- Home

- »

- Animal Health

- »

-

Pet DNA Testing Market Size & Share, Industry Report, 2030GVR Report cover

![Pet DNA Testing Market Size, Share & Trends Report]()

Pet DNA Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats), By Sample Type (Blood, Saliva), By Test Type (Breed Profile, Health & Wellness, Genetic Diseases), By End-user (Breeders, Pet Owners), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-030-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet DNA Testing Market Summary

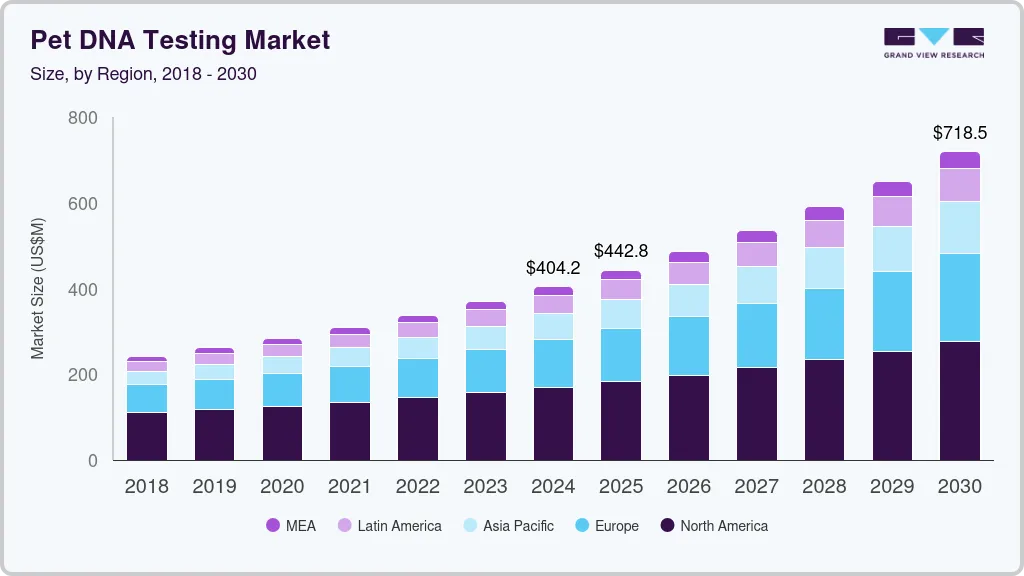

The global pet DNA testing market size was estimated at USD 404.21 million in 2024 and is projected to reach USD 718.51 million by 2030, growing at a CAGR of 10.16% from 2025 to 2030. Factors driving market growth include increasing pet adoption rates, growing consumer genomics, increased R&D activity by key players and academic researchers, and increased awareness and sales of pet DNA testing kits.

Key Market Trends & Insights

- North America pet DNA market dominated the global market with revenue share of 41.8%.

- The pet DNA testing market in U.S. is growing rapidly.

- Based on animal type, dogs segment is dominated the market with a revenue share of 52.06% in 2024.

- Based on sample type, the saliva segment held the largest revenue share of 53.90% in 2024.

- Based on test type, the breed profile segment held the highest revenue share of 38.07% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 404.21 million

- 2030 Projected Market Size: USD 718.51 million

- CAGR (2025-2030): 10.16%

- North America: Largest market in 2024

Furthermore, advancements in DNA testing technologies, coupled with more affordable and accessible testing options, are fueling the expansion of this market globally. For instance, in January 2025, Mug Root Beer launched a novelty DNA test kit, the Mug Root Beer Dawg DNA Kit, on TikTok Shop, playing into internet humor and its bulldog mascot. The kit humorously determines if users "got that dawg" in them while including a real canine DNA test for pet owners. This stunt increases awareness of pet DNA testing, attracting new consumers through entertainment-driven marketing and potentially expanding the market for pet DNA testing.

Additionally, in June 2024, The Dublin Society for the Prevention of Cruelty to Animals (DSPCA) launched the "Know Your Pet" DNA testing kit for dogs in collaboration with Ancestry. This simple test, using a saliva sample, provides a detailed genetic breakdown, helping owners understand their dog's breed mix, traits, and behavior. The goal is to enhance care by tailoring it to the dog's specific needs. According to DSPCA's Corporate Volunteer Manager, this advancement promotes responsible pet ownership and animal welfare.

