- Home

- »

- Healthcare IT

- »

-

Patient Access Solutions Market Size, Industry Report, 2033GVR Report cover

![Patient Access Solutions Market Size, Share & Trends Report]()

Patient Access Solutions Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software & Services), By Type (Integrated, Standalone), By Deployment Mode (Cloud-Based, On Premise, Web-Based), By Functionality, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-752-2

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Patient Access Solutions Market Summary

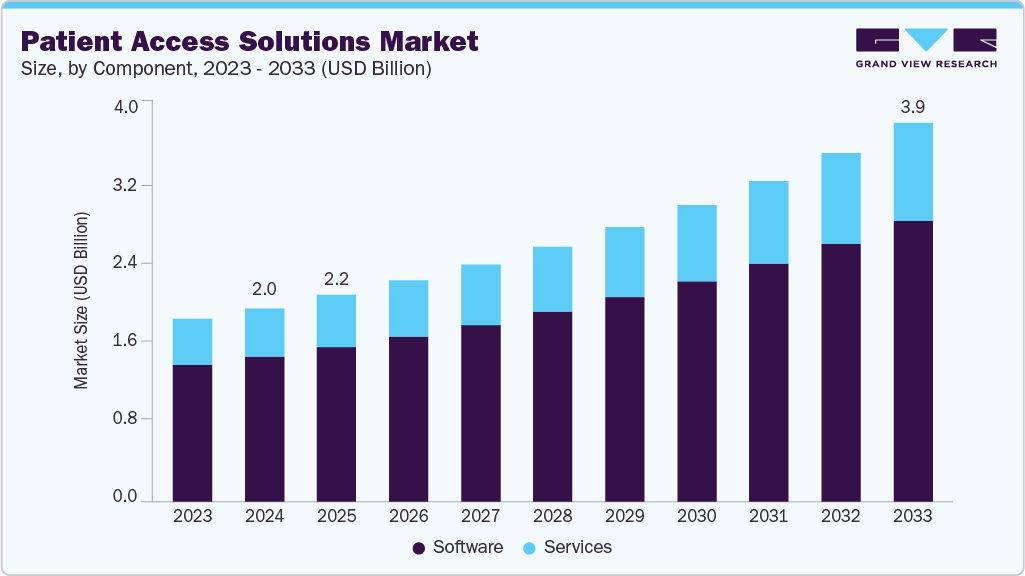

The global patient access solutions market size was estimated at USD 2.04 billion in 2024 and is projected to reach USD 3.97 billion by 2033, growing at a CAGR of 7.8% from 2025 to 2033. This growth is attributed to rising claim denials due to front-end errors, increasing complexity of insurance verification & prior authorizations, growing shift toward digital patient engagement, and rise in telehealth and virtual care requiring digital access solutions.

Key Market Trends & Insights

- North America dominated the global patient access solutions market with a share of 44.18% in 2024.

- Asia Pacific is estimated to be the fastest-growing region over the forecast period.

- By component, the software segment held the largest market share of 74.84% in 2024.

- By type, the integrated segment held the largest revenue share in the patient access solutions market in 2024.

- By deployment mode, the integrated segment held the largest revenue share in the patient access solutions market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.04 Billion

- 2033 Projected Market Size: USD 3.97 Billion

- CAGR (2025-2033): 7.84%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The global patient access solutions market is driven by increasing challenges in claim denials, reimbursement delays, and declining confidence in revenue cycle technologies. According to Experian Health’s 2024 survey:-

Almost 3 out of 4 providers report that claim denials are increasing (up from 43% in 2022).

-

77% of providers note more frequent payer policy changes (up from 67% in 2022).

-

67% of providers report longer reimbursement timelines (up from 51% in 2022).

-

55% of providers see rising claim errors (up from 43% in 2022).

These trends highlight the mounting administrative burden and financial uncertainty, driving demand for advanced patient access solutions that automate eligibility verification, prior authorization, and claims processing to reduce denials and strengthen reimbursement confidence.

