- Home

- »

- Biotechnology

- »

-

Personalized Medicine Market Size And Share Report, 2030GVR Report cover

![Personalized Medicine Market Size, Share & Trends Report]()

Personalized Medicine Market Size, Share & Trends Analysis Report By Product (Personalized Medicine Diagnostics, Personalized Medicine Therapeutics), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-443-7

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Personalized Medicine Market Size & Trends

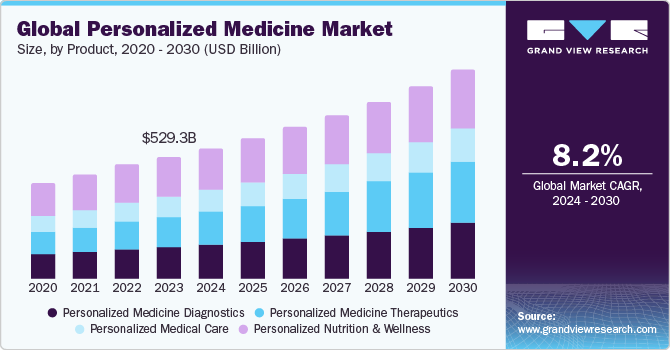

The global personalized medicine market was valued at USD 529.28 billion in 2023 and is projected to grow at a CAGR of 8.20% from 2024 to 2030. The personalized medicine market is driven majorly by the growing demand for novel drug discovery to combat the rising incidence of cancers and other diseases across the globe. Moreover, numerous collaborations among researchers and market players are also anticipated to have a positive impact on the personalized medicine market growth.

For instance, in February 2023, Roche extended its partnership with Janssen Biotech Inc., intensifying efforts in the development of companion diagnostics for targeted therapies. This expanded collaboration encompasses various precision technologies, such as immunohistochemistry, digital pathology, next-generation sequencing, polymerase chain reaction, and immunoassays, fostering advancements in research and innovation.

One of the most important factors expected to have a significant impact on the market is how much and to what extent the growth of Next-Generation Sequencing (NGS) will affect the adoption of personalized medicine(PM) in the coming seven years. The exponentially decreasing cost of sequencing whole genomes and technological advancements in NGS in a way with Moore’s law for semiconductors in the field of life sciences. For instance, as per the Medical Device Network article published in 2023, sequencing costs have significantly decreased over time as a result of increased competition and advancements in technology.

The increasing prevalence of rare diseases is also anticipated to boost the demand for growth of the market. The increasing level of understanding and correlation of characteristics of the human genome paved the way for efforts in devising various precision medicine and therapeutic exercises. For instance, in September 2022, a research study carried out at the University of California at Irvine, proposed a novel technique for the management of inherited retinal diseases (IRDs) by using precision genome editing that is very specific to an individual’s requirements.

Companion diagnostics are tests or assays that are specifically designed to identify biomarkers for patient stratification, ensuring that the right patients receive the right therapies at the right time. Many companies are embracing this approach to tailor treatments based on individual patient characteristics, optimizing therapeutic outcomes while minimizing potential adverse effects. For instance, in November 2023, Foundation Medicine announced a partnership with Pierre Fabre Laboratories aimed at advancing the development of FoundationOneCDx and FoundationOneLiquidCDx, which are high-quality genomic tests. The goal is to establish these tests as companion diagnostics for novel targeted therapies designed to treat individuals diagnosed with Non-Small Cell Lung Cancer (NSCLC).

Personalized medicine is poised to reshape the healthcare landscape in the coming years, fueled by four prominent trends. This evolution is driven by decision support techniques utilizing the potential of the human genome, the integration of big data analytics and machine learning in healthcare practices, reimbursement strategies promoting preventative care within health systems, and the introduction of advanced tools facilitating increased data accessibility and interoperability. For instance, in June 2023, Dartmouth inaugurated its Center for Precision Health and Artificial Intelligence (CPHAI) propelled by an initial USD 2 million funding. CPHAI is dedicated to advancing interdisciplinary research exploring the application of artificial intelligence and biomedical data in enhancing personalized medicine and health outcomes. Emphasizing the importance of maintaining ethical standards in health AI, the center aims to leverage AI's transformative potential in addressing real-world clinical challenges, improving patient outcomes, and ensuring equitable healthcare access.

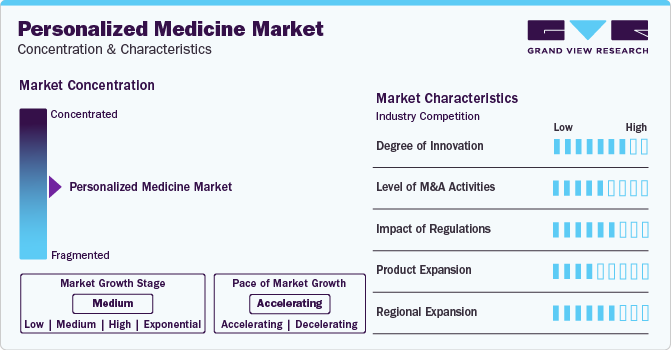

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The personalized medicine market is booming, fueled by groundbreaking innovations. Advanced technologies like genomics, proteomics, and artificial intelligence drive tailored therapies, diagnostics, and preventive measures. This dynamic landscape offers immense opportunities for professionals and investors, shaping the future of healthcare through unprecedented levels of precision and effectiveness.

