- Home

- »

- Homecare & Decor

- »

-

Pet Hard Goods Market Size, Share, Industry Report, 2030GVR Report cover

![Pet Hard Goods Market Size, Share & Trends Report]()

Pet Hard Goods Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Pet Toys, Collars, Leashes And Harnesses, Feeding Supplies), By Distribution Channel (Store-driven/Brick-and-Mortar, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-626-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Hard Goods Market Summary

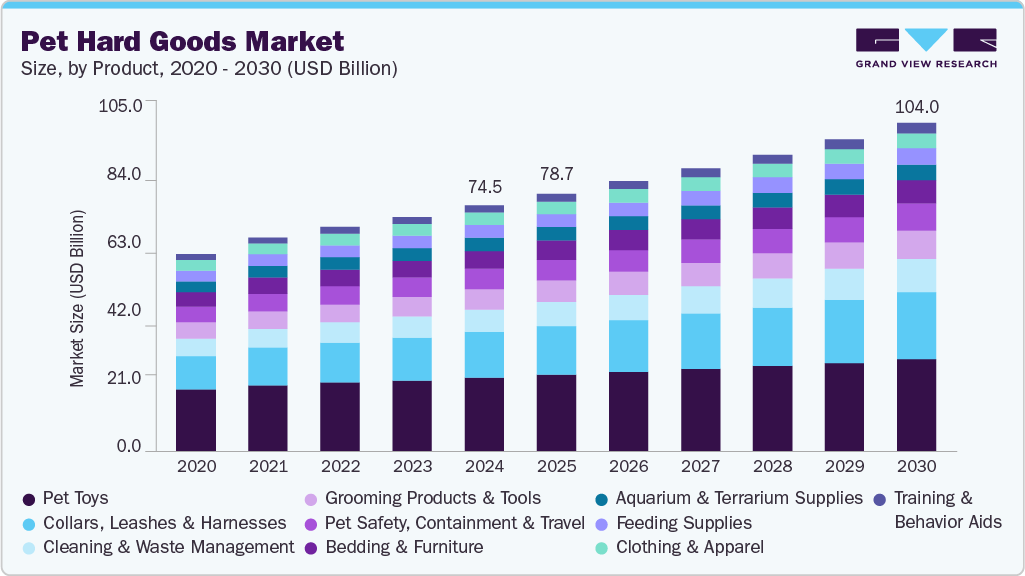

The global pet hard goods market size was estimated at USD 74.54 billion in 2024 and is projected to reach USD 104.04 billion by 2030, growing at a CAGR of 5.7% in the forecast period from 2025 to 2030. The key drivers of the global pet hard goods market include the rising trend of pet humanization, technological innovations, and product accessibility and personalization.

