- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Pea Protein Market Size, Share And Trends Report, 2030GVR Report cover

![Pea Protein Market Size, Share & Trends Report]()

Pea Protein Market Size, Share & Trends Analysis Report By Product (Isolates, Concentrates), By Form (Dry, Wet), By Source, By Application (Food & Beverages, Animal Feed), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-458-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Pea Protein Market Size & Trends

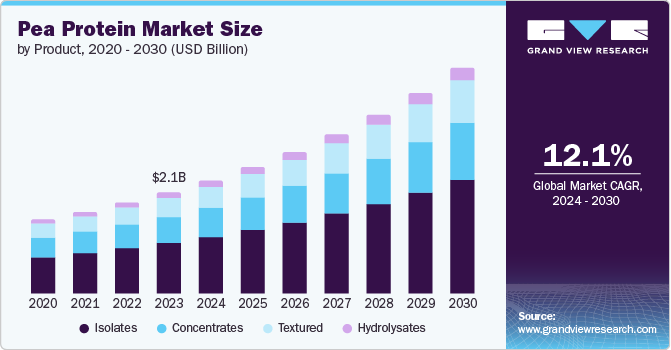

The global pea protein market size was valued at USD 2.12 billion in 2023 and is expected to grow at a CAGR of 12.1% from 2024 to 2030. With increasing awareness about animal agriculture's environmental impact and health concerns associated with meat consumption, more consumers opt for plant-based alternatives. Pea protein, a high-quality protein source, is gaining popularity among vegetarians, vegans, and health-conscious consumers. It is free from common allergens such as soy and gluten, making it a suitable option for people with dietary limitations.

The global rise in vegan and vegetarian lifestyles is significantly reshaping consumer preferences, leading to a surge in demand for plant-based alternatives. Pea protein is a versatile ingredient increasingly used in meat substitutes, from meat substitutes and dairy alternatives to functional foods. The growing number of vegan restaurants, cafes, and product launches catering to this demographic is increasing the demand for pea protein. Additionally, the rising importance of a flexitarian diet due to increasing concerns about the cardiological impacts of red meat consumption and growing awareness regarding the adverse effects of foods containing gluten and lactose drives market growth.

Innovations in food processing technologies have improved pea protein's taste, texture, and functionality, making it more demanding to manufacturers and consumers. These developments have led to its incorporation in a wider range of products, from plant-based meats and dairy alternatives to snacks and baked goods. The ability to customize pea protein formulations to meet specific dietary needs or consumer preferences further drives its market growth. For instance, Danone Canada launched Silk Greek-Style Yogurt, a plant-based yogurt made with pea protein from Canada. It is available in Key Lime and Vanilla flavors with 12 grams of protein per 175g serving.

Product Insights

Isolates segment dominated the market with a revenue share of 49.9% in 2022. Pea protein isolates are rich in essential amino acids, particularly branched-chain amino acids (BCAAs), necessary for muscle growth and recovery. They also contain high levels of iron and are easily digestible, making them a suitable option for health-conscious consumers. The increasing focus on fitness, weight management, and overall wellness increases the demand for high-quality protein sources such as pea protein isolates. Additionally, their benefits for heart health, muscle maintenance, and growth further drive consumer interest.

The textured segment is expected to witness significant growth over the forecast period. Textured pea protein plays a crucial role as a texturing agent in various food products, including meat products, baked goods, and confectionery items. Its fibrous content further enhances its potential application in energy powders and fruit juice mixes. Its versatility, functionality, sustainability, and nutritional profile make it a suitable ingredient for developing meat analogs or extenders.

Form Insights

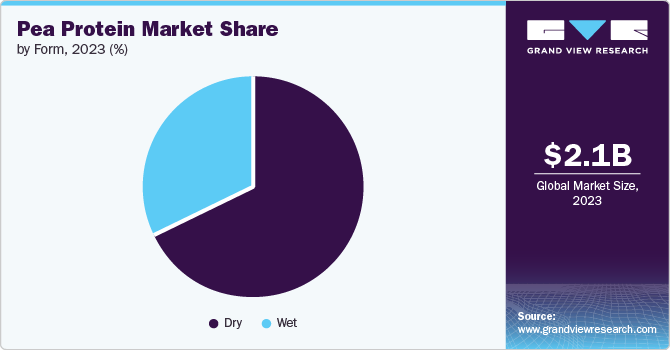

Dry segment accounted for the largest revenue share in 2023. The dry processing methods used to produce pea protein concentrates and isolates produce a more concentrated protein product, making it suitable for manufacturers and consumers seeking efficient protein sources. This stability allows for easy storage and transportation, making it ideal for various applications, including protein powders, snack bars, and meal replacements. The convenience of dry pea protein aligns with the busy lifestyles of modern consumers who seek quick and easy ways to meet their nutritional needs.

