- Home

- »

- Consumer F&B

- »

-

Pasta & Noodles Market Size, Share, Industry Report, 2030GVR Report cover

![Pasta And Noodles Market Size, Share & Trends Report]()

Pasta And Noodles Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dried, Instant, Frozen/Canned), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-073-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pasta & Noodles Market Summary

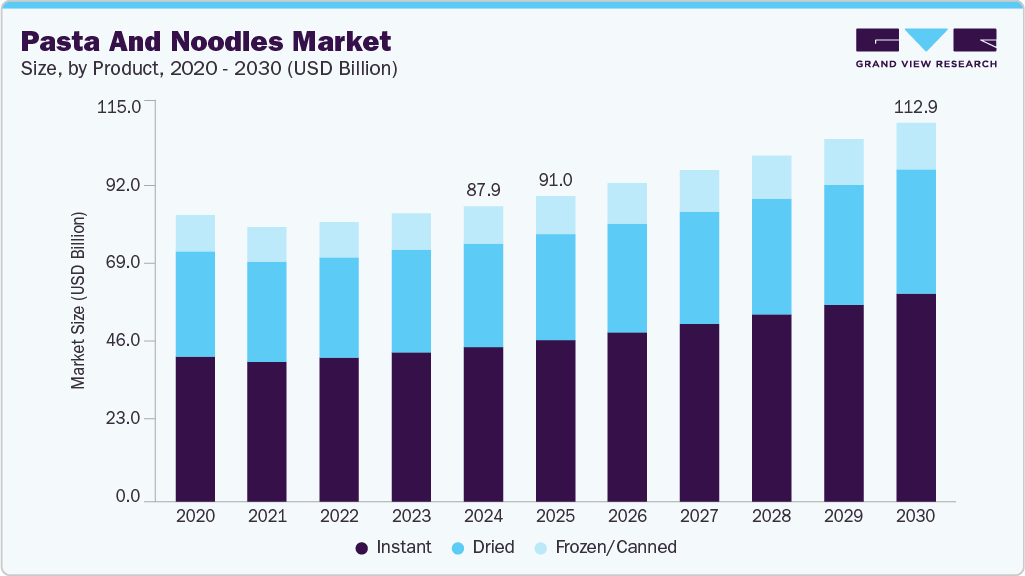

The global pasta & noodles market size was estimated at USD 87.97 billion in 2024 and is projected to reach USD 112.90 billion by 2030, growing at a CAGR of 4.4% from 2025 to 2030. The industry is significantly driven by rising disposable income levels, evolving dietary habits influenced by urbanization, and increased preference for convenient, premium, and diversified product offerings tailored to consumer tastes.

Key Market Trends & Insights

- Asia Pacific held the largest share of the global pasta & noodles market in 2024, accounting for 62.7%.

- The pasta & noodles market in the Middle East & Africa is expected to register the fastest CAGR from 2025 to 2030.

- By product, the instant segment dominated the market with a 52.3% share in 2024.

- By distribution channel, the offline segment dominated the pasta & noodles industry, with a share of 93.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 87.97 Billion

- 2030 Projected Market Size: USD 112.90 Billion

- CAGR (2025-2030): 4.4%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

As disposable incomes continue to rise and health-conscious dietary choices gain traction globally, demand for premium and nutritious pasta & noodles is expected to grow. Consumers are increasingly seeking products that offer cleaner labels, plant-based ingredients, whole grains, and reduced additives, aligning with their priorities for wellness and sustainability. In parallel, digital marketing strategies and e-commerce platforms are enhancing product visibility and expanding access to a diverse range of regional and gourmet varieties. In October 2025, Pasta Garofalo introduced a new high-protein pasta made from premium durum wheat, utilizing advanced milling techniques. Each 3.5-ounce serving provides 19 grams of protein, a lower glycemic index, and 50% more fiber than average whole wheat pasta. In addition, in March 2025, Yo Mama’s Foods launched its new High-Protein Pasta. Made from alubia beans, this gluten-free pasta provides 18 grams of protein and 10.5 grams of fiber per serving, supporting energy and digestive health, and is available in fusilli, penne, and elbow shape.