The market is witnessing heightened merger and acquisition (M&A) activity, reflecting a strategic shift within the industry. Major players, such as pharmaceutical giants acquiring biotech startups or diagnostic companies, aim to strengthen their portfolios in genomics and targeted therapies. An illustrative example is Roche's acquisition of Foundation Medicine, enhancing its position in precision oncology through comprehensive genomic profiling and personalized cancer care.

Regulatory frameworks significantly influence the market, ensuring patient safety and product efficacy. Striking a balance between innovation and oversight, regulations shape the industry's growth. For instance, the FDA's approval of genetic tests and targeted therapies demonstrates a proactive approach, fostering advancements while maintaining stringent standards. Robust regulatory measures inspire confidence, attracting investments and facilitating the responsible expansion of personalized medicine.

In the market, product expansion is considered one of the major market characteristics. Product launches continually redefine patient care. GE Healthcare launched CardioVisio for Atrial Fibrillation (AFib), a digital tool to help physicians visualize longitudinal data from various data sources, which is important to support evidence-based clinical decision-making guided by the most recent AFib guidelines. The new technology was exhibited from August 25-28, 2023, at the European Society of Cardiology (ESC) Congress in Amsterdam, Netherlands. Such launches signify ongoing advancements, expanding the frontier of precision medicine and enhancing individualized healthcare solutions.

The regional expansion strategies are vital for companies seeking broader influence in this market. By tailoring their approaches to diverse healthcare landscapes, companies can penetrate new markets, connect with a larger customer base, and amplify sales and revenue. Such strategies facilitate the global dissemination of personalized healthcare solutions, driving industry growth.

Product Insights

Personalized nutrition & wellness recorded a dominant revenue share of 32.57% in 2023. The growth of the segment is due to the extensive consumption rate and market penetration. Further, the high rate of over-the-counter (OTC) sales of nutrition products boosts the demand due to lowered regulatory implications. For instance, in November 2023, Viome Life Sciences announced the acquisition of Naring Health, which includes gaining ownership of DiscernDX. The latter is recognized for enabling regular health monitoring, early disease detection, and personalized care. This strategic move positions Viome to augment its personalized health solutions, providing more accurate food and supplement recommendations. The acquisition marks a significant step in ushering in a new era of personalized nutrition, offering customers comprehensive insights into their body's status and personalized nutrition strategies to address issues at their root cause.

The personalized medicine therapeutics segment is projected to record the fastest CAGR from 2024 to 2030. Next-generation sequencing technology plays a major role in PM therapeutics. Due to the development of high-capacity rapid sequencing platforms, the cost of sequencing the whole human genome is expected to reduce significantly. Consequentially, this will translate into high market adoption and usage rates for precision medical therapies.

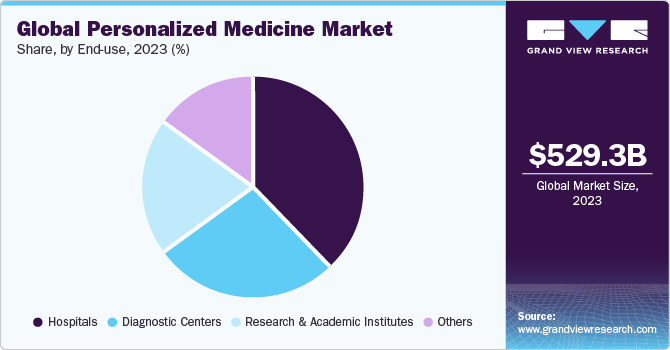

End-use Insights

Hospital end-use segment led the market with a dominant revenue share in 2023. Hospitals play a pivotal role in the personalized medicine market, both as end-users and influencers. The increasing integration of genomic diagnostics and targeted therapies within hospital settings is a notable trend. This reflects a shift towards personalized medicine, where hospitals leverage genetic insights to tailor treatments for patients.

The demand for personalized medicine within hospitals is a significant market driver, prompting advancements in diagnostic tools and therapeutic approaches. As hospitals embrace genomics, they contribute to the market's growth by fostering innovation, improving patient outcomes, and positioning themselves at the forefront of transformative healthcare practices, ultimately shaping the future of personalized medicine.

