- Home

- »

- Medical Devices

- »

-

Pediatric Oral Care Market Size, Share, Industry Report 2030GVR Report cover

![Pediatric Oral Care Market Size, Share & Trends Report]()

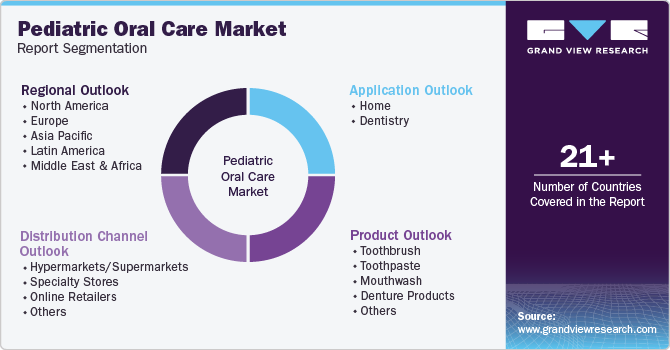

Pediatric Oral Care Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Toothbrush, Toothpaste, Mouthwash), By Application (Home, Dentistry), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-985-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pediatric Oral Care Market Summary

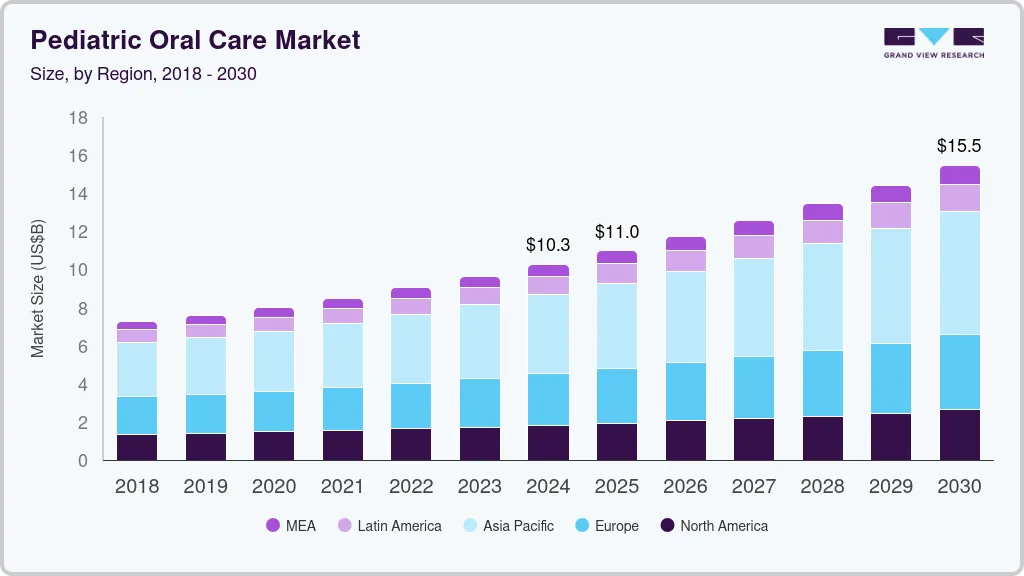

The global pediatric oral care market size was estimated at USD 10.3 billion in 2024 and is projected to reach USD 15.5 billion by 2030, growing at a CAGR of 7.1% from 2025 to 2030. The market is driven by several key factors, such as the increasing prevalence of dental issues among children, growing awareness about the importance of oral hygiene from a young age, technological advancements in pediatric dental care, and the rising focus on preventive dental care.

Key Market Trends & Insights

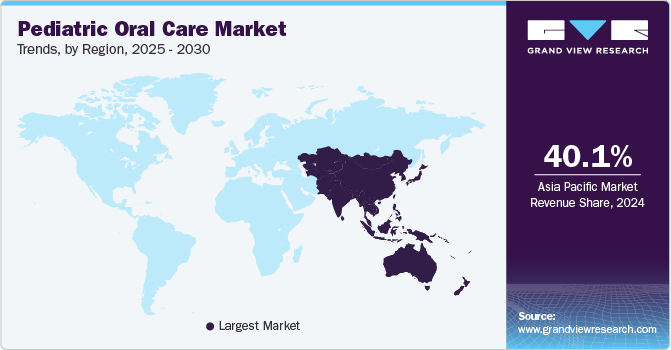

- APAC pediatric oral care market dominated the industry with a revenue share of over 40.1% in 2024.

