biometrics can analyze user behavior patterns and identify anomalies that might indicate fraudulent activity. This allows retailers to flag suspicious transactions and protect themselves from financial losses.

Regional Insights

North America dominated the passive authentication market with a revenue share of 39.0% in 2023. North America faces a high volume of cyberattacks targeting businesses and individuals. Passive authentication offers higher security compared to traditional methods like passwords, reducing the risk of unauthorized access. Moreover, high-profile data breaches have heightened awareness of the importance of data security. Passive authentication can help prevent unauthorized access to sensitive information, mitigating the impact of breaches.

U.S. Passive Authentication Market Trends

The passive authentication market in U.S. is anticipated to exhibit at a significant CAGR over the forecast period. The U.S. consumers value a smooth and fast online experience. Passive authentication eliminates the need for remembering complex passwords or multi-factor authentication every time, improving user experience for online services like banking and shopping. Mobile wallet adoption is on the rise in the U.S. Passive authentication integrates seamlessly with these mobile payment methods, offering a secure and convenient way to conduct transactions.

Europe Passive Authentication Market Trends

The passive authentication market in Europe is expected to witness at a significant CAGR over the forecast period. GDPR mandates stricter data protection measures for businesses operating in the EU. Passive authentication can help companies comply with GDPR by ensuring that only authorized individuals can access sensitive user data.

Asia Pacific Passive Authentication Market Trends

The passive authentication market in the Asia Pacific is anticipated to register at the fastest CAGR over the forecast period. APAC countries are experiencing rapid technological advancements, with a growing number of smartphone users and increasing internet penetration. Thus, there is high adoption of mobile-based passive authentication solutions. Various APAC governments are actively promoting digitalization and cashless economies. These initiatives often include regulations mandating stronger authentication for online transactions, driving the demand for passive authentication solutions.

Key Passive Authentication Company Insights

Key passive authentication companies include Thales, Source, NEC Corporation of America, and International Business Machines Corporation. Companies active in the global market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development.

For instance, in November 2023, Source, passive authentication technology provider, launched Banking-as-a-Service (BaaS) solutions to ensure that sponsor banks possess the essential insights and controls needed for effective partnerships with fintech companies. Fintech companies often lack a banking license and often collaborate with sponsor banks that offer the necessary infrastructure for regulated operations, such as loans and deposits. Partnership and collaboration enable them to concentrate on developing unique and innovative services. Thus, Banking-as-a-Service (BaaS) solutions represent a vital chance for revenue enhancement and innovation.

Key Passive Authentication Companies:

The following are the leading companies in the passive authentication market. These companies collectively hold the largest market share and dictate industry trends.

- Aware Inc

- BehavioSec

- Cisco Systems, Inc.

- FICO Company

- International Business Machines Corporation

- Jumio

- NEC Corporation of America

- OneSpan

- Source

- Thales

Recent Developments

-

In June 2024, Thales launched Passwordless 360°, password less authentication system, providing Thales’ clients with the most comprehensive range of passwordless capabilities for various user types and levels of assurance. Passwordless 360° offers businesses the chance to adopt the newest technologies such as FIDO passkeys, while also maximizing the benefits from earlier investments in password less solutions

-

In May 2024, ID Dataweb, cross-channel identity verification solutions provider, collaborated with International Business Machines Corporation to integrate ID Dataweb’s identity verification workflows within IBM Security Verify. By combining the two industry-leading solutions, organizations will be able to confirm the identity of a user within existing workflows as their credentials are being seamlessly issued and used

-

In March 2024, NEC Corporation of America launched the NeoFace® Reveal Version 5, forensic face recognition solution. The advanced business software is designed to transform the way criminal investigations and fraud prevention are conducted by government bodies, law enforcement agencies, and organizations processing civil applications

Passive Authentication Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.97 billion

Revenue forecast in 2030

USD 6.77 billion

Growth rate

CAGR of 22.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization size, function, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Aware Inc.; BehavioSec; Cisco Systems, Inc.; FICO Company; International Business Machines Corporation; Jumio; NEC Corporation of America ; OneSpan; Source; and Thales

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Passive Authentication Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global passive authentication market report based on component, deployment, organization size, function, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Function Outlook (Revenue, USD Million, 2017 - 2030)

-

Compliance Management

-

Marketing Management

-

Risk Management

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Government

-

IT & Telecommunications

-

Retail and consumer goods

-

Healthcare

-

Media and Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global passive authentication market size was estimated at USD 1.64 billion in 2023 and is expected to reach USD 1.97 billion in 2024.

b. The global passive authentication market is expected to grow at a compound annual growth rate of 22.8% from 2024 to 2030 to reach USD 6.77 billion by 2030.

b. North America dominated the passive authentication market with a share of 39.0% in 2023. North America faces a high volume of cyberattacks targeting businesses and individuals. Passive authentication offers higher security compared to traditional methods like passwords, reducing the risk of unauthorized access. Moreover, high-profile data breaches have heightened awareness of the importance of data security. Passive authentication can help prevent unauthorized access to sensitive information, mitigating the impact of breaches.

b. Some key players operating in the passive authentication market include Aware Inc.; BehavioSec; Cisco Systems, Inc.; FICO Company; International Business Machines Corporation; Jumio; NEC Corporation of America ; OneSpan; Source; and Thales.

b. Passive authentication offers a more robust security approach by verifying users based on their inherent characteristics or device behavior, making it difficult for unauthorized access. Various factors, such as increasing demand for enhanced security, growing need for frictionless user experience, stringent data privacy regulations, advancements in biometric technology, and growing awareness of security threats, are primarily driving the growth of the passive authentication market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.