Insurance verification and prior authorizations have become increasingly burdensome as payers implement frequent policy changes, introduce complex benefit structures, and enforce stricter documentation requirements. Providers often struggle with manual eligibility checks and lengthy prior authorization processes, which can delay patient care, frustrate patients, and raise the likelihood of claim denials if requirements are missed. Patient access solutions help overcome these challenges by automating eligibility verification, providing real-time integration with payer databases, and streamlining prior authorization workflows.

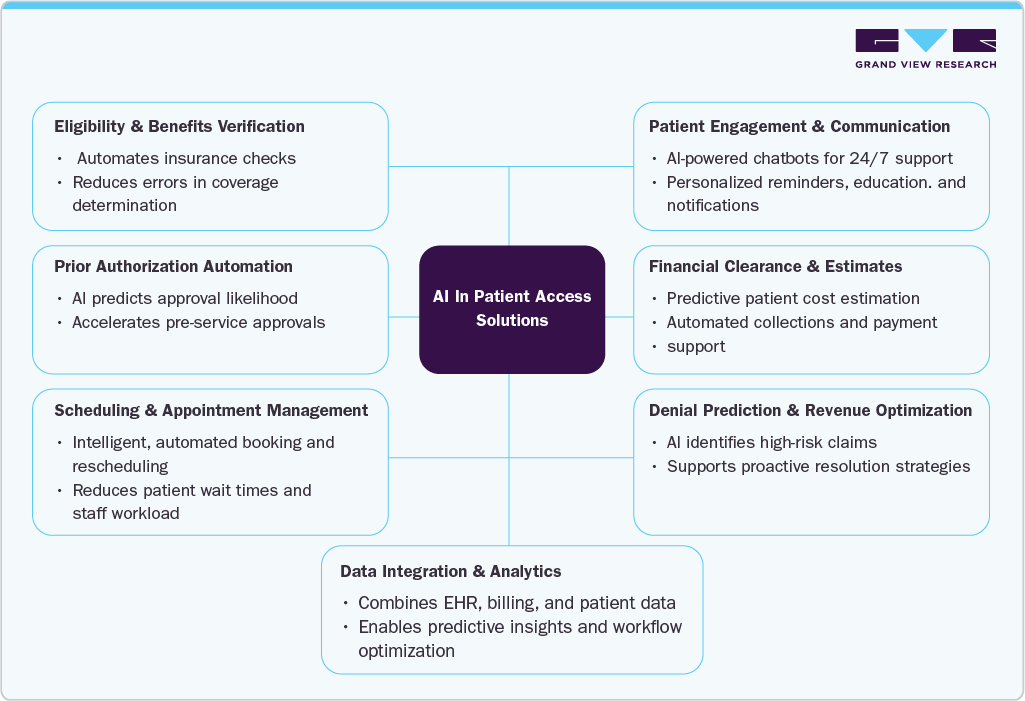

Integration of AI in Patient Access Solutions

AI increasingly transforms patient access solutions by automating critical front-end processes such as eligibility verification, prior authorizations, patient registration, and denial prediction. These technologies accelerate approvals, reduce claim denials, and improve overall revenue cycle efficiency by minimizing manual errors and ensuring accurate, real-time verification.

Some of the leading patient access solutions provides are leveraging AI and automation to streamline workflows, enhance patient engagement, and optimize revenue cycles. The table below highlights key AI-driven capabilities of major market players.

Vendor

AI in Patient Access Features

AI/Automation Capabilities

Infinx

Automates eligibility checks, prior authorizations, patient pay estimates, and insurance discovery

AI agents, OCR document capture, predictive denial analytics.

