- Home

- »

- Next Generation Technologies

- »

-

Personal Finance Software Market Size & Share Report 2030GVR Report cover

![Personal Finance Software Market Size, Share & Trends Report]()

Personal Finance Software Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Mobile-based, Desktop-based), By End-user (Small Businesses, Individuals), By Deployment (On-premise, Cloud), By Tools, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-105-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Personal Finance Software Market Summary

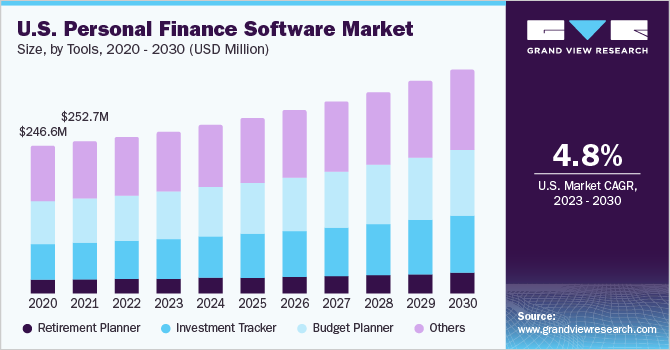

The global personal finance software market size was estimated at USD 1.08 billion in 2022 and is projected to reach USD 1.59 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. The growth of the market can be attributed to the growing adoption of digital banking services across the globe.

Key Market Trends & Insights

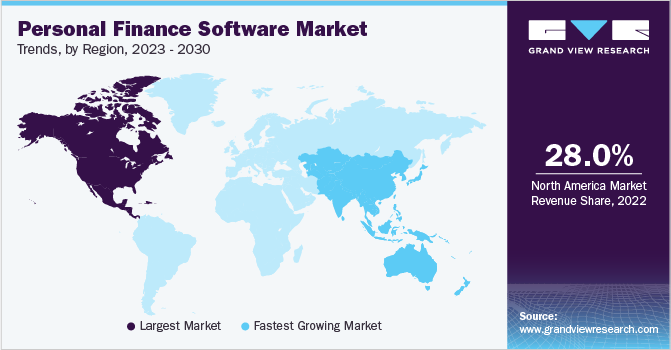

- North America dominated the global market in 2022 accounting for a share of more than 28.0% of the overall revenue.

- Asia Pacific is expected to be the fastest-growing region over the forecast period.

- Based on tools, the budget planner segment accounted for the second-largest share of more than 28.0% of the overall revenue in 2022.

- Based on type, the desktop-based software segment dominated the market in 2022 accounting for a share of more than 53.0% of the overall revenue.

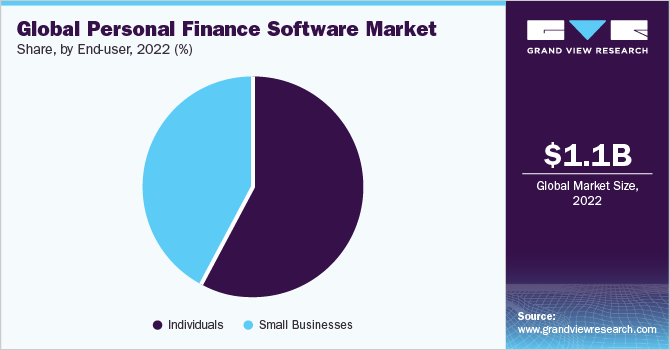

- Based on end-user, the individuals segment dominated the market in 2022 accounting for a share of more than 57.0% of the overall revenue.

Market Size & Forecast

- 2022 Market Size: USD 1.08 Billion

- 2030 Projected Market Size: USD 1.59 Billion

- CAGR (2023-2030): 5.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The rise in financial awareness among consumers has driven the market’s growth. For instance, several companies and banking firms, such as Banco Bilbao Vizcaya Argentaria, S.A. (BBVA), a financial service company, have launched programs to boost financial education among the people at a global level. The increasing launches of software embedded with personal finance management tools are anticipated to drive growth further. For instance, in April 2023, P&N Group’s BCU Bank division announced the launch of a personal financial management application.

This launch aimed to offer its customers an oversight of their money through the application. It offered various tools like spend tracking, budgeting, and categorizing transactions. Technological advancement in data visualization has enabled personal finance software to present financial data in visually appealing and easily understandable formats. Using charts, graphs, and interactive dashboards has made it easy for users to adopt and understand such personal finance software. Furthermore, digitalization in the banking industry has made it possible to introduce features, such as Automated Bill Payments, that offer time-saving and reduce the chances of missing payments.

