- Home

- »

- Pharmaceuticals

- »

-

Perjeta Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Perjeta Market Size, Share & Trends Report]()

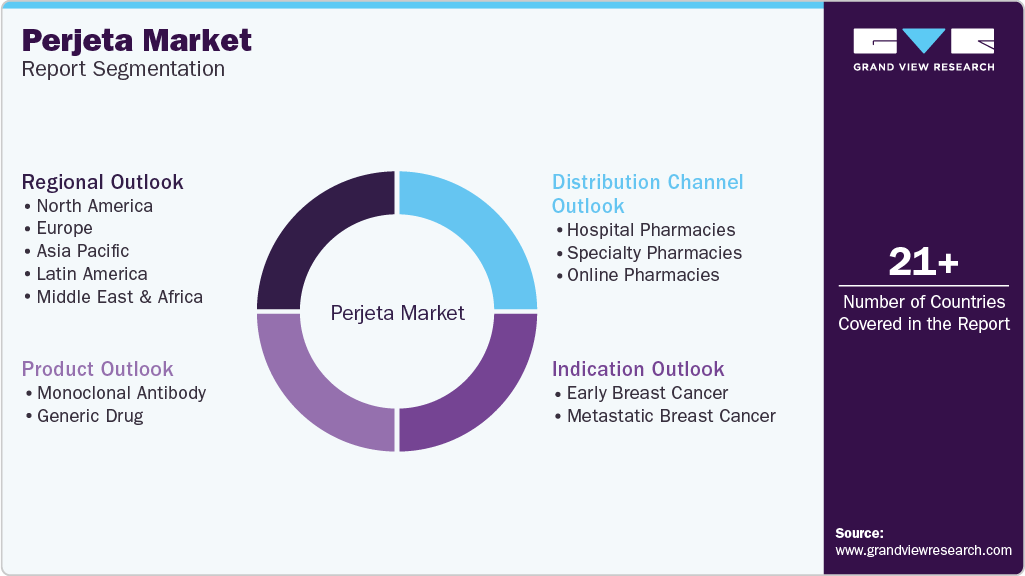

Perjeta Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Monoclonal Antibody, Generic Drug), By Indication (Early Breast Cancer), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-590-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Perjeta Market Size & Trends

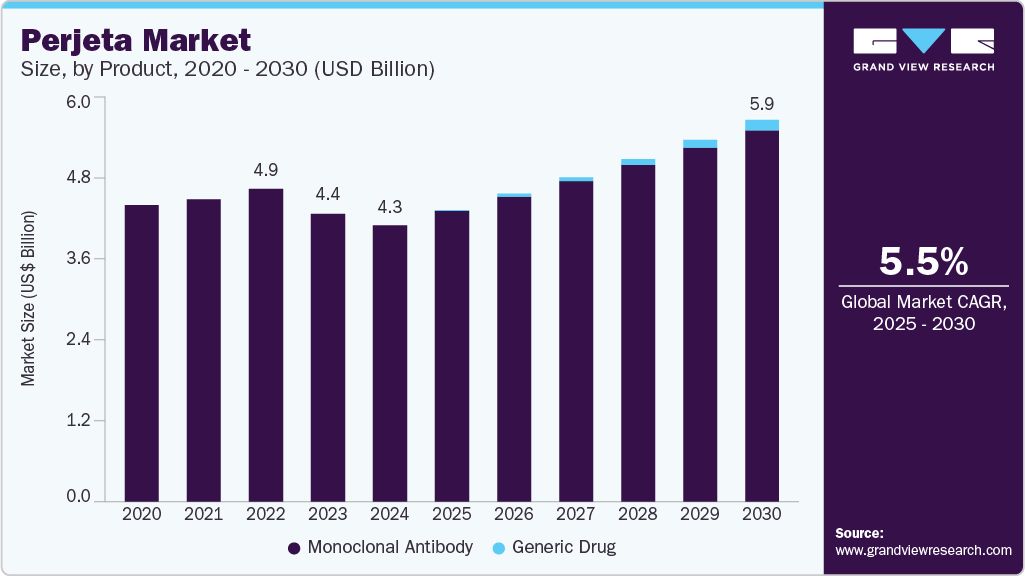

The global perjeta market size was estimated at USD 4.30 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030, driven by the increasing prevalence of HER2-positive breast cancer worldwide. Early detection and enhanced diagnostics have increased the identification of eligible patients, expanding the treatment pool.

