- Home

- »

- Animal Health

- »

-

Pet Services Market Size And Share, Industry Report, 2033GVR Report cover

![Pet Services Market Size, Share & Trends Report]()

Pet Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Medical, Non-Medical), By Pet (Dogs, Cats), By Delivery Channel, By Service Provider, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-923-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Services Market Summary

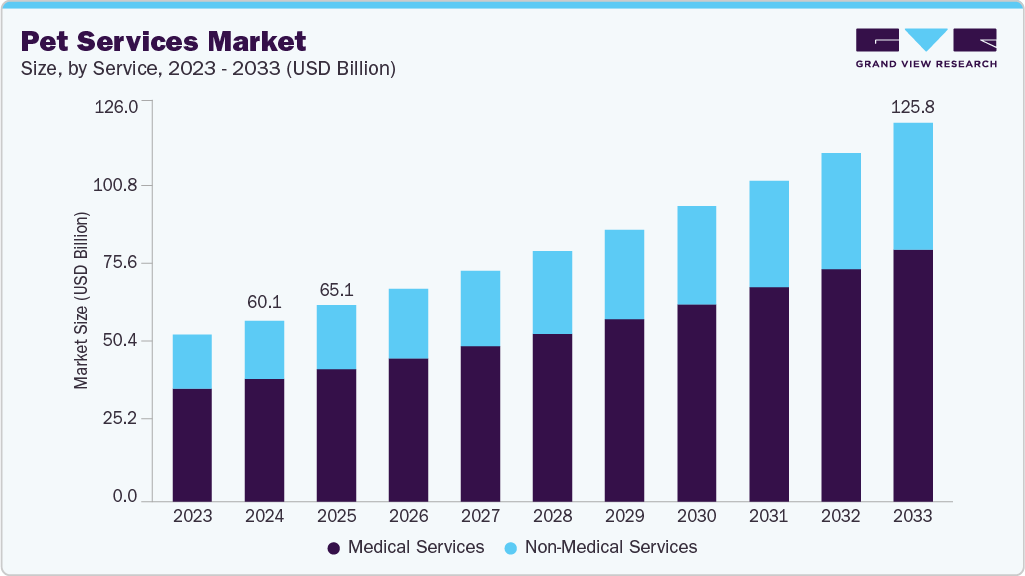

The global pet services market size was estimated at USD 60.08 billion in 2024 and is projected to reach USD 125.77 billion by 2033, growing at a CAGR of 8.58% from 2025 to 2033. Some of the key factors driving the market growth are rising disposable income and premiumization, expanding urbanization and nuclear households and growing fundraising and investment in pet service startups.

Key Market Trends & Insights

- North America pet services market held the largest revenue share of 38.46% in 2024.

- U.S. dominated the North America region with largest revenue share in 2024.

- By service, medical services segment held largest in the market of 67.72% in 2024.

- By pet, dogs segment held the largest share in the market in 2024.

- Based on delivery channel, commercial facilities segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 60.08 Billion

- 2033 Projected Market Size: USD 125.77 Billion

- CAGR (2025-2033): 8.58%

- North America region: Largest market in 2024

- Asia Pacific region: Fastest growing market

As disposable incomes increase, pet owners are more willing to spend on premium and customized services that enhance their pets’ comfort and lifestyle. This growing financial capacity fuels demand for luxury grooming, boutique boarding, and personalized training programs. According to American Pet Products Association (APPA) 2025 State of the Industry Report revealed that U.S. pet industry spending reached USD 152 billion in 2024 and is projected to rise to USD 157 billion in 2025, reflecting continued market growth. In addition, according to a Redseer report, pet spending in India surged from USD 1.6 billion in 2019 to USD 3.6 billion in 2024, driven by rising demand for pet boarding, insurance, and specialized veterinary care. As a result, pet service providers are expanding high-end offerings with superior amenities and specialized care packages. The shift toward premiumization also drives innovation in service quality, technology integration, and customer experience.As urbanization accelerates and households shift toward smaller, nuclear family structures, the demand for structured and reliable pet services has intensified. With busier schedules and limited living space, pet owners increasingly depend on professional support for daily care needs. This lifestyle shift has fueled rapid growth in urban pet service ecosystems, including grooming studios, veterinary care centers, pet-sitting networks, and mobile service models. Apartment living, in particular, is driving strong demand for dog-walking, daycare, enrichment programs, and behavioral training, as pets require stimulation and supervision beyond what owners can provide at home. The rise of tech-enabled service platforms-offering app-based bookings, smart monitoring, and personalized care plans-further reflects the market’s shift toward convenience, transparency, and premium service expectations. Collectively, these trends show how evolving urban lifestyles are transforming pets into integral lifestyle companions. This shift is reshaping the pet services market toward more accessible, flexible, and technology-integrated offerings across grooming, wellness, training, and daily care categories.

