- Home

- »

- Medical Devices

- »

-

Pediatric Diabetes Management Market Size Report 2033GVR Report cover

![Pediatric Diabetes Management Market Size, Share & Trends Report]()

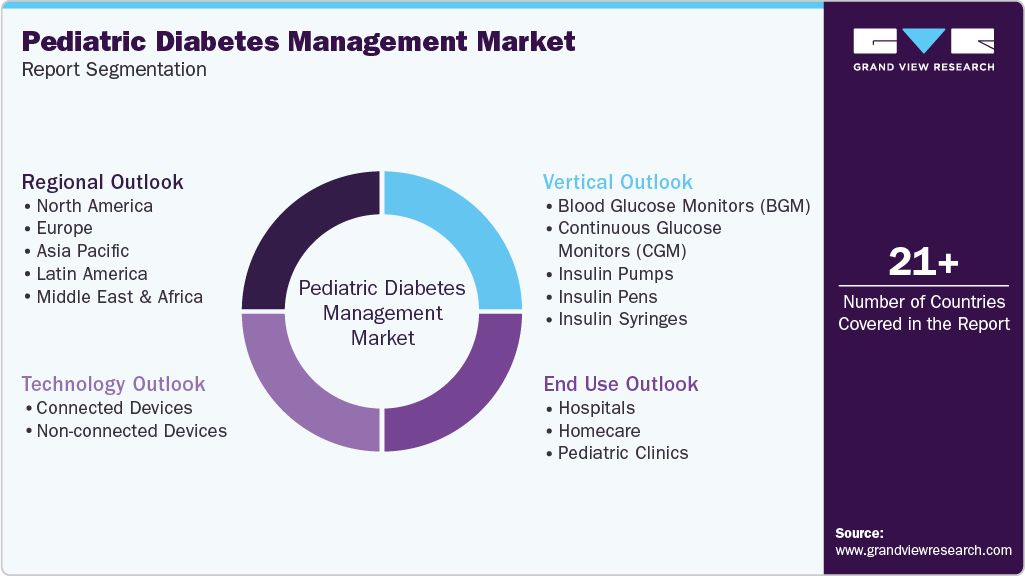

Pediatric Diabetes Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Insulin Pump, Insulin Pen), By Technology (Connected, Non-Connected), By End Use (Homecare, Pediatric Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-651-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pediatric Diabetes Market Summary

