- Home

- »

- Medical Devices

- »

-

Peptide and Oligonucleotide CDMO Market Report, 2033GVR Report cover

![Peptide And Oligonucleotide CDMO Market Size, Share & Trends Report]()

Peptide And Oligonucleotide CDMO Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Product (Peptides, Oligonucleotides) By Service (Contract Development, Contract Manufacturing), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-182-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Peptide And Oligonucleotide CDMO Market Summary

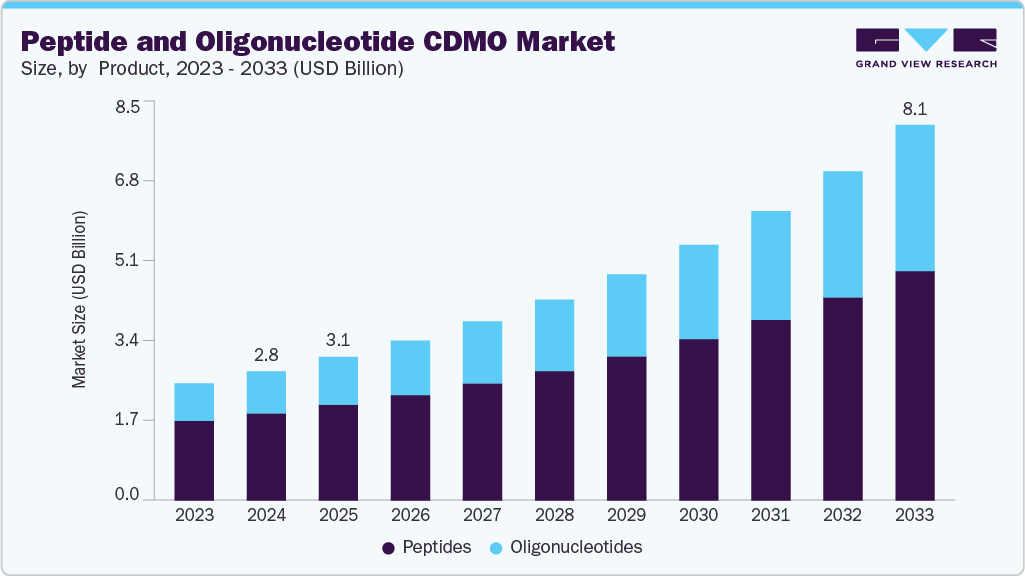

The global peptide and oligonucleotide CDMO market size was valued at USD 2.80 billion in 2024 and is projected to reach USD 8.14 billion by 2033, growing at a CAGR of 12.8% from 2025 to 2033. The market is driven due to increasing demand for complex and targeted therapeutics, growing investment in biologics and nucleic acid-based drug development, rising outsourcing trends among pharmaceutical and biopharmaceutical companies, and advancements in synthesis and delivery technologies for peptides and oligonucleotides.

Key Market Trends & Insights

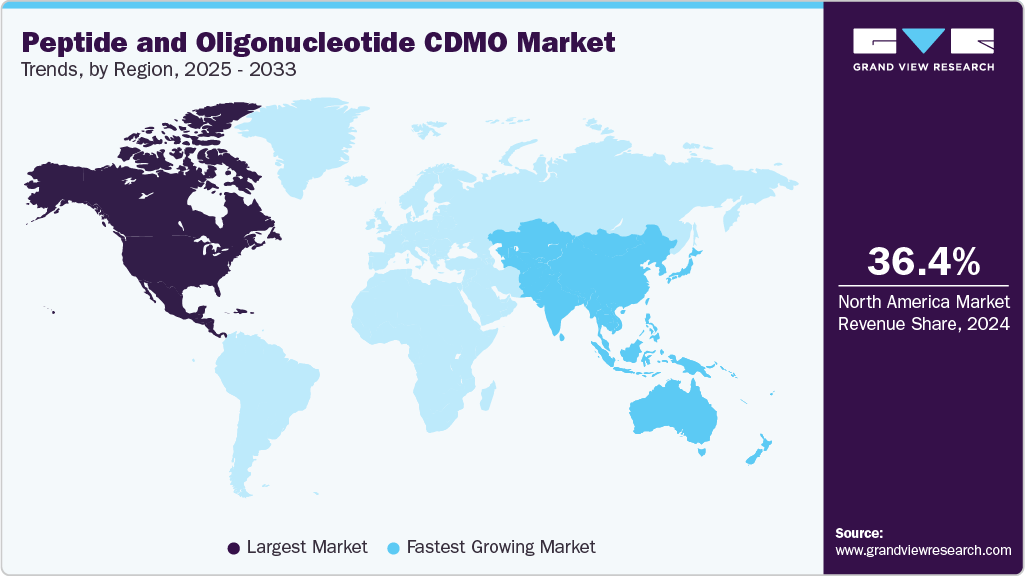

- North America Peptide and Oligonucleotide CDMO market held the largest share of 36.37% of the global market in 2024.