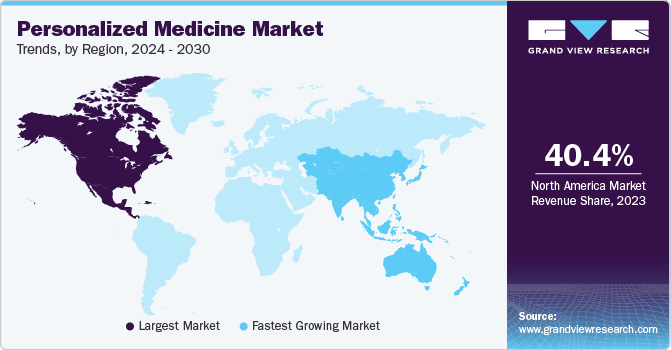

Regional Insights

North America personalized medicine market accounted for the largest share of 40.37% in 2023. This is attributed to the support of research institutes and pharmaceutical giants. Personalized medicine is now preferred for all kinds of diseases and therefore is part of research on any given disease and drug discovery. There are emerging advancements in precision diagnostics in the region. For instance, in January 2021, Illumina, Inc. developed the TruSight Oncology 500 (TSO 500) assay that uses nucleic acids from tumor regions and capably identifies as many as 523 cancer biomarkers.

U.S. Personalized Medicine Market Trends

The U.S. personalized medicine market is expected to grow from 2024 to 2030 attributed to the presence of key players such as GE Healthcare; Illumina, Inc.; ASURAGEN, Inc.; Danaher; Abbott Laboratories, and 23andMe, Inc. Key companies are increasingly entering into partnerships, collaborations, and agreements to enhance access to personalized medicine.

Europe Personalised Medicine Market Trends

Europe personalized medicine market is expected to grow at a significant CAGR from 2024 to 2030. Furthermore, current levels of development in Germany, the UK, and France are expected to provide lucrative opportunities for market growth over the forecast period.

The personalized medicine market in the UK is expected to grow along with the overall Europe market owing to the growing development of companion diagnostics (CDxs) and the subsequent establishment of molecular diagnostics by the prominent market participants.

The France personalized medicine market is expected to grow at a notable CAGR from 2024 to 2030 due to various funding initiatives undertaken by public & private organizations focusing on developing and commercializing novel precision diagnostic & therapeutic solutions. Human Precision MEDicine (Hu-PreciMED) project was launched by Intersystems & Oncodesign and is aimed at structuring the precision medicine industry in France. It includes over 45 medical and digital companies.

The personalized medicine market in Germany is expected to grow at a lucrative CAGR from 2024 to 2030 owing to the ongoing developments in the advancement of personalized medicine in Germany by public and private organizations, such as EuroBioForum, the German Center for Infection Research, and the Personalized Medicine Coalition (PMC).

Asia Pacific Personalized Medicine Market Trends

Asia Pacific personalized medicine market is projected to grow at the fastest CAGR from 2024 to 2030. Developing healthcare infrastructure and rising healthcare expenditure in emerging economies contribute to the accelerated growth of the regional market.Various key players are entering Asia Pacific, which is expected to positively impact the growth of the market. For instance, in June 2022, MGI collaborated with MiRXES to expand the region's access to advanced spatial multiomics research capabilities. This agreement is expected to expand the reach of the companies.

The personalized medicine market in China is growing lucratively attributed to government support and involvement in cross-border international collaborations for preventive & personalized medicine.Expected developments in Chinese insurance policies and the growing adoption of Western medicine are also expected to contribute to the market growth.

The Japan personalized medicine market is expected to grow at a notable CAGR from 2024 to 2030. This share is due to the outcome of an active expansion strategy under execution by several market participants to strengthen their position in the Asia Pacific region. For instance, in October 2023, NTT Corporation (Japan) entered into an agreement with BC Platforms AG, PRIME-R, and Bioxcellerator to develop the Japan Precision Medicine Platform (JPP).

Latin America Personalized Medicine Market Trends

Latin America personalized medicine market is primarily driven by continuous advancements in cancer treatments, such as the expansion of less-toxic targeted therapies, improve patients' quality of life. Several events and conferences in Latin America to raise awareness about personalized and advanced therapies also drive the market.

The personalized medicine market in Brazil is expected to grow from 2024 to 2030 owing to increasing number of industrial developments such as expansion policies, mergers & acquisitions, and joint ventures.

MEA Personalized Medicien Market Trends

MEA personalized medicine market was identified as a lucrative region in this industry with the emergence of various national genome projects in the UAE, Saudi Arabia, Kuwait, and Qatar. The Saudi Human Genome Program (SHGP), the UAE Human Genome Project, the Qatar Genome Programme (QGP), and the Kuwait Genome Project are among the few genomic projects.

The personalized medicine market in Saudi Arabia is expected to grow from 2024 to 2030 attributed to the increasing awareness and prevalence of infectious diseases, including HIV, and other conditions requiring blood diagnostics.

Key Personalized Medicine Company Insights

Some key players operating in the market include Abbott; GE Healthcare., Inc.; Illumina, Inc., and Danaher Corporation. Established players focus majorly on innovation & technology advancements to develop cutting-edge diagnostic solutions and partner with emerging players to leverage their technology. Mature players also have a strong global presence with a diverse portfolio of genetic testing products and a well-established brand reputation which gives them a competitive edge.

Emerging players however focus on launching products in limited countries and then expanding regionally. Some operating strategies also include strategic partnerships, acquisitions, or collaborations to enhance their capabilities and market presence. Additionally, these players may be more flexible and agile than established players in terms of responding and changing to market needs and demand, allowing them to quickly adapt and develop new technologies.

