- Home

- »

- Animal Health

- »

-

Pet Therapeutic Diet Market Size, Industry Report, 2030GVR Report cover

![Pet Therapeutic Diet Market Size, Share & Trends Report]()

Pet Therapeutic Diet Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Wet Food, Dry Food), By Animal Type, By Indication, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-551-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Therapeutic Diet Market Size & Trends

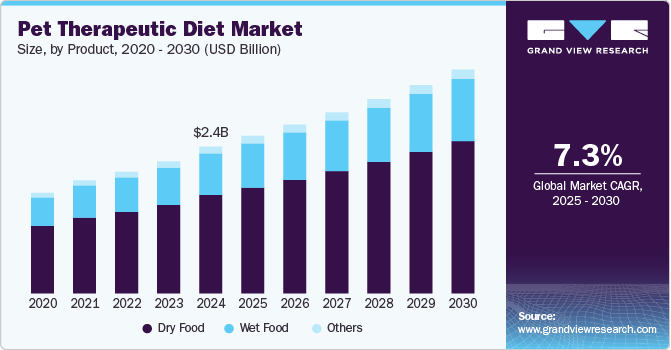

The global pet therapeutic diet market size was estimated at USD 2.41 billion in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2030. Some of the key drivers of the market include the rising prevalence of chronic health conditions among pets-such as obesity, kidney disease, and gastrointestinal disorders-coupled with increasing pet humanization, where owners seek specialized, vet-recommended nutrition. According to the Association for Pet Obesity Prevention, over 55% of dogs and 59% of cats in the U.S. were overweight in 2022, fueling demand for targeted diets.

In addition, the growing launch of innovative pet therapeutic diets by key players is expected to drive market growth. For instance, in January 2025, Hill's Pet Nutrition introduced major advancements in microbiome science at VMX 2025, spotlighting its enhanced Prescription Diet and Science Diet products, many of which now feature ActivBiome+ technology. This includes new formulations targeting digestion, kidney function, cognitive health, and multi-organ support-designed to help pets with complex health needs.

The Science Diet line has also been upgraded with ActivBiome+ Multi-Benefit to promote lifelong well-being in healthy pets. These innovations support Hill's leadership in science-led nutrition and raise the standard for personalized, condition-specific pet food. By integrating cutting-edge gut microbiome research, Hill's is enhancing clinical outcomes and driving demand and growth in the pet therapeutic diet industry-especially for products addressing multiple health conditions simultaneously.

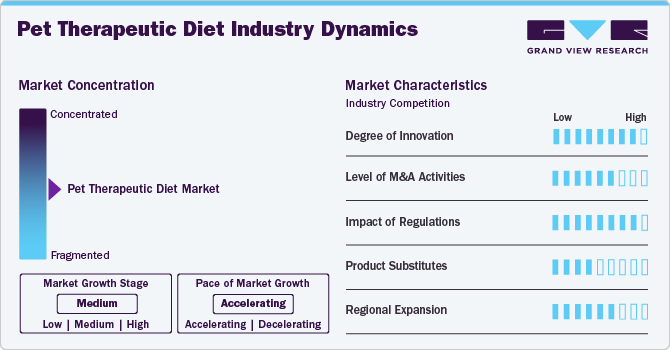

Market Concentration & Characteristics

The pet therapeutic diet industry exhibits moderate industry concentration, with a mix of small, specialized companies and larger or established players dominating the market. Leading companies, such as Colgate-Palmolive Company (Hill's Pet Nutrition Inc.), Nestlé, and Mars Petcare (Royal Canin), hold significant market share due to strong brand recognition and broad product portfolios. The industry is competitive, with a growing number of new entrants focusing on cost-effective therapeutic diet lines to meet rising consumer demand for holistic pet health solutions. Expansion into online retail channels has also increased competition, allowing smaller brands to gain visibility and market traction.

A high degree of innovation in the pet therapeutic diet industry drives product differentiation and meets the growing demand for condition-specific nutrition. For example, Hill's Pet Nutrition's Small Paws Innovation Center and Royal Canin's personalized veterinary diets enhance treatment outcomes and strengthen brand leadership, fueling market growth and consumer trust.

High levels of M&A activity in the pet industry, such as General Mills’ acquisition of Whitebridge Pet Brands and Nestlé’s expansion of Purina, enhance market consolidation and drive innovation in therapeutic diets. These deals increase R&D investment, broaden distribution channels, and strengthen brand portfolios, accelerating growth in the premium, science-based pet nutrition segment.

Strict FDA regulations significantly shape the pet therapeutic diets industry by ensuring that only scientifically validated, vet-prescribed diets are legally distributed. This limits market entry to highly specialized manufacturers, reinforces consumer trust, increases production costs, and restricts product availability.