- The pediatric oral care market in China is experiencing rapid expansion driven by driven by the high prevalence of dental caries among preschool children, highlighting the urgent need for improved oral hygiene practices and preventive dental care products.

- By product, the toothpaste segment led the market in 2024 with a revenue share of more than 34.1%.

- By application, the home segment holds the largest revenue share of 73.7% in 2024 in the pediatric oral care market.

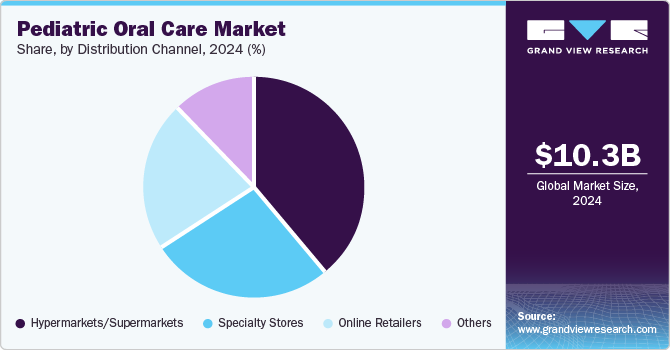

- By distribution channel, the hypermarkets/supermarkets segment dominated the market and accounted for 38.5% revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.3 Billion

- 2030 Projected Market Size: USD 15.5 Billion

- CAGR (2025-2030): 7.1%

- Asia Pacific: Largest market in 2024

For instance the American Dental Association organizes National Children's Dental Health Month every February to promote awareness among children and their parents about the importance of regular tooth brushing, flossing, and dental check-ups to prevent dental issues.The rising prevalence of oral diseases among children is another primary driver of the pediatric oral care market. According to the World Health Organization, an estimated 514 million children globally suffer from cavities in their primary teeth. Typical oral health issues affecting children include malocclusions, tooth sensitivity, thumb sucking, lip sucking, and tongue thrusting. Children with poor oral health tend to miss more school days and perform lower academically compared to their peers with better oral health.

The growing demand for innovative products drives the pediatric oral care market. There is an increasing preference for flavored toothpaste, cavity-protection toothpaste, baby tongue cleaners, and cartoon-themed mouthwash, boosting market growth. In addition, the inclusion of dental health coverage for children up to 18 years old as an essential health benefit under the U.S. Affordable Care Act has further driven the demand for pediatric oral care products.

Market Concentration & Characteristics

Degree of innovation in the pediatric oral care market is high. Companies launch various new products to cater to children's specific needs, including developing flavored toothpaste, cavity-protection toothpaste, baby tongue cleaners, and cartoon-themed mouthwashes, driving increased demand from parents. For instance, in July 2024, Stratasys introduced TrueDent, a breakthrough solution enabling dental labs to 3D print monolithic, full-color permanent dentures with natural-looking gums, accurate tooth structure, shade, and clarity in a single print.

Level of merger and acquisition (M&A) activities in the pediatric oral care market is moderate. M&A activities were notable in the pediatric oral care market, with various dental service providers looking to expand their reach and offerings through strategic partnerships. For instance, in December 2024, Abra Health Group acquired All About Kids Pediatric Dentistry in Connecticut, expanding its presence beyond New Jersey and Pennsylvania. In addition, the company has plans to open a new Bridgeport location in 2025 to enhance pediatric dental care access.

Regulations play a crucial role in shaping the pediatric oral care market by ensuring quality standards, patient safety, and ethical practices within the industry. For instance, regulatory bodies such as the American Academy of Pediatric Dentistry (AAPD) establish guidelines for pediatric dental practices to safeguard children’s oral health and promote evidence-based care. Compliance with HIPAA (Health Insurance Portability and Accountability Act) regulations also governs patient data protection and confidentiality in pediatric dentistry settings.

Product expansion within the pediatric oral care market shows high growth, with companies launching various new and innovative products to cater to children's specific needs. For instance, Pigeon Corporation offers a wide range of oral care products for infants and toddlers, including toothbrushes, toothpaste, and training cups. The increasing demand for flavored toothpaste, cavity-protection toothpaste, baby tongue cleaners, and cartoon-themed mouthwashes drove companies to expand their product portfolios to meet the evolving preferences of parents and children.