Key Personalized Medicine Companies:

The following are the leading companies in the personalized medicine market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Illumina, Inc.

- ASURAGEN, INC.

- Abbott

- Dako A/S

- Exact Sciences Corporation

- Danaher Corporation (Cepheid, Inc.)

- Decode Genetics, Inc.

- QIAGEN

- Exagen Inc.

- Precision Biologics

- Celera Diagnostics LLC.

- Biogen

- Genelex

- International Business Machines Corporation (IBM)

- Genentech, Inc.

- 23andMe, Inc.

Recent Developments

-

In September 2023, A Memorandum of Understanding (MOU) was signed by Agilent Technologies & Advanced Cell Therapy and Research Institute, Singapore (ACTRIS) to advance in gene and cell therapy over the next 3 years.

-

In July 2023, As a part of Illumina's oncology product portfolio, Pillar Biosciences and Illumina formed a strategic partnership to commercialize Pillar's suite of oncology assays worldwide. Completing the agreement will lead to an unparalleled offering of additional Next-Generation Sequencing (NGS) solutions, improving patient access to personalized cancer treatment solutions.

-

In June 2023, GE Healthcare and DePuy Synthes signed a distribution agreement to expand the reach of OEC 3D Imaging System and product offerings of DePuy Synthes to more surgeons & patients in the U.S.

-

In June 2023, Exact Sciences Corp. collaborated independently with two distinguished healthcare institutions at the forefront of cancer research. The agreements seek to increase access to genomic information in order to enhance patient care.

Personalized Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 567.10 billion

Revenue forecast in 2030

USD 909.80 billion

Growth Rate

CAGR of 8.20% from 2024 to 2030

Actual years

2018 - 2023

Forecast years

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare, Illumina, Inc., ASURAGEN, INC., Abbott, Dako A/S, Exact Sciences Corporation, Danaher Corporation (Cepheid, Inc.), Decode Genetics, Inc., QIAGEN, Exagen Inc., Precision Biologics, Celera Diagnostics LLC, Biogen, Genelex, IBM, Genentech, Inc., 23andMe, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Personalized Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global personalized medicine market report based on the product, end-use and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personalized Medicine Diagnostics

-

Genetic Testing

-

Direct-To-Consumer (DTC) Diagnostics

-

Esoteric Lab Services

-

Esoteric Lab Tests

-

-

Personalized Medicine Therapeutics

-

Pharmaceutical

-

Genomic Medicine

-

Medical Devices

-

-

Personalized Medical Care

-

Telemedicine

-

Health Information Technology

-

-

Personalized Nutrition & Wellness

-

Retail Nutrition

-

Complementary & Alternative Medicine

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Research & Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global personalized medicine market size was estimated at USD 529.28 billion in 2023 and is expected to reach USD 567.10 billion in 2024.

b. The global personalized medicine market is expected to grow at a compound annual growth rate of 8.20% from 2024 to 2030 to reach USD 909.80 billion by 2030.

b. North America dominated the personalized medicine market with a share of 40.37% in 2023. This is attributable to the increasing adoption of NGS methods and healthcare IT systems in clinical workflow along with supportive government policies and funding.

b. Some key players operating in the personalized medicine market include GE Healthcare, Illumina, Inc., ASURAGEN, INC., Abbott, Dako A/S, Exact Sciences Corporation, Danaher Corporation (Cepheid, Inc.), Decode Genetics, Inc., QIAGEN, Exagen Inc., Precision Biologics, Celera Diagnostics LLC, Biogen, Genelex, IBM, Genentech, Inc., 23andMe, Inc.

b. Key factors that are driving the personalized medicine market growth include the advancement of next-generation sequencing, a growing number of companion/associated diagnostics, an increasing number of retail clinics across the developed regions of North America and Europe, an increasing prevalence of cancer, and increasing usage of biomarkers for PM cancer therapy.

b. The personalized nutrition and wellness product segment dominated the personalized medicine market and accounted for the largest revenue share of 57.82% in 2022.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Product

1.2.2. End-use

1.2.3. Regional scope

1.2.4. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. End-use outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Personalized Medicine Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Advancements in next-generation sequencing technology

3.2.1.2. Expanding portfolio of companion/associated diagnostics

3.2.1.3. Increasing prevalence of cancer & usage of biomarkers for personalized medicine cancer therapy

3.2.1.4. Technological advancements to facilitate R&D for personalized medicine

3.2.2. Market restraint analysis

3.2.2.1. Presence of nonvalue-based personalized medicine diagnostics reimbursement policy

3.2.2.2. Lack of proper intellectual property regulations for personalized medical technologies

3.3. Personalized Medicine Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

Chapter 4. Personalized Medicine Market: Product Estimates & Trend Analysis

4.1. Product Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Personalized Medicine Market by Product Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Personalized Medicine Diagnostics

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.1.2. Genetic Testing

4.4.1.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.1.3. DTC Diagnostics

4.4.1.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.1.4. Esoteric Lab Services

4.4.1.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.1.5. Esoteric Lab Tests