Key Highlights:

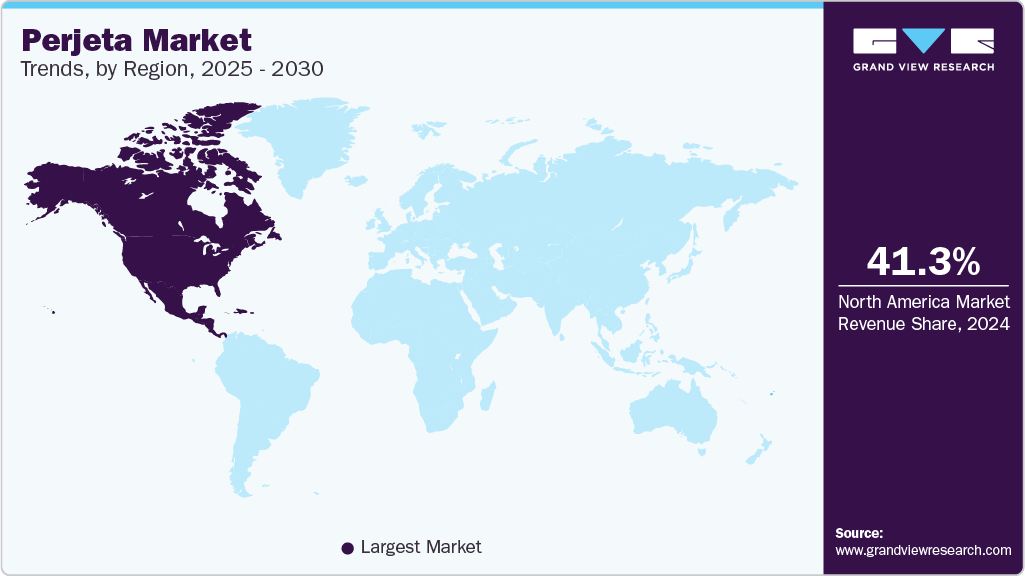

- North America leads the Perjeta market with share of 41.28%, due to its advanced healthcare infrastructure and early adoption of innovative cancer therapies

- The U.S. dominates the North American Perjeta market, which cutting-edge cancer treatment centers and widespread diagnostic capabilities support

- In terms of segment, the monoclonal antibody segment dominated the Perjeta market with a significant revenue share in 2024

- In terms of segment, the metastatic breast cancer segment dominated the Perjeta market with the largest revenue share of 66.64% in 2024