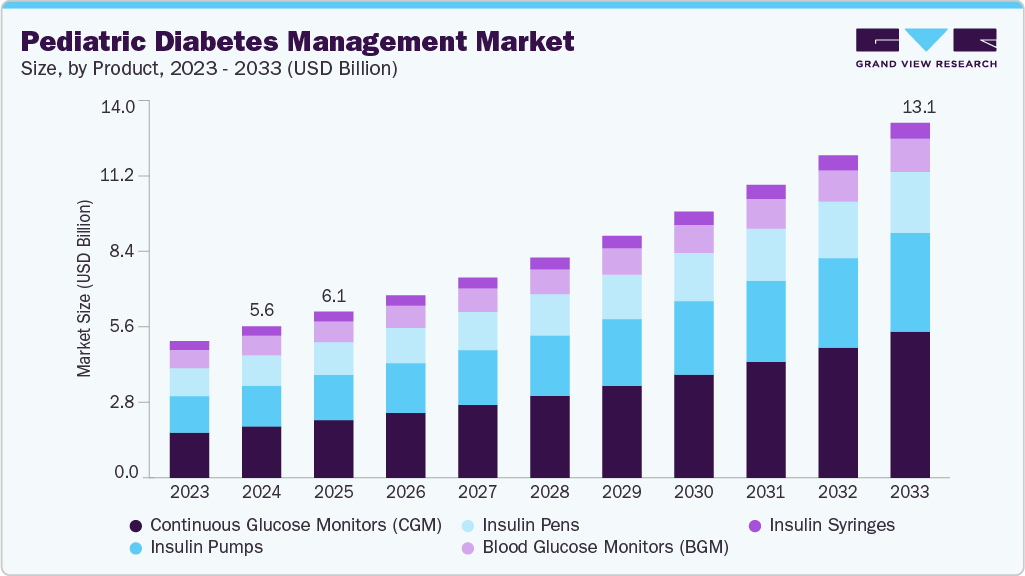

The global pediatric diabetes management market size was estimated at USD 5.59 billion in 2024 and is projected to reach USD 13.11 billion by 2033, growing at a CAGR of 9.96% from 2025 to 2033. The growth of the market is attributed to the rising global prevalence of diabetes, particularly Type 1, among children and adolescents, which has significantly increased the demand for effective monitoring and treatment solutions.

Key Market Trends & Insights

- North America dominated the pediatric diabetes management market with the largest revenue share of 40.7% in 2024.

- The pediatric diabetes management market in the U.S. accounted for the largest market revenue share of 88.8% in North America in 2024.

- Based on product, the Continuous Glucose Monitors (CGM) segment led the market with the largest revenue share of 34.0% 2024.

- Based on technology, the connected devices segment led the market with the largest revenue share of 55.2% in 2024.

- By end-use, the hospitals segment led the market with the largest revenue share of 42.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.59 Billion

- 2033 Projected Market Size: USD 13.11 Billion

- CAGR (2025-2033): 9.96%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Technological advancements in blood glucose monitoring (BGM), continuous glucose monitoring (CGM), and insulin delivery systems have improved accuracy, convenience, and compliance, making them more suitable for pediatric use. Globally, type 1 diabetes remains the most common form in children, but the rising incidence of childhood obesity, sedentary lifestyles, and poor dietary habits has led to a significant rise in type 2 diabetes diagnoses in younger age groups. According to the International Diabetes Federation, around 1.52 million people aged 20 years had diabetes in 2022. This high prevalence of diabetes is increasing demand for constant monitoring and long-term disease management, thereby contributing to demand for pediatric-focused diabetes care solutions. The increasing regulatory support and initiatives to address diabetes in pediatric patient groups further fuel the market growth.Technological advancements in diabetes management devices have significantly influenced the market growth as comfort, usability, and real-time insights are crucial for disease adherence. Companies are increasingly investing in the development of compact, minimally invasive, and user-friendly devices that cater specifically to children and adolescents. Innovations such as tubeless insulin pumps, continuous glucose monitors (CGMs) with extended sensor life, and smartphone-connected systems have improved patient compliance and parental monitoring. These devices reduce the burden on both children and caregivers by automating insulin dosing and generating predictive alerts, minimizing the risks of hypoglycemia or hyperglycemia.

Additionally, market players are focusing on launching pediatric-specific design features, such as miniaturization of products, further contributing to their increasing adoption. For instance, in July 2023, Tandem Diabetes Care’s miniature-sized insulin pump, Tandem Mobi, controllable via iPhone app and compatible with CGM, got FDA clearance for children (≥6 years) and adults. Half the size of t : slim X2, it integrates Control‑IQ automation, features shorter tubing, and remote updates.

Key Innovations in Pediatric Diabetes Management Products

Company Name

KOLs

Blood Glucose Monitors (BGM)

- Smaller lancets to minimize pain during frequent checks

- Visual apps designed for child engagement and understanding

Continuous Glucose Monitors (CGM)

- Approved for children as young as 2 years (e.g., Dexcom G7)

- Real-time alerts shared with parents via smartphones

Insulin Pump

- Tubeless, wearable designs for active children (e.g., Omnipod)