Similarly, pet parents are becoming increasingly ready to spend more on pet care to save or prolong the lives of their beloved dogs and cats, thus fueling market growth. For example, according to the FEDIAF 2024 report, pet-related products and services sales reached USD 27.45 billion in 2023, a significant rise over the prior year. As the study of genomics advances in the veterinary profession, pet genetic test kits become more prevalent. For more than 15 years, companies have provided at-home dog and cat DNA testing options to breeders, pet owners, and veterinarians. Since Mars Petcare introduced direct-to-consumer genetic test products in 2009, the market has grown rapidly, offering numerous potential customers. DNA profiling techniques are expanding in the veterinary industry, much like the field of human genomics and genetic testing is increasing.

Pet DNA tests have gained popularity among pet owners, breeders, and veterinarians for identifying breed composition, ancestry, and potential genetic health risks. These tests, available online and in pet supply stores, range from $40 to $300 for dogs and $100 to $500 for cats. Basic breed identification tests start at $40 - $100. Advanced health screening kits cost $150 - $300. Prices depend on the type of kit, with premium options offering advanced health screening.

Table no.1 Costs of Dog DNA tests

Brand

Test Type

Price Range (USD)

Embark

Breed Identification

129.0 - 199.0

Wisdom Panel

Breed & Health Analysis

79.9 - 149.9

DNA My Dog

Breed & Genetic Traits

68.9 - 88.9

Orivet

Breed & Health Screening

95.0 - 149.0

Dognomics

Breed & Health Profile

147.0

Source: Research Gate Journal, Grand View Research

Table no.2 Costs of cat DNA tests

Brand

Test Type

Price Range (USD)

Basepaws

Breed & Health Profile

129.0 - 499.0

Wisdom Panel

Feline Health & Breed Test

99.9

Orivet

Breed & Health Screening

119.0

Source: Research Gate Journal, Grand View Research

The pricing of pet DNA tests has fluctuated since the pandemic, mainly due to increasing demand, technological advancements, and competition among leading companies.

-

Pre-pandemic (2018 - 2019): Basic breed identification tests cost $50 to $100, while advanced genetic health screening tests cost $150 to $250.

-

During the Pandemic (2020 - 2021), the demand for pet DNA tests surged as pet adoptions increased. Prices rose by 15-25%, with comprehensive health and breed tests reaching up to $300 due to supply chain disruptions and higher demand.

-

Post-pandemic (2022 - 2025): Prices have stabilized as more companies enter the market. Basic tests range from $40 to $100, while premium genetic tests cost between $150 and $500, depending on features. The entry of new players like Neogen and GENSOL has introduced low-cost options, bringing affordability to a broader audience.

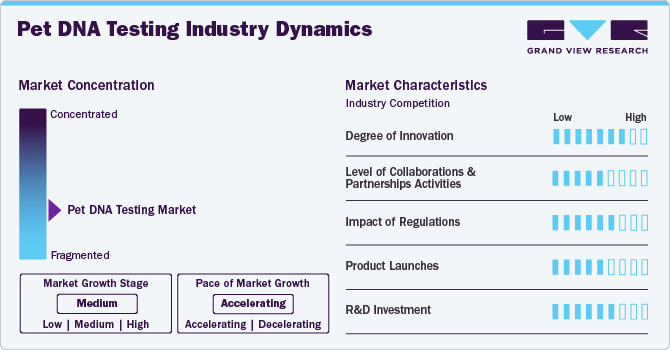

Market Concentration & Characteristics

The pet DNA testing industry is generally consolidated. The market is at a medium-growth stage, and the expansion rate is expanding. Rapid advances in veterinary diagnostics and increased R&D expenditure by the key players are key drivers of market growth. The rate of technical advancement influences market concentration. Companies investing in R&D to introduce novel products with improved features and efficacy could gain a competitive advantage and expand their market shares. In contrast, companies that fail to keep up with technological advances risk losing market share to competitors.