Region expansion within the pediatric oral care market shows moderate growth. Companies focus on penetrating new markets and reaching a broader consumer base. For instance, in June 2024, Sage Dental expanded into Tennessee, marking a significant milestone. This strategic move allows Sage to broaden its reach and impact in the dental care industry, tap into a growing market, and gain a competitive advantage.

Product Insights

The toothpaste segment led the market in 2024 with a revenue share of more than 34.1%. The demand for toothpaste increases with age as this group is more vulnerable to oral diseases such as cavities, tooth decay, and gum problems. The increase in the number of toothpaste launches for kids also drove the market. For instance, Chicco, a prominent baby oral care brand, launched the "4-Week Brushing Champion Challenge" on World Oral Health Day '24. This initiative aims to help babies learn brushing and motivate them through a rewarding program, supporting parents in developing healthy oral care habits. Moreover, established companies such as Dabur, entered kids’ toothpaste category and launched Dabur Herb'l Kids Toothpaste in December 2024. It is specially curated for kids above 3 years of age with no added chemicals. The availability of this toothpaste in strawberry flavor along with themes such as Iron Man and Elsa makes it more attractive for children. Such innovative chemical-free toothpaste with herbal ingredients makes it a trusted choice for parents, thereby increasing growth of the market.

The toothbrush segment is expected to register the fastest growth rate in the market over the forecast period. Modifications and innovations in toothbrush design, such as the introduction of electric toothbrushes and improvements in the size and quality of bristles, further attracted consumers as they provide better oral care results. For instance, Oral-B launched specialized electric toothbrushes designed for children, featuring smaller brush heads, softer bristles, and engaging designs to make brushing more appealing and effective for young users. Similarly, there is rising demand for interactive and technology-driven dental solutions such as Philips Sonicare for Kids, Foreo Issa Kids, AutoBrush Sonic Pro, and BriteBrush GameBrush. These innovative toothbrushes incorporate sonic technology, gamification, and AI-powered brushing assistance, making oral care more engaging for children while improving brushing habits and overall dental hygiene.

Application Insights

The home segment holds the largest revenue share of 73.7% in 2024 in the pediatric oral care market. The increasing parental awareness of the significance of oral hygiene for children is fueling a rise in the demand for children’s at-home oral care products. This growth is propelled by the availability of specialized oral care items tailored for children, such as toothbrushes, toothpaste, and mouthwashes. In addition, the market is seeing a surge in engaging and educational products featuring beloved characters that resonate with parents and promote oral care practices at home.

The dentistry segment is expected to witness significant growth in the pediatric oral care market application segment. This growth can be attributed to the rising prevalence of oral diseases, which necessitate treatment in dental clinics. With the increasing population and healthcare awareness, the demand for dental services is expected to rise, driving the growth of the dentistry segment.

Distribution Channel Insights

The hypermarkets/supermarkets segment dominated the market and accounted for 38.5% revenue share in 2024. These markets consist of a large variety of products and different brands in one place. Oral care products are readily available in hypermarkets/supermarkets. For instance, major retailers such as Walmart, Target, and Costco dedicated aisles and shelves for children's oral care products, making it convenient for parents to compare and purchase these items during regular grocery and household shopping trips.

The online retailer segment is expected to register the fastest growth rate of 7.6% in the market during the forecast period. This can be attributed to the increasing convenience and accessibility of online purchasing oral care products for children. Online shopping allows parents to compare prices, read reviews, and products delivered directly to their doorstep, saving time and effort. Major e-commerce platforms, including Amazon and Flipkart, have sections for pediatric oral care products, offering various options from leading brands.

Regional Insights

The North America pediatric oral care market is witnessing a rise in demand for natural and organic oral care products, driven by the expansion of specialized pediatric dental networks. For instance, according to the news published in November 2024, Vitana Pediatric & Orthodontic Partners is growing its presence across multiple states, including Texas. As a dentist-led dental partnership organization (DPO), Vitana focuses on elite pediatric dental and orthodontic practices, ensuring high-quality, specialized oral care for children. The growing network of specialized pediatric clinics is expected to drive greater awareness and accessibility of children's oral hygiene solutions, fueling market growth.

