- Home

- »

- Biotechnology

- »

-

Peptide Microarray Market Size, Share & Trends Report 2030GVR Report cover

![Peptide Microarray Market Size, Share & Trends Report]()

Peptide Microarray Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Reagents, Services), Application (Disease Diagnostics, Protein Functional Analysis), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-028-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Peptide Microarray Market Size & Trends

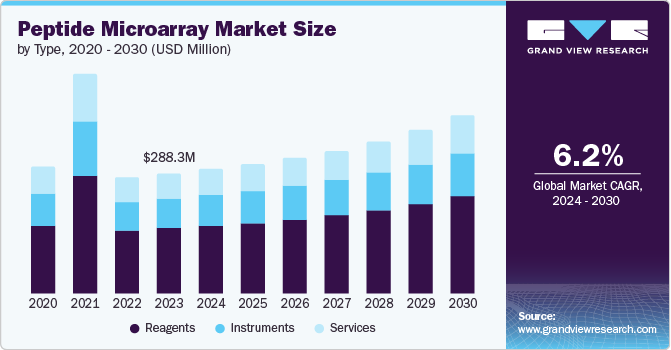

The global peptide microarray market size was valued at USD 288.3 million in 2023 and is projected to grow at a CAGR of 6.18% from 2024 to 2030. The growing burden of chronic diseases, technological advancements in diagnostic testing, and rising adoption of peptide microarrays are some of the factors that drive market growth.

The rising global prevalence of chronic diseases is a major factor expected to drive the market growth over the forecast period. Conditions such as cancer, diabetes, cardiovascular diseases, and autoimmune disorders are increasing in prevalence due to aging populations, lifestyle changes, and environmental factors. This trend necessitates more efficient, accurate, and early diagnostic methods for effective disease management & treatment. Peptide microarrays, known for their high throughput, high specificity, and sensitive biomarker detection capabilities, are becoming essential tools in this domain. Early detection and diagnosis are important for improving patient outcomes in chronic diseases. Peptide microarrays enable the identification of disease-specific biomarkers at low concentrations, which is especially crucial for early cancer detection. The shift toward personalized medicine in chronic disease management relies on treatments tailored to individual genetic and disease profiles.

Moreover, peptide microarrays are gaining traction in the scientific community due to their versatility and high-throughput capabilities in studying protein interactions, antibody specificity, and enzyme-substrate relationships. These microarrays allow for the simultaneous analysis of thousands of peptides, enabling detailed mapping of protein binding sites and post-translational modifications. Researchers are increasingly adopting peptide microarrays for drug discovery, biomarker identification, and vaccine development, as they provide a comprehensive & efficient method to screen for potential therapeutic targets & immune responses.

Furthermore, technological advancements in diagnostic testing are expected to drive the market growth over the coming years. These advancements are making diagnostic tests faster, more accurate, and capable of detecting a broader range of conditions, which can increase the utility & demand for peptide microarrays in various applications. Modern technologies have enhanced the sensitivity and specificity of peptide microarrays, allowing for the detection of low-abundance biomarkers with high precision. This is crucial in early disease diagnosis and monitoring therapy effectiveness.

The COVID-19 pandemic positively impacted the market by accelerating its adoption and driving significant technological advancements. One of the primary reasons for this positive impact was the urgent need for rapid and comprehensive tools to understand the SARS-CoV-2 virus & develop effective responses. Moreover, during the COVID-19 pandemic, numerous companies, including PEPperPRINT and JPJ Technologies, responded to the urgent need for advanced research tools by launching specialized SARS-CoV-2 products & services. These innovations were specifically adapted to facilitate coronavirus research, focusing on viral protein interactions, immune response mapping, and therapeutic target identification. The pandemic spurred substantial investment in biomedical research, particularly in technologies that could expedite the understanding and management of infectious diseases. Funding from governments, private sectors, and international organizations was channeled into COVID-19 research, leading to increased demand for peptide microarrays.