The pet DNA testing market has seen significant innovation, particularly with advancements in genetic analysis technology. Innovations include tests for breed identification, health predispositions, ancestry, and behavior traits. For instance, in March 2025, The Canine Genetics Centre (CGC) launched a genetic test for Primary Hyperparathyroidism (PHPT) in Keeshonds, marking a breakthrough in canine genetic research. CGC's advancements enhance the accuracy and availability of genetic tests, accelerating innovation in the pet DNA testing market. By identifying disease-related mutations and expanding breed-specific tests, they contribute to improved canine health management and drive demand for genetic screening services.

The pet DNA testing market experienced a surge in collaborations and partnerships, significantly driving market growth. For instance, in November 2024, Wisdom Panel partnered with the Canine Genetics Centre (CGC) at the University of Cambridge to advance canine genetic research. This collaboration will analyze genetic data from over 4.5 million dogs, focusing on disease mutations and conditions like chondrodystrophy with intervertebral disc disease (CDDY with IVDD) in breeds such as Dachshunds and Beagles. This partnership strengthens cross-institutional collaborations in the market, increasing data-sharing, accelerating genetic discoveries, and improving breed-specific health insights.

Regulations in the pet DNA testing market can enhance test accuracy, credibility, and consumer trust, leading to wider veterinary adoption. Currently, the lack of standardization raises concerns about inconsistent results and misuse. Stricter guidelines could drive innovation, improve transparency, and ensure responsible use of genetic data.

New product launches drive market growth by expanding testing capabilities and consumer engagement. Innovations enhance accuracy, attract a wider audience, and solidify brand leadership, ultimately increasing adoption rates and revenue in the pet DNA testing industry. For instance, in October 2024, Wisdom Panel introduced a groundbreaking behavior insights feature in its dog DNA tests, making it the only service to analyze genetic influences on canine behavior. Powered by a vast database, this feature helps pet parents modify training, anticipate behavioral tendencies, and personalize dog care.

R&D investment in the pet DNA testing market is crucial for driving innovation and enhancing genetic testing capabilities. Companies are allocating significant resources to develop advanced technologies that improve the accuracy and comprehensiveness of tests. Investments focus on genetic health screenings, breed identification, and disease susceptibility analysis. Collaborations with academic institutions, like Mars Petcare's partnership with the Broad Institute, further amplify R&D efforts by leveraging cutting-edge genetic research. This commitment to R&D not only fuels product development but also helps address emerging pet health issues, ultimately expanding the overall market.

Animal Type Insights

Based on animal type, the market is segmented into dogs, cats, and others. The dogs segment is dominated the market with a revenue share of 52.06% in 2024. The adoption of pets, especially dogs, is significantly increasing among the American population. According to the National Pet Owners Survey 2023-2024 conducted by the American Pet Products Association (APPA), 65.1 million households (around 63%) in the U.S. owned dogs, which increased from 54% of households registered in 2022. Dogs have maintained significant status and popularity in North America for decades, with people often treating them as loyal family members. To a degree, where one-third of the U.S. population loves their dogs more than their partners.

Furthermore, the cats segment is expected to be the fastest-growing segment at the highest CAGR of 10.80% over the forecast period. Cats are the second-most popular pet choice. This segment is driven by growing trends of adopting cats over dogs owing to their calm nature with excellent memory & learning capabilities. Cats are often considered to be low-maintenance pets as they do not require training for basic self-cleaning.

Younger generations, especially millennials, have become more attracted to cats, with around 46.5 million households in the U.S. owning cats in 2023, according to the American Pet Products Association (APPA). So far, over 250 hereditary diseases have been discovered in cats, and understanding their breed history will be key in curing such diseases with timely treatments. Recent studies have revealed that cat DNA tests have shown that some feline populations have lived alongside humans for over 3000 years.

Sample Type Insights

Based on sample type, the saliva segment held the largest revenue share of 53.90% in 2024. Saliva-based DNA tests dominate the pet DNA testing market due to their ease of use and convenience compared to other methods like blood sampling. Collecting a saliva sample from a dog, typically by swabbing the inside of the cheek, is a simple and non-invasive process. This ease of collection, especially for owners unfamiliar with more technical procedures, drives the popularity of saliva DNA testing.