The wet segment is expected to witness significant growth over the forecast period. Wet pea protein, available as a paste or slurry, offers convenience for food manufacturers as it is directly incorporated into various food products without rehydration or additional processing. This form is particularly useful in producing plant-based meat analogs, dairy alternatives, and other processed foods where moisture content and consistency are crucial. The ease of integration into manufacturing processes makes wet pea protein convenient for food producers looking to streamline their operations.

Source Insights

The yellow split peas segment accounted for the largest revenue share in 2023. Their high protein content and essential nutrients, including fiber, vitamins, and minerals, make them ideal for pea protein extraction. Additionally, they are widely available, ensuring a consistent supply. Yellow split peas also have favorable functional properties and a neutral flavor, making them versatile for various food applications. Consumer familiarity and acceptance of yellow split peas contribute to their prominence in the market.

Others segment is expected to witness significant growth over the forecast period. The increasing demand for plant-based proteins drives the diversification of protein sources, with chickpeas and lentils emerging as prevalent alternatives in the pea protein market. Consumers are pursuing variety in their plant-based diets, and chickpeas and lentils offer unique nutritional profiles that complement those of peas. This diversification is essential as the market for plant-based proteins continues to grow, with consumers looking for new and innovative ingredients that provide health benefits, sustainability, and versatility.

Application Insights

The food & beverages segment dominated the market in 2023 due to the increasing consumer demand for plant-based and vegetarian/vegan options. Pea protein's functional properties, nutritional benefits, and versatility make it a preferred ingredient for enhancing various food and beverage product's texture, stability, and nutritional profile. Pea proteins offer several functional benefits in bakery applications, including water holding, gelation, and increased browning, particularly in gluten-free applications.

The personal care & cosmetics segment is expected to witness significant growth over the forecast period owing to the rising demand for natural and plant-based ingredients, vegan and cruelty-free product preferences, and the skin and hair benefits pea protein offers. Consumers increasingly seek natural and plant-based ingredients in their personal care and cosmetics. Pea protein, derived from plant sources, fits into the growing clean and sustainable beauty trend. Its natural origin and perceived benefits drive its demand in the market.

Regional Insights & Trends

The North America pea protein market accounted for the largest revenue share of 33.1% in 2023. Major regional retailers and food chains have identified the growing demand for plant-based products, leading to increased shelf space and product offerings featuring pea protein. The widespread availability of these products in supermarkets, health food stores, and online platforms has made it convenient for consumers to access and try pea protein-based products. Additionally, the food service industry, including restaurants, cafes, and fast-food chains, increasingly offers plant-based options to cater to consumers' growing preferences, further boosting the demand for pea protein.

U.S. Pea Protein Market Trends

The U.S. pea protein market accounted for the largest revenue share in 2023. Consumers are becoming more aware of the potential health benefits of plant-based proteins, such as improved cardiovascular health, better weight management, and reduced risk of chronic diseases. Pea protein is considered a healthier alternative to animal-based proteins, as it is low in fat, cholesterol-free, and rich in essential amino acids. Additionally, pea protein is hypoallergenic, making it suitable for people with allergies or sensitivities to common proteins such as dairy, soy, or gluten. The growing focus on health and wellness increases the demand for pea protein.

Asia Pacific Pea Protein Market Trends

Asia Pacific pea protein market is expected to witness the fastest CAGR over the forecast period. Consumers in the region are increasingly shifting towards vegetarian, vegan, and flexitarian lifestyles, driven by health concerns, environmental awareness, and ethical considerations. This shift is rising in urban areas where awareness of plant-based nutrition is higher, and the availability of plant-based products is more extensive, resulting in increasing demand for alternative protein sources such as pea protein. The popularity of plant-based diets has led to an increase in product launches featuring pea protein, including meat substitutes, dairy alternatives, and protein supplements, fueling market growth.