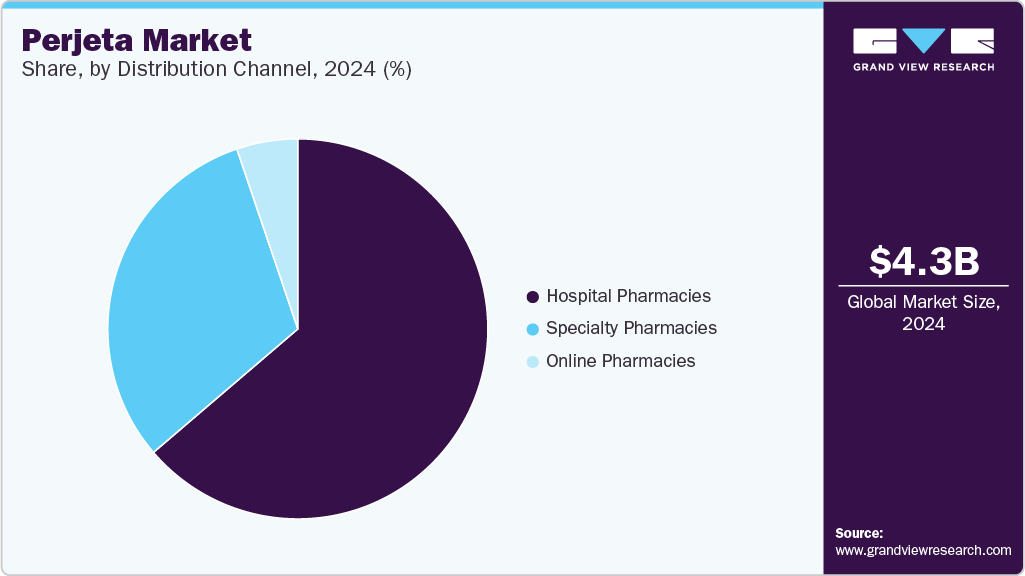

- In terms of segment, the hospital pharmacies segment dominated the Perjeta market with the largest revenue share of 63.74% in 2024

The APHINITY study demonstrated a 17% reduction in the risk of death over ten years when Perjeta was added to trastuzumab and chemotherapy in early-stage HER2-positive breast cancer patients. Additionally, the neoadjuvant setting has seen nearly double the rate of pathological complete response with the Perjeta-based regimen compared to trastuzumab and chemotherapy alone. These clinical outcomes have solidified Perjeta's role as a first-line therapy in various stages of HER2-positive breast cancer. The combination's efficacy and manageable side effects have contributed to its widespread adoption in clinical practice.

Advancements in treatment guidelines and introducing subcutaneous formulations have further propelled Perjeta's market growth. The 2024 NCCN guidelines recommend using Perjeta in preoperative/adjuvant and metastatic settings. The subcutaneous formulation, PHESGO, offers a fixed-dose combination of Perjeta and trastuzumab, reducing administration time and enhancing patient convenience. This innovation has improved patient adherence to treatment regimens. The availability of PHESGO in over 120 countries has expanded access to therapy, particularly in regions with limited healthcare infrastructure. These developments have reinforced Perjeta's position as a cornerstone in HER2-positive breast cancer treatment.

Ongoing clinical research is expected to broaden Perjeta’s therapeutic applications beyond breast cancer. Studies evaluate its effectiveness in other HER2-positive malignancies, including gastric and lung cancers. Positive results from these trials may expand treatment options for patients with diverse tumor types. Innovations in drug delivery methods, such as fixed-dose combinations, improve patient convenience and adherence. Enhanced patient support programs and awareness campaigns also contribute to sustained market demand. These scientific and clinical advancements collectively drive Perjeta’s growth and future potential in oncology care.

Perjeta (Pertuzumab) Pipeline Analysis

Trial Name

Phase

Indication

Design

Key Outcomes

NeoSphere

II

Neoadjuvant HER2+ breast cancer

Multicenter, randomized, open-label with 417 patients

Perjeta + trastuzumab + docetaxel significantly improved pCR rates compared to other regimens

CLEOPATRA

III

Metastatic HER2+ breast cancer

Randomized, comparing Perjeta combo vs. placebo combo

Perjeta significantly improved progression-free survival and overall survival

APHINITY

III

Adjuvant HER2+ early breast cancer

Randomized, double-blind, placebo-controlled

10-year data showed 17% death risk reduction; 21% in node-positive subgroup

DESTINY-Breast09

III

Metastatic HER2+ breast cancer

Testing Enhertu + Perjeta combo vs. standard of care

Significant improvement in progression-free survival (Enhertu + Perjeta arm)

Key Patents and Intellectual Property of Perjeta (Pertuzumab)

The core patents for Perjeta in the US and EU are set to expire in 2025, with biosimilar entry anticipated as early as 2026. This impending loss of exclusivity is expected to significantly impact Perjeta’s market share and revenue, as lower-cost biosimilars enter the market and intensify competition. While Roche may retain some market through brand loyalty and fixed-dose combination offerings like PHESGO, the shift toward biosimilars or generics is likely to drive price erosion and reduced sales volume in mature markets, marking the beginning of Perjeta’s transition into the late lifecycle phase.