U.S. Pediatric Oral Care Market Trends

The U.S. pediatric oral care market is experiencing notable growth driven by increasing awareness about the importance of early dental hygiene practices, the rising prevalence of pediatric dental issues, and advancements in pediatric dentistry.According to the Centers for Disease Control and Prevention, cavities are among the most common chronic diseases in childhood in the U.S. Technological advancements and product innovation play a vital role in this market segment. For instance, in February 2023, Stratasys introduced TrueDent, a breakthrough solution enabling dental labs to 3D print monolithic, full-color permanent dentures with natural-looking gums, accurate tooth structure, shade, and clarity in a single print. This innovation enhances customization, efficiency, and accessibility in pediatric dental care, particularly for early tooth loss cases and orthodontic applications. The growing adoption of digital dentistry and advanced materials is accelerating demand for specialized pediatric oral care products, improving overall treatment outcomes for children.

Europe Pediatric Oral Care Market Trends

The European pediatric oral care market is shifting towards natural and organic products due to growing awareness about potential health risks associated with chemicals in traditional oral care products. Consumers are becoming more discerning about the ingredients used in children's oral care products, driving demand for natural and eco-friendly options. In addition, parents emphasized preventive dental care, leading to increased sales of products such as fluoride-free toothpaste, organic toothbrushes, and biodegradable floss picks.

The UK pediatric oral care market is experiencing a surge in product innovation and development, with companies focusing on creating fun and engaging oral care solutions for children. This includes toothbrushes featuring popular cartoon characters, flavored options, and interactive apps promoting good oral hygiene habits. The market is also witnessing increased awareness campaigns to educate parents about the importance of early dental care for children.

France pediatric oral care market is driven by a strong emphasis on advancing pediatric dentistry through professional events and knowledge-sharing platforms. In 2024, major conferences such as the Pediatric Dentistry Symposium, World Pediatric Congress, and Euro Dentistry Congress brought together experts to discuss innovations in children's oral healthcare. These events highlight the increasing focus on early intervention, preventive care, and advanced treatment options for pediatric dental health. As a result, the market is seeing greater adoption of specialized oral care products and contribute to market growth.

Asia Pacific Pediatric Oral Care Market Trends

APAC pediatric oral care market dominated the industry with a revenue share of over 40.1% in 2024. This growth is owing to the high adoption rate and awareness among parents regarding the kids' oral care products for maintaining oral hygiene. Factors such as an increase in the incidence of oral diseases such as tooth decay and cavities among children and the presence of major key players in the region are expected to boost the market's growth. For instance, in January 2024, Dr. Dento, a rising oral care brand, launched a new product range featuring natural ingredients that deliver professional-grade results while being gentle on teeth and gums, just in time for the festive season.

The pediatric oral care market in China is experiencing rapid expansion driven by driven by the high prevalence of dental caries among preschool children, highlighting the urgent need for improved oral hygiene practices and preventive dental care products. For instance, according to an article published in August 2024, a study conducted in Huizhou, China, found that 72.9% of children surveyed had dental caries, with prevalence rates rising from 58.2% at age 3 to 80.5% by age 5. These alarming statistics underscore the growing demand for fluoride-based toothpaste, cavity-fighting mouthwashes, and interactive toothbrushes designed specifically for young children. In addition, regional dietary and cultural differences influence oral health outcomes, further driving the need for targeted oral care solutions and educational programs to promote better dental hygiene from an early age.

Latin America Pediatric Oral Care Market Trends

Latin America's pediatric oral care market is witnessing a surge in demand for innovative and specialized products catered to children's preferences. Companies are launching flavored toothpaste, electric toothbrushes with engaging designs, and mouthwashes with fun flavors to make oral care more appealing for young consumers. For instance, the Pan American Health Organization (PAHO) worked with regional and national health authorities to implement school-based oral health programs, contributing to the market's expansion.

Brazil is one of Latin America's largest markets for pediatric oral care products. The country witnessed a surge in product innovation and launches explicitly tailored for children, such as flavored toothpaste, interactive toothbrushes, and educational apps promoting oral hygiene. This focus on innovation increased consumer interest and drove competition among manufacturers to offer unique and effective solutions for pediatric oral health.