Moreover, the market is also being driven by rapid growth of the pet care startup ecosystem in pet service market. Some of the emerging startups are introducing innovative, tech-enabled solutions such as mobile grooming, on-demand vet consultations, and digital pet wellness platforms. For instance, in June 2025, Pawzeeble, India based startup has been building a tech-driven pet care ecosystem connecting pet parents, services, and brands. It aims to enhance responsible pet parenting through community engagement and digital solutions. In addition, in August 2025, BhaoBhao, India based premium at-home pet grooming startup raised USD 200,000 in angel funding to expand across India and plans a USD 4-5 million round by year-end, reflecting strong investor confidence in India’s growing pet care service market. These startups utilize AI, IoT, and data analytics to enhance service personalization and convenience. They are supported by strong investor interest and consumer adoption that are expanding market accessibility through subscription models, doorstep delivery, and integrated care networks. Thus, the influx of entrepreneurial activity is intensifying competition, improving service quality, and accelerating market growth.

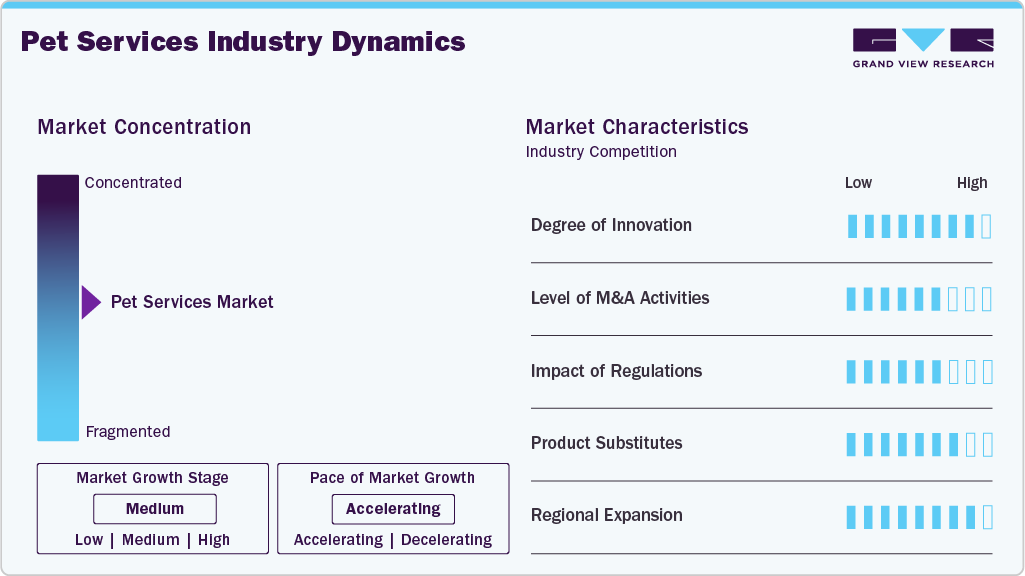

Market Concentration & Characteristics

The pet services market is moderately fragmented, with numerous regional and local players alongside emerging tech-driven startups. The global brands such as Petco and Rover dominate mature markets, India and other developing regions remain highly competitive, driven by niche providers offering personalized grooming, boarding, and wellness services.

The pet services market is witnessing strong innovation through AI-powered health monitoring, tele-veterinary apps, smart grooming tools, and personalized wellness plans. Companies are adopting data-driven insights and subscription-based service models to enhance convenience. Innovation is centered on pet well-being for instance, in February 2025, Supertails, India’s leading tech-enabled pet care brand, launched its first Fear Free Certified offline clinic in Bengaluru, integrating digital and physical services to transform veterinary care and bridge critical healthcare gaps.