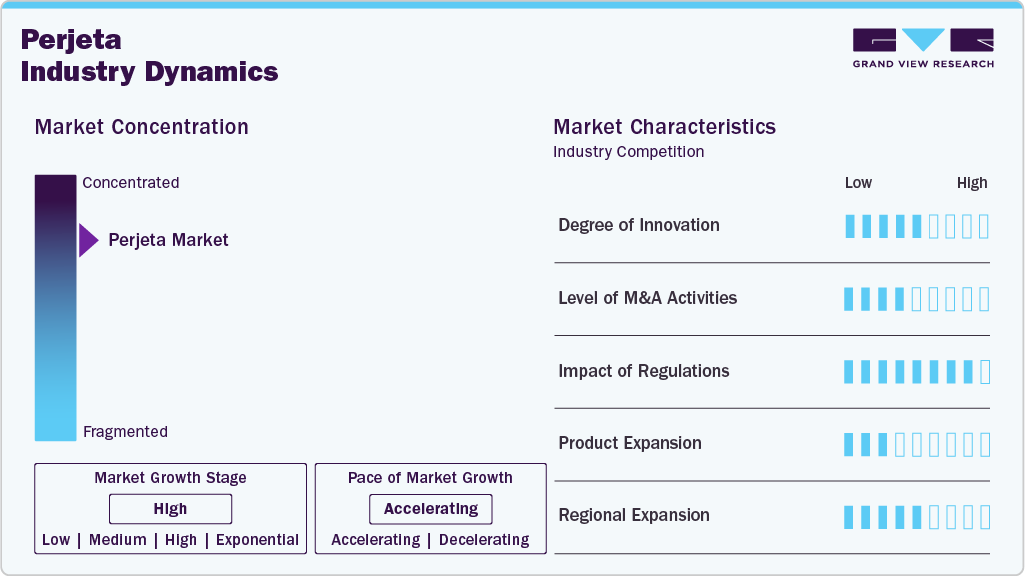

Market Concentration & Characteristics

The Perjeta market is characterized by ongoing innovation primarily aimed at improving treatment efficacy, safety profiles, and patient convenience. Advances focus on enhancing the monoclonal antibody’s binding affinity and optimizing Generic Drug formulations to increase stability and reduce immunogenicity. Combination therapies involving Perjeta with other HER2-targeted agents and chemotherapies are being refined to maximize clinical outcomes in early and metastatic breast cancer.

High entry barriers exist in the Perjeta market due to the complexity of developing biologics, requiring significant investment in R&D and manufacturing capabilities. Biosimilars and generic biologics face rigorous regulatory scrutiny, particularly regarding clinical equivalence and immunogenicity, limiting rapid market penetration. F. Hoffmann-La Roche Ltd’s entrenched position, with strong patent protections and established clinical evidence, consolidates its market dominance. Manufacturing monoclonal antibodies demands advanced biotechnological expertise and robust quality control to ensure batch consistency and safety. Additionally, the costly and lengthy clinical trials necessary to prove efficacy in early and metastatic breast cancer further restrict new entrants. Pricing pressures and reimbursement challenges, especially in markets with cost-containment policies, pose further obstacles for new competitors.