4.4.1.5.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.2. Personalized Medicine Therapeutics

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.2.2. Pharmaceutical

4.4.2.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.2.3. Genomic Medicine

4.4.2.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.2.4. Medical Devices

4.4.2.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.3. Personalized Medical Care

4.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.3.2. Telemedicine

4.4.3.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.3.3. Health Information Technology

4.4.3.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.4. Personalized Nutrition & Wellness

4.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.4.2. Retail Nutrition

4.4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.4.3. Complementary & Alternative Medicine

4.4.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 5. Personalized Medicine Market: End-use Estimates & Trend Analysis

5.1. Method Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Personalized Medicine Market by End-use Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Hospitals

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.2. Academic & Research Institutes

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.3. Diagnostic Centers

5.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.4. Others

5.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 6. Personalized Medicine Market: Regional Estimates & Trend Analysis

6.1. Regional Market Share Analysis, 2023 & 2030

6.2. Regional Market Dashboard

6.3. Global Regional Market Snapshot

6.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

6.5. North America

6.5.1. U.S.

6.5.1.1. Key country dynamics

6.5.1.2. Regulatory framework/ reimbursement structure

6.5.1.3. Competitive scenario

6.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Billion)

6.5.2. Canada

6.5.2.1. Key country dynamics

6.5.2.2. Regulatory framework/ reimbursement structure

6.5.2.3. Competitive scenario

6.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Billion)

6.6. Europe

6.6.1. UK

6.6.1.1. Key country dynamics

6.6.1.2. Regulatory framework/ reimbursement structure

6.6.1.3. Competitive scenario

6.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.2. Germany

6.6.2.1. Key country dynamics

6.6.2.2. Regulatory framework/ reimbursement structure

6.6.2.3. Competitive scenario

6.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.3. France

6.6.3.1. Key country dynamics

6.6.3.2. Regulatory framework/ reimbursement structure

6.6.3.3. Competitive scenario

6.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.4. Italy

6.6.4.1. Key country dynamics

6.6.4.2. Regulatory framework/ reimbursement structure

6.6.4.3. Competitive scenario

6.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.5. Spain

6.6.5.1. Key country dynamics

6.6.5.2. Regulatory framework/ reimbursement structure

6.6.5.3. Competitive scenario

6.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.6. Norway

6.6.6.1. Key country dynamics

6.6.6.2. Regulatory framework/ reimbursement structure

6.6.6.3. Competitive scenario

6.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.7. Sweden

6.6.7.1. Key country dynamics

6.6.7.2. Regulatory framework/ reimbursement structure

6.6.7.3. Competitive scenario

6.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Billion)

6.6.8. Denmark

6.6.8.1. Key country dynamics

6.6.8.2. Regulatory framework/ reimbursement structure

6.6.8.3. Competitive scenario

6.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Billion)

6.7. Asia Pacific

6.7.1. Japan

6.7.1.1. Key country dynamics

6.7.1.2. Regulatory framework/ reimbursement structure

6.7.1.3. Competitive scenario

6.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Billion)

6.7.2. China

6.7.2.1. Key country dynamics

6.7.2.2. Regulatory framework/ reimbursement structure

6.7.2.3. Competitive scenario

6.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Billion)

6.7.3. India

6.7.3.1. Key country dynamics

6.7.3.2. Regulatory framework/ reimbursement structure

6.7.3.3. Competitive scenario

6.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Billion)

6.7.4. Australia

6.7.4.1. Key country dynamics

6.7.4.2. Regulatory framework/ reimbursement structure

6.7.4.3. Competitive scenario

6.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Billion)

6.7.5. South Korea

6.7.5.1. Key country dynamics

6.7.5.2. Regulatory framework/ reimbursement structure

6.7.5.3. Competitive scenario

6.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Billion)

6.7.6. Thailand

6.7.6.1. Key country dynamics

6.7.6.2. Regulatory framework/ reimbursement structure

6.7.6.3. Competitive scenario

6.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Billion)

6.8. Latin America

6.8.1. Brazil

6.8.1.1. Key country dynamics

6.8.1.2. Regulatory framework/ reimbursement structure

6.8.1.3. Competitive scenario

6.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Billion)

6.8.2. Mexico

6.8.2.1. Key country dynamics

6.8.2.2. Regulatory framework/ reimbursement structure

6.8.2.3. Competitive scenario

6.8.2.4. Mexico market estimates and forecasts 2018 to 2030 (USD Billion)

6.8.3. Argentina

6.8.3.1. Key country dynamics

6.8.3.2. Regulatory framework/ reimbursement structure

6.8.3.3. Competitive scenario

6.8.3.4. Argentina market estimates and forecasts 2018 to 2030 (USD Billion)

6.9. MEA

6.9.1. South Africa

6.9.1.1. Key country dynamics

6.9.1.2. Regulatory framework/ reimbursement structure

6.9.1.3. Competitive scenario

6.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Billion)

6.9.2. Saudi Arabia

6.9.2.1. Key country dynamics

6.9.2.2. Regulatory framework/ reimbursement structure

6.9.2.3. Competitive scenario

6.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Billion)