Middle East & Africa Pediatric Oral Care Market Trends

The pediatric oral care market in the Middle East is witnessing a surge in demand for innovative and specialized products catered to children's preferences. There is a growing emphasis on preventive dental care, with governments and healthcare organizations actively promoting awareness campaigns about the importance of maintaining good oral hygiene from an early age. For instance, in March 2024, the Gulf Cooperation Council (GCC) countries implemented regulations to improve oral health standards, such as mandatory dental check-ups for school-aged children, further propelling the market's expansion.

In South Africa, the pediatric oral care market is experiencing distinct trends that reflect the region's unique dynamics. Parents' growing preference for chemical-free alternatives drives the increasing adoption of natural and organic oral care products for children. This shift towards natural ingredients spurred innovation in the market, with companies launching new product lines that cater to this demand. In addition, there is a heightened focus on promoting oral health awareness among children through educational campaigns and school programs aimed at instilling good dental habits early on.

Key Pediatric Oral Care Company Insights

Companies invest heavily in research and development to introduce new and improved products that cater to the unique requirements of children’s dental health. Regulatory bodies include the FDA to closely monitor the pediatric oral care market to ensure product safety and efficacy. This drives companies to adhere to stringent regulations while launching new products or claiming benefits.

Key Pediatric Oral Care Companies:

The following are the leading companies in the pediatric oral care market. These companies collectively hold the largest market share and dictate industry trends.

- Colgate-Palmolive Company

- Procter & Gamble

- GSK plc.

- Johnson & Johnson Services, Inc.

- Unilever

- Lion Corporation

- Sunstar Suisse S.A.

- Doctor Fresh

- Church & Dwight Co., Inc.

Recent Developments

-

In August 2024, Colgate-Palmolive (India) partnered with the Government of Uttar Pradesh to expand its Bright Smiles, Bright Futures program, aiming to reach 50 lakh students by 2026 with oral health education. This initiative will promote proper oral care habits, tobacco prevention, and nutrition awareness among children aged 6-15, strengthening early dental hygiene practices through increased awareness and product adoption.

-

In April 2024, Sage Dental, a dental service organization (DSO), opened two new practices in South Tampa and Viera, Florida, expanding its network to over 120 locations across Florida and Georgia. As a DSO, Sage Dental supports its affiliated practices with clinical and non-clinical services, allowing dentists to focus on patient care.

-

In February 2024, Colgate partnered with IMPAct4Nutrition, a UNICEF India-incubated platform focusing on nutrition. This partnership merges Colgate's social responsibility with IMPAct4Nutrition's specialized knowledge to improve children's awareness of oral health and nutrition. The objective is to impact an additional 10 million children by 2025 positively.

-

In March 2023, TheraBreath launched a new anti-cavity mouthwash for kids, designed to strengthen teeth and prevent tooth decay with fluoride. Available in Grapes Galore, Wacky Watermelon, and Strawberry Splash flavors, the product offers a safe and effective oral care solution for pediatrics.

Pediatric Oral Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.9 billion

Revenue forecast in 2030

USD 15.5 billion

Growth rate

CAGR of 7.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Colgate-Palmolive Company; Procter & Gamble; GSK plc.; Johnson & Johnson Services, Inc.; Unilever; Lion Corporation; Sunstar Suisse S.A.; Doctor Fresh; Church & Dwight Co., Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pediatric Oral Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pediatric oral care market report based on product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Toothbrush

-

Toothpaste

-

Mouthwash

-

Denture Products

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Home

-

Dentistry

-

-

Distribution channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Specialty Stores

-

Online Retailers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pediatric oral care market size was estimated at USD 10.3 billion in 2024 and is expected to reach USD 10.9 billion in 2025.

b. The global pediatric oral care market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2030 to reach USD 15.5 billion by 2030.

b. The Asia Pacific dominated the pediatric oral care market with a share of 40.1% in 2024. This is attributable to an increase in the incidence of oral diseases such as tooth decay and cavities among children and a rise in awareness of the kid’s oral care products among the parents for maintaining oral hygiene.

b. Some of the players operating in this market are Unilever Plc, Johnson & Johnson, Church & Dwight Co. Inc., Pigeon Corporation, Procter & Gamble Company, Colgate-Palmolive Company, Anchor Group, Oriflame, Amway, Dr. Fresh., Chattem, Dabur, and Splat Baby

b. Key factors that are driving the pediatric oral care market growth include the rising awareness for pediatric oral hygiene, increasing prevalence of oral diseases in pediatrics, and increase in the number of launches of toothpaste for pediatrics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.