AGS Health

AI-enabled eligibility, benefits verification, prior authorizations, pre-service collections

Intelligent Authorization, NLP, predictive analytics, hybrid AI + human oversight

IKS Health

Patient access workflows, denial prediction, pre-visit summaries, financial clearance

Generative AI with human-in-the-loop, unified data analytics platform

Persistent Systems

Personalized patient interactions, 24/7 AI-powered chat support, predictive resource allocation

Generative AI, predictive analytics, intelligent automation, integration with EMR systems

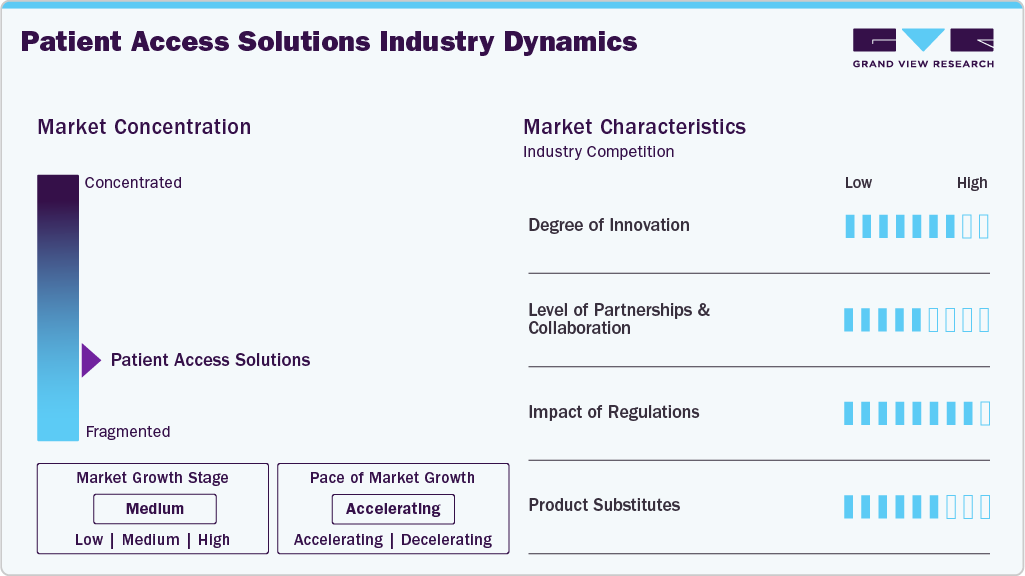

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the patient access solutions market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, moderate growth was observed in regional expansion.

The degree of innovation in the patient access solutions market is high, driven by the need to reduce claim denials, streamline workflows, and enhance patient engagement. Vendors are rolling out AI-powered platforms that automate eligibility checks, prior authorizations, and digital scheduling, helping providers cut delays and improve accuracy. For instance, in July 2025, Innovaccer launched Comet, an AI-powered Access Center solution offering 24/7 omnichannel AI agents and intelligent staff augmentation to streamline patient access, reduce call times by up to 38%, automate over 70% of interactions, and boost appointment conversions by 30%.

“Comet is not a chatbot upgrade. It’s the beginning of a new era in healthcare access, an intelligent front door where every interaction is valued and served, and every patient feels seen.

- Abhinav Shashank, cofounder and CEO at Innovaccer.

The level of partnerships and collaborations in the patient access solutions market is moderate, focusing on improving care access and patient experience. Vendors collaborate with health systems and technology providers to expand interoperability and integrate AI-driven tools. For instance, In May 2025, Omilia and SpinSci Technologies partnered to deliver an AI-powered, EHR-integrated self-service solution that enables patients to manage appointments, refill prescriptions, and follow up on labs via phone, web, or mobilecutting costs, reducing call center load, and enhancing patient access

Regulations have a high impact on shaping the patient access solutions market, as compliance with HIPAA, the No Surprises Act, and CMS interoperability rules requires providers to ensure secure data exchange, accurate cost transparency, and timely patient access to care. These mandates drive adoption of digital tools that streamline eligibility checks, price estimates, and prior authorizations, but also increase vendor responsibility for data security and integration, making regulatory compliance both a growth driver and a challenge for the market.