The China pea protein market accounted for the largest revenue share in 2023. With the increasing focus on fitness and lifestyles, a growing demand for high-quality protein sources supports muscle growth, recovery, and overall performance. The demand for pea protein is rising due to its high content of branched-chain amino acids, which are essential for muscle repair and growth. Additionally, pea protein is easily digestible, making it a preferred choice for athletes and fitness enthusiasts looking for alternative protein sources such as whey or soy. The expanding range of sports nutrition products that feature pea protein, including protein powders, shakes, and bars, contributes to market growth.

Europe Pea Protein Market Trends

The Europe pea protein market is expected to witness significant growth over the forecast period. High-profile celebrities, athletes, and influencers promoting plant-based diets and fitness routines influence consumer choices and increase the visibility of pea protein products. Documentaries and social media campaigns emphasizing plant-based diet's health benefits and environmental impact also contribute to the growing demand for pea protein. This increased visibility is expanding plant-based consumption and encouraging more consumers to try pea protein products, contributing to the overall market growth.

The UK pea protein market accounted for the largest revenue share in 2023. The food service industry in the UK is increasingly incorporating plant-based options into its menus to cater to the rising demand for healthier, sustainable, and allergen-friendly foods. Restaurants, fast-food chains, and cafes are introducing pea protein-based dishes, such as plant-based burgers, bowls, and smoothies, for health-conscious diners and those with dietary restrictions. This trend is rising in metropolitan areas with high consumer awareness of plant-based nutrition. The food service sector's adoption of pea protein is driving growth in the market.

Key Pea Protein Company Insights

Key players in pea protein market include Nutri-Pea, The Scoular Company, Roquette Frères, Axiom Foods, Inc., and others

-

Nutri-Pea specializes in the production of high-quality pea protein and other pea-derived ingredients. Its food applications include health foods, sports nutrition, plant-based meal Replacements, dairy Replacements, baked goods, meat, and seafood. Its product offerings include Propulse Pea Protein, Centara Pea Hull Fiber, Accu-Gel Pea Starch, Uptake 80 Pea Cell Wall Fiber, and others.

-

The Scoular Company is a prominent player in the global agriculture industry. Focusing on connecting farmers, processors, and end-users, Scoular operates across various sectors, including grain trading, feed and food ingredient supply, and logistics. It provides grains and seeds, food ingredients, pet food ingredients, and animal food ingredients.

Key Pea Protein Companies:

The following are the leading companies in the pea protein market. These companies collectively hold the largest market share and dictate industry trends.

- Burcon

- Roquette Frères

- The Scoular Company

- DuPont

- COSUCRA.

- Nutri-Pea

- Shandong Jianyuan Group

- SOTEXPRO

- Ingredion.

- Axiom Foods, Inc.

- FENCHEM

- Martin & Pleasance

- The Green Labs LLC.

Recent Developments

-

In March 2023, Nepra Foods announced a manufacturing & distribution partnership with Scoular for specialized plant-based products. Under this agreement, Nepra provides its R&D team with the development of new products, with specialty ingredients from both companies involved. Scoular further promotes Nepra’s products through its strong supply chain network

-

In January 2023, Roquette announced a significant investment in the Japan-based food tech startup DAIZ Inc. DAIZ specializes in developing technologies and processes to improve plant-based food's texture, flavor, and nutritional profile. DAIZ's proprietary germination technology, the Ochiai Germination Method JP-5795679, was initially developed for soy and recently expanded to peas.

-

In July 2024, Ingredion Incorporated announced the launch of Vitessence Pea 100 HD, a new pea protein enhanced for cold-pressed bars for the Canada and U.S. markets. It delivers softness throughout the shelf life of cold-pressed bars.

Pea Protein Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.37 billion

Revenue forecast in 2030

USD 4.71 billion

Growth Rate

CAGR of 12.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, source, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Neatherlands, Japan, China, India, Australia & New Zealand, South Korea, Brazil, Argentina, and South Africa

Key companies profiled

Burcon, Roquette Frères, The Scoular Company, DuPont, COSUCRA., Nutri-Pea, Shandong Jianyuan Group, SOTEXPRO, Ingredion., Axiom Foods, Inc., FENCHEM, Martin & Pleasance, The Green Labs LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pea Protein Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the pea protein market report based product, form, source, application, and region.

