- Home

- »

- Animal Feed and Feed Additives

- »

-

Pet Food Ingredients Market Size And Share Report, 2030GVR Report cover

![Pet Food Ingredients Market Size, Share & Trends Report]()

Pet Food Ingredients Market (2024 - 2030) Size, Share & Trends Analysis Report By Ingredients (Specialty Protein, Amino Acid, Phosphates, Vitamins, Acidifiers, Antioxidants, Mold Inhibitors), By Pet, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-772-8

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Food Ingredients Market Summary

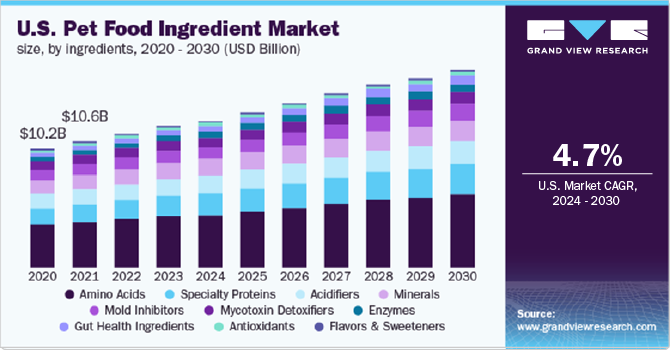

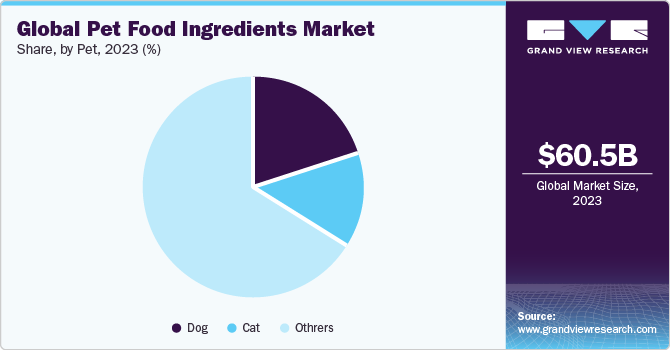

The global pet food ingredients market size was estimated at USD 60.48 billion in 2023 and is projected to reach USD 83.60 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. The increasing adoption of pets globally and pet humanization due to the work-from-home trend, which affected consumer perception regarding the pet’s nutritional needs, are driving the demand for the pet food ingredient market.

Key Market Trends & Insights

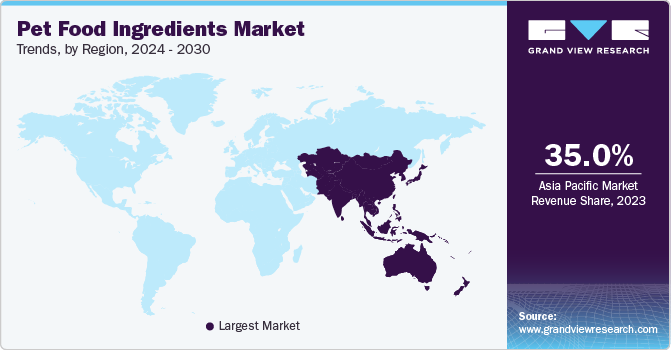

- Asia Pacific dominated the market with a share of over 35.0% in 2023.

- China dominated the Asia Pacific market and is expected to expand at the fastest CAGR of over 5.8% during the forecast period.

- Based on ingredient type, The amino acids segment accounted for the largest market share of 30.9% in 2022 in terms of revenue and is expected to expand at a CAGR of 6.3% in the forecast period.

- Based on pet, dogs dominated the market with a share of over 40% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 60.48 Billion

- 2030 Projected Market Size: USD 83.60 Billion

- CAGR (2024-2030): 4.9%

- Asia Pacific: Largest market in 2023

The COVID-19 pandemic had a positive impact on the growth of the pet food ingredients market. During the pandemic, most consumers adopted pets, resulting in a spike in sales of pet food ingredients. This sales spike was witnessed during the first lockdown, as consumers stocked up on food in anticipation of future shortages. The growing trend of pet humanization was witnessed during the pandemic as consumers could spend more time bonding with their pets.

The increasing consumer awareness of pets' health-specific needs and the work-from-home trend resulted in an increase in the adoption of pets across the globe. Due to the work-from-home trend, pet parents have been able to bond with their pets and see them as a member of their family. This results in taking care of the specific needs of pets and becoming more aware of their nutritional needs, as different nourishment is required for pets that are sedentary, spayed, ill, or very active. These factors drive the demand for quality pet food in the pet market.