Mergers and acquisitions are shaping the pet services market as leading players consolidate to expand service portfolios and geographic reach. Large veterinary chains and pet care brands are acquiring grooming, training, and telehealth startups to build integrated ecosystems. For instance, in August 2025, Pet Service Holding N.V. acquired a majority stake in Petlux B.V., enhancing its premium pet product portfolio and European retail presence, reinforcing its growth strategy through strategic acquisitions and organic expansion.

Regulations increasingly emphasize animal welfare, professional licensing, and hygiene standards in grooming, boarding, and veterinary practices. Governments are tightening compliance for service quality, waste management, and health certification. Regulatory scrutiny also promotes transparency in online pet services and veterinary teleconsultations, encouraging formalization and quality assurance across the pet services ecosystem.

Pet care options such as automated feeders, wearable trackers, and self-cleaning litter systems are some of the product substitutes that offer convenience and partly substitute human-based services. However, emotional and specialized aspects of grooming, veterinary care, and training maintain demand for professional services.

The pet services market is expanding rapidly across emerging regions, driven by rising pet ownership, urbanization, and disposable income. International brands are entering Middle Eastern and Asian markets through franchising and partnerships, while local entrepreneurs develop culturally tailored offerings.

Service Insights

On the basis of service, medical services segment dominated with largest revenue share of 67.72% in 2024, increasing pet ownership, rising awareness of preventive care, and the humanization of pets. The growing prevalence of pet obesity, diabetes, and age-related conditions further boosts demand for medical services. In addition, veterinary consultations, diagnostics, surgeries, vaccinations, and specialized treatments contribute significantly to revenue. For instance, in July 2025, Zigly launched its first pet hospital and experience center in India, converting Small Animal Clinic & Surgical Centre into a full-service ecosystem, expanding Western India presence. Furthermore, pet parents are prioritizing health and wellness, opting for regular check-ups, advanced therapies, and chronic disease management for their pets. Tele-veterinary consultations, mobile clinics, and digital health monitoring are enhancing accessibility and convenience accelerating market growth.

The non-medical services, such as grooming, daycare, boarding, training, and pet walking, represent the fastest growing segment over the forecast period. The rising urbanization, dual-income households, and busy lifestyles are driving demand for convenient, professional care solutions. Moreover, innovations such as mobile grooming vans, tech-enabled booking platforms, and subscription-based daycare services enhance accessibility and customer convenience. These services grow faster because they involve recurring, high-frequency usage compared to medical visits, creating consistent demand throughout the year. In addition, they are more discretionary and trend-driven, allowing providers to quickly introduce new offerings and scale them without regulatory constraints, accelerating market expansion.

Pet Insights

On the basis of pet, dogs segment dominated the market with largest share in 2024 revenue. The segment comprises of small, medium and large breed dogs. This segment is driven by their widespread ownership, strong human-animal bonds, and high expenditure on health, grooming, and lifestyle services. Pet parents increasingly treat dogs as family members, investing in premium grooming, daycare, boarding, training, and medical care. In the U.S., the average dog owner spends approximately USD 2,524 annually, or about USD 210 per month, on regular pet-related expenses. Other factors include a rise in nuclear households, a declining birth rate in key markets, and increasing adoption of pet insurance. In addition, rising awareness of canine health, behavior, and nutrition fuels demand for specialized offerings.

The cats segment is projected to grow at the fastest CAGR from 2025 to 2033. The market’s expansion is fueled by increasing adoption in urban households and the rise of single-person and dual-income families. According to a World Animal Foundation report of July 2025, U.S. animal shelters received 5.8 million animals marking a 0.4% increase from 2023, accompanied by 17,153 additional adoptions compared to the previous year. Furthermore, owners are investing more in feline-specific services, including grooming, boarding, daycare, veterinary care, and enrichment activities, highlighting the growing humanization of cats.

Delivery Channel Insights

On the basis of delivery channel, commercial facilities held the largest revenue share in 2024. Growth of this segment is due to urbanization, and dual-income households that drive demand for professional, convenient, and safe environments for pets. In addition, technological integration, including app-based bookings, smart monitoring, and digital health tracking, enhances operational efficiency and customer experience. For instance, in August 2025, Bengaluru-based PawSpace startup, offered pet sitting, boarding, grooming, and pet taxi services through an asset-light, Urban Company-style model, aiming to simplify safe, convenient pet care. Such initiatives play a critical role in meeting the evolving needs of modern pet owners.