6.9.3. UAE

6.9.3.1. Key country dynamics

6.9.3.2. Regulatory framework/ reimbursement structure

6.9.3.3. Competitive scenario

6.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Billion)

6.9.4. Kuwait

6.9.4.1. Key country dynamics

6.9.4.2. Regulatory framework/ reimbursement structure

6.9.4.3. Competitive scenario

6.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. Vendor Landscape

7.3.1. List of key distributors and channel partners

7.3.2. Key customers

7.3.3. Key company market share analysis, 2023

7.3.4. GE Healthcare

7.3.4.1. Overview

7.3.4.2. Financial Performance

7.3.4.3. Product Benchmarking

7.3.4.4. Strategic Initiatives

7.3.5. Illumina, Inc.

7.3.5.1. Overview

7.3.5.2. Financial Performance

7.3.5.3. Product Benchmarking

7.3.5.4. Strategic Initiatives

7.3.6. ASURAGEN, INC.

7.3.6.1. Overview

7.3.6.2. Financial Performance

7.3.6.3. Product Benchmarking

7.3.6.4. Strategic Initiatives

7.3.7. Abbott

7.3.7.1. Overview

7.3.7.2. Financial Performance

7.3.7.3. Product Benchmarking

7.3.7.4. Strategic Initiatives

7.3.8. Dako A/S

7.3.8.1. Overview

7.3.8.2. Financial Performance

7.3.8.3. Product Benchmarking

7.3.8.4. Strategic Initiatives

7.3.9. Exact Sciences Corporation

7.3.9.1. Overview

7.3.9.2. Financial Performance

7.3.9.3. Product Benchmarking

7.3.9.4. Strategic Initiatives

7.3.10. Danaher Corporation (Cepheid, Inc.)

7.3.10.1. Overview

7.3.10.2. Financial Performance

7.3.10.3. Product Benchmarking

7.3.10.4. Strategic Initiatives

7.3.11. Decode Genetics, Inc.

7.3.11.1. Overview

7.3.11.2. Financial Performance

7.3.11.3. Product Benchmarking

7.3.11.4. Strategic Initiatives

7.3.12. QIAGEN

7.3.12.1. Overview

7.3.12.2. Financial Performance

7.3.12.3. Product Benchmarking

7.3.12.4. Strategic Initiatives

7.3.13. Exagen Inc.

7.3.13.1. Overview

7.3.13.2. Financial Performance

7.3.13.3. Product Benchmarking

7.3.13.4. Strategic Initiatives

7.3.14. Precision Biologics

7.3.14.1. Overview

7.3.14.2. Financial Performance

7.3.14.3. Product Benchmarking

7.3.14.4. Strategic Initiatives

7.3.15. Celera Diagnostics LLC

7.3.15.1. Overview

7.3.15.2. Financial Performance

7.3.15.3. Product Benchmarking

7.3.15.4. Strategic Initiatives

7.3.16. Biogen

7.3.16.1. Overview

7.3.16.2. Financial Performance

7.3.16.3. Product Benchmarking

7.3.16.4. Strategic Initiatives

7.3.17. Genelex

7.3.17.1. Overview

7.3.17.2. Financial Performance

7.3.17.3. Product Benchmarking

7.3.17.4. Strategic Initiatives

7.3.18. IBM

7.3.18.1. Overview

7.3.18.2. Financial Performance

7.3.18.3. Product Benchmarking

7.3.18.4. Strategic Initiatives

7.3.19. Genentech, Inc.

7.3.19.1. Overview

7.3.19.2. Financial Performance

7.3.19.3. Product Benchmarking

7.3.19.4. Strategic Initiatives

7.3.20. 23andMe, Inc.

7.3.20.1. Overview

7.3.20.2. Financial Performance

7.3.20.3. Product Benchmarking

7.3.20.4. Strategic Initiatives

List of Tables

Table 1 List of Abbreviation

Table 2 North America Personalized Medicine Market, By Country, 2018 - 2030 (USD Billion)

Table 3 North America Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 4 North America Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 5 U.S. Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 6 U.S. Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 7 Canada Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 8 Canada Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 9 Europe Personalized Medicine Market, By Country, 2018 - 2030 (USD Billion)

Table 10 Europe Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 11 Europe Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 12 France Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 13 France Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 14 Germany Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 15 Germany Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 16 UK Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 17 UK Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 18 Spain Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 19 Spain Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 20 France Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 21 France Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 22 Italy Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 23 Italy Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 24 Sweden Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 25 Sweden Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 26 Norway Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 27 Norway Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 28 Denmark Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 29 Denmark Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 30 Asia Pacific Personalized Medicine Market, By Country, 2018 - 2030 (USD Billion)

Table 31 Asia Pacific Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 32 Asia Pacific Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 33 Japan Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 34 Japan Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 35 China Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 36 China Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 37 India Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 38 India Personalized Medicine Market, By End-Use, 2018 - 2030 (USD Billion)

Table 39 South Korea Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 40 South Korea Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 41 Australia Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 42 Australia Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 43 Thailand Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 44 Thailand Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 45 Latin America Personalized Medicine Market, By Country, 2018 - 2030 (USD Billion)