Manufacturers of all sizes, from start-ups to the most extensive pet retailers in the U.S., are introducing new goods and services such as human-grade fresh meals, activity monitors, and medical diagnostic tools. Many brands that market human-grade food for dogs and cats have emerged due to the rising pet humanization trend. Some of those meals include a whole wheat food diet, squash, and sweet potatoes. Animal-based pet food ingredients are associated with various health advantages, including improved skin and coat condition, improved cognitive benefits for older pets, and efficient support for digestive and intestinal health. For instance, Farmina, a global pet food manufacturer, manufactures various animal-based pet food items such as chicken, lamb, duck, and fish.

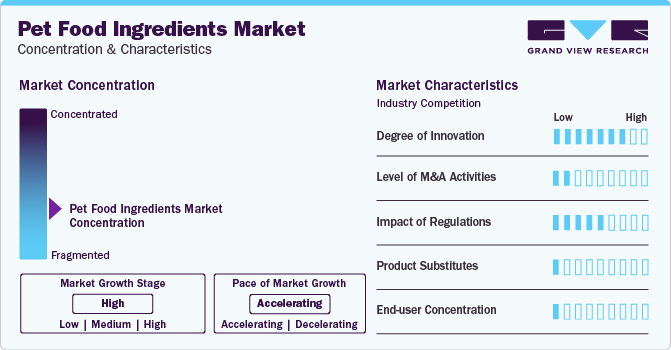

Market Concentration & Characteristics

The market is relatively fragmented and competitive in nature. The market participants are focusing on increasing their market share. The market is at a promising stage characterized by various new product launches, expansion, mergers and acquisitions.

Key manufacturers are also inclined toward the establishment of production facilities at strategic locations to reduce transportation cost, benefit from local incentives, and make the product readily available to the end users.

Key companies are fully integrated across the value chain, from growing agricultural crops to developing supplements for industrial and commercial use.Companies are anticipated to adopt backward as well as forward integration in order to ensure a consistent supply of raw materials and reduce costs involved in logistics & operations.

Companies enter into long term contracts with agricultural firms, meat processors and slaughter houses for sourcing raw materials. They employ highly qualified scientist who evaluate the product in terms of availability, quantity, and quality.

Ingredient Type Insights

Based on ingredient type, the market has been segmented into amino acids, acidifiers, vitamins, specialty proteins, minerals, flavors and sweeteners, gut health ingredients, mold inhibitors, phosphates, and carotenoids. The amino acids segment accounted for the largest market share of 30.9% in 2022 in terms of revenue and is expected to expand at a CAGR of 6.3% in the forecast period. This is owing to the efficiencies offered by the ingredient, including supporting good vision, cardiac and immune system function, heart health, preventing infections, and slowing the growth of bacteria and pathogens among pets.

The gut health ingredient segment is expected to advance at the fastest CAGR of 10.9% during the forecast period of 2024-2030. As consumers today are looking for products having ingredients that support the gut health of pets and farm animals, the segment is expected to proliferate in the coming years. The increased awareness about pet health-specific ingredients and their availability in the market has given rise to this segment.

Pet Insights

Based on pet, dogs dominated the market with a share of over 40% in 2023. Growing consumer concerns towards pet health have increased the spending on healthy dog foods. Dog obesity is one of the most common heath concerns amongst dog owners. According to Vet Innovations, Inc., nearly 100 million pets in the U.S. are estimated to be overweight Thus, with increasing health concerns the consumers have been adopting functional pet food with added ingredients such as nutrients, protein, vitamins, & minerals to keep their pets healthy.

Prebiotics as well as probiotics are widely utilized gut health ingredients in cat food. Cats have short, simple gastrointestinal tracts leading to restricted capacity to ferment non-digestible substances. Hence in order to increase digestibility and maintain gut health, ingredients such as prebiotics are added. Prebiotic intake can reduce the occurrence or severity of infections. They stimulate the growth of healthy gut bacteria. While these ingredients are naturally present in cat food, some of the consumers externally supplement probiotics to cats’ diets.

Regional Insights

Asia Pacific dominated the market with a share of over 35.0% in 2023. China dominated the Asia Pacific market and is expected to expand at the fastest CAGR of over 5.8% during the forecast period. The trend of grain-free & natural pet food and functional ingredients in pet food markets has been growing in popularity, which is gaining the interest of consumers in China. The regulations for pet food labeling in China include standardized tables with exact amounts of different ingredients that must be declared on a label. For instance, pet food must include at least 26% chicken to be designated a Chicken Formula. Additionally needed are declarations of moisture content.

Australia Pet Food Ingredients Market

Australia has a pet population of approximately 28.7 million with dogs and cats accounting for a share of around 48% and 33% respectively. The consumers in the economy spend over USD 33.2 billion on pet care.