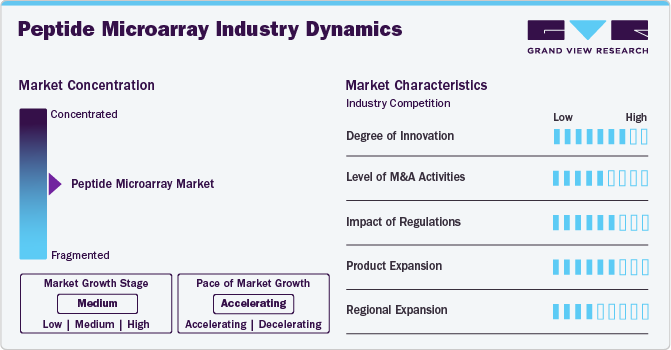

Market Concentration & Characteristics

The industry has seen significant technological advancements that have revolutionized peptide microarray applications. Innovations such as proteome-wide peptide microarrays, which can detect and localize specific antibodies in patient serum for various purposes, including vaccine production and diagnostic tests, have propelled the market forward. Furthermore, the use of peptide microarrays gained traction for innovative approaches in drug discovery in medicine and therapeutics.

Companies operating in this sector have engaged in strategic partnerships, acquisitions, and mergers to enhance their market presence, expand their product offerings, and capitalize on emerging opportunities. These activities have been driven by the need for technological advancements, access to new markets, and the desire to strengthen competitive positions. For instance, in May 2020, Nimble Therapeutics, Inc. announced a partnership with Roche Diagnostics to hasten the identification of innovative peptide-based molecules. This collaboration was intended to advance the creation of in vitro diagnostic assays for SARS-CoV-2.

The stringent regulatory frameworks in the peptide microarray industry may pose significant challenges for new entrants. High compliance costs and complex approval processes may deter potential entrants, leading to a more consolidated market dominated by established companies.

The peptide microarray industry is experiencing moderate growth due to the expanding applications, advancements in biotechnology & production processes, and increased research and development investments. Numerous industry players are focusing on expanding their product and services portfolio.

The industry is currently witnessing a moderate level of regional expansion, with growth prospects driven by an expanding customer base for novel diagnostic products & services. As scientific awareness of the technique grows globally and access to biotechnology improves in emerging markets, a rise in regional expansion initiatives is expected from key players in the market.

Type Insights

Based on type, the market is segmented into instruments, reagents, and services. The reagents segment held the largest revenue share of 54.21% in 2023. Reagents form an important component in the preparation, processing, and analysis of peptide microarrays as they are involved in several key areas, including maintaining peptide stability, ensuring specific interactions, and enhancing detection sensitivity. Reagents such as amino acid solutions, coupling reagents, buffers, and binding reagents are essential for synthesizing peptides with precise sequences. Moreover, one of the key factors expected to propel segment growth is the presence of leading participants engaged in providing customized solutions based on different protocols. The introduction of innovative products from key players is expected to boost the demand in the market.

The services segment is expected to witness the fastest CAGR over the forecast period. Custom peptide microarray services offered by companies encompass a wide range of applications and services tailored to meet the specific needs of researchers in drug discovery, diagnostics, and basic biomedical research. The services provided in the peptide microarray market include consulting and customized peptide array services, including the design, synthesis, printing, and analysis of peptide microarrays. Outsourcing these services helps reduce the time and technical expertise required for running protocols.

Application Insights

The disease diagnostics segment dominated the market in terms of revenue in 2023, with a market share of 39.29%. This large share is due to the growing demand for high-density peptide microarrays in disease diagnostics for early disease detection, accurate diagnosis, and prognosis assessment. Moreover, funding in protein research has supported the use of peptide microarrays in the diagnosis of Neglected Tropical Diseases (NTDs). For instance, in July 2022, a study in Zimbabwe utilized peptide microarrays to profile antibody reactivity against B-cell epitopes derived from various pathogens causing NTDs. This high-throughput approach aids in the simultaneous identification of multiple infections, improving disease surveillance and diagnosis in resource-limited settings. Hence, the growing research into peptide microarrays has significantly advanced their application in disease diagnosis, providing high-throughput, cost-effective, and accurate tools for identifying biomarkers and understanding immune responses across a range of diseases.

The protein functional analysis segment is anticipated to grow at the fastest CAGR of 6.68% over the forecast period. Peptide microarrays are a powerful tool for protein functional analysis, offering several applications that enhance the researcher’s understanding of protein interactions, enzyme functionality, and cellular processes. Protein and peptide microarrays are emerging as one of the powerful high-throughput tools for proteomics and clinical assays. These microarrays enable the tracking of binding events and biological activities, facilitating the large-scale determination of protein functions. This high-throughput capability allows for the rapid screening of thousands of proteins or peptides simultaneously, significantly accelerating R&D in drug discovery and biomarker identification.