Key Market Trends & Insights

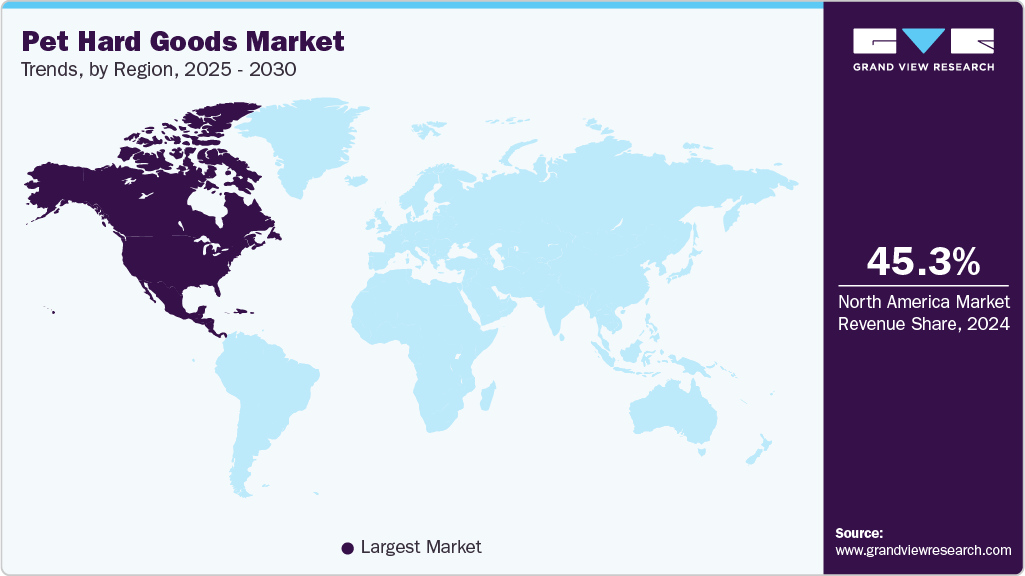

- The pet hard goods industry in North America held a market share of 45.27% of the global revenue in 2024.

- By product, the pet toys segment accounted for a share of 28.86% of the pet hard goods industry in 2024.

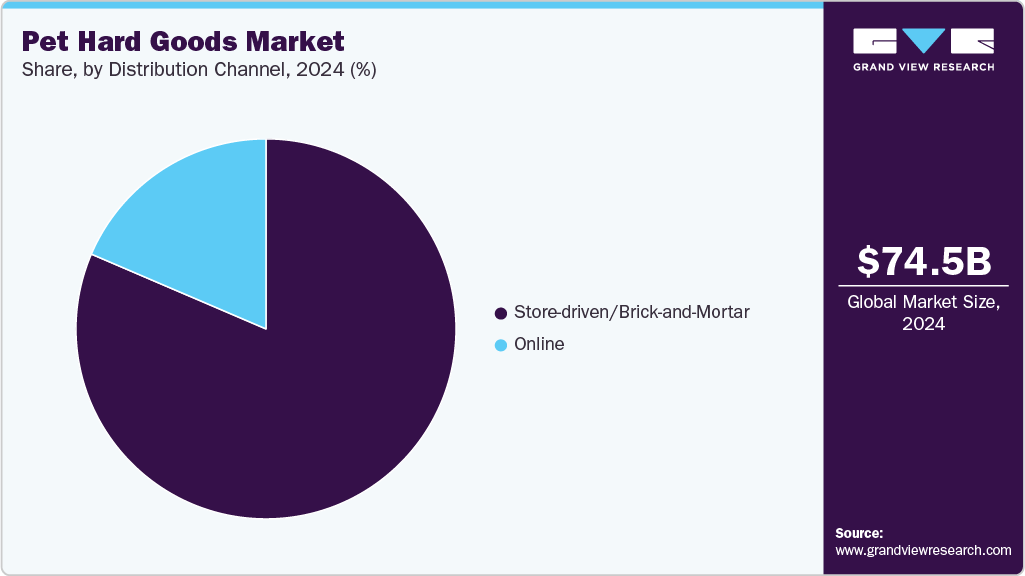

- By distribution channel, the distribution through brick-and-mortar channels accounted for a share of about 82.25%.

Market Size & Forecast

- 2024 Market Size: USD 74.54 Billion

- 2030 Projected Market Size: USD 104.04 Billion

- CAGR (2025-2030): 5.7%

- North America: Largest market in 2024

In addition, urbanization and changing lifestyles are increasing the need for compact, multifunctional products and a growing focus on pet health.There is a growing emphasis on the health and wellness of pets, leading to increased demand for products that support their physical well-being. Orthopedic dog beds, for example, are designed to alleviate joint pain and provide enhanced comfort, which is especially beneficial for senior dogs or those with arthritis. These beds often feature memory foam and ergonomic designs to ensure optimal support. In India, brands such as Prazuchi offer handcrafted orthopedic dog beds with premium materials designed for durability and comfort. Their products feature multi-layer foam cushions, waterproof linings, and washable covers, catering to the specific needs of senior dogs or those with joint issues.

