- Home

- »

- Next Generation Technologies

- »

-

Global Payment As A Service Market Size & Share Report, 2030GVR Report cover

![Payment As A Service Market Size, Share & Trends Report]()

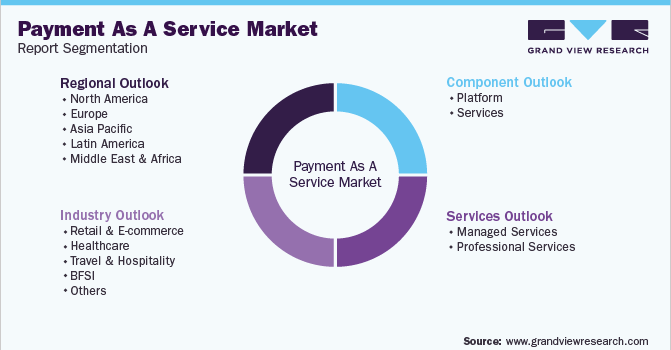

Payment As A Service Market Size, Share & Trends Analysis Report By Component (Platform, Services), By Services (Managed Services, Professional Services), By Industry, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-589-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global payment as a service market size was valued at USD 13.88 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 15.2% from 2023 to 2030. Technological advancements and increasing demand for digital payment systems to make online payments are major factors driving the growth. COVID-19 has also changed the way consumers and businesses buy and pay for goods and services. While banks dominate the payments market space, the role of Payment as a Service (PaaS) with a range of business models continues to gain prominence. At the same time, the adoption of artificial intelligence and machine learning technologies in payment systems is further expected to contribute to the market’s growth.

Initiatives being taken across various countries to encourage digital and online transactions are expected to drive the industry’s growth. Additionally, the introduction of payment networks such as Mastercard, Visa, and Rupay across the globe for processing seamless payments for customers is also expected to contribute to the growth of the PaaS market. Furthermore, PaaS offers services like issuing e-money, merchant financing, virtual assets, and a much more comprehensive set of activities other than providing payment gateways and solutions. Such factors are anticipated to create lucrative growth opportunities for the industry over the forecast period.

The rising usage of cloud-based payment solutions contributes significantly to market growth. The demand for cloud deployment of payment solutions is expected to rise significantly over the forecast period, as hosted or cloud deployment allows users to easily access data from any location. Cloud deployment also eliminates the need to upgrade the software at frequent intervals. Physical servers are associated with high operating costs and provide business services at a reduced rate. Therefore, using a cloud-based services model helps businesses resolve these optimization issues. Hence shift from on-premise to cloud is leading to the development of omnichannel solutions and e-wallets, thus contributing to the growth.

Retailers across the globe are also focused on adopting digital payment technology to provide a more seamless shopping experience to customers owing to the growth of the e-commerce industry. For instance, according to the statistics of BigCommerce Pty. Ltd, an e-commerce platform, e-commerce industry would make up to 22% of the global retail sales by 2023, which in turn, would provide more growth opportunities for the PaaS market.

Additionally, the rise in online purchases by consumers is mainly due to the increased usage of smartphones for mobile shopping, online marketplaces, and usage of social media. Digital payment solution providers are also focused on enhancing the security and services of payments. This is often made through modes such as smartphones and bank cards. Integrating artificial intelligence and blockchain technology promises many new opportunities in this arena.

The introduction of digital banking, mobile banking, and digital wallets is also expected to contribute to the growth of the market. Mobile wallets can benefit retailers by easing the payment-making process, reducing the checkout time, and eliminating the hassles associated with handling cards. Virtual payment services are likely to be affected by ongoing global developments to address challenges in cross-border payments to a certain extent over the period.

Some of the cross-border challenges are high costs, limited access, and insufficient transparency. Furthermore, governments of numerous countries are focusing on developing governmental forums, which are expected to overcome the resistance formed by these challenges. For instance, in July 2020, the G20 made developing cross-border payments its priority during the 2020 summit, focusing on coordinating supervisory, regulatory, and oversight approaches.

COVID-19 Impact Analysis

The pandemic has further boosted the trend of digital payments. Consumers have shown a certain degree of shift in using traditional payment methods since the pandemic hit. This was partially driven due to concerns such as potential coronavirus transmission through cash transactions. The scenario has boosted the uptake of contactless payments to minimize the number of touchpoints at the point of sales. Factors like shelter-in-place requirements and public restrictions have contributed significantly to the traditional payment shift. The market landscape became competitive post-pandemic outbreak and presents many opportunities over the forecast period.