- Automated insulin delivery adjusted for pediatric dosing needs

Insulin Pen

- Half-unit dosing for precise insulin delivery in low body weight children

- Memory function pens to assist caregivers with dosing history

Insulin Syringes

- Short, ultra-fine needles to reduce injection discomfort

- Color-coded syringes to help distinguish between child and adult doses

Source: Company Websites, Annual Reports, Grand View Research

Furthermore, the increasing global emphasis on healthcare accessibility and policy support for chronic disease management in children contributes to market growth. Several developed countries offer reimbursement schemes and subsidized access to advanced glucose monitors and insulin pumps, extending them to pediatric patients. Moreover, public health campaigns and studies strengthening the beneficial role of diabetes management devices in pediatric diabetes management are fueling the adoption of these devices. For instance, a Stanford study published in January 2022 found that initiating continuous glucose monitoring (CGM) within a month of type‑1 diabetes diagnosis significantly improves glycemic control in children. Compared to a pre‑CGM cohort, early users had lower HbA1c levels at six and twelve months, with 66% meeting the <7.5% target versus 43%, and 53% meeting the stricter <7% goal versus 28%. Moreover, CGM reduces finger‑prick discomfort, reduces parental stress, and enables remote monitoring via EMR dashboards to efficiently target education and support. This evidence supports prioritizing early CGM access and insurance coverage to enhance outcomes.

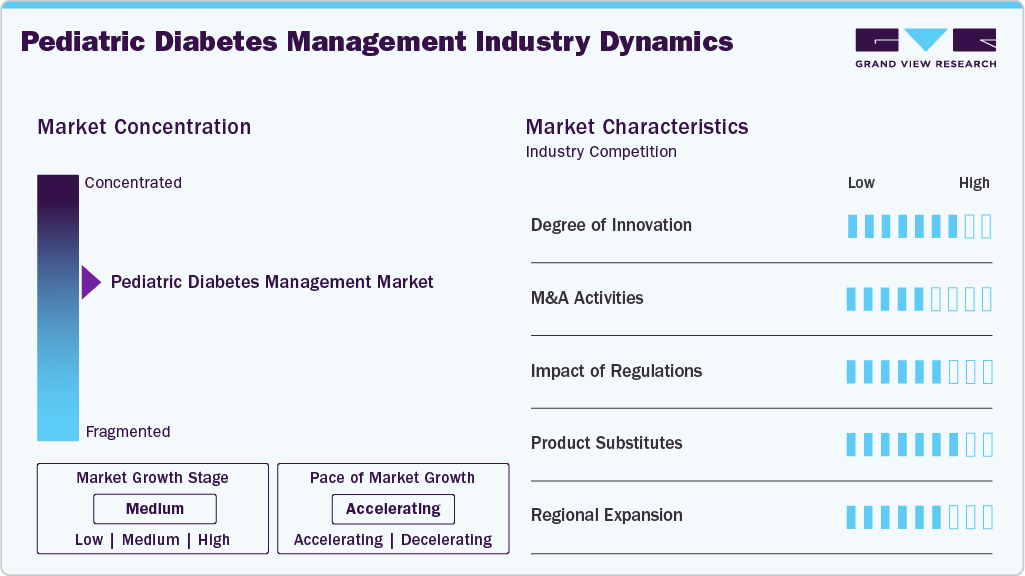

Market Concentration & Characteristics

The industry is experiencing a significant degree of innovation, driven by the need for improved glycemic control and quality of life for young patients. There is a rise in technological advancements, particularly in continuous glucose monitoring (CGM) systems, which offer real-time glucose data and integration with insulin pumps. For instance, in August 2024, The Twiist Automated Insulin Delivery (AID) system, developed by DEKA Research & Development and Sequel Med Tech, received FDA 510(k) clearance for use in patients aged six and older with type 1 diabetes. It is the first insulin pump to integrate the patient-driven Tidepool loop algorithm and to offer Apple Watch control, providing customizable, precise insulin delivery and improved time-in-range outcomes in clinical studies, though its launch date remains unannounced.

Regulation significantly impacts the pediatric diabetes management industry through the approval and monitoring of medical devices. Stringent regulations by bodies such as the FDA in the U.S. and the EMA in Europe directly influence market dynamics. These regulations influence the timelines and costs associated with bringing new technologies, such as continuous glucose monitors (CGMs) and insulin pumps, to market, impacting the competitive landscape and the availability of innovative solutions for children with diabetes.