Moreover, personal finance software enables businesses and individuals to track income and expenses in budgeting. The increasing investments in the market are one of the other major factors driving the market growth. For instance, in June 2021, Truebill, a personal finance start-up, announced that it raised USD 45 million through a Series D funding round. The company in November 2020 also raised USD 17 million through a series C funding round. The existing investors in the series D funding round were Cota Capital, Bessemer Venture Partners, and Eldridge Industries. The company aimed to utilize these funds for adding new tools and upgrading its personal finance application.

Though the market is anticipated to grow significantly, some challenges, such as low financial literacy among individuals across the globe, are expected to restrain the market's growth. For instance, as per the article published on Annuity.org, a company providing insights related to finance, nearly 75% of teens need more confidence in their knowledge of personal finance. Similarly, according to a 2018 Financial Industry Regulatory Authority (FINRA) study, more than 53% of adults say that thinking about their finances makes them feel anxious. Furthermore, the limited accessibility and affordability of personal finance software is another major factor hindering the market's growth.

COVID-19 Impact Analysis

The COVID-19 pandemic had a positive impact on the global market. The growth in digitalization and adoption of online banking services motivated individuals and small business owners to develop trust in online financial tracking software. Furthermore, the job losses and income disruptions during the COVID-19 pandemic led to increased investment and retirement planning, eventually propelling the market's growth. In addition, the increasing mobile and internet penetration during and after the COVID-19 pandemic also contributed to the market's growth.

Tools Insights

The budget planner segment accounted for the second-largest share of more than 28.0% of the overall revenue in 2022. The budget planner helps individuals and business owners to plan and budget their expenses. It enables them to achieve financial stability by paying bills on time and saving funds for other major expenses, such as a car or home. Furthermore, the increasing launches of such budget planner across the globe is anticipated to drive the segment’s growth. For instance, in November 2022, Santander UK, a financial services company, announced the launch of its financial support hub, a budget calculator, and financial health check.

The investment tracker segment is projected to register the fastest CAGR from 2023 to 2030. The growth of this segment can be attributed to the increasing awareness about investments among customers. Various organizations, such as The Securities and Exchange Commission's Office of Investor Education and Advocacy (OIEA), promote investment awareness among individuals. Furthermore, various personal finance software, such as Quicken Inc., Buxfer Inc., and Intuit, provide investment tracking tools that bode well with the segment’s growth.

Type Insights

The desktop-based software segment dominated the market in 2022 accounting for a share of more than 53.0% of the overall revenue. The dominance of the desktop-based software segment is primarily due to the accessibility of maximum features, including charts and graphs, over a desktop compared to mobile phones. Desktop-based software may be of more utility to institutions due to the complex nature of their cash flow. Several personal finance software, such as Moneydance, a desktop-based personal finance software, can be accessed using Windows, Mac, or Linux desktops.

The mobile-based software segment is projected to register the fastest growth rate over the forecast period. The growth of this segment can be attributed to the high penetration rate of mobile phones worldwide. For instance, in 2022, according to Newzoo International B.V., a video games and gamer data company, the smartphone penetration rate across China, the U.S., and Japan has climbed to 68.4%, 81.6%, and 78.6%, respectively. Furthermore, various desktop-based personal software companies have already started introducing applications based on Android and iOS operating systems.

Deployment Insights

The cloud segment dominated the market in 2022 and accounted for a share of more than 51.0% of the overall revenue. An increase in the adoption of the cloud by several enterprises across the globe is expected to drive the segment's growth. Furthermore, the cloud allows syncing of the data and offers multi-device access to the users. For instance, a person can easily switch between a mobile device and a desktop with cloud deployment; thereby, such benefits are expected to fuel the segment's growth over the forecast period.

The on-premise deployment segment is anticipated to register the second-fastest growth rate from 2023 to 2030. The growth of on-premise personal finance software can be attributed to its highly secured nature. The on-premise deployments provide control over software upgrades and their frequency. As a result, it can be a preferred choice for many small enterprises, as it offers the best way to secure and manage their financial data.