- The Peptide and Oligonucleotide CDMO industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the peptides segment led the market with the largest revenue share of 67.48% in 2024.

- Based on service, the contract manufacturing segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.80 Billion

- 2033 Projected Market Size: USD 8.14 Billion

- CAGR (2025-2033): 12.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

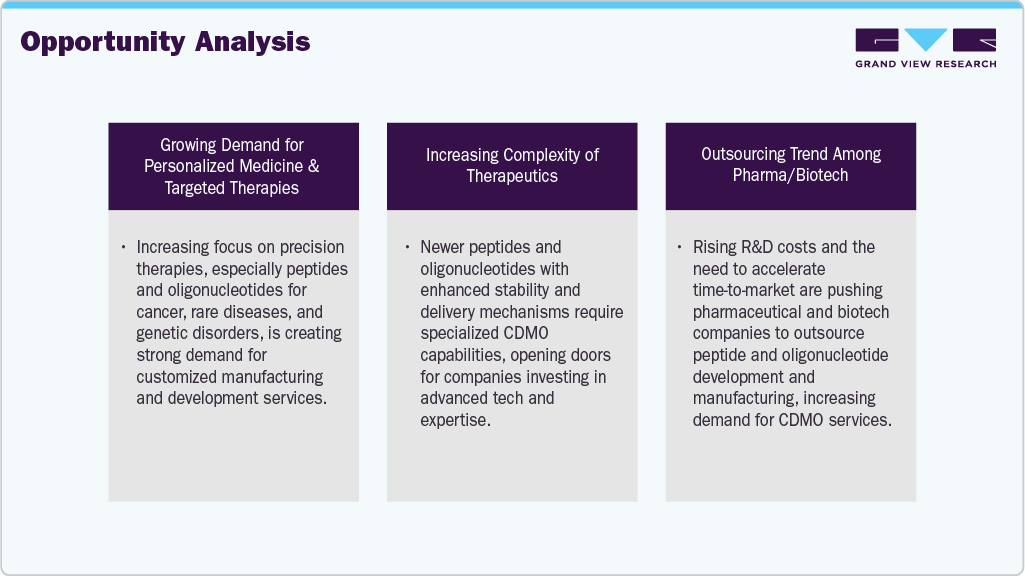

In addition, oligonucleotides and peptides have shown potential in treating a wide range of ailments, including metabolic disorders, cancer, and genetic diseases. Innovations in peptide synthesis, synthetic chemistry, and oligonucleotide manufacturing have made it easier to produce and design complex molecules. This has substantially increased the applications of peptides and oligonucleotides in therapeutic usage and thus boosted the demand for contract development and manufacturing organizations (CDMOs) with specialized proficiency in these areas.

Furthermore, the rising trend toward personalized medicine has driven the need for customized peptide and oligonucleotide therapies, thereby supporting the demand for CDMOs that are vital in the production and development of these personalized treatment therapies. Moreover, regulatory bodies such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) have diligently worked on establishing guidelines for the manufacturing and development of oligonucleotides and peptides. Hence, the aforementioned factors are responsible for the lucrative growth of the market.

Product Insights

On the basis of product segment, the market is classified into peptides and oligonucleotides. The peptides segment accounted for the largest revenue share in the API CDMO industry of 67.48% in 2024. The segment's growth is due to its significant therapeutic applications in areas such as oncology, endocrinology, and cardiovascular diseases, coupled with higher market penetration of peptide-based drugs compared to oligonucleotides. Moreover, the complex and specialized manufacturing processes required for peptides are also pushing the pharmaceutical companies to outsource production to CDMOs.

Oligonucleotides segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is driven due to increasing advancements in gene therapy, RNA-based treatments, and personalized medicine, which rely heavily on oligonucleotide therapeutics. In addition, growing research and clinical pipeline of antisense oligonucleotides, siRNA, and mRNA drugs are driving demand for specialized CDMO services capable of handling complex synthesis and stringent quality requirements.

Service Insights

On the basis of service segment, the market is segregated into contract development and contract manufacturing. The contract manufacturing segment held the largest share in the market in 2024. The growth of the segment is due to the increasing outsourcing trend by several pharmaceutical and biotech companies to reduce capital expenditure and accelerate time-to-market. Moreover, this segment is also driven by the growing demand for commercial-scale manufacturing of peptides and oligonucleotides, which require specialized facilities and expertise.

Contract development segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is due to the increasing demand for specialized R&D services, including process optimization, formulation development, and analytical testing. Pharmaceutical and biotech companies are increasingly outsourcing early-stage development activities to reduce costs, leverage expert knowledge, and accelerate drug development timelines.