In recent years, the demand for international cuisines has increased significantly, resulting in a rise in the consumption of pasta and noodles worldwide. There has been growing consumption of Italian pasta in the U.S. and Asian countries, which bodes well for the market growth. Key growth drivers include rapid urbanization and busy lifestyles, which favor quick-preparation formats, as well as rising middle-class incomes in emerging markets, enabling higher penetration. There is a shift towards health-oriented innovations, such as high-protein or fiber-fortified pasta and noodles, as well as retail channel expansion, particularly the growth of modern convenience and e-commerce platforms. The growth can largely be attributed to increased purchasing of packaged and shelf-stable products. Furthermore, in the pasta category, the product’s extended shelf life has made it a popular choice for consumers seeking to stockpile and consume it for a longer period. The demand for dried pasta in the grocery stores was overwhelming during the pandemic.

Product Insights

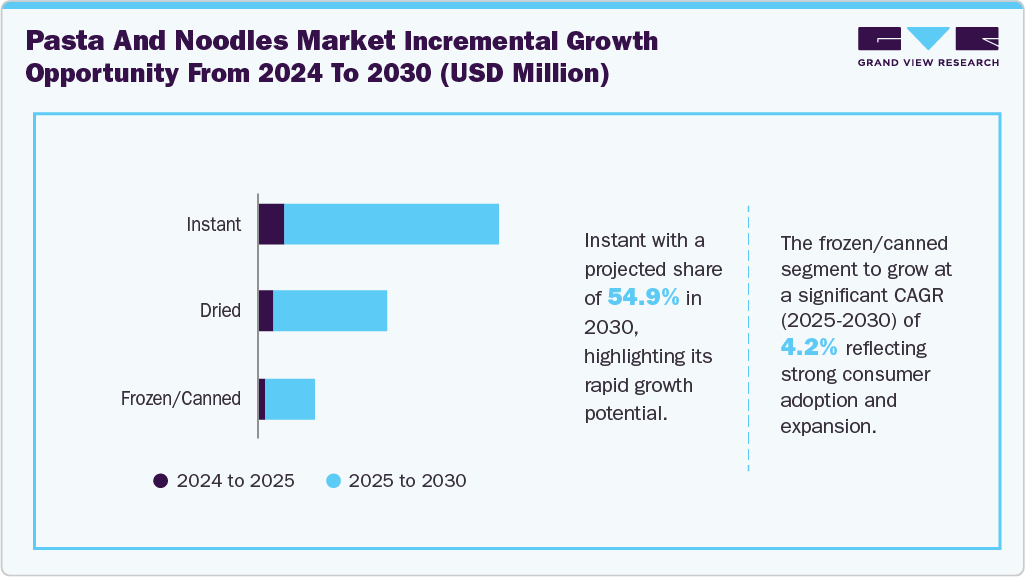

The instant segment accounted for the largest revenue share of 52.3% in 2024 and is expected to record the fastest CAGR over the forecast period. The segment's growth is characterized by increased interest in RTD, flavorful, and convenient foods. Instant noodles are convenient for eaters who need to travel or work in austere environments; as a result, their consumption is tremendously increasing. For instance, in March 2025, Wow! Momo Foods expanded into the instant noodles segment with the launch of Wow! Noodles. The company is leveraging its brand presence and consumer reach to capitalize on India’s growing demand for convenient, ready-to-eat meal options.

In July 2024, Nissin Foods USA launched Cup Noodles Campfire S’mores, a sweet & gooey noodle experience. It was available at SRP of USD 1.18 exclusively at stores & online at Walmart, for a limited time.

The frozen/canned segment is projected to grow at a significant CAGR of 4.2% from 2025 to 2030. Frozen pasta products offer quick cooking with enhanced texture retention, while canned noodles provide accessible, affordable, and ready-to-eat solutions for stocking the pantry. These products are gaining traction among working populations and students who require time-saving meal options that do not compromise taste or nutritional value. Moreover, manufacturers strategically leverage limited-edition and seasonal flavors to invigorate the category.