The patient access solutions market is expanding across regions, driven by the rising need to improve care coordination, reduce claim denials, and enhance patient convenience. Growth is supported by the adoption of digital scheduling, AI-driven eligibility checks, automated prior authorization tools, and increasing investments in healthcare IT infrastructure.

Case Study: Enhancing Patient Access and Experience for a Large Midwestern Health System

Organization Profile

One of the largest kidney care providers in the U.S., managing a large patient base with complex, long-term care needs.

Challenges

The organization faced difficulties in:

-

Managing large patient volumes with complex care journeys.

-

Lack of a unified patient view, leading to inefficiencies in case handling.

-

Limited collaboration between care teams and patients, causing delays in care delivery.

-

Insufficient integration across internal systems, which hindered comprehensive reporting and care transitions

Solution

Persistent implemented its Patient Access Services Solution, enabling:

-

A 360-degree Health Console view of each patient, improving case visibility.

-

Seamless collaboration tools for real-time engagement between patients and care teams.

-

Robust system integrations that unified data from disparate internal sources.

-

Advanced reporting capabilities for managerial insights and transitional care planning.

Results

-

Efficient patient case handling, reducing delays in care coordination.

-

Stronger care team-patient collaboration, resulting in more timely and focused interventions.

-

Data-driven decision making, enabled by detailed managerial and transitional reporting.

-

Enhanced ability to manage large patient populations with improved quality of care.

Component Insights

The software segment held the largest market share of 74.84% in 2024, driven by a wide range of core functionalities provided by software, such as automated eligibility checks, prior authorization management, appointment scheduling, insurance verification, patient registration, and denial prediction tools. The availability of cloud-based, AI-enabled, and interoperable solutions further supports their adoption. For instance, in April 2024, Innovaccer launched its AI-powered Healthcare Experience Platform, designed to deliver a holistic consumer experience by improving interoperability and enabling seamless, patient-centered interactions.

However, the services segment is expected to grow at the fastest rate during the forecast period. This growth is driven by the rising demand for implementation, integration, training, and ongoing support services that ensure the effective deployment of patient access solutions. As healthcare providers increasingly adopt advanced digital platforms, they rely on service providers to manage system customization, workflow optimization, compliance, and maintenance.

Type Insights

The integrated segment held the largest revenue share of 78.60% in 2024. Healthcare providers increasingly prefer solutions that provide diverse features such as eligibility verification, prior authorization, scheduling, billing, and patient engagement within a single platform. In addition, the integrated solutions reduce the need for multiple vendors, minimize data silos, and ensure smoother interoperability with EHRs and other healthcare IT systems, ultimately improving efficiency and delivering a more seamless experience for both providers and patients.

In addition, this segment is expected to register the fastest CAGR during the forecast period in the patient access solutions market. Integrated platforms allow providers to improve care coordination, ensure regulatory compliance, and gain real-time insights from consolidated data. The shift toward value-based care models and the demand for cost efficiency are accelerating the adoption of integrated solutions.

Deployment Mode Insights

The cloud-based segment held a large revenue share in 2024 and is expected to grow at the fastest CAGR during the forecast period. The large market share is attributed to advantages such as scalability, cost efficiency, and ease of deployment. Cloud platforms enable real-time data access from any location, which supports remote patient engagement and telehealth integration. In addition, market players are increasingly focusing on developing cloud-based platforms, further supporting the segment's growth.

For instance, in October 2024, Oracle introduced two cloud applications Oracle Health Patient Portal and Oracle Health Patient Administration that empower patients to securely manage their healthcare and reduce administrative tasks for staff. These integrated tools enable patients to review health records, schedule appointments, and share information while simplifying front desk operations with guided workflows and self-service options.

The on-premise segment is expected to grow steadily over the forecast period, driven by providers prioritizing greater control over data and security, workflow customization, strict regulatory compliance, and leveraging existing IT infrastructure investments.