The industry is witnessing significant M&A activities driven by market players seeking to expand their product portfolios, acquire innovative technologies, and strengthen their market presence. For instance, in August 2024, Ypsomed announced the sale of its blood glucose monitoring (BGM) and pen needle business to Medical Technology and Devices (MTD). This strategic decision was driven by Ypsomed's intent to focus its resources on the development and expansion of its mylife Loop insulin pump system and related digital diabetes solutions. MTD, a specialist in injection and infusion systems, aimed to strengthen its global market presence with this acquisition.

The industry faces a relatively low threat of substitute products, primarily due to the effective and crucial nature of the treatments. While alternative therapies such as oral medications are available for some adult diabetes cases, they cannot directly replace these devices in pediatric applications. The core products, including blood glucose meters (BGMs), continuous glucose monitors (CGMs), insulin pumps, insulin pens, and insulin syringes, have limited direct substitutes. The advancements in closed-loop systems, which integrate CGMs and insulin pumps to automate insulin delivery, further solidify the market position by offering improved glycemic control and reduced burden for patients and caregivers.

The industry is witnessing significant regional expansion, driven by increasing prevalence rates and improved diagnostic capabilities. The growth in emerging markets, where rising disposable incomes and changing lifestyles contribute to a surge in type 1 and type 2 diabetes cases among children, further drives regional expansion. These regional expansions are reshaping the competitive landscape, with companies strategically investing in localized product offerings and distribution networks to capitalize on the growing demand for pediatric diabetes management solutions.

Product Insights

On the basis of product, the continuous glucose monitors (CGM) segment accounted for the largest revenue share of 34.0% in 2024. This growth can be attributed to the enhanced accuracy and real-time data provided by CGM systems, which offer enhanced glycemic control compared to traditional finger-prick methods, leading to improved health outcomes for children with diabetes, Moreover, technological advancements, such as integration with insulin pumps and remote monitoring capabilities, enhance the convenience and effectiveness of CGM systems, making them more appealing to both patients and healthcare providers.

The insulin pump segment is expected to witness significant growth over the forecast period. This can be attributed to the improved clinical outcomes offered by these devices. The enhanced quality of life for children with diabetes, coupled with the precision of insulin delivery offered by pumps, contributes to their increasing adoption. Furthermore, the development of user-friendly interfaces and features specific to pediatric needs, such as smaller devices and simplified user interfaces, is increasing their appeal to both children and their caregivers.

Technology Insights

On the basis of technology, the connected devices segment held the largest share in 2024. Integrated systems offer real-time data monitoring and personalized insights, which are significantly beneficial for patients and caregivers for pediatric diabetes management. Thus, the adoption of continuous glucose monitors (CGMs) and insulin pumps, often integrated with smartphones and cloud platforms, is accelerating. This allows for remote monitoring by healthcare providers and facilitates proactive intervention, leading to better outcomes for young patients. Furthermore, the ability to share data seamlessly between devices and healthcare professionals is driving the demand for these devices.

The non-connected devices are expected to witness significant growth over the forecast period. Non-connected devices benefit from their affordability and ease of use, making them accessible to a wider range of patient populations, particularly those in underserved communities or with limited access to advanced technologies. Moreover, the devices, such as traditional blood glucose meters and insulin pens, are well-established and familiar to many healthcare providers and patients, preferred due to their ease of use and affordability. Furthermore, the preference and better accessibility of these devices in underdeveloped and cost-sensitive regions further fuel segment growth.

End-use Insights

On the basis of end-use, the hospital segment accounted for the largest revenue share of 42.0% in 2024. Hospitals serve as primary access points for diagnosis, initial treatment, and ongoing management of pediatric diabetes, offering comprehensive services including endocrinology consultations, diabetes education, and access to advanced technologies such as continuous glucose monitoring (CGM) and insulin pumps. Furthermore, hospitals are crucial for managing acute complications such as diabetic ketoacidosis (DKA), a life-threatening condition common in children with diabetes. The concentration of specialized medical staff, diagnostic equipment, and emergency care capabilities within hospitals further strengthens their market position.