Product substitutes in the pet therapeutic diets industry-such as medications, homemade diets, supplements, and raw diets-can impact demand by offering alternative treatment options. While safe alternatives like medications and vet-guided homemade diets may reduce reliance on commercial therapeutic foods, unsafe substitutes like unregulated supplements and raw diets pose health risks, potentially reinforcing the need for trusted, vet-recommended products.

Regional expansion in the pet therapeutic diets industry boosts production efficiency, research capabilities, and distribution reach. It allows companies to meet growing demand better, improve supply chain resilience, and strengthen their market presence in both domestic and global markets. For instance, in January 2023, Hill's Pet Nutrition is relocating its global and U.S. headquarters to Overland Park, Kansas, while maintaining its science and manufacturing hubs in Topeka. The expansion supports global growth and meets the rising demand for science-led pet nutrition, with continued investment in innovation and community engagement across Kansas. This strategic expansion strengthens Hill’s market leadership by boosting research, production, and operational efficiency, positioning the brand to better meet rising demand in the global pet therapeutic diet industry.

Product Insights

The dry food segment accounted for the largest market revenue share in 2024 and is estimated to grow at the fastest CAGR of 7.6% in 2024. This is attributed to its longer shelf life, convenience in storage and feeding, and cost-effectiveness for pet owners. It is projected to grow at the fastest rate, driven by innovations in condition-specific formulations such as Hill's Prescription Diet Metabolic + Mobility Canine dry food, which supports weight and joint health. In addition, dry food allows better portion control, which is crucial for managing chronic conditions like obesity and diabetes.

The wet food segment holds a significant share in the pet therapeutic diet industry due to its high palatability, better hydration benefits, and ease of consumption for pets with dental issues or decreased appetite. Wet diets are especially effective for managing conditions like urinary tract health and kidney disease, where increased moisture intake is critical. For example, Hill’s Prescription Diet c/d Multicare Stress Feline wet food supports urinary health while appealing to picky eaters with flavors like Tuna and Chicken Stew.

Animal type Insights

Based on animal type, the dogs segment accounted for the largest market revenue share in 2024. Dogs are the most widely adopted pets in the world and have a very high adoption rate. The American Pet Products Association's National Pet Owners Survey 2023-2024 indicates that there were over 89.7 million pet dogs in the U.S. in 2023. In addition, companies are offering new dog therapeutic diets, fueling the market's growth over the forecast period. For instance, in January 2024, Hill's introduced two new therapeutic dog diets in 2024-z/d Low Fat and c/d Multicare Low Fat-targeting fat sensitivities and promoting digestive and urinary health. Formulated with the Science of Taste, these diets ensure dogs receive the effective nutrition they enjoy.

The cats segment is estimated to witness at the fastest CAGR of 7.9% during the forecast period, due to rising cat ownership, increased awareness of feline health issues, and innovation in therapeutic nutrition. The number of households with cats continues to expand globally. According to the American Pet Products Association (APPA), cat ownership in the U.S. increased from 42.7 million households in 2019 to approximately 45.3 million by 2024. Furthermore, veterinarians and pet food companies are increasingly highlighting the importance of managing chronic conditions like urinary tract disease, obesity, diabetes, and gastrointestinal disorders, which are more prevalent in cats due to sedentary indoor lifestyles. In addition, growing innovations in therapeutic cat diets will contribute to market demand. For instance, Hill’s Prescription Diet Gastrointestinal Biome Stress Feline is an upgraded formula launching in June 2024, addressing GI issues and stress, both common in indoor cats-with enhanced palatability and proven microbiome support.

Indication Insights

Based on indication, the obesity care segment led the market with the largest revenue share of 21.66% in 2024, due to the rising prevalence of pet obesity. In 2024, pet obesity remains a serious health concern, with approximately 59% of dogs and 61% of cats in the United States classified as overweight or obese. This translates to roughly 50 million dogs and 56 million cats suffering from excess weight issues. Similar trends are observed globally, with developed nations reporting 40-50% obesity rates across companion animal populations. Overweight pets face significantly higher risks of developing diabetes, arthritis, cardiovascular disease, respiratory problems, and reduced lifespan (by up to 2.5 years in some studies). Pet Therapeutic Diets provides scientifically formulated nutrition to address weight management while meeting essential nutritional requirements. Brands like Hill’s Prescription Diet Metabolic offer clinically proven formulas that help pets lose weight safely-96% of dogs lost weight in two months at home when fed Metabolic, underscoring its effectiveness and market appeal.