Functionality Insights

The eligibility verification & coverage discovery held the dominant market share in 2024. Eligibility verification & coverage discovery serves as the foundational step in the healthcare revenue cycle, by accurately verifying a patient’s insurance coverage before services are provided, it prevents claim denials, reduces administrative burdens, and ensures timely reimbursement. Moreover, the necessity of eligibility verification & coverage discovery across hospitals, clinics, and specialty care settings, combined with seamless integration with EHR and billing systems contributes to the large segment share.

The prior authorization automation segment is expected to grow at the fastest CAGR during the forecast period, as it automates the time-consuming process of obtaining insurer approvals for treatments and medications. In addition, features such as real-time eligibility checks, automated submission of authorization requests, status tracking, and integration with EHR systems streamline workflows, reduce administrative burden, minimize errors, and accelerate reimbursement contributes to the growth of the segment.

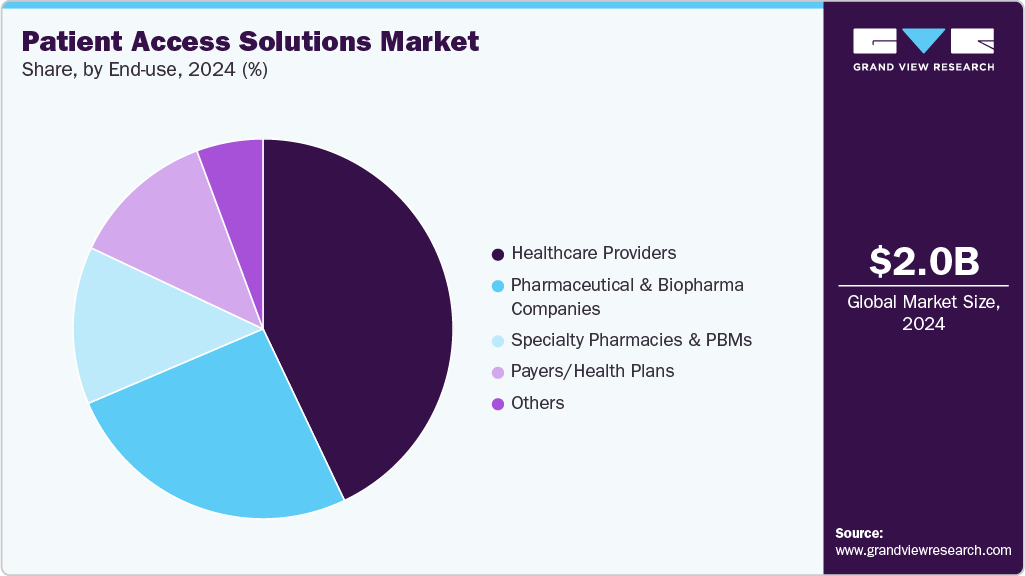

End Use Insights

The healthcare providers held the dominant market share in 2024. The hospitals, clinics, and specialty centers increasingly relied on these platforms to manage high patient volumes, streamline scheduling and prior authorizations, reduce claim denials, and improve front-end revenue cycle efficiency. The growing emphasis on enhancing patient experience and operational efficiency further strengthened adoption among providers.

The pharmaceutical & biopharma companies segment expected to witness the fastest growth over the forecast period, driven by the increasing complexity and high cost of specialty therapies. These companies implement patient access solutions to automate prior authorizations, coordinate with payers, manage patient support programs, and monitor therapy adherence, ensuring timely treatment initiation and continuity.

Regional Insights

North America Patient Access Solutions Market dominated the global market with a share of 44.18% in 2024. Advanced healthcare IT infrastructure, high claim denial rates, and a strong regulatory focus on cost transparency and interoperability support the market's growth. The No Surprises Act and CMS interoperability rules in the U.S. are accelerating the adoption of digital tools for eligibility checks, prior authorizations, and real-time scheduling. However, rising payer complexity and fragmented systems remain challenges across the region.

