- Home

- »

- Medical Devices

- »

-

Peripheral Vascular Stents Market Size & Share Report, 2030GVR Report cover

![Peripheral Vascular Stents Market Size, Share & Trends Report]()

Peripheral Vascular Stents Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Drug Eluting Stents, Bare Metal Stents, Bioabsorbable Stents), By Mode of Delivery, By Product, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-100-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global peripheral vascular stents market size was estimated at USD 1.67 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. The market for peripheral vascular stents is projected to witness growth driven by various factors, including the rising prevalence of peripheral diseases, a growing elderly population, and the introduction of advanced product offerings. Diseases such as peripheral arterial disease (PAD), atherosclerosis, and deep vein thrombosis are becoming more prevalent, resulting in a substantial demand for peripheral vascular stents. As indicated in a 2021 report from the American Heart Association, PAD affects over 200 million individuals worldwide and is associated with significant mortality and morbidity rates.

The COVID-19 pandemic substantially impacted surgical procedures for patients with PAD and their willingness to seek medical treatment. Restrictions imposed during the pandemic led to a significant reduction in the number of PAD patients undergoing surgery. Consequently, those who did receive surgery had more severe limb ischemia than the previous year, resulting in a higher incidence of perioperative complications.

An article published by PubMed Central in August 2021 highlighted that limited access to regular medical follow-ups and hospitals during the early stages of the pandemic contributed to advanced and acute clinical complications in PAD patients requiring surgery. However, cardiological procedures are now being conducted as usual as the pandemic has subsided. Consequently, the market for peripheral vascular stents is expected to experience stable growth during the forecast period, considering the subsiding effects of the pandemic.

The continuous evolution of stent design has led to enhanced stent performance and patient outcomes. Manufacturers have focused on developing stents with improved flexibility, deliverability, and radial strength, allowing for better deployment and expansion within the peripheral arteries. These advancements have increased procedural success rates and reduced complications associated with stent placement. For instance, in June 2023, ReFlow Medical's vascular stent displayed encouraging initial outcomes. The six-month data demonstrated a notable 86% patency rate among patients with infrapopliteal arterial disease.

The company unveiled promising results from a sub-study on vessel recoil involving 38 patients. Notably, the study recorded a significant reduction of over 50% in vessel recoil. Depending on the results of further follow-ups, this stent can offer an additional treatment option for individuals suffering from peripheral arterial disease (PAD) and critical limb ischemia (CLI). The stent's design features a series of expandable spikes that enable the seepage of antiproliferative drugs into the vessel wall. These promising outcomes are expected to positively impact the growth of the overall market.

Prominent market players play a vital role in promoting the adoption of technological advancements within the peripheral vascular stent market. These companies actively incorporate these advancements into their product offerings to enhance patient outcomes and broaden the availability of advanced treatment options. For instance, in March 2022, Cordis, a key player in the peripheral stent industry, obtained US FDA approval for its Smart Radianz Vascular Stent System.

This particular stent is a self-expanding device that caters to radial peripheral procedures. Introducing specialized and advanced products like the Smart Radianz Vascular Stent System allows companies to effectively address the specific requirements of physicians and patients, thus bolstering their market position and competitiveness. Furthermore, these strategic collaborations and partnerships enable market players to access untapped market segments and expand their geographical reach, thereby driving overall growth.

The aging population has been a significant driving factor in developing and adopting peripheral vascular stents, as the senior population is particularly susceptible to peripheral vascular diseases. As the elderly population grows, the demand for minimally invasive treatments for PAD increases. According to the World Health Organization (WHO), it is estimated that by the year 2030, one out of every six individuals worldwide will fall into this age category. Moreover, by 2050, the number of people aged 60 and older is expected to double, reaching a remarkable figure of 2.1 billion individuals. Thus, with the aging population being more prone to peripheral vascular diseases, the demand for peripheral stents is expected to grow substantially to cater to this demographic, driving the market growth.