F. Hoffmann-La Roche Ltd is actively expanding Perjeta’s reach into emerging markets such as Asia Pacific, Latin America, and Eastern Europe, driven by rising breast cancer incidence and improving healthcare infrastructure. Localized manufacturing partnerships and adaptive pricing strategies help overcome affordability barriers and increase penetration in these fast-growing regions. Hospital pharmacies remain the primary distribution channel for Perjeta, especially for metastatic breast cancer treatments, while retail and online pharmacies are gradually increasing access for adjuvant and maintenance therapies.

Regulatory authorities such as the FDA and EMA impose stringent requirements for Generic Drugs like Perjeta, demanding extensive clinical trial data across breast cancer stages and patient subpopulations. Approval pathways often include scrutiny of combination therapies and long-term safety monitoring, particularly for monoclonal antibodies administered alongside chemotherapy. Regulatory frameworks also encourage the development of patient access programs to facilitate broader availability in diverse geographies.

Perjeta faces competition from other HER2-targeted therapies, including trastuzumab and newer antibody-drug conjugates, which serve as substitutes depending on the clinical context. Small-molecule tyrosine kinase inhibitors targeting HER2 provide oral alternatives, mainly for metastatic breast cancer, although with different safety and efficacy profiles. Biosimilar trastuzumab has expanded treatment options by offering lower-cost alternatives, particularly in resource-constrained settings, potentially impacting Perjeta’s market share.

Product Insights

The monoclonal antibody segment dominated the Perjeta market with a significant revenue share in 2024, due to its proven efficacy in targeting HER2-positive breast cancer cells. For instance, the FDA approval of Perjeta combined with chemotherapy for neoadjuvant treatment in early HER2-positive breast cancer patients has strengthened its clinical use. Its ability to enhance the effects of other HER2-targeted therapies, such as trastuzumab, further reinforces its market position. The high specificity and reduced side effects compared to traditional chemotherapy contribute to its preference among oncologists and patients. Recent Phase III trial data showing improved progression-free survival have boosted confidence in this treatment approach. Established manufacturing processes and broad physician awareness drive sales growth in this segment.

The generic drug segment is projected to grow at the highest CAGR over the forecast period, fueled by patent expiry. As patents expire in the US and EU, manufacturers are preparing to launch lower-cost biosimilar versions, enhancing treatment accessibility and affordability. This shift is expected to increase competition, reduce treatment costs, and expand patient reach, particularly in price-sensitive markets. Additionally, healthcare systems and payers are increasingly supporting biosimilar adoption to manage oncology drug expenditure. As a result, the generic segment is poised for strong growth, reshaping market dynamics and gradually capturing a share of Perjeta’s existing patient base.

Indication Insights

The metastatic breast cancer segment dominated the Perjeta market with the largest revenue share of 66.64% in 2024. Perjeta’s demonstrated effectiveness in controlling advanced disease progression. The recent publication of updated data from the CLEOPATRA trial confirms its benefit in improving overall survival for metastatic patients receiving Perjeta plus trastuzumab and docetaxel. Perjeta’s mechanism targets resistant cancer cells, enhancing metastatic patients' outcomes. Expanded clinical trial data reinforce its safety and efficacy in later-stage cancer settings. Physicians seek targeted treatment options, making Perjeta a preferred choice for combination regimens. The unmet medical need in metastatic breast cancer sustains strong demand and market expansion

The early breast cancer segment is projected to grow at a significant CAGR over the forecast period due to the drug’s approval for adjuvant therapy in HER2-positive early-stage patients. Recent real-world evidence studies have demonstrated the long-term survival benefits of Perjeta in early breast cancer, encouraging wider use. Early intervention with Perjeta reduces recurrence risks and improves patient outcomes, which increases treatment adoption globally. Clinical guidelines from ASCO and ESMO recommend Perjeta following surgery and chemotherapy, strengthening its role in early breast cancer management. Growing awareness among patients and oncologists supports its uptake in this indication. Increasing breast cancer screening programs have led to more early diagnoses, expanding the patient pool eligible for Perjeta therapy.