U.S. Patient Access Solutions Market Trends

Patient access solutions market in the U.S. is driven by the need to reduce administrative waste and accelerate clinical throughput. Automation of eligibility checks and prior authorizations has become a key focus, as these tasks often delay care and contribute to clinician burnout. According to a 2024 AMA survey, physicians' practices complete an average of 39 prior authorization requests per week, with each physician and their staff spending approximately 13 hours weekly on these tasks. These inefficiencies have fueled the adoption of patient access solutions that streamline workflows, minimize manual errors, and accelerate approvals, enabling providers to focus more on patient care while improving operational efficiency.

Europe Patient Access Solutions Market Trends

Patient access solutions market in Europe is driven by government initiatives such as the European Health Data Space (EHDS), which promotes enhanced interoperability, secure data sharing, and cross-border patient access. Countries such as Germany and France are expanding reimbursement frameworks for digital health tools, creating opportunities for vendors offering scheduling, eligibility, and patient engagement platforms. However, differing national regulations and strict GDPR compliance requirements can slow uniform adoption, making integration and security capabilities critical for success in this region.

Patient access solutions market in the UK is driven by efforts taken by the NHS to cut waiting lists and improve care access, driving demand for digital tools that streamline scheduling, referrals, and patient engagement. For instance, in January 2025, the NHS launched a national plan that enables direct GP referrals and same day diagnostics to help nine in ten patients receive routine care within 18 weeks. Such reforms create strong opportunities for digital health vendors. However, limited budgets and complex procurement processes remain barriers to large-scale adoption.

Germany patient access solutions market is driven bygovernment policies and digital health initiatives. The Digital Act (DigiG, 2024) allows reimbursement for approved digital health tools, while the DiGA pathway encourages the adoption of regulated digital applications. Such initiatives promote digital transformation in healthcare, reduce administrative inefficiencies, and enhance the overall patient experience, driving broader adoption of patient access solutions in the country.

Asia Pacific Patient Access Solutions Market Trends

The Asia Pacific Patient Access Solutions market is driven by increasing digital health adoption, mobile-first patient engagement, and government initiatives aimed at improving healthcare access and efficiency. Rising investments in healthcare IT infrastructure, along with the growing emphasis on telehealth and remote patient services, are fueling the adoption of automated scheduling, eligibility checks, and patient registration solutions. For instance, India’s Ayushman Bharat Digital Mission (ABDM) is creating an integrated digital health ecosystem that enables patients and providers to access healthcare services seamlessly, highlighting the impact of government-led digital initiatives on market growth.

Japan patient access solutions market is growing due togovernment-led digital health initiatives, rising adoption of electronic medical records, and increasing demand for efficient patient intake and scheduling systems. The Ministry of Health, Labour and Welfare’s support for digital health programs, rising investments in hospital IT modernization, and the need for integrated platforms that streamline patient registration, appointment management, and engagement across healthcare facilities further support the adoption of patient access solutions.

Patient access solutions market in China is driven by the rapid expansion of telemedicine, growing platform-based healthcare services, and increasing government support for digital health. In addition, the rise of online appointment booking and registration, integration of patient-facing digital platforms, and the need to improve access to care in urban and rural areas, all supported by ongoing investments in digitalization of healthcare infrastructure and policy initiatives promoting digital adoption.

Latin America Patient Access Solutions Market Trends

Patient access solutions market in Latin America, is driven by increasing healthcare digitalization, rising patient awareness of digital care options, and the expansion of private and public telemedicine programs. Furthermore, the adoption of mobile health platforms, implementation of virtual triage and remote consultation services, and growing investments in regional healthcare infrastructure to improve efficiency and accessibility positively impacted the patient access solutions market in Latin America.

Middle East & Africa Patient Access Solutions Market Trends

Patient access solutions market in Middle East & Africa, is driven by increasing government investment in digital health initiatives, rising adoption of mobile and cloud-based healthcare platforms, and growing demand for efficient patient management. In addition, national strategies such as Saudi Arabia’s Vision 2030 health sector transformation program and the UAE’s digital health initiatives, operational efficiency, and patient experience.