Moreover, many key players offer comprehensive saliva-based DNA test kits that provide a wide array of genetic data. For example, premium test kits like the Wisdom Panel’s dog DNA kit include over 180 health screenings, making them highly attractive. Even though pet saliva contains pathogenic agents, proper preparation methods, such as mixing with water to minimize contamination, help maintain the accuracy of these tests. This blend of convenience and reliable results positions saliva as the preferred sample type, driving its market dominance.

On the other hand, the blood segment is anticipated to grow significantly at a CAGR of 10.63% during the forecast period. The demand for blood samples in pet DNA testing is increasing due to their higher accuracy and reliability for complex genetic analyses. Blood samples contain more stable and concentrated DNA than saliva, which may be contaminated by food or pathogens. This makes blood a preferred choice for advanced screenings related to hereditary diseases and precise health diagnostics, particularly in clinical settings. Additionally, veterinarians often recommend blood-based tests for pets with known health issues to ensure the most accurate genetic data.

Test Type Insights

Based on test type, the breed profile segment held the highest revenue share of 38.07% in 2024. Pet DNA testing is primarily used for breed profiling because owners seek to understand their pet’s genetic heritage, traits, and potential health risks. This segment dominates the market as mixed-breed pet owners want clarity on lineage, behavior, and predisposition to diseases. Companies like Embark and Wisdom Panel provide breed composition reports, helping owners tailor nutrition and healthcare based on breed-specific needs. Wisdom Panel offers tests from USD 97.25 to 181.55, with premium versions screening for over 260 genetic health risks.

Additionally, owners are driven by concerns over misidentified breeds, health risks, and legal restrictions. For example, some mistakenly believe their Labrador is an XL Bully, leading them to confirm lineage. Companies like Ancestry and The Kennel Club have also entered the pet DNA market, highlighting its growing demand. Additionally, law enforcement is exploring forensic DNA testing for identifying dogs involved in attacks on livestock.

Health and Wellness segment is expected to grow at the highest CAGR of 10.50% over the forecast period. Pet owners are increasingly interested in pet DNA testing to understand better their pets' breeds, traits, and potential health risks. This helps predict size, temperament, and exercise needs while promoting early preventive care. Pet DNA tests allow owners, breeders, and veterinarians to create tailored diets and healthcare plans based on genetic predispositions. Customization of premium pet food based on a pet's genetic profile, such as that offered by Mars Veterinary, contributes to the growing demand for these test kits.

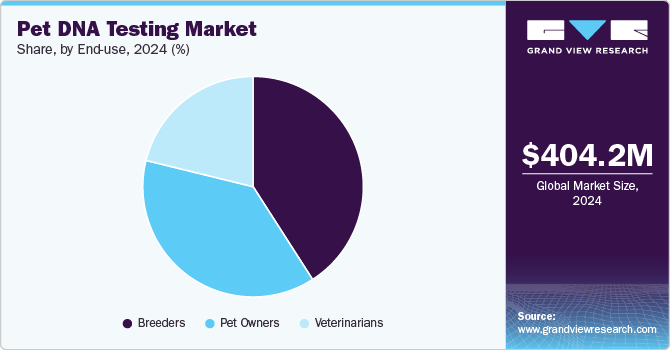

End-use Insights

Based on end use, the breeders segment held the largest revenue share of 40.92% in 2024. Breeders worldwide strive to breed better dog or cat breeds with quality traits that suit every generation of owners' requirements. Along with physical features such as attractive fur color, eye color, height, weight, and other characteristics, owners are now looking for animals with better health and talents in specific tasks. Owing to these factors, breeders are educating themselves about several breed mixes and possible mating to suit people's needs.

A commonly used product for the said application is a pet DNA test kit. Professional dog breeders must know more about the genetics of animals considered for breeding. This way, breeders can reduce the risk of producing puppies associated with genetically inherited diseases. Key players in the market offer handy DNA test kits for dog or cat breeders to analyze potential genotypes before breeding. For instance, the Embark Dog DNA test kit for breeders screens over 230 genetic health risks, enabling breeders to enhance their breeding programs.