Millennials and Gen Z are reshaping the pet industry by treating pets as integral family members, often called "fur babies." This perspective has led to increased spending on premium pet products. According to a 2024 survey by Talker Research for The Pets Table, 52% of Gen Z dog owners in the U.S. buy birthday presents for their dogs-more than any other generation. Their dedication extends beyond gift-giving: 62% provide premium food and treats, 21% purchase pet clothing, and 20% invest in luxury grooming services. The financial commitment is notable, with average annual spending on dogs reaching $612 and 1 in 7 owners willing to spend over $1,000. Luxury brands like Dolce & Gabbana are responding to this trend, launching high-end products such as $108 dog perfumes. The survey also reveals that many Gen Z pet owners make personal sacrifices and lifestyle decisions-such as housing or career changes-with their pets in mind, reflecting a deep emotional bond. This behavior underscores the ongoing premiumization of the pet care industry.

Social media platforms such as Instagram and TikTok have become powerful tools in shaping pet product trends. Pet influencers, or "petfluencers," showcase various products, from stylish accessories to innovative gadgets, influencing their followers' purchasing decisions. Brands often collaborate with these influencers to promote products, leveraging their trust and engagement with their audiences. For Instance, PetSmart, a prominent pet retail brand, collaborates with influencers to leverage their large, engaged social media audiences. This enables the brand to promote its products more authentically and organically, directly reaching a targeted community of pet owners.

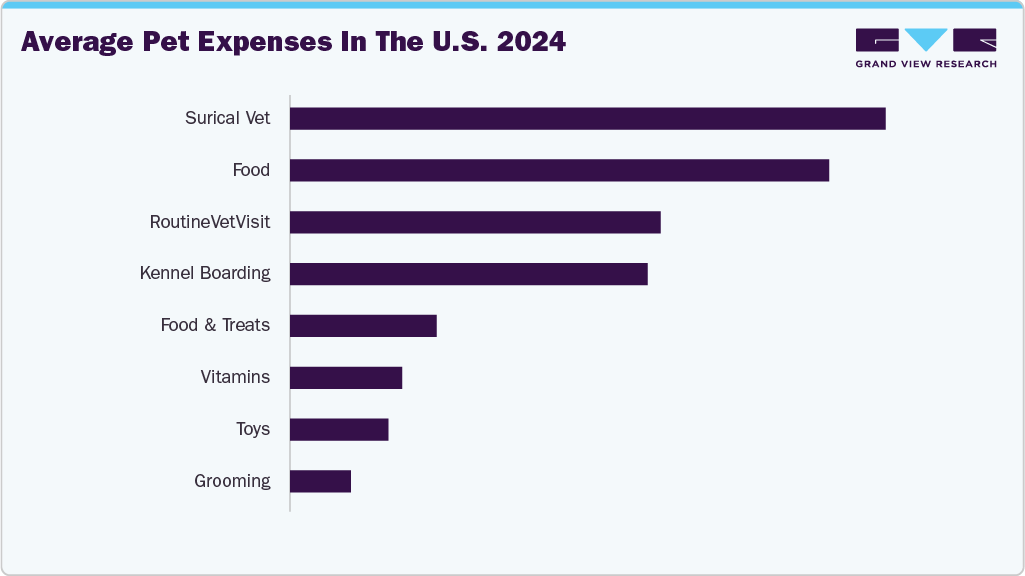

Consumer Insights & Surveys

According to the survey conducted by the American Pet Association, it shows that U.S. pet owners spend the most on surgical vet care ($373) and food ($338), highlighting a strong focus on health and nutrition. Routine vet visits ($232) and kennel boarding ($226) also represent significant costs, indicating regular medical care and frequent use of pet boarding services. Lower but notable spending is seen in areas like treats, vitamins, toys, and grooming, reflecting ongoing care and enrichment. The data suggests that pet owners prioritize essential health needs while investing in their pets' comfort and well-being.