The other segment comprising of at-home and online pet service channels is the fastest-growing segment over the time frame 2025-2033, driven by convenience, urban lifestyles, and rising demand for personalized care. Some of the services such as mobile grooming, in-home veterinary visits, dog walking, and tele-veterinary consultations allow pet owners to access professional care without leaving their homes. Online platforms and apps facilitate easy booking, real-time tracking, and subscription-based models, enhancing engagement.

Service Provider Insights

On the basis of service provider, hospitals and clinics constituted the largest segment in 2024, owing to rising awareness of preventive care, and growing expenditure on pet health. Veterinary consultations, diagnostics, surgeries, vaccinations, and chronic disease management are key revenue contributors. The segment also benefits from rising prevalence of chronic conditions, senior pets, and exotic breeds.

The standalone institutions which includes clinical and nonclinical institutions such as diagnostic laboratories, boarding/sitting/grooming institutions, among others; represents the fastest growing segment over the forecast period due to their rapid expansion fueled by urbanization, rising disposable incomes, and increasing pet humanization, prompting owners to seek personalized, high-quality care. They offer flexibility, customized services, and niche expertise, catering to specific breed needs, behavioral training, or wellness preferences, unlike large hospital chains.

Regional Insights

North America dominated the market with largest revenue share of 38.46% in 2024. The market is driven due to rising pet humanization, increased spending on premium care, and growing demand for convenience-based offerings like mobile grooming and daycare. Major players such as PetSmart, Rover, and Wag!, alongside niche startups offering specialized wellness and training services. the regulatory landscape emphasizes animal welfare, sanitation, and licensing standards for boarding and grooming facilities.

In addition, technological advancements such as AI-driven health monitoring, tele-veterinary platforms, and app-based booking systems are enhancing service quality and customer experience. For instance, in November 2025, DocuPet launched the National Pet Registry and National Animal Shelter Network, launching North America’s first unified pet registration system to streamline shelter operations and improve lost pet recovery through real-time, connected data.

U.S. Pet Services Market Trends

The pet services market in the U.S. accounted for the highest market share in the North America market, owing to aging pet population, increasing millennial and GEN Z pet ownership and expansion of e-commerce and DTC services. According to a report, in U.S., the proportion of senior pets has increased notably, with senior dogs rising from 42% to 52% and senior cats from 46% to 52% between 2012 and 2022. Furthermore, technological advancements are transforming service delivery. In addition, in November 2025, Pumpkin, a U.S. pet insurance and wellness brand, has launched the AI-powered Pet Health Predictor that helps pet owners anticipate common health issues and estimate veterinary costs, offering personalized insights based on breed, age, and location for proactive care planning.

The Canada Pet services market is expected to grow at a significant CAGR during the forecast period. The region is transforming due to increasing disposable income and rising awareness of pet health and wellness. For instance, in September 2025, PetSmart Charities of Canada marked Pet Hunger Awareness Day by awarding a USD 100,000 grant to The Food Bank of York Region, supporting pets of families experiencing food insecurity. They partnered with Feed Ontario, the initiative to ensure pets receive necessary nutrition alongside their owners.

Europe Pet Services Market Trends

The Europe pet services market is expanding rapidly, supported by increasing pet humanization, increasing technological integration and rising urbanization and busy lifestyles. Some of the major players such as AniCura, Mars Petcare, and VetPartners, along side numerous local and regional service providers offering specialized and tech-enabled solutions. In addition, consumers seek high-quality, convenient, and health-focused services, prompting innovation and differentiation among providers. For instance, in June 2024, ADM launched seven functional pet treat and supplement formulas in Europe, responding to growing demand for science-backed, wellness-focused products. They were available as soft chews and powder sachets, these offerings comply with European regulations and support pets’ holistic health.

Pet services market in UK is expected to grow significantly over the forecast period. The market is expanding rapidly, driven by growing pet adoption, increasing innovations in technology and digital platforms and rising collaborations between emerging players. For instance, in May 2025, Mars and Calm partnered to launch Calm’s first pet-inspired collection, highlighting how everyday interactions with pets support mental wellbeing, relaxation, and self-care, based on a global survey of pet owners.