The pet owners segment is expected to grow at the highest CAGR of 10.54% during the forecast period. Owing to their increased willingness to spend more money and time on their pets, some owners are purchasing pet DNA tests purely for fun to unveil interesting information about their pets' ancestral history, breed makeup, & insights into the future physical traits, including height, weight, color, and others.

However, certain valuable information from DNA tests helps understand the possible behavioral changes, predisposition of genetic diseases, and drug sensitivity conditions. This information enables pet owners to begin timely treatment at early stages. Moreover, ancestry DNA tests are preferred among pet owners to confirm the breed before buying from breeders at significant costs.

Regional Insights

North America pet DNA market dominated the global market. The increase in collaboration and corporate partnerships in North America is significantly fueling the pet DNA testing market. For instance, in September 2023, Embark Veterinary partnered with Assistance Dogs International (ADI) to provide DNA testing kits to North American members of ADI’s breeding cooperative.

This partnership helps screen for over 250 genetic health conditions in assistance dogs, ensuring healthier breeding practices and longer service dog careers. Thus, partnerships between companies like Embark Veterinary and Assistance Dogs International and Mars Petcare's collaboration with the Broad Institute are expected to enhance access to genetic testing and expand research capabilities. These alliances enable the sharing of resources, data, and expertise, leading to the development of more comprehensive and accurate testing solutions.

U.S. Pet DNA Testing Market Trends

The pet DNA testing market in U.S. is growing rapidly due to the rise in technological advancements to enhance early disease detection and personalized treatment options for pets, along with the presence of key market players. For example, in September 2022, Antech expanded its canine cancer diagnostic capabilities with new molecular tests like SearchLight DNA and OncoK9 to enhance early detection and tailored treatment strategies.

These innovations integrate digital cytology, imaging technologies, and molecular diagnostics to support veterinarians and improve outcomes for dogs with cancer. Furthermore, key trends in the U.S. market include the adoption of advanced molecular tests, such as DNA-based assays and biomarker identification tools, which improve diagnostic accuracy and therapeutic decisions in veterinary oncology and other specialized fields.

Europe Pet DNA Testing Market Trends

The European pet DNA testing market is projected to grow significantly due to rising demand for breed verification and health management and the increasing availability of affordable testing kits through retailers like Pets At Home and Amazon. In several European countries like France, Spain, and Italy, there has been increasing adoption of pet DNA testing to combat dog waste, thus growing adoption of pet DNA testing kits in the region.

For example, in January 2024, In Bolzano, Italy, authorities launched a dog DNA registration database to identify owners who fail to clean up after their pet’s poo on the street, to promote the use of DNA testing for responsible pet ownership, including tracking breed-related health issues. Similarly, in France, municipalities are exploring DNA databases to identify owners of dogs that do not have their waste cleaned up, reflecting a shift towards regulatory applications of DNA technology. This combination of health awareness and regulatory efforts is expected to further fuel market expansion across the continent.

The pet DNA testing market in UK is experiencing significant growth during the forecast period due to rising demand for genetic health screening, breed identification, and responsible breeding practices. Advances in DNA technology and increased pet owner awareness are driving market growth. For instance, in February 2025, The Kennel Club introduced two new DNA testing schemes for gangliosidosis (GM1_2 and GM2_2) in Japanese Shiba Inu dogs.

These tests help identify whether a dog is clear, a carrier, or affected by the disease, supporting responsible breeding and improved canine health. The new testing schemes enhance genetic screening standards, increasing demand for advanced pet DNA testing. This strengthens breeder confidence, promotes responsible breeding, and drives growth in the UK's pet DNA testing industry.

There has been a notable increase in government initiatives in France’s pet DNA testing market aimed at reducing dog waste, particularly in urban areas. Municipalities are implementing mandatory dog DNA testing to create genetic registries, enabling authorities to trace waste back to pet owners. This trend is exemplified by the trial in Béziers, where a "genetic passport" system is being introduced in July 2023. These initiatives are driving growth in the pet DNA testing market in France, as pet owners are required to have their dogs tested to comply with local regulations. The introduction of DNA testing not only helps maintain cleanliness in public spaces but also promotes responsible pet ownership. As municipalities adopt similar measures across the country, the demand for pet DNA testing services is expected to rise, contributing to the overall expansion of the market.