-

Product Outlook (Revenue, USD Million, Metric Tons, 2018 - 2030)

-

Isolates

-

Concentrates

-

Textured

-

Hydrolysates

-

-

Form Outlook (Revenue, USD Million, Metric Tons, 2018 - 2030)

-

Dry

-

Wet

-

-

Source Outlook (Revenue, USD Million, Metric Tons, 2018 - 2030)

-

Yellow Split Peas

-

Others

-

-

Application Outlook (Revenue, USD Million, Metric Tons, 2018 - 2030)

-

Food & Beverages

-

Meat substitutes

-

Bakery goods

-

Dietary supplements

-

Beverages

-

Others

-

-

Personal Care & Cosmetics

-

Animal Feed

-

Others

-

-

Regional Outlook (Revenue, USD Million, Metric Tons, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pea protein market size was estimated at USD 2.12 billion in 2023 and is expected to reach USD 2.37 billion in 2024.

b. The global pea protein market is expected to grow at a compound annual growth rate of 12.1% from 2024 to 2030 to reach USD 4.71 billion by 2030.

b. The North America region dominated the market with a revenue share of 33.1% in 2023, due to high consumer demand for plant-based products, a strong food and beverage industry, and abundant agricultural supply of yellow split peas.

b. Some of the key market players in the pea protein market are Burcon Nutrascience; Roquette Freres; The Scoular Company; DuPont; Cosucra Groupe Warcoing SA; Nutri-Pea; Shandong Jianyuan Group; Sotexpro SA; Ingredion, Inc.; Axiom Foods, Inc.; Fenchem, Inc.; Martin & Pleasance; The Green Labs LLC, among others.

b. The growth factors such as increasing demand for plant-based protein, health and fitness trends, and the growing vegan and vegetarian population are being projected to augment demand over the forecast period. Furthermore, the versatility of pea protein and its ability to provide functional properties like emulsification, texture enhancement, and foaming have widened its market potential

b. The U.S. pea protein market dominated the North America market in 2023. The large presence of market players such as Burcon, Nutri-Pea, and Roquette, among others have contributed to the increased availability and improved quality of pea protein in the U.S. market.

Table of Contents

Chapter 1 Pea Protein Market: Methodology and Scope

1.1 Market Segmentation & Scope

1.2 Research Methodology

1.3 Assumptions

1.4 InProductation Procurement

1.4.1 Purchased Database

1.4.2 GVR’s Internal Database

1.4.3 Secondary Sources

1.4.4 Third-Party Perspective

1.4.5 Primary Research

1.5 InProductation Analysis & Data Analysis Models

1.6 List of Data Sources

Chapter 2 Pea Protein Market: Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Pea Protein Market: Industry Outlook

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.1.2 Related/Ancillary Market Outlook

3.2 Penetration & Growth Prospect Mapping

3.3 Industry Value Chain Analysis

3.3.1 Raw Material Trends

3.3.2 Manufacturing Trends

3.3.3 Sales Channel Analysis

3.4 Technology Framework

3.5 Market Dynamics

3.5.1 Market Drivers Analysis

3.5.2 Market Restraints Analysis

3.5.3 Market Challenges

3.6 Business Environment Analysis

3.6.1 Porter’s Five Forces Analysis

3.6.2 PESTEL Analysis

3.7 Market Entry Strategies

Chapter 4 Pea Protein Market: Product Estimates & Trend Analysis

4.1 Product Movement Analysis & Market Share, 2022 & 2030

4.2 Pea Protein Market Estimates & Forecast, By Product (Metric Tons, USD Million)

4.3 Isolates

4.4 Concentrates

4.5 Textured

4.6 Hydrolysates

Chapter 5 Pea Protein Market: Form Estimates & Trend Analysis

5.1 Form Movement Analysis & Market Share, 2022 & 2030

5.2 Pea Protein Market Estimates & Forecast, By Form (Metric Tons, USD Million)

5.3 Dry

5.4 Wet

Chapter 6 Pea Protein Market: Source Estimates & Trend Analysis

6.1 Form Movement Analysis & Market Share, 2022 & 2030

6.2 Pea Protein Market Estimates & Forecast, By Form (Metric Tons, USD Million)

6.3 Yellow Split Peas

6.4 Others

Chapter 7 Pea Protein Market: Application Estimates & Trend Analysis

7.1 Application Movement Analysis & Market Share, 2022 & 2030

7.2 Pea Protein Market Estimates & Forecast, By Application (Metric Tons, USD Million)

7.3 Food & Beverages

7.3.1 Meat substitutes

7.3.2 Bakery goods

7.3.3 Dietary supplements

7.3.4 Beverages

7.3.5 Others

7.4 Personal Care & Cosmetics

7.5 Animal Feed

7.6 Others

Chapter 8 Pea Protein Market: Regional Estimates & Trend Analysis

8.1 Global Pea Protein Market: Regional Outlook

8.2 North America

8.2.1 North America Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.2.2 North America Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.2.3 U.S.

