- Home

- »

- Animal Health

- »

-

Pet Fitness Care Market Size, Share & Growth Report, 2030GVR Report cover

![Pet Fitness Care Market Size, Share & Trends Report]()

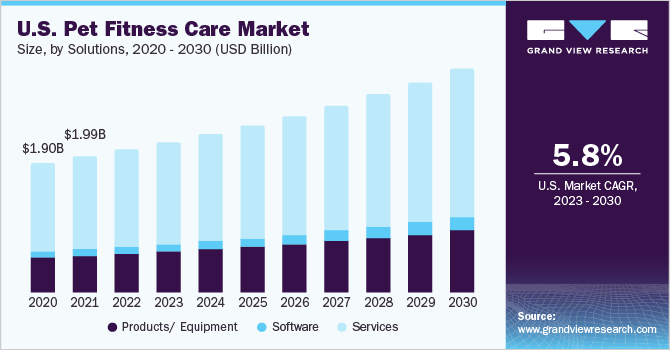

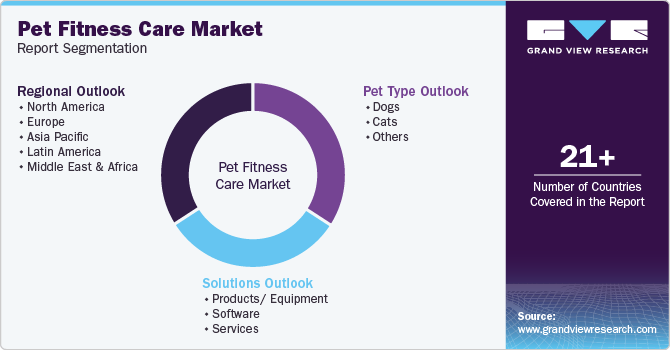

Pet Fitness Care Market Size, Share & Trends Analysis Report By Solutions (Products/ Equipment, Software, Services), By Pet Type (Dogs, Cats, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-125-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

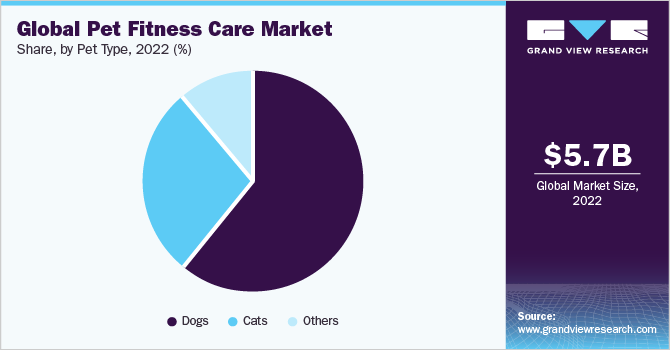

The global pet fitness care market size was valued at USD 5.71 billion in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. Some of the key market drivers include the increasing prevalence of diseases, rising pet humanization, changing consumer demographics, growing pet expenditure, and the presence of several market players. As per a study published in August 2022 in the PLOS journal, 65.8% of the pet parents surveyed reported doing moderate exercise with their dogs regularly. About 35% of respondents reported spending around 30-60 minutes per day exercising with their dogs, followed by 26% of respondents spending 15-30 minutes exercising. Thus, the increasing trend of incorporating pet fitness routines into their daily exercise routines is expected to fuel the demand for pet fitness care solutions.

The COVID-19 pandemic has had a significant impact on various sectors, including the market for pet fitness care. While some aspects of this market were negatively affected, others experienced growth and changes due to shifts in pet owner behavior and priorities. During lockdowns and periods of social isolation, many people turned to pet adoption to provide companionship.

This surge in pet ownership led to increased demand for pet fitness care services and products, as new pet owners sought ways to keep their pets healthy and active.The pandemic created a heightened awareness about the importance of pet wellness and fitness among owners. They became more conscious of the need to keep their pets physically active and mentally engaged, leading to increased interest in pet fitness services and products.

The increasing prevalence of diseases is a key factor driving market growth. With the rising number of senior pets and the growing prevalence of obesity, pet parents are more and more concerned about keeping their pets healthy and fit. This is expected to propel the demand for pet fitness products, software, and services. For instance, as per the Association for Pet Obesity Prevention (APOP), approximately 59% of dogs were estimated to be overweight or obese in 2022.This percentage has increased from 56% in 2018 and 2017. Similarly, 61% of cats were found to be overweight or obese in 2022, an increase from 60% estimated in 2018 and 2017.

The rising pet humanization trend is another key factor fueling market growth. As per a survey by the Human Animal Bond Research Institute (HABRI) and Zoetis, published in January 2022, 95% of respondents, comprising dog and cat owners, considered their pets to be a part of their family.Survey participants represented several key countries such as the U.S., UK, Brazil, France, Germany, Spain, Japan, and China.

Furthermore, 90% of the respondents opined that they have a close relationship with their pets, and about 86% were ready to pay whatever it takes to provide necessary veterinary care to their pets. This trend is expected to continue in the near future, thus contributing to an increase in demand for pet fitness care products and services.