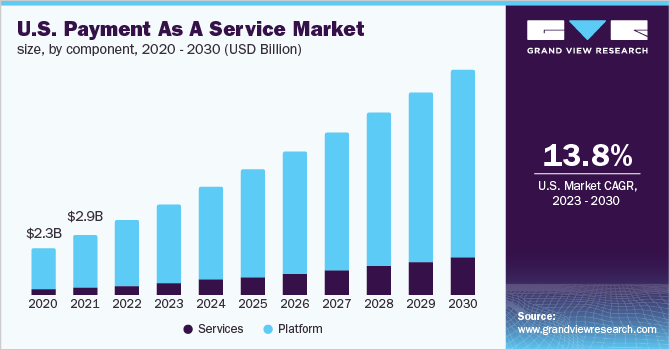

Component Insights

The platform segment dominated the market in 2022 with more than 80.0% of the global revenue. The ability of the payment platforms to help protect the consumer's sensitive payment information is a major factor driving the growth of the segment. With the evolving customer-centric model, businesses are more concerned about improving their services and are establishing digital platforms to increase sales.

Payment platforms offer vendors a variety of services other than transaction services. These services include merchant financing, consumer financing, multiple payment gateways, data fraud detection, and regulatory compliances, which assist the vendors' need to increase the reach of their businesses. Thus, several advantages are associated with this segment, providing several growth opportunities for the segment growth.

The services segment is anticipated to witness significant growth over the forecast period. The segment growth can be attributed to the ability of services to enhance customer experience and additional requirements of consumers. These services are crucial because of their direct association with the enhancement of the consumer experience. Thus, the industry does not have leeway, and hence, cannot afford to compromise on this factor. Moreover, all pre and post-deployment solutions are directed with the assistance of these services, thereby contributing to the growth of the segment.

Services Insights

The professional services segment accounted for the largest revenue share of more than 68.0% in 2022. Increasing adoption of professional services globally to offer API-based services for digital payments is a major factor driving the growth of the segment. These services help businesses make online payments easy, comply with multiple tax requirements, assure payment safety and security, self-service accounts, and track financial performance, among others. Hence, adopting professional services has become essential. It continues to influence many businesses worldwide to adopt them, thus, propelling the segment’s growth over the forecast.

The managed services segment is anticipated to witness significant growth over the forecast period. Companies worldwide are finding it difficult nowadays to focus on their core business process while supporting other functions, which highlights the need for managed services. Outsourcing non-core business operations for customer services is a significant factor driving the segment growth. Outsourcing has become a prevalent strategy globally, as it provides effective mechanisms to merchants by reducing operational costs while enabling them to focus more on their core operations.

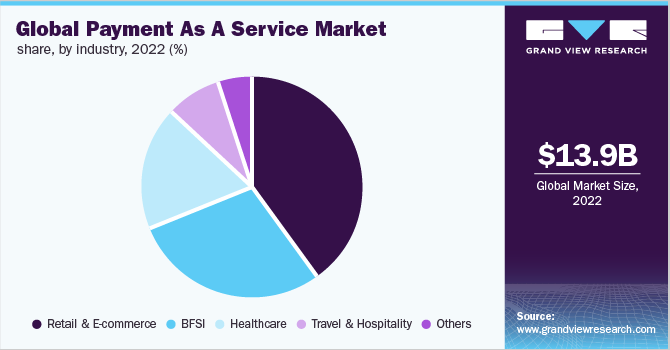

Industry Insights

The retail & e-commerce segment held a dominant revenue share of more than 39.0% in 2022. The rapid increase in online shopping through e-commerce platforms coupled with better internet connectivity is a major factor supporting the growth of the segment. PaaS enables retailers and online vendors to accept payments from customers in numerous methods through digital wallets, internet banking, and credit/debit cards. This helps retailers to increase revenue by offering customers better payment facilities and enhances the customer experience by servicing them with the best prices and offers. Such factors bode well for growth.

The healthcare segment is anticipated to witness significant growth over the forecast period. The introduction of different payment options through PaaS for medical payments drives segment growth. The healthcare segment is different from other industries, as invoices are of large amounts, and people face difficulties while transacting for medical services on an uncertain timeline. Enabling consumers with multiple payment options presents them with easy payments such as credit cards, giving them a time frame of 50 days to settle the bill.