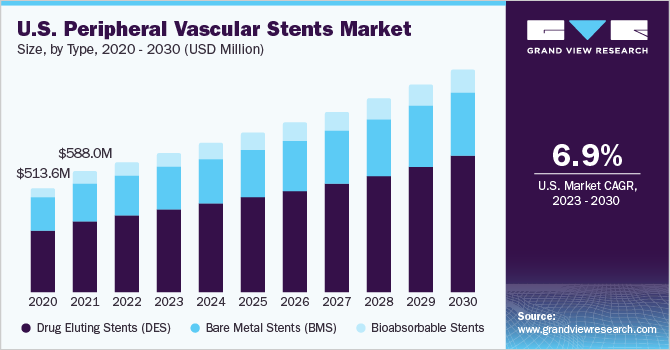

Type Insights

Based on type, the drug-eluting stents (DES) segment accounted for the largest market share of 60.52% in 2022. Drug-eluting stents can reduce the rate of restenosis compared to bare metal stents (BMS). The ability of DES to reduce the incidence of major adverse cardiac events (MACE) is a significant driving factor for their widespread adoption. The drug coating on the stent prevents stent thrombosis, reducing the risk of blood clot formation within the stent. This lowers the occurrence of heart attacks, strokes, and other cardiovascular events, leading to improved patient safety and overall survival rates.

For instance, in May 2022, Medtronic plc obtained approval from the US FDA for the Onyx Frontier DES. This innovative stent, belonging to the Resolute DES family, features the same innovative stent platform found in the Resolute Onyx DES. It incorporates a novel delivery mechanism specifically designed to enhance acute performance, particularly in challenging cases. This advancement aims to improve patient outcomes and provide better treatment options for individuals with complex conditions.

The bioabsorbable stents segment is also expected to grow significantly over the forecast period. Bioabsorbable stents have emerged as a revolutionary advancement in interventional cardiology. It eliminates long-term risks like in-stent restenosis and late-stent thrombosis by gradually dissolving in the body, reducing the chances of adverse events. Unlike permanent stents, bioabsorbable stents allow the artery to maintain natural flexibility and movement, resulting in better patient outcomes.

The need to overcome the limitations associated with permanent stents is the primary driving force behind developing and adopting bioabsorbable stents. According to a study published in the Catheterization and Cardiovascular Intervention journal in May 2020 titled, "Safety and Efficacy of Bioabsorbable Polymer Everolimus-Eluting Stent versus Durable Polymer Drug-Eluting Stents in High-Risk Patients Undergoing PCI: TWILIGHT-SYNERGY". The research findings in this study indicate that in high-risk patients undergoing percutaneous coronary intervention (PCI), bioabsorbable polymer (BP) DES exhibits superior safety and efficacy compared to durable polymer (DP) DES. As a result, polymer-based bioabsorbable stents' anticipated high level of safety and efficacy is expected to drive growth in this segment over the forecast period.

Mode of Delivery Insights

Based on mode of delivery, the balloon-expanding stents segment accounted for the largest share of 53.92% in 2022. Balloon-expanding stents offer a significant benefit by enabling accurate and controlled expansion within the affected blood vessel. This characteristic ensures the ideal scaffolding of the vessel, leading to enhanced blood flow and a decreased risk of re-narrowing or restenosis. In addition, these stents are suitable for application in intricate anatomical locations, enabling effective treatment even in challenging cases.

Moreover, the shift towards minimally invasive procedures has significantly contributed to the segment growth. In June 2021, Cardiovascular Systems, Inc. announced the availability of the complete range of OrbusNeich JADE over-the-wire balloon catheters for percutaneous transluminal angioplasty (PTA) procedures in the U.S. JADE is specifically designed for treating wide range of conditions in the peripheral vasculature, including blockages in native arteries, synthetic arteriovenous dialysis fistulae, and facilitating post-dilatation of both balloon-expandable and self-expanding stents.

The self-expanding stents segment is expected to experience substantial growth in the market over the forecast period. The self-expanding stents are designed with materials like nitinol, which have shape memory properties and can expand to fit the vessel walls. This flexibility allows the stent to conform to challenging lesions or narrow arteries, providing effective support and restoration of blood flow. Moreover, advancements in stent technologies, including improved stent designs and materials, contribute to the growth of the market.