Key Patient Access Solutions Company Insights

Key players in the patient access solutions market are adopting innovative strategies, offering AI-powered eligibility checks, automated prior authorizations, digital scheduling, and patient engagement platforms to enhance operational efficiency and patient experience. Integration of interoperable healthcare IT systems, telehealth capabilities, and partnerships with hospitals, clinics, and payer networks are further driving adoption and expanding market reach.

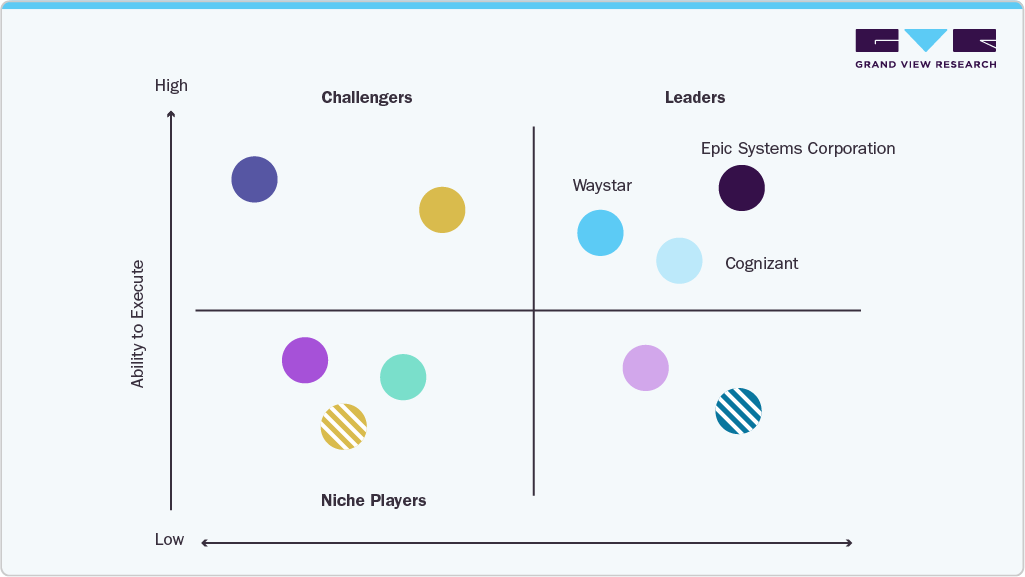

Company Evaluation Matrix Analysis

Key Patient Access Solutions Companies:

The following are the leading companies in the patient access solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Epic Systems Corporation

- AGS Health LLC

- IKS Health

- Persistent Systems

- Experian Information Solutions, Inc.

- FinThrive

- Oracle

- PRIA Healthcare

- GeneDx, LLC

- Quadax, Inc.

- Cognizant

- R1

- Waystar

- Conifer Health Solutions

- Infinx Healthcare

- Engage

- Annexus Health

- Conduent Incorporated

- Call 4 Health

Recent Developments

-

In March 2025, Relatient launched Dash Direct, an intelligent, open scheduling API platform that automates patient appointment booking, rescheduling, and cancellations across multiple digital channels, reducing manual workload and improving patient access and convenience while integrating with diverse healthcare technologies.

“We hear all the time from our clients that the simplest appointment and administrative tasks collectively take up most of their staff’s time. Dash Direct opens a new toolkit, enabling healthcare organizations to solve that problem through better interoperability across every point of patient access.”

- Jeff Gartland, CEO of Relatient.

-

in August 2024, SoundHound AI partnered with MUSC Health to deploy an AI agent (“Emily”) using its Amelia Patient Engagement solution, which integrates with Epic, to allow patients to manage appointments and get non-clinical questions answered 24/7.