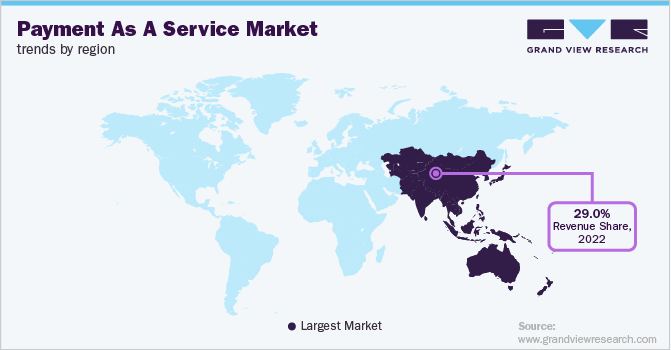

Regional Insights

Asia Pacific dominated the payment as a service market in 2022 and accounted for a share of over 29.0% of the global revenue. The regional growth can be attributed to the initiatives being pursued aggressively by various governments to promote digitization and encourage the adoption of digital payment technology. Continued investments in the e-commerce industry are also expected to contribute to the growth of the regional market. Asia Pacific is home to 50% of the global internet users, with a median age of only 30 years. The way these digitally savvy clients pay for goods and services for their evolving digital experience drives regional growth.

Latin America is expected to witness significant growth over the forecast period. Growth in innovative payment technology adoption and increasing online transactions have led to the high adoption of payment processing solutions across the region, thereby contributing to regional market growth. Additionally, industrial innovations like Buy Now Pay Later (BNPL) and cryptocurrency propel regional market growth. For instance, according to Chainalysis, a blockchain analysis firm, Latin America captured 8-10% of the global cryptocurrency activity in 2022.

Key Companies & Market Share Insights

The market landscape remains fragmented at large. Increasing digitalization has disrupted traditional payment methods and has given rise to business strategies like mergers & acquisitions to consolidate a fragmented industry. For instance, in Feb 2020, Worldline, a French payment service provider, acquired its competitor Ingenico for USD 9.5 billion. Hence, it creates a new heavyweight in the region and enhances its customer base.

The key players have also developed novel concepts & ideas, improved payment techniques, upgraded the current set of products, and enhanced their profitability to sustain the intense competition. Market players have adopted new product development as their key development strategy to cater to the increasing demands of end-users.

Prominent players are innovating their payment network systems to enhance their service experience and increase their customer base. For instance, in June 2022, Mastercard announced the shift of its payment network to Web3 and NFTs integration to enable NFT commerce. This system development eases consumer access with convenience as compared to conventional systems. Through this initiative, Mastercard also expanded its adoption of Web 3 to offer better customer services. Some prominent players in the global payment as a service market include:

-

Agilysys NV LLC.

-

Alpha Fintech

-

Aurus Inc.

-

First American Payment Systems L.P.

-

Fiserv Inc.

-

Ingenico

-

Paysafe Holdings UK Ltd.

-

Pineapple Payments

-

Total System Services LLC.

-

VeriFone, Inc.

Payment As A Service Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.02 billion

Revenue forecast in 2030

USD 45.84 billion

Growth rate

CAGR of 15.2% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, services, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Agilysys NV LLC.; Alpha Fintech; Aurus Inc.; First American Payment Systems L.P.; First Data (Fiserv Inc.); Ingenico; Paysafe Holdings UK Ltd.; Pineapple Payments (Fiserv); Total System Servicess LLC.; VeriFone, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Payment As A Service Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global payment as a service market report based on component, services, industry, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Platform

-

Services

-

-

Services Outlook (Revenue, USD Million, 2017 - 2030)

-

Managed Services

-

Professional Services

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail & E-commerce

-

Healthcare

-

Travel & Hospitality

-

BFSI

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global payment as a service market was estimated at USD 13.88 billion in 2022 and is expected to reach USD 17.02 billion in 2023.

b. The global payment as a service market is expected to witness a compound annual growth rate of 15.2% from 2023 to 2030 reaching USD 45.84 billion by 2030.

b. The Asia Pacific accounted for the largest share of the payment as a service market with the highest share of 29.88% in 2022. The growth of the PaaS market in the Asia Pacific can be attributed to the initiatives being pursued aggressively by various governments to promote digitization and encourage the adoption of digital payment technology.

b. Some key players operating in the payment as a service market include PaySafe, Agilysys Inc., First American Payments Systems, Alpha Fintech, Aurus, Ingenico, First Data (Fiserv Inc.), Pineapple Payments, TSYS (Global Payments Inc.), Verifone.

b. Key factors that are driving the payment as a service market growth include optimized customer experience with quick and secure payment methods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."