Self-expanding stents, in particular, offer advantages such as better flexibility, conformability, and reduced risk of recoil or collapse after deployment. For instance, in July 2022the FDA approved BIOTRONIK's Pulsar-18 T3 peripheral self-expanding stent system, which is the first and only 4-french low-profile stent system of its kind. It uses a tri-axial design to ensure accurate and stable implantation, reducing the risk of complications and minimizing the need for closure devices.

Product Insights

Based on product, the Iliac artery stents segment accounted for the largest share of 33.46% in 2022. Iliac artery stents are specialized medical devices designed to treat blockages or narrowing in the iliac arteries, which are the blood vessels located in the pelvis that supply blood to the lower extremities. Iliac arterial occlusive disease has a considerable impact, affecting approximately 8 million individuals in the U.S. alone.

These stents are typically made of metal or polymer materials and are inserted into the affected artery to help restore proper blood flow and prevent complications such as PAD or limb ischemia. For instance, in March 2023,Getinge, a medical technology company, obtained premarket approval from the US FDA for its iCast-covered stent system. This innovative device is specifically designed for the treatment of individuals suffering from iliac arterial occlusive disease, a form of PAD.

The carotid artery stent segment is also expected to grow significantly over the forecast period. The growth of the carotid artery stent segment is due to the increasing prevalence of carotid artery disease (CAD), primarily caused by atherosclerosis. Atherosclerosis is the buildup of plaque within the arteries, leading to narrowing and decreased blood flow.According to reports from the Centers for Disease Control and Prevention (CDC), CAD is the most prevalent heart condition and a leading cause of mortality in the U.S. It is responsible for claiming the lives of over 370,000 individuals annually.

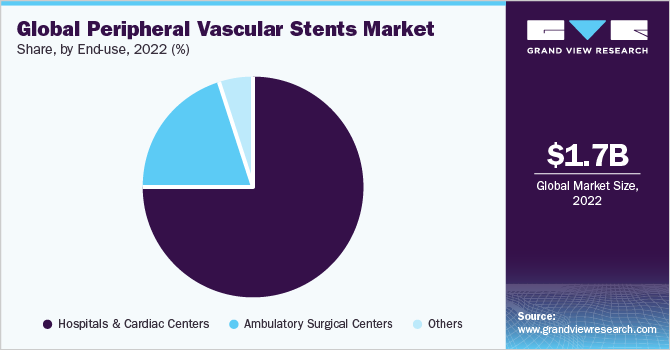

End-use Insights

Based on end-use, the hospital & cardiac centers segment accounted for the largest share of 74.54% in 2022. The rising prevalence of CVDs and the growing geriatric population. In addition, the increasing popularity of minimally invasive procedures further contributes to the market's growth and development.According to the WHO, CVDs are the leading cause of death worldwide, claiming an estimated 17.9 million lives each year. CVDs encompass a range of conditions that affect the heart and blood vessels, including coronary artery disease, heart attacks, stroke, and peripheral arterial disease. Moreover, hospital & cardiac centers are specialized medical facilities that play a crucial role in diagnosing and treating CVDs, including conditions related to PAD.

The ambulatory care centers segment is expected to experience substantial growth in the market over the forecast period. Ambulatory care centers have become a driving factor in the adoption and utilization of peripheral vascular stents. These centers provide an efficient and cost-effective alternative to traditional hospital settings for a wide range of outpatient procedures, including the placement of peripheral vascular stents.

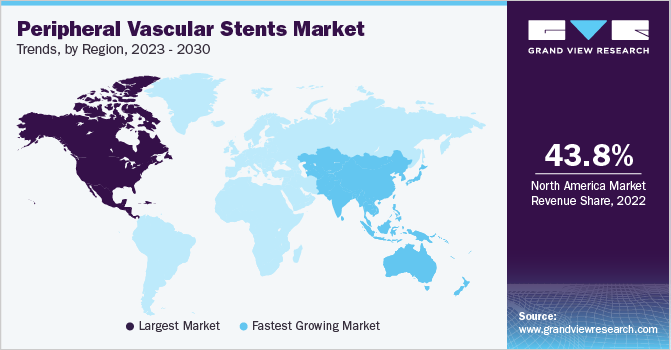

Regional Insights

North America accounted for the largest share of 43.79% in 2022. North America has a well-established healthcare infrastructure, including advanced medical facilities and skilled healthcare professionals. This infrastructure supports the diagnosis and treatment of CVDs, making peripheral vascular stents readily available to patients in the region.