The homecare segment is expected to witness the fastest growth at a CAGR of 11.2% over the forecast period. The home setting allows for more frequent monitoring of blood glucose levels, medication adherence, and dietary adjustments, which are crucial for effective diabetes management in children. This growth is further supported by advancements in telehealth and remote patient monitoring technologies, enabling healthcare providers to offer virtual consultations and real-time data analysis, enhancing the efficiency and accessibility of homecare services.

Regional Insights

North America pediatric diabetes management market dominated the industry with the largest revenue share of 40.65% in 2024. North America has a significantly high prevalence of diabetes that continues to rise in the region, fueled by an aging population and increasing rates of obesity and sedentary lifestyles. This high prevalence requires advanced and accessible diabetes management solutions. Furthermore, favorable reimbursement policies and increasing healthcare expenditure in North America are enhancing the adoption of these innovative technologies and therapies, thereby supporting market growth.

U.S. Pediatric Diabetes Management Market Trends

The pediatric diabetes management market in the U.S. held the largest share of North America in 2024. The increasing prevalence of diabetes is a primary driver, fueled by an aging population and rising rates of obesity and sedentary lifestyles. For instance, according to the Breakthrough T1D, in 2024, approximately 20,000 U.S. children and adolescents under age 20 were newly diagnosed with type 1 diabetes. Moreover, according to the same source, around 198,000 U.S. youth are currently living with the condition. Technological advancements in glucose monitoring, insulin delivery systems, and digital health solutions are also significantly contributing to market expansion as the U.S. market benefits from a well-established healthcare infrastructure, high healthcare spending, and strong adoption of innovative technologies.

Europe Pediatric Diabetes Management Market Trends

The pediatric diabetes management market in Europe is growing rapidly, owing to rising incidents of diabetes in the region’s youth coupled with rising rates of obesity and sedentary lifestyles. This increase in cases is contributing to higher demand for diabetes management products and services. Furthermore, the increasing adoption of innovative technologies, coupled with supportive government initiatives and reimbursement policies in several European countries, is significantly contributing to market expansion.

The rising prevalence of diabetes is a primary driver of the pediatric diabetes management market in the UK, with increasing rates of obesity contributing significantly to the surge in cases. Furthermore, government initiatives and healthcare policies focused on early diagnosis and improved diabetes management are also playing a crucial role, creating a favorable environment for market growth. The UK's National Health Service (NHS) commitment to providing comprehensive diabetes care, including access to innovative treatments and technologies, further supports market expansion in the country.

Asia Pacific Pediatric Diabetes Management Market Trends

The pediatric diabetes management market in Asia Pacific is expected to witness the fastest CAGR from 2025 to 2033. This can be attributed to the increasing prevalence of childhood obesity and unhealthy dietary habits, coupled with a rising awareness of diabetes among parents. Moreover, the market is expected to expand due to improved healthcare infrastructure, increased government initiatives promoting early diagnosis and treatment, and the growing adoption of advanced diabetes management technologies, such as continuous glucose monitoring (CGM) systems and insulin pumps, across the region.

China pediatric diabetes management industry is experiencing strong growth driven by the rise in diabetes cases. As more people get diagnosed, the demand for blood sugar monitors, insulin, and diabetes-related products is increasing. The government is also playing a significant role by encouraging early diagnosis and better disease management through public health programs. In addition, local companies are developing affordable diabetes products, making them more accessible to a wider population.

Latin America Pediatric Diabetes Management Market Trends

The pediatric diabetes management industry in Latin America is experiencing steady growth, driven by the region's rising urbanization, increasing access to advanced pediatric diabetes management devices, and rising awareness about the benefits of advanced devices. Moreover, local governments and NGOs are promoting early screening programs and education campaigns, leading to increased diagnosis and treatment rates. A growing middle-class population and improved digital infrastructure are also fueling the adoption of connected diabetes management technologies in the region.