The Germany Pet services market held significant share in 2024. The market is expanding rapidly, supported by growing humanization, and increased spending on grooming, daycare, and wellness services. In addition, innovations such as digital platforms for booking, tele-veterinary consultations, and subscription-based services are gaining momentum. For instance, in October 2025, pet parking pads, in Germany are gaining popularity, offering a safe space for pets while owners shop. Strong regulatory frameworks on animal welfare, hygiene, and licensing ensure high service standards, supporting sustainable growth

Asia Pacific Pet Services Market Trends

Asia Pacific is expected to grow at a fastest CAGR over the forecast period. The region's market is expanding due to a rising pet population, expanding service providers, and increasing disposable incomes. Key players include India’s Petsfolio, offering training, grooming, walking, and boarding services, and Australia’s Pet Care Association INC, established in 1992 to support businesses in daycare, pet resorts, kennels, and dog training. These factors create significant opportunities for market expansion across the region.

The Pet services market in Japan held significant revenue share andis witnessing new growth opportunities due to rising pet humanization, and increasing demand for luxury, convenience, and wellness-focused offerings. For instance, in June 2025, Japan’s luxury pet market is booming, demonstrated at Interpets Asia Pacific 2025, where 980 exhibitors and 78,000 visitors explored innovations in pet food, fashion, grooming, wellness, and accessories, highlighting the nation’s growing demand for premium pet services and products.

The market for Pet services in India is emerging supported by expanding middle class and disposable income, booming pet startup ecosystem and rising awareness of pet health and wellness. Some of the emerging startups are introducing innovative, tech-enabled solutions such as mobile grooming, on-demand vet consultations, and digital pet wellness platforms. In 2025, India’s pet startups secured significant funding across grooming, veterinary care, food, and technology sectors, driving innovation and reshaping the rapidly growing pet care industry. For instance, in June 2025, Goofy Tails, a New Delhi-based direct-to-consumer pet food company specializing in healthy meals and treats, raised USD 1 million in an early-stage round led by Wipro Consumer Care Ventures. The funding will help expand distribution, diversify products, and strengthen its digital presence.

Latin America Pet Services Market Trends

The Latin American pet services market is driven by rising pet ownership, growing urbanization, and increasing humanization of pets, prompting demand for grooming, daycare, boarding, and wellness services. Expanding disposable incomes and dual-income households further support spending on premium and convenient care options. The competitive landscape includes local chains, independent service providers, and emerging startups offering specialized and tech-enabled solutions. Consumers increasingly prioritize quality, safety, and health-focused services, driving differentiation and innovation.

Brazil Pet services market is gaining momentum due to rising pet ownership, increasing pet humanization, and growing demand for convenient, health-focused services such as grooming, daycare, boarding, and tele-veterinary care. In addition, innovative offerings for instance, of October 2025, in which GM’s OnStar Emergency Pet Service highlighted the integration of technology and safety in pet care. In addition, consumers value convenience, quality, and wellness, driving service differentiation, digital adoption, and steady growth across Brazil’s expanding pet services sector.

Middle East & Africa Pet Services Market Trends

The MEA Pet services market is propelled by rising pet adoption and growing awareness amongst the owners, supported by government initiatives enhancing animal healthcare. For instance, in September 2024, Tree Digital Insurance Agency launched Saudi Arabia’s first pet insurance, providing comprehensive coverage for cats and dogs, including veterinary care, surgeries, and medications. This innovative offering aligns with Vision 2030, enhancing digital insurance solutions and improving quality of life for pet owners.

South Africa Pet services market held the largest revenue share and is expanding, fueled by rising awareness amongst the consumers for prioritizing convenience, quality, and health-focused offerings and increasing adoption of digital platforms. For instance, in June 2025, Pet Express launched on South Africa’s popular delivery app Mr D, offering fast, reliable access to pet care essentials. They deliver orders within 60 minutes, providing convenience, quality products, and a one-stop solution for pet owners’ daily needs.