For instance, as per the CDC's updated report published in October 2022 revealed that in the U.S., a heart attack occurs approximately every 40 seconds, and each year approximately 805,000 Americans experience a heart attack. Furthermore, the presence of key market players and technological advancements in the field of peripheral vascular stents has contributed to the market's growth in North America. Many leading medical device companies are headquartered or have a significant presence in the region, facilitating the development and commercialization of innovative stent technologies.

The Asia Pacific region is expected to witness significant growth during the forecast period. This growth can be attributed to various factors such as sedentary lifestyles, unhealthy dietary habits, and an aging population contributing to the increased incidence of conditions like PAD. As a result, there is a growing demand for effective treatment options like peripheral vascular stents. In addition, rising government initiatives and supportive policies in the region, including public awareness campaigns, disease prevention programs, and favorable reimbursement policies, drive the growth of the peripheral vascular stents industry by promoting cardiovascular health and encouraging the adoption of advanced medical devices.

Key Companies & Market Share Insights

Key players are introducing advanced products at affordable prices to increase their market share and implementing strategic initiatives, such as acquisitions, mergers, and collaborations, to maximize their market dominance.

For instance, in October 2022, Cordis announced its planned acquisition of MedAlliance, a Swiss company known for its innovative drug-eluting balloons.This strategic decision by Cordis is driven by the goal of broadening its global presence and offering potential treatment to approximately two million patients by 2027, utilizing MedAlliance's innovative SELUTION SLR (Sustained Limus Release) drug-eluting balloon. Some prominent players in the global peripheral vascular stents market include:

-

Boston Scientific Inc.

-

Medtronic

-

Terumo Medical

-

Abbott

-

Biotronik

-

Lifetech

-

iVascular SLU

-

Stryker

-

Cook Medical

-

Microport Scientific Corporation

-

Stentys S.A.

-

Hellman & Friedman (Cordis Inc.)

Peripheral Vascular Stents Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.80 billion

Revenue forecast in 2030

USD 2.97 billion

Growth rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, mode of delivery, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Medtronic; Terumo Medical; Abbott; Biotronik; Lifetech; iVascular SLU; Stryker; Cook Medical; Microport Scientific Corporation; Stentys S.A.; Hellman & Friedman (Cordis Inc.)

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Peripheral Vascular Stents Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global peripheral vascular stents market report based on type, mode of delivery, product, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Eluting Stents (DES)

-

Bare Metal Stents (BMS)

-

Bioabsorbable Stents

-

-

Mode of Delivery Outlook (Revenue, USD Million, 2018 - 2030)

-

Self-expanding Stents

-

Balloon-expandable Stents

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Iliac Artery Stents

-

Femoral Artery Stents

-

Carotid Artery Stents

-

Renal Artery Stents

-

Other Peripheral Stents

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Cardiac Centers

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global peripheral vascular stents market size was estimated at USD 1.67 billion in 2022 and is expected to reach USD 1.80 billion in 2023.

b. The global peripheral vascular stents market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 2.97 billion by 2030.

b. The drug-eluting stents (DES) segment accounted for the largest share of 60.52% of the market in 2022. Drug-eluting stents have the ability to reduce the rate of restenosis compared to bare metal stents (BMS). The ability of DES to reduce the incidence of major adverse cardiac events (MACE) is a significant driving factor for their widespread adoption.

b. Some key players operating in the peripheral vascular stents market include Medtronic, Terumo Medical, Abbott, Biotronik, Lifetech, iVascular SLU, Stryker, Cook Medical, Microport Scientific Corporation, Stentys S.A., Hellman & Friedman (Cordis Inc.)

b. The increasing prevalence of cardiac disorders and technological advancements in stent design and materials are driving the peripheral vascular stents market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.