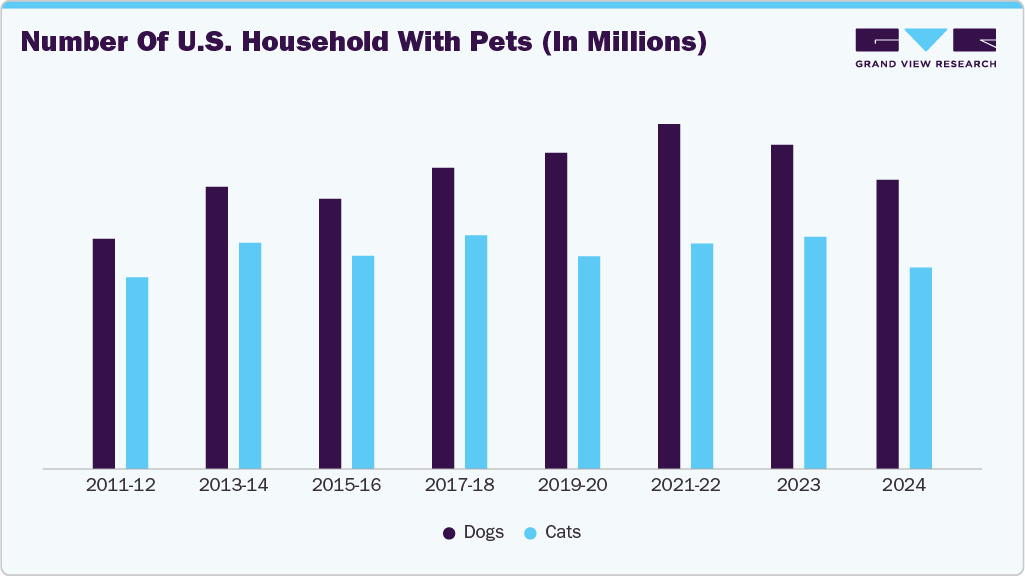

The survey conducted by the American Pet Association shows trends from 2011 to 2024, highlighting a consistent rise in pet ownership, particularly for dogs. Dog ownership increased from 46.3 million households in 2011-12 to a peak of 69.0 million in 2021-22 before slightly declining to 58.0 million in 2024. Cat ownership followed a similar trend but remained consistently lower, peaking at 47.1 million in 2017-18 and gradually declining to 40.0 million in 2024. The growth through 2021-22 may reflect increased interest in pet companionship during the COVID-19 pandemic, while the recent decline could be attributed to economic factors or evolving lifestyles.

Product Insights

The pet toys segment accounted for a share of 28.86% of the pet hard goods industry in 2024 due to their diverse benefits that address pets' physical, mental, and emotional needs while also being budget-friendly and widely accessible for owners. One of their primary advantages is keeping pets physically active and mentally engaged. Toys such as fetch balls, ropes, and tug toys help burn energy. In contrast, interactive and puzzle toys challenge pets cognitively, improving their problem-solving skills and reducing the risk of boredom-related behavioral problems such as chewing aggression or excessive barking. Physical activity promoted through toys also contributes to better weight management, helping pets avoid obesity-related health issues such as joint pain or diabetes.

Demand for pet collars, leashes, and harnesses is projected to rise at a CAGR of 7.5% from 2025 to 2030 due to practical needs, lifestyle changes, and evolving pet parenting trends. These products are essential for daily walks and safe outdoor activities as urbanization rises. Safety is the focus, with harnesses offering better control and collars increasingly equipped with reflective or GPS features. Innovations such as ergonomic designs and multifunctional features further enhance their appeal, making them indispensable for modern pet care and training. For instance, the WAUDOG R-leash by the COLLAR Company features an integrated waste bag container, reflective tape for nighttime visibility, and an ergonomic handle for comfort. This leash also comes with biodegradable bags, emphasizing environmental responsibility.