End-user Insights

The individuals segment dominated the market in 2022 accounting for a share of more than 57.0% of the overall revenue. The growth of this segment can be attributed to the increasing adoption of personal finance software by individuals to track their financial data. A rise in the adoption of personal finance software can be attributed to the rising financial awareness among individuals. For instance, according to the FINRA survey, around 71% of adult Americans believe they have high financial literacy levels. The small businesses segment is expected to register the fastest CAGR from 2023 to 2030.

The growth can be attributed to the increasing adoption of personal finance software by small business owners. The adoption can be attributed to the benefits provided by the software, which include allowing small business owners to do expense tracking and budgeting, invoicing & payment management, and managing cash flow. Furthermore, the increasing number of small businesses across the globe is anticipated to fuel the segment's growth. For instance, according to advocacy.sba.gov and Oberlo, in 2022, the number of small businesses reached 33.2 million across the U.S.

Regional Insights

North America dominated the global market in 2022 accounting for a share of more than 28.0% of the overall revenue. The presence of prominent personal finance software providers, such as Quicken Inc., Intuit, Inc. (Mint), and Buxfer Inc., is anticipated to fuel the regional market's growth. Furthermore, the rising campaigns and financial literacy programs are expected to fuel the regional market's growth over the forecast period. In addition, the rising investments in personal finance software companies also bode well for regional market growth.

Asia Pacific is expected to be the fastest-growing region over the forecast period. The region's growth can be attributed to the increasing adoption of personal finance software across countries, including China and India. Furthermore, a rise in the population of these countries creates growth opportunities for the regional market. In addition, the increasing financial awareness among individuals in this region is expected to drive regional market growth over the forecast period.

Key Companies & Market Share Insights

The market is characterized as a moderately consolidated market. Prominent players are involved in expansion initiatives, strategic partnerships, and joint ventures to gain a competitive edge. For instance, in August 2021, InComm Payments, a payment technology company, partnered with Doxo Inc., a personal finance software provider. This partnership aimed to allow Doxo users to pay household bills at over 60,000 retail locations across the U.S. with cash. Though the largest players dominate the market, it is competitive with high growth potential.

The key players are also involved in regional expansions to expand their offerings beyond the boundaries. For instance, in January 2023, Plum, a smart European money application, announced the launch of its personal finance application across five European countries, including Portugal, Italy, Greece, the Netherlands, and Cyprus. As a result of this expansion, Plum customers in these countries were enabled to connect their bank accounts to the application. Some of the prominent players in the global personal finance software market include:

-

Quicken Inc.

-

The Infinite Kind

-

Intuit, Inc. (Mint)

-

You Need A Budget LLC

-

Buxfer Inc.

-

Doxo Inc.

-

Money Dashboards

-

Moneyspire Inc.

-

Personal Capital Corp.

-

Pocket Smith Ltd.

Personal Finance Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.12 billion

Revenue forecast in 2030

USD 1.59 billion

Growth rate

CAGR of 5.1% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Tools, type, deployment, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; The Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Quicken Inc.; The Infinite Kind; Intuit, Inc. (Mint); You Need A Budget LLC; Buxfer Inc.; Doxo Inc.; Money Dashboards; Moneyspire Inc.; Personal Capital Corp.; Pocket Smith Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personal Finance Software Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the personal finance software market report based on tools, type, deployment, end-user, and region:

-

Tools Outlook (Revenue, USD Million, 2017 - 2030)

-

Budget Planner

-

Retirement Planner

-

Investment Tracker

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Desktop-based Software

-

Mobile-based Software

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premise

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Small Businesses

-

Individuals

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

The Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global personal finance software market size was estimated at USD 1.08 billion in 2022 and is expected to reach USD 1.12 billion in 2023.

b. The global personal finance software market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 to reach USD 1.59 billion by 2030.

b. North America dominated the personal finance software market with a share of 28.29% in 2022. The presence of prominent personal finance software providers, such as Quicken Inc., Intuit, Inc. (Mint), and BUXFER INC., is anticipated to fuel the regional market's growth.

b. Some key players operating in the personal finance software market include Quicken Inc.; The Infinite Kind; Intuit, Inc. (Mint); you need a budget llc; BUXFER INC.; DOXO INC.; Money Dashboards; MONEYSPIRE INC.; Personal Capital Corporation; Pocket Smith Ltd.

b. Key factors that are driving the market growth include a rise in internet and smartphone penetration and growing investments in personal finance software.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.