8.2.3.1 U.S. Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.2.3.2 U.S. Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.2.4 Canada

8.2.4.1 Canada Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.2.4.2 Canada Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.2.5 Mexico

8.2.5.1 Mexico Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.2.5.2 Mexico Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3 Europe

8.3.1 Europe Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.2 Europe Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.3 Germany

8.3.3.1 Germany Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.3.2 Germany Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.4 UK

8.3.4.1 UK Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.4.2 UK Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.5 France

8.3.5.1 France Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.5.2 France Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.6 Italy

8.3.6.1 Italy Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.6.2 Italy Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.7 Spain

8.3.7.1 Spain Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.7.2 Spain Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.8 Sweden

8.3.8.1 Sweden Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.8.2 Sweden Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.3.9 Netherlands

8.3.9.1 Netherlands Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.3.9.2 Netherlands Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.4 Asia Pacific

8.4.1 Asia Pacific Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.4.2 Asia Pacific Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.4.3 China

8.4.3.1 China Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.4.3.2 China Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.4.4 Japan

8.4.4.1 Japan Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.4.4.2 Japan Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.4.5 India

8.4.5.1 India Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.4.5.2 India Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.4.6 Australia & New Zealand

8.4.6.1 Australia & New Zealand Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.4.6.2 Australia & New Zealand Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.4.7 South Korea

8.4.7.1 South Korea Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.4.7.2 South Korea Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.5 Central & South America

8.5.1 Central & South America Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.5.2 Central & South America Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.5.3 Brazil

8.5.3.1 Brazil Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.5.3.2 Brazil Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.5.4 Argentina

8.5.4.1 Argentina Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.5.4.2 Argentina Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.6 Middle East & Africa

8.6.1 Middle East & Africa Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.6.2 Middle East & Africa Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.6.3 UAE

8.6.3.1 UAE Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.6.3.2 UAE Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

8.6.4 South Africa

8.6.4.1 South Africa Pea Protein Market Estimates & Forecast, 2018 - 2030 (Metric Tons)

8.6.4.2 South Africa Pea Protein Market Estimates & Forecast, 2018 - 2030 (USD Million)

Chapter 9 Competitive Landscape

9.1 Company/Competition Categorization (Key Innovators, Market Leaders, And Emerging Players)

9.2 Participants’ Overview

9.3 Financial Performance

9.4 Product Benchmarking

9.5 Company Market Share Analysis, 2022

9.6 Company Heat Map Analysis, 2022

9.7 Strategy Mapping

List of Tables

Table 1 Pea Protein Market Revenue Estimates and Forecasts, By Product, 2017 - 2030 (Metric Tons)

Table 2 Pea Protein Market Revenue Estimates and Forecasts, By Product, 2017 - 2030 (USD Million)

Table 3 Pea Protein Market Revenue Estimates and Forecasts, By Form, 2017 - 2030 (Metric Tons)

Table 4 Pea Protein Market Revenue Estimates and Forecasts, By Form, 2017 - 2030 (USD Million)

Table 5 Pea Protein Market Revenue Estimates and Forecasts, By Source, 2017 - 2030 (Metric Tons)

Table 6 Pea Protein Market Revenue Estimates and Forecasts, By Source, 2017 - 2030 (USD Million)

Table 7 Pea Protein Market Revenue Estimates and Forecasts, By Application, 2017 - 2030 (Metric Tons)

Table 8 Pea Protein Market Revenue Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