The renal care segment is projected to grow at the fastest CAGR of 7.8% during the forecast period. Renal disease is a common and serious health issue in pets, especially in older cats and certain dog breeds. Proper management is crucial for maintaining quality of life and slowing disease progression. Studies show that up to 30% of cats over 15 years old and a significant percentage of senior dogs are affected by CKD. Renal diets are essential in managing this condition by reducing phosphorus, protein, and sodium levels while enhancing palatability and hydration. For example, Hill's Prescription Diet k/d supports kidney function and has been clinically shown to improve quality of life and extend survival time in pets with chronic kidney disease, driving increased adoption and long-term demand.

Distribution Channel Insights

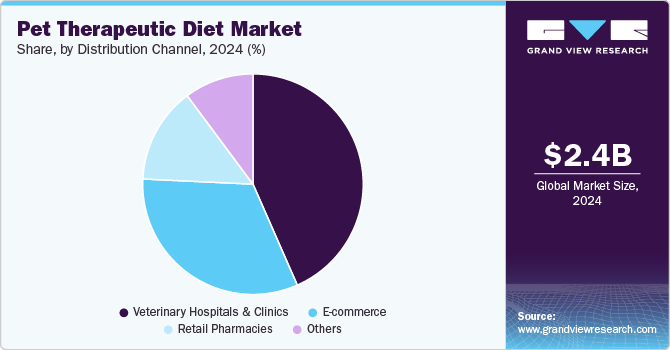

Based on distribution channel, the veterinary hospitals & clinics segment led the market with the largest revenue share of 43.42% in 2024. This is attributed to veterinarians' critical role in diagnosing health conditions and prescribing therapeutic diets, ensuring trust and compliance among pet owners. Most therapeutic diets-such as Hill's Prescription Diet or Purina Pro Plan Veterinary Diets-require a veterinary prescription, making clinics the primary point of purchase. In addition, clinics provide personalized nutritional guidance and regular monitoring, reinforcing the preference for in-clinic purchases. According to industry data, over 65% of therapeutic pet diet sales originate from veterinary channels, highlighting their dominance in distribution.

Moreover, in March 2025, Purina is driving growth in its therapeutic pet food segment through its Vet Direct model, allowing pet owners to order prescribed diets directly from veterinary clinics and have them delivered to their homes. Purina's Vet Direct model is reshaping the veterinary hospitals and clinics segment by eliminating inventory challenges and enhancing consumer convenience through direct-to-home delivery of prescribed diets. This innovation supports continued market growth while reinforcing the clinic's role as the primary point of prescription and nutritional guidance.

On the other hand, the e-commerce segment is projected to grow at the fastest CAGR of 8.6% during the forecast period, due to increasing consumer preference for convenient, home-delivered solutions and rising digital adoption among pet owners. Platforms like Amazon, Chewy, and Petco now offer access to prescription diets, often integrated with vet telehealth services for authorization. For example, the study published in May 2024 by Nestlé Purina Petcare stated that Purina Pro Plan Veterinary Diets are now available on Amazon, providing easier access to over 30 prescription diets for various pet health conditions. Purina Pro Plan Veterinary Diets' availability on Amazon simplifies access to specialized nutrition, driving growth. In addition, the pandemic accelerated online shopping trends, and by 2023, over 35% of U.S. pet food purchases occurred online, a number expected to rise steadily through the next decade.

Regional Insights

North America dominated the pet therapeutic diet market with the largest revenue share of 40.4% in 2024. The Market is experiencing robust growth driven by rising pet obesity rates, increased diagnosis of chronic conditions, and growing pet humanization trends. The region maintains market leadership due to advanced veterinary infrastructure, high pet insurance penetration, and innovative product development by key players like Hill's Pet Nutrition, Royal Canin, and Purina Pro Plan Veterinary Diets. Major market trends include the expansion of condition-specific formulations, enhanced e-commerce distribution channels, and increasing consumer demand for natural and limited-ingredient therapeutic options.

U.S. Pet Therapeutic Diet Market Trends

The pet therapeutic diet market in the U.S. is growing rapidly due to rising pet obesity, aging pet populations, and increased diagnosis of chronic conditions like kidney disease, GI disorders, and allergies. Pet owners increasingly seek science-backed, vet-recommended diets such as Hill's Prescription Diet Metabolic for weight loss and Purina Pro Plan Veterinary Diets EN for digestive health. E-commerce platforms and D2C models like Purina Vet Direct also accelerate market accessibility and adoption.