Solutions Insights

Pet fitness services accounted for the highest revenue share of over 67% in 2022, while the software segment is expected to grow at the highest rate of 9% through 2030. This is owing to the high uptake of services and increasing adoption of varied fitness activities to maintain pet fitness. The services segment is divided intophysio assessments, agility & gym sessions, yoga classes, aquatic sessions, outdoor fitness exercises, and others. Among these, the agility & gym sessions segment dominated the market in 2022.The availability of specialized fitness programs for pets, such as agility training, canine sports, and aquatic sessions, attracts owners seeking structured and engaging fitness activities for their pets.

The demand for fitness products is also expected to increase notably in the coming years. For instance, the demand for equipment such as pet treadmills is on the rise, particularly in urban areas where outdoor space may be limited. These treadmills are designed to accommodate various pet sizes and provide controlled exercise options, making them suitable for both dogs and cats.

Overall, the pet fitness care market is benefiting from a combination of demographic, lifestyle, health, and societal trends, as well as the increasing recognition of pets as cherished family members. This market is expected to continue growing in the coming years, as pet owners prioritize the health and well-being of their animal companions.

Pet Type Insights

With regard to pet type, dogs dominated the market with a revenue share of over 60% in 2022. This is owing to the continued popularity of dogs as pets, the availability of a wide range of fitness products and services, and the willingness of dog parents to spend on their pets. dogPACER, for example, offers smart treadmills specific for small, medium, and large canines.

On the other hand, the cats segment is anticipated to grow at the fastest rate of about 7% from 2023 to 2030. According to the American Veterinary Medical Association (AVMA) and internal GVR estimates, there were an estimated 90 million dogs in the U.S. in 2022. This number is projected to exceed 100 million by 2030. Similarly, the U.S. cat population was estimated at 69 million in 2022 and is expected to reach about 85 million by 2030. The increasing population of pet dogs and cats is thus a key factor driving market growth.

Regional Insights

North America dominated the market with a revenue share of over 41% in 2022. This is owing to the presence of key players and a high pet expenditure in the region. Gyms For Dogs, GoPet LLC, FitPaws, and Agility by Carlson, for instance, are some of the key players based in the U.S. that contribute to the notable share of the regional market. These companies offer a diverse range of products, including fitness and training equipment, to attract a wider customer base and cater to different pet needs and preferences.

The Asia Pacific region, on the other hand, is projected to expand at the fastest CAGR of 7.7% in the coming years. As pet owners become more health-conscious and aware of the importance of their pets' well-being, they are increasingly investing in fitness equipment and accessories to keep their furry companions active and healthy.The convenience of online shopping has significantly boosted the pet fitness equipment market in the region. E-commerce platforms provide a wide range of products, allowing pet owners to easily access and purchase fitness products such as hurdles, agility rings, etc. for their pets from the comfort of their homes.

Key Companies & Market Share Insights

The market is fragmented in nature owing to the presence of numerous companies operating in the pet fitness products, software, and services sectors. These stakeholders are continuously involved in deploying strategic initiatives to increase their market presence and share. For instance, the quality and availability of fitness facilities and specialized equipment can set businesses apart. Modern and well-maintained facilities catering to various pet needs provide a competitive advantage.

Businesses have also started offering resources, workshops, or consultations educating pet owners about the importance of pet fitness and how to maintain their pets' physical well-being, to gain a competitive edge. Moreover, innovations in pet fitness products are defining USPs for companies. This includes new materials, designs, or technologies that enhance the exercise experience for pets or make it more convenient for pet owners to engage in fitness activities with their animals. GoPet LLC, for example, specializes in dog and cat treadmills and treadwheels. Some of the prominent players in the global pet fitness care market include:

-

Gyms For Dogs

-

FitPaws

-

GoPet, LLC

-

GoodPup (Rover)

-

dogPACER (International Pet Group)

-

Tractive

-

Frolick Dogs

-

Kathy Santo Dog Training

-

Splash Canine Aquatic Services

-

Agility by Carlson

Pet Fitness Care Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.04 billion

Revenue forecast in 2030

USD 9.39 billion

Growth Rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solutions, pet type, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Norway; Sweden; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Gyms For Dogs; FitPaws; GoPet, LLC; GoodPup (Rover); dogPACER (International Pet Group); Tractive; Frolick Dogs; Kathy Santo Dog Training; Splash Canine Aquatic Services; Agility by Carlson

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Fitness Care Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global pet fitness care market report on the basis of solutions, pet type, and region:

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Products/ Equipment

-

Balance Training Products

-

Pet Agility Equipment

-

Treadmills & Treadwheels

-

Other Exercise Equipment

-

-

Software

-

Services

-

Physio Assessments

-

Agility & Gym Sessions

-

Yoga Classes

-

Aquatic Sessions

-

Outdoor Fitness Exercises

-

Others

-

-

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global Pet Fitness Care market size was estimated at USD 5.71 billion in 2022 and is expected to reach USD 6.04 billion in 2023.

b. The global Pet Fitness Care market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 9.39 billion by 2030.

b. By region, North America dominated the market with a share of over 40% in 2022. This is owing to the presence of key players and a high pet expenditure.

b. Some key players operating in the Pet Fitness Care market include Gyms For Dogs; FitPaws; GoPet, LLC; A Place for Rover, Inc.; dogPACER (International Pet Group); Tractive; Frolick Dogs; Kathy Santo Dog Training; Splash Canine Aquatic Services; and Agility by Carlson.

b. Key factors that are driving the Pet Fitness Care market growth include the increasing prevalence of diseases, rising pet humanization, changing consumer demographics, pet expenditure, and the presence of several market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."