Asia Pacific Pet DNA Testing Market Trends

The Asia Pacific pet DNA testing market is driven by rising pet ownership, increased awareness of pet health, and a growing demand for breed identification and genetic insights. In countries like Japan and Australia, pet owners increasingly invest in DNA tests to monitor health risks and hereditary conditions. Additionally, the expansion of e-commerce platforms in the region has made these testing kits more accessible. Government initiatives promoting responsible pet ownership further support market growth, as seen in South Korea's campaigns to enhance pet welfare.

In the pet DNA testing market in India, advancements in DNA testing have significantly enhanced wildlife forensics, aiding in investigating wildlife crimes. For instance, in December 2023, the Centre for Cellular and Molecular Biology (CCMB) and the Wildlife Institute of India (WII) developed a procedure identifying species from small biological samples like hair, blood, or bone. This method is beneficial for verifying wildlife products under the government's amnesty scheme. With a growing database of DNA signatures currently housing about 2,000 species, the aim is to expand this to 50,000.

Successful applications have included tracking down a leopard causing disturbances near a zoo, showcasing the effectiveness of these tests in real-world scenarios, and highlighting India's emerging role in wildlife DNA testing. Additionally, the Indian government’s initiatives to promote responsible pet ownership and welfare have further fueled interest in DNA testing. As awareness of the benefits of genetic testing rises, the market is projected to expand, potentially reaching new heights in the coming years, supported by advancements in biotechnology and increased investment in veterinary services.

Latin America Pet DNA Testing Market Trends

The Latin America pet DNA testing market is experiencing significant growth, driven by rising pet ownership and increased awareness of animal health and genetics. Key factors include a growing demand for personalized pet care and the need for reliable information about breed characteristics and potential health issues. Countries like Brazil and Mexico are leading the market, supported by advancements in technology and increased veterinary services. Additionally, regulatory developments and educational initiatives enhance consumer confidence in DNA testing, further propelling market expansion.

Increasing awareness among pet owners about the importance of responsible breeding and animal welfare drives the pet DNA testing market in Brazil. Pet owners are now more informed about potential fraud from breeders who misrepresent the origins of animals. DNA testing is a crucial tool in verifying pets' lineage and genetic health, helping prevent deceptive practices. This trend is supported by a growing demand for transparency in pet ownership, leading to more significant investment in DNA testing services. As pet owners seek to ensure their pets' breeding and health authenticity, the Brazilian pet DNA testing market continues to expand.

Middle East & Africa Pet DNA Testing Market Trends

The Middle East and Africa pet DNA testing market is gaining traction, mainly due to increased concerns over pet safety and breed identification. Following a series of dog attacks, including a tragic incident involving a five-year-old boy in Eastern Cape, South Africa, in April 2023, authorities are increasingly utilizing DNA analysis to identify aggressive dog breeds, particularly pit bulls, accurately.

The South African Department of Agriculture conducts comprehensive DNA tests on suspected pit bulls to address public safety and investigate crossbreeding issues. Additionally, growing public awareness and initiatives like petitions to ban certain breeds drive demand for genetic testing services. This trend reflects a broader movement in the region towards responsible pet ownership and the desire for a greater understanding of pet genetics.

The pet DNA testing market in South Africa is witnessing significant growth driven by increased product launches from domestic players. Companies are introducing innovative testing solutions tailored to local pet owners' needs. For example, the launch of breed identification and health screening tests by local firms like EasyDNA South Africa and International Biosciences South Africa expanded consumer access to affordable genetic testing options. These products not only help identify breed composition but also screen for potential genetic health risks, empowering pet owners to make informed care decisions. This surge in domestic offerings fosters competition and enhances market awareness, ultimately driving growth in the pet DNA testing sector across South Africa.