Europe Pet Therapeutic Diet Market Trends

The pet therapeutic diet market in Europe is projected to grow at a significant CAGR during the forecast period, due to increasing awareness of pet health, a rising aging pet population, and growing demand for specialized diets for chronic conditions such as renal, gastrointestinal, and urinary disorders. Countries like Germany, France, and the UK lead the market due to high pet ownership rates and strong veterinary infrastructure. Regulatory support for prescription-based pet food and increased adoption of premium and vet-recommended diets are also fueling market expansion.

The UK pet therapeutic diet market is witnessing steady growth, driven by increasing pet humanization, higher spending on veterinary care, and a surge in chronic conditions such as obesity, renal disease, and pet food allergies. According to the Pet Food Manufacturers' Association (PFMA), over 50% of UK pets are overweight or obese, boosting demand for specialized diets like Hill's Prescription Diet Metabolic and Royal Canin Satiety. The veterinary channel remains dominant for distribution, while e-commerce platforms such as Amazon and Pets at Home are expanding accessibility. Growing awareness about tailored nutrition and support from veterinarians continue to drive the UK's therapeutic diet market forward.

The pet therapeutic diet market in Germany is expanding due to rising pet ownership, increased awareness of pet health, and a strong veterinary infrastructure. With over 34 million pets in German households, there's a growing demand for science-backed diets targeting chronic conditions like renal disease, diabetes, and gastrointestinal disorders. Brands such as Royal Canin, Hill's, and VetConcept dominate the market, offering prescription diets through veterinary clinics and licensed online platforms. The country's focus on pet wellness and preventive care, along with regulatory support for high-quality therapeutic formulations, is fueling sustained market growth.

Asia Pacific Pet Therapeutic Diet Market Trends

The pet therapeutic diet market in Asia Pacific is estimated to grow at the fastest CAGR of 8.0% from 2025 to 2030. The Asia Pacific market is witnessing rapid growth driven by increasing pet humanization, rising disposable incomes, and expanding veterinary services across countries like China, Japan, and India. Urban pet owners are increasingly seeking specialized diets to manage conditions like obesity, renal disease, and gastrointestinal issues. Global brands such as Hill's, Royal Canin, and Purina are expanding their presence, while regional players are also introducing condition-specific diets supported by e-commerce growth and greater access to veterinary care.

The India pet therapeutic diet market is witnessing steady growth driven by rising pet ownership, increased awareness of pet health, and a shift toward specialized veterinary nutrition. Brands like Hill's and Royal Canin and emerging Indian players like Vetsense are introducing targeted diets for conditions like obesity, gastrointestinal issues, and skin sensitivities. For example, Royal Canin's GI formulas and Vetsense's Weight Management range cater to pets with specific medical needs. The market is also seeing a rise in demand for natural, vet-recommended, and functional ingredients in therapeutic foods.

Latin America Pet Therapeutic Diet Market Trends

The pet therapeutic diet market in Latin America is witnessing gradual growth, fueled by increased pet adoption, rising disposable income, and greater awareness of pet health and nutrition. Countries like Brazil and Argentina are leading the trend, with Brazil holding the largest share of the regional pet care market. The demand for therapeutic diets-especially for managing obesity, renal issues, and digestive disorders-is growing, supported by expanding veterinary networks and the presence of global players like Hill’s, Royal Canin, and Purina. E-commerce platforms and veterinary clinics are crucial distribution channels, driving accessibility across urban and semi-urban areas.

The Brazil pet therapeutic diet market is expanding rapidly, driven by the country's position as the second-largest pet food market globally, after the U.S., according to ABINPET. Increasing pet humanization, higher awareness of pet health conditions, and a growing middle-class population fuel demand for specialized diets targeting issues like obesity, renal disease, allergies, and gastrointestinal disorders. Major brands like Royal Canin, Hill's, and Purina are investing in local operations and product localization. Veterinary clinics remain a dominant distribution channel, though e-commerce is rapidly growing, enhancing access to therapeutic diets across urban centers like São Paulo and Rio de Janeiro.

Middle East & Africa Pet Therapeutic Diet Market Trends

The pet therapeutic diet market in Middle East & Africa is witnessing steady growth, driven by increasing pet ownership, rising awareness of pet health, and growing veterinary infrastructure, particularly in urban areas of the UAE, Saudi Arabia, and South Africa. As pet humanization trends gain momentum, demand for specialized diets addressing conditions like obesity, kidney disease, and digestive issues is increasing. Premiumization and the availability of international brands such as Hill’s, Royal Canin, and Purina are also shaping the market. However, challenges remain, including limited local manufacturing and higher import dependency, which affect accessibility and price.