Table 9 Company Market Share, 2022

List of Figures

Fig. 1 Pea protein market segmentation & scope

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Primary research process

Fig. 5 Primary research approaches

Fig. 6 Pea protein market: Market snapshot

Fig. 7 Pea protein market: Segment outlook

Fig. 8 Pea protein market: Competitive Outlook

Fig. 9 Pea protein market: Penetration & growth prospect mapping

Fig. 10 Pea protein market: Value chain analysis

Fig. 11 Pea protein market: Porter’s analysis

Fig. 12 Pea protein market: PESTEL analysis

Fig. 13 Pea protein market, by product: Key takeaways

Fig. 14 Pea protein market, by product: Market share, 2022 & 2030

Fig. 15 Isolates Pea protein market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 16 Isolates Pea protein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 17 Concentrates Pea protein market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 18 Concentrates Pea protein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 19 Textured Pea protein market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 20 Textured Pea protein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 21 Hydrolysates Pea protein market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 22 Hydrolysates Pea protein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 23 Pea protein market, by form: Key takeaways

Fig. 24 Pea protein market, by form: Market share, 2022 & 2030

Fig. 25 Dry Pea protein market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 26 Dry Pea protein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 27 Wet Pea protein market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 28 Wet Pea protein market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 29 Pea protein market, by source: Key takeaways

Fig. 30 Pea protein market, by source: Market share, 2022 & 2030

Fig. 31 Pea protein market estimates & forecasts, by yellow split peas, 2017 - 2030 (Metric Tons)

Fig. 32 Pea protein market estimates & forecasts, by yellow split peas 2017 - 2030 (USD Million)

Fig. 33 Pea protein market estimates & forecasts, by others, 2017 - 2030 (Metric Tons)

Fig. 34 Pea protein market estimates & forecasts, by others, 2017 - 2030 (USD Million)

Fig. 35 Pea protein market, by application: Key takeaways

Fig. 36 Pea protein market, by application: Market share, 2022 & 2030

Fig. 37 Pea protein market estimates & forecasts, by food & beverages, 2017 - 2030 (Metric Tons)

Fig. 38 Pea protein market estimates & forecasts, by food & beverages, 2017 - 2030 (USD Million)

Fig. 39 Pea protein market estimates & forecasts, by meat substitutes, 2017 - 2030 (Metric Tons)

Fig. 40 Pea protein market estimates & forecasts, by meat substitutes, 2017 - 2030 (USD Million)

Fig. 41 Pea protein market estimates & forecasts, by bakery goods, 2017 - 2030 (Metric Tons)

Fig. 42 Pea protein market estimates & forecasts, by bakery goods, 2017 - 2030 (USD Million)

Fig. 43 Pea protein market estimates & forecasts, by dietary supplements, 2017 - 2030 (Metric Tons)

Fig. 44 Pea protein market estimates & forecasts, by dietary supplements, 2017 - 2030 (USD Million)

Fig. 45 Pea protein market estimates & forecasts, by beverages, 2017 - 2030 (Metric Tons)

Fig. 46 Pea protein market estimates & forecasts, by beverages, 2017 - 2030 (USD Million)

Fig. 47 Pea protein market estimates & forecasts, by others, 2017 - 2030 (Metric Tons)

Fig. 48 Pea protein market estimates & forecasts, by others, 2017 - 2030 (USD Million)

Fig. 49 Pea protein market estimates & forecasts, by personal care & cosmetics, 2017 - 2030 (Metric Tons)

Fig. 50 Pea protein market estimates & forecasts, by personal care & cosmetics, 2017 - 2030 (USD Million)

Fig. 51 Pea protein market estimates & forecasts, by animal feed, 2017 - 2030 (Metric Tons)

Fig. 52 Pea protein market estimates & forecasts, by animal feed, 2017 - 2030 (USD Million)

Fig. 53 Pea protein market estimates & forecasts, by others, 2017 - 2030 (Metric Tons)

Fig. 54 Pea protein market estimates & forecasts, by others, 2017 - 2030 (USD Million)

Fig. 55 North America market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 56 North America market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 57 U.S. market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 58 U.S. market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 59 Canada market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 60 Canada market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 61 Mexico market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 62 Mexico market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 63 Europe market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 64 Europe market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 65 Germany market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 66 Germany market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 67 UK market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 68 UK market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 69 France market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 70 France market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 71 Italy market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 72 Italy market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 73 Spain market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 74 Spain market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 75 Sweden market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 76 Sweden market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 77 Netherlands market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 78 Netherlands market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 79 Asia Pacific market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 80 Asia Pacific market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 81 China market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 82 China market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 83 Japan market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 84 Japan market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 85 India market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 86 India market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 87 Australia & New Zealand market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 88 Australia & New Zealand market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 89 South Korea Zealand market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 90 South Korea market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 91 Central & South America market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 92 Central & South America market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 93 Brazil market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 94 Brazil market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 95 Argentina market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 96 Argentina market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 97 Middle East & Africa market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 98 Middle East & Africa market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 99 South Africa market estimates & forecasts, 2017 - 2030 (Metric Tons)