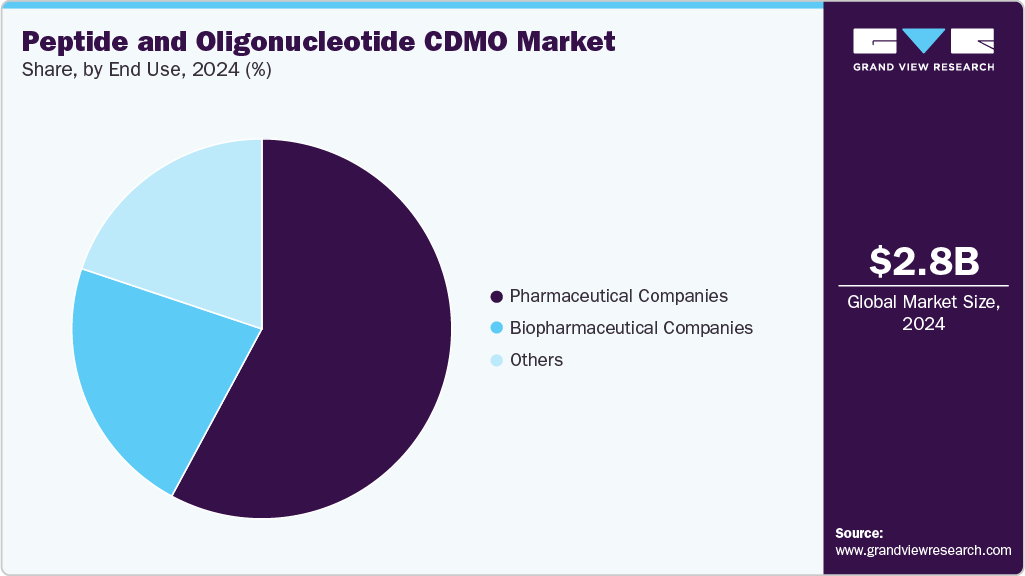

End Use Insights

On the basis of the end use segment, the market is segregated into pharmaceutical companies, biopharmaceutical companies, and others. The pharmaceutical companies segment accounted for the largest revenue share in 2024 due to their extensive focus on developing peptide and oligonucleotide-based therapeutics for a wide range of diseases, including chronic and lifestyle disorders. These companies increasingly rely on CDMOs to outsource both development and manufacturing processes to optimize costs, enhance efficiency, and accelerate time-to-market.

The biopharmaceutical companies segment is anticipated to grow at the fastest CAGR during the forecast period. This growth is due to the rapid expansion of biotech firms specializing in innovative Peptide and Oligonucleotide therapeutics, particularly in personalized medicine and gene therapy. These companies often lack in-house manufacturing capabilities and thus increasingly depend on CDMOs for specialized development and scalable production.

Regional Insights

North America accounted for the largest revenue share of 36.37% in peptide and oligonucleotide CDMO market in 2024. This is attributed to the regions well-established pharmaceutical and biotechnology industries, strong R&D infrastructure, and presence of leading CDMO service providers. In addition, favorable regulatory frameworks, significant investments in advanced manufacturing technologies, and high adoption of personalized medicine and biologics contribute to the region’s dominance.

U.S. Peptide And Oligonucleotide CDMO Market Trends

The peptide and oligonucleotide CDMO market in the U.S. held the largest share in 2024. The country’s growth is due to the country’s strong biopharmaceutical ecosystem, extensive R&D investments, and presence of numerous leading pharmaceutical and biotech companies. Moreover, supportive regulatory policies from agencies like the FDA, along with advanced manufacturing infrastructure and a focus on innovation in personalized medicine, have made the U.S. a preferred hub for peptide and oligonucleotide drug development and manufacturing.

Europe Peptide And Oligonucleotide CDMO Market Trends

The peptide and oligonucleotide CDMO market in Europe is expected to grow significantly due to increasing investments in biotechnology and pharmaceutical R&D, supportive government initiatives promoting advanced therapies, and a strong focus on personalized medicine across the region.

The peptide and oligonucleotide CDMO market in Germany held a significant share in 2024, owing to the country’s strong pharmaceutical and biotechnology industry, advanced manufacturing infrastructure, and robust investment in research and development. Germany’s supportive regulatory framework, skilled workforce, and strategic location within Europe make it an attractive hub for CDMO services.

The peptide and oligonucleotide CDMO market in the UK held the significant share in 2024. The growth of the market is due to country’s strong biopharmaceutical sector, substantial investments in cutting-edge research, and government initiatives supporting innovation in advanced therapies. The UK’s well-established clinical trial ecosystem, skilled talent pool, and favorable regulatory environment encourage the development and outsourcing of peptide and oligonucleotide therapeutics.