The South Africa pet therapeutic diet market is experiencing gradual growth, supported by increasing urbanization, rising pet humanization, and a growing middle class willing to invest in specialized pet care. Conditions like obesity, renal disease, and food sensitivities in pets are driving demand for therapeutic diets recommended by veterinarians. International brands such as Hill's and Royal Canin have a strong presence and are often sold through veterinary clinics and specialty pet retailers. However, economic disparities and limited access to veterinary services in rural areas somewhat constrain market expansion. E-commerce is also emerging as a key distribution channel for wider access.

Key Pet Therapeutic Diet Company Insights

Key players in the pet therapeutic diet industry include Hill's Pet Nutrition (Colgate-Palmolive), Royal Canin (Mars Inc.), and Nestlé Purina PetCare. These companies collectively hold a significant market share due to their strong veterinary networks, R&D capabilities, and global presence. These companies continue to lead with innovations targeting specific health conditions and expanding accessibility through e-commerce and D2C models.

Key Pet Therapeutic Diet Companies:

The following are the leading companies in the pet therapeutic diet market. These companies collectively hold the largest market share and dictate industry trends.

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- Nestlé

- Mars Petcare (Royal Canin)

- General Mills Inc. (Blue Buffalo Company, Ltd.)

- Diamond Pet Foods, Inc.

- Virbac

- Veterinary Nutrition Group

- Farmina Pet Foods

- JustFoodForDogs

- EmerAid, LLC

Recent Developments

-

In August 2024, Rossari Biotech's Pet Care division launched Vetsense, a new line of prescription diets to enhance pet health, introduced at IVACON 2024. The initial range includes formulas for gastrointestinal support, weight management, dermatological care, and a weaning supplement-all developed with natural ingredients and veterinary expertise to support therapeutic needs and overall vitality.

-

In April 2024, Royal Canin U.S. expanded its Veterinary Gastrointestinal portfolio with five new diets tailored to support digestive health in cats and dogs, including options with hydrolyzed proteins, low fat, and high fiber formulations. These science-backed diets are designed to manage food sensitivities, promote microbiome balance, and address common GI issues.

-

In January 2024, Hill's Pet Nutrition unveiled innovations in its Prescription Diet line at VMX 2024, addressing digestive, urinary, and stress-related issues in pets with science-backed, highly palatable formulas. Key launches include z/d Low Fat Canine, c/d Multicare Low Fat Canine, and enhanced feline GI and stress diets. Hill's also supports weight management through tools and resources that help veterinarians and pet parents tackle pet obesity effectively.

Pet Therapeutic Diet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.53 billion

Revenue forecast in 2030

USD 6.44 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, animal type, indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Colgate-Palmolive Company (Hill's Pet Nutrition Inc.); Nestlé; Mars Petcare (Royal Canin); General Mills Inc. (Blue Buffalo Company, Ltd.); Diamond Pet Foods, Inc.; Virbac; Veterinary Nutrition Group; Farmina Pet Foods; JustFoodForDogs; EmerAid, LLC

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Therapeutic Diet Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet therapeutic diet market report based on product, indication, animal type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wet Food

-

Dry Food

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Renal Care

-

Obesity Care

-

Diabetic Care

-

Dental Care

-

Gastrointestinal Care

-

Recovery Care

-

Joint Care

-

Oncology (Restorative) Care

-

Others (Hydrolyzed Care, Urolith Care, Thyroid Care, etc.)

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

E-commerce

-

Veterinary hospitals & clinics

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pet therapeutic diet market size was estimated at USD 2.41 billion in 2024 and is expected to reach USD 4.53 billion in 2025.

b. The global pet therapeutic diet market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 6.44 billion by 2030.

b. North America dominated the pet therapeutic diet market with a share of 40.4% in 2024. This is attributable to rising pet obesity rates, increased diagnosis of chronic conditions, and growing pet humanization trends. The region maintains market leadership due to advanced veterinary infrastructure, high pet insurance penetration, and innovative product development by key players like Hill's Pet Nutrition, Royal Canin, and Purina Pro Plan Veterinary Diets.

b. Some key players operating in the pet therapeutic diet market include Colgate-Palmolive Company (Hill's Pet Nutrition Inc.), Nestlé, Mars Petcare (Royal Canin), General Mills Inc. (Blue Buffalo Company, Ltd.), Diamond Pet Foods, Inc., Virbac, Veterinary Nutrition Group, Farmina Pet Foods, JustFoodForDogs, EmerAid, LLC

b. Key factors that are driving the market growth include the rising prevalence of chronic health conditions among pets—such as obesity, kidney disease, and gastrointestinal disorders—coupled with increasing pet humanization, where owners seek specialized, vet-recommended nutrition.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.