Fig. 100 South Africa market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 101 Pea protein market: Key Company/Competition Categorization

Fig. 102 Pea protein market: Company market share analysis (public companies)

Fig. 103 Company market position analysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Pea Protein Product Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Pea Protein Form Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

- Dry

- Wet

- Pea Protein Source Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

- Yellow Split Peas

- Others

- Pea Protein Application Outlook (Volume, Metric Tons; Revenue, USD Million, 2017 - 2030)

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Pea Protein Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- North America Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- North America Pea Protein Market, by Form

- Dry

- Wet

- North America Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- North America Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- U.S.

- U.S. Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- U.S. Pea Protein Market, by Form

- Dry

- Wet

- U.S. Pea Protein Market, by Source

- Yellow Split Peas

- Others

- U.S. Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- U.S. Pea Protein Market, by Product

- Canada

- Canada Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Canada Pea Protein Market, by Form

- Dry

- Wet

- Canada Pea Protein Market, by Source

- Yellow Split Peas

- Others

- Canada Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Canada Pea Protein Market, by Product

- Mexico

- Mexico Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Mexico Pea Protein Market, by Form

- Dry

- Wet

- Mexico Pea Protein Market, by Source

- Yellow Split Peas

- Others

- Mexico Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- North America Pea Protein Market, by Product

- Europe

- Europe Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Europe Pea Protein Market, by Form

- Dry

- Wet

- Europe Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Europe Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Germany

- Germany Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Germany Pea Protein Market, by Form

- Dry

- Wet

- Germany Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Germany Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Germany Pea Protein Market, by Product

- U.K

- U.K Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- U.K Pea Protein Market, by Form

- Dry

- Wet

- U.K Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- U.K Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- U.K Pea Protein Market, by Product

- France

- France Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- France Pea Protein Market, by Form

- Dry

- Wet

- France Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- France Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- France Pea Protein Market, by Product

- Italy

- Italy Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Italy Pea Protein Market, by Form

- Dry

- Wet

- Italy Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Italy Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Italy Pea Protein Market, by Product

- Spain

- Spain Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Spain Pea Protein Market, by Form

- Dry

- Wet

- Spain Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Spain Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Spain Pea Protein Market, by Product

- Sweden

- Sweden Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Sweden Pea Protein Market, by Form

- Dry

- Wet

- Sweden Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Sweden Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Sweden Pea Protein Market, by Product

- Netherlands

- Netherlands Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Netherlands Pea Protein Market, by Form

- Dry

- Wet

- Netherlands Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Netherlands Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Netherlands Pea Protein Market, by Product

- Europe Pea Protein Market, by Product

- Asia Pacific

- Asia Pacific Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Asia Pacific Pea Protein Market, by Form

- Dry

- Wet

- Asia Pacific Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Asia Pacific Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- China

- China Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- China Pea Protein Market, by Form

- Dry

- Wet

- China Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- China Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- China Pea Protein Market, by Product

- India

- India Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- India Pea Protein Market, by Form

- Dry

- Wet

- India Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- India Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- India Pea Protein Market, by Product

- Japan

- Japan Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Japan Pea Protein Market, by Form

- Dry

- Wet

- Japan Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Japan Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Japan Pea Protein Market, by Product

- Australia & New Zealand

- Australia & New Zealand Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Australia & New Zealand Protein Market, by Form

- Dry

- Wet

- Australia & New Zealand Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Australia & New Zealand Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Australia & New Zealand Pea Protein Market, by Product

- South Korea

- South Korea Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- South Korea Pea Protein Market, by Form

- Dry

- Wet

- South Korea Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- South Korea Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- South Korea Pea Protein Market, by Product

- Asia Pacific Pea Protein Market, by Product

- Central & South America

- Central & South America Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Central & South America Pea Protein Market, by Form

- Dry

- Wet

- Central & South America Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Central & South America Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Brazil

- Brazil Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Brazil Pea Protein Market, by Form

- Dry

- Wet

- Brazil Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Brazil Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Brazil Pea Protein Market, by Product

- Argentina

- Argentina Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Argentina Pea Protein Market, by Form