In October 2024, Nestlé launched its Vital Pursuit range in the U.S., featuring 14 frozen meal options that include pasta made with pea protein, vegetables, and whole grains, designed to support dietary goals such as weight management. In India, Nestlé introduced Maggi Nutri-licious Chatpata Besan Noodles, made with chickpea flour, to enhance the protein and fiber content while preserving familiar regional taste profiles. These initiatives reflect Nestlé's strategy to combine nutrition and convenience with local consumer preferences through continuous product modernization.

Distribution Channel Insights

The offline segment accounted for the largest revenue share of 93.2% in 2024. An increasing number of offline retailers, such as supermarkets & hypermarkets, and wide product availability drive the segment growth. In March 2025, South Africa’s SPAR Group announced plans to launch a premium “SPAR Gourmet” supermarket format, featuring 30 to 40 high-end stores that target affluent urban shoppers. The initiative focuses on urban locations and aims to provide premium food solutions, bakery, coffee, and indulgent products through a curated assortment.

The online segment is projected to grow at the fastest CAGR of 7.1% from 2025 to 2030. E-commerce has significantly changed people’s shopping habits, offering various advantages such as doorstep delivery, lucrative discounts, and the convenience of accessing a wide range of items on a single site. Subscription meal kits and digital grocery marketplaces are promoting recurring purchases of pasta and noodles as part of planned food routines. Personalized recommendations, targeted promotions, and social-media-influenced brand discovery further accelerate conversion rates in the online segment.

Regional Insights

The North America pasta & noodles market is experiencing significant growth, driven by a combination of evolving consumer lifestyles, changing dietary preferences, and demographic shifts. Americans and Canadians alike are increasingly turning to pasta and noodles as convenient and versatile meal options that easily fit into their busy schedules. With the rise of dual-income households and fast-paced routines, these products offer quick preparation times and the flexibility to create a variety of dishes, making them a staple in many kitchens.

U.S. Pasta And Noodles Market Trends

The U.S. pasta & noodles industry led the North American market in 2024. The growth is driven by rising demand for products that combine convenience with dietary benefits, such as high-protein, low-carb, or plant-based formats, as well as flavor innovations drawing on global cuisines and consumer demand for premium experiences. In March 2025, General Mills entered the instant ramen market by launching its first-ever ramen noodle line under the Old El Paso and Totino brands. Available at Walmart, the new range includes bold and unique flavors such as Old El Paso Fajita and Beef Birria ramen, as well as Totino’s Cheese Pizza and Buffalo-Style Chicken Pizza ramen. With this move, General Mills is expanding its presence in the savory snacks and meals segment while leveraging the strong brand recognition of Old El Paso and Totino’s to stand out in the competitive instant noodles category.

Europe Pasta And Noodles Market Trends

The pasta & noodles industry in Europe is expected to grow at a CAGR of 4.8% over the forecast period. The growth is driven by changing consumer lifestyles and evolving food preferences. Europeans are increasingly embracing pasta and noodles due to their versatility, affordability, and convenience, which fit well into busy schedules and modern meal patterns. While pasta has long been a staple in Mediterranean countries, its popularity is now spreading across the continent, appealing to consumers looking for quick, satisfying, and nutritious meal options.

Countries such as Italy, Germany, France, and the United Kingdom are among the largest consumers of pasta and noodles in Europe. Italy remains the leading market, deeply rooted in its culinary tradition and culture. In contrast, Germany and the UK have shown strong demand for both traditional pasta and instant noodle varieties, particularly among younger consumers and working professionals who prioritize convenience without compromising on taste.

Asia Pacific Pasta And Noodles Market Trends

The Asia Pacific pasta & noodles industry accounted for a 62.7% share in 2024. The market is witnessing significant growth due to a combination of cultural familiarity, evolving consumer lifestyles, and increasing globalization of food preferences. Noodles have long been a staple in many Asian countries, forming the backbone of traditional cuisines in China, Japan, South Korea, and Southeast Asia. This inherent affinity has made the population more receptive to variations such as instant noodles and pasta. Besides, rising urbanization and the fast-paced nature of daily life have created a strong demand for convenient, quick-to-prepare meals, making instant noodles and ready-to-cook pasta popular choices across both urban and semi-urban populations.