Middle East Africa Pediatric Diabetes Management Market Trends

The pediatric diabetes management market in the Middle East and Africa is driven by the developing healthcare infrastructure, increasing adoption of technologically advanced management solutions and increasing efforts to reduce the burden of pediatric diabetes in the region. Moreover, the increasing efforts by governments in the region to improve healthcare access to a wider population are further expected to drive the adoption of these devices in the region. Furthermore, the increasing awareness about pediatric diabetes, driven by awareness campaigns and initiatives, is expected to fuel the market growth over the forecast period.

Key Pediatric Diabetes Management Company Insights

Key players operating in the pediatric diabetes management market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Pediatric Diabetes Management Companies:

The following are the leading companies in the pediatric diabetes management market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Dexcom

- Abbott

- Tandem Diabetes Care

- Insulet Corporation

- Novo Nordisk

- Sanofi

- Eli Lilly and Company

- Roche Diabetes Care

- Ascensia Diabetes Care

Recent Developments

-

In June 2024,Dexcom broadened its Automated Insulin Delivery (AID) system partnerships into the Netherlands, offering improved diabetes management solutions. This expansion includes integrations with various insulin pump systems, enhancing the options available to individuals managing their diabetes. The announcement highlights the growing collaboration between Dexcom and other companies, such as Omnipod, to provide comprehensive diabetes care solutions in the Netherlands.

-

In October 2022, the U.S. FDA expanded approval of Eli Lilly’s rapid-acting insulin Lyumjev (insulin lispro-aabc) to include children with diabetes, based on a phase 3 study showing it effectively improves glycemic control. Lyumjev can be administered at mealtime or within 20 minutes after, or via an insulin pump.

-

In October 2022, Dexcom launched the G7 continuous glucose monitor for people with diabetes aged two and older, offering real-time glucose tracking every five minutes directly to smartphones and smartwatches. The G7 features a 30-minute warm-up, customizable alerts, including predictive low glucose warnings and a smaller, more comfortable sensor, enhancing diabetes management for all age groups.

Pediatric Diabetes Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.13 billion

Revenue forecast in 2033

USD 13.11 billion

Growth rate

CAGR of 9.96% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Medtronic; Dexcom; Abbott; Tandem Diabetes Care; Insulet Corporation; Novo Nordisk; Sanofi; Eli Lilly and Company; Roche Diabetes Care; Ascensia Diabetes Care

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pediatric Diabetes Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pediatric diabetes management market report on the basis of product, technology, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Blood Glucose Monitors (BGM)

-

Continuous Glucose Monitors (CGM)

-

Insulin Pumps

-

Insulin Pens

-

Insulin Syringes

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Connected Devices

-

Non-connected Devices

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

General Hospitals

-

Children Hospitals

-

-

Homecare

-

Pediatric Clinics

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pediatric diabetes management market size was estimated at USD 5.59 billion in 2024 and is expected to reach USD 6.13 billion in 2025.

b. The global pediatric diabetes management market is expected to grow at a compound annual growth rate of 9.96% from 2025 to 2030 to reach USD 13.11 billion by 2030.

b. The Continuous Glucose Monitors (CGM) segment accounted for the largest market share of 34.0% in 2024, owing to their enhanced accuracy and data in pediatric diabetes care applications.

b. Some key players operating in the pediatric diabetes management market include Medtronic; Dexcom; Abbott; Tandem Diabetes Care; Insulet Corporation; Novo Nordisk; Sanofi; Eli Lily and Company; Roche Diabetes Care; Ascensia Diabetes Care

b. Key factors that are driving the market growth include the increasing prevalence of diabetes in children, and technological advancements in pediatric diabetes care devices, including blood glucose monitors, continuous glucose monitors, insulin pens, and others. Moreover, the increasing awareness about benefits of early detection of diabetes in children is further contributing to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.