- Dry

- Wet

- Argentina Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Argentina Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- Argentina Pea Protein Market, by Product

- Central & South America Pea Protein Market, by Product

- Middle East & Africa

- Middle East & Africa Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- Middle East & Africa Pea Protein Market, by Form

- Dry

- Wet

- Middle East & Africa Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- Middle East & Africa Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- South Africa

- South Africa Pea Protein Market, by Product

- Isolates

- Concentrates

- Textured

- Hydrolysates

- South Africa Pea Protein Market, by Form

- Dry

- Wet

- South Africa Pea Protein Market, by Source

- Yellow Split Peas

- Wet

- South Africa Pea Protein Market, by Application

- Food & Beverages

- Meat substitutes

- Bakery goods

- Dietary supplements

- Beverages

- Others

- Personal Care & Cosmetics

- Animal Feed

- Others

- Food & Beverages

- South Africa Pea Protein Market, by Product

- Middle East & Africa Pea Protein Market, by Product

- North America

Pea Protein Market Dynamics

Driver: Growing Preference For High-Protein Diet

The consumption of a high-protein diet among consumers and rising health awareness are estimated to drive market growth. Rising incidences of chronic illnesses due to changing lifestyles and growing fitness trends, particularly among the millennial population are projected to boost protein intake. With increasingly busier lifestyles, consumers are unable to consume a nutritionally rich complete diet regularly, which prompts them to seek nutrients from packaged food products. The competition within packaged food products has increased significantly during the past few years. To outpace the competition, manufacturers are increasingly incorporating functional ingredients into their products to increase the protein content of the product, thereby attracting health-conscious consumers and fitness enthusiasts. These factors are estimated to drive market growth over the forecast period.

Driver: Rising Popularity of Meat Substitutes

Meat substitutes, also known as meat analogs, offer nearly similar aesthetic characteristics such as flavor, texture, and appearance as well as nutritional characteristics as that of traditional meat products. These substitutes are often made from soy-based products such as tofu and tempeh. The growing vegan population globally is anticipated to drive market growth. Moreover, animal cruelty and rising impact of social media regarding veganism are among the few other factors leading to the growth of the vegan population. Processed food manufacturers are increasingly utilizing ingredients that are sourced from plants to cater to the vegan population, which, in turn, is expected to fuel the growth of the pea protein market.

Restraint: High Penetration of Animal Protein Ingredients

The demand for animal protein among consumers is high which is estimated to harm market growth. The animal protein ingredients industry is also strengthened by the presence of dominant market participants, including GELITA AG, Omega Protein Corporation, and Bovogen Biologicals Pty Ltd among others.

What Does This Report Include?

This section will provide insights into the contents included in this pea protein market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Pea protein market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Pea protein market quantitative analysis

-

Market size, estimates, and forecast from 2017 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

Grand View Research employs a comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of the methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For a comprehensive understanding of the market, it is essential to understand the complete value chain, and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia, and trade journals. Technical data is also gathered from an intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development, and pricing trends are fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression, and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, industry experience, and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of the technology landscape, regulatory frameworks, economic outlook, and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restraints, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts, and buyers so as to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation but also provide critical insights into the market, current business scenario, and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market-leading companies

• Raw material suppliers

• Product distributors

• BuyersThe key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight in to the current market and future expectationsData Collection Matrix

Perspective

Primary research

Secondary research

Supply-side

- Manufacturers

- Technology distributors and wholesalers

- Company reports and publications

- Government publications

- Independent investigations

- Economic and demographic data

Demand-side

- End-user surveys

- Consumer surveys

- Mystery shopping

- Case studies

- Reference customers

Industry Analysis MatrixQualitative analysis

Quantitative analysis

- Industry landscape and trends

- Market dynamics and key issues

- Technology landscape

- Market opportunities

- Porter’s analysis and PESTEL analysis

- Competitive landscape and component benchmarking

- Policy and regulatory scenario

- Market revenue estimates and forecast up to 2030

- Market revenue estimates and forecasts up to 2030, by technology

- Market revenue estimates and forecasts up to 2030, by application

- Market revenue estimates and forecasts up to 2030, by type

- Market revenue estimates and forecasts up to 2030, by component

- Regional market revenue forecasts, by technology

- Regional market revenue forecasts, by application

- Regional market revenue forecasts, by type

- Regional market revenue forecasts, by component

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."