The market expansion is further supported by changing dietary habits, a rise in dual-income households, and the growth of modern retail formats and online grocery platforms. Many brands are innovating with flavor customization, healthier options (such as gluten-free, multigrain, or fortified pasta), and regional taste profiles to appeal to the diverse palates of the Asia Pacific market. For instance, in September 2023, Samyang Foods launched a new Korean pasta brand called Tangle, targeting international markets with its first product, Tangle Bulgogi Alfredo Tangluccine. This instant pasta features air-dried, flat noodles with a unique bouncy texture and combines the classic Korean bulgogi flavor with creamy Alfredo sauce, offering a fusion taste designed for global consumers.

The pasta & noodles industry in China dominated the regional market in 2024 due to its long-established culinary heritage and substantial daily consumption of wheat-based staples. Domestic manufacturers are increasingly expanding their portfolios with healthier formulations, regional flavor diversification, and premium ingredients to align with evolving dietary expectations.

Middle East & Africa Pasta And Noodles Market Trends

The pasta & noodles industry in the Middle East & Africa is projected to grow at the fastest CAGR of 5.2% over the forecast period, driven by rising urbanization, changing lifestyles, and increasing demand for convenient and affordable food options. Across major cities such as Dubai, Saudi Arabia, and South Africa, consumers are increasingly gravitating toward ready-to-cook meals due to longer working hours and busy lifestyles. Pasta and noodles, particularly instant varieties, have become go-to meal choices as they are quick to prepare and relatively inexpensive compared to other staple foods, such as rice or meat-based dishes.

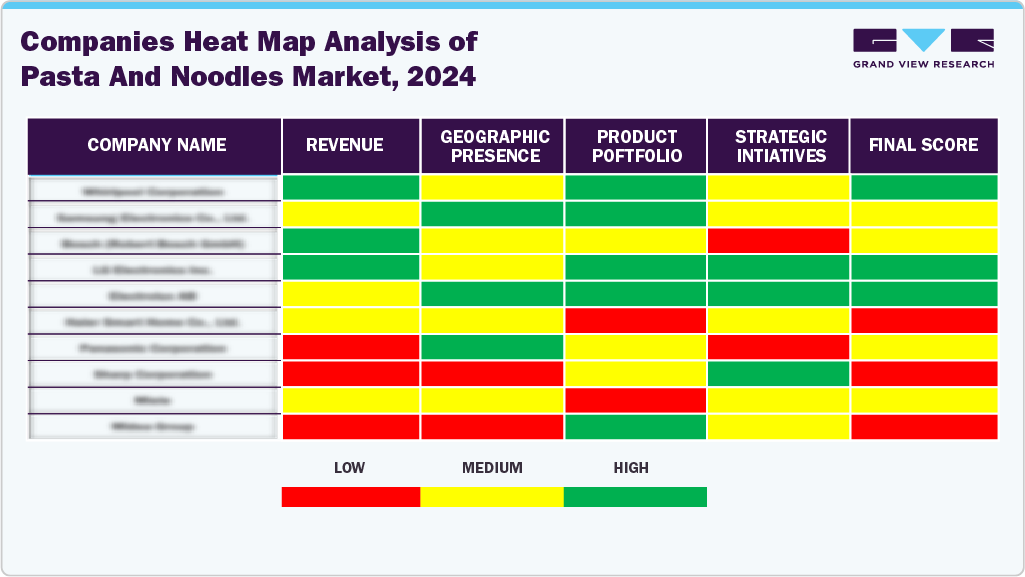

Key Pasta And Noodles Company Insights

Many brands in the global pasta & noodles industry have recognized untapped opportunities within their product portfolios and are actively working to capitalize on these gaps. By targeting niche segments and emerging preferences, these brands aim to expand their market share and enhance their competitive positioning globally.

Key Pasta & Noodles Companies:

The following are the leading companies in the pasta & noodles market. These companies collectively hold the largest Market share and dictate industry trends.