Distribution Channel Insights

The hospital pharmacies segment dominated the Perjeta market with the largest revenue share of 63.74% in 2024, driven by hospitals being primary treatment centers for cancer patients requiring intravenous monoclonal antibody therapies. A recent trend includes major cancer centers integrating Perjeta infusions as standard care, supported by specialized oncology nursing staff. Hospitals provide the necessary infrastructure for the administration and monitoring of Perjeta infusions. Oncology specialists predominantly practice in hospitals, ensuring drug availability through these channels. Bulk purchasing agreements and reimbursement policies favor hospital pharmacy distribution. High patient volumes in hospital outpatient and inpatient departments support steady sales.

The online pharmacies segment is projected to grow at the fastest CAGR over the forecast period, fueled by rising patient preference for convenient medication access and home delivery services. The COVID-19 pandemic accelerated the adoption of online pharmacy platforms for specialty drugs, including monoclonal antibodies such as Perjeta. Advanced digital health platforms enable secure prescription fulfillment and remote consultations. Online channels increase accessibility for patients in remote or underserved areas. Growth in telemedicine supports expanded use of online pharmacies for cancer therapies. Integration with healthcare providers ensures proper handling of specialty drugs like Perjeta, promoting patient confidence in online purchases.

Regional Insights

North America leads the Perjeta market with share of 41.28%, due to its advanced healthcare infrastructure and early adoption of innovative cancer therapies. The high prevalence of HER2-positive breast cancer has created strong demand for targeted treatments such as Perjeta. Access to well-established reimbursement frameworks ensures patients receive timely treatment. Significant investments in oncology research and development contribute to the availability of new therapeutic options. Awareness among healthcare professionals and patients about Perjeta’s clinical benefits drives its widespread use. Strong presence of key pharmaceutical companies in this region facilitates market growth.

U.S. Perjeta Market Trends

The U.S. dominates the North American Perjeta market, which cutting-edge cancer treatment centers and widespread diagnostic capabilities support. Large-scale clinical trials conducted domestically provide robust data reinforcing Perjeta’s efficacy. High patient awareness and proactive screening programs aid early diagnosis, boosting Perjeta’s utilization. Private and commercial insurance coverage increases affordability for many patients. Oncology specialists’ preference for combination therapies that include Perjeta enhances its market share. The presence of leading biopharmaceutical companies ensures efficient drug distribution and marketing.

Europe Perjeta Market Trends

Europe holds a significant share in the Perjeta market, driven by comprehensive cancer care frameworks and advanced medical facilities. Increased detection rates of breast cancer have expanded the target patient pool. The region benefits from collaborative clinical research efforts validating Perjeta’s safety and effectiveness. Strong hospital networks enable wide accessibility to novel biologics. Growing adoption of personalized medicine approaches supports Perjeta’s integration into treatment regimens. Increasing investment in healthcare infrastructure enhances the availability of advanced therapies.

UK Perjeta market is growing steadily due to structured healthcare delivery and focus on oncology treatment guidelines. High standards for clinical practice ensure that innovative treatments are quickly adopted in breast cancer care. National screening programs facilitate early detection of HER2-positive tumors, expanding eligibility for Perjeta. Reimbursement policies favor advanced biologics that demonstrate survival benefits. Oncology specialists endorse Perjeta as part of combination therapies, strengthening its use. Continued research activities and clinical trials in the UK contribute to treatment protocol improvements.

Perjeta market in Germany is witnessing growth due to its strong healthcare system and extensive oncology expertise. The country has an efficient healthcare reimbursement system that supports access to costly biologics. High incidence rates of breast cancer and advanced diagnostic services expand patient eligibility. German physicians actively participate in international clinical trials, reinforcing Perjeta’s clinical evidence. Adoption of multidisciplinary approaches in cancer treatment facilitates Perjeta’s use alongside other therapies. Increasing focus on precision medicine further propels demand for targeted agents like Perjeta.