Europe pet food ingredients market accounted for a significant market share in 2023 and is anticipated to progress at a CAGR of over 4.5% over the forecast period. Western Europe dominated the region with a significant market share. This is attributed to several factors, including the increasing cat population over dogs, the pet humanization trend, growing consumer demand for high-quality pet food providing good health to pets, and the palatability of the ingredients. Countries such as Germany, the U.K., and France are significant contributors to the growth of the regional market.

Key Companies & Market Share Insights

The pet food ingredient market features various global and regional players, which makes it a competitive market. The world’s leading companies are using partnerships, collaborations, acquisitions, mergers, and agreements as strategies to withstand the intense competition and increase their market share.

- In September 2023, Symrise inaugurated its dry pet food pilot plant in Elven, France. The facility is equipped with an R&D unit with an aim of understanding the dry pet food production process, measurement of palatability performance, and laboratory studies.

- In July 2023, Symrise transformed its pet nutrition ingredients brand into “Nuvin”. This was aimed at strengthening company’s offerings in egg, chicken, hydrolyzed protein, and other pet health solutions.

Key Pet Food Ingredients Companies:

- FoodSafe Technologies

- Symrise

- AFB International

- DuPont Nutrition & Health

- Biorigin

- Lallemand, Inc.

- Eurotec Nutrition

- Impextraco Ltda Brazil

- Pancosma

- Alltech

- Vitablend Nederland B.V.

- Elanco

Pet Food Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 62.88 billion

Revenue forecast in 2030

USD 83.60 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Ingredient type, pet, region

Regional scope

U.S., Canada, Mexico, Western Europe, Germany, U.K., France, Eastern Europe, Russia, China, Japan, Thailand, Australia, Taiwan, South Korea, Brazil, Argentina, Chile, Colombia, Saudi Arabia , South Africa, Turkey, Morocco

Country scope

Acail Gás , Air Liquide, Air Products and Chemicals, Inc., Greco Gas Inc., Linde AG, Messer Group, Sicgil India Limited, SOL Group, Strandmøllen A/S, Taiyo Nippon Sanso Corporation

Key companies profiled

FoodSafe Technologies, Symrise, AFB International, DuPont Nutrition & Health, Biorigin, Lallemand, Inc., Eurotec Nutrition, Impextraco Ltda Brazil, Pancosma, Alltech, Vitablend Nederland B.V., Elanco

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Food Ingredients Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet food ingredients market report based on ingredient type, pet, and region:

-

Ingredient Type Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Specialty Proteins

-

Beef Proteins

-

Egg Proteins

-

Blended Proteins

-

Hydrolyzed Proteins

-

Pork Protein

-

Fish Protein

-

Poultry Protein

-

Ovine Proteins

-

Cervine Proteins

-

Other animal Proteins

-

Plant Proteins

-

Algal proteins

-

-

Amino Acids

-

Lysine

-

Methionine

-

Threonine

-

Cysteine

-

Others

-

-

Mold Inhibitors

-

Gut Health Ingredients

-

Beta-glucan

-

Cereals

-

Mushroom

-

Yeasts

-

Seaweed

-

-

Phosphates

-

Monocalcium

-

Dicalcium

-

Phospholipids

-

Others

-

-

Vitamins

-

Water-soluble

-

Fat-soluble

-

-

Acidifiers

-

Carotenoids

-

Astaxanthin

-

Beta-carotene

-

Zeaxanthine

-

Lutein

-

Others

-

-

Enzymes

-

Phytases

-

Carbohydrases

-

Proteases

-

Others

-

-

Mycotoxin Detoxifiers

-

Flavors & Sweeteners

-

Antimicrobials & Antibiotics

-

Minerals

-

Antioxidants

-

-

Pet Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Dog

-

Cat

-

Others

-

- Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Western Europe

-

Germany

-

U.K.

-

France

-

-

Eastern Europe

-

Russia

-

-

-

Asia Pacific

-

China

-

Japan

-

Thailand

-

Australia

-

South Korea

-

Taiwan

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Turkey

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global pet food ingredients market size was estimated at USD 57.4 billion in 2022.

b. The global pet food ingredients market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 83.6 billion by 2030

b. Asia Pacific dominated the pet food ingredients market with a revenue share of 36% in 2022. This is attributed to the presence of major market vendors, availability of raw materials, and labor at a lower price

b. Some of the key players operating in this industry are FoodSafe Technologies, Symrise, AFB International, DuPont Nutrition & Health, Biorigin, Lallemand Inc., Eurotec Nutrition, Impextraco Ltda Brazil, Pancosma, Altech, Vitablend Nederland B.V., and Elanco among others.

b. The key factors that are driving the global pet food ingredients market include pet humanization, pet premiumization, and increased pet ownership.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.