The Pet services market in UAE is driven by high disposable incomes, which fuel demand for premium grooming, daycare, boarding, and wellness services. Some of the global brands, regional chains, and niche startups offer specialized and tech-enabled solutions in UAE. For instance, in July 2025, Milano by Danube entered the UAE petcare market with its new lifestyle line, Milano Petshouse. The collection features smart, design-focused products for cats and dogs, including grooming kits, travel carriers, app-enabled litter boxes, Wi-Fi feeders, and stylish water fountains, catering to tech-savvy pet owners.

Key Pet Services Company Insights

The global pet services market is led by major players such as PetSmart, Rover, Mars Petcare, AniCura, and Banfield Pet Hospital. These companies dominate through extensive service networks, premium offerings, and technological integration, while numerous regional and niche providers compete by focusing on specialized, personalized, and tech-enabled pet care solutions. For instance, in November 2025 Goose partnered with Digs Dog Care, integrating its platform across 25+ premium resorts to unify booking, operations, marketing, and analytics, enhancing guest experience, staff empowerment, and operational efficiency nationwide.

Key Pet Services Companies:

The following are the leading companies in the pet services market. These companies collectively hold the largest market share and dictate industry trends.

- CVS Group Plc

- Mars Incorporated

- National Veterinary Associates

- Pets at Home Group PLC

- Greencross Vets

- Fetch! Pet Care

- IVC Evidensia

- A Place for Rover, Inc.

- PetSmart LLC

- Airpets International

- Pooch Dog SPA

- Animals at Home Ltd.

Recent Developments

-

In November 2025, HTX Happy Tails Dog Walking & Pet Services opened in New Caney, Texas, serving East Montgomery County and Kingwood with dog walking, boarding, daycare, and home “drop-in” services.

-

In October 2025, Akasa Air upgraded its ‘Pets on Akasa’ service, allowing two pets in-cabin and reducing booking to 24 hours before departure. Since November 2022, the airline has flown over 8,500 pets.

-

In October 2025, Pet Service Holding NV reported 14% organic revenue growth in Europe, despite margin pressure from growth investments, highlighting expansion in veterinary products, animal healthcare, and premium pet supplies.

Pet Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 65.12 billion

Revenue forecast in 2033

USD 125.77 billion

Growth rate

CAGR of 8.58% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, pet, delivery channel, service provider, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

CVS Group Plc; Mars Incorporated; National Veterinary Associates; Pets at Home Group PLC; Greencross Vets; Fetch! Pet Care; IVC Evidensia; A Place for Rover, Inc.; PetSmart LLC; Airpets International; AirPets International; Pooch Dog SPA; Animals at Home Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the pet services market report based on service, pet, delivery channel, service provider, and region:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical Services

-

Diagnosis

-

In-Vitro Diagnosis

-

In-Vivo Diagnosis

-

-

Preventive Care

-

Treatment

-

Consultation

-

Surgery

-

Others

-

-

-

Non-Medical Services

-

Boarding

-

Training

-

Grooming

-

Transportation

-

Sitting & Walking

-

End-of-Life

-

Other Non-Medical Services

-

-

-

Pet Outlook (Revenue, USD Million, 2021 - 2033)

-

Dogs

-

Small Breeds

-

Medium Breeds

-

Large Breeds

-

-

Cats

-

Other Pets

-

-

Delivery Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Facilities

-

Mobile/ Outdoors

-

Other Channels

-

-

Service Provider Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital & Clinics

-

Standalone Institutions

-

Other Providers

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global pet services market size was estimated at USD 60.08 billion in 2024 and is expected to reach USD 65.12 billion in 2033.

b. The global pet services market is expected to grow at a compound annual growth rate of 8.58% from 2025 to 2033 to reach USD 125.77 billion by 2033.

b. North America dominated the market with largest revenue share of 38.46% in 2024. The high share of the North American region is owing to the presence of key service providers, the adoption of various strategic initiatives to increase market penetration, and rising pet expenditure.

b. Some key players operating in the pet services market include CVS Group Plc; Mars Incorporated; National Veterinary Associates; Pets at Home Group PLC; Greencross Vets; Fetch! Pet Care; IVC Evidensia; A Place for Rover, Inc.; PetSmart LLC; Airpets International; AirPets International; Pooch Dog SPA; Animals at Home Ltd.

b. Key factors that are driving the pet services market growth include the increasing population of companion animals, pet humanization, strategies implemented by key companies, and expenditure on pets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.