France Perjeta market benefits from a robust healthcare system focused on advanced cancer care and early detection. High breast cancer incidence drives demand for targeted therapies with superior efficacy. Based on strong clinical guidelines, French oncology specialists integrate Perjeta into standard treatment regimens. Comprehensive diagnostic networks ensure the timely identification of HER2-positive patients. Reimbursement frameworks facilitate patient access to expensive biologics, supporting market growth. Continuous investment in oncology research and collaboration with pharmaceutical companies sustain innovation and adoption of Perjeta.

Asia Pacific Perjeta Market Trends

Asia Pacific region is experiencing the fastest CAGR in the Perjeta market, driven by improving healthcare access and rising cancer incidence. Rapid economic growth in emerging countries allows greater investment in oncology infrastructure. Increasing awareness of breast cancer and expanding diagnostic facilities support early identification of candidates for Perjeta treatment. Pharmaceutical companies are intensifying efforts to introduce Perjeta across this diverse region. Growing patient populations and expanding middle-class demographics fuel demand for innovative therapies. Collaborations between local healthcare providers and global drug manufacturers enhance market penetration.

Japan Perjeta market is supported by its advanced healthcare system and strong focus on oncology innovation. Early detection programs and comprehensive cancer care improve the identification of patients eligible for targeted treatment. High healthcare expenditure per capita ensures the availability of expensive therapies like Perjeta. Collaboration between research institutes and pharmaceutical firms boosts clinical evidence generation. Oncologists in Japan prefer treatment regimens that enhance patient outcomes, driving Perjeta usage. Government policies encouraging innovation indirectly facilitate market expansion.

Perjeta market in China is growing rapidly with rising breast cancer prevalence and expanding healthcare services. The increasing availability of advanced diagnostic technologies enables timely HER2 testing. Pharmaceutical market liberalization and expanding healthcare insurance improve patient access to high-cost biologics. Rising awareness among oncologists about Perjeta’s efficacy promotes wider adoption. Efforts to incorporate international treatment standards support the use of Perjeta in clinical practice. Strong local partnerships accelerate distribution and patient reach.

Latin America Perjeta Market Trends

Latin America Perjeta market is expanding steadily due to growing breast cancer awareness and diagnostic infrastructure improvements. Rising incidence of HER2-positive breast cancer increases demand for targeted therapies. The region is witnessing enhanced healthcare spending, especially in the private sector, which facilitates access to biologics like Perjeta. Increasing collaborations between local healthcare providers and global pharmaceutical companies accelerate market penetration. Adoption of international treatment protocols promotes standardized use of advanced therapies. Patient education and advocacy programs are gradually improving acceptance of novel cancer treatments.

Brazil Perjeta market dominates the Latin America market due to its relatively developed healthcare system and rising breast cancer prevalence. Expanding oncology centers in urban areas improves diagnosis and treatment access. The country’s growing middle class contributes to increased demand for innovative cancer therapies. Local clinical trials and real-world evidence support Perjeta’s use and reimbursement. Physicians are increasingly adopting combination therapies involving Perjeta due to proven survival benefits. Strategic partnerships between pharmaceutical firms and healthcare institutions strengthen distribution and awareness.

Middle East & Africa Perjeta Market Trends

MEA region is witnessing gradual growth in the Perjeta market due to expanding healthcare infrastructure and increased cancer diagnosis rates. Rising investments in private healthcare facilities improve access to advanced cancer therapies. Growing awareness of breast cancer and better diagnostic capabilities enhance patient identification. Collaboration with global pharmaceutical companies supports the introduction of innovative treatments. Increasing healthcare expenditure among affluent populations drives demand for targeted therapies. Strategic partnerships are enabling better market penetration across key countries.