Distribution Channel Insights

The distribution through brick-and-mortar channels accounted for a share of about 82.25% of the pet hard goods industry in 2024 due to several key consumer preferences. Shoppers highly value the ability to physically inspect products important for items like toys, leashes, and crates where quality, durability, and size matter. Immediate gratification is another major factor, as offline shopping allows consumers to take products home instantly, avoiding delivery delays. Many consumers also trust local retailers more, appreciating the authenticity of products and in-store staff's personalized service and advice. In addition, offline shopping minimizes the hassle of returns since buyers can evaluate items in person before purchasing. Involving pets in the shopping experience by letting them try out toys or accessories adds another layer of appeal.

The online sales channels are anticipated to register a CAGR of 7.0% from 2025 to 2030. E-commerce platforms provide competitive pricing, frequent discounts, and subscription services that ensure timely, recurring deliveries of essentials such as pet food and supplies. In addition, online stores offer a wider variety of products, including specialty and niche items not always available offline, catering to specific pet needs. The availability of customer reviews and detailed product descriptions helps buyers make informed decisions.

Regional Insights

The pet hard goods industry in Asia Pacific held a market share of 16.57% of the global revenue in 2024. There is a rising emphasis on sustainability, with consumers seeking eco-friendly products made from recycled or biodegradable materials, reflecting heightened environmental awareness. Health and wellness are also becoming central to product development, with increasing demand for items such as orthopedic bedding, grooming tools, and toys that support physical and dental health. Customization and personalization have become popular, allowing pet owners to tailor accessories, feeding schedules, and products to their pets’ specific needs. Together, these trends highlight a shift toward more thoughtful, responsible, and lifestyle-oriented pet care across the region.

A notable example of a company emphasizing sustainability in pet durables is Dofu Cat, a women-led brand based in Vancouver, Canada, with a presence in Australia, Canada, and the U.S. Launched in 2021, Dofu Cat has developed eco-friendly cat litter made from upcycled food-waste byproducts, such as tofu and noodle fibers that would otherwise end up in landfills. Their litter is designed to be almost dust-free, quick-clumping, and low-tracking, catering to environmentally conscious pet owners seeking sustainable alternatives. By transforming food manufacturing waste into functional pet products, Dofu Cat contributes to reducing the environmental impact associated with traditional pet care items.

North America Pet Hard Goods Market Trends

The pet hard goods industry in North America held a market share of 45.27% of the global revenue in 2024, The rise of e-commerce has also significantly boosted market accessibility, allowing consumers to conveniently explore and purchase a wide range of pet accessories online. Technological innovations such as smart collars, GPS trackers, and health-monitoring devices are gaining traction among tech-savvy pet owners seeking to better care for their pets. For Instance, Whistle Labs is a company specializing in smart pet wearables.

Whistle offers GPS-enabled collars that track pets’ location and monitor their health metrics like activity levels and rest patterns. Their devices sync with mobile apps, providing pet owners with real-time insights and alerts to help ensure their pets’ safety and well-being. Whistle’s innovative technology has made it a leader in the pet tech space, meeting the growing demand for smart, connected pet durables. In addition, shifting lifestyles, including more single-person households and urban living, have increased pet ownership, further driving demand for durable pet goods.

Key Pet Hard Goods Company Insights

The dominance of major companies such as Spectrum Brands Holdings Inc., Coastal Pet Products Inc., and KONG Company, continues to define the upper tier of the competitive spectrum in the pet hard goods industry.

-

Spectrum Brands Holdings, Inc. is a diversified American consumer products company headquartered in Middleton, Wisconsin. The company operates across multiple segments, including Global Pet Care, Home and Garden, and Home and Personal Care. As of 2024, Spectrum Brands reported revenues of approximately $2.96 billion and employed around 3,100 people worldwide. The company continues to focus on delivering high-quality, reliable products that enhance everyday life for consumers globally.

-

Coastal Pet Products, Inc., founded in 1968 by Jim and Tom Stout in Alliance, Ohio, is a family-owned U.S. manufacturer known for pioneering nylon pet accessories. The company introduced the curved "Kanine Buckle" in 1977 to improve dog comfort and safety. It operates a 400,000-square-foot facility and produces a wide range of high-quality pet products, including collars, leashes, harnesses, grooming tools, toys, and travel gear.