Key Pet DNA Testing Company Insights

Key players in the pet DNA testing industry are actively engaged in competitive and highly fragmented market dynamics. These companies emphasize R&D and introduce new products to enhance their market presence. Furthermore, they frequently collaborate with research institutions and academic organizations to boost R&D efforts and expand the availability of pet DNA testing solutions in veterinary healthcare. They are also expanding globally to tap into emerging markets and influence the increasing awareness of veterinary diagnostics.

Key Pet DNA Testing Companies:

The following are the leading companies in the pet DNA testing market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis Inc. (Basepaws Inc.)

- Mars Petcare (Wisdom Panel)

- Orivet Genetic Pet Care Limited

- Embark Veterinary, Inc.

- Dognomics (public: Clinomics)

- DNA MY DOG (Canadian Dog Group Ltd.)

- Neogen Corporation

- EasyDNA (Genetic Technologies)

- CirclePaw (Prenetics Global Limited)

- Macrogen, Inc.

Recent Developments

-

In February 2025, The Kennel Club introduced two new DNA testing schemes for gangliosidosis (GM1_2 and GM2_2) in Japanese Shiba Inu dogs to help identify carriers and affected individuals. This initiative supports responsible breeding by reducing the risk of this fatal neurological disease.

-

In January 2025, DNA My Dog entered into a partnership with DreamWorks Animation’s Dog Man to launch a sweepstakes allowing dog owners to discover their pet’s breed makeup while celebrating the upcoming Dog Man movie. The collaboration merges canine DNA testing with entertainment, enhancing pet care awareness and engagement.

-

In August 2024, Researchers at the University of Cambridge, with support from Wisdom Panel, developed a DNA test to eradicate progressive retinal atrophy (PRA) in English Shepherd Dogs.

-

In July 2024, Mars completed the acquisition of two veterinary diagnostics companies, Cerba Vet and Antagene, based in France. Cerba Vet operates six veterinary diagnostic labs, while Antagene specializes in DNA testing for animals and disease diagnostics.

Pet DNA Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 442.81 million

Revenue Forecast in 2030

USD 718.51 million

Growth rate

CAGR of 10.16% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Animal type, sample type, test type, end-user, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Zoetis Inc. (Basepaws Inc.); Mars Petcare (Wisdom Panel); Orivet Genetic Pet Care Limited; Embark Veterinary, Inc.; Dognomics (public: Clinomics); DNA MY DOG (Canadian Dog Group Ltd.); Neogen Corporation; EasyDNA (Genetic Technologies); CirclePaw (Prenetics Global Limited); Macrogen, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet DNA Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet DNA testing market report based on animal type, sample type, test type, end-user, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood

-

Saliva

-

Fecal

-

Others

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Breed Profile

-

Genetic Diseases

-

Health and Wellness

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Pet Owners

-

Breeders

-

Veterinarians

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global pet DNA testing market size was estimated at USD 404.21 million in 2024 and is expected to reach USD 442.81 million in 2025.

b. The global pet DNA testing market is expected to grow at a compound annual growth rate (CAGR) of 10.16% from 2025 to 2030 to reach USD 718.51 million by 2030.

b. Based on end use, the Breeders segment held the largest share of 40.92% in 2024. Breeders worldwide strive to breed better dog or cat breeds with quality traits that suit every generation of owners' requirements. Along with physical features such as attractive fur color, eye color, height, weight, and other characteristics, owners are now looking for animals with better health and talents in specific tasks. Owing to these factors, breeders are educating themselves about several breed mixes and possible mating to suit people's needs.

b. Some key players operating in the global pet DNA testing market include Zoetis Inc. (Basepaws Inc.), Mars Petcare (Wisdom Panel), Orivet Genetic Pet Care Limited, Embark Veterinary, Inc., Dognomics (public: Clinomics), DNA MY DOG (Canadian Dog Group Ltd.), Neogen Corporation, EasyDNA (Genetic Technologies), CirclePaw (Prenetics Global Limited), Macrogen, Inc., and others.

b. The market growth is propelled by factors such as increasing pet adoption rates, growing consumer genomics, increased R&D activity by key players and academic researchers, and increased awareness and sales of pet DNA testing kits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.