-

In June 2024, Infinx Healthcare launched Intelligent Payer Mapping within its Patient Access Plus suite, using AI and machine learning to standardize payer data, streamline eligibility checks, prior authorizations, and claims processing, reducing manual effort and errors while boosting automation accuracy and efficiency in healthcare revenue cycle management.

“Healthcare providers frequently face the challenge of disparate systems and varied payer names that complicate data processing for eligibility or prior authorization requests. Our Intelligent Payer Mapping capability not only reduces the time and potential for error in mapping these payers but also enhances the overall accuracy and efficiency of the automation processes we support.”

- Aakarsh Sethi, Principal Product Manager at Infinx.

https://www.newswire.com/news/infinx-launches-intelligent-payer-mapping-within-its-patient-access-22360102

-

In July 2023, Inizio Engage Launched Patient Access Services, an integrated suite supporting patients, care partners, and healthcare providers in specialty and rare diseases by offering education, prior authorization assistance, reimbursement management, and clinical support through a unified platform to enhance treatment adherence and health outcomes.

“The launch of Patient Access Services is a significant advancement in the capabilities we offer to support their patients on their treatment journey. Partnering education and financial services behind a single point of contact will reduce friction for patients, HCPs and their care partners and improve health outcomes.”

-Greg Flynn, CEO of Inizio Engage

Patient Access Solutions Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.17 billion

Revenue forecast in 2033

USD 3.97 billion

Growth rate

CAGR of 7.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Market Value in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, functionality, deployment mode, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Epic Systems Corporation; AGS Health LLC; IKS Health; Persistent Systems; Experian Information Solutions, Inc.; FinThrive; Oracle; PRIA Healthcare; GeneDx LLC; Quadax, Inc.; Cognizant; R1; Waystar; Conifer Health Solutions; Infinx Healthcare; Engage; Annexus Health; Conduent Incorporated; Call 4 Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Access Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global patient access solutions market report based on component, type, deployment mode, functionality, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

Implementation & integration (EHR + payer interfaces)

-

Managed patient access services (outsourced scheduling/registration)

-

Patient access hubs (benefit verification / financial assistance / prior auth)

-

Others

-

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Integrated

-

Standalone

-

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Premise

-

Web-Based

-

Cloud Based

-

-

Functionality Outlook (Revenue, USD Million, 2021 - 2033)

-

Scheduling & registration tools

-

Eligibility verification & coverage discovery

-

Prior authorization automation

-

Patient cost estimation & financial counseling tools

-

Patient portals & communication systems

-

Patient Assistance Programs (PAPs) & Co-pay Assistance

-

Benefits Investigation & Reimbursement Support

-

Specialty Drug Prior Authorization & Enrollment Support

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare Providers

-

Pharmaceutical & Biopharma Companies

-

Specialty Pharmacies & PBMs

-

Payers/Health Plans

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global patient access solutions market size was estimated at USD 2.04 billion in 2024 and is expected to reach USD 2.17 billion in 2025.

b. The global patient access solutions market is expected to grow at a compound annual growth rate of 7.84% from 2025 to 2033 to reach USD 3.97 billion by 2033.

b. The software segment held the largest market share of 74.84% in 2024, driven by a wide range of core functionalities provided by software, such as automated eligibility checks, prior authorization management, appointment scheduling, insurance verification, patient registration, and denial prediction tools.

b. Some key players operating in the patient access solutions market include Epic Systems Corporation, AGS Health LLC, IKS Health, Persistent Systems, Experian Information Solutions, Inc., FinThrive, Oracle, PRIA Healthcare, GeneDx, LLC, Quadax, Inc., Cognizant, R1, Waystar, Conifer Health Solutions, Infinx, Healthcare, Engage, Annexus Health, Conduent Incorporated, and Call 4 Health .

b. Key factors that are driving the market growth include rising claim denials due to front-end errors, increasing complexity of insurance verification & prior authorizations, growing shift toward digital patient engagement, and rise in telehealth and virtual care requiring digital access solutions

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.