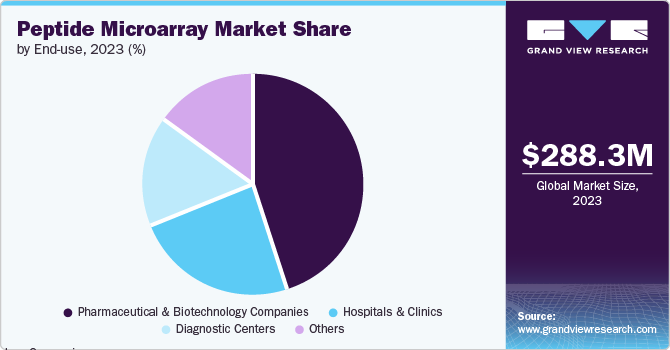

End Use Insights

The pharmaceutical & biotechnology companies segment held the largest market share of 45.29% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Pharmaceutical & biotechnology companies have established a strong position in the market, primarily driven by their intensive involvement in drug discovery & development. These sectors utilize peptide microarrays for numerous applications, such as the high-throughput screening of potential drug candidates, identification of novel biomarkers for diseases, and clarification of protein interactions that play key roles in disease mechanisms. The technology’s ability to provide rapid, accurate insights makes it invaluable for accelerating the pace of pharmaceutical R&D, contributing to its dominance in the market.

The diagnostic centers segment is expected to witness growth at a significant CAGR from 2024 to 2030. The growing demand for peptide microarrays in diagnostic centers highlights a significant transformation in diagnostic techniques and medical research methodologies. Diagnostic centers leverage the identification of diagnostic biomarkers and potential therapeutic intervention insights to improve diagnostic accuracy, predict patient outcomes, and streamline diagnostic procedures. Moreover, the growing need for peptide microarrays is expected to create a conducive environment for personalized diagnostics, tailoring to individual protein variations and interactions. This personalized approach to diagnostics aligns with the industry’s increasing emphasis on precision medicine, driving the adoption of peptide microarray analysis within diagnostic center services.

Regional Insights

North America peptide microarray market dominated globally with a 41.95% revenue share in 2023 owing to the advancements in research related to immunology and molecular biology. Furthermore, the region benefits from substantial research and development investments, government funding for biotechnology and healthcare research, and highly advanced healthcare infrastructure.

U.S. Peptide Microarray Market Trends

The peptide microarray market in the U.S. is expected to grow significantly over the forecast period due to the robust research and development landscape in biotechnology and life sciences, fostering innovation & technological advancements in diagnostics, and the presence of key players in the country.

Europe Peptide Microarray Market Trends

Europe peptide microarray market was identified as a lucrative region in this industry. Strong research & development in biology, pharmaceuticals, and therapeutics, along with the presence of key market players in the region, are factors driving market growth.

The peptide microarray market in the UK is expected to grow over the forecast period. Rise in demand for personalized medicine, increased prevalence of chronic and hereditary diseases, and the surge in molecular and immunotherapies has propelled the use of peptide microarray techniques in the country.

The Germany peptide microarray market is expected to grow over the forecast period driven by factors such as technological advancements, increasing demand for high-throughput screening tools in biomedical research, and the rising prevalence of chronic diseases that require advanced diagnostic solutions.

The peptide microarray market in France is anticipated to grow over the forecast period due to the rising prevalence of chronic diseases like cancer and diabetes. The country’s healthcare sector’s focus on advanced diagnostic technologies and therapies is likely to drive the adoption of peptide microarrays for disease diagnosis and research purposes.

Asia Pacific Peptide Microarray Market Trends

Asia Pacific peptide microarray market is anticipated to witness the fastest CAGR of 7.10% from 2024 to 2030. The fast growth is due to the increased government support in the healthcare industry, high awareness about antibody-based research, and expansion of proteomics in the region.

The peptide microarray market in Japan is anticipated to grow at a significant CAGR over the forecast period. The country’s emphasis on technological advancements in healthcare and biotechnology contributes to the growth of the market in the country.

The China peptide microarray market is expected to grow over the forecast period owing to the country’s focus on healthcare innovation, increasing research and development activities, and the adoption of advanced technologies in proteomics and clinical assays.