Table 46 Latin America Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 47 Latin America Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 48 Brazil Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 49 Brazil Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 50 Mexico Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 51 Mexico Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 52 Argentina Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 53 Argentina Personalized Medicine Market, By End-Use, 2018 - 2030 (USD Billion)

Table 54 MEA Personalized Medicine Market, By Country, 2018 - 2030 (USD Billion)

Table 55 MEA Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 56 MEA Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 57 South Africa Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 58 South Africa Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 59 Saudi Arabia Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 60 Saudi Arabia Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 61 UAE Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 62 UAE Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

Table 63 Kuwait Personalized Medicine Market, By Product, 2018 - 2030 (USD Billion)

Table 64 Kuwait Personalized Medicine Market, By End-use, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market research process

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value chain-based sizing & forecasting

Fig. 6 Market formulation & validation

Fig. 7 Personalized medicine market segmentation

Fig. 8 Market snapshot, 2023

Fig. 9 Market trends & outlook

Fig. 10 Market driver relevance analysis (current & future impact)

Fig. 11 Market restraint relevance analysis (current & future impact)

Fig. 12 PESTEL analysis

Fig. 13 Porter’s five forces analysis

Fig. 14 Global personalized medicine market, for product, 2018 - 2030 (USD Billion)

Fig. 15 Global personalized medicine market, for diagnostics, 2018 - 2030 (USD Billion)

Fig. 16 Global personalized medicine market, for genetic testing, 2018 - 2030 (USD Billion)

Fig. 17 Global personalized medicine market, for direct-to-consumer (DTC) testing, 2018 - 2030 (USD Billion)

Fig. 18 Global personalized medicine market, for esoteric lab services, 2018 - 2030 (USD Billion)

Fig. 19 Global personalized medicine market, for esoteric lab tests, 2018 - 2030 (USD Billion)

Fig. 20 Global personalized medicine market, for therapeutics, 2018 - 2030 (USD Billion)

Fig. 21 Global personalized medicine market, for pharmaceutical, 2018 - 2030 (USD Billion)

Fig. 22 Global personalized medicine market, for genomic medicine, 2018 - 2030 (USD Billion)

Fig. 23 Global personalized medicine market, for medical devices, 2018 - 2030 (USD Billion)

Fig. 24 Global personalized medicine market, for personalized medical care, 2018 - 2030 (USD Billion)

Fig. 25 Global personalized medicine market, for telemedicine, 2018 - 2030 (USD Billion)

Fig. 26 Global personalized medicine market, for health information technology, 2018 - 2030 (USD Billion)

Fig. 27 Global personalized medicine market, for personalized nutrition & wellness, 2018 - 2030 (USD Billion)

Fig. 28 Global personalized medicine market, for retail nutrition, 2018 - 2030 (USD Billion)

Fig. 29 Global personalized medicine market, for complementary & alternative medicine, 2018 - 2030 (USD Billion)

Fig. 30 Global personalized medicine market, for End-use, 2018 - 2030 (USD Billion)

Fig. 31 Global personalized medicine market, for diagnostics centers, 2018 - 2030 (USD Billion)

Fig. 32 Global personalized medicine market, for academic and research institutes, 2018 - 2030 (USD Billion)

Fig. 33 Global personalized medicine market, for hospitals, 2018 - 2030 (USD Billion)

Fig. 34 Global personalized medicine market, for others, 2018 - 2030 (USD Billion)

Fig. 35 Regional outlook, 2023 & 2030

Fig. 36 North America personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 37 U.S. personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 38 Canada personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 39 Europe personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 40 Germany personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 41 UK personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 42 France personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 43 Italy personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 44 Spain personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 45 Denmark personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 46 Sweden personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 47 Norway personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 48 Asia Pacific personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 49 Japan personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 50 China personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 51 India personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 52 Australia personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 53 Thailand personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 54 South Korea personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 55 Latin America personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 56 Brazil personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 57 Mexico personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 58 Argentina personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 59 MEA personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 60 South Africa personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 61 Saudi Arabia personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 62 UAE personalized medicine market, 2018 - 2030 (USD Billion)

Fig. 63 Kuwait personalized medicine market, 2018 - 2030 (USD Billion)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Personalized Medicine Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Personalized Medicine End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Personalized Medicine Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- North America End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- U.S.