Key Pet Hard Goods Companies:

The following are the leading companies in the pet hard goods market. These companies collectively hold the largest market share and dictate industry trends.

- Spectrum Brands Holdings, Inc.

- Coastal Pet Products, Inc.

- Radio Systems Corporation (PetSafe)

- KONG Company

- The Hartz Mountain Corporation (Hartz)

- ZippyPaws

- GNV Commodities Pvt Ltd (Ruffwear)

- Lee's Aquarium & Pet Products

- MidWest Homes for Pets

- New Age Pet

Recent Developments

-

In July 2025, Coastal Pet expanded its popular Sublime collection with four new double-sided patterned designs for collars, leashes, and overhead harnesses. These additions are tailored for larger dog breeds, featuring wider-than-average widths and improved durability.

-

In April 2025, Coastal Pet launched a sustainable product line to commemorate Earth Day. This initiative includes a variety of durable pet goods made with environmentally conscious materials. The Eco Turbo Scratcher is crafted entirely from reclaimed plastics and packaged using eco-friendly materials, and Turbo Scratcher Replacement Pads are made from 95% recycled content. Additionally, the New Earth line of collars, leashes, and harnesses is made from plant-based soy fibers.

-

In 2024, Lee's Aquarium & Pet Products introduced several new durable solutions aimed at improving pet care and aquarium management. Among the key additions is the Kritter Keeper® Large Terrarium Container, designed for housing small animals and reptiles. It features a ventilated lid and a durable plastic body for safe, long-term use. Additionally, Lee’s expanded its line of Aquarium Divider Systems in various sizes to allow fishkeepers to safely separate species within the same tank, demonstrating their commitment to functionality and pet safety.

Pet Hard Goods Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 78.69 billion

Revenue forecast in 2030

USD 104.04 billion

Growth rate (Revenue)

CAGR of 5.7% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Argentina; Brazil; UAE

Key companies profiled

Spectrum Brands Holdings, Inc.; Coastal Pet Products, Inc.; Radio Systems Corporation (PetSafe); KONG Company; The Hartz Mountain Corporation (Hartz); ZippyPaws; GNV Commodities Pvt Ltd (Ruffwear); Lee's Aquarium & Pet Products; MidWest Homes for Pets; New Age Pet

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Pet Hard Goods Market Report Segmentation

This report forecasts revenue growth at the global level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the pet hard goods market report by product, distributional channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bedding & Furniture

-

Pet Toys

-

Collars, Leashes & Harnesses

-

Feeding Supplies

-

Grooming Products & Tools

-

Cleaning & Waste Management

-

Training & Behavior Aids

-

Clothing & Apparel

-

Aquarium & Terrarium Supplies

-

Pet Safety, Containment & Travel

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Store-driven/Brick-and-Mortar

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pet hard goods market was estimated at USD 74.54 billion in 2024 and is expected to reach USD 78.69 billion in 2025.

b. The global pet hard goods market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach USD 104.04 billion by 2030.

b. The pet toys segment accounted for about 28.86% of the pet hard goods industry in 2024 due to their diverse benefits. They address pets' physical, mental, and emotional needs while also being budget-friendly and widely accessible for owners. One of their primary advantages is keeping pets physically active and mentally engaged.

b. Some of the key players in the pet hard goods market are Spectrum Brands Holdings, Inc.; Coastal Pet Products, Inc.; Radio Systems Corporation (PetSafe); KONG Company; The Hartz Mountain Corporation (Hartz); ZippyPaws; GNV Commodities Pvt Ltd (Ruffwear); Lee's Aquarium & Pet Products; MidWest Homes for Pets; and New Age Pet.

b. Some of the key factors driving the market growth are the rising trend of pet humanization, technological innovations, and product accessibility and personalization. Additionally, urbanization and changing lifestyles are increasing the need for compact, multifunctional products and a growing focus on pet health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.