- Nestlé

- Barilla G. e R. Fratelli S.p.A

- ITC

- The Kraft Heinz Company.

- Unilever

- TOYO SUISAN KAISHA, LTD.

- NISSIN FOODS HOLDINGS CO., LTD.

- The Campbell’s Company

- Conagra Brands, Inc.

- Nongshim Co., Ltd

- Ebro Foods, S.A.

Recent Developments

-

In October 2025, Nissin introduced its new Geki ramen line in the U.S., focusing on delivering extreme spiciness and bold flavor. The launch includes two varieties, Spicy Carbonara Chicken and Spicy Hot Chicken, offering different heat levels.

-

In July 2025, Unilever introduced Namdong, a Korean-inspired instant noodle brand, in the UK. It is available in the flavors: Chicken Jjigae, Beef Jjigae, and a vegan variant, Kimchi Jjigae.

-

In March 2025, General Mills entered the instant ramen market by launching its first-ever ramen noodle line under the Old El Paso and Totino brands. Available at Walmart, the new range includes bold and unique flavors such as Old El Paso Fajita and Beef Birria ramen, as well as Totino’s Cheese Pizza and Buffalo-Style Chicken Pizza ramen.

-

In July 2024, Napolina introduced two new pasta shapes in the UK: Orzo and Macaroni. Both products are available across major UK retailers at an accessible price point, supporting versatile usage from summer dishes to soups during cooler months.

Pasta And Noodles Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 91.00 billion

Revenue Forecast in 2030

USD 112.90 Billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa; Saudi Arabia

Key companies profiled

Nestlé; Barilla G. e R. Fratelli S.p.A; ITC; The Kraft Heinz Company ; Unilever; TOYO SUISAN KAISHA, LTD.; NISSIN FOODS HOLDINGS CO., LTD.; The Campbell’s Company; Conagra Brands, Inc.; Nongshim Co., Ltd; Ebro Foods, S.A.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

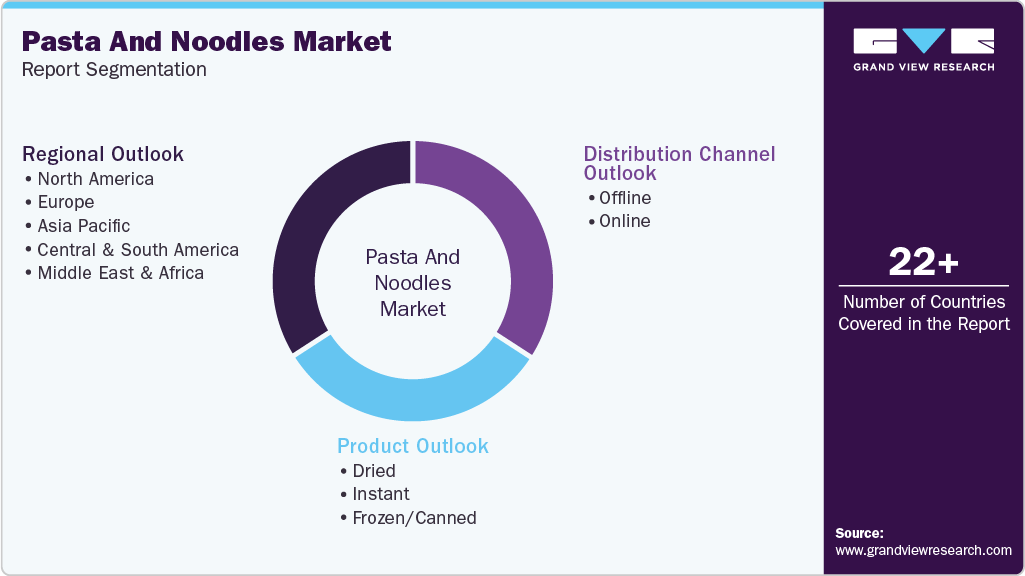

Global Pasta And Noodles Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pasta and noodles market report on the basis of product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dried

-

Instant

-

Frozen/Canned

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.