- U.S. Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- U.S. End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- U.S. Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Canada

- Canada Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Canada End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Canada Product Outlook (Revenue, USD Billion, 2018 - 2030)

- North America Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Europe

- Europe Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Europe End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Germany

- Germany Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Germany End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Germany Product Outlook (Revenue, USD Billion, 2018 - 2030)

- UK

- UK Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- UK End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- UK Product Outlook (Revenue, USD Billion, 2018 - 2030)

- France

- France Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- France End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- France Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Italy

- Italy Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Italy End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Italy Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Spain

- Spain Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Spain End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Spain Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Denmark

- Canada Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Denmark End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Canada Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Sweden

- Sweden Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Sweden End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Sweden Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Norway

- Norway Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Norway End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Norway Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Europe Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Asia Pacific

- Asia Pacific Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Asia Pacific End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- China

- China Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- China End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- China Product Outlook (Revenue, USD Billion, 2018 - 2030)

- India

- India Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- India End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- India Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Japan

- Japan Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Japan End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Japan Product Outlook (Revenue, USD Billion, 2018 - 2030)

- South Korea

- South Korea Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- South Korea End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- South Korea Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Thailand

- Thailand Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Thailand End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Thailand Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Australia

- Australia Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Australia End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Australia Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Asia Pacific Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Latin America

- Latin America Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Latin America End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Brazil

- Brazil Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Brazil End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Brazil Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Mexico

- Mexico Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Mexico End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Mexico Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Argentina

- Argentina Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Argentina End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Argentina Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Latin America Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Middle East & Africa

- Middle East & Africa Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Middle East & Africa End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- South Africa

- South Africa Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- South Africa End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- South Africa Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Saudi Arabia

- Saudi Arabia Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Saudi Arabia End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Saudi Arabia Product Outlook (Revenue, USD Billion, 2018 - 2030)

- UAE

- UAE Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- UAE End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- UAE Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Kuwait

- Kuwait Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Personalized Medicine Diagnostics

- Genetic Testing

- Direct-To-Consumer (DTC) Diagnostics

- Esoteric Lab Services

- Esoteric Lab Tests

- Personalized Medicine Therapeutics

- Pharmaceutical

- Genomic Medicine

- Medical Devices

- Personalized Medical Care

- Telemedicine

- Health Information Technology

- Personalized Nutrition & Wellness

- Retail Nutrition

- Complementary & Alternative Medicine

- Personalized Medicine Diagnostics

- Kuwait End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic Centers

- Research & Academic Institutes

- Others

- Kuwait Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Middle East & Africa Product Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

Personalized Medicine Market Dynamics

Drivers: Advancements In Next-Generation Sequencing Technology

One of the most important factors expected to have a significant impact on the market is how much and to what extent the growth of Next-Generation Sequencing (NGS) will affect the adoption of personalized medicine in the coming seven years. The exponentially decreasing cost of sequencing whole genomes and technological advancements in NGS in a way align with Moore’s law for semiconductors in the field of life sciences. For instance, as per the Medical Device Network article published in 2023, sequencing costs have significantly decreased over time as a result of increased competition and advancements in technology. In addition, leading NGS platform players, such as Illumina and Life Technologies, have stated that the cost of sequencing a whole genome using their technology is currently less than USD 1,000. Thus, due to this reduction in prices, the demand for NGS is expected to grow in clinical diagnostics. Several oncologists believe that in the coming seven years, NGS combined with companion diagnostics can be expected to play a major role in personalized diagnostics and therapeutics. Owing to the development of a regulatory framework for the safety & efficacy of NGSbased lab tests and increasing clinical investigation data on disease heterogeneity, the demand for next-generation sequencing is expected to grow, which is anticipated to serve as a high-impact rendering driver of personalized medicine market over the forecast period

Expanding Portfolio Of Companion/Associated Diagnostics

Companion diagnostics are tests or assays that are specifically designed to identify biomarkers for patient stratification, ensuring that the right patients receive the right therapies at the right time. Many companies are embracing this approach to tailor treatments based on individual patient characteristics, optimizing therapeutic outcomes while minimizing potential adverse effects. Due to the successful launch of companion diagnostics, usage & penetration rates of personalized diagnostics and drugs will greatly depend on the level of adoption of their respective companion. diagnostic tests. In the coming seven years, more than 150 companion diagnostic on-label combinations and a wide array of personalized medicines are expected to be under clinical trials. The adoption of companion diagnostics is expected to increase even further post-FDA approval of novel tests. The expected increase in accuracy of testing and development of their analysis systems are likely to positively impact the market for companion diagnostics as well as personalized therapeutics and diagnostics over the forecast period.

Restraints: Presence Of Nonvalue-Based Personalized Medicine Diagnostics Reimbursement Policy

Several reimbursement structures provided by payors do not take the value provided by personalized medical tests and only incorporate the “cost-plus” approach, thus, there is a lack of complete potential reimbursement for personalized medicine tests in the market. This may hinder market growth as it negatively affects usage and adoption. However, the expected revision of regulatory and reimbursement policy with growing advancements in personalized medical products is expected to reduce the impact of this restraint over the forecast period. Moreover, the lack of consistent reimbursement policies limits incentives for innovation, potentially leading to a slowdown in the development of advanced personalized diagnostics. This uncertainty not only complicates regulatory compliance and adds administrative burdens but also contributes to unequal access to personalized medicine, fostering disparities among patients based on diagnosis and geographic location. The resulting complex landscape poses challenges for market players, potentially stalling the broader adoption of personalized medicine into routine clinical care. Thus, addressing these challenges in reimbursement policies is crucial for creating an environment that fosters innovation, encourages market growth, and ensures equitable access to the transformative potential of personalized medicine in enhancing patient outcomes.

What Does This Report Include?

This section will provide insights into the contents included in this personalized medicine market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Personalized medicine market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Personalized medicine market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the personalized medicine market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for personalized medicine market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.