Saudi Arabia Perjeta market is growing as the country develops specialized oncology centers and improves cancer screening programs. Rising breast cancer prevalence encourages demand for targeted therapies with proven efficacy. Healthcare providers are adopting international guidelines that recommend Perjeta in HER2-positive breast cancer treatment. Expanding insurance coverage facilitates patient access to costly biologics. Increasing focus on personalized medicine drives the incorporation of Perjeta in treatment protocols. Collaboration with global pharma companies supports training and awareness among healthcare professionals.

Key Perjeta Company Insights

F. Hoffmann-La Roche Ltd holds a dominant position in the Perjeta (pertuzumab) market, having exclusively developed, manufactured, and commercialized the drug as a key component of HER2-positive breast cancer treatment. Perjeta, often used in combination with Herceptin and chemotherapy, has become a cornerstone of first-line therapy for metastatic and early-stage HER2-positive breast cancer, backed by strong clinical data and widespread adoption. Roche's market leadership is reinforced by its robust oncology portfolio, global regulatory approvals, and established distribution networks. However, with Perjeta’s patents in the US and EU set to expire in 2025, the market is poised for significant change. The anticipated entry of biosimilar competitors and the emergence of next-generation HER2-targeted therapies could challenge Roche’s dominance, leading to shifts in pricing, market share, and therapeutic strategies within the HER2-positive breast cancer landscape.

Competitive Landscape & Emerging Players

-

Ambrx Biopharma: ARX788 is an antibody-drug conjugate (ADC) targeting HER2-positive tumors, designed to deliver cytotoxic agents directly to cancer cells. It has shown promising results in Phase II/III trials, demonstrating improved progression-free survival in patients with HER2-positive metastatic breast cancer

-

Carisma Therapeutics: CT-0525 is a chimeric antigen receptor macrophage (CAR-M) therapy engineered to target HER2-overexpressing solid tumors. It has received FDA Fast Track designation, aiming to harness the innate immune system to combat cancer.

-

Byondis: SYD985 is an ADC combining trastuzumab with a potent cytotoxic agent, designed to target HER2-positive tumors.

Key Perjeta Companies:

The following are the leading companies in the perjeta market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd.

- Ambrx Biopharma

- Carisma Therapeutics

- Byondis

Recent Developments

-

In May 2025, Roche announced final overall survival outcomes from its long-term Phase III trial of a Perjeta-based regimen for HER2-positive breast cancer. The trial demonstrated a 17% reduction in mortality risk among participants receiving the Perjeta-based treatment. This regimen has been approved in over 120 countries for treating both early-stage and metastatic HER2-positive breast cancer.

-

In May 2025, Roche disclosed that its primary patents for Perjeta in the U.S. and the European Union were set to expire in 2025. Based on publicly available information, the company expected the first biosimilar versions of Perjeta to enter the U.S. and European markets in 2026. Roche reported that global sales of Perjeta reached CHF 3,616 million in 2024.

Perjeta Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.54 billion

Revenue forecast in 2030

USD 5.93 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd; Ambrx Biopharma; Carisma Therapeutics; Byondis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Perjeta Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Perjeta market report based on product, indication, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Monoclonal Antibody

-

Generic Drug

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Early Breast Cancer

-

Metastatic Breast Cancer

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Specialty Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global perjeta market size was estimated at USD 4.30 billion in 2024 and is expected to reach USD 4.54 billion in 2025.

b. The global perjeta market is expected to grow at a compound annual growth rate of 5.51% from 2025 to 2030 to reach USD 5.93 billion by 2030.

b. Based on product, the monoclonal antibody segment accounted for the largest revenue share of 100.00% in 2024, due to complete patent right for sale of drug. In addition, its proven efficacy in targeting HER2-positive breast cancer cells is expected to boost market growth.

b. Key players operating in the market are F. Hoffmann-La Roche Ltd, Ambrx Biopharma, Carisma Therapeutics, Byondis

b. The Perjeta market driven by factors such as increasing prevalence of breast cancer, supportive government regulations and guidelines, and advancements in treatment options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.