Asia Pacific Peptide And Oligonucleotide CDMO Market Trends

Asia Pacific peptide and oligonucleotide CDMO market is anticipated to witness the fastest CAGR over the estimated timeline. The regional growth is due to the region’s rapidly growing pharmaceutical and biotechnology sectors, cost-effective manufacturing capabilities, and increasing investments in R&D infrastructure. In addition, rising demand for personalized medicine and biologics, supportive government policies, and the presence of emerging CDMOs with advanced technological capabilities are driving market expansion.

The peptide and oligonucleotide CDMO market in China held the largest share in 2024. The growth is due to the country’s rapidly expanding pharmaceutical and biotechnology industries, significant government support for innovation, and increasing investments in advanced manufacturing infrastructure. China’s large patient population, cost-efficient production capabilities, and growing number of clinical trials further boost demand for outsourced peptide and oligonucleotide development and manufacturing services.

The peptide and oligonucleotide CDMO market in Japan is expected to grow over the forecast period. The country’s growth is due to the country’s strong pharmaceutical industry, advanced technological capabilities, and significant investments in biopharmaceutical R&D. Japan’s aging population and increasing prevalence of chronic diseases are driving demand for innovative peptide and oligonucleotide therapies.

The peptide and oligonucleotide CDMO market in India is anticipated to grow at the lucrative CAGR over the forecast period. The country’s market growth is due to the lower operational costs, skilled scientific workforce, and growing R&D investments from both domestic and multinational companies.

Key Peptide And Oligonucleotide CDMO Company Insights

The major players operating across the market are focused on adopting inorganic strategic initiatives such as mergers, partnerships, acquisitions, etc. Moreover, companies focus on technological innovations to augment their market position.

Key Peptide and Oligonucleotide CDMO Companies:

The following are the leading companies in the peptide and oligonucleotide CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- PolyPeptide Group

- STA Pharmaceutical Co. Ltd.

- Bachem

- Creative Peptides

- Aurigene Pharmaceutical Services Ltd.

- Merck KGaA

- EUROAPI

- Curia Global, Inc.

- CordenPharma

- Sylentis, S.A.

Recent Developments

-

In July 2024, CordenPharma announced to invest USD 1061.24 million (Euro 900 Million), which aims to expand its peptide platform, both at its Colorado, U.S. site and in Europe. This expansion covers both existing facilities and new constructions.

-

In April 2024, Aurigene Pharmaceutical Services Ltd. Entered into a partnership agreement with Vipergen ApS, a small-molecule drug discovery service provider which aims to accelerate innovation in drug discovery by increasing success rates and reducing timelines through screening a more billion small-molecule compounds.

Peptide And Oligonucleotide CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.12 billion

Revenue forecast in 2033

USD 8.14 billion

Growth Rate

CAGR of 12.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE; Oman; Qatar

Key companies profiled

PolyPeptide Group; STA Pharmaceutical Co. Ltd.; Bachem; Creative Peptides; Aurigene Pharmaceutical Services Ltd.; Merck KGaA; EUROAPI; Curia Global, Inc.; CordenPharma; Sylentis, S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peptide And Oligonucleotide CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global peptide and oligonucleotide CDMO market report based on product, service, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Peptides

-

Oligonucleotides

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Contract Development

-

Contract Manufacturing

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global peptide and oligonucleotide CDMO market size was valued at USD 2.80 billion in 2024 and is expected to reach USD 3.12 billion in 2025.

b. The global peptide and oligonucleotide CDMO market is expected to grow at a compound annual growth rate of 12.75% from 2025 to 2033 to reach USD 8.14 billion by 2033.

b. By product, the peptides segment held a market share of 67.48% in 2024. The segment is driven by its significant therapeutic applications in areas such as oncology, endocrinology, and cardiovascular diseases, coupled with higher market penetration of peptide-based drugs compared to oligonucleotides.

b. The major players operating across the peptide and oligonucleotide CDMO market includes PolyPeptide Group; STA Pharmaceutical Co. Ltd.; Bachem; Creative Peptides; Aurigene Pharmaceutical Services Ltd.; Merck KGaA; EUROAPI; Curia Global, Inc.; CordenPharm; Sylentis, S.A.

b. The pharmaceutical industry has witnessed a rise in demand for peptides and oligonucleotides as therapeutic agents. Oligonucleotides and peptides have shown potential in treating a wide range of ailments, including metabolic disorders, cancer, and genetic diseases. Innovations in peptide synthesis, synthetic chemistry, and oligonucleotide manufacturing have made it easier to produce and design complex molecules. This has substantially increased the applications of peptides and oligonucleotides in therapeutic usage and thus boosted the demand for contract development and manufacturing organizations (CDMOs) with specialized proficiency in these areas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.