The peptide microarray market in India is anticipated to grow rapidly over the forecast period. With the increasing burden of diseases such as cancer and diabetes in the country, there is a growing demand for advanced diagnostic tools like peptide microarrays. India’s large population and rising healthcare awareness are driving factors for the adoption of innovative technologies in the medical field.

Middle East and Africa Peptide Microarray Market Trends

The peptide microarray market in the Middle East and Africa is projected to grow moderately in the near future. Factors such as economic conditions, technological advancements, regulatory environment changes, consumer preferences, and competitive landscape dynamics are likely to influence the market in this region.

The Saudi Arabia peptide microarray market is expected to grow moderately over the forecast period due to the substantial investment in the field of biotechnology, increased research activities, and government initiatives supporting scientific advancements.

The peptide microarray market in Kuwait is anticipated to witness moderate growth over the forecast period. Kuwaiti institutions are actively collaborating with international researchers and companies in biotechnology research. This collaboration facilitates knowledge transfer and access to cutting-edge technologies, potentially accelerating market growth.

Key Peptide Microarray Company Insights

Key players operating in the peptide microarray industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Peptide Microarray Companies:

The following are the leading companies in the peptide microarray market. These companies collectively hold the largest market share and dictate industry trends.

- PEPperPRINT GmbH

- RayBiotech, Inc.

- Creative Biolabs.

- Aurora Biomed Inc.

- Kinexus Bioinformatics Corporation

- Bio-Synthesis Inc.

- Microarrays Inc.

- Arryait Corporation (ARYC).

- JPT Peptide Technologies

- Merck KGaA

- Innopsys

- Nimble Therapeutics, Inc.

Recent Developments

-

In March 2024, JPT Peptide Technologies announced the launch of PepMix Peptide Pools, which is designed to encompass the spike glycoprotein and its receptor-binding domain (RBD) of the SARS-CoV-2 virus, providing essential resources for tracking immune responses and identifying T cell epitopes.

-

In October 2022, JPT Peptide Technologies launched the high-purity SARS2 Omicron BA.4/BA.5 PepMixes, leveraging its PepMixes platform.

-

In September 2022, JPT Peptide Technologies launched the PepMix Pools covering conserved & seasonal influenza A & B hemagglutinin antigens.

-

In January 2020, PEPperPRINT GmbH announced the launch of a comprehensive proteome-wide peptide microarray for the novel coronavirus 2019-nCoV (COVID-19). This microarray was designed to identify IgG and IgM antibody responses at the epitope level within.

Peptide Microarray Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 298.1 million

Revenue forecast in 2030

USD 427.3 million

Growth Rate

CAGR of 6.18% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

PEPperPRINT GmbH; RayBiotech, Inc.; Creative Biolabs.; Aurora Biomed Inc.; Kinexus Bioinformatics Corporation; Bio-Synthesis Inc.; Microarrays Inc; Arryait Corporation (ARYC).; JPT Peptide Technologies; Merck KGaA; Innopsys; Nimble Therapeutics, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peptide Microarray Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global peptide microarray market report based on type, application, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Disease Diagnostics

-

Protein Functional Analysis

-

Antibody Characterization

-

Drug Discovery

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Clinics

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global peptide microarray market size was estimated at USD 288.3 million in 2023 and is expected to reach USD 298.1 million in 2024.

b. The global peptide microarray market is expected to grow at a compound annual growth rate of 6.18% from 2024 to 2030, to reach USD 427.3 million by 2030.

b. The disease diagnostics segment dominated the market in terms of revenue in 2023, due to the growing demand for high-density peptide microarrays in disease diagnostics for early disease detection, accurate diagnosis, and prognosis assessment.

b. A few of the key players include PEPperPRINT GmbH; RayBiotech, Inc.; Creative Biolabs.; Aurora Biomed Inc.; Kinexus Bioinformatics Corporation; Bio-Synthesis Inc.; Microarrays Inc; Arryait Corporation (ARYC).; JPT Peptide Technologies; Merck KGaA; Innopsys; Nimble Therapeutics, Inc.

b. Peptide microarrays are a robust technique in the field of proteomics & clinical assays that can track the binding activity, histone-modifying enzymes, and protein linkage function on a large scale. Growing burden of chronic diseases, technological advancements in diagnostic testing, and rising adoption of peptide microarrays are some of the factors that drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.